GITEX 2012 INTERVIEWS ITU TELECOM World 2012 - Teletimes

GITEX 2012 INTERVIEWS ITU TELECOM World 2012 - Teletimes GITEX 2012 INTERVIEWS ITU TELECOM World 2012 - Teletimes

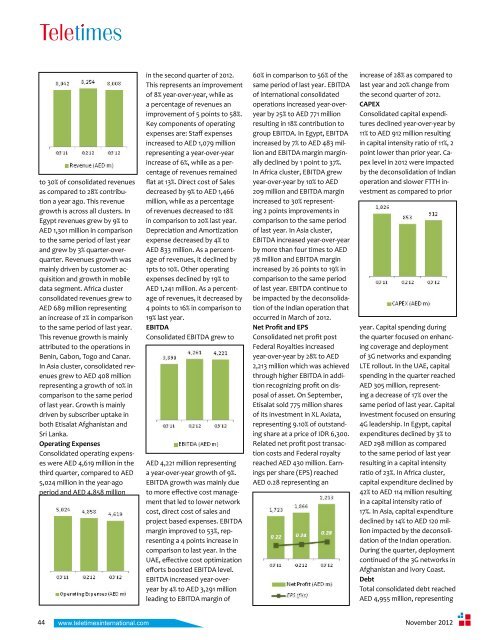

to 30% of consolidated revenuesas compared to 28% contributiona year ago. This revenuegrowth is across all clusters. InEgypt revenues grew by 9% toAED 1,301 million in comparisonto the same period of last yearand grew by 3% quarter-overquarter.Revenues growth wasmainly driven by customer acquisitionand growth in mobiledata segment. Africa clusterconsolidated revenues grew toAED 689 million representingan increase of 2% in comparisonto the same period of last year.This revenue growth is mainlyattributed to the operations inBenin, Gabon, Togo and Canar.In Asia cluster, consolidated revenuesgrew to AED 408 millionrepresenting a growth of 10% incomparison to the same periodof last year. Growth is mainlydriven by subscriber uptake inboth Etisalat Afghanistan andSri Lanka.Operating ExpensesConsolidated operating expenseswere AED 4,619 million in thethird quarter, compared to AED5,024 million in the year-agoperiod and AED 4,858 millionin the second quarter of 2012.This represents an improvementof 8% year-over-year, while asa percentage of revenues animprovement of 5 points to 58%.Key components of operatingexpenses are: Staff expensesincreased to AED 1,079 millionrepresenting a year-over-yearincrease of 6%, while as a percentageof revenues remainedflat at 13%. Direct cost of Salesdecreased by 9% to AED 1,466million, while as a percentageof revenues decreased to 18%in comparison to 20% last year.Depreciation and Amortizationexpense decreased by 4% toAED 833 million. As a percentageof revenues, it declined by1pts to 10%. Other operatingexpenses declined by 19% toAED 1,241 million. As a percentageof revenues, it decreased by4 points to 16% in comparison to19% last year.EBITDAConsolidated EBITDA grew toAED 4,221 million representinga year-over-year growth of 9%.EBITDA growth was mainly dueto more effective cost managementthat led to lower networkcost, direct cost of sales andproject based expenses. EBITDAmargin improved to 53%, representinga 4 points increase incomparison to last year. In theUAE, effective cost optimizationefforts boosted EBITDA level.EBITDA increased year-overyearby 4% to AED 3,291 millionleading to EBITDA margin of60% in comparison to 56% of thesame period of last year. EBITDAof international consolidatedoperations increased year-overyearby 25% to AED 771 millionresulting in 18% contribution togroup EBITDA. In Egypt, EBITDAincreased by 7% to AED 483 millionand EBITDA margin marginallydeclined by 1 point to 37%.In Africa cluster, EBITDA grewyear-over-year by 10% to AED209 million and EBITDA marginincreased to 30% representing2 points improvements incomparison to the same periodof last year. In Asia cluster,EBITDA increased year-over-yearby more than four times to AED78 million and EBITDA marginincreased by 26 points to 19% incomparison to the same periodof last year. EBITDA continue tobe impacted by the deconsolidationof the Indian operation thatoccurred in March of 2012.Net Profit and EPSConsolidated net profit postFederal Royalties increasedyear-over-year by 28% to AED2,213 million which was achievedthrough higher EBITDA in additionrecognizing profit on disposalof asset. On September,Etisalat sold 775 million sharesof its investment in XL Axiata,representing 9.10% of outstandingshare at a price of IDR 6,300.Related net profit post transactioncosts and Federal royaltyreached AED 430 million. Earningsper share (EPS) reachedAED 0.28 representing anincrease of 28% as compared tolast year and 20% change fromthe second quarter of 2012.CAPEXConsolidated capital expendituresdeclined year-over-year by11% to AED 912 million resultingin capital intensity ratio of 11%, 2point lower than prior year. Capexlevel in 2012 were impactedby the deconsolidation of Indianoperation and slower FTTH investmentas compared to prioryear. Capital spending duringthe quarter focused on enhancingcoverage and deploymentof 3G networks and expandingLTE rollout. In the UAE, capitalspending in the quarter reachedAED 305 million, representinga decrease of 17% over thesame period of last year. Capitalinvestment focused on ensuring4G leadership. In Egypt, capitalexpenditures declined by 3% toAED 298 million as comparedto the same period of last yearresulting in a capital intensityratio of 23%. In Africa cluster,capital expenditure declined by42% to AED 114 million resultingin a capital intensity ratio of17%. In Asia, capital expendituredeclined by 14% to AED 120 millionimpacted by the deconsolidationof the Indian operation.During the quarter, deploymentcontinued of the 3G networks inAfghanistan and Ivory Coast.DebtTotal consolidated debt reachedAED 4,955 million, representing44 November 2012www.teletimesinternational.com

a decline of 23% in comparisonto debt balance as of September2011. Main reason for thedecline is the deconsolidationProfit and Loss Summary(AED m) Q3’11 Q2’12 Q3’12 QoQ YoYRevenue 8,042 8,254 8,008 -3% 0%EBITDA 3,890 4,261 4,221 -1% +9%EBITDA Margin 48% 52% 53% +1pp +4ppFederal Royalties 1,723 1,866 2,213 +19% +28%Net Profit 1,723 1,866 2,213 +19% +28%Net Profit Margin 21% 23% 28% +5pp +6ppBalance Sheet Summary(AED m) Q4’11 Q2’12Cash & Cash Equivalents 9,972 12,176Total Assets 72,892 73,699Total Debt 6,696 4,955Net Cash 3,276 7,221Total Equity 41,704 43,013Cash flow Summary(AED m) 9M’11 9M’12Operating 7,255 8,403Investing (1,744) (55)Financing (5,306) (5,994)Net change in cash 204 2,354Effect of FX rate changes 19 (149)Ending cash balance 10,500 12,176Reconciliation of Non-IFRS Financial MeasurementsAED m Q3’11 Q2’12 Q3’12 Q4’11EBITDA 3,890 4,261 4,221 4,218Depreciation & Amortization (871) (865) (833) (959)Exchange gain/(loss) (119) 71 (6) (122)Share of Associates and JVs results 366 324 272 404Impairment 0 0 0 (3,044)Operating Profit Before Federal Royalty 3,266 3,791 3,654 497of the Indian operation. Mostof the existing debt is relatedto international operations tofinance networks deploymentand the majority of the balanceis for long term maturity.Consolidated cash balancereached AED 12,176 million asof September 2012 leading to apositive net cash of AED 7,221million after deducting the debtbalance.Reconciliation of Non-IFRSFinancial MeasurementsWe believe that EBITDA isa measurement commonlyused by companies, analystsand investors in the telecommunicationsindustry, whichenhances the understanding ofour cash generation ability andliquidity position, and assists inthe evaluation of our capacityto meet our financial obligations.We also use EBITDA asan internal measurement tooland, accordingly, we believethat the presentation of EBITDAprovides useful and relevantinformation to analysts andinvestors.Our EBITDA definition includesrevenue, staff costs, direct costof sales, regulatory expenses,operating lease rentals, repairsand maintenance, generalfinancial expenses, and otheroperating expenses.EBITDA is not a measure of financialperformance under IFRS,and should not be construedas a substitute for net earnings(loss) as a measure of performanceor cash flow from operationsas a measure of liquidity.The following table provides areconciliation of EBITDA, whichis a non-IFRS financial measurement,to Operating Profitbefore Federal Royalty, whichwe believe is the most directlycomparable financial measurementcalculated and presentedin accordance with IFRS.November 2012www.teletimesinternational.com45

- Page 1: Al RostamaniCommunicationscelebrati

- Page 7: In this edition18Coverage on GITEX

- Page 11 and 12: Naveed KianiMachine to Machine Comm

- Page 13 and 14: Future remained the key themeareas

- Page 17: PCCW GlobalConnected with your worl

- Page 20 and 21: GITEX once again establishes its ro

- Page 23: GITEX Technology Week 2012A single

- Page 26 and 27: Africa tipped as decade’s next bi

- Page 29 and 30: Teletimes InterviewsBy: Gulraiz Kha

- Page 31 and 32: expertise in the market. So wehave

- Page 33 and 34: stay in the country. So ourarchitec

- Page 35 and 36: We are # 1 in many marketsand # 2 i

- Page 38 and 39: Simpana:Reducingcomplexity andincre

- Page 41 and 42: Huawei and ZTE fall into trouble at

- Page 43: performance layer to theIntelsat fl

- Page 48 and 49: ARC adopts aConsultative andSystem

- Page 50 and 51: Qtel Group Chairman challengesTelec

- Page 52 and 53: du recertified to ISO 14001and OHSA

- Page 54: Smarter infrastructure neededto han

- Page 57 and 58: Teletimes ReportO3b Networks announ

- Page 59: Comguard and WatchGuard run a serie

- Page 62 and 63: PTCL holds 17th Annual General Meet

- Page 64 and 65: Global Telecom events 2012-13Novemb

- Page 66: TeletoonsHelp!She’s fallen,and ca

to 30% of consolidated revenuesas compared to 28% contributiona year ago. This revenuegrowth is across all clusters. InEgypt revenues grew by 9% toAED 1,301 million in comparisonto the same period of last yearand grew by 3% quarter-overquarter.Revenues growth wasmainly driven by customer acquisitionand growth in mobiledata segment. Africa clusterconsolidated revenues grew toAED 689 million representingan increase of 2% in comparisonto the same period of last year.This revenue growth is mainlyattributed to the operations inBenin, Gabon, Togo and Canar.In Asia cluster, consolidated revenuesgrew to AED 408 millionrepresenting a growth of 10% incomparison to the same periodof last year. Growth is mainlydriven by subscriber uptake inboth Etisalat Afghanistan andSri Lanka.Operating ExpensesConsolidated operating expenseswere AED 4,619 million in thethird quarter, compared to AED5,024 million in the year-agoperiod and AED 4,858 millionin the second quarter of <strong>2012</strong>.This represents an improvementof 8% year-over-year, while asa percentage of revenues animprovement of 5 points to 58%.Key components of operatingexpenses are: Staff expensesincreased to AED 1,079 millionrepresenting a year-over-yearincrease of 6%, while as a percentageof revenues remainedflat at 13%. Direct cost of Salesdecreased by 9% to AED 1,466million, while as a percentageof revenues decreased to 18%in comparison to 20% last year.Depreciation and Amortizationexpense decreased by 4% toAED 833 million. As a percentageof revenues, it declined by1pts to 10%. Other operatingexpenses declined by 19% toAED 1,241 million. As a percentageof revenues, it decreased by4 points to 16% in comparison to19% last year.EBITDAConsolidated EBITDA grew toAED 4,221 million representinga year-over-year growth of 9%.EBITDA growth was mainly dueto more effective cost managementthat led to lower networkcost, direct cost of sales andproject based expenses. EBITDAmargin improved to 53%, representinga 4 points increase incomparison to last year. In theUAE, effective cost optimizationefforts boosted EBITDA level.EBITDA increased year-overyearby 4% to AED 3,291 millionleading to EBITDA margin of60% in comparison to 56% of thesame period of last year. EBITDAof international consolidatedoperations increased year-overyearby 25% to AED 771 millionresulting in 18% contribution togroup EBITDA. In Egypt, EBITDAincreased by 7% to AED 483 millionand EBITDA margin marginallydeclined by 1 point to 37%.In Africa cluster, EBITDA grewyear-over-year by 10% to AED209 million and EBITDA marginincreased to 30% representing2 points improvements incomparison to the same periodof last year. In Asia cluster,EBITDA increased year-over-yearby more than four times to AED78 million and EBITDA marginincreased by 26 points to 19% incomparison to the same periodof last year. EBITDA continue tobe impacted by the deconsolidationof the Indian operation thatoccurred in March of <strong>2012</strong>.Net Profit and EPSConsolidated net profit postFederal Royalties increasedyear-over-year by 28% to AED2,213 million which was achievedthrough higher EBITDA in additionrecognizing profit on disposalof asset. On September,Etisalat sold 775 million sharesof its investment in XL Axiata,representing 9.10% of outstandingshare at a price of IDR 6,300.Related net profit post transactioncosts and Federal royaltyreached AED 430 million. Earningsper share (EPS) reachedAED 0.28 representing anincrease of 28% as compared tolast year and 20% change fromthe second quarter of <strong>2012</strong>.CAPEXConsolidated capital expendituresdeclined year-over-year by11% to AED 912 million resultingin capital intensity ratio of 11%, 2point lower than prior year. Capexlevel in <strong>2012</strong> were impactedby the deconsolidation of Indianoperation and slower FTTH investmentas compared to prioryear. Capital spending duringthe quarter focused on enhancingcoverage and deploymentof 3G networks and expandingLTE rollout. In the UAE, capitalspending in the quarter reachedAED 305 million, representinga decrease of 17% over thesame period of last year. Capitalinvestment focused on ensuring4G leadership. In Egypt, capitalexpenditures declined by 3% toAED 298 million as comparedto the same period of last yearresulting in a capital intensityratio of 23%. In Africa cluster,capital expenditure declined by42% to AED 114 million resultingin a capital intensity ratio of17%. In Asia, capital expendituredeclined by 14% to AED 120 millionimpacted by the deconsolidationof the Indian operation.During the quarter, deploymentcontinued of the 3G networks inAfghanistan and Ivory Coast.DebtTotal consolidated debt reachedAED 4,955 million, representing44 November <strong>2012</strong>www.teletimesinternational.com