Pricing and Hedging Asian Basket Options with Quasi-Monte ... - Infn

Pricing and Hedging Asian Basket Options with Quasi-Monte ... - Infn

Pricing and Hedging Asian Basket Options with Quasi-Monte ... - Infn

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

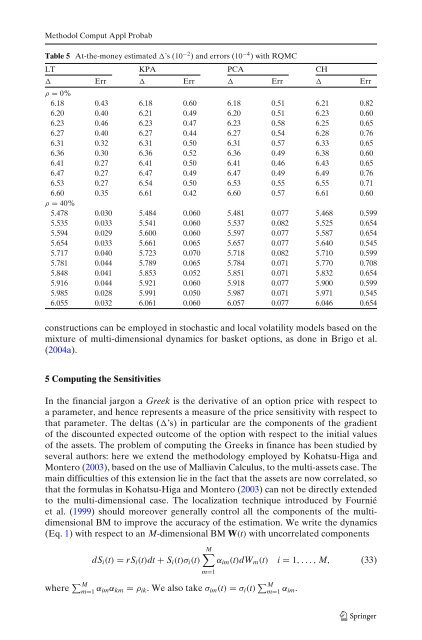

Methodol Comput Appl ProbabTable 5 At-the-money estimated ’s (10 −2 ) <strong>and</strong> errors (10 −4 )<strong>with</strong>RQMCLT KPA PCA CH Err Err Err Errρ = 0%6.18 0.43 6.18 0.60 6.18 0.51 6.21 0.826.20 0.40 6.21 0.49 6.20 0.51 6.23 0.606.23 0.46 6.23 0.47 6.23 0.58 6.25 0.656.27 0.40 6.27 0.44 6.27 0.54 6.28 0.766.31 0.32 6.31 0.50 6.31 0.57 6.33 0.656.36 0.30 6.36 0.52 6.36 0.49 6.38 0.606.41 0.27 6.41 0.50 6.41 0.46 6.43 0.656.47 0.27 6.47 0.49 6.47 0.49 6.49 0.766.53 0.27 6.54 0.50 6.53 0.55 6.55 0.716.60 0.35 6.61 0.42 6.60 0.57 6.61 0.60ρ = 40%5.478 0.030 5.484 0.060 5.481 0.077 5.468 0.5995.535 0.033 5.541 0.060 5.537 0.082 5.525 0.6545.594 0.029 5.600 0.060 5.597 0.077 5.587 0.6545.654 0.033 5.661 0.065 5.657 0.077 5.640 0.5455.717 0.040 5.723 0.070 5.718 0.082 5.710 0.5995.781 0.044 5.789 0.065 5.784 0.071 5.770 0.7085.848 0.041 5.853 0.052 5.851 0.071 5.832 0.6545.916 0.044 5.921 0.060 5.918 0.077 5.900 0.5995.985 0.028 5.991 0.050 5.987 0.071 5.971 0.5456.055 0.032 6.061 0.060 6.057 0.077 6.046 0.654constructions can be employed in stochastic <strong>and</strong> local volatility models based on themixture of multi-dimensional dynamics for basket options, as done in Brigo et al.(2004a).5 Computing the SensitivitiesIn the financial jargon a Greek is the derivative of an option price <strong>with</strong> respect toa parameter, <strong>and</strong> hence represents a measure of the price sensitivity <strong>with</strong> respect tothat parameter. The deltas (’s) in particular are the components of the gradientof the discounted expected outcome of the option <strong>with</strong> respect to the initial valuesof the assets. The problem of computing the Greeks in finance has been studied byseveral authors: here we extend the methodology employed by Kohatsu-Higa <strong>and</strong><strong>Monte</strong>ro (2003), based on the use of Malliavin Calculus, to the multi-assets case. Themain difficulties of this extension lie in the fact that the assets are now correlated, sothat the formulas in Kohatsu-Higa <strong>and</strong> <strong>Monte</strong>ro (2003) can not be directly extendedto the multi-dimensional case. The localization technique introduced by Fourniéet al. (1999) should moreover generally control all the components of the multidimensionalBM to improve the accuracy of the estimation. We write the dynamics(Eq. 1) <strong>with</strong> respect to an M-dimensional BM W(t) <strong>with</strong> uncorrelated componentsdS i (t) = rS i (t)dt + S i (t)σ i (t)M∑α im (t)dW m (t) i = 1,...,M, (33)m=1where ∑ Mm=1 α imα km = ρ ik .Wealsotakeσ im (t) = σ i (t) ∑ Mm=1 α im.