FWCS 2009 Budget - Fort Wayne Community Schools

FWCS 2009 Budget - Fort Wayne Community Schools

FWCS 2009 Budget - Fort Wayne Community Schools

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>FWCS</strong> <strong>2009</strong> <strong>Budget</strong>August 11, 2008

<strong>Budget</strong>s to Approve Property Tax Supported:• Racial Balance• Capital Projects• Transportation• Operations• Bus Replacement• Debt Service & Pension Bond• Museum of Art Other:• General• Special Ed Pre-School

Total Teachers – All FundsClassroomSpecial EdElem. art, music, PEResourceCareer CenterOther – media,remediation, ALPTotal1,320.33290.9108.6147.7736.5102.982,007.08

<strong>Budget</strong> Adoption Calendar* Board Meetings*August 11August 14 & 21*August 25Public presentation<strong>Budget</strong>s advertised<strong>Budget</strong> hearingBus Replacement Plan hearingCapital Projects Plan Hearing*September 8 Deadline 9/30 extended to 12/1:<strong>Budget</strong> adoptionDeadline 9/20 extended to 11/20:Bus Replacement Plan adoptionCapital Projects Plan adoptionDates set by state:<strong>Budget</strong> hearing<strong>Budget</strong> order issued by Dept. ofLocal Government Finance

Board Approval Required1. <strong>2009</strong> Appropriations (budget)2. <strong>2009</strong> Maximum Levy (property tax)3. Excess Levy Appeal for 2007property tax shortfalls• General Fund - $249,872• Transportation - $74,0114. Note: Fiscal year change is comingwith next budget adoption

Assessed Value - <strong>FWCS</strong> 2007 pay 2008 $8.2 billion 2008 pay <strong>2009</strong> estimate $7 billion Decrease almost 15% due to changes inresidential assessed value calculation Will impact fix rated funds• Capital Projects Fund• Racial Balance

Assessed Value ReductionResidentialGross Assessed ValueHomestead Standard DeductionRemainder $100,000-$45,000 = $55,00035% Homestead SupplementalDeduction (NEW) = $55,000 * 35%Mortgage DeductionTaxable Assessed Value =2008$100,000-45,000-3,000$52,000<strong>2009</strong>$100,000-45,000-19,260-3,000$32,750

Property Tax CalculationExample – all units <strong>Wayne</strong> TownshipGross Assessed ValueTaxable Assessed Value<strong>Wayne</strong> Township rateHB 1001 adjustmentsEst. township rate <strong>2009</strong>Gross taxes2007$100,000$52,000$3.2601$1,6952008$100,000$52,000$3.2651$1,698

Property Tax CalculationExample – all units <strong>Wayne</strong> TownshipGross Assessed ValueTaxable Assessed Value<strong>Wayne</strong> Township rateHB 1001 adjustmentsEst. township rate <strong>2009</strong>Gross taxesLess creditsNet tax paid by home ownerChange from 20072007$100,000$52,000$3.2601$1,695667$1,0282008$100,000$52,000$3.2651$1,6981,073$625-39%

Property Tax CalculationExample – all units <strong>Wayne</strong> Township20072008<strong>2009</strong>SimulationGross Assessed Value$100,000$100,000$100,000Taxable Assessed Value$52,000$52,000$32,750<strong>Wayne</strong> Township rate$3.2601$3.2651$3.2651HB 1001 adjustments-.3976Est. township rate <strong>2009</strong>$2.8675Gross taxes$1,695$1,698$939Less credits6671,07385Net tax paid by home owner$1,028$625$854

Circuit Breaker – <strong>FWCS</strong>In millions<strong>2009</strong>20102011Circuit Breaker Rates:Homeowners1.5%1%1%Other residential2.5%2%2%Business3.5%3%3%<strong>FWCS</strong> Circuit Breaker$1.2$4.8$4.8Less: State Support-0--0-2.2Net Circuit Breaker$1.2$2.6$4.8<strong>Budget</strong>ed estimated loss$1.4

Circuit Breaker -Estimated reductions in ’09 budgetCapital ProjectsRacial BalanceTransportationBus ReplacementMuseum of ArtTotal$750,000150,000310,000217,0005,000$1,432,000

General Fund Salaries & fringe benefits• Teachers, administrators, custodial,clerical Operating costs• Utilities, insurance, legal School materials & supplies

General Fund Expenditures<strong>2009</strong> <strong>Budget</strong> $218,250,000$12.05%$53.525%$6.33%$146.467%Salaries &WagesFringePurchasedServicesOther

Funding FormulaTuition Support(formula)Academic Honors Diploma($900/diploma)Special Education(based on exceptionality)Vocational Education(based on course)Prime Time(formula)Total2008$164,629,427558,00014,977,2271,298,1005,281,896$186,744,650<strong>2009</strong>$173,454,3185.4%574,2002.9%15,050,265.5%1,298,1000%4,297,808-18.6%$194,674,6914.2%

Tuition Support - Factors Enrollment – past 5 years and nextestimate Complexity Index – uses free & reducedlunch rate only Prior year revenue

Tuition Support –EnrollmentNumber of students for determiningteacher allocationsReduce kindergarten ½Deduct preschoolAdd special ed studentsDual enrollment adjustmentNew charter school estimateEnrollment for funding formulaState Adjusted30,554.0-1,213.5-641.0947.0-18.8-400.029,227.729,516.3

Tuition Support –Complexity IndexFree & reduced lunch rateTimes State multiplierPlus 1Calculated indexAdditional index provided forbeing over 1.25Equals Complexity Index60.57%.4974.30131.00001.3013-1.2500.05131.3013.05131.3526Multiplied by per pupil State FoundationamountCalculated Formula per pupil$4,825$6,526

Tuition Support –per pupil and total revenueState Foundation Amount<strong>FWCS</strong> Calculated FormulaTotal<strong>FWCS</strong> AllowedTotalAmount below formulaTotal2008$4,790$6,318$187.3 million$5,560$164.8 million$758$22.5 million<strong>2009</strong>$4,825.7% increase$6,5263.3% increase$192.6 million$5,8775.7% increase$173.4 million$649$19.2 million

Full-Day Kindergarten<strong>FWCS</strong> Per pupil funding2008$5,560<strong>2009</strong>$5,8772 nd half kindergarten notin funding formulaState grant forkindergartenPer pupil not fundedKindergarten studentsTotal not funded½ = $2,780$792$1,9882,374$4.7 million½ = $2,938$1,036$1,9022,346$4.4 million

Utilities & Insurance$12,000,000$10,000,000$8,000,000$6,000,000$4,000,000$2,000,000$02003 2004 2005 2006 2007 2008 <strong>2009</strong>CPF General Total

Racial Balance Fund Established in 1989 Funding provided by a reduction in CPF Provides resources that encourage racialbalance in a school• Magnet schools• Reading Recovery• Student Support

Racial Balance ExpensesStudentSupport17%SchoolMaterials8%<strong>Budget</strong> $9,086,000Other 3%ResourceTeachers40%ReadingRecovery26%SchoolAssistant6%

Racial Balance RevenueAssessed ValueTimes fixed rate $.0890= Levy2008$8.2 billion$7.3 million<strong>2009</strong>$7 billion$6.3 million+ misc. revenueTotal revenueLess circuit breaker.7 million$8 million.7 million$7 million-$150,000

Capital Projects Fund(CPF) 3-year Plan Required Building construction, renovation, repair,maintenance• 63 buildings, average age 51 years Equipment & Technology purchases andrepairs Lower than other districts due to RacialBalance Fund

Capital Projects Fund<strong>Budget</strong> OverviewTotal to approveRequired reduction:Pension Bond tax neutralityPotential reductions:Assessed value adjustmentCircuit breakerProposed expenditures<strong>2009</strong>$27,175,3002,700,0003,000,000750,000$6,450,000$20,725,300

Capital Projects Fund<strong>Budget</strong> OverviewImprovements &ReplacementsUtilities & InsuranceTotal expected budgetDifference2008$19,479,5226,179,026$25,658,548<strong>2009</strong>$14,546,2746,179,026$20,725,300-$4,933,248

Capital Projects DetailImprovements & Replacements:Building ImprovementsEquipmentBuilding & Equipment RepairTechnologyEnergy Savings ContractsEmergency AllocationLand2008$10,018,1231,750,0003,247,9992,783,400730,000600,000350,000$19,479,522<strong>2009</strong>$5,651,2741,605,0003,329,6002,696,400514,000600,000150,000$14,546,274

<strong>2009</strong> Building Improvements2008 <strong>2009</strong> ChangeLakeside Middle School $ 3,468,974 $ - $ (3,468,974)Major Project 3,468,974 - (3,468,974)Professional Services 125,000 100,000 (25,000)Roof Replacement 1,500,000 1,500,000 -Site 327,145 250,000 (77,145)General Building Systems 590,000 400,000 (190,000)Mechanical/Electrical 811,921 600,000 (211,921)HVAC Replacement 1,802,000 1,410,000 (392,000)Traffic/Safety 468,673 511,274 42,601School Programmatic Needs 140,000 110,000 (30,000)Hazardous Materials 320,000 280,000 (40,000)A.D.A. Projects 270,000 180,000 (90,000)School Sports Facilities 194,410 310,000 115,590$ 10,018,123 $ 5,651,274 $ (4,366,849)

<strong>2009</strong> Capital Projects PlanTechnology19%EnergySavingsContracts4%EmergencyAllocation4%Land1%BuildingImprovements38%Building &EquipmentRepair23%Equipment11%

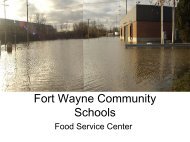

Debt Service FundSouth Side addition & renovationNorth Side addition & renovationFood Service CenterState Technology loans (CSF & STAA)Interest on tax anticipation warrantsUnfunded textbooksTotalThrough2012Through2018Through2018$3,768,0383,740,0001,283,6003,394,833500,00010,187$12,696,658

Debt Service Funds<strong>Budget</strong> Overview2008<strong>2009</strong>ExpenditureExpenditureChange<strong>Budget</strong><strong>Budget</strong>Debt Service-Regular$12,230,248$12,696,658$466,410Debt Service-3,891,4153,886,555-4,860Pension Bond(tax neutral with cutsto CPF & BusReplacement)Total$16,121,663$16,583,213$461,550

Debt Service RateComparison (2007 rates)<strong>FWCS</strong>Ranked 264 of 284 districtsState averageState meanHighest in state – CrawfordsvilleLowest in state – Speedway$.1364Per $100 ofAssessed Value$.3713$.3228$1.0616$.0058

Transportation Fund Operations• Annual budget determined by stateformula, supported by property taxes Bus Replacement• Annual budget determined by 12 yearreplacement plan• Pension bond tax neutrality furtherlengthens replacement plan

Transportation Operations2008<strong>2009</strong><strong>Budget</strong> to approveLess circuit breakerExpected budget$18,000,000$19,080,000-310,000$18,770,0004.3%

Bus Replacement Plan14 PassengerHS & MS24 PassengerWith lifts48 PassengerSpecial Ed.84 PassengerRegular Ed.TOTALInventory2008334346218340Total<strong>Budget</strong><strong>2009</strong>Add 11Replace 40Add 217

Bus Replacement<strong>Budget</strong> Overview2008Expenditure<strong>Budget</strong><strong>2009</strong>Expenditure<strong>Budget</strong>Bus Replacement to approve$3,403,223$2,366,789As Reduced*for pension bond tax neutrality*for circuit breaker967,434890,000217,000Total – As Reduced$2,435,789$1,259,605

Special EducationPreschool Fund Indiana mandate• Formula fixed at $2,750 per student since1991• State to fund in <strong>2009</strong> (no property taxes)• <strong>2009</strong> budget $1,386,000 General Fund support about $212,000 Serve about 421 students

Museum of Art Fund Pass through to <strong>Fort</strong> <strong>Wayne</strong> Museumof Art To provide ongoing programs for ourstudents <strong>Budget</strong> same at $185,500

<strong>2009</strong> Expected <strong>Budget</strong><strong>2009</strong> <strong>Budget</strong>To ApproveReductions<strong>2009</strong> <strong>Budget</strong>ExpectedGeneral$218,250,000$218,250,000Racial Balance9,086,000$150,0008,936,000Capital Projects27,175,3006,450,00020,725,300Transportation21,446,6051,417,00020,029,605Debt-Regular12,696,65812,696,658Debt-Pension3,886,5553,886,555Special Ed PS1,386,0001,386,000Museum of Art185,5005,000180,500Total$294,112,618$8,022,000$286,090,618

<strong>2009</strong> Summary by FundExpected<strong>Budget</strong>ExpectedLevyGeneral-Regular$218,250,000Racial BalanceCapital ProjectsTransportationDebt Service-RegularDebt Service-PensionSpecial EducationPreschoolMuseum of ArtTotal8,936,00020,725,30020,029,60512,696,6583,886,5551,386,000180,500$286,090,618$6,265,68918,917,96617,484,04511,865,0373,470,216154,133$58,157,086

<strong>Budget</strong> Comparison2008<strong>2009</strong><strong>Budget</strong>EstimateDifferenceTotal All$283,514,406$286,090,618$2.6 million<strong>Budget</strong>sLevy$111,379,296$58,157,086-$53.2 millionLevy as %of <strong>Budget</strong>39%20%

2008 & <strong>2009</strong> <strong>Budget</strong>sSummary2008 <strong>Budget</strong><strong>2009</strong> <strong>Budget</strong>PercentageExpectedChangeGeneral$210,000,000$218,250,0003.9%Racial Balance8,995,0008,936,000-.7%Capital Projects25,768,54820,725,300-19.6%Transportation20,435,78920,029,605-2.0%Debt Service12,977,94412,696,658-2.2%3,891,4153,886,555-.1%Special Ed PS1,161,2101,386,00019.4%Museum of Art185,500180,500-2.7%Total$283,415,406$286,090,618.9%

<strong>2009</strong> Tax RatesGeneral-RegularGeneral-Charter <strong>Schools</strong>Racial BalanceCapital ProjectsTransportationDebt Service-RegularDebt Service-Pension BondSpecial Education PreschoolMuseum of ArtTotalAdvertise <strong>2009</strong> $1.27812008Rate$.5872.0123.0890.2615.2144.1414.0437.0023.0022$1.3540Expected<strong>2009</strong>Tax Rate$-0-.0890.2687.2484.1685.0493-0-.0022$.8261

Average Homeowner Impact– <strong>FWCS</strong> portion only2007 2008 <strong>2009</strong>Gross Assessed Value $100,000 $100,000 $100,000Taxable Assessed Value $52,000 $52,000 $32,750<strong>FWCS</strong> rate $1.3812 $1.3540 $0.8261Gross taxes $718 $704 $271Less credits $283 $445 $25Tax $435 $259 $246Change ($176) ($13)

Four Circle Modelfor <strong>Budget</strong> Priorities#1 In the classroom#2 Touches classroom#3 Outside classroom, but touches academics#4 Outside the classroom#3#1#4#2

School Expenditures –Category Percentages2006-072006-07<strong>2009</strong><strong>2009</strong>ActualWithout Debt<strong>Budget</strong>Without Debt1AcademicAchievement62.565.762.666.32InstructionalSupport7.98.38.08.5Subtotal –Instruction70.4State 61.474.1State 68.870.674.83Overhead &Operational19.420.418.119.24Non-Operational10.25.611.36.0TOTAL100.0100.0100.0100.0

Next StepsAugust 14 & 21August 25September 8<strong>Budget</strong>s advertised<strong>Budget</strong> hearingBus Replacement Plan hearingCapital Projects Plan Hearing<strong>Budget</strong> adoptionBus Replacement Plan adoptionCapital Projects Plan adoption