Technical Breakout Texmaco Rail and Engineering ... - ICICI Direct

Technical Breakout Texmaco Rail and Engineering ... - ICICI Direct

Technical Breakout Texmaco Rail and Engineering ... - ICICI Direct

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

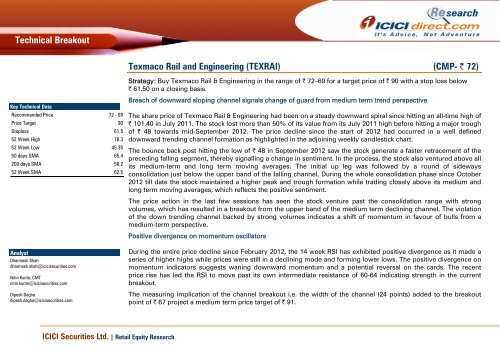

<strong>Technical</strong> <strong>Breakout</strong><strong>Texmaco</strong> <strong>Rail</strong> <strong>and</strong> <strong>Engineering</strong> (TEXRAI) (CMP- | 72)Strategy: Buy <strong>Texmaco</strong> <strong>Rail</strong> & <strong>Engineering</strong> in the range of | 72–69 for a target price of | 90 with a stop loss below| 61.50 on a closing basis.Key <strong>Technical</strong> DataRecommended Price 72 - 69Price Target 90Stoploss 61.552 Week High 78.352 Week Low 45.3550 days SMA 65.4200 days SMA 58.252 Week SMA 62.5AnalystDharmesh Shahdharmesh.shah@icicisecurities.comNitin Kunte, CMTnitin.kunte@icicisecurities.comDipesh Daghadipesh.dagha@icicisecurities.comBreach of downward sloping channel signals change of guard from medium term trend perspectiveThe share price of <strong>Texmaco</strong> <strong>Rail</strong> & <strong>Engineering</strong> had been on a steady downward spiral since hitting an all-time high of| 101.40 in July 2011. The stock lost more than 50% of its value from its July 2011 high before hitting a major troughof | 48 towards mid-September 2012. The price decline since the start of 2012 had occurred in a well defineddownward trending channel formation as highlighted in the adjoining weekly c<strong>and</strong>lestick chart.The bounce back post hitting the low of | 48 in September 2012 saw the stock generate a faster retracement of thepreceding falling segment, thereby signalling a change in sentiment. In the process, the stock also ventured above allits medium-term <strong>and</strong> long term moving averages. The initial up leg was followed by a round of sidewaysconsolidation just below the upper b<strong>and</strong> of the falling channel. During the whole consolidation phase since October2012 till date the stock maintained a higher peak <strong>and</strong> trough formation while trading closely above its medium <strong>and</strong>long term moving averages, which reflects the positive sentiment.The price action in the last few sessions has seen the stock venture past the consolidation range with strongvolumes, which has resulted in a breakout from the upper b<strong>and</strong> of the medium term declining channel. The violationof the down trending channel backed by strong volumes indicates a shift of momentum in favour of bulls from amedium-term perspective.Positive divergence on momentum oscillatorsDuring the entire price decline since February 2012, the 14 week RSI has exhibited positive divergence as it made aseries of higher highs while prices were still in a declining mode <strong>and</strong> forming lower lows. The positive divergence onmomentum indicators suggests waning downward momentum <strong>and</strong> a potential reversal on the cards. The recentprice rise has led the RSI to move past its own intermediate resistance of 60-64 indicating strength in the currentbreakout.The measuring implication of the channel breakout i.e. the width of the channel (24 points) added to the breakoutpoint of | 67 project a medium term price target of | 91.<strong>ICICI</strong> Securities Ltd. | Retail Equity Research

Exhibit 1: <strong>Texmaco</strong> <strong>Rail</strong> & <strong>Engineering</strong> Ltd. – Weekly C<strong>and</strong>lestick ChartSource: Spider software, <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd. | Retail Equity Research Page 2

Pankaj P<strong>and</strong>ey Head – Research pankaj.p<strong>and</strong>ey@icicisecurities.com<strong>ICICI</strong>direct.com Research Desk,<strong>ICICI</strong> Securities Limited,1st Floor, Akruti Trade Centre,Road No 7, MIDCAndheri (East)Mumbai – 400 093research@icicidirect.comDisclaimerThe report <strong>and</strong> information contained herein is strictly confidential <strong>and</strong> meant solely for the selected recipient <strong>and</strong> may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any otherperson or to the media or reproduced in any form, without prior written consent of <strong>ICICI</strong> Securities Ltd (I-Sec). The author may be holding a small number of shares/position in the above-referred companies as ondate of release of this report. I-Sec may be holding a small number of shares/position in the above-referred companies as on date of release of this report. This report is based on information obtained from publicsources <strong>and</strong> sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report <strong>and</strong> information herein is solely for informational purpose <strong>and</strong>may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting <strong>and</strong>tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed <strong>and</strong> opinions expressed in this report may not be suitable for allinvestors, who must make their own investment decisions, based on their own investment objectives, financial positions <strong>and</strong> needs of specific recipient. This report may not be taken in substitution for the exercise ofindependent judgment by any recipient. The recipient should independently evaluate the investment risks. I-Sec <strong>and</strong> affiliates accept no liabilities for any loss or damage of any kind arising out of the use of thisreport. Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. I-Sec may have issued other reports that are inconsistent with <strong>and</strong>reach different conclusion from the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in anylocality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject I-Sec <strong>and</strong> affiliates to any registration or licensingrequirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may comeare required to inform themselves of <strong>and</strong> to observe such restriction.<strong>ICICI</strong> Securities Ltd. | Retail Equity Research Page 3