Dodge & Cox Funds Statutoary Prospectus dated May 1, 2013

Dodge & Cox Funds Statutoary Prospectus dated May 1, 2013

Dodge & Cox Funds Statutoary Prospectus dated May 1, 2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

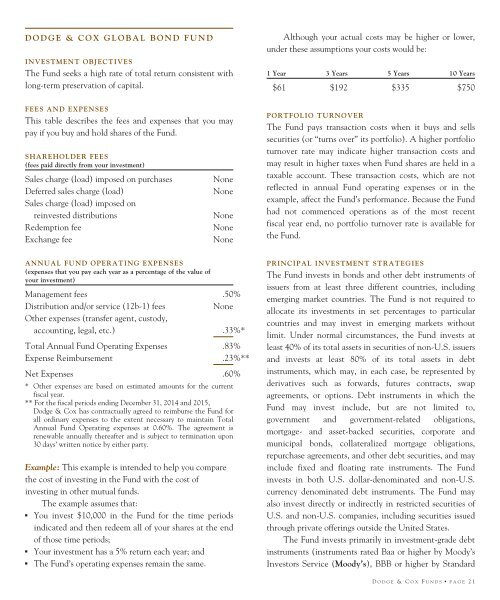

DODGE & COX GLOBAL BOND FUNDINVESTMENT OBJECTIVESThe Fund seeks a high rate of total return consistent withlong-term preservation of capital.FEES AND EXPENSESThis table describes the fees and expenses that you maypay if you buy and hold shares of the Fund.SHAREHOLDER FEES(fees paid directly from your investment)Sales charge (load) imposed on purchasesDeferred sales charge (load)Sales charge (load) imposed onreinvested distributionsRedemption feeExchange feeNoneNoneNoneNoneNoneAlthough your actual costs may be higher or lower,under these assumptions your costs would be:1 Year 3 Years 5 Years 10 Years$61 $192 $335 $750PORTFOLIO TURNOVERThe Fund pays transaction costs when it buys and sellssecurities (or “turns over” its portfolio). A higher portfolioturnover rate may indicate higher transaction costs andmay result in higher taxes when Fund shares are held in ataxable account. These transaction costs, which are notreflected in annual Fund operating expenses or in theexample, affect the Fund’s performance. Because the Fundhad not commenced operations as of the most recentfiscal year end, no portfolio turnover rate is available forthe Fund.ANNUAL FUND OPERATING EXPENSES(expenses that you pay each year as a percentage of the value ofyour investment)Management fees .50%Distribution and/or service (12b-1) feesNoneOther expenses (transfer agent, custody,accounting, legal, etc.) .33%*Total Annual Fund Operating Expenses .83%Expense Reimbursement .23%**Net Expenses .60%* Other expenses are based on estimated amounts for the currentfiscal year.** For the fiscal periods ending December 31, 2014 and 2015,<strong>Dodge</strong> & <strong>Cox</strong> has contractually agreed to reimburse the Fund forall ordinary expenses to the extent necessary to maintain TotalAnnual Fund Operating expenses at 0.60%. The agreement isrenewable annually thereafter and is subject to termination upon30 days’ written notice by either party.Example: This example is intended to help you comparethe cost of investing in the Fund with the cost ofinvesting in other mutual funds.The example assumes that:▪ You invest $10,000 in the Fund for the time periodsindicated and then redeem all of your shares at the endof those time periods;▪ Your investment has a 5% return each year; and▪ The Fund’s operating expenses remain the same.PRINCIPAL INVESTMENT STRATEGIESThe Fund invests in bonds and other debt instruments ofissuers from at least three different countries, includingemerging market countries. The Fund is not required toallocate its investments in set percentages to particularcountries and may invest in emerging markets withoutlimit. Under normal circumstances, the Fund invests atleast 40% of its total assets in securities of non-U.S. issuersand invests at least 80% of its total assets in debtinstruments, which may, in each case, be represented byderivatives such as forwards, futures contracts, swapagreements, or options. Debt instruments in which theFund may invest include, but are not limited to,government and government-related obligations,mortgage- and asset-backed securities, corporate andmunicipal bonds, collateralized mortgage obligations,repurchase agreements, and other debt securities, and mayinclude fixed and floating rate instruments. The Fundinvests in both U.S. dollar-denominated and non-U.S.currency denominated debt instruments. The Fund mayalso invest directly or indirectly in restricted securities ofU.S. and non-U.S. companies, including securities issuedthrough private offerings outside the United States.The Fund invests primarily in investment-grade debtinstruments (instruments rated Baa or higher by Moody’sInvestors Service (Moody’s), BBB or higher by StandardD ODGE & C OX F UNDS ▪ PAGE 21