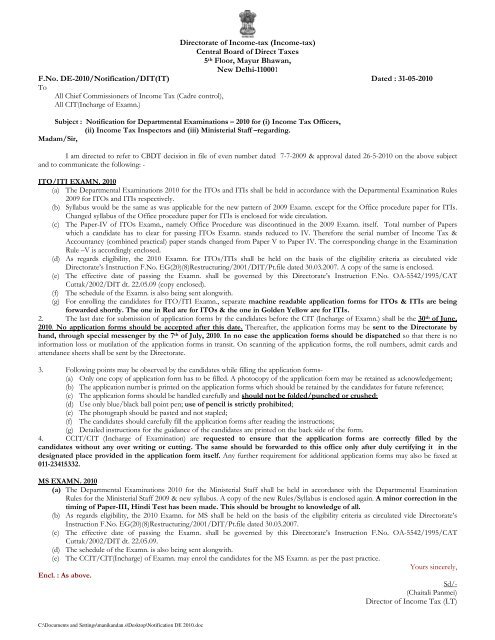

Notification - Income Tax Department

Notification - Income Tax Department

Notification - Income Tax Department

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Inspectors’ Exam, 2010In the Rule V of DEPARTMENTAL EXAMINATION RULES FOR INCOME TAX INSPECTORS – 2009the name of paper IV “Office Procedure (<strong>Income</strong> tax)” (without books) (objective type) stands changed to “Office Procedure(without books) (objective type) and its syllabus for 2010 and subsequent examinations stands modified as under :Paper IV : Office Procedure(Objective Type without books)-----------------------------------------------------------------------------------------------------------------------------------------------Duration : 2 hours Max. Marks : 100-----------------------------------------------------------------------------------------------------------------------------------------------(100 multiple choice questions of one marks each ; 1/8 mark to be deducted for every incorrect attempt)Part (A)(a) Important definitions of Fundamental Rules.(b) Travelling allowance and joining time.(c) Financial powers.(d) Government servents conduct rules.(e) Classification, control and Appeal Rules.(f) Medical Attendance Rules.(g) Home Travel Concession(h) Children’s Education Allowance.(i) House Rent provisions.(j) Revised Leave Rules(k) Pension, Gratuity and Family Pension Provisions.(l) General Provident Fund Rules.(m) Preparation and maintenance of cash book.(n) Contingent Registers.(o) Pay bills of Gazetted and non-Gazetted officers.(50 Marks)Part (B)(i) Registers prescribed for an <strong>Income</strong> <strong>Tax</strong> Office, their use purposes.(ii) Procedure regarding issue of notices, including summons, under different sections of the <strong>Income</strong> <strong>Tax</strong> Act,1961(iii) In-depth understanding of procedures of collection and Recovery of <strong>Tax</strong>es under the <strong>Income</strong> <strong>Tax</strong> Act, 1961(iv) Procedure regarding granting of refunds.(v) Periodical statistical reports.(vi) Expenditure and Revenue Budget.(vii) In-depth understanding of procedures of search & seizure & survey under the <strong>Income</strong> <strong>Tax</strong> Act.(viii) Procedure regarding Appeals and Revision.(ix) Internal Audit & Revenue Audit.(x) Central action plan & scrutiny guidelines issued by the CBDT from time to time relevant to the financial yearimmediately preceding the financial year in which the examination is being conducted.(xi) Procedure for reopening assessments under the <strong>Income</strong> <strong>Tax</strong> Act. And Wealth <strong>Tax</strong> Act.(xii) Time limitations for finalization of assessments and penalty proceedings under the <strong>Income</strong> <strong>Tax</strong> Act andwealth Act.(xiii) Procedure regarding write-off of <strong>Tax</strong>es.(50 Marks)C:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

C:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

C:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

DEPARTMENTAL EXAMINATION RULES FOR MINISTERIAL STAFF – 2009(Effective from Exam. 2010 onwards)INTRODUCTIONThese rules may be called the <strong>Department</strong>al Examination Rules for MINISTERIAL STAFF, 2009. These ruleswill be applicable for the <strong>Department</strong>al Examination for the calendar year 2010 and subsequent years.RULES-I : AUTHORITY AND PERIODICITYA <strong>Department</strong>al Examination for Ministerial Staff will be held by the Directorate of <strong>Income</strong> <strong>Tax</strong> (<strong>Income</strong> <strong>Tax</strong>)on behalf of the Central Board of Direct <strong>Tax</strong>es, New Delhi once a year, preferably in the first half of the calendaryear. This is, however, subject to change at the discretion of the Director of <strong>Income</strong> <strong>Tax</strong> (IT). The Director of<strong>Income</strong> <strong>Tax</strong> (IT) will notify the exact dates of examination and fix the time table, well in advance of the examination.RULE-II : CIT - INCHARGE OF EXAMINATIONA Commissioner of <strong>Income</strong> <strong>Tax</strong> nominated by the Chief Commissioner of <strong>Income</strong> <strong>Tax</strong> (Cadre Control) shall beresponsible for the proper conduct of the <strong>Department</strong>al Examination for Ministerial Staff in that Region/Charge. TheChief Commissioner of <strong>Income</strong> <strong>Tax</strong> shall authorise the Commissioner of <strong>Income</strong> <strong>Tax</strong> so nominated :(a) to receive applications from the candidates appearing in the examination in the prescribed proforma providein Rule-XI of these Rules;(b) to intimate to the Director of <strong>Income</strong> <strong>Tax</strong> (IT) the requirement of question papers;(c) to furnish all statement that have a bearing on the conduct of the examination in the form as prescribed byDIT(IT) from time to time;(d) to make all arrangements for the proper conduct of the examination and declaration of results thereofincluding allotment of Roll numbers, distribution of question papers, prescribing the procedure in theExamn. Hall etc.(e) to perform such other essential functions not covered by Sub-Rules II(a) to II(d) as may be deemednecessary by the DIT (IT).RULE-III : ELIGIBILITYEligibilty of the candidates to appear in the <strong>Department</strong>al Examination for Ministerial Staff shall be determinedby the DIT(IT) from time to time after approval from the Chairman, CBDT.RULE-IV : CHANCES PERMISSIBLE AND AGE LIMIT(a) A maximum of 10 number of chances may be availed of by a candidate;(b) There shall be no bar on age limit for appearing in the <strong>Department</strong>al Examn.EXPLANATION : In the calculation of maximum number of ten chances the chances availed by the candidatesprior to the 2010 Examn. shall not be taken into account.RULE-V : SUBJECTS OF THE EXAMINATION(a) The <strong>Department</strong>al Examination for Ministerial Staff will be in the following subjects as per syllabus given in theappendix :Paperno.SUBJECT Type MaximumMarks1. Precis Writing & Drafting & Computer Basics (Without Subjective 100books)2. Office Procedure (FR, SR, GFR etc.) & Calculation of Subjective 100<strong>Income</strong>-tax (With Books)3. Hindi Subjective 100(b) Paper No. 1 shall be of 2 hrs. duration; Paper no. 2 shall be of 3 hrs. duration and paper no. 3 shall be of 1 hr.duration.(c) Those who have qualified in Hindi paper in the matriculation, its equivalent or any higher Examn. will beexempted from passing the Hindi paper in this Examn.RULE-VI : PASS PERCENTAGEC:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

(a) A candidate will be declared to have completely passed the <strong>Department</strong>al Examination for MS if he secures aminimum of 40% (35% in the case of SC/ST candidate) in each of the subjects referred to in Rule V aboveand 40% marks in aggregate (35% in the case of SC/ST candidate).(b) A candidate who has secured 40% (35% in the case of SC/ST candidate) or more marks in a particularsubject or subjects in one examination will be exempted from appearing in that subject or those subjects inthe subsequent examination.(c) Marks in any paper being a fraction like ¼, ½, ¾ shall be rounded off to the nearest whole number i.e. 39¼shall be rounded of to 39; 39½ & 39¾ shall be rounded off to 40;RULE-VII : TREATMENT OF CANDIDATE USING UNFAIR MEANSA candidate who is or has been found to be indulging in any one or more of the following :i. Obtaining support for his candidature by any means;ii. Impersonating;iii. Procuring impersonation by any person;iv. Submitting fabricated document or documents which have been tampered with;v. Making statements which are incorrect or false : suppressing material information;vi. Resorting to any other irregularity or any other improper means in connection with his or her candidature forthe examination or in connection with the result of the Examination;vii. Using unfair means in the examination hall;viii. Misbehaving in the examination hall in any manner andix. Attempting to commit or as the case may be to abet in the commission of all or any of the acts specified in theforegoing clauses.may, in addition to rendering himself liable to criminal prosecution and disciplinary action under the appropriate rules,will be liable to any one or more of the following penalties :(a) to be disqualified by the Competent Authority from the examination for which he is a candidate and bedeclared as failed obtaining Zero marks in all the papers in which he appeared in that Examination.(b) to be debarred either permanently or for a specified period by the Competent Authority.(c) to be given an adverse entry in the Annual Confidential Report by the Controlling Officer / ReviewingOfficer on the advice of the CIT(Incharge of Examn.).Explanation I : ``Competent Authority’’ shall be the concerned Commissioner of <strong>Income</strong>-tax (Incharge of Examn.).Explanation II : A candidate found in possession of any paper, book, note or any other material, the use ofwhich is not permitted in the examination hall shall be deemed to have used unfair means in the examination hall.Candidates communicating with each other or exchanging calculators, chits, blotting papers etc. (on which somethingis written) shall also be treated to have used unfair means.RULE-VIII : PROCEDURE FOR AWARD OF PUNSIHMENT(a) The Competent Authority shall issue a memorandum to the candidate requiring him to submit his explanationwithin 30 days (which may be extended at the discretion of the Competent Authority in appropriate case forsufficient reasons) of the receipt of the memorandum of charges of which he/she has been found guilty.(b) The Competent Authority shall examine all the material available on record. After making a careful evaluationof the said material on record, if the Competent Authority arrives at the conclusion that the allegation againstcandidate stand proved either wholly or partly, he shall proceed to determine the punishment to be imposedand pass appropriate order in writing.RULE-IX : REVIEWING AUTHORITY(a) A candidate aggrieved by the order of punishment by the Competent Authority under Rule-VIII may within30 days of the receipt of the said order represent to the concerned Chief Commissioner of <strong>Income</strong>-tax (CadreControl) for the review of the punishment order. The Director General (Admn.), New Delhi shall have thepowers to condone the delay in filing of the review petition for a further period of 30 days from the date ofreceipt of the said order of punishment by the candidate.(b) The concerned Chief Commissioner of <strong>Income</strong>-tax (Cadre Control) after going through the facts reported tohim appraising the evidence on record and the representation of the candidate, shall pass appropriate orders inwriting. The order passed by the concerned Chief Commissioner of <strong>Income</strong>-tax (Cadre Control), in respect toall matters connected with the imposition modification or revocation of the punishment shall be final.RULE-X : REVALUATION & REPRESENTATIONC:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

No request under any circumstances shall be entertained for revaluation of answer-scripts. The request forrecounting of marks for the subjective type paper will, however, be entertained, if a representation is submitted by thecandidate to the Commissioner (In-charge of Examination) within 30 days from the date of declaration of the resultby him. The Commissioner of <strong>Income</strong> <strong>Tax</strong> (In-charge of Examination) shall be the final deciding authority in respectof the subjective type paper.RULE-XI : APPLICATION FOR APPEARING IN THE EXAMINATIONThe application for appearing in the examination will be made by the candidate to the Commissioner of <strong>Income</strong><strong>Tax</strong> (Incharge of Examination) in the prescribed format as and when called for, after the declaration of the results forthe preceding year by the CCIT / CIT (Incharge of Examination).RULE-XII : RESULT OF THE CANDIDATESThe result of the examination will be compiled and declared by the Commissioners (Incharge ofExamination). The Commissioner (Incharge of Examination) will announce the same to the candidates showing themarks in each subject. They will declare the names of the candidates who have passed the examination fully and sendthe list of fully successful candidates to the Director of <strong>Income</strong> <strong>Tax</strong> (<strong>Income</strong> <strong>Tax</strong>), Director General of <strong>Income</strong>-tax(Admn.) and the CBDT within 15 days of the declaration of the results.Explanation:(a) Delay in conduct of Examn. or declaration of the results shall not give rise to any rightful claim to theapplicants for being considered for promotion for vacancies of the year by deeming to be eligible as on 1 st ofJanuary of the relevant vacancy year irrespective of when the Examn. is held and when the results aredeclared;(b) No relaxation, whatsoever, would be given to any categories of employees on account of delay in conductingExamn. or declaring the results thereof.C:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

PAPER – I : Precis Writing, Drafting and Computer Basics(Subjective type )-------------------------------------------------------------------------------------------------------------------------------Duration : 2 hours Max. Marks : 100-------------------------------------------------------------------------------------------------------------------------------(A)Precis Writing and DraftingCandidate will be tested in précis writing and drafting letters etc. on subject connected with work in an<strong>Income</strong>-tax Office.[50 Marks](25 Marks each for Precis Writing and Drafting)(B)Computer BasicsTheory• Basics of computer – CPU, monitor, keyboard, mouse, printer• Basics of windows- Creating, copying and renaming files, folders• Basics functions of MS Office• Basics functions of ITD Application modules25 Marks(ii) Practical 25 Marks• Handling of computers – Booting, Shutting Down, priter.• Using Windows – Creating, copying and renaming files folders.• Using MS Word and MS Excel – Creating files, editing and saving.• Data entry in AST• Running Query and generating reports in AST, TAS, AIS and other, if any related programs.***PAPER – II : Office procedure (FR,SR,GFR etc) and calculation of <strong>Income</strong> <strong>Tax</strong>(Subjective type with books)-------------------------------------------------------------------------------------------------------------------------------Duration : 3 hours Max. Marks : 100-------------------------------------------------------------------------------------------------------------------------------(Office Procedure – FR, SR & GFR etc)SECTION –A (50 Marks)(a)Fundamental RulesChapter IIChapter IIIChapter IVChapter XChapter XI- Definition- General conditions and service.- Pay- Leave- Joining Time.(b)Supplementary RulesDivision IIIDivision IVDivision VIDivision VIIDivision XXIIDivision XII-A- Medical certificate of fitness on firstentry into Government service.- Drawal of compensatory allowance.- Travelling Allowances.- Records of service.- Amount of joining time admissible.- Revised Leave Rules.(c) CCS (Revised Pay) Rules 1960.C:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

(d) Delegation of Financial Powers Rules 1978.(e) CCS (Conduct) Rules 1964.(f) Following portion of General Financial Rules 2005Chapter-I Introductory Rule 2 to 6Chapter-II General System ofRule 7 to 14Financial ManagementI. General Principles Rule 21 to 26relating to expenditure &payment of moneyChapter-IIIBudget formulation &ImplementationII. Defalcation & losses Rule 33, 34, 35Rule 42 to 47, 50Control of expenditureagainst budgetRule 52, 55, 58, 60 &61Chapter-IV Government Accounts Rule 65 to 73, 77 to80Personal Deposit Account Rule 88, 89Capital and ExpenditureAccountRule 90 to 96.Chapter-VI Procurement of goods &servicesRule 137, 144, 145,146, 150 to 153, 160,161Chapter-VII Inventory Management Rule 186 to 189, 190,Chapter-XIIList of FormsMisc.196I. Establishment Rule 253 to 268II. Debt and272 to 274miscellaneous obligationof Govt.IV. Security deposits 275 to 277VIII. Destruction of Rule 289 alongwithrecords connected with Appendix -13accountsIX. Contingent & misc.expenditure290 – 993Forms GFR 33, GFR33 (Appendix), GFR40, GFR 41NOTE :The candidate’s general knowledge of the rules and order with which the staff in a Government office should befamiliar will be tested, without going into detailed questions of interpretation and application of rules in complicatedcases.SECTION –B (50 Marks)(Calculation of <strong>Income</strong> <strong>Tax</strong>)1. From given particulars, the candidate will be required to work out income of an assessee under various heads,the total income tax payable therein and to fill in all assessments forms including ITNS- 150, ITNS-15A andITS-7.2. Calculation of deduction and relief Chapter VIA of the <strong>Income</strong> <strong>Tax</strong> Act.3. Filling in statement of carry forward of losses.4. Calculation of refunds and tax deductible at source.5. Calculation of interest chargeable u/s 234A, 234B, 234C, 234D, 201(1A), 220(2)6. and interest payable u/s 244A of the <strong>Income</strong> <strong>Tax</strong> Act.7. Calculation of penalties u/s 271AA. 271B, 271BB, 272A, 271(1)(c) etc.C:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc

PAPER – III : HINDI TEST(Subjective Type)-------------------------------------------------------------------------------------------------------------------------------Duration : 1 hour 30 Minutes Max. Marks : 100-------------------------------------------------------------------------------------------------------------------------------Part-IPart –IITranslation of passage from English to Hindi(a passage about 200 words)(50 marks : 1 hour).Reading of petition and documents written in manuscript in Hindi(20 marks : 15 minutes).Part –III Hindi conversation (30 marks : 15 minutes )NOTE 1Part –I above will be a common paper whereas parts 2 and 3 will beconducted locally at the different centres.NOTE 2 The candidates should be advised to study the following books :-Name of the Publisher(1) Rashtrya Bhasha Indian Press Ltd., Allahabad(2)Hindi Rachana, Part I to IIIDakshina Bharat HindustaniPrachar Sabha, Madras.(3.) Hindi in thirty days Pt. Dulary Lal Bhargava GangaFine Arts Press,Lucknow.C:\Documents and Settings\manikandan.s\Desktop\<strong>Notification</strong> DE 2010.doc