Powering growth - Aztech Group Ltd - Investor Relations

Powering growth - Aztech Group Ltd - Investor Relations Powering growth - Aztech Group Ltd - Investor Relations

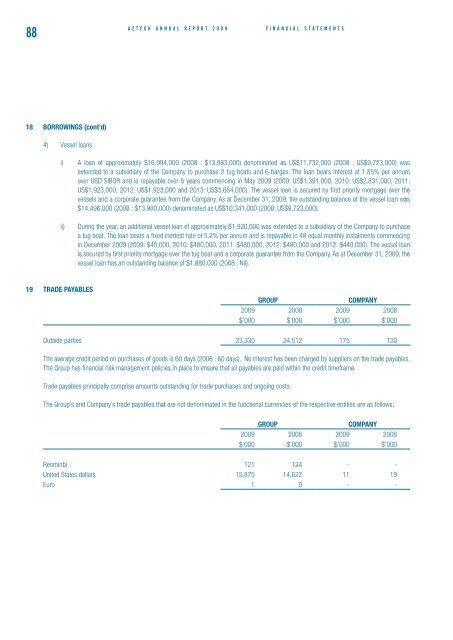

88a z t e c h a n n u a l r e p o r t 2 0 0 9F i n a n c i a l S t a t e m e n t s18 BORROWINGS (cont’d)4) Vessel loansi) A loan of approximately $16,994,000 (2008 : $13,983,000) denominated as US$11,732,000 (2008 : US$9,723,000) wasextended to a subsidiary of the Company to purchase 2 tug boats and 6 barges. The loan bears interest at 1.85% per annumover USD SIBOR and is repayable over 5 years commencing in May 2009 (2009: US$1,391,000, 2010: US$2,831,000, 2011:US$1,923,000, 2012: US$1,923,000 and 2013: US$3,664,000). The vessel loan is secured by first priority mortgage over thevessels and a corporate guarantee from the Company. As at December 31, 2009, the outstanding balance of the vessel loan was$14,496,000 (2008 : $13,980,000) denominated as US$10,341,000 (2008: US$9,723,000).ii)During the year, an additional vessel loan of approximately $1,920,000 was extended to a subsidiary of the Company to purchasea tug boat. The loan bears a fixed inertest rate of 5.2% per annum and is repayable in 48 equal monthly instalments commencingin December 2009 (2009: $40,000, 2010: $480,000, 2011: $480,000, 2012: $480,000 and 2012: $440,000). The vessel loanis secured by first priority mortgage over the tug boat and a corporate guarantee from the Company. As at December 31, 2009, thevessel loan has an outstanding balance of $1,880,000 (2008 : Nil).19 TRADE PAYABLESGROUPCOMPANY2009 2008 2009 2008$’000 $’000 $’000 $’000Outside parties 23,330 24,512 175 130The average credit period on purchases of goods is 60 days (2008 : 60 days). No interest has been charged by suppliers on the trade payables.The Group has financial risk management policies in place to ensure that all payables are paid within the credit timeframe.Trade payables principally comprise amounts outstanding for trade purchases and ongoing costs.The Group’s and Company’s trade payables that are not denominated in the functional currencies of the respective entities are as follows:GROUPCOMPANY2009 2008 2009 2008$’000 $’000 $’000 $’000Renminbi 121 124 - -United States dollars 15,875 14,622 11 19Euro 1 9 - -

F i n a n c i a l S t a t e m e n t sa z t e c h a n n u a l r e p o r t 2 0 0 98920 OTHER PAYABLES AND PROVISIONSGROUPCOMPANY2009 2008 2009 2008$’000 $’000 $’000 $’000Subsidiaries (Notes 5 and 12) - - 13,975 8,459Accrued expenses 5,428 6,225 1,183 2,293Customer deposits 1,970 951 33 496Provision for warranty 26 54 - -Other payables 1,149 1,460 619 638Total 8,573 8,690 15,810 11,886Provision for warrantyBalance at January 1 54 57 - -(Reversal) Charge from/to profit or loss (25) 31 - -Utilised (3) (34) - -Balance at December 31 26 54 - -The provision for warranty represents management’s best estimate of the Group’s liability under 12 months warranties granted on computerperipherals and multicommunication products based on past experience and industry averages for defective products.The Group’s and Company’s other payables that are not denominated in the functional currencies of the respective entities are as follows:GROUPCOMPANY2009 2008 2009 2008$’000 $’000 $’000 $’000Singapore dollars - 54 - -Renminbi 2,627 2,242 - -Hong Kong dollars - - - 1,124United States dollars 1,982 1,826 3,078 511

- Page 39 and 40: F i n a n c i a l S t a t e m e n t

- Page 41 and 42: F i n a n c i a l S t a t e m e n t

- Page 43 and 44: F i n a n c i a l S t a t e m e n t

- Page 45 and 46: F i n a n c i a l S t a t e m e n t

- Page 47 and 48: F i n a n c i a l S t a t e m e n t

- Page 49 and 50: F i n a n c i a l S t a t e m e n t

- Page 51 and 52: F i n a n c i a l S t a t e m e n t

- Page 53 and 54: F i n a n c i a l S t a t e m e n t

- Page 55 and 56: F i n a n c i a l S t a t e m e n t

- Page 57 and 58: F i n a n c i a l S t a t e m e n t

- Page 59 and 60: F i n a n c i a l S t a t e m e n t

- Page 61 and 62: F i n a n c i a l S t a t e m e n t

- Page 63 and 64: F i n a n c i a l S t a t e m e n t

- Page 65 and 66: F i n a n c i a l S t a t e m e n t

- Page 67 and 68: F i n a n c i a l S t a t e m e n t

- Page 69 and 70: F i n a n c i a l S t a t e m e n t

- Page 71 and 72: F i n a n c i a l S t a t e m e n t

- Page 73 and 74: F i n a n c i a l S t a t e m e n t

- Page 75 and 76: F i n a n c i a l S t a t e m e n t

- Page 77 and 78: F i n a n c i a l S t a t e m e n t

- Page 79 and 80: F i n a n c i a l S t a t e m e n t

- Page 81 and 82: F i n a n c i a l S t a t e m e n t

- Page 83 and 84: F i n a n c i a l S t a t e m e n t

- Page 85 and 86: F i n a n c i a l S t a t e m e n t

- Page 87 and 88: F i n a n c i a l S t a t e m e n t

- Page 89: F i n a n c i a l S t a t e m e n t

- Page 93 and 94: F i n a n c i a l S t a t e m e n t

- Page 95 and 96: F i n a n c i a l S t a t e m e n t

- Page 97 and 98: F i n a n c i a l S t a t e m e n t

- Page 99 and 100: F i n a n c i a l S t a t e m e n t

- Page 101 and 102: F i n a n c i a l S t a t e m e n t

- Page 103 and 104: F i n a n c i a l S t a t e m e n t

- Page 105 and 106: F i n a n c i a l S t a t e m e n t

- Page 107 and 108: F i n a n c i a l S t a t e m e n t

- Page 109 and 110: F i n a n c i a l S t a t e m e n t

- Page 111 and 112: F i n a n c i a l S t a t e m e n t

- Page 113 and 114: F i n a n c i a l S t a t e m e n t

- Page 115 and 116: F i n a n c i a l S t a t e m e n t

- Page 117 and 118: F i n a n c i a l S t a t e m e n t

- Page 119 and 120: F i n a n c i a l S t a t e m e n t

- Page 121 and 122: F i n a n c i a l S t a t e m e n t

- Page 123: HEAD OFFICEAZTECH GROUP LTD31 Ubi R

88a z t e c h a n n u a l r e p o r t 2 0 0 9F i n a n c i a l S t a t e m e n t s18 BORROWINGS (cont’d)4) Vessel loansi) A loan of approximately $16,994,000 (2008 : $13,983,000) denominated as US$11,732,000 (2008 : US$9,723,000) wasextended to a subsidiary of the Company to purchase 2 tug boats and 6 barges. The loan bears interest at 1.85% per annumover USD SIBOR and is repayable over 5 years commencing in May 2009 (2009: US$1,391,000, 2010: US$2,831,000, 2011:US$1,923,000, 2012: US$1,923,000 and 2013: US$3,664,000). The vessel loan is secured by first priority mortgage over thevessels and a corporate guarantee from the Company. As at December 31, 2009, the outstanding balance of the vessel loan was$14,496,000 (2008 : $13,980,000) denominated as US$10,341,000 (2008: US$9,723,000).ii)During the year, an additional vessel loan of approximately $1,920,000 was extended to a subsidiary of the Company to purchasea tug boat. The loan bears a fixed inertest rate of 5.2% per annum and is repayable in 48 equal monthly instalments commencingin December 2009 (2009: $40,000, 2010: $480,000, 2011: $480,000, 2012: $480,000 and 2012: $440,000). The vessel loanis secured by first priority mortgage over the tug boat and a corporate guarantee from the Company. As at December 31, 2009, thevessel loan has an outstanding balance of $1,880,000 (2008 : Nil).19 TRADE PAYABLESGROUPCOMPANY2009 2008 2009 2008$’000 $’000 $’000 $’000Outside parties 23,330 24,512 175 130The average credit period on purchases of goods is 60 days (2008 : 60 days). No interest has been charged by suppliers on the trade payables.The <strong>Group</strong> has financial risk management policies in place to ensure that all payables are paid within the credit timeframe.Trade payables principally comprise amounts outstanding for trade purchases and ongoing costs.The <strong>Group</strong>’s and Company’s trade payables that are not denominated in the functional currencies of the respective entities are as follows:GROUPCOMPANY2009 2008 2009 2008$’000 $’000 $’000 $’000Renminbi 121 124 - -United States dollars 15,875 14,622 11 19Euro 1 9 - -