202. 2010 AKAM Annual Report - Aga Khan Development Network

202. 2010 AKAM Annual Report - Aga Khan Development Network

202. 2010 AKAM Annual Report - Aga Khan Development Network

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Aga</strong> <strong>Khan</strong> Agency for MicrofinanceA C T I V I T Y R E P O R T 2 0 1 0A N A G E N C Y O F T H E A G A K H A N D E V E L O P M E N T N E T W O R K

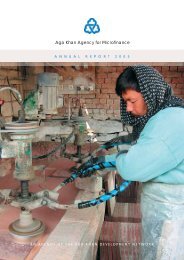

Artisans, like this silversmith on Ibo Island, Mozambique receive business loans from <strong>AKAM</strong> and are alsosupported by AKF’s technical training programmes so that their crafts are treated as valued commodities.

CONTENTS <strong>2010</strong>3INTRODUCTION810131619COUNTRY REVIEWSSOUTH AND CENTRAL ASIAAFGHANISTANKYRGYZ REPUBLICPAKISTANTAJIKISTAN222427MIDDLE EASTEGYPTSYRIA30323437AFRICAWEST AFRICAMADAGASCAREAST AFRICA42KEY FINANCIAL INDICATORS444748PARTNERS AND AFFILIATESFACTS AT A GLANCEABBREVIATIONSCONTACTS1

INTRODUCTIONFor more than 60 years, various agencies of the <strong>Aga</strong> <strong>Khan</strong> <strong>Development</strong><strong>Network</strong> (AKDN) have offered microfinance servicesthrough integrated development programmes and self-standingmicrofinance institutions. Savings groups and revolving housingloans were offered by AKDN institutions as early as the 1950s.Later, the <strong>Aga</strong> <strong>Khan</strong> Rural Support Programmes (AKRSP) in Indiaand Pakistan made savings groups a cornerstone of their integratedapproach to development. With support from AKRSPin Pakistan, for example, over US$ 8 million has been saved bymembers of more than 4,500 village organisations. These programmes,as well as others, helped start businesses, create jobs,build homes and finance house improvements, purchase seedand livestock, smooth over the impact of unforeseen healthcosts and make higher education possible.Today, these programmes have been brought together as regulatedmicrofinance institutions under the <strong>Aga</strong> <strong>Khan</strong> Agency forMicrofinance’s (<strong>AKAM</strong>) administration. <strong>AKAM</strong> continues towork closely with the other AKDN agencies, as part of a coordinatedapproach that brings together many inputs and disciplines.“Over these fifty years, theworld has made enormous, indeedbreathtaking, progress inmany areas, but often wherethe needs are most urgent, ourprogress has been too slow. Wehave learned how to addressparticular symptoms of poverty,but unforeseen variables havediluted our impact. Our experiencein the field has encouragedus to focus on the complexitiesand subtleties of development,to think as pragmatically and holisticallyas possible, and to developresponses which are punctual,targeted and replicable.”-His Highness the <strong>Aga</strong> <strong>Khan</strong>’sspeech to the “Marketplace onInnovative Financial Solutions for<strong>Development</strong>” in Paris, France inMarch <strong>2010</strong>.<strong>AKAM</strong> works with the <strong>Aga</strong> <strong>Khan</strong> Foundation (AKF), which iswell known for its work in difficult and resource-poor areas.AKF concentrates on health, education, rural development, theenvironment and the strengthening of civil society. A good exampleof <strong>AKAM</strong> and AKF collaboration is the work with therice farmers in Madagascar. These farmers go through an AKFtechnical support programme before they receive loans from<strong>AKAM</strong>. There are a number of ongoing projects, particularlyrelated to rural development, in which <strong>AKAM</strong> and AKF are cooperating.This, in many cases, involves AKF taking responsibilityfor social mobilisation and the provision of technical servicesand training, while <strong>AKAM</strong> provides financing to the same clients.<strong>AKAM</strong> also provides microfinance services to employees andcontractors of the <strong>Aga</strong> <strong>Khan</strong> Fund for Economic <strong>Development</strong>’s(AKFED) projects, as well as other residents in neighbouringareas. Some of AKFED’s investments are in fragile and complexenvironments, including economies that have suffered the effectsof natural disasters, civil turmoil or war. It mobilises investmentfor the construction, rehabilitation or expansion of infrastructure,sets up sustainable financial institutions and buildseconomically viable commercial enterprises.3

<strong>AKAM</strong> is in the process of building relationships with the commercialbanks and insurance companies in the AKFED group.Client linkages are also being developed that will ensure anyclient whose business is successful and whose financial needsprogress beyond the microfinance level will continue to have accessto financial services from AKFED institutions when needed.Leveraging institutional connections such as these have provenessential in creating the critical mass of development activitynecessary to achieve lasting improvements in the quality of lifein the 13 countries where <strong>AKAM</strong> is present.The underlying objectives of <strong>AKAM</strong> are to reduce poverty, diminishthe vulnerability of poor populations and alleviate economicand social exclusion. <strong>AKAM</strong> aims to improve the qualityof life of people by helping them to improve their incomes,become self-reliant and gain the skills needed to graduate intothe mainstream financial markets.At the end of <strong>2010</strong>, <strong>AKAM</strong> had a network of 13 field entitiesthat operated 289 branches and outlets with 3,371 employees.In <strong>2010</strong>, these institutions were able to support 309,973microfinance and SME loans with US $226.6 million in loansdisbursed. These activities are further highlighted in the followingsection of the report.A significant part of <strong>AKAM</strong>’s lending activities are directed tosocial sectors, including housing, education and health. Althoughthese loans only represent a small portion of the overall <strong>AKAM</strong>portfolio, clients have been showing increasing interest in themfor the purpose of cash-flow smoothing, for payment of medicalexpenses and tuition fees, or for improving housing. These loanshave a direct impact on the clients as they meet their day-todayneeds, and allow <strong>AKAM</strong> to have a big impact on the qualityof life of the poor.Loans for income generating activities continue to represent thelargest proportion of loans provided by <strong>AKAM</strong> entities. Theseloans cover a large spectrum of sectors and industries, rangingfrom livestock, planting, trading or production. Loan terms andconditions are designed to reflect the various cash-flows fromthose sectors, and to fit clients’ needs as closely as possible.In addition to its main microfinance activities, <strong>AKAM</strong> supportssmall and medium enterprises (SME) to create jobs or stimulate4

increased economic activity. Despite their importance to economicgrowth and employment, many SMEs find it extremelydifficult to access financial services, particularly long-term loansthat fit their needs. Many SMEs are considered too risky bymainstream banks, as they are perceived to be either too smallor to have insufficient collateral or credit histories to be able tosecure loans or financing from traditional commercial banks. Asa result, SMEs are caught in a gap between the growing supplyof finance for micro-entrepreneurs and the mainstream marketfor traditional business financing.His Highness the <strong>Aga</strong> <strong>Khan</strong>and President Amadou ToumaniTouré of Mali review tapestrywork being restored inthe National Museum of Mali.The <strong>Aga</strong> <strong>Khan</strong> Trust for Culture(AKTC) and <strong>AKAM</strong> are workingtogether in the Komoguel regionof Mopti, Mali. AKTC is renovatingthe mosque in Mopti and<strong>AKAM</strong> is giving loans to householdsin the areas around theAKTC project.<strong>AKAM</strong>’s approach has as its foundation a long-term commitmentto the geographical areas in which it works. <strong>AKAM</strong> seeks to focuson poverty alleviation through innovative product design basedon clearly understood needs of the target clients, effective managementand the introduction of new initiatives to enhance accessto financial services for poor and low-income households.As illustrated in this report, <strong>AKAM</strong>’s microfinance operationsprovide financial services which have demonstrated a clear linkto improved incomes. While microfinance may not be the cureallfor poverty, it has been shown that it is a critical piece of thepuzzle in poverty alleviation.5

Agriculture constitutes an important source of income in Syria, and accounts for one-fourth of theemployment in the country. Credit from FMFI Syria supports farmers and helps them increase theirbusiness size while technical assistance from AKF helps increase yields. Eissa Najla was able to open agreenhouse for his tomatoes.7

COUNTRY REVIEWSSOUTH AND CENTRAL ASIAKAZAKHSTANUZBEKISTAN")A")A")ATURKMENISTANTAJIKISTAN.")A")ADUSHAN BE")AAlisher Turakhonov runs a carpentry business started by his father,building doors and windows. The reason for his first loan from FMFBTajikistan was to buy materials and a generator.IRAN")A")A")A")A")A")A")A ")A ")A")A")A")A")A")A")A")A")A")A")A")A")A")A ")A")A")A")A")A.")AKABUL")A")A")A")A")A")A ")A ")A")A")A")AISLA MAB ADAFGHANISTAN")A ")A")A")A")A ")A")A")A")A")AFMFB Afghanistan, along with other <strong>AKAM</strong> institutions, is committedto the development of its management and staff with the help of theTraining Academy.")APAKISTAN")A")A")A ")A")A")A")A ")A ")A")A")A ")A")A")A")A")A")A")A ")A")A ")A")A")A")A")A")A")A")A")A")A")A")A ")AASIA0 200 Km")A.BranchesCapita lsAKDN countries of activity8

")A")A")A ")A")A.BISHKEKKYRGYZ REPUBLIC")A")A")ALoan officers in the Kyrgyz Republic, who are familiar with theirclients’ businesses, often have specific knowledge of agriculturalactivities such as the sale of seedling trees.")A ")A")A")A")A")A")A")A")A")A")A")A")ACHINA. ")A")A")A")A")A")A")A ")A")A")A")AProduction of traditional handicrafts in Pakistan can be a source ofincome for many women. FMFB-P supports such activities throughmore than 20 branches in Gilgit-Baltistan.")A ")A")A")A.NEW DELHIINDIANEPALBANGLADESHDHAKA.Ahmad Mirzayee, a client of FMFB Afghanistan, utilised his self-taughtcomputer skills and entrepreneurial spirit to start a digital printingbusiness that designs advertising for small businesses in Kabul.9

AFGHANISTANThere are 2.6 million households living below the poverty linein Afghanistan, with about 288,000 having access to microfinanceservices. In <strong>2010</strong>, the sector experienced limited growth(11 percent by the end of <strong>2010</strong>), due to the deteriorating securityenvironment and the overall consolidation of the microfinancesector.The First MicroFinance Bank Afghanistan (FMFB-A) sought toconsolidate its position as the leading Afghan microfinance institution,and recorded a small client growth in <strong>2010</strong> while othermicrofinance institutions were struggling to offer servicesto their clientele. FMFB-A is currently the largest microfinanceinstitution in Afghanistan in terms of outstanding portfolio sizewith US$ 45.7 million in <strong>2010</strong> in microfinance loans comparedto US$ 39.8 million in 2009. Of the total portfolio, 31 percentof the client base is rural. The institution’s rural portfoliorepresents 13,490 loans disbursed valued at US$ 22 million.<strong>AKAM</strong> offers loans to carpentersthroughout Afghanistan asmany areas, including Kabul, aregoing through a building boom.Building windows and doors canbe a profitable enterprise forpeople with the right skills.As part of FMFB-A’s focus on ameliorating the quality of lifeof its clients by offering them financial access, the bank has anetwork of 45 branches, 17 of which are in rural areas, covering14 provinces.FMFB-A is exploring strategies that would make access easierfor clients in remote areas and to make services more efficient.Marketing offices and mobile solutions to improve access arebeing looked at, as is the introduction of biometric technologyavailable for fingerprint recognition to assist in managingpotential risk and speeding up the processing and repaymentsof clients.The number of individual depositors went up last year, from37,342 in 2009 to 57,841 in <strong>2010</strong>. The purpose of saving forthe individual depositors is not necessarily about accumulatingassets. It is often about smoothing consumption when a family’sincome is irregular. In 2011 FMFB-A is hoping to review itsdeposit offerings to better meet clients’ savings needs (savingsfor education, for housing, for cash flow smoothing); and toencourage savers to gradually increase their savings balances.10

SPOTLIGHT: HOUSING LOANSOne of the key product development priorities for <strong>AKAM</strong> in<strong>2010</strong> was the development of a housing portfolio and methodologythroughout six countries. Significant progress has beenmade on this front; many <strong>AKAM</strong> institutions are offering loansfor the refurbishment and renovation of homes. By providingcredit to poor families to restore and upgrade their homes,<strong>AKAM</strong> institutions are contributing to genuine improvementsin the quality of life of its constituents.In Afghanistan, FMFB-A piloted a habitat improvement productin 2008. With the support of IFC, a housing microfinance loanproduct was developed.As of December <strong>2010</strong>, FMFB-A had 5,003 outstanding housingimprovement loans and an outstanding total housing loanportfolio of US$ 6,759,010. This product is available in 21 urbanbranches and now FMFB-A is looking at adapting the product forrural areas – conducting a rural demand and repayment capacitysurvey to develop the most suitable product for these areas.FMFI Syria’s clients areoperating a small concrete brickmaking factory in Syria. Suchlocally produced constructionmaterials are needed to supportlocal housing refurbishment andrenovation projects.In addition, in collaboration with the <strong>Aga</strong> <strong>Khan</strong> Planning andBuilding Services, Pakistan and the <strong>Aga</strong> <strong>Khan</strong> Foundation USA,along with a grant from the United States Agency for International<strong>Development</strong>, FMFB-A will be providing constructionadvisory services in 2011.In <strong>2010</strong>, the agencies took the first step and developed guidelinesfor the construction and retrofitting of non-engineeredbuildings. Based on those standards, FMFB-A will provide constructionappraisal and advisory services and promote innovativehousing upgrades.Construction advisory services consider a number of factors.These include site and construction material selection and constructiondesign with regards to disaster mitigation, particularlyin earthquake prone areas; and material selection and constructiondesign with regards to sustainability, energy efficiency, sanitationand other health aspects. If these factors are taken intoconsideration, the housing infrastructure that is insufficient inboth quantity and quality can be improved.11

In addition to microfinance loans, since 2005 FMFB-A has beenoffering small and medium enterprise (SME) loans in 18 branches,based in nine cities. At the end of <strong>2010</strong>, the outstanding SMEportfolio was 466 active borrowers with a portfolio of US$5.9 million. These SME borrowers support over 11,000 full andpart-time jobs in Afghanistan.With the support of the International Finance Corporation, ahousing microfinance loan product was developed. The productis currently available in all urban branches and FMFB-A is workingon replicating and adapting the product for rural areas. Theproduct will expand with a Construction Advisory Service, withthe support of the <strong>Aga</strong> <strong>Khan</strong> Planning and Building Services. Thisadvisory service, which covers seismic and disaster mitigation,energy efficiency, sanitation, crowding reduction and properventilation, will ensure that individuals who are provided withloans make smart, long lasting investments by providing technicalguidance on construction and upgrades that will improvethe entire family’s health and safety.FMFB-A’s pursuit of social goals is supported by an adherenceto principles of financial stability and sustainability. It is throughthis model that the bank will be able to help the long-term developmentof Afghanistan.FMFBAFGHANISTANIndicators 2008 2009 <strong>2010</strong>Microfinance Loans Disbursed: Value (US$ '000) 59,035 64,396 79,486Microfinance Loans Disbursed: Number 38,055 46,765 42,015Microfinance Portfolio Outstanding: Value (US$ '000) 28,336 39,801 51,600Microfinance Portfolio Outstanding: Number 35,644 42,975 47,949Average Microfinance Loan Size (US$ unit) 795 926 1,035Percentage of Women Borrowers 13% 13% 15%Microfinance Portfolio at Risk (%) 1.5% 0.4% 0.5%SME Disbursed: Value (US$ ‘000) 7,786 8,520 7,728SME Disbursed: Number 402 425 372SME Outstanding: Value (US$ ‘000) 5,246 5,736 5,892SME Outstanding: Number 414 456 466SME Portfolio at Risk (%) 2.1% 4.3% 2.2%Number of Individual Savers 24,785 37,342 47,752Value of Individual Deposits (US$ ‘000) 7,379 10,867 14,065Number of Staff 647 907 82912

SPOTLIGHT: AGRICULTURAL LENDINGIn the Kyrgyz Republic, 65 percent of its people work in theagrarian sector; 44 percent of them work on family farms. Agriculturaloutput accounts for over 35 percent of the gross domesticproduct. Harvesting of the main crops such as wheat,sugar beets, potatoes, cotton, tobacco, vegetables and fruit, aswell as raising livestock, is the main business in the country.FMCC is the largest microfinance provider in the southern regionof the Kyrgyz Republic. It works in provinces that havesome of the highest poverty rates. Given FMCC’s mandate totarget the poor and underserved, it maintains a strong rural andagricultural focus with agricultural and livestock loans representing73 percent of disbursements by number in <strong>2010</strong>.The Kyrgyz Republic’s agricultural products include cotton, vegetablesand fruits. As far as total production, the largest crop isassorted types of animal fodder to feed livestock. The secondlargest crop is winter wheat, followed by barley, corn and rice.Livestock rearing is central tothe economic livelihood of manyrural populations. <strong>AKAM</strong> helpspeople acquire and care forwhat is often a household’s mostvaluable asset.Animal husbandry is the main economic input in the mountainousregions and so sheep, goats, cattle and wool are popularproducts to sell as are chickens, horses, pigs and in some areas,yaks. This means that not all clients will be equally affected byweather conditions or disease outbreaks.14

Republic. FMCC works in the provinces which have some ofthe highest poverty rates.While most of the other microfinance institutions have a strongfocus in Bishkek and other urban areas, FMCC intently targetsrural areas because its mandate includes serving clients who donot have access to financial services.The number of loans outstanding is 11,050 beneficiaries, foran outstanding loan amount of US$ 8.1 million. This is an eightpercent decrease as compared to 2009, mainly caused by thepolitical instability and a stagnant economy.To some extent, the decrease was limited by the performanceof loans in animal husbandry, which increased by nine percent,whereas all other sectors decreased. FMCC’s performanceconfirmed that, as the political events mainly affected Osh Cityand surrounding towns, rural areas were relatively unaffected.As the situation in the country is stabilising, FMCC will be focusingon getting a deposit-taking licence so that clients cansave as well as take out loans. This would allow them to withstandshock better and smooth their incomes when their incomesare less stable.FMCC is engaged in a comprehensive training plan for its staffto help strengthen processes and procedures especially afterthe crisis and to prepare for the future so that the company canbe ready to take deposits and serve its clients well.Indicators 2008 2009 <strong>2010</strong>Microfinance Loans Disbursed: Value (US$ '000s) 12,276 13,232 11,572Microfinance Loans Disbursed: Number 10,683 12,449 11,201FMCCKYRGYZREPUBLICMicrofinance Portfolio Outstanding: Value (US$ '000s) 8,167 8,848 8,675Microfinance Portfolio Outstanding: Number 9,938 11,987 11,050Average Microfinance Loan Size (US$ unit) 822 738 785Percentage of Women Borrowers 42% 41% 41%Portfolio at Risk (%) 1.6% 1.8% 5.5%Number of Staff 125 164 17415

PAKISTANDuring <strong>2010</strong>, the main focus of the First MicroFinance BankPakistan (FMFB-P) remained consolidation. A challenging macro-economicenvironment and natural disasters such as unprecedentedfloods, were some of the contributing factors thatforced the microfinance sector to slow down.FMFB-P is now focusing on achieving operational sustainabilityand mitigating operational risks. To do this, eight unprofitablebranches were closed or merged while one branch was openedin Sargodha in November <strong>2010</strong>. The year-end total number ofbranches stood at 147 as compared to 157 in December 2009.These locations include 83 FMFB-P branches and 64 PakistanPost Office (PPO) outlets.Unprecedented floods hit Pakistan in July <strong>2010</strong> and causedlarge-scale devastation to life and property in Gilgit, Baltistan,Chitral, Khyber Pakhtunkhwa, South Punjab and Sindh, whichaffected the repayment capacity of the borrowers.The credit services offered byFMFB Pakistan have enabledthis family in Multan, Punjabto expand its bangle makingbusiness and increase its householdincome.More than 17,000 clients who had an outstanding loan amountof US$ 3.4 million were affected (excluding the Chitral Region,the total number of affected borrowers was close to 15,000with an outstanding portfolio of US$ 3 million).FMFB-P field teams were mobilised to determine the extent ofthe portfolio at risk. Estimates of the damage caused by floodswere finalised in September <strong>2010</strong>. Subsequently, the managementstarted developing a loan rescheduling package to providerelief to the flood affected borrowers. The package is to bedeployed selectively to avoid damage to current portfolio andminimise losses from the affected portfolio.The Chitral Region, with five branches, was affected by theMalakand Relief Package, which is a waiver on loans by theGovernment of Pakistan. The State Bank of Pakistan issued tworelief packages offering waivers on agricultural loans and markup differential relief to the banks and customers.This difficult situation has caused FMFB-P to face financial lossesthough the clients have been told that the initial waiver of loanswas not applicable to microfinance banks. FMFB-P finished theyear with 166,927 outstanding loans valued at US$ 29.5 millionand 35 percent of FMFB-P’s total beneficiaries were women.More than 217,000 individuals deposited over US$ 45 millionwith the bank.16

SPOTLIGHT: SAVINGSWhile microfinance can help alleviate poverty through lending andproductivity, micro savings can help to protect households fromwhat is often not only a lower income, but an unpredictable one.In rural and remote areas where financial services are not available,many people save but not in formal institutions. Instead,they buy extra livestock or gold or they put their cash under amattress and hope that it will not be stolen. For them, there isnowhere to store money safely. In response, <strong>AKAM</strong> is moving allof its entities to become deposit taking, if the regulations allow,to help move its clients away from this sort of savings. Some institutions,like FMFB-P, work in rural and remote areas becausepart of their mission is to make savings accessible to everyoneso that they can build their assets and save for the moments theydeem important in life, whether it is for the education of a child, awedding in the family or medical expenses for the birth of a child.In <strong>2010</strong>, the number of new deposit accounts in FMFB-P increasedby 36,958 to a total of 217,006 accounts, registering agrowth of 20 percent over 2009. Of all of FMFB-P’s depositorsabout 85 percent are micro savers and they have an averagesavings of less than US$ 495.FMFB-P’s entire loan book is funded by deposits and, in 2011, thebank will continue to enhance the sustainability of its growth ofdeposits with the objectives to provide saving services to the poorso that they can build assets over time; and increase its outreach.FMFB Pakistan’s social performanceresearch analyst conductsan information disclosure sessionwith female members of thelocal community as part of FMFBPakistan’s drive to promote itsservices including deposits.17

FMFB-P has also made advancements in terms of monitoringand research of its social performance.FMFB-P completed a project in partnership with Harvard University,Kennedy School of Government, to develop a set ofstandard social indicators both to segment poverty and to monitorthe impact of the bank’s services on the lives of the poor.The project helped to develop a poverty scorecard that will helpsharpen the FMFB-P’s ability to formulate need-specific services.One of FMFB-P’s goals is to reach more clients in remote areas.The village group financial services (VGFS) are tailored grouploans offered to rural clients to help promote home based industryand enable women to earn a supplementary income fortheir families.More than 70 percent of the population of Pakistan residesin the rural areas. VGFS meet the specific requirements of therural poor and this loan product is able to reach out to theunbanked population of Pakistan.Cash-flow based lending ensures that borrowers do not facefinancial burdens. The bank’s collaboration with the PPO givesFMFB-P access to the remote populations through PPO’s extensivenetwork of 4,000 offices throughout Pakistan. This hasenabled the bank to ensure delivery of its products to the remotepoor in a cost effective manner.FMFBPAKISTANIndicators 2008 2009 <strong>2010</strong>Microfinance Loans Disbursed: Value (US$ '000s) 40,329 56,663 48,579Microfinance Loans Disbursed: Number 207,874 273,733 210,552Microfinance Portfolio Outstanding: Value (US$ '000s) 26,815 33,298 29,495Microfinance Portfolio Outstanding: Number 171,795 206,644 166,927Average Microfinance Loan Size (US$ unit) 156 161 177Percentage of Women Borrowers 33% 25% 35%Portfolio at Risk (%) 1.3% 3.3% 12.3%Number of Individual Savers 144,898 189,878 217,006Value of Individual Deposits (US$ ‘000) 26,488 40,260 45,413Number of Staff 1,175 1,135 1,12118

TAJIKISTANTajikistan is one of the least developed of the 15 former SovietRepublics partially due to limited employment possibilities inthe country.Around 350,000 households are estimated to be living underthe poverty line, out of which it is estimated that 127,000households had access to microfinance services at the end ofDecember <strong>2010</strong>.The microfinance sector faced challenges through much of2009 and the total national microfinance portfolio declined dueto a fall in disbursements and weakening portfolio quality. Thesector has returned to health since mid-<strong>2010</strong> and the portfoliovalue has even recovered to pre-crisis levels in the order ofUS$ 108 million.The First MicroFinance Bank Tajikistan (FMFB-T), which commencedoperations as a microfinance bank in July 2004, spentmuch of the last year consolidating and, at the end of the year,started to rebuild the ground that it had lost during the economiccrisis. At the end of <strong>2010</strong>, FMFB-T had 12,535 outstandingloans with a total value of US$ 25.4 million. The bank alsoheld 7,072 individual deposits worth US$ 4.9 million at the endof the year. FMFB-T came back to sustainability in mid-<strong>2010</strong>,after having experienced a deficit in 2009.Beekeepers in Tajikistan areprime examples of small cottageindustries that can scale uprapidly with greater access tofinancing. Apiculture is useful becauseof the number of productsit yields including honey, wax andexcess pollen (which can be usedin health supplements).FMFB-T is currently one of two microfinance banks in the country,along with numerous microfinance institutions. The bank isthe country’s second largest provider of microfinance services.FMFB-T’s mandate is to provide a comprehensive range of financialservices to low-income families throughout Tajikistan.In addition to the head office in Dushanbe, the bank also hasbranches in Khorog, Gharm, Khujand and Kulyab. The branchesare supported by a network of 36 banking service centres servingsemi-urban and rural areas.In <strong>2010</strong>, FMFB-T began the process of refurbishing its networkof branches and banking service centres. Historically, microfinanceinstitutions invested little into the infrastructure andappearance of the branch and service centre network. FMFB-T has seen that improving the facilities shows respect for itsstaff and clients, it portrays the professionalism that it wants itsbrand to be associated with as well as a sense of permanence.For this reason, FMFB-T will be upgrading its entire networkover the next two years.19

SPOTLIGHT: REMITTANCESTajikistan has one of the lowest gross domestic products percapita among the 15 former Soviet Republics and nearly twothirdsof the population continues to live in poverty. In recentyears, the economy has become heavily reliant on migrant remittances.More than 43 percent of Tajikistan’s GDP is made upby remittances.The average Tajik migrant is a 32-year old, male, who hasthree dependents, spending 14 months at a time (cyclically)in Russia and remitting US$ 2,000-2,500 on averageper year (US$ 150-200 per month). Remittances are generallyseasonal and peak between September and Decembereach year, around the time migrants return home afterthe completion of a contract. Recipients of remittancesare most often women who remain to care for the family.At FMFB Tajikistan, remittanceservices are now available at 29banking service centres throughoutthe country, reflecting theimportance of remittances in theTajik economy.Over the last year, FMFB-T has worked on increasing thenumber of access points for banking operations so that manycommunities can access remittances close to their homes. In2009, the National Bank of Tajikistan granted FMFB-T the rightto engage in money transfer activities in its banking service centresbecause remittance recipients are more inclined to receiveremittances through banks or operators that have locationsclose to where they reside.The bank is also advertising its remittance services so thatit can begin to build a visible presence in Tajikistan. In RussiaFMFB-T has established a greater presence to attract remittancebusiness and promote the services of the bank.Establishing a stronger presence in Russia enables the bank toengage more with the migrant communities, building relationshipswhich can be further strengthened by remittance officersin Tajikistan.FMFB-T has started to develop several remittance-linked productsto help its clients increase the amount of the remittancesthat go into asset building as opposed to income smoothing. In<strong>2010</strong>, FMFB-T started considering a remittance-linked savingsproduct to foster the building of assets of its clients.20

Many of FMFB-T’s clients are supported by remittances. Morethan 800,000 (out of a population of only seven million) Tajikswork in Russia or Kazakhstan at any given time.Considering the importance of remittance services for thecountry, and the fact that only one percent of those remittancesgo to housing, education, health or asset building,FMFB-T has decided to particularly focus on remittances.In <strong>2010</strong>, FMFB-T increased its capacity to offer remittance serviceswith 29 of its outlets now providing this service. This willease access to money transfers for the clients.FMFB-T is also trying to stream clients into creating assets bygetting them to improve their homes and save the money theyget from remittances. FMFB-T has successfully completed aremittance-linked housing project in collaboration with Habitatfor Humanity with a grant from the International Fund forAgricultural <strong>Development</strong>. The project is aimed at linking remittanceinflows to investment in housing refurbishment in theRasht Valley. During the project, 30 households received a loanto improve their dwellings with a savings component and withrepayments coming through remittance inflows.The decrease in inflows from remittances activities in 2009, andits profound impact on the local Tajik economy, also highlightedthe importance of encouraging clients to save and maintain acushion to absorb economic shocks. To do this, FMFB-T will beconducting surveys to better understand client needs. This willhelp the bank adjust and redesign its current savings and depositproducts to make it easier and more appealing for clients to save.Indicators 2008 2009 <strong>2010</strong>Microfinance Loans Disbursed: Value (US$ '000s) 45,915 22,849 30,975FMFBTAJIKISTANMicrofinance Loans Disbursed: Number 20,309 10,522 12,045Microfinance Portfolio Outstanding: Value (US$ '000s) 32,532 20,510 25,369Microfinance Portfolio Outstanding: Number 19,335 11,704 12,535Average Microfinance Loan Size (US$ unit) 1,683 1,759 2,024Percentage of Women Borrowers 23% 26% 28%Portfolio at Risk (%) 0.6% 5.3% 2.1%Number of Individual Savers 6,450 6,448 7,072Value of Individual Deposits (US$ ‘000) 3,378 4,424 4,876Number of Staff 358 417 41721

SYRIAIRANIRAQFMFI Syria works with AKF to support many family farms in theSalamieh Region. These farmers took loans to build greenhouses thatwill extend the growing season for their gladiolas.In Syria AKF’s Health Programme in Salamieh launched a motorcyclesafety campaign to reduce injuries. To support the campaign, FMFISyria is offering loans to those who wish to buy a helmet.QATARDOHA.FMFI Syria and AKF collaborated on drip irrigation systems. Clientscan get a discounted price on the systems, which are needed in thisarea because the water table is low.0 200 Km")A Branches. CapitalsAKDN countries of activity23

EGYPTDuring <strong>2010</strong>, the First MicroFinance Foundation Egypt (FMF)sought to maintain steady growth in light of the continued latentimpact of the financial crisis, while further strengtheningthe institution and building staff capacity. The onset of the revolutionin early January 2011 caused immediate disruption toFMF’s operations in Cairo and substantial upset of clients’ businesses.In the south, the impact was felt more gradually as tourismrevenues declined and the overall economy suffered. As thisdocument went to press, FMF was seeing a gradual return to itshistorical levels of portfolio quality, though the loan portfoliogrowth was down significantly from past years.FMF had 17,680 beneficiaries in <strong>2010</strong>, with an outstanding loanportfolio totalling US$ 5.0 million. The proportion of womenborrowers has been maintained at 45 percent.In the Darb al-Ahmar area ofCairo, artisanal traders like thisfurniture maker are partiallyresponsible for the touriststhat visit the area and help toincrease economic activity.Complementing its loans, FMF also provides non-financial servicesthrough its Business <strong>Development</strong> Services (BDS) Centreestablished under the Canadian International <strong>Development</strong>Agency’s Cairo Economic Livelihood Project. The BDS Centre’sgoal is to provide non-financial services to microfinance clients.BDS initiatives are designed to stimulate the development andsustainability of micro, small and medium enterprises by providingthe necessary knowledge, guidance and business linkagesthat the enterprise needs to thrive in a competitive businessenvironment. The wide range of business development servicesand business consulting helps entrepreneurs lay the foundationfor building a successful and rewarding business. Since its initiationin 2009, BDS has provided financial education services to2,878 clients, out of which 56 percent are women.There are three key activities being carried out by the BDSCentre which started in <strong>2010</strong>:• Financial literacy: Though training started out with very basicinformation, which was necessary, the curriculum is beingupdated based on a needs assessment. The revised curriculumwill include bookkeeping, pricing, sales and marketing.• Registering businesses: Though only a limited number havebeen registered, the rationale for registering businesses is toallow them to respond to large tenders from governmentand others thereby participating in the formal economy.• Exhibitions: This has been the cornerstone of BDS Centre24

SPOTLIGHT: SMALL AND MEDIUM ENTERPRISESSmall and medium enterprises (SME) are often referred to asthe “missing middle” in developing country economies. Whileindividual microenterprises help to sustain and support thecore livelihoods of families and households and are central toimproving quality of life and alleviating poverty, SME activity is atthe heart of growth, sustaining jobs and employment creationfor all including youth and disadvantaged individuals.Additionally, the job creation element of SMEs can enable manypoor people to feel more secure, because SME loans provide amechanism to smooth incomes so that SMEs can employ andpay monthly salaries.Through its SME lending, <strong>AKAM</strong> aims to stimulate sustainableemployment to promote economic development and povertyalleviation. <strong>AKAM</strong> also supports investment in communityservices for broader improvements, such as improved access tohealth care and education, and upgrades in the built environment.In 2008, based on the success in Afghanistan, the first institutionto offer SME loans, <strong>AKAM</strong> launched a pilot of a similar SMEinitiative in Egypt which added an integrated in-house businessdevelopment services component provided directly by <strong>AKAM</strong>’smicrofinance institution in Egypt.<strong>AKAM</strong> supports of local innovators,such as this Afghan man whoinvented and now manufacturespressure cookers for householduse. Previously, all such productswere imported from Pakistan orfurther abroad.The SME department of FMF has financed a number of businessesin Darb al-Ahmar. A total of 17 SME loans worth acombined US$ 117,000 were disbursed in <strong>2010</strong>. The SME unit,in 2011, will look at expanding the portfolio as the experienceof the staff increases and cultural lessons are learned.<strong>AKAM</strong> sees that providing access to financial services will stimulatethe independence and self-development of poor households.SMEs, on average, are responsible for the creation ofaround 20 full and part-time jobs per business. This providesthe poor with a way to maintain or improve their quality of lifein the face of uncertainty. Moreover, gaining access to financialservices is a critical step in connecting the poor to a broadereconomic life and building their confidence so that they canplay a role in the larger community.25

with the recent exhibition in Italy and some local exhibitionsprior to the revolution. Specifically, there have been linkagesto buyers and value chain linkages that have taken place.The BDS Centre in Darb al-Ahmar is currently revising theservices it offers. The new courses will include bookkeeping,business management, pricing, negotiation skills and selling. TheCentre will also be offering coaching programmes, feasibilityand business planning services.One of the services being offered by FMF is a tool to addressenvironmental challenges in Darb al-Ahmar and ManshiatNaser. Through this tool, loan officers will be able to examinethe environmental state of businesses during the investigationphase. The tool focuses on creating healthy and environmentallyfriendly business sites. FMF plans to collaborate in 2011 with anenvironmental consultant to refine and pilot this tool.In November <strong>2010</strong>, Her Royal Highness Princess Máxima of theNetherlands, the United Nations Secretary General’s SpecialAdvocate for Inclusive Finance for <strong>Development</strong>, visited FMF’sBusiness <strong>Development</strong> Service Centre in Darb al-Ahmar. Shevisited the FMF operation sites and clients’ workshops andspoke to FMF’s clients about the challenges they face as well aspotential strategies to overcome them. Princess Máxima alsolistened to the clients’ view about the impact of loans and BDSservices they had received.FMFEGYPTIndicators 2008 2009 <strong>2010</strong>Microfinance Loans Disbursed: Value (US$ '000s) 8,058 9,088 10,141Microfinance Loans Disbursed: Number 19,384 20,345 19,223Microfinance Portfolio Outstanding: Value (US$ '000s) 3,713 4,501 5,011Microfinance Portfolio Outstanding: Number 17,818 18,375 17,680Average Microfinance Loan Size (US$ unit) 208 245 283Percentage of Women Borrowers 45% 45% 45%Portfolio at Risk (%) 1.9% 1.6% 2.0%SME Disbursed: Value (US$ ‘000) 0 127 117SME Disbursed: Number 0 17 17SME Outstanding: Value (US$ ‘000) 0 93 85SME Outstanding: Number 0 15 23SME Portfolio at Risk (%) 0% 0% 6.6%Number of Staff 169 175 16626

SYRIAThe First MicroFinance Institution Syria (FMFI-S) was establishedas a programme in March 2003 and was the first private-sectormicrofinance service provider in Syria. In 2009, the institutionwas transformed into a regulated non-bank financial institutionunder the new Syrian microfinance law. This allowed it to inviteother shareholders and mobilise deposits from the public.During <strong>2010</strong> FMFI-S continued its transformation from a programmeinto a regulated and professional institution. It did thisby strengthening its operational policies and procedures, upgradingits human resources, and developing new risk management,product development and marketing strategies with inputand support from the Frankfurt School of Finance & Managementand the Mennonite Economic <strong>Development</strong> Associatesas part of technical assistance projects funded by KfW and theInternational Finance Corporation.FMFI-S has branches in Damascus, Aleppo, Lattakia, Tartous,Masyaf, Sweida, Salamieh and Homs and one service unit inKadmous (Tartous).FMFI-S completed major renovations to most of its branchnetwork in <strong>2010</strong>. It transitioned to a deposit taking institutionand piloted the deposit product in six branches, with a view toexpanding to the remaining two branches (Aleppo and Masyaf)once the office refurbishments were complete.Husein al Jaber used to sell roastedbeans from a cart on the street.This did not provide him with aregular income, so he took outa loan to open this shop wherehe sells and repairs gas stoves. Asa result, his monthly net incomehas increased by 50 percent.Since the roll-out of the deposits, FMFI-S’s deposit portfoliohas grown from 572 individual depositors with a value of US$144,000 at the end of 2009 to 2,822 individual depositors witha value of US$ 3.6 million at the end of <strong>2010</strong>.This rapid growth demonstrates that there is considerable unmetdemand for financial access and safe savings opportunitiesamongst the population. At the end of <strong>2010</strong>, FMFI-S had an outstandingportfolio of 20,004 loans valued at US$ 21.3 million.With the introduction of deposit and savings services, FMFI-Salso took another transformative step from being a transaction-focusedinstitution providing clients with a single loan tobeing a relationship-focused institution where individual clientsmay use a range of different financial products and services.27

SPOTLIGHT: CALL CENTREAt the First MicroFinance Institution Syria (FMFI-S) it was foundthat beside the branch network, FMFI-S had no other channelsin place to sell its products and/or service to its clients. Theinstitution decided that the set-up of a call centre would improveits service and eventually its outreach. International bestpractices have also shown that for the microfinance client targetgroup, this channel can be very successful and cost effective.Some seven million Syrians, about 38 percent of the country’spopulation, have a mobile phone. This makes getting in touchwith clients and others who have shown an interest in gettinga microfinance loan easier. With the help of the FrankfurtSchool of Finance & Management, FMFI-S started the processof improving customer service by upgrading the staffs’ skillsand reducing loan approval time.This call centre run by FMFISyria is helping the institutionfurther its outreach and betterunderstand what its clients want.To ensure that the clients were getting the best possible service,FMFI-S established a call centre to handle customer complaints;customer queries; or to get information to dormantclients or to people referred by other clients.The call centre handles product issues including promotionalcampaigns. This call centre also allows the institution to diversifyand expand the SME client base using lower cost solutionsthan the expansion of the branch network.By the end of <strong>2010</strong>, seven outbound campaigns had been executed.The result of this campaign was that 32 percent of thosewho were called had a conversation with an FMFI-S staff member.Of this 32 percent, about 10 percent of them went into abranch and got a loan. Although the actual outreach throughthe call centre only equaled three percent of total loans disbursed,this is expected to increase in the coming months.All branches have anecdotally noticed that the call centre hasplayed a role in attracting new clients. Though there is an increasedtraffic burden on the branches, the call centre has contributedto the increasing number of visitors (potential clients)in Damascus and Masyaf branches. The call centre has alsohelped in achieving the target sales in Lattakia branch duringthe fourth quarter of <strong>2010</strong>.28

This necessitated a change in front-line staff, as loan officersbecame relationship officers with the added responsibility ofpromoting savings and deposits as well as various loan products.The relationship officer is engaged with the clients so that theyunderstand what FMFI-S can do for them and what optionsthey will have in the future.In January <strong>2010</strong>, FMFI-S partnered with the Damascus Governorate,Syrian Saving Bank and the German Government’sGIZ. FMFI-S gives restoration loans to homeowners of the oldresidential buildings in the Old City.The initiative offers residents the access to subsidised loansand encourages them to restore and preserve the Old City’sunique architectural heritage in cooperation with GIZ. Thesigned agreement has the Syrian Government, represented bythe Governorate of Damascus, supporting its citizens living inthe Old City with low-cost loans for restoration and maintenanceof their homes.Culture is another area where FMFI-S works closely with the<strong>Aga</strong> <strong>Khan</strong> Cultural Services Syria (AKCS-S) to emphasise theneed to preserve and rehabilitate old and valuable historicalmonuments in Damascus and Aleppo. FMFI-S, in collaborationwith AKCS-S, provides small loans to people living in the OldCity of Aleppo in the area surrounding its Citadel to supportlocal entrepreneurs to launch their micro economic projects.Indicators 2008 2009 <strong>2010</strong>Microfinance Loans Disbursed: Value (US$ '000s) 21,526 22,985 29,849FMFISYRIAMicrofinance Loans Disbursed: Number 13,817 14,699 17,550Microfinance Portfolio Outstanding: Value (US$ '000s) 13,837 15,072 21,292Microfinance Portfolio Outstanding: Number 13,669 15,605 20,004Average Microfinance Loan Size (US$ unit) 1,012 966 1,064Percentage of Women Borrowers 26% 24% 21%Portfolio at Risk (%) 0.7% 3.6% 1.5%Number of Individual savers 374 572 2,822Value of Individual Deposits (US$ ’000) 54 144 3,577Number of Staff 147 197 22029

AFRICA.MAURITANIASENEGALDAKAR")A ")AMALINIGERCHADGAMBIAGUINEA-BISSAUGUINEASIERRALEONELIBERIABAMAKO.")A . ")ABURKINA FASO")A")A")A")A ")AYAMOUSSOUKRO.CÔTE D'IVOIREOUAGADOUGOUTOGOGHANABENINNIGERIACAMEROONGABONCONGOThe Green market in Ouagadougou, Burkina Faso. PAMF opened anew branch in the capital of Burkina Faso in <strong>2010</strong> to offer financialservices to urban populations..KINSHASAPAMF Côte d’Ivoire works closely with Ivoire Coton to supplylocal cotton growers with the loans for their crops. IvoireCoton then purchases the raw cotton.ANGOLAIn Mozambique, <strong>AKAM</strong> works with AKF to help clients increase theproductivity of their small garden plots which have cabbage,tomatoes and onions.0 600 KmNAMIBIA")A Branches. CapitalsAKDN countries of activity30

SAUDI ARABIAOMANSUDANERITREAYEMENDJIBOUTICENTRALAFRICAN REPUBLICSOUTH SUDANLoan officers are committed to ensuring that their clients fullyunderstand the loan agreements. FMFA Kenya tries to make surethat its contracts use plain language for clients with limited literacy.SOMALIADEMOCRATIC REPUBLICOF CONGORWANDA..BURUNDIKIGALIUGANDA.BUJUMBUR<strong>AKAM</strong>PALATANZANIAKENYA")A")A.NAIROBIDAR ES SALAAM")A")A")A")A ") A")A.PAMF-Madagascar collaborates with AKF, offering a group loanproduct and methodology targeted at rice producers in a countrywhere over 80 percent of the population works in agriculture.ZAMBIAMALAWI")A ") AMOZAMBIQUE")A") A")A")A") ")AA ")A")AZIMBABWE")A")A . ") AANTANANARIVOMADAGASCARBOTSWANASOUTH AFRICA.MAPUTOSWAZILANDLESOTHO31

WEST AFRICA<strong>AKAM</strong> established the Première Agence de Microfinance(PAMF) Burkina Faso and PAMF Mali in 2006 and now serves clientsin Burkina Faso through five branches and in Mali throughtwo branches. In 2008 <strong>AKAM</strong> established PAMF Côte d’Ivoire,which has two branches.The number of beneficiaries in the three institutions was18,036 in <strong>2010</strong>. The value of outstanding loans was US$ 3.8 million.Women accounted for 40 percent of borrowers at the endof the year. The number of individual savers was 15,894 with avalue of US$ 1.3 million in deposits. Currently, PAMF’s activitiesand branches are overwhelmingly concentrated in rural areasand on rural products.The Niger River is an importantsource of fish for communitieslike this one in Mopti, Mali, wherethe surplus fish is smoked, saltedand dried to be eaten later. Thisclient of PAMF Mali received aloan so that he could rent a largerspace to dry his fish.About 70 percent of loans in the region are disbursed fromrural branches. The PAMF microfinance institutions offer creditfor agricultural inputs primarily for cereals and horticulture,animal fattening, storage of crops so that they can be sold laterin the season, and trading. PAMF also offers a savings accountproduct in all three countries which has no fees or minimumbalance requirements to keep the product simple and flexiblefor clients. Every loan client is offered a free deposit accountto encourage clients to save.Burkina FasoIn January <strong>2010</strong>, PAMF opened its fifth branch in Burkina Faso.The Ouaga-Dapoya Branch is PAMF’s first exclusively urbanbranch that targets the urban poor, traders and craftsmen. Itis the first branch opened in a capital city and it will pilot newproducts such as small and medium enterprise loans and termdeposit accounts.In <strong>2010</strong> PAMF launched a promotional campaign to encouragemore clients to open savings accounts. Clients who opened anew deposit account received a gift. Awareness of PAMF’s productswas strengthened through radio broadcasting in marketsand in front of the branches.PAMF in Burkina Faso provides credit for animal fattening, cerealsstorage, fertiliser and seeds to over 3,000 villagers who alsosupply agro-processor Faso Coton, a subsidiary of AKFED, withraw cotton. This cooperation is a key example of the syner-32

gies that are characteristic of AKDN operations in a numberof countries. The concept is to deliver microcredit to cottonfarmers, building on the infrastructure of the industrial venture,which will then serve as a cornerstone for serving the broaderlocal population with an array of services extending beyondcotton finance. In <strong>2010</strong>, the number of loans disbursed wasabout 22,813 worth US$ 5.4 million.Côte d’IvoireIn spite of the political situation in the country, PAMF is one ofthe few microfinance institutions to remain operational in thenorth, providing reliable services in the rural areas. By the end ofthe year, PAMF-CI had disbursed over US$ 1.4 million in loans.Outstanding loans were valued at US$ 260,000 distributedamong 1,201 beneficiaries, 45 percent of whom were women.MaliPAMF is currently targeting urban, peri-urban and rural populationsin Mopti and Sévaré, and is coordinating its efforts withAKF’s rural development programmes in the area to enhancethe impact on the agricultural productivity and quality of life oflocal residents with the support of a Food for Progress grantfrom the United States Department of Agriculture. Loans areprovided to farmers participating in projects run by AKDN’sagencies to assist them with financial needs that arise prior toreceiving harvest revenues. At the end of <strong>2010</strong>, PAMF Mali haddisbursed 4,644 loans worth close to US$ 1.6 million.Burkina CôteIndicatorsMali CombinedFaso D’IvoireMicrofinance Loans Disbursed: Value (US$ '000s) 5,450 1,447 1,582 8,479PAMFWEST AFRICAMicrofinance Loans Disbursed: Number 22,813 5,661 4,644 33,118Microfinance Portfolio Outstanding: Value (US$ '000s) 2,937 260 585 3,782Microfinance Portfolio Outstanding: Number 14,312 1,201 2,523 18,036Average Microfinance Loan Size (US$ unit) 205 216 232 240Percentage of Women Borrowers 40% 45% 40% 40%Portfolio at Risk (%) 0.4% 6.3% 3.4% 0.8%Number of Individual Savers 10,962 2,139 2,793 15,894Value of Individual Deposits (US$ ‘000) 1,107 53 134 1,294Number of Staff 100 22 20 14233

MADAGASCARAccording to the Human <strong>Development</strong> Index, Madagascar wasranked 135 out of 169 countries in <strong>2010</strong>. It is one of the poorestcountries in Africa. It has also been calculated by the WorldBank that 67.8 percent of the 20 million inhabitants live onless than US$ 1.25 per day (44 percent of them facing extremepoverty).Madagascar’s economy is based on agriculture and the mainagricultural products are rice, cocoa, cassava, beans, onions andvanilla. The agricultural sector, which accounts for over a quarterof the gross domestic product and employs over 80 percentof the population, is prone to periods of heavy cyclones anddrought.The microfinance market is still underserved in Madagascar.While the number of people who could benefit from access tomicrofinance services is estimated at more than 14 million, thepenetration rate calculated by the “Coordination Nationale dela Microfinance” at the end of <strong>2010</strong> was only 17.5 percent.When Jean-Marc heard aboutPAMF he immediately contactedthe agency because he wantedto increase his funds to be ableto satisfy his orders. Jean-Marccan now produce up to 50 metalcookers per week, after receivinghis loan of 500,000 Ariary(US$ 244), which is sufficientto satisfy his clients’ needs fornow. He would like to extend hisactivity in order to sell his productsin other regions.By the end of <strong>2010</strong>, the number of active borrowers reportedfor the whole sector was 734,000 clients with an outstandingamount of US$ 88 million. This represents an annual growth of17 percent compared to 2009. Of these clients, 46 percent ofthe active borrowers at the end of <strong>2010</strong> were women.While the supply of financial services is found primarily in Antananarivoand other urban centres of the island, the PremièreAgence de Microfinance Madagascar (PAMF-Mada) is dedicatedto serving those clients who are most in need of financial services,particularly in remote areas. This focus allowed growth inPAMF-Mada’s portfolio by 83 percent during <strong>2010</strong> compared tothe year before.The total outstanding portfolio by December <strong>2010</strong> was US$3.42 million for more than 15,000 active clients against US$1.87 million one year before. In the same year, the breakdownof the loan disbursements was 67 percent of loans went to thebusiness sector; 48 percent went to the agricultural sector; andnine percent to services, arts and crafts.For the overall microfinance sector, deposits were estimated tobe worth US$ 68 million. PAMF-Mada’s deposit collection was34

SPOTLIGHT: AGRICULTURAL LENDINGGiven the scarce access to financial services among the ruralpoor and the importance of agriculture as a critical livelihoodactivity, agricultural finance is a key focus area for <strong>AKAM</strong>. Severalof <strong>AKAM</strong>’s institutions, particularly in sub-Saharan Africa,Pakistan, the Kyrgyz Republic and Tajikistan, have significant ruraloutreach and agriculture portfolios, but the unmet demandis still vast. Where there are sister agencies, <strong>AKAM</strong>’s entitiescollaborate to help increase the farmers’ yield.PAMF Madagascar’s focus is to expand outreach in rural areaswhere the microfinance penetration rate is extremely low –currently at around 3.5 percent – and where poverty is high.Consequently, 62 percent of its loans are rural. Although agricultureis a mainstay of the economy, employing 80 percent ofthe population, access to agricultural finance is low, particularlyamong PAMF-Mada’s focus areas of Sofia and Itasy.The focus of PAMF-Mada’s initial rural expansion has beensmall agricultural loans – in <strong>2010</strong>, 48 percent of the numbersof loan disbursements were for agriculture. PAMF Madagascaralso collaborates with AKF to provide loans to rice farmersorganised and trained by AKF in improved cultivation practices.To continue to support its target market, PAMF Madagascarexpects small agricultural loans to remain an important shareof its lending activity. However, to support growth in agriculturemore broadly, increase impact and support sustainability,PAMF Madagascar plans to introduce an agricultural SME productto develop appropriate financial services for other actorsand gaps in the rice value chain in particular.A farmer in Madagascar harvestsa rice crop by hand. <strong>AKAM</strong> andAKF work with rice farmers tohelp increase their yield whichhave increased by as much as300 percent in programme areas.35

launched at the end of 2009 and by the end of <strong>2010</strong> it had collectedUS$ 551,000 for over 8,200 individual depositors.PAMF-Mada collaborated with AKF in the Sofia Region to providetraining and funding to the rice cultivators in the area. Between2005 and <strong>2010</strong>, AKF trained nearly 17,000 small scale farmersin participatory rice farming methods. On average, groupsparticipating in the programme more than tripled their yields.Optimising the use of water, transplanting young shoots in rowswith adequate spacing, managing pests and weeding are some ofthe techniques taught to these clients. Bringing in their savingsas contribution, the villagers approach PAMF-Mada and obtainloans to acquire inputs and the agricultural equipment necessaryto make use of these techniques.To allow the institution to grow its deposit base further, smalland medium sized deposits will be developed in 2011. A comprehensiveassessment will be done to see if there is a need forsocial loans such as those for housing improvement or refurbishmentand for school stationery and books.PAMF-Mada will build on the progress made in <strong>2010</strong> in advancingits outreach and successfully building on its deposit services.Although the launch of a small and medium enterprise (SME)loan product was planned for the fall of <strong>2010</strong>, the first disbursementswere postponed to the first half of the next year. In 2011PAMF-Mada plans to strengthen institutional capacity, build adiversified deposit base and provide loans to SMEs.PAMFMADAGASCARIndicators 2008 2009 <strong>2010</strong>Microfinance Loans Disbursed: Value (US$ '000s) 2,525 3,348 6,177Microfinance Loans Disbursed: Number 10,382 14,588 22,208Microfinance Portfolio Outstanding: Value (US$ '000s) 1,124 1,873 3,421Microfinance Portfolio Outstanding: Number 6,335 9,555 15,688Average Microfinance Loan Size (US$ unit) 177 196 218Percentage of Women Borrowers 68% 62% 58%Portfolio at Risk (%) 1.8% 1.8% 1.4%Number of Individual Savers - 1,180 8,229Value of Individual Deposits (US$ ‘000) - 47 551Number of Staff 127 154 19236

EAST AFRICAIn East Africa, <strong>AKAM</strong>’s primary objective is to provide loans tomicroenterprises and small businesses for income generatingactivities such as small-scale agriculture, fishing, artistic activitiesand retail.<strong>AKAM</strong>’s East African institutions had about 3,918 beneficiariesin <strong>2010</strong>, with 46 percent of the beneficiaries being women. Thevalue of outstanding loans surpassed US$ 605,000.MozambiqueAt the end of 2004, the First Microcredit Programme (FMP)was established to support AKF’s Coastal Rural Support Programmeactivities. FMP did this by providing microcredit servicesto AKF’s beneficiaries and the poor in Cabo Delgado. In2009, <strong>AKAM</strong> set up the First MicroBank, S.A. (FMB-M) to takeover the activities previously undertaken by FMP. This transferof activity took place in <strong>2010</strong> after the bank received a ruralmicro bank licence from the Banco de Moçambique.The prime objective of FMB-M is to improve the quality of life ofthe poor in Mozambique by supporting economic developmentthrough the provision of sustainable financial services. FMB-Mprovides microfinance services in Cabo Delgado Province (Pemba,the districts of Metuge, Quissanga, Ibo Island and Chiure).<strong>AKAM</strong> is working with AKFin East Africa to enhance theproductivity of small gardenplots as part of an effortto move rural residents beyondsubsistence agriculture.The FinScope Survey published in 2009 showed that about 78percent of the bankable population in Mozambique had no accessto any sort of banking or microfinance services; 12 percentof that population had access to banking services; one percenthad access to formal microfinance services; and 10 percent hadaccess only to the informal microfinance sector. The surveyalso showed that 61 percent of urban and 86 percent of peoplein rural areas had no access to formal banking services.FMB-M was incorporated in 2009 and was authorised to startoperations as a licenced microfinance bank. This licence enablesthe institution to provide credit, ranging from microfinance tosmall and medium enterprise loans but more importantly toinitiate savings mobilisation, which it plans to do by the end of2011 or beginning of 2012.37

As part of its licencing and development process, FMB-M upgradedits main branch in Pemba and opened a new branch in Chiure.FMB-M had 1,224 outstanding loans in <strong>2010</strong>, worth US$ 322,000.The microfinance activities in the Province of Cabo Delgadoare a part of an integrated approach taken by AKDN and itsagencies to reach out to remote populations and alleviate poverty.The inauguration of the bank and the procurement of therural banking licence will enable FMB-M to aid developmentin Mozambique’s northern provinces, which have the highestpoverty rates in the country. FMB-M will offer its clients agricultural,entrepreneurial and salary-based loans.In 2011, FMB-M will be launching Core Microfinance & Banking(the management information system). It will also be strengtheningits policies and procedures and ensuring that its entirestaff is trained by the <strong>AKAM</strong> Training Academy.Tanzania and KenyaThe First Microfinance Agency Tanzania disbursed 1,444 loansworth US$ 406,000 by the end of <strong>2010</strong>. The First MicrofinanceAgency Kenya disbursed 1,887 loans valued at US$ 571,000.Having faced operational difficulties, <strong>AKAM</strong> is in the process ofreengineering both entities starting with a re-conceptualisationof the model (methodology and approach) in line with the socioeconomicenvironment as well as the human resource capacity.E ASTAFRICAIndicators Mozambique Kenya Tanzania CombinedMicrofinance Loans Disbursed: Value (US$ '000s) 371 571 406 1,348Microfinance Loans Disbursed: Number 587 1,887 1,444 3,918Microfinance Portfolio Outstanding: Value (US$ '000s) 322 202 81 605Microfinance Portfolio Outstanding: Number 1,224 1,345 780 3,349Average Microfinance Loan Size (US$ unit) 263 150 104 172Percentage of Women Borrowers 24% 58% 55% 46%Portfolio at Risk (%) 47.4% 7.5% 0.3% 18.4%Number of Staff 38 33 19 9038

SPOTLIGHT: TRAINING ACADEMYDelivering Core Skills Training to Improve Service<strong>2010</strong>’s central goal for <strong>AKAM</strong>’s Training Academy was to completethe delivery of a core skills training programme for allfield staff, and bring skills up to a standard level of competencyacross <strong>AKAM</strong>’s entities worldwide. This programme includesthe course on <strong>Development</strong> Ethics, which is the introductionto <strong>AKAM</strong>’s mission and values, the Loan Officer course, whichteaches core lending skills for all staff working in client services,and the Branch Manager course for all branch managers anddeputies, designed to improve management and planning skills.At the end of <strong>2010</strong>, 11 of 13 countries had completed 2,500 instancesof core skills training covering over 90 percent of theirstaff. These instances cover 2,000 staff inducted in <strong>Development</strong>Ethics, 350 loan officers and branch managers trained inLoan Officer Core Lending Skills, and 150 line employees whohave become trainers certified with facilitation skills to allowthem to deliver courses to staff in local languages and in localregions to reduce cost per learner to the institution.SME loan officers at a trainingsession in Afghanistan in December<strong>2010</strong>, working to preparea loan request for a complexcase study so that theycan improve their understandingof the SME methodologyand the loan appraisal process.Afghanistan and Pakistan, the largest entities, experienced severechallenges battling natural disasters and political instabilityresulting in a lag of training activity in both countries. By theend of <strong>2010</strong>, Afghanistan was able to train a significant numberof their staff and they will complete core skills training by endof 2011. Pakistan will begin core skills training in 2011.Developing SME departments in every entity is a critical globalstrategy in <strong>AKAM</strong>’s goal to support local economic developmentand job creation. To this end, the course for SME loan officerswas developed and piloted in Afghanistan, where FMFB-Ahas been giving out SME loans since 2005. In 2011 four morecountries will deploy SME lending, starting with loan officersarmed with advanced credit skills and rigorous policy and processtraining to ensure systematic risk reduction and performanceof this new product.<strong>AKAM</strong> continues to develop, in-house, its core skills curriculum.At the introductory levels, having customised training for specificjob positions tailored to the institution’s operating modelshas been critical to filling the gap in capacity created by rapidgrowth and change and achieving job competency for new staff.39

“After <strong>Development</strong> Ethics the SME team was motivated towork together and we reduced our processing time for loansfrom 30 days to 15 days. The Canada Goose story really workedto show them how we can fly farther if we work together!”SME Manager AfghanistanImpact of Evaluation on the Learning ApproachIn <strong>2010</strong> the evaluation process was formalised and, in additionto the measurement of training, key indicators were identifiedand impact assessment programmes to evaluate the effectivenessof the programme were implemented. A series of focusgroups, conducted to assess the post training impact and workplacetransfer of skills, confirmed that customer service hadimproved significantly. Staff are more engaged with the missionand values of the institution and are more sensitive to clients’challenges and needs. Productivity and team work have reducedconflicts and time wasted in the lending process. Loan officersare able to explain the benefits of deposit mobilisation to clients.Branch managers have seen an increased level of skill in businessand risk analysis and a more diligent attitude in the workplace.Surveys show that 75 percent of learners can identifyspecific learned skills they have applied in the workplace andoverall satisfaction with the quality of training materials andtrainers is over 95 percent; confirming that the learner-centricapproach is working and has sparked a desire for self-improvementand positive contribution to the performance of the institution.In addition to improvements in performance, traininghas impacted the quality of life of staff through promotions dueto enhanced skills and leadership ability gained in the training oftrainers programme.Strategically, the Training Academy seeks to impact the quality ofhuman capital, which is <strong>AKAM</strong>’s most critical resource. In <strong>2010</strong>,several initiatives were advanced to begin the process of buildingstronger human resources for the future. The first was toenhance the quality of new staff being recruited into operations.A course on recruitment was developed and delivered to everyhuman resources manager in the field. This innovative courseimproves the recruitment process and will be delivered to linemanagers in 2011 to improve the quality of new candidates.The second initiative was to build the capacity of local trainingdepartments. Capacity building workshops were conducted ontraining needs analysis, local training plans and coaching. Localtraining departments need to be strengthened so that they canassist in the execution of the institutions’ business plans.40

“After Loan Officer 100 training I was able to analyse my client’scash flow and know how much the client actually neededfor his business rather than recommending the standard loanamount.” Loan Officer KenyaA Curriculum that Targets Increased ProductivityCore skills’ training only addresses the current gap in skills. Goingforward, the Training Academy is moving to lay a more rigorousfoundation for curriculum development and trainer education.A process of consultation has begun with AKDN financial servicesinstitutions and educational institutions that have expertisein developing professional education programmes. AKDN institutionswill be leveraged to provide management and bankingeducation through access to their training programmes at thesenior level and through shared curriculum content, which canbe customised for field based microfinance staff so that greateraccess can be provided at a reasonable cost.To engage in this process the Training Academy has begun toidentify career path training for each key position. A globalneeds analysis, slated for mid-2011, will determine the trainingneeds of each institution based on the business plan. This willbe followed by the development of competency matrices whichdefine skills, knowledge, attitudes and behaviour for each positionand level of performance.Loan officers in West Africa playthe cash flow game to understandand track cash in the client’sbusiness. It is critical for theloan officers to have on the jobtraining as well as to understandthe mission and ethical preceptsof the institution.This competency framework will then be used to define thetraining plan for 2011-2013 and the resources required to helpstaff perform to the level that is needed to deliver on the businessplan. In addition, each institution has set ambitious goalsfor enhancing productivity. The competency-based curriculumdeliberately forms required job competency in the staff andthen improves competency over several years to contribute togreater performance and enhanced productivity. This processwill be completed by end of 2011 and will map out the longterm strategy of <strong>AKAM</strong>’s training programme.<strong>AKAM</strong>’s Training Academy is critical to the ability of the institutionto achieve its goals. It contributes to the integrity andperformance of the institution today and into the future as itdevelops the “Right People for the Job”: inspired, skilled andmotivated to improve the lives of the people <strong>AKAM</strong> and itsentities serve.41

KEY FINANCIAL INDICATORS<strong>AKAM</strong> KEY FIGURES, UNAUDITED*Indicator 2009 <strong>2010</strong>Microfinance Loans disbursed: Value (US$ '000s) 196’531 218’718Microfinance Loans disbursed: Number 433'681 373'334Microfinance Portfolio outstanding: Value (US$ '000s) 130'904 142'719Microfinance Portfolio outstanding: Number 344'341 309'484Microfinance Percentage of women borrowers 24.5% 33%Average Microfinance Loan Size 380 461Microfinance Portfolio At Risk (%) 2.6% 3.8%SME Loans disbursed: Value (US$ '000s) 8'651 7'845SME Loans disbursed: Number 444 389SME Portfolio outstanding: Value (US$ '000s) 5'855 5'977SME Portfolio outstanding: Number 472 489Average SME Loan Size 19’484 20'168SME Portfolio At Risk (%) 4.3% 2.3%Number of Individual Savers 236'105 298'775Value of Deposits (US$ ‘000s) 56'464 69'776Total Assets (US$ ‘000s) 304'955 332'642Number of Staff 3'347 3'371Loans and advances to agencies (In USD millions) 2009 <strong>2010</strong>Première Agence de MicroFinance (Burkina Faso) 4.73 5.16First Microfinance Foundation (Egypt) 4.69 4.95First MicroFinance Agency (Kenya) 2.49 2.62First MicroCredit Company (Kyrgyz Republic) 1.83 0.99Première Agence de MicroFinance (Madagascar) 0.54 0.14Fanasoavana SA (Madagascar) 0.30 0.30Première Agence de MicroFinance (Mali) 1.64 1.70First Microfinance Programme (Mozambique) 2.61 2.63First MicroBank (Mozambique) 0.55 0.65First MicroFinanceInstitution (Syria) 3.26 3.89MCF Programme (Syria) 1.19 -First MicroFinance Agency (Tanzania) 1.55 1.75First MicroInsurance Tanzania 0.17 0.06Première Agence de MicroFinance (Côte d’Ivoire) 0.08 0.09TOTAL 25.64 24.92*Combined balance sheets of all of the <strong>AKAM</strong> field entities42

Equity participations (In USD millions) 2009 <strong>2010</strong>First MicroFinanceBank (Afghanistan) 2.88 2.88First MicroCredit Company (Kyrgyz Republic) 3.89 3.89Fanasoavana SA (Madagascar) 0.09 0.09Première Agence de MicroFinance (Madagascar) 2.87 3.27First MicroFinanceBank (Pakistan) 4.12 7.05First Microinsurance Agency (Pakistan) 0.50 0.50First MicroFinanceBank (Tajikistan) 1.93 4.43First MicroFinance Institution (Syria) 8.69 8.69First MicroFinance Holding (West Africa) 0.02 0.02First MicroInsurance Agency (Tanzania) 0.05 0.05First MicroBank (Mozambique) 0.05 0.05TOTAL 25.10 30.93SHAREHOLDING STRUCTUREFirst MicroFinanceBank - Afghanistan<strong>Aga</strong> <strong>Khan</strong> Agency for MicrofinanceInternational Finance CorporationKfW Banking GroupFirst MicroFinanceBank - Pakistan<strong>Aga</strong> <strong>Khan</strong> Agency for Microfinance<strong>Aga</strong> <strong>Khan</strong> Rural Support ProgrammeInternational Finance Corporation32.33%51%24.24%45.46%16.67%30.30%First MicroFinanceBank - Tajikistan<strong>Aga</strong> <strong>Khan</strong> Agency for Microfinance<strong>Aga</strong> <strong>Khan</strong> FoundationInternational Finance CorporationKfW Banking GroupFirst MicroFinance Institution - Syria<strong>Aga</strong> <strong>Khan</strong> Agency for MicrofinanceInternational Finance CorporationKfW Banking GroupEuropean Investment BankOther Individual Investors12.64%14.49%14.58%17.17%55.61%14.43%14.57%56.51%43

PARTNERSAFDThe French <strong>Development</strong> Agency is a financial institution that is at the heartof France’s <strong>Development</strong> Assistance policy. AFD began its collaboration with<strong>AKAM</strong> in 2007 providing a loan to FMFB Afghanistan.Bill & Melinda Gates FoundationGuided by the belief that every life has equal value, the Bill and Melinda GatesFoundation works to reduce inequities and improve lives around the world.The Gates Foundation has provided a US$ 5.4 million grant over five years tofund the <strong>AKAM</strong> Microinsurance Initiative.BlueOrchardBlueOrchard Finance is a Swiss company specialising in the management ofmicrofinance investment products. BlueOrchard began its partnership with<strong>AKAM</strong> in 2006 by lending US$ 2 million to FMFB Tajikistan.CIDAThe Canadian International <strong>Development</strong> Agency, part of the Canadian federalgovernment, supports sustainable growth in developing countries to reducepoverty and contribute to a more secure, equitable, and prosperous world.CIDA has provided grant funding for FMFB Tajikistan, FMF Egypt, FMFB Pakistan,FMFB Afghanistan and PAMF Mali.DEGDEG, member of KfW Bankengruppe, finances investments of private companiesin developing and transition countries. As one of Europe’s largest developmentfinance institutions, it promotes private business structures to contribute tosustainable economic growth and improved living conditions.EIBThe European Investment Bank’s, shareholders of FMFI Syria, two mainpriorities in the Mediterranean region are support for the private sectorand the creation of an investment-friendly environment through efficientinfrastructure and appropriate financial systems.EBRDThe European Bank for Reconstruction and <strong>Development</strong> was established in1991 during the collapse of communism. The EBRD began its cooperation with<strong>AKAM</strong> institutions by providing a US$ 4 million credit line to FMFB Tajikistan.FMOFinancierings-Maatschappij voor Ontwikkelingslanden is the development bankof the Netherlands. FMO provided local currency loans to FMFB Afghanistanand a grant to <strong>AKAM</strong>’s Training Academy.FrontiersFrontiers is a company that provides practical solutions to the problems ofmicrofinance organisations from Kyrgyzstan, Kazakhstan and Tajikistan throughchanneling financial resources, high quality of services, proven managementtechniques and implementation.44