Overview of Alexkor - Parliamentary Monitoring Group

Overview of Alexkor - Parliamentary Monitoring Group

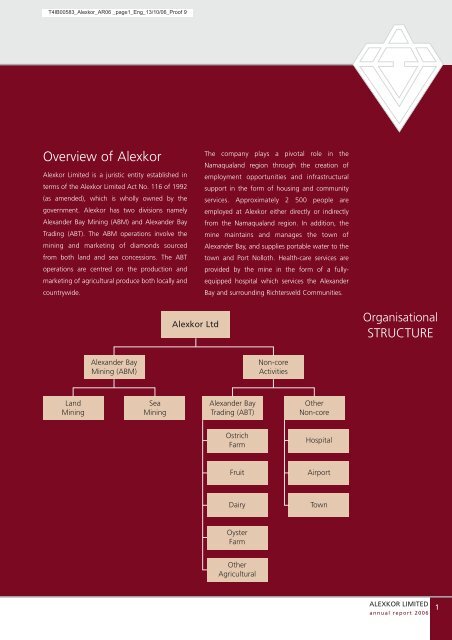

Overview of Alexkor - Parliamentary Monitoring Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

T4IB00583_<strong>Alexkor</strong>_AR06 _page2_Eng_13/10/06_Pro<strong>of</strong> 9Board <strong>of</strong>DIRECTORSMartin van ZylBoard MemberJohan van DeventerBoard MemberMzamani MdakaBoard MemberNchakha MoloiChairpersonVuyo MahlatiBoard MemberRian CoetzeeBoard MemberDr Tanya AbrahamseBoard MemberAuditCOMMITTEEReggie MuzaririChairperson – ExternalXoliswa MotswaiExternalJohan van DeventerBoard Member2ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page3_Eng_13/10/06_Pro<strong>of</strong> 9CurrentManagementSTRUCTUREMzamani MdakaChief Executive OfficerDavid BeukesEngineering Managerand Acting Mine ManagerGe<strong>of</strong>f DaviesMineral Resourcesand Marine ManagerWilna Gilbert-CloeteHuman Resources ManagerMario van der WaltChief Financial OfficerCheryl SinghCompany SecretaryAs at 31 March 2006 Senior Management consisted <strong>of</strong> thefollowing members:M E MdakaR CloeteW MeyerD BeukesG M DaviesW M Gilbert-CloeteS LaingChief Executive OfficerActing Chief Financial OfficerMine Manager and ABT ManagerEngineering ManagerMineral Resources and Marine ManagerHuman Resources ManagerSecurity ManagerSchalk LaingSecurity ManagerMessrs E Adams and C Matthews resigned from the positions <strong>of</strong>Chief Financial Officer and Company Secretary respectively at the end<strong>of</strong> February 2006.Ms C Singh and Mr M van der Walt joined <strong>Alexkor</strong> on 10 July 2006and 1 August 2006 respectively.ALEXKOR LIMITEDannual report 20063

T4IB00583_<strong>Alexkor</strong>_AR06 _page5_Eng_13/10/06_Pro<strong>of</strong> 9stage for the development <strong>of</strong> sustainablecommunities with improved service delivery fromthe State.The company keeps itself fully appraised withmajor international developments in the diamondmarket and uses these developments to informstrategies and business models to enhanceshareholder returns and maximise shareholdervalue. A combination <strong>of</strong> the rapidly changinginternational diamond industry, the newlegislative developments and the land claims casedemand a responsive and visionary Board <strong>of</strong>Directors to grow the company.The Board is <strong>of</strong> the opinion that the speedy andefficient realisation <strong>of</strong> the restructuring and realigmentinitiatives as well as the resolution <strong>of</strong> theland claims case will create optimal returns for boththe company and the South African public at large.Business PerformanceLast year <strong>Alexkor</strong>, along with other State-ownedenterprises, begun the process <strong>of</strong> implementingInternational Financial Reporting Standards.<strong>Alexkor</strong>’s financial reporting framework wasaccordingly adapted both in terms <strong>of</strong> content andstyle, in order to comply with these standards.The financial performance <strong>of</strong> the company ishampered primarily by the land claim and theimpact <strong>of</strong> unfavourable weather and seaconditions on the shallow water marine miningoperations.The Board <strong>of</strong> Directors has summed up the results<strong>of</strong> the financial business activities <strong>of</strong> <strong>Alexkor</strong> forthe year ended 31 March 2006. The companycontinues to make losses.Below is a comparison <strong>of</strong> 2005 and 2006, the2005 financial year being a nine-month period:• Revenue increased to R159.4 million fromR152.4 million.• Net operating expenses increased toR197.6 million from R121.3 million.• Loss from operations <strong>of</strong> R38.2 million from apr<strong>of</strong>it <strong>of</strong> R1.5 million.• Pr<strong>of</strong>it margin decreased to -0.23% from0.61% in 2005.• Return on capital employed decreased to-47%, from -0.01% in 2005.• Operating cash flow decreased to R6.2 millionfrom R0.6 million in the previous year.• Total debt ratio decreased to 1.74:1 timesfrom 3.99:1 times in 2005.• Current ratio decreased to 4:1 from 4.14:1in 2005.Social InvestmentMining, particularly the diamond industry, is thebackbone <strong>of</strong> the Namaqualand economy andmakes the largest contribution to labourremuneration in the region.Although not the biggest employer inNamaqualand, <strong>Alexkor</strong> provides employment toapproximately 1 851 people in the region directlyand indirectly. Personnel expenses amounting toR60.9 million were paid for the financial yearunder review.The mine supports a hospital at Alexander Bayand included in the social welfare contributionswhich <strong>Alexkor</strong> provides to the region, is a clinicfacility for the Richtersveld pensioners.Schooling is provided in <strong>Alexkor</strong>’s facilities to allchildren resident at Alexander Bay as well as forchildren living at nearby mining communities.The communities also stand to benefit from<strong>Alexkor</strong>’s ancillary business operation (ABT) afterthe takeover by the Richtersveld Community.<strong>Alexkor</strong>, in its endeavour to create jobs for localcommunities, created an alternative economicactivity for the retrenched employees and localcommunities. The company outsourced its entireshallow water operations to small and mediumsizedbusinesses, with significant economicparticipation by former (retrenched) <strong>Alexkor</strong>employees and members <strong>of</strong> the communities, inline with <strong>Alexkor</strong>’s social plan.Of the current annual turnover <strong>of</strong> approximatelyR159.4 million which is generated by <strong>Alexkor</strong>,approximately R71.2 million is injected into theregional economy to the greatest benefit <strong>of</strong> theengineering, general supply and constructionbusiness sectors. Around 38% <strong>of</strong> the annualturnover was paid to the marine contractors.ALEXKOR LIMITEDannual report 20065

T4IB00583_<strong>Alexkor</strong>_AR06 _page7_Eng_13/10/06_Pro<strong>of</strong> 9The CEO, Mzamani Mdaka, continues fromstrength to strength and has done a sterling job inkeeping <strong>Alexkor</strong> intact. Mzamani leads a seniormanagement team in the persons <strong>of</strong> M van derWalt (Chief Financial Officer), C Singh (CompanySecretary), Ge<strong>of</strong>f Davies (Mineral ResourcesManager), David Beukes (Engineering Managerand acting Mine Manager), Wilna Gilbert-Cloete(Human Resources Manager), Schalk Laing(Security Manager) and Clifford Oppel (actingManager for ABT).E Adams, the Chief Financial Officer andC Matthews, the Company Secretary left thecompany’s employ during the year. Wilna Gilbert-Cloete was appointed the Human ResourcesManager, M van der Walt the new CFO andC Singh the new Company Secretary.ALEXKOR LIMITEDannual report 20067

T4IB00583_<strong>Alexkor</strong>_AR06 _page8_Eng_13/10/06_Pro<strong>of</strong> 9Chief Executive’sREPORTIntroductionThe period under review is considered to havebeen one <strong>of</strong> the most difficult times for thecompany. Management was faced with achallenge <strong>of</strong> sustaining current operations asgoing concern with limited resources whilst thecompany continued to operate at a loss. Thesecurrent operations are comprised <strong>of</strong> the miningactivities on land and sea mining areas, as well asthe non-mining activities such as ABT, the town,the hospital and the airport. The mining activitiesform the core <strong>of</strong> <strong>Alexkor</strong>’s business. Over the past10 years, the company’s carat production basefrom land and sea has declined from a high <strong>of</strong>227 000 carat per annum in 1995 to 43 000in 2006, which is the lowest production levelrecorded in the company’s recent history.A number <strong>of</strong> constraints have resulted in <strong>Alexkor</strong>operating at a loss as is evident in the FY2006performance. This situation has resulted in thedepletion <strong>of</strong> the company’s cash resources sinceno capital injection was made to address theidentified constraints. Despite the extent <strong>of</strong> thedeposits, the current mining operations areseverely constrained by the lack <strong>of</strong> an identifiedreserve base; a poorly maintained and aging earthmovingfleet; a plant infrastructure requiringupgrading; an overdependence on unreliable,contracted, diver-directed mining methods; and alack <strong>of</strong> capital or access to capital to rectify thesituation.Financial Performance<strong>Alexkor</strong>’s consolidated revenues and costsfrom current operations for the FY2006 wereR159.5 milllion and R197.6 million respectively,resulting in an operating loss <strong>of</strong> R38.1 million. Inaddition to this, adjustments were made for thepost-retirement medical liability and rehabilitationliability to the amounts <strong>of</strong> R11.4 million andR160.1 million respectively, in line withrequirements <strong>of</strong> the IFRS implementation. Theimpact <strong>of</strong> these adjustments resulted in areported total loss <strong>of</strong> R205.5 million for FY2006.When excluding the effects <strong>of</strong> the adjustments(R171.3 million) and costs associated withthe subsidisation <strong>of</strong> the non-core assets ABT(R4.1 million), the town (R4.1 million) and thehospital (R2.6 million), the mining activities wouldhave made an operating loss <strong>of</strong> R23.4 million.Challenges and Turnaround PlansThe main factors impacting negatively on turnaroundplans for ABM include the continuedmaintenance and subsidising <strong>of</strong> non-core assets,uncertainties related to the settlement <strong>of</strong> the landclaims case and the lack <strong>of</strong> defined ore reserves.The pending land claims case has hugely affectedthe development and implementation <strong>of</strong> plansnecessary to turn the company into pr<strong>of</strong>itabilitysince no capital investments or long-term miningplans could be implemented on land mining,which is the subject <strong>of</strong> the claim. The company’sloss-making situation was exacerbated by the lack<strong>of</strong> defined ore reserves in the current miningareas; the fixed costs associated with personnelexpenses; and maintenance <strong>of</strong> existing plant andequipment.Alexander Bay Trading (ABT), currently theagricultural and trading division <strong>of</strong> <strong>Alexkor</strong>, is inthe process <strong>of</strong> being corporatised into a separatelegal entity. The future development <strong>of</strong> a postminingeconomy suggests that creativepartnerships ought to be found to ensure theeffective investment in ABT without burdeningthe mining operations. This would includerunning each business unit as a separate entity.Other business units were identified as non-coreand will be transferred to the relevantgovernment authorities. These include theairport, hospital, pharmacy and Alexander Baytown.In order to turn the mining operations intopr<strong>of</strong>itability, the objective is to maximiseproduction from land and sea mining areas.The restructuring <strong>of</strong> land mining operations toa three-shift configuration commenced inAugust 2005 with the initiation <strong>of</strong> a twoshiftconfiguration on the mining areas.Implementation <strong>of</strong> the three-shift configurationwas completed in May 2006, and has so farshown improvements in tonnages processed atthe plants. To achieve the short-term plan, anexploration plant that was constructed in thesouth <strong>of</strong> the mine to support mining in theMuisvlak area has been relocated to the northern8ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page9_Eng_13/10/06_Pro<strong>of</strong> 9part <strong>of</strong> the mine where current mining is takingplace. Exploration will be conducted ahead <strong>of</strong> themining activities confirming economically viableblocks for mining. These targeted blocks will beidentified from historical sampling. Managementis reviewing the allocation <strong>of</strong> mining-related coststo account for land and marine mining activitiesseparately, which will make it easier to monitorthe trends in unit costs and the pr<strong>of</strong>itability <strong>of</strong>each business unit.In an attempt to reduce overreliance on diverdirectedmining operations, remote miningmethods are being implemented. The first remotemining unit has commenced production inJuly 2006. Until the remote mining techniqueshave proven their ability to effectively operate onthe <strong>Alexkor</strong> concessions, the diver-directedoperations will remain the major contributor to<strong>Alexkor</strong>’s production and this is a concern whenconsidering the continuous downward trend inthe number <strong>of</strong> sea days.In the longer term, the objective <strong>of</strong> the miningoperations will be the establishment <strong>of</strong> a mineralreserve base from which reliable mining andbusiness plans can be developed. Management,after consultation and approval by the Board, hasdeveloped a recapitalisation programme aimed atexpanding operations through new and upgradedinfrastructure and increased equipment levels.The recapitalisation programme’s requirementshave been submitted to the Department <strong>of</strong> PublicEnterprises (DPE) and emphasis has been placedon the need to conduct exploration on both landand sea concessions in order to convert theinferred resource into probable and provenreserve. The integral part in the development <strong>of</strong> areliable mine plan is the availability <strong>of</strong> probable orproven reserves which are deduced from theresults <strong>of</strong> an exploration programme. <strong>Alexkor</strong>, inrecent years, has not conducted any meaningfulexploration that would have resulted in theconversion <strong>of</strong> the mineral resource into aprobable or proven reserve.Safety and Health<strong>Alexkor</strong> obtained its first 1 000 fatalityfreeproduction shifts in March 2005. Thisachievement resulted from a dedicated teameffort from management, workers andcontractors as well as meticulous adherence togood safety practices. It is with regret that thecompany reports the loss <strong>of</strong> two lives in separateaccidents that occurred in the 2006 financial year.One <strong>of</strong> the two fatalities resulted from a vehicleaccident that occurred in October 2005, and theother involved a diving supervisor who lost his lifeafter an underwater incident whilst conductingdiving operations in January 2006. The reportedLost Time Injury (LTIFR) and Reportable Injury(RIFR) Frequency Rates for the 2006 financialyear are 1.13 and 0.98 respectively. This is animprovement when compared to 2005 LTIFR andRIFR <strong>of</strong> 1.27 and 1.11 respectively. The safety andhealth <strong>of</strong> our employees remain a high priorityand management is committed to improving theprevious financial year’s performance in 2007.ALEXKOR LIMITEDannual report 20069

T4IB00583_<strong>Alexkor</strong>_AR06 _page10_Eng_13/10/06_Pro<strong>of</strong> 9Review <strong>of</strong> Financial PerformanceREVIEW<strong>of</strong> FinancialPerformanceand OperationsRevenue<strong>Alexkor</strong>’s consolidated income for the 2006financial year was R159.4 million (2005:R152.4 million) against a budget <strong>of</strong> R289.7 million.The shortfall was largely as a result <strong>of</strong> lowerdiamond production from the mining operations.The company’s revenue stream is broken down intoincome from ABM <strong>of</strong> R139.0 million, R13.9 millionfrom ABT and R6.5 million from the non-strategicassets.Net Operating Pr<strong>of</strong>it/LossTotal costs for the period under review wereR197.6 million compared to R151.8 million in2005 with the latter being for a period <strong>of</strong> onlynine months. The net operating loss for theperiod under review is R38.1 million (2005:R1.5 million pr<strong>of</strong>it). This is further broken downinto a loss attributable to mining operations <strong>of</strong>R27.3 million and the balance <strong>of</strong> R10.8 millionloss related to the non-strategic assets i.e. ABT,town maintenance and the running <strong>of</strong> thehospital. The company had budgeted for anoperating pr<strong>of</strong>it <strong>of</strong> R24.4 million.<strong>Alexkor</strong> did not account for any amount to bepaid to SARS on normal income tax as thecompany expects to still make a loss in the currentfinancial year.Non-cash AdjustmentsTwo major adjustments were made on the2006 Annual Financial Statements amounting toR171.3 million, namely:• Restating <strong>of</strong> the rehabilitation liability in linewith the IFRS requirements by an amount <strong>of</strong>R160.0 million (2005: R642 135) based onthe estimate conducted by an independentenvironmental management consultant. Thestudy conducted estimates the current liabilityto be R193.0 million. This adjustment hasresulted in an increase in the rehabilitationprovision from R22.3 million to R178.8 million.• Provision for post-retirement medical benefitsincreased by R11.4 million (2005: R10 million) asper the actuarial valuation on 31 March 2006.Balance SheetThe impact <strong>of</strong> the non-cash adjustments amountingto R171.3 million on the balance sheet was <strong>of</strong>fsetby the inclusion <strong>of</strong> revaluation <strong>of</strong> the property, plantand equipment as required by IFRS. The revaluation<strong>of</strong> these assets has resulted in a R409.3 millionincrease in accumulated reserves during FY 2005 (asa comparative adjustment).Capital ExpenditureThe decline in the carat production over the yearscan be associated with the lack <strong>of</strong> meaningfulcapital investment required to expand productioncapacity and revenue growth pr<strong>of</strong>ile. No majorexpansion plans were implemented in the pastwith the exception <strong>of</strong> the R25 million spent in2003 to 2004 on the exploration programme andthe purchase <strong>of</strong> two infield screening plants aswell as two rigid haul trucks. Capital expenditurefor the period under review was R5.8 million, asignificant portion <strong>of</strong> which was spent on aninfield screening plant, the Heyman SecurityScanner, IT equipment and other operatingequipment. The capital expenditure for ABM inthe past five years is depicted in Figure 1.Figure 1: Historical Capital ExpenditureR (million)201510502001Cash Flow2002 2003 2004 2005 2006CapexCapex % on Income14%12%10%Cash outflow from operations <strong>of</strong> R6.5 millionwere derived from normal operating activities asper the income statement and adjustments forchanges in working capital and non-cash flowitems.Cash flow from investing activities <strong>of</strong> R6.1 millionwere mainly as a result <strong>of</strong> capital purchases <strong>of</strong>R5.83 million.During the year none <strong>of</strong> the operations werefinanced from external sources.8%6%4%2%0%10ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page11_Eng_13/10/06_Pro<strong>of</strong> 9Core OperationsAlexander Bay Mining (ABM )The goal <strong>of</strong> ABM’s business plan is to “maximiseshareholder value” through revenues gainedfrom the mining and sale <strong>of</strong> rough diamondssourced from both land and marine operations.The marine operations comprise 75 miningcompanies contracted to deliver diamondiferousgravel to <strong>Alexkor</strong>’s processing plants where thegravel is processed for the recovery <strong>of</strong> diamonds.The land mining operations include <strong>Alexkor</strong>’s ownmining teams, in addition to three contractedmining companies, that extract and deliverdiamondiferous gravel to the processing plants.Income from the sale <strong>of</strong> diamonds wasR129.1 million (2005: R143.3 million) against abudget <strong>of</strong> R217 million. The contribution torevenue from marine operations was R101.6 million(2005: R120.9 million), and the contribution fromland operations was R27.5 million (2005:R22.4 million) – see charts below. ABM’s incomefrom diamond sales was 46% below budget <strong>of</strong>R217 million. This was as a result <strong>of</strong> lower caratproduction <strong>of</strong> 43 207 carats (2005: 49 577 carats)which was 51 046 carats or 54% below thebudgeted carat production. The marine operationscontributed 30 046 carats (2005: 38 454 carats) tothe mine’s production whilst the land operationscontributed 13 161 carats (2005: 11 123 carats).Figure 2: Diamond Revenue and Carat ProductionContributionCt produced (000’s)1201008060402002001 2002 2003 2004 2005 2006ECarat ProducedDiamond Income300250200150100The carat production from marine operations was28 599 carats below target due to adverse seaconditions. Only 34 diving days (2005: 44 days)were available for mining operations as opposedto 55 in the preceding 12 months. The decline inthe number <strong>of</strong> diving days is a continuation <strong>of</strong> atrend established over recent years that hasimpacted on the mine’s ability to maintainhistorical marine carat production levels.500R (million)The carat production from the land operations <strong>of</strong>13 161 carats was 22 447 carats below budget.The bulk <strong>of</strong> the carat shortfall, 19 084 carats,was due to the planned contractor operationsat Witvoorkop and Muisvlak not becomingoperational. The targeted diamond income fromthese operations was R29.3 million whichaccounts for the net shortfall on the landdiamond revenue <strong>of</strong> R29.5 million. The revenuefrom <strong>Alexkor</strong>’s own mining teams wasR6.5 million below target and this was <strong>of</strong>fset byR6.3 million generated by the three land miningcontractors. <strong>Alexkor</strong>’s revenue shortfall wasattributable to lower productivity levels associatedwith mining an inferred resource.Diamond MarketContinued strength in the diamond marketresulted in improved prices received for the mine’srough diamonds in specific size ranges. The pricereceived for the year’s production was US$474per carat which was 21% above target. The pricereceived was lower than the previous year’s price<strong>of</strong> US$522 per carat due to increased productionfrom the south <strong>of</strong> the mine with an associatedsmaller stone size.<strong>Alexkor</strong> changed its marketing strategy at theend <strong>of</strong> the year from selling to a single buyer toselling on the open market through a tenderprocess. Improved prices were realised as a result<strong>of</strong> the change in strategy.The establishment <strong>of</strong> a State Diamond Trader(SDT) in terms <strong>of</strong> the Diamonds Amendment Bill isawaited with interest. The Bill requires producersto sell a proportion <strong>of</strong> their diamond productionto the SDT and the diamond parcel from eachproducer will be evaluated by the State DiamondValuator. The full implications and effect <strong>of</strong> theprovisions <strong>of</strong> the Bill on the local diamondindustry will only become apparent once the Billhas been implemented. At this stage, it is unclearwhat the ramifications will be on fair diamondevaluation and selection <strong>of</strong> the diamond parcel tobe purchased by the SDT.Status <strong>of</strong> Mineral ResourcesA major constraint to the successful operation <strong>of</strong>the mine is the lack <strong>of</strong> a diamond reserve orbankable diamond resource in accordance withALEXKOR LIMITEDannual report 200611

T4IB00583_<strong>Alexkor</strong>_AR06 _page12_Eng_13/10/06_Pro<strong>of</strong> 9REVIEW<strong>of</strong> FinancialPerformanceand Operations(continued)the requirements <strong>of</strong> the South African Code forthe Reporting <strong>of</strong> Mineral Resources and MineralReserves (The SAMREC Code). The current landoperations are extracting a diamond resourcedefined at the inferred level only. The marineoperations are based on a diamondiferousdeposit in which diamond occurrences are tooerratic to adequately define an inferred resource.In order to develop a sound operational plan, adefined ore reserve is required and <strong>Alexkor</strong> hasnot been able to identify any ore reserves fromthe current inferred resource. The currentoperational plan thus has a high level <strong>of</strong>uncertainty regarding the achievement <strong>of</strong> caratand revenue targets.In order to generate a reserve base and to ensurethat the mine operates according to generallyaccepted good practices, a strategic plan basedupon the recapitalisation <strong>of</strong> the mine has beendeveloped with an aim <strong>of</strong> embarking on a majorexploration programme on <strong>Alexkor</strong>’s land and atsea concessions.The exploration programme will focus on drivingthe resource estimates <strong>of</strong> the different miningareas from that <strong>of</strong> an inferred status to that <strong>of</strong> anindicated resource status. This will be followed byTable 1: Diamond Resource at an Inferred Level.a feasibility study conducted to establish theeconomic and mineability <strong>of</strong> the indicatedresource and converting these to a defined orereserve base, at the required level <strong>of</strong> confidence.The status <strong>of</strong> <strong>Alexkor</strong>’s mineral resource andreserve base is as illustrated by the resourcetriangle shown below for the land-basedresources.Figure 3: Resource to ReserveECONOMICVIABILITYRESERVEINDICATEDINCREASING RESOURCECONFIDENCEINFERREDRESOURCE00.33 0.66 1.0 M caratsAlexander Bay Peacock Bay GifkopHolgat North Port Nolloth CliffsHolgat South Kaap Voltas LangpanPerdevlei Rietfontein MuisvlakInferred resource inventory at a cut-<strong>of</strong>f <strong>of</strong> 0.1 cphcThe land resource base <strong>of</strong> ABM is stated inaddition to the SAMREC definitions <strong>of</strong> theclassification <strong>of</strong> diamond reserves and resourcesand is as summarised in Table 1 below:Mine Area Resource Grade Content Stone sizeArea m 2 cts/100 m 2 cts cts/stnAlexander Bay 1 200 000 2.79 35 000 0.5Kaap Voltas 6 500 000 11.75 763 000 0.5Peacock Bay 2 300 000 11.62 267 000 0.5Rietfontein 8 300 000 6.24 518 000 0.3Gifkop 9 500 000 7.92 752 000 0.3Holgat North 1 700 000 5.96 101 000 0.3Holgat South 2 700 000 6.96 188 000 0.3Perdevlei 3 900 000 6.43 250 000 0.3Cliffs 8 200 000 6.04 494 000 0.3Langpan 10 300 000 7.49 771 000 0.2Muisvlak 7 600 000 9.21 699 000 0.3Port Nolloth 4 400 000 4.15 182 000 0.3Totals 66 600 000 7.54 5 020 000 0.3Notes:1. This Resource Statement is based on the Mineralisation Inventory as at 31 August 20042. The Resource Statement is quoted at a cut-<strong>of</strong>f grade <strong>of</strong> 2.1 cphm 3 (which equates to the in situ Breakeven Grade as calculated by<strong>Alexkor</strong> from direct mining costs as at 31 October 2005)3. Since 31 August 2004 the resource has been depleted by an amount <strong>of</strong> 15 000 carats4. Figures quoted are for a bottom cut-<strong>of</strong>f screen size <strong>of</strong> 1.6 mm5. Figures quoted are in situ6. This statement was prepared by P Hollick, an independent consultant and competent person as registered with SACNAS.12ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page13_Eng_13/10/06_Pro<strong>of</strong> 9The SAMREC code states that “an ’inferreddiamond resource’ is that part <strong>of</strong> a diamondresource for which tonnage, grade and averagediamond value can be estimated with a low level<strong>of</strong> confidence. It is inferred from geologicalevidence and assumed but not verified bygeological and/or grade continuity and asufficiently large diamond parcel is not availableto ensure a reasonable representation <strong>of</strong> thediamond assortment. It is based on informationgathered through appropriate techniques fromlocation such as outcrops, trenches, pits, workingand drillholes that may be limited or <strong>of</strong> uncertainquality and reliability.”Insufficient confidence exists in the historicalquality and quantity <strong>of</strong> sampling conducted onABM’s land-inferred resource base to identify aresource at a higher level <strong>of</strong> confidence such asan indicated diamond resource or measureddiamond resource. In the classification <strong>of</strong> adiamond reserve, the SAMREC code states that“a ’diamond reserve’ is the economically mineablematerial derived from a measured and/orindicated diamond resource”. The company hasnot declared an indicated resource or measuredresource, thereby precluding the statement <strong>of</strong> areserve.The planned recapitalisation <strong>of</strong> the miningoperations will allow for the execution <strong>of</strong><strong>Alexkor</strong>’s exploration programme which willincrease the level <strong>of</strong> confidence in the inferredresource to a level that will allow theidentification <strong>of</strong> an indicated diamond resourcefrom which a diamond reserve may be defined.Safety, Health and EnvironmentParagraph on safety stats for the year andstatement on the two fatalitiesThe mining operations are conducted in anenvironmentally-responsible manner in accordancewith the Environmental Management Programme(EMP) Report authorised in 1995 by theDepartment <strong>of</strong> Minerals and Energy (DME). To thisend all efforts are made to minimise the impactsthat any mining activities may have on theenvironment, and to manage any disturbancesthat do occur in such a way that theenvironmental liability <strong>of</strong> the mine is notincreased. In excavating mining sites, a system <strong>of</strong>concurrent rehabilitation is practised wherebyexcavated overburden is immediately used tobackfill historically mined out areas.The historical rehabilitation responsibilities <strong>of</strong> themine have been identified, updated and capturedin a database. Rehabilitation methodologies forthe identified sites have been compiled and a costestimate for their rehabilitation determined. Therehabilitation methodologies and the updatedrehabilitation liability will be submitted to theDepartment <strong>of</strong> Minerals and Energy in the comingyear for approval as amendments to the mine’sEMP. The liability has been estimated byenvironmental consultants, Site Plan Consulting,as R193 million.Asset ProtectionThe vision <strong>of</strong> <strong>Alexkor</strong>’s security department is tominimise the impact <strong>of</strong> illegal diamond buyingand related activities at the mine and surroundingareas, as well as the protection <strong>of</strong> all valuableassets <strong>of</strong> <strong>Alexkor</strong>. Security services at <strong>Alexkor</strong> arecontracted out to Protea Security Services (Pty)Ltd who commenced with operations inAugust 2005 after cancellation <strong>of</strong> the formerCoin Security contract. The relevant securityrequirements were reviewed to ensure propercompliance to the security needs <strong>of</strong> the company.Continuous training and development <strong>of</strong> securitystaff in line with the needs <strong>of</strong> the company areviewed as crucial in areas such as marine and landmining operations. To this end, training courseswere presented to security staff in line with thesecurity requirements for both land and marineoperations.Protection <strong>of</strong> the company’s assets in linewith strategic objectives shall remain a priorityfor <strong>Alexkor</strong>. In order to minimise any potentialdiamond theft, a Heymann full body X-raymachine was installed during the financial yearunder review. This machine performs continuousbody scans on all individuals exiting the miningarea. In addition to this initiative the securitydepartment also introduced security on shoreunits, as well as shallow- and mid-water vessels.<strong>Alexkor</strong>’s security department continues tonurture constructive relationships and cooperationwith the relevant stakeholders in thepolicing and security environment in itsendeavour to combat the flow <strong>of</strong> illegal diamondsin the broader Namaqualand region.ALEXKOR LIMITEDannual report 200613

T4IB00583_<strong>Alexkor</strong>_AR06 _page15_Eng_13/10/06_Pro<strong>of</strong> 9Strategic OutlookManagement’s key focus for 2007 will be todevelop and implement plans aimed at returningthe mine to pr<strong>of</strong>itability. This strategy will requirethe generation <strong>of</strong> a reserve base for the mine, anincrease in production volumes from land, and areduction in ABM’s dependence on unreliablediver-directed mining methods for marine mining.The inferred land-based diamond resource <strong>of</strong> themine <strong>of</strong> 5.9 million carats at an average stonesize <strong>of</strong> 0.34 carats per stone represents anopportunity for the development <strong>of</strong> a significantdiamond mining operation. To realise such anoperation an exploration programme is plannedwith an objective <strong>of</strong> defining a reserve base forthe mine from which a bankable business plancan be developed. The equipment levels andplant infrastructure required for the explorationprogramme will be funded through a recapitalisationprogramme to be motivated inthe coming year. The programme will includegeophysical surveys at sea to identify targets forremote mining.• the opening <strong>of</strong> the south <strong>of</strong> the mine toshore-based units, thereby allowing boatbasedunits to operate in in-shore areas onthose days when sea conditions prevent boatsfrom operating; and• exploring possibilities <strong>of</strong> co-operating withother mining companies to take advantage <strong>of</strong>synergies on land and sea mining operations.The achievement <strong>of</strong> the company’s strategicobjectives, especially regarding increased caratproduction from the land resource base is largelydependent on the extent <strong>of</strong> capital allocationas stated in the company’s recapitalisationrequirements.Production volumes on land are being increasedby bringing to account unutilised mining andplant capacity. This was achieved through theimplementation <strong>of</strong> a three-shift production dayfor the mining and plant operations. Theincreased volumes will increase carat productionand reduce unit-mining costs, thereby increasingthe potential for the pr<strong>of</strong>itable extraction <strong>of</strong> theresource.In order to reduce the mine’s exposure to erraticsea conditions, remote, non-diver-directed miningtechniques are being introduced. The first suchunit commenced production in July 2006.Further initiatives to return the mine to pr<strong>of</strong>itabilityare:• the creation <strong>of</strong> an environment which willallow for increased levels <strong>of</strong> productivityby shallow water contractors. Initiativestaken in this regard include encouraging theamalgamation <strong>of</strong> contracts into a smallernumber <strong>of</strong> enlarged, stronger contracts;ALEXKOR LIMITEDannual report 200615

T4IB00583_<strong>Alexkor</strong>_AR06 _page16_Eng_13/10/06_Pro<strong>of</strong> 9HUMANRESOURCESand SocialDevelopmentHuman ResourcesOver the past few years the Human Resourcesdepartment has reported on trends indevelopments related to good practices beingimplemented at <strong>Alexkor</strong>. The Human Resourcesdepartment validated and expanded its strategicrole in the business. Since 2003, <strong>Alexkor</strong> hascommitted itself to develop various structures andmanagement frameworks to provide and supportthe business with human resources practicesand competencies which add value, therebyimproving the company’s economic performanceand contribution towards social needs.<strong>Alexkor</strong> remains committed to show animprovement in key areas <strong>of</strong> management focusin the following domains:• complying to laws impacting on labour andemployment practices in the Republic <strong>of</strong>South Africa;• improving employee skills through continuousdevelopment and training interventions;• succession planning, attraction and retention<strong>of</strong> talent;• continuing to advance employment equity byrecruiting suitable candidates from previouslydisadvantaged groups; and• creating HIV/AIDS awareness.The Human Resources department is fullycommitted to upholding and implementing thecompany’s vision, mission and values and thedepartment expresses this commitment activelyin its day-to-day management <strong>of</strong> humanresources functions. Operational performanceand benchmarking <strong>of</strong> human resources trends,continue to form an integral part <strong>of</strong> the HumanResources department’s responsibilities.Figure 4: Socio-economic ContributionContribution to EmploymentThe various business activities at <strong>Alexkor</strong> andemployment opportunities over the past threeyears for the main mining activities are depicted inthe following table:Table 2: <strong>Alexkor</strong>’s Business ActivitiesDivision FY 04 FY 05 FY 06Mining 253 264 246Farming 109 106 110Health services 27 27 25Municipal services 33 33 31Temporary (contract) 36 26 39Marine contractors 996 1 117 1 164Other contractors 287 277 236Total 1 741 1 850 1 851As depicted in the table above, the contractorsaccount for high employment opportunities in theGreater Namaqualand District – approximately76% (1 400) <strong>of</strong> the total FY2006 staff strength isattributed to contractor employees. The majorcontracting companies and suppliers <strong>of</strong> <strong>Alexkor</strong>include Barloworld, Engen, Protea SecurityServices, Quality Tyres, Royal Foods Services andSunrise Motor Spares. The majority <strong>of</strong> thesecompanies are black empowered. In addition,<strong>Alexkor</strong> as a responsible corporate citizen,channels social investments into education andtraining, infrastructural development, welfare,arts and culture.FY2005 (R million)0.7FY2006 (R million)0.9Health ServicesMunicipal ServicesSocial Services5.76.47.26.116ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page17_Eng_13/10/06_Pro<strong>of</strong> 9Socio-economic Contributions<strong>Alexkor</strong> also maintains and runs the town <strong>of</strong>Alexander Bay, including the supply <strong>of</strong> water toAlexander Bay and Port Nolloth. It also continuesto provide housing, water and electricity to itsemployees, contractors and other stakeholders atsubsidised rates.Employment Equity (EE)<strong>Alexkor</strong> regards employment equity as a strategicpriority and monitors progress closely in thisregard. Barriers within policies, procedures andprocesses which impede on the enhancement <strong>of</strong>EE and other goals have been eliminated.Table 3: Current Employment Equity statistics <strong>of</strong> <strong>Alexkor</strong>MaleFemaleOccupational Number <strong>of</strong> % <strong>of</strong> DesignatedLevel Incumbents AM CM WM IF CF WF <strong>Group</strong>Top Management 1 1 100Senior Management 5 1 2 1 1 60Pr<strong>of</strong>essionally Qualified 12 3 2 4 1 2 67Skilled 71 23 37 3 8 48Semi-skilled 215 7 141 20 33 14 91Unskilled 97 10 57 30 100Total 401 21 224 63 1 68 24 84AM = African Male CM = Coloured Male WM = White Male IF = Indian Female CF = Coloured Female WF = White FemaleBlack Economic Empowerment<strong>Alexkor</strong> set a target that procurement fromhistorically disadvantaged South Africans (HDSA)must be in excess <strong>of</strong> 25% over a three-yearperiod starting 1 March 2004. For the year ended31 March 2006, <strong>Alexkor</strong> procured goods andservices from BEE companies which includemining contractors, companies providing servicessuch as security, catering and maintenance.The spend on black-empowered companiesaccounted to R91.4 million representing 55% <strong>of</strong>total spending.<strong>Alexkor</strong> continues to strive to serve the communityby awarding new contracts to black-empoweredcompanies. This ensures that contracts reflectcommunity participation and involvement.As a responsible corporate citizen, <strong>Alexkor</strong>continued to focus on female empowerment andcommitted itself to the objectives <strong>of</strong> capacitybuilding to ensure meaningful female participationin the local and mainstream economy, and thealleviation <strong>of</strong> poverty amongst marginalised females.In an endeavour to achieve these objectives capacitybuilding amongst females was streamlined byinitiatives such as the allocation <strong>of</strong> bursaries inmining-related disciplines, the placement <strong>of</strong> femaleson mentorship programmes, the employment <strong>of</strong>females on learnerships in engineering trades andtraining <strong>of</strong> females as earth-moving operators.Further initiatives to ensure female participationin the local economy include awarding shallowwater and land mining concessions to contractorssubject to a female equity ownership. Femaleshareholding in shallow water and land miningconcessions amounts to approximately 17.5%.<strong>Alexkor</strong> also allocated 50% <strong>of</strong> Witvoorkop,one <strong>of</strong> the mining areas within <strong>Alexkor</strong>’s landconcessions, to a women’s empowerment groupcomprising women from the Richtersveld area.HIV/AIDSHIV/AIDS has a direct impact on <strong>Alexkor</strong>, both interms <strong>of</strong> its workforce as well as the communitieswithin which it operates. A prevalence survey wasconducted in April 2003 which indicated aninfection rate <strong>of</strong> 2.8%. Activities and formalmanagement around HIV/AIDS awareness wereidentified, implemented and compounded duringthe review period.ALEXKOR LIMITEDannual report 200617

T4IB00583_<strong>Alexkor</strong>_AR06 _page19_Eng_13/10/06_Pro<strong>of</strong> 9<strong>Alexkor</strong> continued with its bursary programmeduring the review period. Of the six bursariesallocated, five were granted to historicallydisadvantaged candidates from the Richtersveldand the broader Namaqualand region. In so doing,<strong>Alexkor</strong> will ensure employing academicallyqualifiedcandidates from the local communities inmining-related disciplines in future. ABET learnersare in various stages <strong>of</strong> progress ranging from levels2 to 4 in English, Mathematics and Numeracy.A turnaround strategy on the retraining andredeployment <strong>of</strong> non-production staff toproduction teams was launched andimplemented during the review period. Thisstrategic initiative is in line with the strategicobjectives <strong>of</strong> <strong>Alexkor</strong> to ensure optimisation <strong>of</strong>production on the land mining areas. Aftercompletion <strong>of</strong> the retraining and redeployment <strong>of</strong>selected staff, the split in terms <strong>of</strong> production vsnon-production staff changed from 40%production to 60% production staff. This initiativecommenced in January 2006 and was completedat the end <strong>of</strong> March 2006.In an endeavour to optimise production, a threeshiftcontinuous configuration was implementedon land mining and processing departments. Themulti-skilling <strong>of</strong> earth-moving operators in line withthe three-shift configuration was implemented toensure continuity as well as flexibility. This initiativecommenced in February 2006 and is ongoing,until all earth-moving operators are multi-skilled.Intensive training <strong>of</strong> plant processing staff was alsoinitiated in support <strong>of</strong> optimised plant utilisation, inline with the continuous three-shift configurationoperation.Industrial Relations<strong>Alexkor</strong> continues to have a constructiverelationship with the National Union <strong>of</strong>Mineworkers (NUM) and United Association <strong>of</strong>South Africa (UASA). Owing to the good rapportwith the unions, there were no lost-time hours asa result <strong>of</strong> industrial action for the review period.The company continues to engage with organisedlabour on various forums where salaries, conditions<strong>of</strong> employment, training and development,HIV/AIDS, and safety and productivity are discussedcandidly. At these forums common outcomes tothe benefit <strong>of</strong> all are sought. Participative structuresare in place to ensure the ongoing involvement <strong>of</strong>employees and organised labour in formulating<strong>Alexkor</strong>’s policies and procedures.Rigorous industrial relations policies, proceduresand methodologies have been adopted andimplemented, enabling effective management <strong>of</strong>industrial relations.Substantive negotiations for the FY2006 withNUM and UASA were concluded within themandated percentage increase and addressed thesalary disparities as well as normal salaryadjustments.The major components <strong>of</strong> the company’s humanresources strategies are in place and we arepositioned to deliver on the challenges facing<strong>Alexkor</strong> for the FY2007. Through appropriatehuman resources interventions, we contributedto the development <strong>of</strong> innovative solutionsand improved efficiencies in the company’soperations.In an endeavour to improve staff morale andproductivity, as well as to ensure properremuneration <strong>of</strong> our human capital, the companyaddressed the historical salary disparities withinjob levels and specific positions. The underlyingcriteria applied to ascertain anomalies within postlevels was based on the number <strong>of</strong> years <strong>of</strong>experience in the employ <strong>of</strong> the company, years<strong>of</strong> experience in existing positions, post level andthe level <strong>of</strong> responsibility to a particular job inrelation to the same or similar job in another area.ALEXKOR LIMITEDannual report 200619

T4IB00583_<strong>Alexkor</strong>_AR06 _page20_Eng_13/10/06_Pro<strong>of</strong> 9CorporateGOVERNANCEIntroduction<strong>Alexkor</strong> is committed to developing andimproving its corporate governance processesand frameworks in line with the Companies Act,the Public Finance Management Act (PFMA),the King II Code on Corporate Governanceand international best practices. The company isfocusing on a number <strong>of</strong> initiatives to ensure strictadherence and compliance with the dynamic andongoing process <strong>of</strong> corporate governance toachieve fair and ethical trading in a competitivebusiness environment.ShareholdingThe National Government under the auspices <strong>of</strong>the Department <strong>of</strong> Public Enterprises remains<strong>Alexkor</strong>’s sole shareholder.Composition <strong>of</strong> the <strong>Alexkor</strong> BoardThe Board comprises seven directors, six <strong>of</strong> whichare non-executive, the Chief Executive Officerbeing the only executive director.Mzamani Elias Mdaka was appointed as ChiefExecutive Officer on 1 July 2005 after theresignation <strong>of</strong> Dalikhaya Rain Zihlangu on31 March 2005. The shareholder appointed thenew Chief Executive Officer after consultationwith and approval from the <strong>Alexkor</strong> Board. TheChief Executive Officer is responsible for theefficient and effective day-to-day managementand operations <strong>of</strong> <strong>Alexkor</strong>, in accordance withstrategic decisions <strong>of</strong> the Board and theshareholder. The Chief Executive Officer remainsaccountable to the Board.Functions and Responsibilities<strong>of</strong> the BoardThe Board is tasked with ensuring that thecompany and the Chief Executive Officer isprovided with clear strategic direction and in thislight the Board has approved <strong>Alexkor</strong>’s 2007strategic plan.The Board accepts ultimate responsibility for duecompliance with all statutory requirements and itexercises a role in evaluating the performance <strong>of</strong>the Chief Executive Officer and the company. Italso exercises overriding control over the business<strong>of</strong> <strong>Alexkor</strong>.The Board has unlimited access to allinformation, documents, reports and records itmay require in the performance <strong>of</strong> its duties. TheBoard has access to independent externalpr<strong>of</strong>essional advice, if required, at the company’sexpense. Procedures are in place to record directand indirect interests <strong>of</strong> directors and allconflicts or potential conflicts <strong>of</strong> interest aredocumented. The <strong>Alexkor</strong> Board remains fullyaccountable to the shareholder for the control,performance and operations <strong>of</strong> the company.Board meetings are held at least once aquarter and thereafter when the Board deemsnecessary.Schedule <strong>of</strong> Attendance at Board MeetingsDirector 11-May-05 11-Jul-05 26-Sep-05 24-Feb-06 16-Mar-06Mr N Moloi (Chairman) ✓ ✓ ✓ ✓ ✓Mr M Mdaka (CEO) * ✓ ✓ ✓ ✓Mr M van Zyl ✓ ✓ ✓ ✓ ✓Mr J van Deventer ✓ ✓ ✓ ✓ AMr ZR Coetzee ✓ ✓ ✓ ✓ ✓Ms V Mahlati A ✓ ✓ A ✓Dr T Abrahamse A ✓ A A A✓ = Present A = Apologies * = Not yet appointed20ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page21_Eng_13/10/06_Pro<strong>of</strong> 9Directors’ RemunerationThe Remuneration Committee considers theremuneration <strong>of</strong> the non-executive directors andmakes recommendations to the shareholder.The shareholder then decides on the level <strong>of</strong>remuneration for the non-executive directors.The Remuneration Committee evaluates theremuneration <strong>of</strong> the Chief Executive Officer andsenior management and makes its proposals tothe Board. The shareholder and the Board jointlydetermine the remuneration <strong>of</strong> the Chief ExecutiveOfficer, whilst the Board in consultation withthe Chief Executive Officer determines theremuneration <strong>of</strong> senior management. Details <strong>of</strong>remuneration structure appear on page 52.Board CommiteesThe Board has delegated some <strong>of</strong> its responsibilitiesand functions to the following sub-committees:• Audit Committee;• Remuneration Committee,• Rehabilitation Committee;• ABM and ABT Sub-committees; and• Management Committee.The Board is in the process <strong>of</strong> approving the terms<strong>of</strong> reference <strong>of</strong> each <strong>of</strong> these committees. In theinterim, the Board committees operate on clearlyagreedmandates and reporting procedures.There is transparent and full disclosure from theBoard committees to the <strong>Alexkor</strong> Board. TheBoard regularly evaluates the performance <strong>of</strong> thecommittees against their mandated objectives.Audit CommitteeThe Audit Committee comprises the followingmembers:• Mr R Muzariri (Chair <strong>of</strong> Committee)• Mr J van Deventer (Non-executive Director)• Ms X Motswai (External Member)In compliance with the King II Code, none <strong>of</strong> thecommittee members are executive directors. TheAudit Committee is responsible for monitoringthe accuracy <strong>of</strong> the financial reporting system tothe Board and the shareholder and provides acommunicative link between the Board, theexternal and internal auditors.The Audit Committee has adopted draft terms <strong>of</strong>reference, which will be placed before the Boardfor approval in this financial year. The AuditCommittee has no management responsibilities.Other responsibilities <strong>of</strong> the Audit Committeeinclude:– ensuring the proper review and maintenance<strong>of</strong> an effective internal control system;– ensuring risk is properly identified, managedand monitored;– ensuring proper function <strong>of</strong> the internal auditsystem;– considering and reviewing the audit plan fromthe external and internal auditors; and– ensuring that the internal and external auditfunctions remain separate.Risk ManagementThe Audit Committee is also responsible for theactive monitoring and reviewing <strong>of</strong> <strong>Alexkor</strong>’s riskmanagement process and other significant risk inthe company.The committee is in the process <strong>of</strong> developing arisk management programme.Remuneration CommitteeThe Remuneration Committee comprises thefollowing members:• Mr M van Zyl (Chair <strong>of</strong> Committee)• Mr ZR Coetzee (Non-executive Director)• Ms V Mahlati (Non-executive Director)The functions <strong>of</strong> the Remuneration Committeeare to:– determine and advise the Board on<strong>Alexkor</strong>’s executive and senior managementremuneration;– determine fees to be paid to the Board’s nonexecutivedirectors; and– develop and consider criteria necessary tomeasure the performance <strong>of</strong> the ChiefExecutive Officer and senior management.ALEXKOR LIMITEDannual report 200621

T4IB00583_<strong>Alexkor</strong>_AR06 _page22_Eng_13/10/06_Pro<strong>of</strong> 9CorporateGOVERNANCE(continued)Rehabilitation CommitteeThe Rehabilitation Committee comprises thefollowing members:• Dr T Abrahamse (Chair <strong>of</strong> Committee)• Mr ZR Coetzee (Non-executive Director)• Mr ME Mdaka (CEO)The functions <strong>of</strong> this committee are to review andimplement Alekor’s Environmental RehabilitationPolicy and to administer its Rehabilitation TrustFund.ABM and ABT Sub-committeesThese committees currently comprise thefollowing members:ABT Sub-committee:• Mr N Moloi (Chair <strong>of</strong> Committee)• Mr ME Mdaka (CEO)• Mr ZR Coetzee (Non-executive Director)• Dr T Abrahamse (Non-executive Director)• Mr M van Zyl (External Member)ABM Sub-committee:• Mr N Moloi (Chair <strong>of</strong> Committee)• Mr ME Mdaka (CEO)• Mr J van Deventer ( Non-executive Director)• Ms V Mahlati (Non-executive Director)These committees co-ordinate and monitor theeffective use <strong>of</strong> resources to achieve thecompany’s aims.The Company Secretarial FunctionThe Company Secretary, Ms C Singh, wasappointed on 10 July 2006 after the resignation<strong>of</strong> the former Secretary, Mr CL Matthews on28 February 2006.The Company Secretary is fully empowered by theBoard and has the necessary access to all therequired resources to fulfil this function. She isalso the central source <strong>of</strong> information andguidance and is responsible for advising the Boardon matters <strong>of</strong> business ethics and goodgovernance.Code <strong>of</strong> Ethics<strong>Alexkor</strong> subscribes to the highest levels <strong>of</strong>pr<strong>of</strong>essionalism and integrity in conducting all itsbusiness dealings with its stakeholders. <strong>Alexkor</strong>continually strives to reinforce a culture in itspeople <strong>of</strong> openness, honesty and responsibilityin order that the conduct <strong>of</strong> its directors,management and employees are beyondreproach.The Board and the company are committed to acode <strong>of</strong> ethical and moral behaviour encompassing:– Fairness and honesty– Transparency to all stakeholders– No tolerance <strong>of</strong> theft, dishonesty or any form<strong>of</strong> corrupt activity– No conflict <strong>of</strong> interest in any decision or actionaffecting the company<strong>Alexkor</strong> is in the process <strong>of</strong> adopting an <strong>of</strong>ficialpolicy on ethics for active implementation acrossall levels <strong>of</strong> the company. The code will bepresented to the Board for approval during thisfinancial year.Corporate Communication<strong>Alexkor</strong> regularly informs its shareholder, throughmonthly reports and ad-hoc dialogue with DPE<strong>of</strong>ficials, and through the Annual GeneralMeeting on the business <strong>of</strong> the company, in linewith its statutory and regulatory obligations.22ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page23_Eng_13/10/06_Pro<strong>of</strong> 9ALEXKOR LIMITED(REGISTRATION NUMBER 1992/006368/06)The reports and statements set out below comprise the annual financial statements presented to theshareholder:IndexPageApproval and Statement <strong>of</strong> Responsibility 24Company Secretary’s Certificate 24Report <strong>of</strong> the Independent Auditors 25Directors’ Report 27Balance Sheet 30Income Statement 31Statement <strong>of</strong> Changes in Equity 32Cash Flow Statement 33Notes to the Annual Financial Statements 34Annexure A – Disclosure <strong>of</strong> Remuneration 52Annual FinancialSTATEMENTSfor the year ended31 March 2006ALEXKOR LIMITEDannual report 200623

T4IB00583_<strong>Alexkor</strong>_AR06 _page24_Eng_13/10/06_Pro<strong>of</strong> 9APPROVAL andSTATEMENT<strong>of</strong> ResponsibilityThe Board is responsible for the maintenance <strong>of</strong>adequate accounting records and the preparationand integrity <strong>of</strong> the financial statements andrelated information. The external auditors areresponsible for independently auditing andreporting on the fair presentation <strong>of</strong> the financialstatements in conformity with InternationalStandards <strong>of</strong> Auditing.The financial statements have been prepared inaccordance with International Financial ReportingStandards and in the manner required by theCompanies’ Act (No. 61 <strong>of</strong> 1973) and the PublicFinance Management Act (No. 1 <strong>of</strong> 1999).The financial statements that appear on pages 27to 52 were approved by the Board <strong>of</strong> Directorsand signed on its behalf by:N D MoloiChairperson5 October 2006M E MdakaChief Executive OfficerCompanySecretary’sCERTIFICATEI hereby certify that, to the best <strong>of</strong> my knowledgeand belief, <strong>Alexkor</strong> has lodged with the Registrar<strong>of</strong> Companies all such returns as are required <strong>of</strong> itin terms <strong>of</strong> section 268 G(d) <strong>of</strong> the CompaniesAct, 1973, as amended, and that all such returnsare true, correct and up to date.C SinghCompany Secretary24ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page25_Eng_13/10/06_Pro<strong>of</strong> 9Independent Auditors’ Report tothe Minister <strong>of</strong> Public EnterprisesWe have audited the annual financial statements<strong>of</strong> <strong>Alexkor</strong> Limited set out on pages 27 to 52 forthe year ended 31 March 2006. These financialstatements are the responsibility <strong>of</strong> <strong>Alexkor</strong>Limited’s accounting authority. Our responsibilityis to express an opinion on these financialstatements based on our audit.ScopeThe audit was conducted in accordance withInternational Standards on Auditing. ThoseStandards require that we plan and perform theaudit to obtain reasonable assurance aboutwhether the financial statements are free <strong>of</strong>material misstatement. An audit includesexamining, on a test basis, evidence supportingthe amounts and disclosures in the financialstatements. An audit also includes assessing theaccounting principles used and significantestimates made by management, as well asevaluating the overall financial statementpresentation. The audit was also planned andperformed to obtain reasonable assurance thatour duties in terms <strong>of</strong> section 28 <strong>of</strong> the PublicAudit Act, 25 <strong>of</strong> 2004, have been complied with.We believe that our audit provides a reasonablebasis for our opinion.Audit OpinionIn our opinion, the annual financial statementspresent fairly, in all material respects, the financialposition <strong>of</strong> <strong>Alexkor</strong> Limited at 31 March 2006,and the results <strong>of</strong> its operations and its cash flowsfor the year then ended in accordance withInternational Financial Reporting Standards and inthe manner required by the Public FinanceManagement Act, 1 <strong>of</strong> 1999, as amended and bythe Companies Act, 61 <strong>of</strong> 1973 in South Africa.1. Significant uncertainties regardinglitigation1.1 Without qualifying our opinion, wedraw attention to note 16.1 to thefinancial statements. The governmentand the company were unsuccessful indefending a claim by the RichtersveldCommunity for the restitution <strong>of</strong> theland on which the company’s miningoperations are located. The government,the company and the RichtersveldCommunity are currently in the process<strong>of</strong> negotiating the amount and nature <strong>of</strong>the settlement. The ultimate outcome<strong>of</strong> the matter cannot presently bedetermined, and no provision for anyliability that may result has been made inthe financial statements.1.2 We further draw attention to note 16.2 tothe financial statements. The company isthe defendant in a claim regarding thecompensation, if any, to be paid to anothercompany that was previously contracted torun the operations <strong>of</strong> <strong>Alexkor</strong> Limited. Theamount <strong>of</strong> the compensation claimed bythe said other company is disputed by<strong>Alexkor</strong> Limited. The ultimate outcome <strong>of</strong>the matter cannot presently be determined,and no provision for any liability that mayresult has been made in the financialstatements.2. Environmental rehabilitation liabilityWithout qualifying our opinion, we drawattention to note 9.1 to the financialstatements. An independent review <strong>of</strong> theamount <strong>of</strong> the environmental rehabilitationliability was conducted during the year, resultingin a significant adjustment to the provision forenvironmental rehabilitation liability. Thecompany is also in the process <strong>of</strong> updatingits Environmental Management ProgrammeReport for submission to the Department <strong>of</strong>Minerals and Energy. The necessary financialguarantees will only be provided to theDepartment <strong>of</strong> Minerals and Energy oncompletion <strong>of</strong> this process, as required by theMinerals Act and the regulations thereto.3. Going concernWithout qualifying our opinion, we drawattention to note 22 to the financialstatements. A funding programme wasdeveloped in support <strong>of</strong> the company’sinitiatives to improve production levels andREPORT<strong>of</strong> theIndependentAuditorsALEXKOR LIMITEDannual report 200625

T4IB00583_<strong>Alexkor</strong>_AR06 _page26_Eng_13/10/06_Pro<strong>of</strong> 9REPORT<strong>of</strong> theIndependentAuditor(continued)was submitted to the shareholder as part <strong>of</strong>the Medium-Term Expenditure Frameworkprocess in the form <strong>of</strong> recapitalisation.However, due to uncertainties relating to theRichtersveld Community land claims case,recapitalisation has not yet been effected.The Board <strong>of</strong> directors is also activelyengaging all relevant stakeholders to ensurethat sufficient funding is made available forbridging finance purposes. The Board hasa positive outlook on either successfullyobtaining sufficient shareholder capital oranother form <strong>of</strong> government support.These conditions and the fact that thecompany incurred a loss <strong>of</strong> R205.5 millionindicate the existence <strong>of</strong> a materialuncertainty that casts significant doubt onthe company’s ability to continue as a goingconcern.4. Internal control mattersThe company’s fixed assets managementpolicies are not adequate to ensure properrecording, accounting and safeguarding <strong>of</strong>fixed assets. Several instances were identifiedwhere the company’s fixed assets were eithernot accounted for in the accounting records,or not correctly recorded or not available forphysical inspection.Gobodo IncorporatedRegistered AuditorsPer MP MainganyaDirectorGobodo Inc.1st Floor, Block BEmpire Park55 Empire RoadJohannesburg200112 October 200626ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page27_Eng_13/10/06_Pro<strong>of</strong> 9The Board <strong>of</strong> Directors have pleasure inpresenting their report, which forms part <strong>of</strong> theaudited financial statements <strong>of</strong> the company, forthe financial year ended 31 March 2006. Thisreport and the audited financial statementscomply with the requirements <strong>of</strong> the PublicFinance Management Act No. 1 <strong>of</strong> 1999. Inpromoting the concepts <strong>of</strong> corporate governance,the Directors have included additionalinformation about the company’s strategicobjectives.Background<strong>Alexkor</strong> came into being in 1928 as “StaatsAlluviale Delwerye”. This name remained thesame until 1 May 1989 when the mine becamecommercialised and thus the name changed tothe Alexander Bay Development Corporation(ALEXKOR). The structure remained in place untilNovember 1992 when the corporation became acompany. This structure has since remained thesame. The Government <strong>of</strong> the Republic <strong>of</strong> SouthAfrica, through the Department <strong>of</strong> PublicEnterprises, holds all shares in the company.Nature <strong>of</strong> BusinessThe main business <strong>of</strong> the company is theeconomic exploitation <strong>of</strong> diamonds andassociated support elements. Its ancillary businessincludes diversified agricultural operations andcommercial services to the local and surroundingcommunities.Board <strong>of</strong> DirectorsThe Board meets at least quarterly and retains fulland effective control over the company’s businessand monitors executive management througha structured approach to reporting andaccountability.All Directors receive regular information about thecompany in order to equip them to activelyparticipate in Board meetings. Members <strong>of</strong> theBoard also have access to management and theCompany Secretary for any further informationthey require. None <strong>of</strong> the current Directors haveany interest in the share capital <strong>of</strong> the company,or any contracts entered into by the company, asdisclosed by the statutory records <strong>of</strong> the companyand representations made to the company.Additional details <strong>of</strong> the Board’s sub-committees,Directors’ membership to the sub-committeesand schedule <strong>of</strong> attendance at Board meetings iscontained in the Corporate Governance section<strong>of</strong> the Annual Report. Disclosure <strong>of</strong> remunerationin terms <strong>of</strong> section 55 <strong>of</strong> the PFMA and TreasuryRegulation 28.1.1 is provided in Annexure A onpage 52.Share CapitalThere has been no change in the authorised andissued shares for the period under review. Details<strong>of</strong> the authorised and issued share capital aredisclosed in note 8 <strong>of</strong> the financial statements.ShareholderThe Government <strong>of</strong> the Republic <strong>of</strong> South Africa,through the Department <strong>of</strong> Public Enterprises, isthe sole shareholder.Financial ResultsThe annual financial statements on pages 30 to52 reflect the financial performance, positionand cash flow results <strong>of</strong> the company’s operationsfor the 12 months ended 31 March 2006. Thecomparative financial performance and cash flowresults represents a nine-month period.Total costs for the period under review wereR197.6 million compared to R151.8 million in2005 with the latter being for a period <strong>of</strong> onlynine months. The net operating loss for theperiod under review is R38.2 million against abudgeted operating pr<strong>of</strong>it <strong>of</strong> R24.4 million (2005:R1.5 million pr<strong>of</strong>it). A further breakdown <strong>of</strong> thebusiness units is provided in note 23 <strong>of</strong> the annualfinancial statements.Two major non-cash adjustments are included innet loss <strong>of</strong> R205.5 million (2005: R5.96 million)and related to:• Restating <strong>of</strong> the rehabilitation liability in linewith the IFRS requirements by an amount<strong>of</strong> R159.9 million (2005: R22.3 million)based on the estimates conducted by anindependent environmental managementconsultant. The study conducted estimatethe current liability to be R193.0 million.This adjustment has resulted in an increase inthe rehabilitation provision from R22.3 millionto R178.8 million.• Provision for post-retirement medical benefitsincreased by R11.4 million (2005: R10 million)as per the actuarial valuation completed byindependent actuary on 31 March 2006.DividendsNo dividends have been paid, proposed ordeclared during the period under review.Accounting Framework ChangesThe Board <strong>of</strong> Directors elected to adoptInternational Financial Reporting Standards(“IFRS”) with effect from 1 April 2005. Thefinancial statements have been prepared inaccordance with IFRS (with the date <strong>of</strong> transitionfor the company being 1 July 2004).Directors’REPORTALEXKOR LIMITEDannual report 200627

T4IB00583_<strong>Alexkor</strong>_AR06 _page28_Eng_13/10/06_Pro<strong>of</strong> 9Directors’REPORT(continued)In terms <strong>of</strong> IFRS 1 – First-time Adoption <strong>of</strong>International Financial Reporting Standards, thecompany has restated its opening reserves at1 July 2004, the balance sheets as at 1 July 2004and 31 March 2005 as well as income statementfor the year ended 31 March 2005. There havebeen no adjustments to the cash flows previouslyreported as a result <strong>of</strong> the adoption <strong>of</strong> IFRS.The impact <strong>of</strong> the conversion to IFRS as well asdetails on the key assumptions used arecontained in notes 19 and 20 <strong>of</strong> the financialstatements.Internal ControlThe Board is responsible for the company’s system<strong>of</strong> internal financial control. These are designed toprovide reasonable, but not absolute, assuranceas to the reliability <strong>of</strong> the financial statements,and to adequately safeguard, verify and maintainaccountability <strong>of</strong> assets, and to prevent anddetect misstatements and losses.The internal audit function is outsourced andprovides an independent appraisal functiondesigned to examine and evaluate the company’sactivities. In particular, internal audit is chargedwith examining and evaluating the effectiveness<strong>of</strong> the company’s operational activities in light <strong>of</strong>the attendant business risks and the system <strong>of</strong>internal operation and financial controls. Anymajor weaknesses detected are brought to theattention <strong>of</strong> the Audit Committee, the externalauditors and management for their considerationand remedial action.It has come to the attention <strong>of</strong> the Board that theinternal control environment to ensure properrecording, accounting and safeguarding <strong>of</strong> fixedassets is not adequate. This internal controldeficiency mainly relates to an inadequate fixedasset register and information managementtechnology which is outdated and not meetinguser specifications. Management is currentlyaddressing the weaknesses identified.Shareholder’s CompactNo shareholder’s compact has been signedbetween the Board and the Executive Authorityfor the period under review. The performanceinformation and other criteria as required bysection 55(2) <strong>of</strong> the PFMA have therefore notbeen reported.However, at the time <strong>of</strong> compiling this report theBoard and the Executive Authority werenegotiating a shareholder’s compact for the2006/07 financial year, which will include keyperformance areas and targets.Litigation StatementNaberaThe company is defending a claim by NaberaMining, a company previously engaged by theshareholder to run the operations <strong>of</strong> thecompany. The amount <strong>of</strong> the value added byNabera Mining in terms <strong>of</strong> the managementagreement is disputed by the company. Inconsultation with the company’s legalrepresentatives, no provision has been made inthe financial statements for the above potentialliability.Richtersveld CommunityAs previously reported, the RichtersveldCommunity has successfully instituted a landclaim against <strong>Alexkor</strong> and the Government <strong>of</strong> theRepublic <strong>of</strong> South Africa in respect <strong>of</strong> the subjectland which is currently owned by <strong>Alexkor</strong>. On14 October 2003, the Constitutional Court heldthat the Community is entitled to restitution <strong>of</strong>the land. The matter was then referred back tothe Land Claims Court to determine what formrestitution should take. Restitution can take theform <strong>of</strong> restoration (i.e. the return) <strong>of</strong> the land, orequitable redress or a combination <strong>of</strong> both.In order to determine restitution, the Land ClaimsCourt has heard evidence over April/May 2005 aswell as October/November 2005, whereafterthe parties decided to enter into settlementnegotiations. At the time <strong>of</strong> writing this report,the parties had signed a Memorandum <strong>of</strong>Understanding, but due to the complexity <strong>of</strong> thematter and the wide ambit <strong>of</strong> the various mattersagreed to in principle, various issues still requirenegotiation and agreement. If the parties cannotcome to an agreement on these issues, the mattermay be referred back to the Land Claims Courtfor final determination.Environmental MattersAs stated in the Corporate Governance section<strong>of</strong> the Annual Report, environmental mattersare overseen by an environmental sub-committee<strong>of</strong> the Board. The Environmental Committeecontinuously reviews the environmentaloperations and policies <strong>of</strong> the company andrecommends mitigating strategies and activitiesto limit the impact <strong>of</strong> mining operations on theenvironment as well as to actively addresshistorical damage.A recent study conducted by an independentenvironmental management consultant estimatesthe current liability to be R193.0 million (2005:R22.3 million). The rehabilitation liability wastherefore restated during the period under reviewin line with IFRS by an amount <strong>of</strong> R170.7 million(including inflationary adjustment for previous28ALEXKOR LIMITEDannual report 2006

T4IB00583_<strong>Alexkor</strong>_AR06 _page29_Eng_13/10/06_Pro<strong>of</strong> 9provisions). The carrying amount <strong>of</strong> the provisionas per note 9 <strong>of</strong> the financial statements amountsto R178.8 million and includes the funds held inthe Environmental Rehabilitation Trust Fund.The company is in the process <strong>of</strong> updating itsEnvironmental Management Programme forfuture submission to the Department <strong>of</strong> Mineralsand Energy for approval. Contributions to theEnvironmental Rehabilitation Trust Fund will beadjusted accordingly and necessary guaranteesprovided.Events after Balance Sheet DateThree-shift Land-mining ConfigurationIn order to optimally utilise the mine’s plantcapacity and improve carat production a threeshiftmining configuration was implementedduring May 2006. In essence, land-miningactivities now operate 24 hours a day (except overweekends) comprising <strong>of</strong> three shifts <strong>of</strong> eighthours each. Available human resource capacitywas utilised to configure the three shifts throughappropriate retraining initiatives.As the land-mining equipment is utilised threetimes more than the previous period beforeMay 2006, faster depreciation rates will beapplied during the 2006/07 financial year toaccount for the reduction in life expectancy.As this aspect is treated as a non-adjusting eventafter the balance sheet date in terms <strong>of</strong> IAS 10 –Events after the Balance Sheet Date, noadjustments have been made to the financialstatements.Marine OperationsAs mentioned in the operational reports, diverdirectedmarine operations and resultant caratproduction for the 2005/06 financial year washampered due to a reduction in available seadays. At the date <strong>of</strong> compiling this report,available sea days reduced even more afterbalance sheet date due to unfavourable weatherand sea conditions.As this aspect is treated as a non-adjusting eventafter the balance sheet date in terms <strong>of</strong> IAS 10 –Events after the Balance Sheet Date, noadjustments have been made to the financialstatements.Going ConcernThe Board’s 2006/07 Corporate Plan highlighted anumber <strong>of</strong> initiatives to improve production levelson land as well as marine-mining activities. Theseinitiatives included, inter alia:• a three-shift land-mining configuration asmentioned above;• replacement <strong>of</strong> old and ailing land-miningequipment;• an immediate exploration programme toidentify economical mining reserves in orderto develop an appropriate mining plan;• introducing remote-mining techniques forshallow- to mid-water marine operationsthrough contract assignments; and• Initiating a dredger project in support <strong>of</strong> midtodeep-water marine operations.In addition, a funding programme was developedin support <strong>of</strong> the initiatives and submitted tothe shareholder as part <strong>of</strong> the MediumtermExpenditure Framework process in theform <strong>of</strong> recapitalisation. However, due to theuncertainties relating to the RichtersveldCommunity land claims case, recapitalisation hasnot yet been effected.Although land-mining carat production showedmajor improvements from previous periods due tothe implementation <strong>of</strong> the three-shift miningconfiguration, these improvements were notsufficient to <strong>of</strong>fset the impact <strong>of</strong> the reductionin sea days on marine carat production. The2006/07 carat-production targets are thereforenot being met, to such an extent that the year-todateoperating losses diminished the cashreserves to very low levels.The Board is also actively engaging all relevantstakeholders to ensure that sufficient funding bemade available for bridging purposes and has apositive outlook on either successfully obtainingsufficient shareholder capital or another form <strong>of</strong>government-supported finance.The financial statements have therefore beenprepared on the going concern basis, since theBoard has every reason to believe that thecompany will have adequate resources in place tocontinue with operations for the foreseeablefuture.Public Finance Management ActExcept for the matters noted above, no othermaterial non-compliance to the Public FinanceManagement Act has been identified and/orreported.N D MoloiChairpersonM E MdakaChief Executive OfficerALEXKOR LIMITEDannual report 200629