Business Credit Card Application and Agreement - BECU

Business Credit Card Application and Agreement - BECU Business Credit Card Application and Agreement - BECU

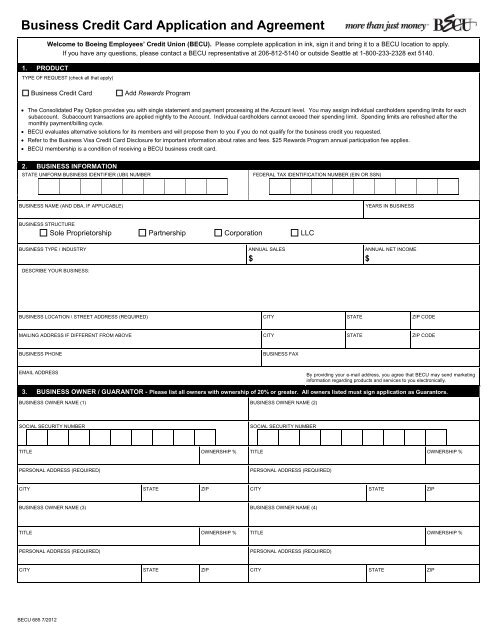

Business Credit Card Application and Agreement1. PRODUCTWelcome to Boeing Employees’ Credit Union (BECU). Please complete application in ink, sign it and bring it to a BECU location to apply.If you have any questions, please contact a BECU representative at 206-812-5140 or outside Seattle at 1-800-233-2328 ext 5140.TYPE OF REQUEST (check all that apply)Business Credit CardAdd Rewards Program The Consolidated Pay Option provides you with single statement and payment processing at the Account level. You may assign individual cardholders spending limits for eachsubaccount. Subaccount transactions are applied nightly to the Account. Individual cardholders cannot exceed their spending limit. Spending limits are refreshed after themonthly payment/billing cycle. BECU evaluates alternative solutions for its members and will propose them to you if you do not qualify for the business credit you requested. Refer to the Business Visa Credit Card Disclosure for important information about rates and fees. $25 Rewards Program annual participation fee applies. BECU membership is a condition of receiving a BECU business credit card.2. BUSINESS INFORMATIONSTATE UNIFORM BUSINESS IDENTIFIER (UBI) NUMBERFEDERAL TAX IDENTIFICATION NUMBER (EIN OR SSN)BUSINESS NAME (AND DBA, IF APPLICABLE)YEARS IN BUSINESSBUSINESS STRUCTURESole Proprietorship Partnership Corporation LLCBUSINESS TYPE / INDUSTRYDESCRIBE YOUR BUSINESS:ANNUAL SALES$ANNUAL NET INCOME$BUSINESS LOCATION \ STREET ADDRESS (REQUIRED) CITY STATE ZIP CODEMAILING ADDRESS IF DIFFERENT FROM ABOVE CITY STATE ZIP CODEBUSINESS PHONEBUSINESS FAXEMAIL ADDRESSBy providing your e-mail address, you agree that BECU may send marketinginformation regarding products and services to you electronically.3. BUSINESS OWNER / GUARANTOR - Please list all owners with ownership of 20% or greater. All owners listed must sign application as Guarantors.BUSINESS OWNER NAME (1) BUSINESS OWNER NAME (2)SOCIAL SECURITY NUMBERSOCIAL SECURITY NUMBERTITLE OWNERSHIP % TITLE OWNERSHIP %PERSONAL ADDRESS (REQUIRED)PERSONAL ADDRESS (REQUIRED)CITY STATE ZIP CITY STATE ZIPBUSINESS OWNER NAME (3) BUSINESS OWNER NAME (4)TITLE OWNERSHIP % TITLE OWNERSHIP %PERSONAL ADDRESS (REQUIRED)PERSONAL ADDRESS (REQUIRED)CITY STATE ZIP CITY STATE ZIPBECU 685 7/2012

- Page 2 and 3: AUTHORIZED CARDHOLDERSIMPORTANT NOT

- Page 4 and 5: BECU Business Credit Card Agreement

- Page 6 and 7: 11 Change in Terms (including Finan

<strong>Business</strong> <strong>Credit</strong> <strong>Card</strong> <strong>Application</strong> <strong>and</strong> <strong>Agreement</strong>1. PRODUCTWelcome to Boeing Employees’ <strong>Credit</strong> Union (<strong>BECU</strong>). Please complete application in ink, sign it <strong>and</strong> bring it to a <strong>BECU</strong> location to apply.If you have any questions, please contact a <strong>BECU</strong> representative at 206-812-5140 or outside Seattle at 1-800-233-2328 ext 5140.TYPE OF REQUEST (check all that apply)<strong>Business</strong> <strong>Credit</strong> <strong>Card</strong>Add Rewards Program The Consolidated Pay Option provides you with single statement <strong>and</strong> payment processing at the Account level. You may assign individual cardholders spending limits for eachsubaccount. Subaccount transactions are applied nightly to the Account. Individual cardholders cannot exceed their spending limit. Spending limits are refreshed after themonthly payment/billing cycle. <strong>BECU</strong> evaluates alternative solutions for its members <strong>and</strong> will propose them to you if you do not qualify for the business credit you requested. Refer to the <strong>Business</strong> Visa <strong>Credit</strong> <strong>Card</strong> Disclosure for important information about rates <strong>and</strong> fees. $25 Rewards Program annual participation fee applies. <strong>BECU</strong> membership is a condition of receiving a <strong>BECU</strong> business credit card.2. BUSINESS INFORMATIONSTATE UNIFORM BUSINESS IDENTIFIER (UBI) NUMBERFEDERAL TAX IDENTIFICATION NUMBER (EIN OR SSN)BUSINESS NAME (AND DBA, IF APPLICABLE)YEARS IN BUSINESSBUSINESS STRUCTURESole Proprietorship Partnership Corporation LLCBUSINESS TYPE / INDUSTRYDESCRIBE YOUR BUSINESS:ANNUAL SALES$ANNUAL NET INCOME$BUSINESS LOCATION \ STREET ADDRESS (REQUIRED) CITY STATE ZIP CODEMAILING ADDRESS IF DIFFERENT FROM ABOVE CITY STATE ZIP CODEBUSINESS PHONEBUSINESS FAXEMAIL ADDRESSBy providing your e-mail address, you agree that <strong>BECU</strong> may send marketinginformation regarding products <strong>and</strong> services to you electronically.3. BUSINESS OWNER / GUARANTOR - Please list all owners with ownership of 20% or greater. All owners listed must sign application as Guarantors.BUSINESS OWNER NAME (1) BUSINESS OWNER NAME (2)SOCIAL SECURITY NUMBERSOCIAL SECURITY NUMBERTITLE OWNERSHIP % TITLE OWNERSHIP %PERSONAL ADDRESS (REQUIRED)PERSONAL ADDRESS (REQUIRED)CITY STATE ZIP CITY STATE ZIPBUSINESS OWNER NAME (3) BUSINESS OWNER NAME (4)TITLE OWNERSHIP % TITLE OWNERSHIP %PERSONAL ADDRESS (REQUIRED)PERSONAL ADDRESS (REQUIRED)CITY STATE ZIP CITY STATE ZIP<strong>BECU</strong> 685 7/2012

AUTHORIZED CARDHOLDERSIMPORTANT NOTE: If approved credit limit differs from the amount you requested <strong>BECU</strong> maintainsthe % allocation between individual cardholders.NUMBER OF CREDIT CARDSREQUESTED#TOTAL REQUESTED CREDIT LIMIT /BUSIINESS$AUTHORIZED CARDHOLDER NAME (1) SOCIAL SECURITY NUMBER DATE OF BIRTH CREDIT LIMIT / CARDHOLDER$AUTHORIZED CARDHOLDER NAME (2) SOCIAL SECURITY NUMBER DATE OF BIRTH CREDIT LIMIT / CARDHOLDER$AUTHORIZED CARDHOLDER NAME (3) SOCIAL SECURITY NUMBER DATE OF BIRTH CREDIT LIMIT / CARDHOLDER$AUTHORIZED CARDHOLDER NAME (4) SOCIAL SECURITY NUMBER DATE OF BIRTH CREDIT LIMIT / CARDHOLDER$AUTHORIZED CARDHOLDER NAME (5) SOCIAL SECURITY NUMBER DATE OF BIRTH CREDIT LIMIT / CARDHOLDER$AUTHORIZED CARDHOLDER NAME (6) SOCIAL SECURITY NUMBER DATE OF BIRTH CREDIT LIMIT / CARDHOLDER$AGREEMENTS <strong>and</strong> SIGNATURESBy signing below you (Guarantor).1. Certify that the information contained herein is complete <strong>and</strong> accurate. You further authorize <strong>BECU</strong> to obtain a consumer credit report <strong>and</strong> a businesscredit report for use in assessing your personal creditworthiness in connection with this application by the <strong>Business</strong> <strong>and</strong> you agree that, as long as thecredit account is open, we may obtain credit reports about you from time to time. You certify that the execution, delivery <strong>and</strong> performance of this<strong>Application</strong> has been authorized by all necessary corporate action by the <strong>Business</strong>. You agree that credit accounts will be used primarily for businesspurposes, <strong>and</strong> not personal, family, or household purposes.2. Guarantee to us the payment <strong>and</strong> performance of each <strong>and</strong> every debt, liability <strong>and</strong> obligation of every type <strong>and</strong> description which the <strong>Business</strong> may oweus, or at any time hereafter owe us, under the <strong>Business</strong> <strong>Credit</strong> <strong>Card</strong> <strong>Agreement</strong> <strong>and</strong> Disclosures (“<strong>Agreement</strong>”), <strong>and</strong> agree to be bound by all terms <strong>and</strong>conditions set out in the <strong>Agreement</strong> as it may be amended from time to time;3. Authorize the issuance of the credit cards to each of the Authorized <strong>Card</strong>holder(s) listed above <strong>and</strong> authorize each <strong>Card</strong>holder to obtain credit under theAccount;4. Affirm that you are an acting officer of the <strong>Business</strong> (Borrower) with the ability to bind the <strong>Business</strong> to the obligations of the <strong>Agreement</strong> so that thebusiness is liable for all balances on all accounts established in the <strong>Business</strong> name;5. Agree that to induce us to lend money or give credit to the Borrower, you (Guarantor) absolutely <strong>and</strong> unconditionally guarantee prompt <strong>and</strong> full paymentof the Account <strong>Credit</strong> Limit you are guaranteeing, shown above, which includes all charges the Borrower <strong>and</strong> <strong>Card</strong>holder(s) place on all cards <strong>and</strong> theAccount, even though doing so may exceed approved credit, plus any Finance Charges, fees <strong>and</strong> all other amounts due us in accordance with the termsof the <strong>Agreement</strong>. You agree to be personally responsible to pay the debt although you may not personally receive any goods, services, or money fromthe advance. We can dem<strong>and</strong> that you pay, even though we do not try to collect from the Borrower <strong>and</strong> without enforcing any security interest theBorrower has given us. The obligations of the Guarantor(s), hereunder is independent of the Borrower’s obligations, <strong>and</strong> as separate action or actionsmay be brought against you on any guaranteed indebtedness. Any payment by you, the Borrower, or any other person shall not reduce your maximumprincipal obligations hereunder. This Guaranty is a Continuing Guaranty. Your Revocation of any <strong>Card</strong>holder’s authorization, including yourauthorization is effective upon receipt of written notice as required in the <strong>Agreement</strong>. Revocation shall be effective at the close of our business day whenthe notice is actually received. Any revocation will be effective only as to <strong>Card</strong>holder’s authorization <strong>and</strong> will not affect your obligation with respect to anyindebtedness existing before such revocation is effective. If you execute more than one guaranty of any indebtedness of the Borrower to the <strong>Credit</strong>Union, the limits of liability with respect to all the guaranties you have executed will be cumulative. You will pay or reimburse the <strong>Credit</strong> Union for allcosts <strong>and</strong> expenses under the terms of the <strong>Agreement</strong> including reasonable attorney fees <strong>and</strong> legal expenses incurred by the <strong>Credit</strong> Union in connectionwith the protection, defense, or enforcement of this guaranty in any litigation, bankruptcy, or insolvency proceedings. You underst<strong>and</strong> that if you leavethe employment of the business, you will continue to be responsible for the outst<strong>and</strong>ing balances of the accounts.You also signify your specific intent to pledge to us <strong>and</strong> to grant us a security interest in all your individual <strong>and</strong> joint <strong>BECU</strong> share <strong>and</strong> depositaccounts you have with us, now or in the future, (excluding retirement or other accounts to the extent that applicable laws precludes the pledge ofsuch account), to secure your <strong>BECU</strong> Account. You authorize us, without notice to you, to apply the balances in these accounts to pay anyamounts due under the Account if you should default.All BUSINESS OWNER / GUARANTOR - All <strong>Business</strong> Owners / Guarantors listed in Section 3 must sign the application belowNAME/GUARANTOR SIGNATURE DATENAME/GUARANTOR SIGNATURE DATENAME/GUARANTOR SIGNATURE DATENAME/GUARANTOR SIGNATURE DATELOCATION REPRESENTATIVE EMPLOYEE #If your application for credit is denied, you have the right to a written statement of the specific reasons for the denial. To obtain this statement, pleasecontact <strong>BECU</strong> Small <strong>Business</strong> Services, P.O. Box 97050 Seattle, WA 98124 or 206-812-5140 within 60 days from the date you are notified of ourdecision. We will send you a written statement of reasons for the denial within 30 days of your request for this statement.<strong>BECU</strong> 685 7/2012

<strong>BECU</strong> <strong>Business</strong> <strong>Credit</strong> <strong>Card</strong> Rates <strong>and</strong> Fees DisclosureANNUAL PERCENTAGE RATE (APR) forPurchases <strong>and</strong> Cash Advances. 10.99%Other APRsDefault APR: Up to the highest rate allowed by law.*Grace period for repayment of Purchase balance.No Finance Charge assessed on new Purchases if the NewBalance is paid in full within 25 days of the close of theprevious billing cycle.Method of computing the balance for Purchases.Average Daily Balance method (including new purchases).Annual Fees.None.Transaction fee for Cash Advances. 2% of advance (up to maximum fee of $10.00).Fees: Overlimit: $25.00, Late Payment: $25.00, Return Check: $25.00. Cash Advances are available for <strong>Business</strong>Principals only.*Default Rate: If your Account is considered in default for any reason, the APR will increase to a fixed rate of up to thehighest allowed by law.Additional Important Information about the <strong>BECU</strong> <strong>Business</strong> <strong>Credit</strong> <strong>Card</strong>The Daily Periodic Rate for Purchases <strong>and</strong> Cash Advances is 0.03011%, which is an ANNUAL PERCENTAGERATE of 10.99%.The information about the costs of the card is accurate as of 1/2008 <strong>and</strong> is subject to change. To find out what mayhave changed, contact the <strong>Credit</strong> Union.<strong>BECU</strong> 618 1/2008

<strong>BECU</strong> <strong>Business</strong> <strong>Credit</strong> <strong>Card</strong> <strong>Agreement</strong> <strong>and</strong> DisclosuresThis <strong>Business</strong> <strong>Credit</strong> <strong>Card</strong> <strong>Agreement</strong> <strong>and</strong> Disclosures (“<strong>Agreement</strong>”) contains the terms <strong>and</strong> conditions that govern your <strong>Business</strong> <strong>Credit</strong> <strong>Card</strong> Account(“<strong>Credit</strong> <strong>Card</strong>”). References to “<strong>Credit</strong> <strong>Card</strong>” below relate to the account (“Account”) associated with the credit card/s <strong>and</strong> not only to transactionsconducted through use of the physical credit card/s itself. It may be supplemented by information in other documents we issue (such as periodic accountbilling statements <strong>and</strong> the materials which accompany new or replacement cards) which we identify as supplementing or making amendments to theterms of this <strong>Agreement</strong>. You automatically accept <strong>and</strong> agree to the terms of this <strong>Agreement</strong> as it may be amended from time to time by making aPurchase, requesting a Balance Transfer, taking a Cash Advance or otherwise using the credit offered or authorizing the use of the Account herein. Youshould read this <strong>Agreement</strong> carefully <strong>and</strong> keep it for your records.1. ResponsibilityIn this <strong>Agreement</strong>, the words “We”, “Us”, “Our” or “<strong>BECU</strong>” means Boeing Employees’ <strong>Credit</strong> Union. “You”, "your” <strong>and</strong> “yours” means each SigningIndividual named on the <strong>Credit</strong> <strong>Card</strong> <strong>and</strong> any other legal entity or person who is contractually liable for, has signed or submitted an application for, hasused or has permitted others to use a <strong>Credit</strong> <strong>Card</strong>. This term also includes the <strong>Business</strong> also known as “Borrower”. “Guarantor” means each person whoguarantees to us the payment <strong>and</strong> performance of each <strong>and</strong> every debt, liability, <strong>and</strong> obligation of every type <strong>and</strong> description which the <strong>Business</strong> mayowe us, or at any time hereafter owe us, under this <strong>Agreement</strong> <strong>and</strong> who authorized the opening of the <strong>Credit</strong> <strong>Card</strong> account <strong>and</strong> the issuance of the <strong>Credit</strong><strong>Card</strong>s to <strong>Card</strong>holders <strong>and</strong> for whom we opened the Account. “<strong>Business</strong>” means the proprietorship, partnership, corporation, limited liability company, orother business entity which is liable to us as Borrower that was identified at the time we opened the Account for the Signing Individual as the entity withrespect to which the Signing Individual will engage in business purpose transactions, <strong>and</strong> its successors <strong>and</strong> assigns. “<strong>Card</strong>holder” means the person(s)authorized by the Signing Individual to obtain credit under the Account, whether named in an application as a <strong>Card</strong>holder or otherwise. By accepting,signing, using, or authorizing the use of any <strong>Credit</strong> <strong>Card</strong> you (a) represent that you are either the sole proprietor or an authorized representative, partner,officer, member, manager, or agent of the <strong>Business</strong> with the authority to legally bind that <strong>Business</strong>; (b) request that an Account be opened for you; (c)request that <strong>Credit</strong> <strong>Card</strong>s be issued on that Account as indicated in the application or any other requests; (d) authorize the receipt, reporting <strong>and</strong>exchange of credit information on the Signing Individual <strong>and</strong> the <strong>Business</strong>; (e) agree to be liable for all charges to the Account as provided in this<strong>Agreement</strong>; (f) agree to be <strong>and</strong> are bound by the terms of this <strong>Agreement</strong> as it may be amended from time to time; (g) represent <strong>and</strong> agree that the<strong>Credit</strong> <strong>Card</strong>s <strong>and</strong> all transactions will be used only for business purposes, including commercial, industrial, professional purposes, <strong>and</strong> will not be usedfor personal, family or household purposes. “New Balance” means the sum of all of the unpaid Purchases, Cash Advances, finance charges, latepayment charges, <strong>and</strong> other charges outst<strong>and</strong>ing on the closing date. “Previous Balance” means the sum of all unpaid Purchases, Cash Advances,finance charges, late payment charges, <strong>and</strong> other charges at the beginning of the billing cycle. “Purchases” mean transactions involving advances otherthan Balance Transfers <strong>and</strong> Cash Advances.2. <strong>Credit</strong> LimitWe will establish a maximum credit limit available for the Master Account. The “Master Account” provides the mechanism for offering single statement<strong>and</strong> payment processing, otherwise known as Consolidated Pay. Consolidated Pay allows one or many Sub Accounts under your Master Account.“SubAccount” means each <strong>Card</strong>holder has an Account number, a <strong>Credit</strong> <strong>Card</strong> <strong>and</strong> a spending limit as controlled by the Master Account. SubAccountspending limits cannot exceed the amount of credit limit offered on the Master Account.The credit limit is specified in the Account acceptance mailer <strong>and</strong> on each periodic billing statement. You agree not to attempt to obtain more credit thanthe amount of your credit limit. If you temporarily exceed your credit limit, you underst<strong>and</strong> such credit does not increase your credit limit <strong>and</strong> youunderst<strong>and</strong> that we can still charge you for all Purchases, Cash Advances <strong>and</strong> other transactions without giving up our rights, we can charge you anoverlimit fee <strong>and</strong> you agree to pay us that excess amount, any over limit fee <strong>and</strong> applicable Finance Charges, immediately. We can increase or decreaseyour credit limit at our discretion. We may suspend or close your credit limit or otherwise terminate your ability to use your Account at any time <strong>and</strong> forany reason. Your obligations under this <strong>Agreement</strong> continue even after we have done this.3. LiabilityThe <strong>Business</strong> <strong>and</strong> the Guarantor, in addition to the <strong>Business</strong>, each promise to pay us all Amounts Due in connection with all <strong>Credit</strong> <strong>Card</strong>s issued to the<strong>Business</strong>, to the Signing Individual <strong>and</strong> to any other <strong>Card</strong>holders, or otherwise requested or charged with respect to the Account. The Guarantor ispersonally liable for such amounts due <strong>and</strong> underst<strong>and</strong>s that “personal liability” means an individual obligation which must be paid byhim/her even if the <strong>Business</strong> becomes insolvent, inactive or ceases to exist or otherwise fails to pay us or he/she discontinues his/heremployment or other connection with the <strong>Business</strong>. The <strong>Business</strong>’s liability <strong>and</strong> the Guarantors personal liability for Amounts Due includes liability forall transactions <strong>and</strong> charges made by anyone whom the <strong>Business</strong>, a <strong>Card</strong>holder or the Guarantor allows to use the Account. We may collect from orbring a legal claim against the Guarantor <strong>and</strong> the <strong>Business</strong>, without giving up any of our rights against any other person or entity. Improper or negligentacts, including acts of omission, with respect to h<strong>and</strong>ling any <strong>Credit</strong> <strong>Card</strong> or Personal Identification Number may result in liability to you <strong>and</strong> the <strong>Business</strong>.Additionally, you may be liable for the loss, theft or unauthorized use of your <strong>Credit</strong> <strong>Card</strong> as well as for losses resulting from negligent actions by you,your agents or authorized <strong>Card</strong>holders.If two or more persons or entities are responsible to pay any outst<strong>and</strong>ing balance, we may refuse to release any of them from liability until all of theunexpired <strong>Credit</strong> <strong>Card</strong>s issued have been returned to us <strong>and</strong>/or the balance is paid in full.4. Lost, Stolen, or Unauthorized Use of Your <strong>Card</strong>You agree to notify us immediately, orally or in writing, of the loss, theft, or unauthorized use of your <strong>Credit</strong> <strong>Card</strong>. We may investigate any cases ofunauthorized use of your <strong>Credit</strong> <strong>Card</strong>. We may terminate or limit access to your <strong>Credit</strong> <strong>Card</strong> if you have notified us or we have determined that your<strong>Credit</strong> <strong>Card</strong> may have been lost or stolen, or that there may be unauthorized access to your <strong>Credit</strong> <strong>Card</strong>. Unless you, your agents or authorized<strong>Card</strong>holders have been negligent or have engaged in improper conduct, you will not be liable for any unauthorized transactions using your lost or stolen<strong>Credit</strong> <strong>Card</strong>. If you are liable for unauthorized transactions, your liability will not exceed $50. However, every <strong>Business</strong> which provides <strong>Credit</strong> <strong>Card</strong>sissued by us to ten (10) or more of its employees, principals or partners, will have unlimited liability for unauthorized use that occurs prior to notification.You will not be liable for unauthorized transactions that occur after you notify us at: <strong>BECU</strong>, P.O. Box 97050, Seattle, WA 98124-9750. Telephone: (206)439-5700 or outside Seattle at 1-800-233-2328 Hours: 7:00 a.m. - 7:00 p.m. PT Monday-Friday; 9:00 a.m. - 1:00 p.m. PT Saturday. After hours: Call 1-800-449-7728. (This number is only for use of reporting the loss, theft, or unauthorized use of your <strong>Credit</strong> <strong>Card</strong>.)5. Purchases <strong>and</strong> Cash AdvancesAny Signing Individual can use the <strong>Credit</strong> <strong>Card</strong> for Purchases <strong>and</strong> Cash Advances. You will owe us for these amounts, plus finance charges, fees <strong>and</strong>other charges. You may not use the <strong>Credit</strong> <strong>Card</strong> for any illegal or unlawful transaction <strong>and</strong> we may decline to authorize any transaction that we believeposes an undue risk of illegality or unlawfulness.<strong>BECU</strong> 6964 7/2012 Page 1 of 4

6. Daily Periodic Rate <strong>and</strong> Annual Percentage RateThe Daily Periodic Rate <strong>and</strong> corresponding ANNUAL PERCENTAGE RATE used to calculate the FINANCE CHARGE is a fixed rate. The Daily PeriodicRate <strong>and</strong> corresponding ANNUAL PERCENTAGE RATE for your Account is stated on the separate Rate <strong>and</strong> Fee Disclosure.a. Default Rate: If your Account is considered in default for any reason <strong>and</strong> your credit privileges terminated, <strong>BECU</strong> reserves the right to change theDaily Periodic Rate used in calculating the FINANCE CHARGE (<strong>and</strong> corresponding Annual Percentage Rate) for Purchases, Cash Advances <strong>and</strong> anyPrevious Balance up to the highest rate allowed by law.7. Finance Chargesa. Purchases: A finance charge will be imposed on purchases included in the new balance when the entire new balance is not paid within 25 days afterthe closing date of the billing cycle. Finance charges will be imposed on purchases made <strong>and</strong>/or outst<strong>and</strong>ing during a billing cycle when you do not payor otherwise satisfy the entire Previous Balance during the first 25 days of the same billing cycle.b. Cash Advances: A finance charge will be imposed on Cash Advances (including Balance Transfers) as follows: (1) On each Cash Advance,excluding Balance Transfers, a Cash Advance Fee (FINANCE CHARGE) of 2% of the amount of the Cash Advance, not to exceed $10.00. (2) Onall Cash Advances, including Balance Transfers, finance charges as described in section 8, regardless of the amount of the Cash Advance, apply fromthe date of the Cash Advance until paid in full.8. How to Determine Finance Chargesa. The types of FINANCE CHARGES that may be assessed on your Account are as follows:Monthly periodic rate finance charges <strong>and</strong> transaction finance charges. Your total FINANCE CHARGES each billing cycle is the sum of each type offinance charges.b. Calculation of Finance Charge:All finance charges for Purchases <strong>and</strong> Cash Advances are added together to calculate the annual percentage rate for each billing cycle.Calculation of Finance Charges for Cash AdvancesA Finance Charge on Cash Advances will be imposed from the date the Cash Advance is posted to your account until paid in full. There is no period inwhich you can pay a Cash Advance in order to avoid incurring a Finance Charge. We calculate the Finance Charge by multiplying the Average DailyBalance by the number of days in the billing cycle <strong>and</strong> then multiplying by the Daily Periodic Rate. We calculate the Average Daily Balance, attributableto Cash Advances by adding the beginning balance of your account each day, add any new Cash Advances <strong>and</strong> new Cash Advance Fees <strong>and</strong> subtractany payments, credits posted to your Account <strong>and</strong> unpaid Finance Charges <strong>and</strong> other charges. Then we add up all the daily balances for the billing cycle<strong>and</strong> divide the total by the number of days in the billing cycle.Calculation of Finance Charges for PurchasesTo avoid incurring additional Finance Charges on the balance of the Purchases reflected on this statement, you must pay the New Balance on or beforethe Payment Due Date. We calculate the Finance Charge by multiplying the Average Daily Balance by the number of days in the billing cycle <strong>and</strong> thenmultiplying by the Daily Periodic Rate. We calculate the Average Daily Balance of Purchases by taking the beginning balance of your account each daythat is attributable to Purchases, add any new Purchases as of the date those charges are posted to your Account <strong>and</strong> subtract any payments, credits,<strong>and</strong> unpaid Finance Charges <strong>and</strong> other charges (unless you have been notified in advance that Return Check Charges will have Finance Chargesassessed). Then we add up all the daily balances for the billing cycle <strong>and</strong> divide the total by the number of days in the billing cycle.9. Other Fees <strong>and</strong> Chargesa. An Overlimit Fee of $25.00 will be assessed when the new balance on the closing exceeds your credit limit.b. A Copy Request Charge of $3.00 may be imposed for copies of each document that you request in connection with this <strong>Credit</strong> <strong>Card</strong>, other than thoseprovided in response to a billing error notice under the Fair <strong>Credit</strong> Billing Act.c. A Late Payment Charge of $25.00 will be imposed on minimum payments not paid by the payment due date.d. A Returned Check Charge of $25.00 will be charged if any check or other instrument given as payment on your <strong>Credit</strong> <strong>Card</strong> is uncollectible or isdishonored for any reason. Unless otherwise required by law, we do not have to attempt to collect any check more than once.e. A <strong>Card</strong> Replacement Fee of $5.00 may be assessed for each <strong>Credit</strong> <strong>Card</strong> lost, stolen or destroyed.f. A <strong>Card</strong> Recovery Fee will be charged <strong>and</strong> added to your balance if: 1) you use your <strong>Credit</strong> <strong>Card</strong> after the <strong>Credit</strong> <strong>Card</strong> has been cancelled, <strong>and</strong> 2) wemust pay a recovery fee to a third party who obtains the <strong>Credit</strong> <strong>Card</strong> for us.g. A Collection Charge will be charged if we must telephone you, write to you, or make a personal visit due to any default on your part.h. A Failed Automatic Payment Charge of $25.00 will be charged if you have elected to make your payment by automatic transfer <strong>and</strong> the funds arenot available in your <strong>BECU</strong> share account on the authorized transfer date.i. Attorneys’ Fees <strong>and</strong> Collection Costs: You agree to pay <strong>BECU</strong>’s internal <strong>and</strong> external costs, collection <strong>and</strong> other expenses such as repossessionfees, expert witnesses, debt collectors, court costs, <strong>and</strong> reasonable attorneys’ fees <strong>and</strong> legal expenses whether or not there is a lawsuit, includingattorneys’ fees in any arbitration or mediation, on appeal, in any bankruptcy (or state receivership or other insolvency proceeding) <strong>and</strong> in any forfeiture orother proceeding. All of these costs <strong>and</strong> expenses may be added to your present debt <strong>and</strong> a finance charge may be imposed on them at the highest rateapplied to any of your credit advances.10. DefaultYou will be in default under this <strong>Agreement</strong> if any of the following happens on the Account: (a) you do not make a payment as required by this <strong>Agreement</strong>on or before the payment due date; (b) you exceed your credit limit without our permission; (c) you become subject to bankruptcy, incompetency orinsolvency proceedings or you die; (d) you make any untrue statements or omissions or provide false signatures on any application or financial statementfurnished to <strong>BECU</strong> or fail to provide us financial information we request; (e) your payment item is returned unsatisfied by your financial institution for anyreason; (f) any credit card check is returned unpaid by us; (g) if we believe (in our sole discretion) that there has been an adverse change in yourfinancial condition; (h) you violate or fail to comply with any term of this <strong>Agreement</strong> or of any other agreement you have with <strong>BECU</strong>;(i) someone tries tolevy, execute upon, or attach any property securing this <strong>Agreement</strong> (including any share or other accounts at <strong>BECU</strong>, but excluding real property); (j) youno longer qualify for <strong>BECU</strong> membership; (k) you become generally unable to pay your debts, or cease doing business as a going concern; (l) wedetermine that you present a risk of future non-payment of your Account obligations,(m) you use, or attempt to use, a <strong>Credit</strong> <strong>Card</strong> or Account for anytransaction by which you purport to purchase goods or services for the <strong>Business</strong> or which, if completed, would constitute fraud or a violation of law, anevent of default or violation of applicable Visa rules, or (n) you breach any other term or condition of this <strong>Agreement</strong>. Upon the occurrence of any event ofdefault under this <strong>Agreement</strong>, <strong>BECU</strong> may charge interest at the highest rate allowed by law, on all Account balances following default <strong>and</strong>/or we have theright to terminate or suspend your credit privileges under this <strong>Agreement</strong>, to change the terms of your Account <strong>and</strong> this <strong>Agreement</strong>, may dem<strong>and</strong> that youimmediately pay the entire unpaid balance. The daily periodic rate, if the rate is increased following a default, shall be the annual percentage rate dividedby the actual number of calendar days in a year. <strong>BECU</strong> may start a collection action in the county in which <strong>BECU</strong> is located or where you reside if youlive outside of Washington. Default on any loan, account or other obligation that you have with us, including loans which are not part of the<strong>Agreement</strong>, will constitute default under this <strong>Agreement</strong>. If any fee or charge, or any portion of any fee or charge, including but not limited to afinance charge or method of computing a finance charge, would but for this sentence be unlawful, the language of this <strong>Agreement</strong> shall be automaticallyreformed to eliminate any excessive or unlawful portion of such fee. In no event shall the fees charged under this agreement exceed the maximumallowed under applicable state or federal law. In its sole discretion, <strong>BECU</strong> may charge <strong>and</strong> collect a lesser amount than that specified in this <strong>Agreement</strong>,or forego any other rights under this <strong>Agreement</strong>. Any waiver of any provision of this <strong>Agreement</strong> shall not be deemed a waiver of such rights in the future.<strong>BECU</strong> 6964 7/2012 Page 2 of 4

11 Change in Terms (including Finance Charges)Subject to applicable law, we may change or terminate any term of this <strong>Agreement</strong> or add new terms at any time, including without limitation adding orincreasing fees, increasing your minimum Periodic Payment <strong>and</strong> increasing the rate or amount of Finance Charge, or changing the method of computingthe balance upon which Finance Charges are assessed. Prior written notice will be provided to you when required by applicable law. Changes may applyto both new <strong>and</strong> outst<strong>and</strong>ing balances. Any notice of change in terms required by law will be sent to the last address appearing on the records of <strong>BECU</strong>,unless you notify us of the change in your address within a reasonable time prior to the notice being sent.12. Periodic StatementsIf you have an outst<strong>and</strong>ing debit or credit balance for a subaccount in excess of $1.00 at the end of a billing cycle, we will send a periodic billingstatement reflecting balances <strong>and</strong> activity in that Account to the <strong>Business</strong> <strong>and</strong>/or the Guarantor(s)at their address(es) shown in our records. We have noobligation to send multiple or duplicate statements. You promise to pay <strong>BECU</strong> the total of all credit advances under the Account, finance charges, <strong>and</strong>other amounts set forth in this <strong>Agreement</strong> on the payment terms set forth in this <strong>Agreement</strong> below.13. Security InterestYou grant the following applicable security interests for amounts outst<strong>and</strong>ing from time to time in connection with the <strong>Credit</strong> <strong>Card</strong>:a. Deposit Account: We have a statutory lien against all of your shares <strong>and</strong>/or deposits at <strong>BECU</strong> that you may withdraw unless you are in default.By applying <strong>and</strong> accepting this Account, you signify your specific intent to pledge to us <strong>and</strong> to grant us a security interest in all yourindividual <strong>and</strong> joint <strong>BECU</strong> share <strong>and</strong> deposit accounts you have with us, now or in the future (excluding retirement or other accounts tothe extent that applicable law precludes the pledge of such accounts), to secure your Account. You authorize us, without further notice toyou, to apply the balances in these account(s) to pay any amounts due under the Account if you should default.b. Collateral for Loans: You grant <strong>BECU</strong> a security interest in collateral securing other loans you have with <strong>BECU</strong> to secure this Account, (other thancollateral consisting of a dwelling or real property).c. Goods Purchased: You hereby grant us a security interest in each item purchased with advances obtained under this <strong>Agreement</strong>. This securityinterest will remain in full force <strong>and</strong> effect as long as there is an outst<strong>and</strong>ing balance on the item purchased. If we have the right to dem<strong>and</strong> full paymentof your new balance, we may also take possession of this property (you promise to give it to us if we ask) <strong>and</strong> sell it to satisfy your debts <strong>and</strong> obligations.Any outst<strong>and</strong>ing debt will be allocated upon the first-bought, first paid rule. You agree that 10 days is reasonable time to give you notice of any such sale.14. Merchant ClaimsYou agree to assert all defenses, complaints, rights <strong>and</strong> claims which you may have relating to goods or services purchased through the use of theAccount only against the Merchant or other person selling or providing those goods or services <strong>and</strong> not against us. You agree that regardless of theexistence of any merchant claims, you will be liable to us as this <strong>Agreement</strong> provides <strong>and</strong> without any exception, we will not be responsible for anymerchant claims you may have.15. The Minimum Periodic Payment Requireda. Payments: You promise to pay <strong>BECU</strong> the total of all credit You or a <strong>Card</strong>holder (including all Purchases, Balance Transfers, Cash Advances <strong>and</strong>other transactions, all fees <strong>and</strong> other charges we assess against the Account <strong>and</strong> all Finance Charges as provided in this <strong>Agreement</strong>. You agree to makeall payments by check or money order to us at the location <strong>and</strong> in the manner specified on your periodic billing statement in U.S. Dollars. Paymentstendered to <strong>and</strong> accepted by us at a location other than the address stated on the billing statement are not effective until received by us at the addressspecified. Payments received at <strong>Card</strong> Services, P.O. Box 84707, Seattle WA 98124-6007 before 5PM Pacific Time on any business day will be creditedto your Account as of that date; payments received on or after 5PM PT, on a weekend or federal holiday will be posted to your Account as of the nextbusiness day. <strong>Credit</strong>ing to your Master Account may be delayed up to five days if payment is received at any other address or not accompanied by theremittance portion of your Account statement. You agree that you will pay at least the required minimum payment specified in this <strong>Agreement</strong> <strong>and</strong> asshown on your periodic billing statement. <strong>Application</strong> of payment amounts to the various components of the Amount Due will be at our discretion, <strong>and</strong>may include, (among other things), application of payments to fees, finance charges before principal amounts <strong>and</strong> to components bearing lower interestrates before components bearing higher interest rates, <strong>and</strong> may vary from time to time. Payments are credited to the Master Account, nightly, <strong>Credit</strong>ing ofpayments to Sub Accounts will occur monthly upon completion of the billing cycle, such that sub-account credit availability is refreshed monthly atstatement cycle. This means <strong>Card</strong>holders will not see an impact to their spending levels until completion of the billing cycle.b. New Balance: If you elect not to pay your New Balance in full, a payment according to the following schedule plus any amount that is past due mustbe made by you within 25 days after the closing date of each billing cycle as shown on your statement. If the New Balance is less than $25 your minimumpayment will be the full balance; if your balance is $25 to $1,000 your minimum payment will be $25; if your balance is more than $1,000 your minimumpayment will be 2- ½% of your New Balance rounded down to the nearest whole dollar. A credit posting from a merchant or reversal of fees do notconstitute nor may be applied toward your minimum paymentc. Past Due <strong>and</strong> Overlimit Amounts: In addition to the above, the minimum payment will also include the greater of any amount past due or any amountby which the new balance exceeds the approved credit limit for the account. If your account is past due, <strong>and</strong>/or overlimit, that amount of the minimumpayment is immediately due.d. Payment in Full: The payment of the new balance in full will not reduce the minimum payment for the next billing cycle if there are new purchases orcash transactions.e. Pre-payment <strong>and</strong> Irregular Payments: You may pay all or part of your balance or loan(s) early, at any time, without paying any penalty. However,payments in excess of your minimum payment will not relieve you of your obligation to make your subsequent minimum payments on the dates whendue. Instead, a prepayment or early payment will reduce the principal amounts owing on your Account. We may accept late payments, partial payments,<strong>and</strong> payments marked “payment in full” or other restrictive endorsements without losing our rights under this <strong>Agreement</strong>. ALL COMMUNICATIONSCONCERNING ANY DISPUTED DEBTS, INCLUDING ANY CHECK OR INSTRUMENT TENDERED AS FULL SATISFACTION OF A DEBT(INCLUDING CREDIT CARDS), SHALL BE SENT ONLY TO THE ATTENTION OF: Risk Management Representative – Account Dispute, P.O. Box97050, Seattle, WA 98124-975016. Additional Provisionsa. Ownership of <strong>Credit</strong> <strong>Card</strong>s: Any <strong>Credit</strong> <strong>Card</strong>, other credit instrument or device which we supply to you is our property <strong>and</strong> must be returned to us orour Agent, immediately upon dem<strong>and</strong>. If we ask, you will destroy the <strong>Credit</strong> <strong>Card</strong> by cutting it in half <strong>and</strong> will surrender it to us or our Agent, mail it to us,or take it to a location we designate.b. Honoring of <strong>Credit</strong> <strong>Card</strong>: We will not be responsible for the failure or refusal of anyone to honor the <strong>Credit</strong> <strong>Card</strong> or any other credit instrument ordevice we supply to you.c. Transfer of <strong>Credit</strong> <strong>Card</strong>: You cannot transfer your <strong>Credit</strong> <strong>Card</strong> to any other person, although you will be liable for any use by anyone else that hasbeen authorized by you or another <strong>Card</strong>holder or as otherwise provided for in this <strong>Agreement</strong>.d. Refunds: If a seller agrees to give you a refund or adjustment, you will accept a credit slip for your <strong>Credit</strong> <strong>Card</strong> in lieu of a cash refund.e. Transactions: For statement verification, you will retain your copy of each slip (ticket/draft) resulting from each Purchase, Cash Advance, or othertransaction on your <strong>Credit</strong> <strong>Card</strong>. We will provide you with photographic or other documentary evidence of each transaction upon your reasonable request<strong>BECU</strong> 6964 7/2012 Page 3 of 4

or upon proper written notice of a billing error. (See section 10 for cost information.)f. International Transactions <strong>and</strong> Foreign Exchange: If you use your card for international transactions, the exchange rate between the transactioncurrency <strong>and</strong> the billing currency used for processing international transactions is a rate selected by Visa from the range of rates available in wholesalecurrency markets for the applicable central processing date, which rate may vary from the rate Visa itself receives, or the government-m<strong>and</strong>ated rate ineffect for the applicable central processing date. In addition, a 1 percent (1%) International Transaction Fee is applicable to all International Transactions,regardless of whether or not currency conversion is involved <strong>and</strong> applies to all international purchase, credit voucher, <strong>and</strong> cash disbursement original <strong>and</strong>reversal transactions. The currency conversion rate on the day before the transaction processing date may differ from the rate in effect at the time of thetransaction or on the date the transaction is posted on your Account.g. Phone Inquiries: Inquiries regarding your <strong>Credit</strong> <strong>Card</strong> (you may not inquire about someone else’s <strong>Credit</strong> <strong>Card</strong>) may be made by calling <strong>BECU</strong> at 206-812-5140 or, outside Seattle at 1-800-233-2328 extension 5140 or by writing us at the address provided below.h. Our Address: Please address all other correspondence, letters <strong>and</strong> notices (excluding payments) with respect to <strong>Credit</strong> <strong>Card</strong>s to us at: <strong>BECU</strong>, P.O.Box 97050 MS 1146-1, Seattle, WA 98124-9750.i. Non-Activation: <strong>BECU</strong> reserves the right to terminate the credit if there are no transactions in one year.j. Inactivity: If any <strong>Card</strong>holder fails to activate Account within 30 calendar days of Account establishment, <strong>BECU</strong> reserves the right to cancel Account.k. Closing your Account: The <strong>Business</strong> or Guarantor(s)or his/her successor can cancel the <strong>Credit</strong> <strong>Card</strong> Account <strong>and</strong> revoke any <strong>Card</strong>holder’sauthorization by either calling us at 206-812-5140 or, outside Seattle at 1-800-233-2328 extension 5140 or writing us at the address provided above. Ifyou cancel the Account, you must immediately pay everything you owe us, including any amounts owed but not yet billed to you. If you do not pay usimmediately, outst<strong>and</strong>ing balances will continue to accrue finance <strong>and</strong> other charges <strong>and</strong> be subject to the terms <strong>and</strong> conditions of this <strong>Agreement</strong>. Youalso agree to return to us or destroy your <strong>Card</strong>(s).17. Account Use after TerminationYou agree that it is your responsibility to contact <strong>and</strong> cancel all reoccurring transactions with merchants or other third parties. Use of the Account or<strong>Credit</strong> <strong>Card</strong> after termination or closure of the Account is fraudulent <strong>and</strong> may be subject to civil liability <strong>and</strong>/or to prosecution.18. <strong>Credit</strong> Information/Financial StatementsYou authorize us to (a) release information from our records regarding you <strong>and</strong> the Account in response to any summons, request or subpoena issued byany state or federal agency, court or by counsel for a party to any litigation; (b) provide responses <strong>and</strong> information about you <strong>and</strong> the Account from ourfiles to others who we reasonably believe are conducting a proper inquiry (e.g., credit bureaus, merchants, <strong>and</strong> other financial institutions) regarding thestatus <strong>and</strong> history of your Account. You agree to provide us upon request at any time with a current financial statement, updated credit information, orany appraisal on the collateral requested in our sole discretion. You also agree we may obtain or have obtained credit reports, employment orinvestigative inquiries on you at any time, at our sole option <strong>and</strong> expense, for any reason, including but not limited to determining whether there has beenan adverse change in your financial condition.19. Governing LawThis <strong>Agreement</strong> will not take effect until it is approved by us in the state of Washington. This <strong>Agreement</strong> shall be governed by the Federal laws <strong>and</strong> thelaws of the state of Washington as they each apply. In accepting the terms of this contract, you agree that venue for any action brought by you or broughtby us to enforce the terms of the agreement may, at our option, be properly located in King County, Seattle, Washington.20. Acknowledgment <strong>and</strong> <strong>Agreement</strong>You underst<strong>and</strong> <strong>and</strong> agree to the terms of this <strong>Agreement</strong>. No consideration has passed or will pass from the borrower to the lender for this extension ofcredit. You acknowledge that you have read this <strong>Agreement</strong> <strong>and</strong> the Fair <strong>Credit</strong> Billing Notice provided to you.21. Captions <strong>and</strong> Catchlines for Reference OnlyCaptions <strong>and</strong> catchlines are intended solely as aids to convenient reference <strong>and</strong> no inference as to intent with respect to this <strong>Agreement</strong> may be drawnfrom them.22. Enforcement<strong>BECU</strong> can delay enforcing any right under this <strong>Agreement</strong> without losing that right or any other right. In the event you die, we can collect any amountsoutst<strong>and</strong>ing under your Account as immediately owed against your estate or agreement are deemed unenforceable or invalid, the remaining provisionswill remain in full force <strong>and</strong> effect.23. AssignmentWe have the right to assign <strong>and</strong> transfer our rights under this <strong>Agreement</strong> <strong>and</strong> any amounts you owe to us. The term “us” shall be deemed to include each<strong>and</strong> every immediate <strong>and</strong> successive assignee. You do not have the right to assign or transfer any of your rights, duties or obligations under this<strong>Agreement</strong>.24. NoticesAll notices <strong>and</strong> statements will be sent to the last address appearing on <strong>BECU</strong> records. You agree to advise us promptly if you change your mailingaddress. We can accept address corrections received from the U.S. Postal Service.<strong>BECU</strong> 6964 7/2012 Page 4 of 4