Financial Statements 2011 - Royal Holloway, University of London

Financial Statements 2011 - Royal Holloway, University of London

Financial Statements 2011 - Royal Holloway, University of London

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

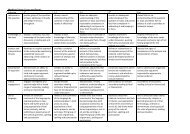

Notes to the <strong>Financial</strong> <strong>Statements</strong>(continued)11 Analysis <strong>of</strong> Expenditure by ActivityOtherOperating Interest 2010/11 2009/10Staff Costs Depreciation Expenses Payable Total Total£000 £000 £000 £000 £000 £000Academic departments 41,702 1,123 5,216 - 48,041 48,802Academic services 4,326 574 4,120 - 9,020 9,136Research grants and5,798 231 5,471 - 11,500 10,022contractsOther contracts 227 - 573 - 800 1,171Residences, catering and5,219 3,235 7,377 2,090 17,921 17,875conferencesPremises (see footnote) 2,378 6,269 4,463 131 13,241 13,377Administration 8,429 17 3,976 - 12,422 12,425Students’ Union to 13 April749 78 859 - 1,686 2,189<strong>2011</strong>Other expenses 2,443 13 8,220 - 10,676 10,369Staff restructuring 261 - - - 261 818Expenditure 71,532 11,540 40,275 2,221 125,568 126,184Premises costs exclude costs relating to residences and catering which are included in that section.Expenditure for the Students’ Union includes £442k <strong>of</strong> grant from the College to 13 April <strong>2011</strong> (2009/10 £645k for the full year).12 TAXATIONUK Corporation Tax 3 6<strong>Royal</strong> <strong>Holloway</strong> Enterprise Ltd gift aids taxable pr<strong>of</strong>its to the College. The tax charge is a provision for Corporation Tax on the retainedtaxable pr<strong>of</strong>its <strong>of</strong> the subsidiary.As explained in the accounting policies, the College is potentially exempt from taxation because <strong>of</strong> its charitable status and no taxationon income or capital gains is payable for 2010/11 or 2009/10.25