Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

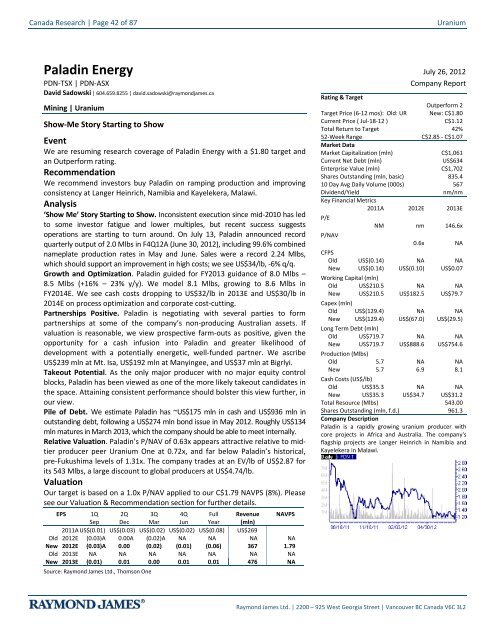

Canada Research | Page 42 of 87UraniumPaladin Energy July 26, 2012PDN-TSX | PDN-ASXDavid Sadowski | 604.659.8255 | david.sadowski@raymondjames.caMining | UraniumShow-Me Story Starting to ShowEventWe are resuming research coverage of Paladin Energy with a $1.80 target andan Outperform rating.RecommendationWe recommend investors buy Paladin on ramping production and improvingconsistency at Langer Heinrich, Namibia and Kayelekera, Malawi.Analysis‘Show Me’ Story Starting to Show. Inconsistent execution since mid-2010 has ledto some investor fatigue and lower multiples, but recent success suggestsoperations are starting to turn around. On July 13, Paladin announced recordquarterly output of 2.0 Mlbs in F4Q12A (June 30, 2012), including 99.6% combinednameplate production rates in May and June. Sales were a record 2.24 Mlbs,which should support an improvement in high costs; we see US$34/lb, -6% q/q.Growth and Optimization. Paladin guided for FY2013 guidance of 8.0 Mlbs –8.5 Mlbs (+16% – 23% y/y). We model 8.1 Mlbs, growing to 8.6 Mlbs inFY2014E. We see cash costs dropping to US$32/lb in 2013E and US$30/lb in2014E on process optimization and corporate cost-cutting.Partnerships Positive. Paladin is negotiating with several parties to formpartnerships at some of the company’s non-producing Australian assets. Ifvaluation is reasonable, we view prospective farm-outs as positive, given theopportunity for a cash infusion into Paladin and greater likelihood ofdevelopment with a potentially energetic, well-funded partner. We ascribeUS$239 mln at Mt. Isa, US$192 mln at Manyingee, and US$37 mln at Bigrlyi.Takeout Potential. As the only major producer with no major equity controlblocks, Paladin has been viewed as one of the more likely takeout candidates inthe space. Attaining consistent performance should bolster this view further, inour view.Pile of Debt. We estimate Paladin has ~US$175 mln in cash and US$936 mln inoutstanding debt, following a US$274 mln bond issue in May 2012. Roughly US$134mln matures in March 2013, which the company should be able to meet internally.Relative Valuation. Paladin’s P/NAV of 0.63x appears attractive relative to midtierproducer peer Uranium One at 0.72x, and far below Paladin’s historical,pre-Fukushima levels of 1.31x. The company trades at an EV/lb of US$2.87 forits 543 Mlbs, a large discount to global producers at US$4.74/lb.ValuationOur target is based on a 1.0x P/NAV applied to our C$1.79 NAVPS (8%). Pleasesee our Valuation & Recommendation section for further details.EPS 1Q 2Q 3Q 4Q Full Revenue NAVPSSep Dec Mar Jun Year (mln)2011A US$(0.01) US$(0.03) US$(0.02) US$(0.02) US$(0.08) US$269Old 2012E (0.03)A 0.00A (0.02)A NA NA NA NANew 2012E (0.03)A 0.00 (0.02) (0.01) (0.06) 367 1.79Old 2013E NA NA NA NA NA NA NANew 2013E (0.01) 0.01 0.00 0.01 0.01 476 NASource: Raymond James Ltd., Thomson OneCompany ReportRating & TargetOutperform 2Target Price (6-12 mos): Old: UR New: C$1.80Current Price ( Jul-18-12 )C$1.12Total Return to Target 42%52-Week RangeC$2.85 - C$1.07Market DataMarket Capitalization (mln)C$1,061Current Net Debt (mln)US$634Enterprise Value (mln)C$1,702Shares Outstanding (mln, basic) 835.410 Day Avg Daily Volume (000s) 567Dividend/Yieldnm/nmKey Financial Metrics2011A 2012E 2013EP/ENM nm 146.6xP/NAV0.6x NACFPSOld US$(0.14) NA NANew US$(0.14) US$(0.10) US$0.07Working Capital (mln)Old US$210.5 NA NANew US$210.5 US$182.5 US$79.7Capex (mln)Old US$(129.4) NA NANew US$(129.4) US$(67.0) US$(29.5)Long Term Debt (mln)Old US$719.7 NA NANew US$719.7 US$888.6 US$754.6Production (Mlbs)Old 5.7 NA NANew 5.7 6.9 8.1Cash Costs (US$/lb)Old US$35.3 NA NANew US$35.3 US$34.7 US$31.2Total Resource (Mlbs) 543.00Shares Outstanding (mln, f.d.) 961.3Company DescriptionPaladin is a rapidly growing uranium producer withcore projects in Africa and Australia. The company'sflagship projects are Langer Heinrich in Namibia andKayelekera in Malawi.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

Uranium Canada Research | Page 43 of 87Investment OverviewEstablished and Growing Mines. In FY2012A (ended June 30, 2012), Paladin produced6.9 Mlbs from its two mines, Langer Heinrich (4.4 Mlbs; 100%-interest) and Kayelekera(2.5 Mlbs; 85%-interest) and sold 7.4 Mlbs. Cash costs in F3Q12A were US$36/lb (fullyearcosts are not yet reported).For FY2013, Paladin guides to production of 8.0 Mlbs – 8.5 Mlbs, a healthy 16% – 23%y/y increase. We project both mines will maintain steady nameplate capacity bycalendar year-end – Kayelekera reached nameplate production in June 2012, whileLanger should soon gain the full, optimized benefit of new heat exchangers, NIMCIXcircuit, and other components. Given results from the Stage IV feasibility study – whichenvisions 8.7 Mlbs/year conventional, plus 1.3 Mlbs/year heap leach of lower gradematerial – have been deferred to year-end (pending clarity on success of Stage III rampup),we have excluded the Stage IV expansion from our model.Exhibit 56: Production and Cash Costs Profile12Production (Mlbs)1086420F2011A F2012E F2013E F2014E F2015E F2016E F2017E F2018E F2019EAustralia Kayelekera Langer Heinrich Cash CostSource: Raymond James Ltd., Paladin Energy403020100Cash Cost ($USD/lb)Capex at Mines Substantively Complete. After spending ~US$0.75 bln on projectdevelopment, Paladin announced following F3Q12A that it had completed major capexon the current phases of Langer and Kayelekera. Working capital expenditure will alsobe reduced now that inventories are near levels required for future contracts (Paladintargets four months of inventory). As stated above, we model no further expansions,which should bolster the company’s near-term ability to service its debt (note ourmodeled payback in FY2013E, FY2015E and FY2016E in Exhibit 57; further details inPotential Concerns section).Exhibit 57: Projected Cash Flows and EOP Cash for Paladin800US$ mln (Cash Flow per Period)6004002000-200-400-6003386634811717370142 1368178308F2008AF2009AF2010AF2011AF2012EF2013EF2014EF2015EF2016EF2017EF2018ESource: Raymond James Ltd., Paladin EnergyCFF CFI CFO Cash (EOP)Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

- Page 1 and 2: Mining & Natural ResourcesDavid Sad

- Page 3 and 4: Uranium Canada Research | Page 3 of

- Page 5 and 6: Uranium Canada Research | Page 5 of

- Page 7 and 8: Uranium Canada Research | Page 7 of

- Page 9 and 10: Uranium Canada Research | Page 9 of

- Page 11 and 12: Uranium Canada Research | Page 11 o

- Page 13 and 14: Uranium Canada Research | Page 13 o

- Page 15 and 16: Uranium Canada Research | Page 15 o

- Page 17 and 18: Uranium Canada Research | Page 17 o

- Page 19 and 20: Uranium Canada Research | Page 19 o

- Page 21 and 22: Uranium Canada Research | Page 21 o

- Page 24 and 25: Canada Research | Page 24 of 87Uran

- Page 26: Canada Research | Page 26 of 87Uran

- Page 30 and 31: Canada Research | Page 30 of 87Uran

- Page 32 and 33: Canada Research | Page 32 of 87Uran

- Page 34 and 35: Canada Research | Page 34 of 87Uran

- Page 36 and 37: Canada Research | Page 36 of 87Uran

- Page 38 and 39: Canada Research | Page 38 of 87Uran

- Page 40 and 41: Canada Research | Page 40 of 87Uran

- Page 44 and 45: Canada Research | Page 44 of 87Uran

- Page 46 and 47: Canada Research | Page 46 of 87Uran

- Page 48 and 49: Canada Research | Page 48 of 87Uran

- Page 50 and 51: Canada Research | Page 50 of 87Uran

- Page 52 and 53: Canada Research | Page 52 of 87Uran

- Page 54 and 55: Canada Research | Page 54 of 87Uran

- Page 56 and 57: Canada Research | Page 56 of 87Uran

- Page 58 and 59: Canada Research | Page 58 of 87Uran

- Page 60 and 61: Canada Research | Page 60 of 87Uran

- Page 62 and 63: Canada Research | Page 62 of 87Uran

- Page 64 and 65: Canada Research | Page 64 of 87Uran

- Page 66 and 67: Canada Research | Page 66 of 87Uran

- Page 68 and 69: Canada Research | Page 68 of 87Uran

- Page 70 and 71: Canada Research | Page 70 of 87Uran

- Page 72 and 73: Canada Research | Page 72 of 87Uran

- Page 74 and 75: Canada Research | Page 74 of 87Uran

- Page 76 and 77: Canada Research | Page 76 of 87Uran

- Page 78 and 79: Canada Research | Page 78 of 87Uran

- Page 80 and 81: Canada Research | Page 80 of 87Uran

- Page 82 and 83: Canada Research | Page 82 of 87Uran

- Page 84 and 85: Canada Research | Page 84 of 87Uran

- Page 86 and 87: Canada Research | Page 86 of 87Uran

Canada Research | Page 42 of 87<strong>Uranium</strong>Paladin Energy July 26, 2012PDN-TSX | PDN-ASXDavid Sadowski | 604.659.8255 | david.sadowski@raymondjames.caMining | <strong>Uranium</strong>Show-Me Story Starting to ShowEventWe are resuming research coverage of Paladin Energy with a $1.80 target <strong>and</strong>an Outperform rating.RecommendationWe recommend investors buy Paladin on ramping production <strong>and</strong> improvingconsistency at Langer Heinrich, Namibia <strong>and</strong> Kayelekera, Malawi.Analysis‘Show Me’ Story Starting to Show. Inconsistent execution since mid-2010 has ledto some investor fatigue <strong>and</strong> lower multiples, but recent success suggestsoperations are starting to turn around. On July 13, Paladin announced recordquarterly output of 2.0 Mlbs in F4Q12A (June 30, 2012), including 99.6% combinednameplate production rates in May <strong>and</strong> June. Sales were a record 2.24 Mlbs,which should support an improvement in high costs; we see US$34/lb, -6% q/q.Growth <strong>and</strong> Optimization. Paladin guided for FY2013 guidance of 8.0 Mlbs –8.5 Mlbs (+16% – 23% y/y). We model 8.1 Mlbs, growing to 8.6 Mlbs inFY2014E. We see cash costs dropping to US$32/lb in 2013E <strong>and</strong> US$30/lb in2014E on process optimization <strong>and</strong> corporate cost-cutting.Partnerships Positive. Paladin is negotiating with several parties to formpartnerships at some of the company’s non-producing Australian assets. Ifvaluation is reasonable, we view prospective farm-outs as positive, given theopportunity for a cash infusion into Paladin <strong>and</strong> greater likelihood ofdevelopment with a potentially energetic, well-funded partner. We ascribeUS$239 mln at Mt. Isa, US$192 mln at Manyingee, <strong>and</strong> US$37 mln at Bigrlyi.Takeout Potential. As the only major producer with no major equity controlblocks, Paladin has been viewed as one of the more likely takeout c<strong>and</strong>idates inthe space. Attaining consistent performance should bolster this view further, inour view.Pile of Debt. We estimate Paladin has ~US$175 mln in cash <strong>and</strong> US$936 mln inoutst<strong>and</strong>ing debt, following a US$274 mln bond issue in May 2012. Roughly US$134mln matures in March 2013, which the company should be able to meet internally.Relative Valuation. Paladin’s P/NAV of 0.63x appears attractive relative to midtierproducer peer <strong>Uranium</strong> One at 0.72x, <strong>and</strong> far below Paladin’s historical,pre-Fukushima levels of 1.31x. The company trades at an EV/lb of US$2.87 forits 543 Mlbs, a large discount to global producers at US$4.74/lb.ValuationOur target is based on a 1.0x P/NAV applied to our C$1.79 NAVPS (8%). Pleasesee our Valuation & Recommendation section for further details.EPS 1Q 2Q 3Q 4Q Full Revenue NAVPSSep Dec Mar Jun Year (mln)2011A US$(0.01) US$(0.03) US$(0.02) US$(0.02) US$(0.08) US$269Old 2012E (0.03)A 0.00A (0.02)A NA NA NA NANew 2012E (0.03)A 0.00 (0.02) (0.01) (0.06) 367 1.79Old 2013E NA NA NA NA NA NA NANew 2013E (0.01) 0.01 0.00 0.01 0.01 476 NASource: Raymond James Ltd., Thomson OneCompany ReportRating & TargetOutperform 2Target Price (6-12 mos): Old: UR New: C$1.80Current Price ( Jul-18-12 )C$1.12Total Return to Target 42%52-Week RangeC$2.85 - C$1.07Market DataMarket Capitalization (mln)C$1,061Current Net Debt (mln)US$634Enterprise Value (mln)C$1,702Shares Outst<strong>and</strong>ing (mln, basic) 835.410 Day Avg Daily Volume (000s) 567Dividend/Yieldnm/nmKey Financial Metrics2011A 2012E 2013EP/ENM nm 146.6xP/NAV0.6x NACFPSOld US$(0.14) NA NANew US$(0.14) US$(0.10) US$0.07Working Capital (mln)Old US$210.5 NA NANew US$210.5 US$182.5 US$79.7Capex (mln)Old US$(129.4) NA NANew US$(129.4) US$(67.0) US$(29.5)Long Term Debt (mln)Old US$719.7 NA NANew US$719.7 US$888.6 US$754.6Production (Mlbs)Old 5.7 NA NANew 5.7 6.9 8.1Cash Costs (US$/lb)Old US$35.3 NA NANew US$35.3 US$34.7 US$31.2Total Resource (Mlbs) 543.00Shares Outst<strong>and</strong>ing (mln, f.d.) 961.3Company DescriptionPaladin is a rapidly growing uranium producer withcore projects in Africa <strong>and</strong> Australia. The company'sflagship projects are Langer Heinrich in Namibia <strong>and</strong>Kayelekera in Malawi.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2