Simplified estimation of structure parameters in hierarchical ...

Simplified estimation of structure parameters in hierarchical ...

Simplified estimation of structure parameters in hierarchical ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Mathematical StatisticsStockholm University<strong>Simplified</strong> <strong>estimation</strong> <strong>of</strong> <strong>structure</strong> <strong>parameters</strong><strong>in</strong> <strong>hierarchical</strong> credibilityEsbjörn OhlssonResearch Report 2005:5ISSN 0282-9150

Postal address:Mathematical StatisticsDept. <strong>of</strong> MathematicsStockholm UniversitySE-106 91 StockholmSwedenInternet:http://www.math.su.se/matstat

Mathematical StatisticsStockholm UniversityResearch Report 2005:5,http://www.math.su.se/matstat<strong>Simplified</strong> <strong>estimation</strong> <strong>of</strong> <strong>structure</strong> <strong>parameters</strong> <strong>in</strong><strong>hierarchical</strong> credibilityEsbjörn Ohlsson ∗May 2005AbstractSome <strong>of</strong> the <strong>structure</strong> <strong>parameters</strong> <strong>in</strong> Jewell’s <strong>hierarchical</strong> credibilitymodel are commonly estimated by pseudo-estimators. Inthis paper we present alternative, unbiased estimators, similarto those <strong>of</strong> the Bühlmann-Straub model. The ma<strong>in</strong> advantage <strong>of</strong>our estimators is that they are given on closed form, while thepseudo-estimators require iterative solution.KeywordsCredibility theory, Jewell’s <strong>hierarchical</strong> model, <strong>structure</strong> parameter,pseudo-estimator.∗ Mathematical Statistics, Stockholm University, and Länsförsäkr<strong>in</strong>gar <strong>in</strong>surance group.E-mail: esbjorn.ohlsson@math.su.se

2 1 INTRODUCTION1 IntroductionIn credibility models there are so called <strong>structure</strong> <strong>parameters</strong> that mustbe estimated before the calculation <strong>of</strong> the credibility estimators themselves.In Jewell’s <strong>hierarchical</strong> credibility model there is one overallmean parameter µ and three variance <strong>structure</strong> <strong>parameters</strong>, here calledσ 2 , a and b – see def<strong>in</strong>itions <strong>in</strong> the next section. This paper is concernedwith the <strong>estimation</strong> <strong>of</strong> the variance <strong>structure</strong> <strong>parameters</strong> <strong>in</strong> the <strong>hierarchical</strong>credibility model.For the Bühlmann-Straub model, standard textbooks present unbiasedestimators <strong>of</strong> all <strong>structure</strong> <strong>parameters</strong>. For Jewell’s <strong>hierarchical</strong> credibilitymodel, there is a simple unbiased estimator <strong>of</strong> σ 2 , while for aand b only so called pseudo-estimators are provided, see, e.g., Goovaerts& Hoogstad (1987) or Dannenburg, Kaas & Goovaerts (1996).A pseudo-estimator is motivated by a formula a = E[f(X, a)] where fis a function and X is a random vector. The estimator is computed byiteratively solv<strong>in</strong>g the equation a = f(x, a), where x is an observation<strong>of</strong> X. As noted by Sundt (1987), the fact that a = E[f(X, a)] doesnot imply that the result<strong>in</strong>g estimator <strong>of</strong> a is unbiased.In the present paper we present alternative, unbiased estimators <strong>of</strong>the <strong>structure</strong> <strong>parameters</strong> a and b that are easier to apply than thepseudo-estimators, s<strong>in</strong>ce they do not require iterative solution. In ourexperience, the new estimators and the pseudo-estimators give rathersimilar results. Hence, the ma<strong>in</strong> advantage <strong>of</strong> the new ones is their simplicity<strong>in</strong> application. There is also a (m<strong>in</strong>or) pedagogical po<strong>in</strong>t <strong>in</strong> nothav<strong>in</strong>g to <strong>in</strong>troduce the concept <strong>of</strong> a pseudo-estimator <strong>in</strong> elementarytexts.

32 Jewell’s <strong>hierarchical</strong> credibility modelHere we present the classical <strong>hierarchical</strong> credibility model <strong>of</strong> Jewell.We call our observations Y jkt , where, <strong>in</strong> the term<strong>in</strong>ology <strong>of</strong> Dannenburget al. (1996), j <strong>in</strong>dicates a sector, k is called a cell and t is an exposureunit with<strong>in</strong> the cell (j, k). In practise, (j, k, t) may <strong>of</strong> course representany <strong>hierarchical</strong> <strong>structure</strong> <strong>of</strong> <strong>in</strong>surance contracts – for <strong>in</strong>stance, j mightbe a county, k a parish and t an <strong>in</strong>dividual <strong>in</strong>surance taken by a resident<strong>of</strong> that parish. In motor <strong>in</strong>surance, j might be a car brand, k a specificcar model and t an <strong>in</strong>dividual car.We <strong>in</strong>troduce random effects U j for the sectors j = 1, . . . , J; and U jkfor the cells k = 1, . . . , K j . The basic model is thatE(Y jkt |U j , U jk ) = U jk (2.1)andby which alsoE(U jk |U j ) = U j (2.2)E(Y jkt |U j ) = U j (2.3)The overall expectation is called µ.µ = . E(U j ) = E(U jk ) = E(Y jkt ) (2.4)Note that U jk is the (conditional) mean <strong>of</strong> all observations for cell (j, k),while U j is the (conditional) mean <strong>of</strong> all observations <strong>in</strong> sector j and µis the mean <strong>of</strong> the entire population.Remark 1.Many texts, like Goovaerts & Hoogstad (1987), <strong>in</strong>troduceabstract risk <strong>parameters</strong> Θ j and Θ jk and put µ(Θ j , Θ jk ).= E(Y jkt |Θ j , Θ jk ) and ν(Θ j ) . = E(µ(Θ j , Θ jk )|Θ j ) = E(Y jkt |Θ j ). However,s<strong>in</strong>ce <strong>in</strong>ference is only made on µ and ν, and not on the Θ:sthemselves, there is no loss <strong>in</strong> generality from us<strong>in</strong>g the random effectsnotation <strong>in</strong>stead, where µ(Θ j , Θ jk ) is replaced by U jk and ν(Θ j )

5By Assumption 1(d), the U jk are identically distributed, and their commonexpected variance is the variance at the cell levela . = E[Var(U jk |U j )] (2.6)Our f<strong>in</strong>al <strong>structure</strong> parameter b is simply the sector varianceb . = Var[U j ] (2.7)which does not depend on j s<strong>in</strong>ce the U jrandom variables.are identically distributedRemark 3.By the standard laws for comput<strong>in</strong>g variances by condition<strong>in</strong>gwe f<strong>in</strong>d the unconditional varianceVar(Y jkt ) = a + b + σ2w jktwhich exhibits the <strong>structure</strong> <strong>parameters</strong> σ 2 , a and b as variance components.We further <strong>in</strong>troduce the credibility factorsz jk. =w jk·w jk· + σ 2 /a(2.8)q j. =z j·z j· + a/b(2.9)Here and <strong>in</strong> the future, the dot notation is used to <strong>in</strong>dicate summation,as <strong>in</strong> w jk· = ∑ t w jkt . We give weighted means a super<strong>in</strong>dex to <strong>in</strong>dicatewhich weights are used, as <strong>in</strong>Y wjk· =∑t w jktY jkt∑t w jkt(2.10)andY zwj·· =∑k z jkY wjk·∑k z jk(2.11)

6 2 JEWELL’S HIERARCHICAL CREDIBILITY MODELThe well-known (<strong>in</strong>homogeneous) credibility estimator at the sectorlevel isÛ j = q j Y zwj·· + (1 − q j )µ (2.12)Further, the credibility estimator at the cell level isÛ jk = z jk Y wjk· + (1 − z jk )Ûj (2.13)See for example Dannenburg et al. (1996, Theorems 3.2.2 and 3.2.3)for a derivation <strong>of</strong> these estimators. The overall expectation µ may begiven by prior <strong>in</strong>formation or estimated by e.g.ˆµ = Y qzw··· =∑j q jY zwj··∑j q j(2.14)In order to apply the credibility estimators <strong>in</strong> practice, we must firstestimate the variance <strong>parameters</strong> σ 2 , a and b.2.1 Traditional estimators <strong>of</strong> variance <strong>parameters</strong>The estimators <strong>in</strong> this section can be found <strong>in</strong> Goovaerts & Hoogstad(1987, p. 90) or Dannenburg et al. (1996, p. 54), to which we alsorefer for pro<strong>of</strong>s. Firstly, an unbiased estimator <strong>of</strong> σ 2 is given byˆσ 2 =1∑ ∑j k (T jk − 1)K J∑ ∑ j T∑ jkj=1 k=1 t=1w jkt (Y jkt − Y wjk·) 2 (2.15)where J is the number <strong>of</strong> sectors, K j is the number <strong>of</strong> cells <strong>in</strong> sectorj, and T jk is the number <strong>of</strong> observations for cell (j, k). For a and b,pseudo-estimators are derived from the fact that⎡⎤Ka = E ⎣1J∑ ∑ j∑j (K z jk (Y wjk· − Y zwj·· ) 2 ⎦ (2.16)j − 1)j=1 k=1[]1J∑b = Eq j (Y zwj·· − Y qzw··· ) 2 (2.17)J − 1j=1S<strong>in</strong>ce z jk is a function <strong>of</strong> a and q j is a function <strong>of</strong> b, we can not simplydrop the expectation signs to get unbiased estimators. However, the

7equation result<strong>in</strong>g from omitt<strong>in</strong>g the expectation <strong>in</strong> (2.16) can be solvedfor a by iteration; the solution is called a pseudo-estimator <strong>of</strong> a. Thisvalue is then <strong>in</strong>serted <strong>in</strong>to (2.17), the expectation sign is dropped, andthe result<strong>in</strong>g equation is iterated to give a pseudo-estimator <strong>of</strong> b.Note that (2.16) and (2.17) do not imply that the pseudo-estimatorsare unbiased.3 The new estimatorsHere we derive the alternative estimators <strong>of</strong> a and b that is the core<strong>of</strong> this paper. The trick is to replace the z- and q-weighted means <strong>in</strong>(2.16) and (2.17) by means with weights that are known (or at leastalready estimated) at that stage <strong>in</strong> the calculations. For a, <strong>in</strong>stead <strong>of</strong>Y zwj··we will use∑kY wwj·· =w jk·Y wjk·∑k w jk·and we suggest the follow<strong>in</strong>g unbiased estimatorâ =∑j∑k w jk·(Y wjk· − Y wwj·· ) 2 − ˆσ ∑ 2 j (K j − 1)w··· − ∑ j (∑ k w2 jk·)/w j··(3.1)Remark 4. Suppose our <strong>hierarchical</strong> model had just one sector j,<strong>in</strong> which case our model was <strong>in</strong> fact non-<strong>hierarchical</strong>, i.e. we had theBühlmann-Straub model. We could then omit the <strong>in</strong>dex j and (3.1)would reduce to the standard unbiased estimator <strong>in</strong> the Bühlmann-Straub model, see e.g. Dannenburg et al. (1996), Theorem 2.3.1.Once we know σ 2 and a, we get z jk from (2.8), and thereby we cancompute Y zwj·· <strong>in</strong> (2.11). In place <strong>of</strong> Y qzw··· that appears <strong>in</strong> the pseudoestimator<strong>of</strong> b we useY zzw··· =∑j z j·Y zwj··∑j z j·

8 3 THE NEW ESTIMATORSOur suggested unbiased estimator <strong>of</strong> b is now∑j ˆb z j·(Y zwj·· − Y zzw··· ) 2 − â(J − 1)=z·· − ∑ j z2 j·/z··(3.2)The estimators â and ˆb are simpler than the pseudo-estimators <strong>in</strong> thatthey do not require iteration. The unbiasedness is proved <strong>in</strong> Theorem3.1 below.Note that even though ˆb as it stands is unbiased, <strong>in</strong> practice we plug<strong>in</strong> â and ˆσ 2 <strong>in</strong>to z jk and then ˆb is no longer strictly unbiased. A similarremark goes for the equation (2.17) that def<strong>in</strong>es the pseudo-estimator– this equation is not strictly true when we plug <strong>in</strong> â and ˆσ 2 <strong>in</strong>to z jk .This k<strong>in</strong>d <strong>of</strong> problem is <strong>of</strong> course common <strong>in</strong> statistics, and will not bediscussed further here.Remark 5. Negative values. As with the correspond<strong>in</strong>g estimator<strong>in</strong> the Bühlmann-Straub model, the suggested estimators may take onnegative values. This problem is discussed for the Bühlmann-Straubmodel <strong>in</strong> Example 2.3.2 <strong>of</strong> Dannenburg et al. (1996). The conclusionis that we can not reject the hypothesis that the parameter is equalto zero, and so the correspond<strong>in</strong>g level <strong>of</strong> random effects should beremoved from the model.In our experience, <strong>in</strong> situations when our â or ˆb is negative, the correspond<strong>in</strong>gpseudo-estimator iterations converge (slowly) to zero. This is<strong>in</strong> accordance with the result for the Bühlmann-Straub model <strong>in</strong> Dubey& Gisler (1981, Theorem 2) which states that the pseudo-estimatorequation has one and only one positive solution if and only if theunbiased estimator gives a strictly positive value; if not, the pseudoestimatorconverges to zero.Remark 6.Multi-level models. We believe that similar estimators

9could be found for <strong>hierarchical</strong> models with three or more levels. Itrema<strong>in</strong>s to work out the details for these multi-level models, though.Theorem 3.1 (a) With â as <strong>in</strong> (3.1), we have E[â] = a.(b) With ˆb as <strong>in</strong> (3.2), we have E[ˆb] = b.Pro<strong>of</strong>. For part (a), we first note thatVar(Y wjk·|U j ) = E[Var(Y wjk·|U j , U jk )|U j ] + Var(E[Y wjk·|U j , U jk ]|U j )By (2.1), (2.5) and (2.6)E[Var(Y wjk·|U j )] = E[Var(Y wjk·|U j , U jk )] + E[Var(U jk |U j )] = σ2w jk·+ aFurther, by (2.3),E[Yjk·|U wj ] = U j and E[Y wwj·· |U j ] = U j(3.3)This justifies the second equality <strong>in</strong> the follow<strong>in</strong>g derivation, <strong>in</strong> whichwe further use the fact from Assumption 1(b) that {Y wjk·; k = 1, . . . , K j }are conditionally <strong>in</strong>dependent given U j .E [ (Y wjk· − Y wwj·· ) 2] = E= E [ Var ( Y wjk· − Y ww )]j·· |U j= E=[ [ (Y wE jk· − Y ww ) 2]]j·· |Uj[ (1 − w ) 2jk·Var(Ywjk·|U wj ) + ∑j··l≠k)(1 − w jk·w j··) 2 ( σ2w jk·+ a(= σ21 − w )jk·+ aw jk· w j··(+ ∑ l≠k1 − 2 w jk·w j··+ ∑ l(wjl·w j··) 2Var(Y wjl·|U j )(wjl·w j··) 2 ( σ2w jl·+ a(wjl·w j··) 2))]

10 3 THE NEW ESTIMATORSThis yields⎡K∑ jE ⎣k=1w jk·(Y w⎤jk· − Y wwj·· ) 2 ⎦= σ 2 (K j − 1) + a(w j·· − 2 ∑ kw 2 jk·w j··+ ∑ l)wjl·2w j··and thus⎡K J∑ ∑ jE ⎣j=1 k=1= σ 2 ∑ jw jk·(Y w⎤jk· − Y wwj·· ) 2 ⎦(K j − 1) + a(w··· − ∑ j∑k)wjk·2w j··which we solve for a. S<strong>in</strong>ce ˆσ 2 is unbiased for σ 2 we conclude that (3.1)gives an unbiased estimator <strong>of</strong> a.We turn to part (b) <strong>of</strong> the theorem and first note that by (3.3)E[Var(Y wjk·|U j )] = az jkand hence E[Var(Y zwj·· |U j )] = az j·,by the conditional <strong>in</strong>dependence assumption <strong>in</strong> Assumption 1(b). Now,s<strong>in</strong>ce E(Y zwj·· |U j ) = U j ,Var(Y zwj·· ) = E[Var(Y zwj·· |U j )] + Var(E[Y zwj·· |U j ])= E[Var(Y zwj·· |U j )] + Var[U j ]= az j·+ bNote that s<strong>in</strong>ce E[Y jkt ] = µ we have E[Y zwj·· ] = E[Y zzw··· ] = µ, whichjustifies the first equality below, where we further use the <strong>in</strong>dependence

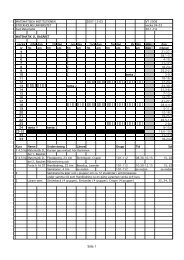

11<strong>of</strong> Assumption 1(a),E [ (Y zw==j··− Y zzw··· ) 2] = Var [ Y zwj··(1 − z ) 2j·Var(Y zwj·· ) + ∑z··l≠j)(1 − z j·z··) 2 ( az j·+ b= a (1 − z )j·+ bz j· z··(+ ∑ l≠j1 − 2 z j·− Y zzw ]···(zl·) 2Var(Y zwl·· )z··( ) 2 (zl· a+ bz·· z l·z··+ ∑ l(zl·z··) 2))F<strong>in</strong>ally we get the result[ J∑] (E z j·(Y zwj·· − Y zzw··· ) 2 = a(J − 1) + bj=1z·· −∑ )j z2 j·z··and s<strong>in</strong>ce â is unbiased, this completes the pro<strong>of</strong> <strong>of</strong> part (b) <strong>of</strong> thetheorem.4 Numerical exampleIn our applications <strong>of</strong> <strong>hierarchical</strong> credibility at Länsförsäkr<strong>in</strong>gar wehave found that the differences between the pseudo and the unbiasedestimators are usually rather small. For confidentiality reasons, we donot present the results here. Instead we use the artificial population<strong>in</strong> Section 3.3 <strong>of</strong> Dannenburg et al. (1996) for illustration. In theirTable 3.1, the values <strong>of</strong> Y wjk· are given, but not the orig<strong>in</strong>al data Y jktthemselves. This is, however, enough for our purposes, if we take thestated value ˆσ 2 = 15.89 as given and only estimate a and b. (Rememberthat our approach uses the same unbiased ˆσ 2 as Dannenburg et al.)The results are given <strong>in</strong> Table 4.1. Supposedly due to round-<strong>of</strong>f errors<strong>in</strong> the data, our pseudo-estimates differ slightly from those provided

12 4 NUMERICAL EXAMPLEby Dannenburg et al. In parenthesis we give the values when all theweights w jkt are set equal to one.True value Pseudo-est. Unbiased est.a 1.000 1.152 (1.093) 1.209 (1.093)b 25.000 25.309 (25.259) 25.300 (25.259)Table 4.1: Comparison <strong>of</strong> estimators for the data <strong>in</strong> Table 3.1 <strong>of</strong> Dannenburget al. (1996). (Equal weights example <strong>in</strong> parenthesis.)The difference between the estimators is negligible for b and less than5% for a. In this case, we know the true values s<strong>in</strong>ce the populationis artificially generated. The pseudo-estimator <strong>of</strong> a is somewhat closerto the true value here, but this might well be due to chance. In thecase with equal weights and balanced design (all K j equal and all T jkequal) it is not hard to show that the pseudo-estimator equations haveexplicit solutions that are equal to our unbiased estimators – as verifiedhere by the numbers given <strong>in</strong> parenthesis.In their comparison <strong>of</strong> the unbiased and pseudo-estimator <strong>of</strong> the parametera <strong>in</strong> the Bühlmann-Straub model, Dubey & Gisler (1981) foundthat “neither <strong>of</strong> the two estimators is universally better than the other”(<strong>in</strong> terms <strong>of</strong> variance). S<strong>in</strong>ce the estimators considered <strong>in</strong> the presentpaper are closely related to the quoted estimators, one might conjecturethat the conclusion <strong>of</strong> Dubey & Gisler are valid <strong>in</strong> our <strong>hierarchical</strong>case, too.Conditional on this conjecture be<strong>in</strong>g true, our choice <strong>in</strong> the <strong>hierarchical</strong>case falls on the unbiased estimators for the sake <strong>of</strong> simplicity <strong>in</strong>application.

135 ReferencesDannenburg, D.R., Kaas, R. & Goovaerts, M.J. (1996): Practical actuarialcredibility models. IAE, Amsterdam.Dubey, A. & Gisler, A. (1981): On Parameter Estimators <strong>in</strong> Credibility.MVSVM, 81:2, 187-212.Goovaerts, M.J. & Hoogstad, W.J. (1987): Credibility theory. Survey<strong>of</strong> Actuarial Studies, Nationale-Nederlanden N.V., Rotterdam.Sundt, B. (1987): Book review <strong>of</strong> Goovaerts & Hoogstad (1987). ASTINBullet<strong>in</strong> 17, No. 2.