Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Canada Research | Page 16 of 87UraniumBoth of these solutions should support higher uranium prices. We remind readers thaturanium demand is largely price inelastic, given the uranium component of fuel typicallycomprises ~10% of reactor operating costs (much less if including capital depreciation).Exhibit 17: RJL Supply Surplus/Deficit (Mlbs/year)30.0100.0Supply Surplus/Deficit (Mlbs/yr)20.010.00.0-10.0-20.0-30.0-40.0-50.050.00.0-50.0-100.0-150.0Cumulative Surplus/Deficit (Mlbs)-60.0-200.020082009201020112012201320142015201620172018201920202021202220232024202520262027202820292030Source: Raymond James Ltd., UxC, WNA, NIW, Company ReportsScenariosSupply Scenarios. Our model reflects our view of the most likely growth curves foruranium supply and demand. We have also run scenarios assuming specific events occuror do not occur. Below, our reference total supply curve is compared against our modelif we assume that DOE increases transfers to 20% of reactor requirements (~10Mlbs/year) – i.e., a positive for supply. Also portrayed are three supply-negativescenarios: BHP does not pursue the Olympic Dam expansion; Kazakhstan maintains goforwardoutput at 2011A levels (50.6 Mlbs/year), and no new mines start-up in Africa,which are generally lower grade and of higher geopolitical risk than other regions. Thesescenarios are compared against our total demand curve in blue (recall, includes burn,new cores, and inventory build).We see more downside risk to ourtotal supply curve, which couldsupport prices furtherExhibit 18: RJL Global Uranium Supply Scenarios vs. RJL Total Demand (Mlbs/yr)3253002752502252001751502010201120122013201420152016201720182019RJL Total Demand RJL Total Supply RJL - DOE Dispose 20% of U.S. Req'tsNo Olympic Dam Expansion Nil Kazakh Growth No New Africa MinesSource: Raymond James Ltd., UxC, WNA, NIW, Company Reports20202021202220232024202520262027202820292030Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

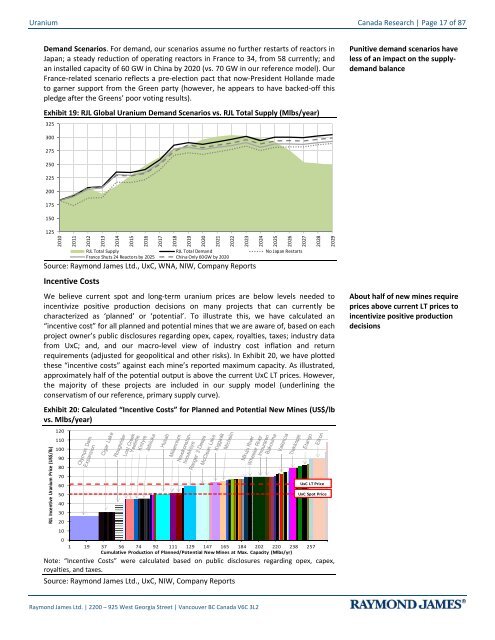

Uranium Canada Research | Page 17 of 87Demand Scenarios. For demand, our scenarios assume no further restarts of reactors inJapan; a steady reduction of operating reactors in France to 34, from 58 currently; andan installed capacity of 60 GW in China by 2020 (vs. 70 GW in our reference model). OurFrance-related scenario reflects a pre-election pact that now-President Hollande madeto garner support from the Green party (however, he appears to have backed-off thispledge after the Greens’ poor voting results).Exhibit 19: RJL Global Uranium Demand Scenarios vs. RJL Total Supply (Mlbs/year)325Punitive demand scenarios haveless of an impact on the supplydemandbalance3002752502252001751501252010201120122013201420152016201720182019RJL Total Supply RJL Total Demand No Japan RestartsFrance Shuts 24 Reactors by 2025 China Only 60GW by 2020Source: Raymond James Ltd., UxC, WNA, NIW, Company ReportsIncentive CostsWe believe current spot and long-term uranium prices are below levels needed toincentivize positive production decisions on many projects that can currently becharacterized as ‘planned’ or ‘potential’. To illustrate this, we have calculated an“incentive cost” for all planned and potential mines that we are aware of, based on eachproject owner’s public disclosures regarding opex, capex, royalties, taxes; industry datafrom UxC; and, and our macro-level view of industry cost inflation and returnrequirements (adjusted for geopolitical and other risks). In Exhibit 20, we have plottedthese “incentive costs” against each mine’s reported maximum capacity. As illustrated,approximately half of the potential output is above the current UxC LT prices. However,the majority of these projects are included in our supply model (underlining theconservatism of our reference, primary supply curve).Exhibit 20: Calculated “Incentive Costs” for Planned and Potential New Mines (US$/lbvs. Mlbs/year)RJL Incentive Uranium Price (US$/lb)12011010090807060UxC LT Price50UxC Spot Price4030201001 19 37 56 74 92 111 129 147 165 184 202 220 238 257Cumulative Production of Planned/Potential New Mines at Max. Capacity (Mlbs/yr)Note: “Incentive Costs” were calculated based on public disclosures regarding opex, capex,royalties, and taxes.Source: Raymond James Ltd., UxC, NIW, Company Reports2020202120222023202420252026202720282029About half of new mines requireprices above current LT prices toincentivize positive productiondecisionsRaymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2

- Page 1 and 2: Mining & Natural ResourcesDavid Sad

- Page 3 and 4: Uranium Canada Research | Page 3 of

- Page 5 and 6: Uranium Canada Research | Page 5 of

- Page 7 and 8: Uranium Canada Research | Page 7 of

- Page 9 and 10: Uranium Canada Research | Page 9 of

- Page 11 and 12: Uranium Canada Research | Page 11 o

- Page 13 and 14: Uranium Canada Research | Page 13 o

- Page 15: Uranium Canada Research | Page 15 o

- Page 19 and 20: Uranium Canada Research | Page 19 o

- Page 21 and 22: Uranium Canada Research | Page 21 o

- Page 24 and 25: Canada Research | Page 24 of 87Uran

- Page 26: Canada Research | Page 26 of 87Uran

- Page 30 and 31: Canada Research | Page 30 of 87Uran

- Page 32 and 33: Canada Research | Page 32 of 87Uran

- Page 34 and 35: Canada Research | Page 34 of 87Uran

- Page 36 and 37: Canada Research | Page 36 of 87Uran

- Page 38 and 39: Canada Research | Page 38 of 87Uran

- Page 40 and 41: Canada Research | Page 40 of 87Uran

- Page 42 and 43: Canada Research | Page 42 of 87Uran

- Page 44 and 45: Canada Research | Page 44 of 87Uran

- Page 46 and 47: Canada Research | Page 46 of 87Uran

- Page 48 and 49: Canada Research | Page 48 of 87Uran

- Page 50 and 51: Canada Research | Page 50 of 87Uran

- Page 52 and 53: Canada Research | Page 52 of 87Uran

- Page 54 and 55: Canada Research | Page 54 of 87Uran

- Page 56 and 57: Canada Research | Page 56 of 87Uran

- Page 58 and 59: Canada Research | Page 58 of 87Uran

- Page 60 and 61: Canada Research | Page 60 of 87Uran

- Page 62 and 63: Canada Research | Page 62 of 87Uran

- Page 64 and 65: Canada Research | Page 64 of 87Uran

<strong>Uranium</strong> Canada Research | Page 17 of 87Dem<strong>and</strong> Scenarios. For dem<strong>and</strong>, our scenarios assume no further restarts of reactors inJapan; a steady reduction of operating reactors in France to 34, from 58 currently; <strong>and</strong>an installed capacity of 60 GW in China by 2020 (vs. 70 GW in our reference model). OurFrance-related scenario reflects a pre-election pact that now-President Holl<strong>and</strong>e madeto garner support from the Green party (however, he appears to have backed-off thispledge after the Greens’ poor voting results).Exhibit 19: RJL Global <strong>Uranium</strong> Dem<strong>and</strong> Scenarios vs. RJL Total <strong>Supply</strong> (Mlbs/year)325Punitive dem<strong>and</strong> scenarios haveless of an impact on the supplydem<strong>and</strong>balance3002752502252001751501252010201120122013201420152016201720182019RJL Total <strong>Supply</strong> RJL Total Dem<strong>and</strong> No Japan RestartsFrance Shuts 24 Reactors by 2025 China Only 60GW by 2020Source: Raymond James Ltd., UxC, WNA, NIW, Company ReportsIncentive CostsWe believe current spot <strong>and</strong> long-term uranium prices are below levels needed toincentivize positive production decisions on many projects that can currently becharacterized as ‘planned’ or ‘potential’. To illustrate this, we have calculated an“incentive cost” for all planned <strong>and</strong> potential mines that we are aware of, based on eachproject owner’s public disclosures regarding opex, capex, royalties, taxes; industry datafrom UxC; <strong>and</strong>, <strong>and</strong> our macro-level view of industry cost inflation <strong>and</strong> returnrequirements (adjusted for geopolitical <strong>and</strong> other risks). In Exhibit 20, we have plottedthese “incentive costs” against each mine’s reported maximum capacity. As illustrated,approximately half of the potential output is above the current UxC LT prices. However,the majority of these projects are included in our supply model (underlining theconservatism of our reference, primary supply curve).Exhibit 20: Calculated “Incentive Costs” for Planned <strong>and</strong> Potential New Mines (US$/lbvs. Mlbs/year)RJL Incentive <strong>Uranium</strong> Price (US$/lb)12011010090807060UxC LT Price50UxC Spot Price4030201001 19 37 56 74 92 111 129 147 165 184 202 220 238 257Cumulative Production of Planned/Potential New Mines at Max. Capacity (Mlbs/yr)Note: “Incentive Costs” were calculated based on public disclosures regarding opex, capex,royalties, <strong>and</strong> taxes.Source: Raymond James Ltd., UxC, NIW, Company Reports2020202120222023202420252026202720282029About half of new mines requireprices above current LT prices toincentivize positive productiondecisionsRaymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2