Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

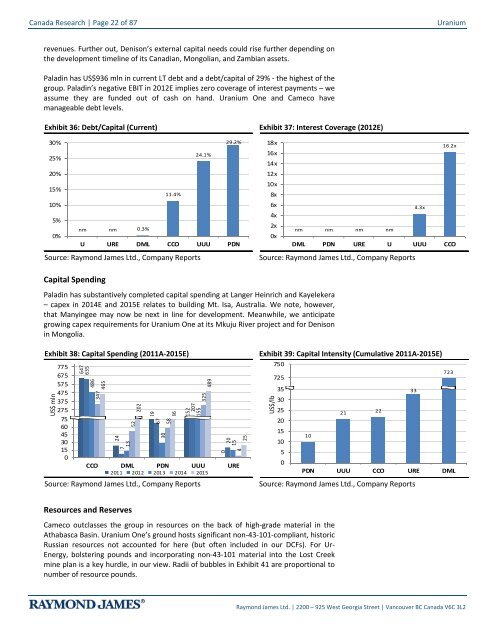

Canada Research | Page 22 of 87Uraniumrevenues. Further out, Denison’s external capital needs could rise further depending onthe development timeline of its Canadian, Mongolian, and Zambian assets.Paladin has US$936 mln in current LT debt and a debt/capital of 29% - the highest of thegroup. Paladin’s negative EBIT in 2012E implies zero coverage of interest payments – weassume they are funded out of cash on hand. Uranium One and Cameco havemanageable debt levels.Exhibit 36: Debt/Capital (Current)30%25%20%Debt/capitalCurrent29.2%24.1%15%11.4%10%5%nm nm 0.3%0%U URE DML CCO UUU PDNSource: Raymond James Ltd., Company ReportsExhibit 37: Interest Coverage (2012E)18x16x14x Interest Coverage12x Current10x8x6x4x16.2x4.3x2xnm nm nm nm0xDML PDN URE U UUU CCOSource: Raymond James Ltd., Company ReportsCapital SpendingPaladin has substantively completed capital spending at Langer Heinrich and Kayelekera– capex in 2014E and 2015E relates to building Mt. Isa, Australia. We note, however,that Manyingee may now be next in line for development. Meanwhile, we anticipategrowing capex requirements for Uranium One at its Mkuju River project and for Denisonin Mongolia.Exhibit 38: Capital Spending (2011A-2015E)US$ mln77567557547537527517575 604530150647635486Capital Spending('11-'15)347465to add24713522021296730588615220715532548902015CCO DML PDN UUU URE2011 2012 2013 2014 2015Source: Raymond James Ltd., Company Reports425Exhibit 39: Capital Intensity (Cumulative 2011A-2015E)750US$/lbUS$/lb723725700 353067525650 20Capital IntensityCumulative '11-'15?21 2215to10add1050PDN UUU CCO URE DMLSource: Raymond James Ltd., Company Reports33Resources and ReservesCameco outclasses the group in resources on the back of high-grade material in theAthabasca Basin. Uranium One’s ground hosts significant non-43-101-compliant, historicRussian resources not accounted for here (but often included in our DCFs). For Ur-Energy, bolstering pounds and incorporating non-43-101 material into the Lost Creekmine plan is a key hurdle, in our view. Radii of bubbles in Exhibit 41 are proportional tonumber of resource pounds.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

- Page 1 and 2: Mining & Natural ResourcesDavid Sad

- Page 3 and 4: Uranium Canada Research | Page 3 of

- Page 5 and 6: Uranium Canada Research | Page 5 of

- Page 7 and 8: Uranium Canada Research | Page 7 of

- Page 9 and 10: Uranium Canada Research | Page 9 of

- Page 11 and 12: Uranium Canada Research | Page 11 o

- Page 13 and 14: Uranium Canada Research | Page 13 o

- Page 15 and 16: Uranium Canada Research | Page 15 o

- Page 17 and 18: Uranium Canada Research | Page 17 o

- Page 19 and 20: Uranium Canada Research | Page 19 o

- Page 21: Uranium Canada Research | Page 21 o

- Page 25 and 26: Uranium Canada Research | Page 25 o

- Page 29 and 30: Uranium Canada Research | Page 29 o

- Page 31 and 32: Uranium Canada Research | Page 31 o

- Page 33 and 34: Uranium Canada Research | Page 33 o

- Page 35 and 36: Uranium Canada Research | Page 35 o

- Page 37 and 38: Uranium Canada Research | Page 37 o

- Page 39 and 40: Uranium Canada Research | Page 39 o

- Page 41 and 42: Uranium Canada Research | Page 41 o

- Page 43 and 44: Uranium Canada Research | Page 43 o

- Page 45 and 46: Uranium Canada Research | Page 45 o

- Page 47 and 48: Uranium Canada Research | Page 47 o

- Page 49 and 50: Uranium Canada Research | Page 49 o

- Page 51 and 52: Uranium Canada Research | Page 51 o

- Page 53 and 54: Uranium Canada Research | Page 53 o

- Page 55 and 56: Uranium Canada Research | Page 55 o

- Page 57 and 58: Uranium Canada Research | Page 57 o

- Page 59 and 60: Uranium Canada Research | Page 59 o

- Page 61 and 62: Uranium Canada Research | Page 61 o

- Page 63 and 64: Uranium Canada Research | Page 63 o

- Page 65 and 66: Uranium Canada Research | Page 65 o

- Page 67 and 68: Uranium Canada Research | Page 67 o

- Page 69 and 70: Uranium Canada Research | Page 69 o

- Page 71 and 72: Uranium Canada Research | Page 71 o

Canada Research | Page 22 of 87<strong>Uranium</strong>revenues. Further out, Denison’s external capital needs could rise further depending onthe development timeline of its Canadian, Mongolian, <strong>and</strong> Zambian assets.Paladin has US$936 mln in current LT debt <strong>and</strong> a debt/capital of 29% - the highest of thegroup. Paladin’s negative EBIT in 2012E implies zero coverage of interest payments – weassume they are funded out of cash on h<strong>and</strong>. <strong>Uranium</strong> One <strong>and</strong> Cameco havemanageable debt levels.Exhibit 36: Debt/Capital (Current)30%25%20%Debt/capitalCurrent29.2%24.1%15%11.4%10%5%nm nm 0.3%0%U URE DML CCO UUU PDNSource: Raymond James Ltd., Company ReportsExhibit 37: Interest Coverage (2012E)18x16x14x Interest Coverage12x Current10x8x6x4x16.2x4.3x2xnm nm nm nm0xDML PDN URE U UUU CCOSource: Raymond James Ltd., Company ReportsCapital SpendingPaladin has substantively completed capital spending at Langer Heinrich <strong>and</strong> Kayelekera– capex in 2014E <strong>and</strong> 2015E relates to building Mt. Isa, Australia. We note, however,that Manyingee may now be next in line for development. Meanwhile, we anticipategrowing capex requirements for <strong>Uranium</strong> One at its Mkuju River project <strong>and</strong> for Denisonin Mongolia.Exhibit 38: Capital Spending (2011A-2015E)US$ mln77567557547537527517575 604530150647635486Capital Spending('11-'15)347465to add24713522021296730588615220715532548902015CCO DML PDN UUU URE2011 2012 2013 2014 2015Source: Raymond James Ltd., Company Reports425Exhibit 39: Capital Intensity (Cumulative 2011A-2015E)750US$/lbUS$/lb723725700 353067525650 20Capital IntensityCumulative '11-'15?21 2215to10add1050PDN UUU CCO URE DMLSource: Raymond James Ltd., Company Reports33Resources <strong>and</strong> ReservesCameco outclasses the group in resources on the back of high-grade material in theAthabasca Basin. <strong>Uranium</strong> One’s ground hosts significant non-43-101-compliant, historicRussian resources not accounted for here (but often included in our DCFs). For Ur-Energy, bolstering pounds <strong>and</strong> incorporating non-43-101 material into the Lost Creekmine plan is a key hurdle, in our view. Radii of bubbles in Exhibit 41 are proportional tonumber of resource pounds.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2