Powering growth - Aztech Group Ltd - Investor Relations

Powering growth - Aztech Group Ltd - Investor Relations Powering growth - Aztech Group Ltd - Investor Relations

78a z t e c h a n n u a l r e p o r t 2 0 0 9F i n a n c i a l S t a t e m e n t s12 INVESTMENT IN SUBSIDIARIES (cont’d)Proportion ofPlace of ownership interest Cost ofincorporation and voting power investmentName of company and operation held by the Group by the Company Principal activity2009 2008 2009 2008% % $’000 $’000AZ Iris Pte Ltd Singapore 100 100 - - Ownership and charteringof sea going vesselAZ Jasmine Pte Ltd Singapore 100 100 - - Ownership and charteringof sea going vesselAZ Sakura Pte Ltd Singapore 100 - - - Ownership and charteringof sea going vesselAZ Ivy Pte Ltd Singapore 100 - - - Ownership and charteringof sea going vesselAZ Marigold Pte Ltd Singapore 100 - - - Ownership and charteringof sea going vessel90,728 102,049* Less than $1,000.All the companies are audited by Deloitte & Touche LLP, Singapore except for the subsidiaries that are indicated as follows:(1)Audited by overseas practices of Deloitte Touche Tohmatsu.(2)Not required to be audited by law in its country of incorporation. The net tangible asset and pre-tax profits of the entities are less than 20% of the Group’sconsolidated NTA and pre-tax profits respectively. Their unaudited financial statements have been reviewed as part of the Group audit.(3)Not audited as the company is in the process of liquidation.(4)Deemed interest arose from financial guarantees provided by the Company to banks in respect of financing facilities granted to its subsidiaries and the share optionsgranted under ESOS 2000 by the Company to employees of its subsidiaries. Management has assessed that the fair value of the financial guarantees equivalent to1.0% (2008 : 1.0%) per annum of the amount of financing facilities guaranteed from the dates when the financing facilities were issued.(5)The company was newly incorporated on December 8, 2009 and there were no transactions from date of incorporation to the end of the reporting period. Itsunaudited financial statements has been reviewed as part of the Group audit.(6)On January 22, 2009, the company was disposed at the consideration of $2. At the date of disposal, the company did not own any assets.(7)This subsidiary was newly incorporated on May 27, 2009. All the companies under the Electronics segment, except for Aztech Systems GmbH, were subsequentlytransferred to Aztech Electronics Pte Ltd on July 1, 2009, as part of the Group’s internal organisation exercise.

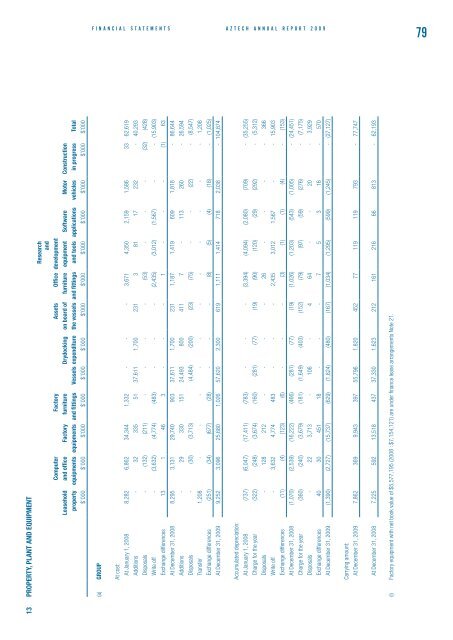

F i n a n c i a l S t a t e m e n t sa z t e c h a n n u a l r e p o r t 2 0 0 97913 PROPERTY, PLANT AND EQUIPMENTResearchandComputer Factory Assets Office developmentLeasehold and office Factory furniture Drydocking on board of furniture equipment Software Motor Constructionproperty equipments equipments and fittings Vessels expenditure the vessels and fittings and tools applications vehicles in progress Total$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000(a) GROUPAt cost:At January 1, 2008 8,282 6,862 34,344 1,332 - - - 3,671 4,350 2,159 1,586 33 62,619Additions - 32 335 51 37,611 1,700 231 3 81 17 232 - 40,293Disposals - (132) (211) - - - - (53) - - - (32) (428)Write off - (3,632) (4,774) (483) - - - (2,435) (3,012) (1,567) - - (15,903)Exchange differences 13 1 46 3 - - - 1 - - - (1) 63At December 31, 2008 8,295 3,131 29,740 903 37,611 1,700 231 1,187 1,419 609 1,818 - 86,644Additions - 29 330 151 24,493 800 411 7 - 113 260 - 26,594Disposals - (30) (3,713) (4,484) (200) (23) (75) - - (22) - (8,547)Transfer 1,208 - - - - - - - - - - - 1,208Exchange differences (251) (34) (677) (28) - - - (8) (5) (4) (18) - (1,025)At December 31, 2009 9,252 3,096 25,680 1,026 57,620 2,300 619 1,111 1,414 718 2,038 - 104,874Accumulated depreciation:At January 1, 2008 (737) (6,047) (17,411) (783) - - - (3,394) (4,094) (2,080) (709) - (35,255)Charge for the year (322) (248) (3,674) (160) (281) (77) (19) (90) (120) (29) (292) - (5,312)Disposals - 128 212 - - - - 26 - - - - 366Write off - 3,632 4,774 483 - - - 2,435 3,012 1,567 - - 15,903Exchange differences (11) (4) (123) (6) - - - (3) (1) (1) (4) - (153)At December 31, 2008 (1,070) (2,539) (16,222) (466) (281) (77) (19) (1,026) (1,203) (543) (1,005) - (24,451)Charge for the year (360) (240) (3,679) (181) (1,649) (403) (152) (79) (97) (59) (276) - (7,175)Disposals - 22 3,713 - 106 - 4 64 - - 20 - 3,929Exchange differences 40 30 451 18 - - - 7 5 3 16 - 570At December 31, 2009 (1,390) (2,727) (15,737) (629) (1,824) (480) (167) (1,034) (1,295) (599) (1,245) - (27,127)Carrying amount:At December 31, 2009 7,862 369 9,943 397 55,796 1,820 452 77 119 119 793 - 77,747At December 31, 2008 7,225 592 13,518 437 37,330 1,623 212 161 216 66 813 - 62,193(i) Factory equipment with net book value of $5,577,195 (2008 : $7,154,121) are under finance lease arrangements Note 21.

- Page 29 and 30: C o r p o r a t e G o v e r n a n c

- Page 31 and 32: C o r p o r a t e G o v e r n a n c

- Page 33 and 34: C o r p o r a t e G o v e r n a n c

- Page 35 and 36: F i n a n c i a l S t a t e m e n t

- Page 37 and 38: F i n a n c i a l S t a t e m e n t

- Page 39 and 40: F i n a n c i a l S t a t e m e n t

- Page 41 and 42: F i n a n c i a l S t a t e m e n t

- Page 43 and 44: F i n a n c i a l S t a t e m e n t

- Page 45 and 46: F i n a n c i a l S t a t e m e n t

- Page 47 and 48: F i n a n c i a l S t a t e m e n t

- Page 49 and 50: F i n a n c i a l S t a t e m e n t

- Page 51 and 52: F i n a n c i a l S t a t e m e n t

- Page 53 and 54: F i n a n c i a l S t a t e m e n t

- Page 55 and 56: F i n a n c i a l S t a t e m e n t

- Page 57 and 58: F i n a n c i a l S t a t e m e n t

- Page 59 and 60: F i n a n c i a l S t a t e m e n t

- Page 61 and 62: F i n a n c i a l S t a t e m e n t

- Page 63 and 64: F i n a n c i a l S t a t e m e n t

- Page 65 and 66: F i n a n c i a l S t a t e m e n t

- Page 67 and 68: F i n a n c i a l S t a t e m e n t

- Page 69 and 70: F i n a n c i a l S t a t e m e n t

- Page 71 and 72: F i n a n c i a l S t a t e m e n t

- Page 73 and 74: F i n a n c i a l S t a t e m e n t

- Page 75 and 76: F i n a n c i a l S t a t e m e n t

- Page 77 and 78: F i n a n c i a l S t a t e m e n t

- Page 79: F i n a n c i a l S t a t e m e n t

- Page 83 and 84: F i n a n c i a l S t a t e m e n t

- Page 85 and 86: F i n a n c i a l S t a t e m e n t

- Page 87 and 88: F i n a n c i a l S t a t e m e n t

- Page 89 and 90: F i n a n c i a l S t a t e m e n t

- Page 91 and 92: F i n a n c i a l S t a t e m e n t

- Page 93 and 94: F i n a n c i a l S t a t e m e n t

- Page 95 and 96: F i n a n c i a l S t a t e m e n t

- Page 97 and 98: F i n a n c i a l S t a t e m e n t

- Page 99 and 100: F i n a n c i a l S t a t e m e n t

- Page 101 and 102: F i n a n c i a l S t a t e m e n t

- Page 103 and 104: F i n a n c i a l S t a t e m e n t

- Page 105 and 106: F i n a n c i a l S t a t e m e n t

- Page 107 and 108: F i n a n c i a l S t a t e m e n t

- Page 109 and 110: F i n a n c i a l S t a t e m e n t

- Page 111 and 112: F i n a n c i a l S t a t e m e n t

- Page 113 and 114: F i n a n c i a l S t a t e m e n t

- Page 115 and 116: F i n a n c i a l S t a t e m e n t

- Page 117 and 118: F i n a n c i a l S t a t e m e n t

- Page 119 and 120: F i n a n c i a l S t a t e m e n t

- Page 121 and 122: F i n a n c i a l S t a t e m e n t

- Page 123: HEAD OFFICEAZTECH GROUP LTD31 Ubi R

F i n a n c i a l S t a t e m e n t sa z t e c h a n n u a l r e p o r t 2 0 0 97913 PROPERTY, PLANT AND EQUIPMENTResearchandComputer Factory Assets Office developmentLeasehold and office Factory furniture Drydocking on board of furniture equipment Software Motor Constructionproperty equipments equipments and fittings Vessels expenditure the vessels and fittings and tools applications vehicles in progress Total$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000(a) GROUPAt cost:At January 1, 2008 8,282 6,862 34,344 1,332 - - - 3,671 4,350 2,159 1,586 33 62,619Additions - 32 335 51 37,611 1,700 231 3 81 17 232 - 40,293Disposals - (132) (211) - - - - (53) - - - (32) (428)Write off - (3,632) (4,774) (483) - - - (2,435) (3,012) (1,567) - - (15,903)Exchange differences 13 1 46 3 - - - 1 - - - (1) 63At December 31, 2008 8,295 3,131 29,740 903 37,611 1,700 231 1,187 1,419 609 1,818 - 86,644Additions - 29 330 151 24,493 800 411 7 - 113 260 - 26,594Disposals - (30) (3,713) (4,484) (200) (23) (75) - - (22) - (8,547)Transfer 1,208 - - - - - - - - - - - 1,208Exchange differences (251) (34) (677) (28) - - - (8) (5) (4) (18) - (1,025)At December 31, 2009 9,252 3,096 25,680 1,026 57,620 2,300 619 1,111 1,414 718 2,038 - 104,874Accumulated depreciation:At January 1, 2008 (737) (6,047) (17,411) (783) - - - (3,394) (4,094) (2,080) (709) - (35,255)Charge for the year (322) (248) (3,674) (160) (281) (77) (19) (90) (120) (29) (292) - (5,312)Disposals - 128 212 - - - - 26 - - - - 366Write off - 3,632 4,774 483 - - - 2,435 3,012 1,567 - - 15,903Exchange differences (11) (4) (123) (6) - - - (3) (1) (1) (4) - (153)At December 31, 2008 (1,070) (2,539) (16,222) (466) (281) (77) (19) (1,026) (1,203) (543) (1,005) - (24,451)Charge for the year (360) (240) (3,679) (181) (1,649) (403) (152) (79) (97) (59) (276) - (7,175)Disposals - 22 3,713 - 106 - 4 64 - - 20 - 3,929Exchange differences 40 30 451 18 - - - 7 5 3 16 - 570At December 31, 2009 (1,390) (2,727) (15,737) (629) (1,824) (480) (167) (1,034) (1,295) (599) (1,245) - (27,127)Carrying amount:At December 31, 2009 7,862 369 9,943 397 55,796 1,820 452 77 119 119 793 - 77,747At December 31, 2008 7,225 592 13,518 437 37,330 1,623 212 161 216 66 813 - 62,193(i) Factory equipment with net book value of $5,577,195 (2008 : $7,154,121) are under finance lease arrangements Note 21.