Staff Reports - East Bay Municipal Utility District

Staff Reports - East Bay Municipal Utility District

Staff Reports - East Bay Municipal Utility District

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

£ BOARD OF DIRECTORSEASTEBMUDBAY M 1011^ UTILITY DISTRICT375 -1 lth Street, Oakland, CA 94607 Office of the Secretary: (510) 287-0440ROLL CALL:AGENDATuesday, January 8, 2013REGULAR CLOSED SESSION11:00 a.m., Board RoomPUBLIC COMMENT: The Board of Directors is limited by State law to providing a brief response, askingquestions for clarification, or referring a matter to staff when responding to items that are rot listed on the agenda.BROWN ACT BRIEFING:• Presentation of the Brown Act and the Ethics Policy of the EBMUD Bo.ard of Directors.ANNOUNCEMENT OF CLOSED SESSION AGENDA:1. Existing litigation pursuant to Government Code section 54956.9(a)a. United States of America, et al. v. <strong>East</strong> <strong>Bay</strong> <strong>Municipal</strong> <strong>Utility</strong> <strong>District</strong>USDC, N.D. Cal, Case No. CV 09-0186 RS2. Initiation of litigation pursuant to Government Code section 54956.9(c): one matter.3. Conference with Real Property Negotiator pursuant to Government Code section 54956.8regarding conditions and terms of payment for the purchase of a mirimum of 10,000 acrefeet of water from Placer County Water Agency for supplemental dry year supplies.Negotiating parties: Richard Sykes, Director of Water and Natural Resources, and MichaelTognolini, Manager of Water Supply Improvements.4. Personnel exception pursuant to Government Code section 54957 to consider publicemployee evaluations: General Manager and General Counsel.(The Board will hold Closed Session in Conference Room 8A/B)

Regular Meeting ofJanuary 8, 2013Page 2 of 3REGULAR BUSINESS MEETING1:15 p.m., Board RoomROLL CALL:BOARD OF DIRECTORS:• Pledge of Allegiance• Election of Officers• 2013 Board Committee Assignment PreferencesANNOUNCEMENTS FROM CLOSED SESSION:PUBLIC COMMENT: The Board of Directors is limited by State law to providing a brief response,asking questions for clarification, or referring a matter to staff when responding to items that are not listed onthe Agenda.CONSENT CALENDAR: (Single motion and vote approving 6 recommendations.)1. Approve the Regular Meeting Minutes of December 11, 2012.2. File correspondence with the Board.3. Award a contract to the lowest responsible/responsive bidder, Duperon Corporation, in theestimated total amount of $1,526,850 for supplying five sets of influent bar screens andwasher compactors for the Main Wastewater Treatment Plant under Proposal No. 1306.4. Authorize an agreement with DesignMind Business Solutions in an amount not to exceed$404,875 for software development services to construct the Private Sewer LateralApplication Enhancements.5. Authorize an amendment to Board Motion 170-10 to include Verizon Wireless as an additionalprovider of cellular telephone and push-to-talk services.6. Authorize the Office of General Counsel to continue the employment of the law firm ofBarg, Coffin, Lewis & Trapp, LLP, for services of special counsel related to environmentalregulation and litigation matters.DETERMINATION AND DISCUSSION:7. Legislative Update:• Federal Legislative Initiatives for 2013• Update on Legislative Issues of Interest to EBMUD8. Approve the execution of remarketing agreements and related supporting documents for the$41,035,000 Water System Revenue Refunding Bonds, Series 2009A-2, and approve theappointment of E.J. De La Rosa & Co. Inc. and RBC Capital Markets Corporation asremarketing agents.(Resolution)

Regular Meeting ofJanuary 8, 2013Page 3 of3DETERMINATION AND DISCUSSION: (Cont'd)9. General Manager's Report:• Water Supply Report• Monthly Report - December 2012• Summary of Board 2012 Committee Agendas and Upcoming Topics for 2013REPORTS AND DIRECTOR COMMENTS:10. Committee <strong>Reports</strong>:• Finance/Administration• Planning• Legislative/Human Resources11. Director Comments.ADJOURNMENT:The next Regular Meeting of the Board of Directors will be held at 1:15 p.m. on Tuesday,January 22, 2013 in the Administration Center Board Room, 375 Eleventh Street, Oakland,California.Disability NoticeIf you require a disability-related modification or accommodation to participate in an EBMUD public meetingplease call the Office of the Secretary (510) 287-0404. We will make reasonable arrangements to ensureaccessibility. Some special equipment arrangements may require 48 hours advance noticz.Document AvailabilityMaterials related to an item on this Agenda that have been submitted to the EBMUD Board of Directors -within 72hours prior to this meeting are available for public inspection in EBMUD's Office of the Secretary at 375 11thStreet, Oakland, California, during normal business hours.W:\Agendas\Agendas 2013\010813_regular_agenda.doc

BOARD CALENDARDateMeetingTime/LocationTopicsTuesday, January 8Planning CommitteeLinney (Chair), Foulkes,Mclntosh9:45 a.m.Training Resource Center• Diablo Vista PumpingPlant ReplacementProject Update• Orinda Water TreatmentPlant NPDES PermitLegislative/Human ResourcesCommitteeMclntosh (Chair), Katz, Mellon10:15 a.m.Training Resource Center• Project LaborAgreements• Federal LegislativeInitiatives for 2013• Legislative UpdateBoard of Directors11:00 a.m.1:15 p.m.• Closed Session• Regular MeetingMonday, January 21Martin Luther King DayHoliday• Offices ClosedTuesday, January 22Finance/AdministrationCommitteeKatz (Chair), Foulkes,Linney9:00 a.m.Training Resource CenterWater Supply Workshop9:30 a.m.Training Resource CenterBoard of Directors11:00 a.m.1:15 p.m.• Closed Session• Regular MeetingTuesday, February 12Lincoln's BirthdayHoliday• Offices ClosedWednesday, February 13FY14-15 Budget & StrategicPlan UpdateTBDTraining Resource CenterBoard of Directors11:00 a.m.1:15 p.m.• Closed Session• Regular MeetingMonday, February 18President's Day Holiday• Offices ClosedTuesday, February 26Energy/SustainabilityCommitteeTBDFinance/AdministrationCommittee10:00 a.m.Training Resource CenterBoard of Directors11:00 a.m.1:15 p.m.• Closed Session• Regular Meeting

eparedMINUTESTuesday, December 11, 2012<strong>East</strong> <strong>Bay</strong> <strong>Municipal</strong> <strong>Utility</strong> <strong>District</strong>Board of Directors375 Eleventh StreetOakland, CaliforniaRegular Closed Session MeetingPresident John A. Coleman called to order the Regular Closed Session Meeting of the Board ofDirectors at 11:00 a.m. in the Administration Center Board Room.ROLL CALLDirectors Katy Foulkes, Andy Katz, Doug Linney, Lesa R. Mclntosh, Frank Mellon, William B.Patterson, and President John A. Coleman were present at roll call.<strong>Staff</strong> present included General Manager Alexander R. Coate, General Coansel Jylana Collins,Attorney Xanthe M. Berry (Item la), Risk Manager Karen A. Curry (Item la), Attorney Derek T.McDonald (Item lb), Director of Wastewater David R. Williams (Item lb), Attorney Karen L.Donovan (Item 2), Director of Water and Natural Resources Richard G. Sykes (Item 2), AttorneyLourdes Matthew (Item 3), Director of Administration Carol Y. Nishita (Item 3), Manager ofHuman Resources Delores A. Turner (Item 3), and Manager of Employee Relations Michael K.Rich (Item 3).PUBLIC COMMENTAddressing the Board were the following persons: 1) Antonio Martinez, President, IFPTE Local21, said that employees provide high quality service to EBMUD customers and as a result theunions expect the <strong>District</strong> to offer appropriate compensation; 2) Ruben Rodriguez, President,AFSCME Local 444 expressed concern regarding the Community Choice Aggregation (CCA)analysis particularly relating to costs, benefit to EBMUD, and staffing impacts; and 3) JohnBriceno, Vice-President, AFSCME Local 444, expressed concern about the cost of an <strong>East</strong> <strong>Bay</strong>CCA t and said that EBMUD should focus on its core goal of delivering high quality water ratherthan venturing into the electric market.ANNOUNCEMENT OF CLOSED SESSION AGENDAPresident John A. Coleman announced the Closed Session agenda. The Board convened toConference Room 8A/B for discussion.Regular Business MeetingPresident John A. Coleman called to order the Regular Business Meeting of the Board of Directors at1:15 p.m. in the Administration Center Board Room.

Regular Meeting Minutes ofDecember 11,2012Page 2 of 9ROLL CALLDirectors Katy Foulkes, Andy Katz, Doug Linney, Lesa R. Mclntosh, Frank Mellon, William B.Patterson, and President John A. Coleman were present at roll call.<strong>Staff</strong> present included General Manager Alexander R. Coate, General Counsel Jylana Collins, andSecretary of the <strong>District</strong> Lynelle M. Lewis.BOARD OF DIRECTORSPresident John A. Coleman led the Pledge of Allegiance.ANNOUNCEMENTS FROM CLOSED SESSIONPresident Coleman announced that the Board, in closed session this morning, by a unanimous vote ofthe Directors attending, authorized the General Counsel to initiate litigation in one matter. The action,defendant and other particulars will be disclosed, upon inquiry, once the actions are formallycommenced. There were no other announcements from closed session.PUBLIC COMMENTThere were no comments.CONSENT CALENDAR• Motion by Director Mclntosh, seconded by Director Patterson, to approve Items 1-13 on theConsent Calendar, carried (7-0) by voice vote.1. Motion No. 149-12 ~ Approved the Regular Meeting Minutes of November 27, 2012.2. The following correspondence was filed with the Board: 1) Report entitled "<strong>East</strong> <strong>Bay</strong>Community Choice Aggregation Preliminary Analysis," dated December 6, 2012; 2)Presentation entitled "Proposed Financings for FY 13, December 11, 2012; 3) Presentationentitled "Water Supply Board Briefing," dated December 11, 2012; 4) Letter dated December11, 2012 from Joseph J. Haraburda, President & CEO, Oakland Metropolitan Chamber ofCommerce, to John Coleman, President, urging the Board to steer clear of a new venture ofCommunity Choice Aggregation and focus on providing water and water treatment; 5) Letter(undated) from Rebecca D. Kaplan, Councilmember At-Large, City of Oakland, to Board ofDirectors, urging the Board to conduct additional study of an <strong>East</strong> <strong>Bay</strong> Community ChoiceEnergy Program; 6) Letter from Bob Canter, ACE, President & CEO, Emeryville Chamber ofCommerce, urging the Board to focus on EBMUD's core mission of providing water andwastewater rather than pursuing Community Choice Aggregation; 7) Letter dated December11, 2012 from Nancy Skinner, Assemblymember, 15 th <strong>District</strong>, California Legislature,regarding support for continued exploration of Community Choice Aggregation; and 8) Letterdated December 6, 2012 from Community Choice Working Group. Berkeley Climate ActionCoalition, to EBMUD Board and <strong>Staff</strong>, urging the Board to prioritize the development of localrenewable energy resources in an <strong>East</strong> <strong>Bay</strong> Community Choice Aggregation.

Regular Meeting Minutes ofDecember 11,2012Page 3 of93. Motion No. 150-12 — Awarded a contract to the lowest responsible/responsive bidder,Mosiac Crop Nutrition in the annual estimated amount of $478,000 for supplying liquidhydrofluosilicic acid (fluoride) for <strong>District</strong> Water Treatment Plar.ts for the period beginningJanuary 1, 2013 and ending December 31, 2013 with one option to renew for an additionalone-year period under Proposal No. 1305.4. Motion No. 151-12 ~ Authorized an agreement with Konecranes, Inc. in an estimatedannual amount of $85,718 for crane inspection and minor repair at multiple <strong>District</strong>locations during the period December 15, 2012 to December 14, 2016, with four optionsto renew for an additional one-year period under RFP No. PUR 074.5. Motion No. 152-12 - Authorized a sole source contract with General Electric EnergyManagement in the amount of $1,771,950 to inspect, remove, design, furnish, test,deliver, replace, and commission the stator windings for Pardee Powerhouse Unit Nos. 1and 2 hydropower generators, including all accessories to complete the rewind.6. Motion No. 153-12 — Authorized an amendment to the agreement with AspenTechnology, Inc. in an amount not to exceed an additional $193 030, to extend theagreement for software maintenance support services for the <strong>District</strong>'soperations/network data historian system to June 30, 2017.7. Motion No. 154-12 ~ Authorized an amendment to the agreement with Pacific Gas &Electric Company for High-Efficiency Clothes Washer Rebate Program services in anamount not to exceed $125,000 from January 1, 2013 through June 30, 2014, with anoption to renew for two additional one-year periods through June 30, 2016 for a totalamount of $375,000.8. Motion No. 155-12 — Authorized an amendment to extend the agreement with the Cityof San Leandro for the provision of sewer agency billing and collection services fromDecember 27, 2012 to June 30, 2013.9. Motion No. 156-12 ~ Authorized the Office of General Counsel to continue theemployment of the law office of Ginn & Crosby, LLP, in an additional amount not toexceed $150,000 for specialized legal services related to construction, contract, claimsand litigation matters.10. Motion No. 157-12 - Authorized the Office of General Counsel to continue theemployment of the law office of Hanson Bridgett, LLP, in an additional amount not toexceed $350,000 for specialized legal services related to construction, contract, claimsand litigation matters.11. Resolution No. 33906-12 ~ Declaring Results Of Election Held On November 6, 2012For The Election Of Directors Of The <strong>East</strong> <strong>Bay</strong> <strong>Municipal</strong> <strong>Utility</strong> <strong>District</strong> (Wards 1, 5and 6).12. Resolution No. 33907-12-- Approving Amendments To Memorandum OfUnderstanding Between The <strong>East</strong> <strong>Bay</strong> <strong>Municipal</strong> <strong>Utility</strong> <strong>District</strong> And The AmericanFederation Of State, County And <strong>Municipal</strong> Employees, Local 444.

Regular Meeting Minutes ofDecember 11,2012Page 4 of913. Resolution No. 33908-12 - Amending The <strong>East</strong> <strong>Bay</strong> <strong>Municipal</strong> <strong>Utility</strong> <strong>District</strong> 401 (a)Tax Deferred Savings Plan To Make Changes Effective January :, 2013.DETERMINATION AND DISCUSSION14. Accept the <strong>East</strong> <strong>Bay</strong> Community Choice Aggregation Preliminary Analysis andProvide Direction to <strong>Staff</strong> on Next Steps.Director of Operations and Maintenance Michael J. Wallis presented highlights from the <strong>East</strong><strong>Bay</strong> Community Choice Aggregation (CCA) Preliminary Analysis report. He said that thereport summarizes studies and reports completed by the <strong>District</strong> and other cities and agenciesthat have evaluated CCAs, and describes the potential barriers, benefits, risks, costs, interestlevels and institutional issues for the <strong>District</strong> associated with participation in an <strong>East</strong> <strong>Bay</strong>CCA.Mr. Wallis said the report describes two institutional models for an <strong>East</strong> <strong>Bay</strong> CCA:1) forming a separate electric utility and 2) forming a Joint Powers Authority (JPA). Thepreliminary review of CCAs indicates that forming an <strong>East</strong> <strong>Bay</strong> CCA may be within the<strong>District</strong>'s authority under the California <strong>Municipal</strong> <strong>Utility</strong> <strong>District</strong> (MUD) Act. However,start-up costs are estimated at $1.6-$3.2 million with $12-20 million as required workingcapital.The benefits include furthering the <strong>District</strong>'s greenhouse gas emission reduction goals andsupporting the <strong>District</strong>'s policies related to water conservation and use of renewable energy.Since the <strong>District</strong> has developed expertise in renewable power generation over severaldecades, another potential benefit is building on this foundation. The <strong>District</strong> can alsoleverage its expertise in other aspects of utility management, such as customer service, riskmanagement, and public outreach.It was noted that a key risk is that the <strong>District</strong> does not have experience in providing utilityservices in a competitive marketplace and a market environment presents new risks thatrequire further study. The report presumes that an <strong>East</strong> <strong>Bay</strong> CCA would rely heavily oncontracted expertise for startup and operations. Another important risk element is thepotential fiscal impact of a CCA on the <strong>District</strong>. This aspect also would require carefulstudy. At the present time the <strong>District</strong> is facing increasing demands on resources forinfrastructure maintenance and water sales are projected to remain lower than historicalaverages for the next several years.Mr. Wallis went to say that if the <strong>District</strong> pursues further study o:f an <strong>East</strong> <strong>Bay</strong> CCA, it wouldbe essential for staff to have clear direction on the goals and objectives of the <strong>District</strong>'sinvolvement. Prior to initiating discussions with interested cities the <strong>District</strong> would need todevelop a set of principles to guide staff in further research and potential negotiations. The<strong>District</strong> would also expect its resource investments of staff time and research funding to bemet with similar levels of investment by all parties interested in evaluating the governancemodels, customer benefits, costs and level of interest, and financing alternatives. A joint

Regular Meeting Minutes ofDecember 11, 2012Page 5 of9effort among the interested parties could be accomplished under a Memorandum ofUnderstanding with each party contributing to the costs and resources. The study cost couldinclude hiring a consultant to folly analyze the governance models and the cost of forming aCCA, to quantify the potential liability of operating a CCA, and to assist in communityoutreach and market assessment. Similar efforts by other agenc.es have cost $250 000 to$500,000.President Coleman opened the meeting to public comment on the CCA analysis.- Addressing the Board were the following persons: 1) Dan Kalb ; Councilmember-Elect,City of Oakland, urged the Board to move forward on the feasib ility study of an <strong>East</strong> <strong>Bay</strong>CCA; 2) Linda Maio, Vice-Mayor, City of Berkeley, commented that the city would like tobe in partnership on an <strong>East</strong> <strong>Bay</strong> CCA; 3) Gordon Wozniak, Berkeley City Council, urgedthe Board to move forward on forming an <strong>East</strong> <strong>Bay</strong> CCA and noted that his preference forthe JPA model; 4) Paul Junge (Young), Oakland Metropolitan Chamber of Commerce,urged the Board to avoid the risk of a CCA and focus on providing quality water andwastewater services; 5) Gregory McConnell, Jobs and Housing Coalition, commented thatEBMUD should focus on its core mission of providing water and wastewater services andsaid that any CCA model would involve substantial risks; 6) Jose Duenas, CEO, AlamedaCounty Hispanic Chamber of Commerce, urged the Board to focus on providing qualitywater and wastewater services and not to spend any more money on studying an <strong>East</strong> <strong>Bay</strong>CCA; 7) Greg Lamberg, commented that a CCA would be costl> and add another layer ofgeneration; 8) Wil Hardee, Oakland African American Chamber of Commerce, commentedthat a CCA is too risky and said that EBMUD should use its resources to increase itssupplier diversity and water conservation efforts; 9) Dat Nguyen. Vietnamese Chamber ofCommerce, said his organization did not support the increased cost for a CCA butencouraged EBMUD to help the business community; 10) Mr. Kim Huggett, HaywardChamber of Commerce, urged the Board to focus on providing quality water andwastewater services and not to spend any more money on studying an <strong>East</strong> <strong>Bay</strong> CCA; 11)Bob Canter, Emeryville Chamber of Commerce, commented thai the benefits of any CCAmodel were modest and he did not support further study; 12) Ma:thew Rinn, President,Pleasant Hill Chamber of Commerce, commented that EBMUD should use its resources inthe community, expressed concern about higher rates, and urged the Board halt furtherstudy of an <strong>East</strong> <strong>Bay</strong> CCA; 13) Antonio Martinez, President, IFPTE Local 21, commentedthat the costs for a CCA were too high and the benefits too low; 14) Carl Chan, ChinatownChamber of Commerce, commented that an <strong>East</strong> <strong>Bay</strong> CCA was too costly and risky andurged the Board not to spend any more money on studies; 15) Ruben Rodriguez, President,AFSCME Local 444, expressed concern about the costs to customers for an <strong>East</strong> <strong>Bay</strong> CCA;16) Thomas Kelly, Community Choice Energy Work Group, Berkeley Climate ActionCoalition, urged the Board to move forward on an <strong>East</strong> <strong>Bay</strong> CCA; 17) Cynthia Wooten,LEAN Energy U.S., urged the Board to proceed with studying the formation of an <strong>East</strong> <strong>Bay</strong>CCA and commented that an electric utility model would benefit the <strong>District</strong>; 18) ObrayVan Buren, Local 342-Plumbers & Steamfitters, commented that the high cost of an <strong>East</strong><strong>Bay</strong> CCA would impact low income customers and the <strong>District</strong> should invest in its staff;

Regular Meeting Minutes ofDecember 11, 2012Page 6 of919) Brenda Wood, Business Agent, AFSCME Local 2019, commented there were stillmany unanswered questions, particularly about employees, job creation, and capitalinvestments, 20) Jennifer Lin, Research Director, <strong>East</strong> <strong>Bay</strong> Alliance for a SustainableEconomy, urged the Board to move forward on an <strong>East</strong> <strong>Bay</strong> CCA; 21) Dave Room, LocalClean Energy Alliance, urged the Board to continue study of an <strong>East</strong> <strong>Bay</strong> CCA; 22) JessicaDervin-Ackerman, Sierra Club- San Francisco <strong>Bay</strong>-Chapter, urged the Board to continuestudy of an <strong>East</strong> <strong>Bay</strong> CCA; 23) Corrine Van Hook, <strong>Bay</strong> Localize, commented that an <strong>East</strong><strong>Bay</strong> CCA would provide many community benefits, help businesses, improve theenvironment and create jobs; 24) Al Weinrub, Oakland Climate Action Coalition, urgedfurther study of a an <strong>East</strong> <strong>Bay</strong> CCA; 25) Joanne Drabek, urged farther study of an <strong>East</strong> <strong>Bay</strong>CCA; 26) Wendy Sommer, StopWaste.org, commented that a JPA would provide energyefficiency to the community; 27) Tim McGallian, Concord Chamber of Commerce, urgedthe Board to discontinue further study of an <strong>East</strong> <strong>Bay</strong> CCA and to continue its partnershipwith PG&E; 28) Hector Stery, IBEW Local 1245, urged the Board to pursue a JPA modeland staff with union trade jobs; 29) Kimberly King, self-employed Renewable EnergyEngineer, urged the Board to continue exploring the feasibility of an <strong>East</strong> <strong>Bay</strong> CCA.The Board discussed at length their views on community choice aggregation. There wasgeneral consensus that the <strong>District</strong> has been a good environmental steward over the yearsand provides high quality water and wastewater treatment services. President Colemanpointed out that the <strong>District</strong> has spent over $1 million over the past ten years studying thisissue. He expressed concern about the <strong>District</strong>'s fiscal health, credit rating and reserves ifit ventured into community choice aggregation. President Coleman said he was not infavor of moving forward with additional study of an <strong>East</strong> <strong>Bay</strong> CCA.Director Katz said the he could support a JPA model but suggested that cities come up withstart up costs and develop a proposal on administration of the CCA. Director Mellon saidhe was not supportive of a JPA model because it offered no benefit to the <strong>District</strong>. He saidhe did not recommend any further study of an <strong>East</strong> <strong>Bay</strong> CCA. Director Mclntoshsuggested that staff continue participating in meetings with local agencies on CCA but notbe the driving force. Director Linney recommended continuing discussions on the JPAmodel. Director Patterson expressed concern about the costs for a CCA and the relativelylow return for the <strong>District</strong>. Director Foulkes also expressed concern about the costs of aCCA and said she was not in favor of spending any more on studies. She recommendedthat the communities who are interested in an <strong>East</strong> <strong>Bay</strong> CCA pay for the study.After considerable discussion, the following recommendations were proposed: 1) Revisitand strengthen Policy 7.07, Renewable Energy, which focuses on developing renewableenergy projects as part of the <strong>District</strong>'s ongoing infrastructure mmagement effort, andupdate its goals and objectives as appropriate; 2) Discontinue further exploration of a<strong>District</strong> led electric utility as a CCA model; and 3) Further studios on exploring a JointPowers Authority (JPA) as a CCA model must be funded by the cities and will not befunded by the <strong>District</strong>. However, staff is authorized to attend meetings and participate indiscussions regarding a city funded regional CCA JPA, and provide updates to the Board aswarranted.

Regular Meeting Minutes ofDecember 11, 2012Page 7 of9© Motion by Director Mellon, seconded by Director Foulkes, to approve the recommenddirection to staff on Community Choice Aggregation, carried (6-1) by the following roll callvote:Ayes:Noes:Abstained:Absent:Foulkes, Katz, Mclntosh, Mellon, Patterson, ColemanLinneyNoneNoneMotion No. 158-12 — Provided direction to staff on Community Choice Aggregation(CCA) as follows: 1) Revisit and strengthen Policy 7.07, Renewable Energy, which focuseson developing renewable energy projects as part of the <strong>District</strong>'s ongoing infrastructuremanagement effort, and update its goals and objectives as appropriate; 2) Discontinuefurther exploration of a <strong>District</strong> led electric utility as a CCA model; and 3) Further studieson exploring a Joint Powers Authority (JPA) as a CCA model must be funded by the citiesand will not be funded by the <strong>District</strong>. However, staff is authorized to attend meetings andparticipate in discussions regarding a city funded regional CCA JPA, and provide updatesto the Board as warranted.15. Legislative Update.Special Assistant Marlaigne K. Dumaine provided updates on state and federal legislativeactivity. She reported that the 2013-2014 California legislative session began December 3,2012 with the swearing in of newly elected members. She said that staff would be followingbills and initiatives of interest to the <strong>District</strong>. The Board asked no questions.16. Approve The Execution Of A Remarketing Agreement And Related SupportingDocuments For The $62.6 Million Wastewater System Revenue Refunding Bonds,Series 2011A, And Approve The Appointment Of JP Morgan As The RemarketingAgent. Also Approve, In Connection With All <strong>District</strong> Wastewater BondsAuthorization For The <strong>District</strong> To Provide, And Bond Trustee To Rely Upon,Instructions And Directions Provided By The <strong>District</strong> By Electronic Means.o Motion by Director Foulkes, seconded by Director Mellon, to approve the recommended actionfor Item 16, carried (5-0) by voice vote. Directors Mclntosh and Patterson were absent.Resolution No. 33909-12 - Authorize The Execution Of A Remarketing Agreement InConnection With The <strong>District</strong>'s Wastewater System Revenue Refolding Bonds, Series2011 A; Authorize The Delivery Of A Preliminary Reoffering Circular And TheExecution And Delivery Of A Final Reoffering Circular; Authorize The Execution AndDelivery Of A Trustee Electronic Instructions Authorization In Connection ThingsDeemed Necessary Or Advisable Relating Thereto.

Regular Meeting Minutes ofDecember 11,2012Page 8 of 9REPORTS AND DIRECTOR COMMENTS17. General Manager's Report.General Manager Coate noted that the Monthly Report for November 2012 was provided tothe Board. Next, Operations and Maintenance Department Manager Eileen M. Whiteprovided a brief water supply update. She reported that Water Year 2012 ended with totalsystem storage full despite low precipitation. She noted that staiewide reservoirs were alsoin good condition. Additionally, she reported that precipitation .md snow for December ismuch higher than last year at this time.18. Committee <strong>Reports</strong>.- Filed with the Board were the Finance/Administration Committe e Minutes of November 272012.13. Director Comments.- Director Foulkes reported meeting with proposers of a rowing CIUD at San Pablo Reservoir onNovember 27.- Director Katz had no comment.- Director Linney had no comment.Director Mclntosh had no comment.- Director Mellon had no comment.- Director Patterson had no comment.- President Coleman reported attending/participating in the following events: ACWAteleconference call on November 24; ACWA teleconference call on November 27; ACWAJPIA meeting in San Diego from December 2-3; ACWA Fall Conference from December 2-7in San Diego; agenda review meeting with General Manager Coate on December 5 in Oakland.He reported on plans to attend/participate in the following upcoming events: UMRWAExecutive Committee teleconference call on December 12; ACWA Executive Committeeteleconference call on December 14; Contra Costa Council Board neeting on December 15 inPleasant Hill; Moose Feed Luncheon on December 15 in San Francisco; and agenda reviewwith General Manager Coat on January 2, 2013.

Regular Meeting Minutes ofDecember 11,2012Page 9 of9ADJOURNMENTThe meeting was adjourned at 5:00 p.m.SUBMITTED BY:Lynelle M. Lewis, Secretary of the <strong>District</strong>APPROVED: January 8, 2013John A. Coleman, President of the BoardW:\Minutes\Minutes 2012U21112_regular_minutes.doc

AGENDA NO.MEETING DATE January 8, 2013TITLEPURCHASE OF INFLUENT SCREENS EQUIPMENTEMOTION • RESOLUTION • ORDINANCERECOMMENDED ACTIONAward a contract to the lowest responsible/responsive bidder, Duperon Corporation, in the estimated totalamount of $1,526,850 for supplying five sets of influent bar screens and washer compactors for the MainWastewater Treatment Plant (MWWTP) under Proposal No. 1306.SUMMARYThe new influent bar screens and washer compactors will replace the existing %-inch climber screens atthe MWWTP Influent Pump Station. The new influent bar screens will have VJ-inch spacing which willsignificantly improve the removal of debris from the wastewater. Debris removal at the headworks iscritical to protect downstream process equipment and increase the reliability and usable capacity of thedigesters.DISCUSSIONThe existing %-inch climber screens allow excess debris such as rags, hair and other fibrous materials toescape downstream to the primary sedimentation tanks, and eventually collect in the digesters. Thisfibrous debris often forms a stringy solid mass, which causes plugging of pumps, heat exchangers, andgrinders. Within the last decade, new developments in screening technology have influenced otherwastewater agencies to replace their screens with finer-spaced screens with ^-inch spacing. Furthermore,as part of the ongoing digester upgrade project, the sludge withdrawal system i s being modified to apassive overflow system that will allow each digester to use its maximum capacity. Finer-spaced barscreens will reduce the potential for plugging issues in the new passive digester overflow system.The scope of work for this project involves replacing the existing %-inch climber screens with new %-inchbar screens and washer compactors. The %-inch spacing allows more debris to be captured and removed atthe headworks, protecting downstream equipment and processes. The new bar screens will also reduceequipment maintenance and the frequency of digester cleaning. The payback for this capital project isapproximately 7 to 8 years.Funds Available: FY13Budget Code:WWC/927/7999/2008216/5301DEPARTMENT SUBMITTING DEPARTMENT MANAGER or DIRECTOR APPROVEDWASTEWATERDavid R. WilliamsA#/a«j£f&General ManagerOJU^Contact the Office of the <strong>District</strong> Secretary with questions about completing or submitting this form.BDl MS 1004

Purchase of Influent Screens EquipmentJanuary 8, 2013Page 2Two bar screens will be replaced in 2013 and three will be replaced in 2014, for a total of five screens.The contract contains a price escalation clause for the purchase of the three bar screens in 2014 that isbased on the U.S. Department of Labor, Bureau of Labor Statistics, Producer Price Index for Metal andMetal Products for December 2012.A separate construction contract for the installation of the new bar screens is being developed, and staffwill recommend award of the installation contract by the Board in April 2013. Due to the long-lead timefor manufacturing and delivery of this equipment (-22 weeks), pre-purchase of this equipment is requiredin order to complete the first two screen installations in 2013 before the onset of the next wet weatherseason, ha addition, equipment pre-purchase will reduce the screen cost to the <strong>District</strong>.SERVICE PROVIDER/CONSULTANT/VENDOR SELECTIONRequests for proposals were sent to three (3) potential proposers and advertised on the <strong>District</strong>'s website.One (1) bid was received. Although only one bid was received, Duperon Corporation provided a very fanbidprice for their equipment based on a comparison of previous sales for their product of similar size andcapacity, hi addition, the bid price by Duperon Corporation was below their initial quotation to the <strong>District</strong>and other competitive manufacturers for the influent bar screens and washer compactors. The engineer'sestimate for the equipment was $1.74 million.CONTRACT EQUITY PROGRAM EFFORTSThe completed P-035 and P-061 forms are attached.FISCAL IMPACTFunds are available for this purchase in the FY13/14 capital budget in the Main Wastewater TreatmentPlant Influent Screen Replacement Project.ALTERNATIVESDo not purchase the influent screens equipment. This alternative is not recommended because pluggingof the digester passive overflow system causes digesters to be out of service. Providing more effectivescreening capture increases digester reliability, reduces equipment maintenance costs, reduces thefrequency for digester cleaning, and increases usable digester capacity.Reject all bids and re-bid. This alternative is not recommended because although one bid was received,the bid is reasonable based on a comparison of previous sales and the engineer's estimate, and is withinthe project budget.AttachmentsW:\NAB\Board Documents\2013\BDlsVTanuary 8\WW - Prepurchase Influent Screens.doc

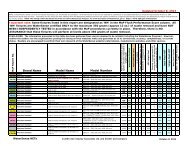

EBMUDCONTRACT EQUITY PROGRAM SUMMARY (P-035)This summary contains information on the contractor's workforce and contract equity participation, (completed by <strong>District</strong>)PROPOSAL NO.: 1306Purchase of Influent Screens Equipment December 20, 2012CONTRACTOR:Duperon CorporationSaginaw, MlSole BidderSmall BusinessIIllllI§iillAvailability Group Contracting Objectives ParticipationBID/PROPOSER'SPRICE:FIRM'S OWNERSHIPWhite Men 25% 100.0%Ethnicity Gender White Women 2% 0.0%$1,526,850 White Men Ethnic Minorities 25% 0.0%:.m^M-^g&||£Mi^^!£^^Ii^^^^BS'RIME:COMPANY NAMEESTIMATEDAMOUNTETHNICITYGENDERnJL;i2Mj£S2Ii!££SCONTRACTING PARTICIPATIONWhite- White-WEthnicPubliclyMen WomenUnclassifiedGov't/NonMinoritiesHeld Corp.ForeignProfitDuperon Corporation$1,526,850 White 100.0%•UBS:^loneTOTAL $1,526,850 100.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%No. of Employees: 30 20White Men White Women Ethnic Minorities Total EmployeesPercent of Total Employees: 54.5% 36.4% 9.1%55MSA Labor Market %: 45.4% 40.2% 14."%WiSA Labor Market Location:Contract Equity Participation - 100% White Men participationSaginaw-<strong>Bay</strong> City-Midland,SEESWorkforce Profile & Statement of NondiscriminationSubmittedNAGood Faith Outreach EffortsRequirement SatisfiedNAAward Approvalf\ Reco\nmended"••. )(P-035-7/11) : 1 of 1 File: Proposal-3117.xls

EBMUDAFFIRMATIVE ACTION SUMMARY (P-0i31)(Completed by <strong>District</strong>)This summarizes information provided by the contractor(s)' P-025 Form regarding their workforce.Title:Purchase of Influent Screens EquipmentProposal*: 1306R=RecmmdP=PrimeS=SubComposition of OwnershipCompany Name, Owner/Contact Person,Address, and Phone NumberDATE:12/20/2012Ethnic Minority Percentages From U.S. Census DataNational9 <strong>Bay</strong> Area CountiesAlameda/CC CountiesB10.55.510.7H10.'16.:>15.15A/PI3.714.215.4AI/AN0.70.40.5Number of Ethnic Minority EmployeesBH A/PI AI/AM TOTAL PERCENT| TOTAL27.339.946.2MSA %RPDuperan CorporationTerry Duperon1200 Leon Scott CourtSaginaw, Ml 48601Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled1--1-411-2----------511129.1%3.3%8.3%14.3%33.3%47.8%989-754-8800<strong>Bay</strong> AreaAA Plan on File:Co. Wide MSA:--NASaginaw-<strong>Bay</strong> City-Midland---Date of last contract with <strong>District</strong>:# Employees-Co. W de: 55NANA<strong>Bay</strong> Area:39.9%0Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> Area39.9%Co. Wide MSA:# Employees-Co. Wide:<strong>Bay</strong> Area:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> Area39.9%Co. Wide MSA:# Employees-Co. Wile:<strong>Bay</strong> Area:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> Area39.9%Co. Wide MSA:# Empioyees-Co. Wiiie:<strong>Bay</strong> Area:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> Area|39.9%Co. Wide MSA:# Employees-Co. Wiile:<strong>Bay</strong> Area:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled3ay AreaCo. Wide MSA:1# Employees-Co. Wide:WM=White Male WW=White Women. EM=Ethnic Minority (Ethnicities: B=Black. H=HisDanic. A/Pl=Asian/Pacific Islander and Ai;AN=Am=riMn Inrlian/AlaskI<strong>Bay</strong> Area:39.9%(P-061 -7/11)Page: 1 of 1File: Proposal-3117.xls

4AGENDA NO.MEETING DATE January 8. 2013TITLEPRIVATE SEWER LATERAL APPLICATION ENHANCEMENTSM MOTION • RESOLUTION • ORDINANCERECOMMENDED ACTIONAuthorize an agreement with DesignMind Business Solutions in an amount not to exceed $404,875.00 forsoftware development services to construct the Private Sewer Lateral (PSL) Application Enhancements.In awarding this contract, the Board of Directors finds that this work cannot be satisfactorily performedunder civil service.SUMMARYA Federal Stipulated Order (SO), signed on July 22, 2009, required the <strong>District</strong> ;o adopt a Private SewerLateral Regional Ordinance (PSL Ordinance) for the wastewater service area, which the Board approvedon February 9, 2010. The PSL Ordinance was implemented January 1, 2011 and requires that propertyowners perform inspections, and if necessary, repairs or replacements, of their sewer laterals, prior toselling their property, obtaining construction permits for the property greater that $100,000, or applyingfor changes to EBMUD water service. The <strong>District</strong> is responsible for witnessing and documenting sewerlateral inspections and issuing certificates of compliance. In order to meet this responsibility, the <strong>District</strong>contracted with DesignMind Business Solutions to construct the PSL Application software.The PSL Application Enhancements are a collection of critical extensions to the PSL Application thatcould not be included in the initial application due to scheduling constraints imposed on the <strong>District</strong> by theEnvironmental Protection Agency (EPA).DISCUSSIONThe goals of the PSL Application Enhancements are to improve the efficiency, productivity andcompliance of the EPA- mandated PSL Program. Improvements include provisions for:• Repeat inspections to facilitate tracking and fee charging for multiple trips to a site• Scheduling, including the ability to upload standardized inspection periods and other efficiencies• Mapping to facilitate geographic optimization of inspections and more efficiently utilize field staffFunds Available FY13Budget Code: WWC/944/7999/2002085/5231DEPARTMENT SUBMITTINGDEPARTMENT MANAGER or DIRECTORAPPROVEDINFORMATION SYSTEMSNicholas J. Iriasfe^neral ManagerContact the Office of the <strong>District</strong> Secretary regarding questions about completing or submitting this form.

Private Sewer Lateral Application Enhancements Software DevelopmentJanuary 8, 2013Page 2• Data management, creating a comprehensive database of inspection results that can be used forEPA reporting• Property management, including systems for tracking exemption requests and waivers, which arecurrently processed manually• Automation of the enforcement process, significantly streamlining manual processing and crosscheckingOnce developed, the system will be maintained in the future by <strong>District</strong> forces.CONSULTANT SELECTIONThe PSL Application is custom software and requires specialized knowledge to enhance. DesignMindBusiness Solutions acquired the requisite business and application knowledge when it completed thedesign and development of the initial version of the PSL Application. DesijjnMind Business Solutionsbuilt the existing application, has in-depth knowledge of the application and our PSL-related businessprocess, and is therefore uniquely qualified to perform this work.CONTRACT EQUITY PROGRAMThe completed P-35 and P-61 forms are attached.FISCAL IMPACT.Sufficient funds are available in the Wastewater FY13 capital budget to complete the planned work.UNION NOTIFICATIONLocals 2019 and 21 were notified of this contract on January 12, 2012. Locals 2019 and 21 did not raiseany specific issues related to this contract.ALTERNATIVESDelay or Do Not Proceed with the Project. This alternative is not recomm ended, because the PSLApplication Enhancements represent a collection of extensions to the existing application whose absenceis making it difficult for the <strong>District</strong> to cost-effectively comply with EPA requirements. Appointmentscheduling and enforcement are currently supported by manual processing which is not sustainable givengrowth in the PSL Program and associated workload. In addition, staff is currently negotiating a longterm consent decree that will have more robust reporting requirements that can not be met without theseupgrades.Perform the Work with <strong>District</strong> Forces. This alternative is not recommended due to the fact thatsoftware development resources are committed to other priority projects, such as the new HR and MMISsystems.

EBMUDCONTRACT EQUITY PROGRAM SUMMARY (P-035)This summary contains information on the contractor's workforce and contract equity partic pation. (Completed by <strong>District</strong>)Professional Services AgreementPrivate Sewer Lateral Application EnhancementsDecember 13, 2012CONTRACTOR:DesignMind Business Solutions, Inc.San Francisco, CADirect AwardSmall BusinessB&^NIB&HBra»B&i&iHHg£3Availability Group Contracting Objectives ParticipationFIRM'S OWNERSHIP 25%BID/PROPOSER'SWhite Men100.0%PRICE: EthnicityGenderWhite Women6%0.0%$404,875 White Men Ethnic Minorities[Tiff"25% 0.0%COMPANY NAMEESTIMATEDAMOUNTETHNICITYGENDERWhite-MenWhite-WomenCONTRACTING PARTICIPATIONEthnicMinoritiesUnclassifiedPubliclyHeld Corp.Gov'UNonProfitForeignPRIME:DesignMind Business Solutions, Inc.SUBS:None$404,875 White100.0%TOTAL $404,875 100.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%ONTRACTOR'S WORKFORCES PROFILE (From P-025 Form)White Men White Women Ethnic MinoritiesTotal EmployeesNo. of Employees: 15Percent of Total Employees: 68.2%4.5% 27.3%22MSA Labor Market %:MSA Labor Market Location:30.8% 25.1%44.0%San FranciscoContract Equity Participation -100% White Men participation and no subcontract opportunities exist.Workforce Profile & Statement of Nondiscrimination Good Faith Outreach EffortsVv Awa^ApprovalSubmitted Requirement Satisfiedf\ \\r \ \ Recomrhjsqded^ " •NANACV^->(P-035-7/11)Page: 1 of 14terPS-3116.xls

EBMUDAFFIRMATIVE ACTION SUMMARY (P-061)(Completed by <strong>District</strong>)This summarizes information provided by the contractor(s)' P-025 Form regardin(| their workforce.Title:Private Sewer Lateral ApplicationEnhancementsProfe. ssional Services AgreementR=RecmmdP=PrimeS=SubComposition of OwnershipCompany Name, OwnerfContact Person, Address,and Phone NumberDATE:12/13/2012Ethnic Minority Percentage:; From U.S. Census DataNational9 <strong>Bay</strong> Area CountiesAlameda/CC CountiesB10.55.510.7H10.716.215.6A/PI3.714.215.4AI/AN0.70.40.5Number of Ethnic Minority EmployeesBH A/PI AI/AN TOTAL PERCENTTOTAL27.339.946.2MSA %RPWM - SBEDesignMind Business Solutions, inc.Mark Ginnebaugh465 California Street, Suite 425San Francisco, CA94104415-538-8484Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaAA Plan on File:Co. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:11---1NASan Francisco44---411---166--Date of last contra* rtwith <strong>District</strong>:# Employees-Co. Wide:# Employees-Co. Wide:# Employees-Co. Wide:# Employees-Co. '/Vide:# Employees-Co. 'Wide:# Employees-Co. /Vide:22-627.3%27.3%NANANA30.0%10/3/2011WM=White Male, WW=White Women, EM=Ethnio Minority (Ethnicities: B=Black, H=Hispanic, A/PI=Asian/Pacific Islander, and AI/AN=,\merican Indian/Alaskan Native)<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:44.0%39.9%2039.9%39.9%39.9%39.9%39.9%(P-061-7/11)Page: 1 of 1File: PS-3116.xls

EBMUDTITLE*S.AGENDA NO.MEETING DATE January 8, 2013CELLULAR TELEPHONE AND PUSH-TO-TALK SERVICES - ADDITIONALPROVIDEREl MOTION.• RESOLUTIOND ORDINANCERECOMMENDED ACTIONAuthorize an amendment to Board Motion 170-10 to include Verizon Wireless as an additional providerof cellular telephone and push-to-talk services.SUMMARYOn December 14, 2010 the Board of Directors authorized an agreement with Sprint Solutions for a threeyearperiod from 2011 through 2013 with two options to renew for additional one-year periods, under theWestern States Contracting Alliance (WSCA) to provide cellular telephone and push-to-talk services foremployees to communicate with each other, within workgroups and to communicate with contractors,vendors and customers. Sprint Solutions and Verizon Wireless responded to the original RFP and weredeemed responsive and qualified. Due to changes in Sprint's cellular network, ihe service performance isno longer meeting the <strong>District</strong>'s communication needs and flexibility is needed :o transition to VerizonWireless. This service provider change will not affect the estimated amount of $320,000 per yearidentified in the original motion.EVALUATIONPublic Contract Code, Section 10298, specifically allows agencies to purchase directly from the statecompetitively awarded contracts without pursuing separate competitive bidding This provides a typicalsavings of 10-15% over pricing the <strong>District</strong> would get if bidding alone. The Verizon Wireless terms ofservice are consistent with the Western States Contracting Alliance (WSCA) contract which wasauthorized by the <strong>District</strong> in 2010.CONTRACT EQUITY PROGRAM EFFORTSThe completed P-35 and P-61 forms are attached.FISCAL IMPACTFunds for this contract are available in the Information Systems Department FY13 operating budget.Based on a rate comparison performed by Verizon, there will be no impact to existing service rates.Funds Available FY: 13-14Budget Code: WSO/252/8500/5372DEPARTMENT SUBMITTINGDEPARTMENT MANAGER or DIRECTORAPPROVEDINFORMATION SYSTEMSNicholas J. Idas

Alternative Cellular Telephone and Push-to-Talk ServicesJanuary 8, 2013Page 2ALTERNATIVESDo not add Verizon Wireless as a service provider. This alternative is not recommended because theability of the <strong>District</strong> work groups to communicate is currently impacted by Sprint's service performance.Conduct a competitive process to obtain pricing and vendors. This alternative is not recommendedbecause the WSCA contract provides the best terms and pricing available to the <strong>District</strong> due to theleveraged buying power of multiple states.

EBMUDCONTRACT EQUITY PROGRAM SUMMARY (P-035)This summary contains information on the contractor's workforce and contract equity participatio l. (Completed by <strong>District</strong>)Amendment to General Services AgreementCellular Telephone and Push-to-Talk Services - Two-Year Contract with 2One-Year Renewal OptionsDecember 20, 2012CONTRACTOR:Verizon WirelessWalnut Creek, CALocal Business Availability Group Contracting Objectives ParticipationFIRM'S OWNERSHIP White Men25%BID/PROPOSER'S0.0%PRICE: EthnicityGender White Women6%0.0%$320,000 /year Publicly Held Corp. Ethnic Minorities25%0.0%COMPANY NAMEESTIMATEDAMOUNTETHNICITYGENDERWWhite-MenWhite-WomenCONTRACTING PARTICIPATIONEthnicMinoritiesUr classifiedPubliclyHeld Corp.Gov't/NonProfitForeignPRIME:Verizon Wireless$320,000Publicly HeldCorp.100.0%SUBS:NoneTOTAL $320,0000.0% 0.0% 0.0% 0.0% 100.0% 0.0%ONTRACTOR'S VftoRKFORCESPROFILE (From P-025 Horm) yWhite MenWhite WomenEthnic MinoritiesTotal Employees0.0%No. of Employees: 27,07518,611 32,592Percent of Total Employees: 34.6% 23.8%41.6%78,278MSA Labor Market %:39.0%33.7%27.2%MSA Labor Market Location:USAmmwfimm 'MmmmMMM^LMMMZMdContract Equity Participation - Zero Contract Equity participation since firm is a publicly held corporation and no subcontractopportunities exist.Workforce Profile & Statement of NondiscriminationSubmittedNAGood Faith Outreach EffortsRequirement SatisfiedNA^^•s.AWAward ApprovalRecommended(P-035-7/11)Page: 1 of 1File: GS-3119.xls

EBMUDAFFIRMATIVE ACTION SUMMARY (P-061)(Completed by <strong>District</strong>)This summarizes information provided by the contractor(s)' P-025 Form regarding their workforce.Title:Cellular Telephone and Push-to-TalkServices - Two-Year Contract with 2 One-Year Renewal OptionsGeneral Services AgreementR=RecmmdP=PrimeS=SubComposition of OwnershipCompany Name, Owner/Contact Person, Address,and Phone NumberDATE:12/20/2012National9 <strong>Bay</strong> Area CountiesAlameda/CC CountiesBEthnic Minority Percentages From U.S. Census DataB I10.55.510.7II |1C.716.21E.6Number of Ethnic Minority EmployeesHA/PIAI/ANA/PI J3.714.215.4TOTALAI/AN |0.70.40.5PERCENTTOTAL27.339.946.2MSA %RPVerizon WirelessRobert E. Graves2795 Mitchell DriveWalnut Creek, CA 94598510-421-1111Publicly Held Corp. - LBECompany WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaAA Plan on File:Co. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:NAUSA17,1483,6444,1719,329WM=\ White Male WW=White Women. EM=Ethnic Minority (Ethnicities: B=Black. H=Hisoanic. A/PI=Asian/Pacific slander, and AI/AN= American Indian/Alaskan Native)48I10,4732,2684,2363,9672144,5482,1891,580779-174:»31D21i)81i>2132,5928,20310,14514,237739Date of last contra ct with <strong>District</strong>:# Employees-Co. Wide: 78,278I# Employees-Co. Wide:# Employees-Co. Wide:# Employees-Co. Wide:# Employees-Co. Wide:# Employees-Co. Wide:41.6%34.7%37.4%51.9%11.9%31.7%10/1/2012[<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area27.2%39.9%123| 39.9%39.9%39.9%39.9%| 39.9%(P-061-7/11)Page: 1 of 1File: GS-3119.xls

EBMUDTITLEAAGENDA NO.MEETING DATE January 8. 2013AUTHORIZE CONTINUED EMPLOYMENT OF BARG, COFFIN, LEWIS & TRAPP, LLP,AS SPECIAL COUNSELm MOTION. • RESOLUTION • ORDINANCERECOMMENDED ACTIONAuthorize the Office of General Counsel to continue employment of the lew firm of Barg, Coffin, Lewis& Trapp, LLP, for services of special counsel related to environmental regulation and litigation matters inan additional amount not to exceed $200,000.DISCUSSIONThe firm of Barg, Coffin, Lewis & Trapp has been retained to assist the Office of General Counsel inenvironmental regulation and related litigation matters. The Office of General Counsel is now requestingauthorization for additional funds for services described in a separate confidential memorandum to theBoard of Directors.CONTRACT EQUITY PROGRAM EFFORTSThe completed P-035 and P-061 forms are attached.FISCAL IMPACTSufficient monies have been budgeted in the Office of General Counsel's budget for fiscal year 2013 forthis request for specialized legal assistance.Funds Available: FY 2013Budget Code: WSO 130 8511 5:»31DEPARTMENT SUBMITTINGDEPARTMENTOffice of General CounselContact the Office of the <strong>District</strong> Secretary regarding questions about completing or submitting this form.BDl PS 1008

EBMUDCONTRACT EQUITY PROGRAM SUMMARY (P-035)This summary contains information on the contractor's workforce and contract equity partio pation. (completed by <strong>District</strong>)Amendment to Professional Services AgreementAuthorize Continued Employment of Barg, Coffin, Lewis, & Trapp, LLP, asSpecial CounselDecember 13, 2012CONTRACTOR:Barg, Coffin, Lewis, & Trapp, LLPSan Francisco, CACOMPANY NAMEESTIMATEDAMOUNTETHNICITYGENDERWhite-MenWhite-WomenCONTRACTING PARTICIPATIONEthnicMinoritiesUnclassifiedPubliclyHeld Corp.Gov't/NonProfitForeignPRIME:Barg, Coffin, Lewis, & Trapp, LLP$200,000 100.0%WhiteSUBS:NoneTOTAL $200,000 100.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%ONTRACTOR'S WORKFORCES PROFILE {From P-025 Form)White MenWhite WomenEthnic MinoritiesNo. of Employees: 12 1411Total EmployeesPercent of Total Employees: 32.4%37.8% 29.7%37MSA Labor Market %:MSA Labor Market Location:30.8% 25.1%ISQMMENTS!44.0%San Franci;3coContract Equity Participation -100% White Men participation and no subcontract opport jnities exist.Workforce Profile & Statement of NondiscriminationSubmittedNAGood Faith Outreach EffortsRequirement SatisfiedNAA

AFFIRMATIVE ACTION SUMMARY (P-OB1)EBMUD(Completed by <strong>District</strong>)Title:This summarizes information provided by the contractors)' P-025 Form regarding their workforce.Authorize Continued Employment of Bara.Coffin, Lewis, & Trapp, LLF , as SpecialCounselProfessional Services AgreementRPR=RecmmdP=PrimeS=SubComposition of OwnershipCompany Name, Owner/Contact Person, Address,and Phone NumberWM - SBEBarg, Coffin, Lewis, & Trapp, LLPJohn F. Barg350 California Street, 22nd FloorSan Francisco, CA 94104415-228-5410DATE:12/13/2012Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaAA Plan on File:Co. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/Unskilled<strong>Bay</strong> AreaCo. Wide MSA:Company WideManager/ProfTechnical/SalesClerical/SkilledSemi/UnskilledNational9 <strong>Bay</strong> Area CountiesAlameda/CC CountiesB21-1-2NASan FranciscoEthnic Minority Percentages From U.S. Census Data<strong>Bay</strong> AreaCo. Wide MSA:# Employees-Co. Wide:<strong>Bay</strong> Area:WM=White Maie. WW=White Women, EM=Ethnic Minority (Ethnicities: B=Black, H=Hispanic, AJPI=Asian/Paci(ic Islander, and AI/AN= \merican Indian/Alaskan Native)|B10.55.510.7" I107162156Number of Ethnic Minority EmployeesH2--2-2A/PI72-5-7AI/AN------A/PI3.714.215.4TOTAL113-8-11Date of last contract with <strong>District</strong>:# Employees-Co. Wide:# Employees-Co. Wide:# Employees-Co. 'Wde:# Employees-Co. 'Wide:# Employees-Co. /Vide:37IAI/AN |0.70.40.5PERCENT29.7%15.8%NA44.4%NA29.7%3/1/2002<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:<strong>Bay</strong> Area:TOTAL27.339.946.2MSA %44.0%39.9%3739.9%39.9%39.9%39.9%39.9%(P-061-7/11)Page: 1 of 1File: PS-3115.xls

EAST BAY MUNICIPAL UTILITY DISTRICT7.DATE: January 3, 2013MEMO TO:Board of DirectorsTHROUGH: Alexander R. Coate, General Managerrft^'FROM:Marlaigne Dumaine, Manager of Legislative AffairsSUBJECT: Federal Legislative Initiatives for 2013OVERVIEWThe 113 th Congress convenes this month amidst a challenging political environment stemming fromthe continued need to address federal spending. In addition to the fiscal issues, congress' domesticpolicy agenda is likely to be comprised of issues of interest to EBMUD, including infrastructure andthe Sacramento-San Joaquin Delta.Infrastructure assistance will continue to be a key policy issue and congress is expected to continue toexplore ways to allocate limited resources for infrastructure funding. The house and senateinfrastructure committees have expressed interest in proposals to promote low interest loans,infrastructure banks, public-private partnerships, and other more traditional financing mechanisms.Congress may also review the issue of local and state tax-exempt financing as part of any tax reformefforts.Congressional efforts to reauthorize the Water Resources Development Act (V/RDA) are likely to gainmomentum during 2013. Congressional leaders have been canvassing members to ascertain the valueof earmarks with a particular emphasis on WRDA. The Senate Committee on Environment and PublicWorks held a hearing on a draft WRDA bill in late 2012, however, the legislation did not advance priorto the end of the session. Senator Barbara Boxer has identified WRDA as a top priority for 2013. TheHouse Committee on Transportation and Infrastructure, with its new Chairman Bill Shuster (R-PA),has also signaled that WRDA is a priority. Accordingly, WRDA legislation is expected to be broughtforth in this congressional session. A new WRDA is anticipated to be policy-oriented as opposed to thetraditional focus on project authorizations. However, it will be important to advance EBMUD's projectauthorization needs to the extent feasible.With regard to securing appropriations for projects with existing WRDA authorizations, including"new starts," the climate in 2013 will continue to be austere. House and senate rules continue to denyproject earmarks. However, there are some indications these rules may be revisited in 2013. It isimportant that EBMUD continue to advance its project appropriation requests to ensure EBMUD'sneeds are communicated to its congressional delegation in the event the earmark rules are revised in amanner that allows for project funding.On the policy front, issues of interest to EBMUD continue to be primarily focused on matters relatingto the Sacramento-San Joaquin Delta, including funding, mitigation, and water supply.

Board of DirectorsFederal Legislative Initiatives for 2013January 3, 2013Page 2EBMUD's 2013 federal legislative initiatives have been developed consistent with the past year'sgoals and objectives with the understanding that congress and the administration are operating in aconstrained fiscal environment. EBMUD's 2013 federal legislative initiatives are focused on items ofhighest priority for EBMUD: infrastructure funding; fiscal year 2014 (FY14) project appropriations,WRDA project authorization requests, and advancing EBMUD's interests within the key policy area ofthe Sacramento-San Joaquin Delta. These four EBMUD 2013 federal initiatives are summarized in thetable below and described in detail in the attachment.FEDERAL INITIATIVE1. Seek federal funding opportunities forinfrastructure projects via any new federalprograms which may be developed and anyexisting programs.2. Continue to seek federal funding forEBMUD's three WRDA authorized projects- the San Ramon Valley Recycled WaterProject, the Integrated Regional RecycledWater Program, and the <strong>Bay</strong> Area RegionalDesalination Project.3. Continue to pursue new WRDA fundingauthorizations for EBMUD's seismicprogram and the San Ramon ValleyRecycled Water Project.4. Advance EBMUD's <strong>Bay</strong> Delta needswith its federal delegation.ACTION• Seek any available federal funding opportunities forEBMUD's infrastructure projects consistent with the <strong>District</strong>'scurrent Capital Improvement Program.• Pursue FY14 federal funding appropriations of $450,000, $5million, and $4 million for the; San Ramon Valley RecycledWater Project, the Integrated Recycled Water Program, andthe <strong>Bay</strong> Area Regional Desalination Project, respectively.• Pursue new WRDA funding authorizations in the amounts of$35 million for EBMUD's seismic program and $20 millionfor the San Ramon Valley Water Recycling Project.<strong>Staff</strong> will focus on EBMUD's priority issues:• EBMUD's ratepayers should not be held responsible for theflow obligations, project mitigations, or the expected habitatrestoration success of others, including the state and federalprojects.• EBMUD's ratepayers should not be asked to pay for costs thatare the responsibility of others, or for any user fee orsurcharge that subsidizes other parties.• Any solution that would impact the Mokelumne salmonidfishery should include mitigat.on by the responsible parties forthe impacts.Attachment

AttachmentFEDERAL INITIATIVES - 2013INTIATIVE #1 -SEEK FEDERAL FUNDING OPPORTUNITIES FORINFRASTRUCTURE PROJECTSBackgroundThe 113 th Congress is expected to focus in large part on infrastructure assistance policy as membersconsider how to support and spur economic growth. Congress is expected to convene hearings on thepriority of water infrastructure with particular attention given to the role of private sector fundingassistance and the use of tax-exempt funding tools. In addition, the conventional funding of the StateRevolving Loan Fund Program, as well as how it would be impacted by private sector assistance,Water Infrastructure Financing Innovation Act assistance, infrastructure bankf), or other innovativefinancing approaches, is anticipated to be part of the larger congressional debate on how waterinfrastructure needs should be addressed.<strong>Staff</strong> will work with EBMUD's delegation, appropriate committee staff, and tie administration toadvance EBMUD's infrastructure funding needs.Recommended ActionSeek any available federal funding opportunities for EBMUD's infrastructure projects consistent withEBMUD's Capital Improvement Program priorities.INTIATIVE #2 -PURSUE FISCAL YEAR 2014 (FY14) FEDERAL FUNDINGAPPROPRIATIONS FOR EBMUD'S SAN RAMON VALLEYRECYCLED WATER PROJECT, EBMUD'S INTEGRATED REGIONALRECYCLED WATER PROGRAM, AND THE BAY AREA REGIONALDESALINATION PROJECTBackgroundIn 2012, EBMUD sought FY13 federal funding appropriations for the San Ramon Valley RecycledWater Project, the Integrated Recycled Water Program, and the <strong>Bay</strong> Area Regional DesalinationProject. However, a combination of federal budget constraints and a congressional ban on projectearmarks rendered each of these requests unsuccessful. Though the likelihood of receiving projectspecificFY14 appropriations remains low, staff will continue to pursue appro] )riations for each ofthese projects as described below. The projects are presented in order of priority, from the highest tothe lowest.San Ramon Valley Recycled Water ProjectThe San Ramon Valley Recycled Water Project is estimated to provide approximately 6,400 acre-feetof recycled water per year for irrigation uses within the San Ramon Valley. Total joint project costs forthe participating agencies (EBMUD and Dublin San Ramon Services <strong>District</strong>) are estimated to be morethan $150 million.

In 1999, the Water Resources Development Act (WRDA) provided congressional authorization for$15 million in federal funding toward planning, design, and construction assistance by the U.S. Corpsof Engineers for the San Ramon Valley Recycled Water Project. The total appropriations for thisproject to date have nearly exhausted the authorized funding level with approximately $450,000remaining in this initial $15 million authorization. Project appropriations totaling approximately $14.5million were granted from FY02 through FY10 for planning, design, and construction activities.Despite the austere federal funding climate, staff will continue to pursue the remaining $450,000 in theexisting WRDA authorization for this project. This funding will be used toward the construction ofpipelines that are part of Phases 2, 3, and 4 of the project. <strong>Staff</strong> will simultaneously pursue a newWRDA funding authorization for this project in the amount of $20 million, as discussed underInitiative #2.Integrated Recycled Water ProgramThe 2008 enactment of WRDA provided a $25 million funding authorization for the IntegratedRegional Recycled Water Program project. An appropriation for this project has not yet been secured.Because this project is considered by congress to be a "new start," it means that funding opportunitieswill hinge on how congress and the administration address new water infrastructure priorities.EBMUD staff will continue to pursue initial funding for the Integrated Regional Recycled WaterProgram in the amount of $5 million as an FY14 appropriations request. Funding for this project willbe used for the design and construction of Phase IB of the <strong>East</strong> <strong>Bay</strong>shore Recycled Water Project. Thisproject could ultimately supply up to approximately 2.5 million gallons per day of recycled water,which includes replacing the use of potable water in portions of Alameda, Oakland, Emeryville,Berkeley, and Albany.<strong>Bay</strong> Area Regional Desalination ProjectThe <strong>Bay</strong> Area's largest water agencies, the Contra Costa Water <strong>District</strong>, the <strong>East</strong> <strong>Bay</strong> <strong>Municipal</strong> <strong>Utility</strong><strong>District</strong>, the San Francisco Public Utilities Commission, the Santa Clara Valley Water <strong>District</strong> and theAlameda County Flood Control and Water Conservation <strong>District</strong> - Zone 7, arc jointly exploring thedevelopment of regional desalination facilities that would benefit over 5.6 million <strong>Bay</strong> Area residentsand businesses served by these agencies. The <strong>Bay</strong> Area Regional Desalination Project would consist ofone or more facilities, with an estimated capacity range of 10 to 50 million gallons per day, enoughwater to serve 100,000 to 500,000 people. This project would provide a local water source and increasewater supply reliability during emergencies, such as droughts and earthquakes, without increasing theregion's reliance on Delta tributaries and would present an opportunity to develop a highlycollaborative approach to leverage funding at the federal level.The existing authorization for regional desalination is $4 million. Due to its presence in Washington,D.C., EBMUD has agreed to represent the partner agencies in pursuing this authorization.Accordingly, EBMUD staff will continue to pursue $4 million on behalf of the project partners inFY14 funding for this project.

Recommended ActionPursue FY14 federal funding appropriations in order of priority: $450,000 for the San Ramon ValleyRecycled Water Project, $5 million for the Integrated Recycled Water Program, and $4 million for,the<strong>Bay</strong> Area Regional Desalination Project.INTIATIVE #3 -CONTINUE TO SEEK FUNDING AUTHORIZATIONS FOR TWOEBMUD WATER RESOURCES PROJECTS UNDER THE WRDAIn 2012, EBMUD staff provided WRDA funding authorization requests for three projects: (1) theRegional EBMUD Seismic Component Upgrade (RESCU) program to increase the seismic stability ofEBMUD's water distribution and raw water storage reservoirs; (2) interties between EBMUD'sMokelumne aqueducts; and (3) the San Ramon Valley Recycled Water Project. However, congress didnot finalize a WRDA package in 2012. The aqueduct intertie project is expected to be substantiallycompleted in 2013, therefore an FY14 authorization request for this project will not be appropriate.<strong>Staff</strong> will maintain the authorization requests for the RESCU program and the San Ramon ValleyRecycled Water Project for FY14, as described below.RESCUEBMUD's RESCU program recognizes the presence of several active earthquake faults that runthrough its service area in the <strong>East</strong> <strong>Bay</strong> and on-going seismic risks in the Delta. This program isintended to increase the seismic stability of the water system, including water storage reservoirs,pipelines, and facilities to treat and pump water. This would help protect the proximate denselypopulated urban communities from flooding during a major earthquake and enhance EBMUD's watersupply reliability. Components of the RESCU program include:• Briones, Chabot, Upper San Leandro, and Lafayette Tower Seismic Upgrades;• Dam Seismic, Operational, Surveillance, and Instrumentation Upgrades;• West of Hills Pressure Zone Improvements; and• Mokelumne Aqueduct upgradesThe cost of the RESCU program is estimated to be $150 million or more. EBMUD's request for aninitial authorization is $35 million. This amount is consistent with prior federal authorizations forsimilar projects.San Ramon Valley Recycled Water ProjectWith the near exhaustion of the existing $15 million funding authorization for the San Ramon ValleyRecycled Water Project, staff will request an additional authorization in the amount of $20 million.Based on past authorization levels for similar projects, a request of $20 million is feasible. Thisfunding will be used for the design and construction of phases 3, 4, 5 and 6 distribution lines and twopump stations (Phases 3 and 4). The areas that will be served by these phases of the project are: SanRamon and Danville (Phase 3); Blackhawk (Phase 4); Blackhawk West (Phase 5); and Danvilleexpansion (Phase 6).

Recommended ActionContinue to work with EBMUD's congressional delegation to ensure continued support of EBMUD'sWRDA authorization requests for the RESCU program and the San Ramon Valley Recycled WaterProject.INITIATIVE #4 -ADVANCE EBMUD'S DELTA NEEDS WITH FEDERAL DELEGATIONThe appropriate federal response to the <strong>Bay</strong> Delta Conservation Plan (BDCP) and the efforts to addressCalifornia water resources issues is likely to continue to be debated in congress. Over the past twoyears, EBMUD has worked with its congressional delegation and relevant stakeholders to ensure thatany Delta-related federal policy or legislation does not negatively impact EBMUD ratepayers.Congress will likely continue to focus on Delta-related issues in 2013 and may continue to work on afederal response to address water supply, water quality, and ecosystem protection needs. <strong>Staff</strong> willmonitor the development of Delta-related legislation and administration policies and work to ensurethat EBMUD's needs are effectively communicated.Recommended ActionsCommunicate and work with EBMUD's congressional delegation, the administration, and relevantcongressional committees on EBMUD's Delta needs and respond to any questions on how proposalsmay impact EBMUD. <strong>Staff</strong> will focus on EBMUD's priority issues:1. EBMUD's ratepayers should not be held responsible for the flow obligations, projectmitigations, or expected habitat restoration success of others, including the state and federalprojects.2. EBMUD's ratepayers should not be asked pay for costs that are the responsibility of others, orfor any user fee or surcharge that subsidizes other parties.3. Any solution that would impact the Mokelumne salmonid fishery should include mitigation bythe responsible parties for the impacts.ARC:MD:JF

TITLEAGENDA NO.MEETING D^ TE January 8, 2013REMARKETING OF SERIES 2009A-2 WATER SYSTEM BONDSMOTION __RECOMMENDED ACTIONm RESOLUTIONORDINANCEKosa & co. Inc. and RBC Capital Markets Corporation as remarketing agents.SUMMARYThe Series 2009A-2 Bonds were remarketed on March 1 2012 at a vari«Mp \ n *~ • • i ,weekiy Secuntias Industry and Financia! Mates Assouan (SMA) MIZ fCld* x°T °financial advisor. At the end of the interest rate period the <strong>District</strong> will have to ^ Z ^ S fIt wZ rbltTut.^ ^ Peri ° d ' rema±et^ b° ndS Wi * ^^ "W-t. o-SeThe bond resolution approves the form of the remarketing agreement, continuing disclosure agreementand preliminary reoffering circular and delegates authority to the General M.mafer FiZ e Srector Orthe Treasury Manager to execute the remarketing agreements and any other agreern^nSTnd ac onsDISCUSSIONThe currently outstanding Series 2009A-2 bonds were most recently remarkeved in March 2012 for atwelve-month interest period and at a variable interest rate equal to the weeklv^SFMA Index pis 1 basispoint. The bonds now need to be remarketed for an additional interest period begi^ng r^rch 1 2013The new interest rate period will be determined closer to the time of pricingDEPARTMENT SUBMITTING DEPARTMENTJ^?A^^sr DIRECTOR APPROVEDFinanceyEric L. Sandiers4tt-rtf.e*Contact the Office of the <strong>District</strong> Secretary with questions about completing or submitting this form.

Remarketing of Series 2009A-2 Water System BondsJanuary 8, 2013Page 2The interest rate on the bonds will change weekly based on the SIFMA Index, and is expected to closelymatch the rate on the pre-existing interest rate swap agreements that are connected to this transaction Atleast three months ahead of the end of this next interest period, the <strong>District</strong> will begin the processnecessary to remarket and reset the interest rate on the bonds for a new interest rate period remarket thebonds with liquidity support, or refund the Series 2009A-2 with a new bone, issue. The bond resolutionauthorizes the Director of Finance and appropriate staff to make the applicable determinations as to theactions the <strong>District</strong> will take at the end of the new interest rate period and to provide notices requiredunder the Bond Indenture in connection therewith.A summary of the key bond documents is as follows:" Am^ded and Restated Remarketing Agreement replaces the existing remarketing agreement andappoints E J. De La Rosa & Co. Inc. and RBC Capital Markets Corporation as remarketing agents.* Preliminary Reoffering Circular provides information about the <strong>District</strong> and the terms of the bondsto be reoffered to potential investors.eContinuing Disclosure Agreement outlines <strong>District</strong>'s responsibility to provide ongoing disclosureinformation to investors in the bonds as provided by the securities lawsFISCAL IMPACTIt is expected that the remarketing of the Series 2009A-2 bonds will allow the <strong>District</strong> to avoid increasedcosts for liquidity support. The remarketing fees and associated costs are not expected to exceedALTERNATIVEDo not remarket the Series 2009A-2 bonds. Alternatives to remarketing the SIFMA Index BondsnlSS^f nOt recommended > incIude either remarketing the bonds as a variable rate demand obligations(VRDO) with liquidity support or refunding them with fixed-rate debt. Either option would result inhigher debt service costs for the <strong>District</strong>.AttachmentsI:SEC\01-08-13 Board Agenda Items\FIN - BD1 Remarketing of Series 2009A2 Water System Bonds 010813.doc