Annual Report 2005/06 THE WORLD OF SOUND - Sonova

Annual Report 2005/06 THE WORLD OF SOUND - Sonova Annual Report 2005/06 THE WORLD OF SOUND - Sonova

Consolidated Balance SheetAssets1,000 CHFCash and cash equivalentsFinancial assets at fair value through profit or lossTrade receivablesOther receivables and prepaid expensesInventoriesTotal current assetsTangible assetsIntangible assetsInvestments in associates/joint venturesOther investments and long-term loansDeferred tax assetsRetirement benefit assetsTotal non-current assetsTotal assetsNotes137, 1415161718211920103131.3.2006179,54912,762194,33045,54294,244526,427117,255208,3794,06412,85459,1463,135404,833931,26031.3.2005 1)173,24312,401139,19719,97286,550431,363115,391139,1411,5967,81144,9233,135311,997743,360Liabilities and equity1,000 CHFShort-term debtsTrade payablesTaxes payableFinancial liabilities at fair value through profit or lossOther short-term liabilitiesShort-term provisionsTotal current liabilitiesMortgagesOther long-term debtsLong-term provisionsOther long-term liabilitiesDeferred tax liabilitiesTotal non-current liabilitiesTotal liabilitiesShare capitalShare premiumTreasury sharesRetained earningsEquity attributable to equity holders of parentMinority interestEquityTotal liabilities and equityNotes2372422252622271031.3.200612,25337,56240,9451,64991,94837,795222,1523779840,8418,71032,04982,075304,2273,318154,042(2,183)469,625624,8022,231627,033931,26031.3.2005 1)30,78930,98822,9601,42185,93626,339198,43312,57147,07812,8815,13717,55695,223293,6563,301146,578(319)298,231447,7911,913449,704743,3601)Including adjustments in accordance with new IFRS accounting standards (see Notes)The Notes are an integral part of the consolidated financial statementsConsolidated Financial Statements47

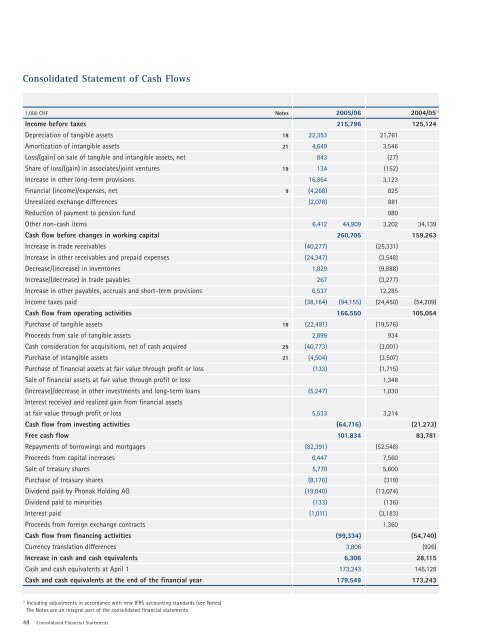

Consolidated Statement of Cash Flows1,000 CHFIncome before taxesDepreciation of tangible assetsAmortization of intangible assetsLoss/(gain) on sale of tangible and intangible assets, netShare of loss/(gain) in associates/joint venturesIncrease in other long-term provisionsFinancial (income)/expenses, netUnrealized exchange differencesReduction of payment to pension fundOther non-cash itemsCash flow before changes in working capitalIncrease in trade receivablesIncrease in other receivables and prepaid expensesDecrease/(increase) in inventoriesIncrease/(decrease) in trade payablesIncrease in other payables, accruals and short-term provisionsIncome taxes paidCash flow from operating activitiesPurchase of tangible assetsProceeds from sale of tangible assetsCash consideration for acquisitions, net of cash acquiredPurchase of intangible assetsPurchase of financial assets at fair value through profit or lossSale of financial assets at fair value through profit or loss(Increase)/decrease in other investments and long-term loansInterest received and realized gain from financial assetsat fair value through profit or lossCash flow from investing activitiesFree cash flowRepayments of borrowings and mortgagesProceeds from capital increasesSale of treasury sharesPurchase of treasury sharesDividend paid by Phonak Holding AGDividend paid to minoritiesInterest paidProceeds from foreign exchange contractsCash flow from financing activitiesCurrency translation differencesIncrease in cash and cash equivalentsCash and cash equivalents at April 1Cash and cash equivalents at the end of the financial yearNotes182119918292122,3534,64984313416,864(4,268)(2,078)6,412(40,277)(24,347)1,8292676,537(38,164)(22,491)2,899(40,773)(4,504)(133)(5,247)5,533(82,391)6,4475,770(8,176)(19,840)(133)(1,011)2005/06215,79644,909260,705(94,155)166,550(64,716)101,834(99,334)3,8066,306173,243179,54921,7613,546(27)(152)3,1238258819803,202(25,331)(3,548)(9,888)(3,277)12,285(24,450)(19,576)934(3,001)(3,507)(1,715)1,3481,0303,214(52,548)7,5605,600(319)(13,074)(136)(3,183)1,3602004/05 1)125,12434,139159,263(54,209)105,054(21,273)83,781(54,740)(926)28,115145,128173,2431)Including adjustments in accordance with new IFRS accounting standards (see Notes)The Notes are an integral part of the consolidated financial statements48 Consolidated Financial Statements

- Page 1 and 2: Annual Report 2005/06Annual Report

- Page 3 and 4: FIVE-YEAR KEY FIGURES(Consolidated)

- Page 5 and 6: CHAIRMAN’S FOREWORDIn 2005/06, th

- Page 7: Move with the melody

- Page 10 and 11: digital entry-level product line, w

- Page 12 and 13: MARKETSGeneral market developmentTh

- Page 15 and 16: NEW TECHNOLOGIES AND PRODUCTSPlatfo

- Page 17 and 18: OPERATIONS AND STAFFOperationsWithi

- Page 19: Listen to life

- Page 22 and 23: This report describes the principle

- Page 24 and 25: Capital StructureChanges in capital

- Page 26 and 27: Left to right: Robert F. Spoerry, D

- Page 28 and 29: Andy Rihs (born in 1942) has been C

- Page 30 and 31: Dr. Valentin Chapero Rueda (born in

- Page 32 and 33: Share and option ownership of membe

- Page 34 and 35: Highest total compensationThe highe

- Page 36 and 37: Investor Relations CalendarJuly 6,

- Page 39 and 40: SUSTAINABILITYPhonak’s management

- Page 41 and 42: Our customers buy a better quality

- Page 43 and 44: Corporate GovernancePhonak’s Boar

- Page 45: Push your performance

- Page 49: Consolidated Income Statement1,000

- Page 53 and 54: Notes to the ConsolidatedFinancial

- Page 55 and 56: equity method, the investment in an

- Page 57 and 58: Short-term debtsShort-term debts co

- Page 59 and 60: Employee benefit plansPhonak has va

- Page 61 and 62: 5. Segment informationProfit or los

- Page 63 and 64: 6. Consolidated Income Statement by

- Page 65 and 66: 9. Financial income/(expenses), net

- Page 67 and 68: 11. Earnings per shareBasic earning

- Page 69 and 70: 17. Inventories1,000 CHFRaw materia

- Page 71 and 72: 19. Investments in associates and j

- Page 73 and 74: GoodwillSoftwareIntangiblesrelating

- Page 75 and 76: Among various other items, other pr

- Page 77 and 78: 27. Other long-term liabilities1,00

- Page 79 and 80: 29. Acquisition of subsidiariesDuri

- Page 81 and 82: 30. Related-party transactionsManag

- Page 83 and 84: The amount recognized in the consol

- Page 85 and 86: Summary of outstanding and exercisa

- Page 87 and 88: 35. Number of employeesAt March 31,

- Page 89 and 90: 38. List of significant consolidate

- Page 91: Cherish the cheers

- Page 95 and 96: Income Statement1,000 CHFIncomeMana

- Page 97 and 98: Notes to the Financial Statements1.

- Page 99 and 100: 3.4 List of significant investments

Consolidated Statement of Cash Flows1,000 CHFIncome before taxesDepreciation of tangible assetsAmortization of intangible assetsLoss/(gain) on sale of tangible and intangible assets, netShare of loss/(gain) in associates/joint venturesIncrease in other long-term provisionsFinancial (income)/expenses, netUnrealized exchange differencesReduction of payment to pension fundOther non-cash itemsCash flow before changes in working capitalIncrease in trade receivablesIncrease in other receivables and prepaid expensesDecrease/(increase) in inventoriesIncrease/(decrease) in trade payablesIncrease in other payables, accruals and short-term provisionsIncome taxes paidCash flow from operating activitiesPurchase of tangible assetsProceeds from sale of tangible assetsCash consideration for acquisitions, net of cash acquiredPurchase of intangible assetsPurchase of financial assets at fair value through profit or lossSale of financial assets at fair value through profit or loss(Increase)/decrease in other investments and long-term loansInterest received and realized gain from financial assetsat fair value through profit or lossCash flow from investing activitiesFree cash flowRepayments of borrowings and mortgagesProceeds from capital increasesSale of treasury sharesPurchase of treasury sharesDividend paid by Phonak Holding AGDividend paid to minoritiesInterest paidProceeds from foreign exchange contractsCash flow from financing activitiesCurrency translation differencesIncrease in cash and cash equivalentsCash and cash equivalents at April 1Cash and cash equivalents at the end of the financial yearNotes182119918292122,3534,64984313416,864(4,268)(2,078)6,412(40,277)(24,347)1,8292676,537(38,164)(22,491)2,899(40,773)(4,504)(133)(5,247)5,533(82,391)6,4475,770(8,176)(19,840)(133)(1,011)<strong>2005</strong>/<strong>06</strong>215,79644,909260,705(94,155)166,550(64,716)101,834(99,334)3,8<strong>06</strong>6,3<strong>06</strong>173,243179,54921,7613,546(27)(152)3,1238258819803,202(25,331)(3,548)(9,888)(3,277)12,285(24,450)(19,576)934(3,001)(3,507)(1,715)1,3481,0303,214(52,548)7,5605,600(319)(13,074)(136)(3,183)1,3602004/05 1)125,12434,139159,263(54,209)105,054(21,273)83,781(54,740)(926)28,115145,128173,2431)Including adjustments in accordance with new IFRS accounting standards (see Notes)The Notes are an integral part of the consolidated financial statements48 Consolidated Financial Statements