Comprehensive Motorcycle Insurance Policy - Pacific & Orient Berhad

Comprehensive Motorcycle Insurance Policy - Pacific & Orient Berhad

Comprehensive Motorcycle Insurance Policy - Pacific & Orient Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

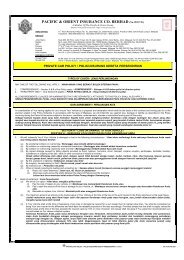

PACIFIC & ORIENT INSURANCE CO. BERHAD (No. 12557-W)A Member Of The <strong>Pacific</strong> & <strong>Orient</strong> Group11 th Floor, Wisma Bumi Raya , No. 10, Jalan Raja Laut, 50350 Kuala Lumpur.P. O. Box 10953, 50730 Kuala Lumpur. Internet: www.pacific-orient.com / https://www.pno-ins.comTelephone: 03-26985033 Fax: 03-26938145 Toll Free: 1 800 88 2121PRODUCT DISCLOSURE SHEET(Read this Product Disclosure Sheet before you decide totake out the <strong>Comprehensive</strong> <strong>Motorcycle</strong> <strong>Insurance</strong> <strong>Policy</strong>.Be sure to also read the general terms and conditions.)<strong>Comprehensive</strong> <strong>Motorcycle</strong> <strong>Insurance</strong><strong>Policy</strong>Date: 1 July 20121. What is this product about?This policy provides insurance against loss or damage to your motorcycle, liability to third parties for bodily injury ordeath and damage to third parties’ property.2. What are the covers / benefits provided?This policy covers:Loss or damage to your motorcycle due to collision or overturning (accidental or due to mechanical breakdownor wear and tear), impact damage caused by falling object not resulted from convulsion of nature, fire, explosionor lightning, burglary, housebreaking or theft, malicious act or when in transit;Third party bodily injury or death; andThird party property damage.The benefits provided under this policy are as follows:The total liability for third party bodily injury and death is unlimited, however the total liability is limited to RM3million for third party property loss or damage in respect to one claim or series of claims arising out of one event;This policy will cover for the person’s legal representatives for liability covered following the death of theperson; andThis policy will cover for the legal cost up to maximum of RM2,000.00 for defence of any charge including thecharge of causing death by driving the vehicle.Duration of cover is for one year. You need to renew the insurance cover annually.3. How much premium do I have to pay?The total premium that you have to pay consist of the standard coverage premium amount and additional coveragerequested, and may vary depending on the no-claim-discount (NCD) entitlement and the underwriting requirementsof the insurance company.The standard coverage premium amount is calculated in accordance with the Motor Tariff and is determined based onthe following criteria:Type of vehicle;Engine capacity of the motorcycle;Sum insured; andAll Riders.

4. What are the fees and charges that I have to pay?TypeAmount Commissions paid to the insurance agent 10% of premiums Stamp duty RM10.005. What are some of the key terms and conditions that I should be aware of?Importance of disclosure – you must disclose all material facts such as previous accidents and modification toengines.You must ensure that your vehicle is insured at the appropriate amount.The excess, that is the amount of loss you have to bear if your vehicle is driven by a person not named in yourpolicy, will be stated in your policy schedule.6. What are the major exclusions under this policy?This policy does not cover certain losses, such as: Your own death or bodily injury due to a motor accident; Your liability against claims from passengers in your vehicle; Loss, damage or liability arising from an act of nature i.e. flood, storm or landslide; Consequential loss of any nature; The loss of use of your vehicle; Depreciation, wear and tear, rust and corrosion, mechanical or electrical or electronic breakdowns, equipment orcomputer malfunction, failures or breakages to your vehicle except breakage of windscreen, window or sunroofincluding lamination / tinting film, if any; Damage to your vehicle’s tyres unless your motor vehicle is damaged at the same time; Any loss or damage caused by or attributed to the act of cheating / criminal breach of trust by any person; Death or bodily injury to any person or damage to property caused or arising outside the limits of anycarriageway or throughfare in connection with the loading onto and unloading from your vehicle; Death or bodily injury to any person where such death or injury arises out of and in the course of the employmentof such person by you or by your authorized driver; Death or bodily injury to any person (other than a passenger carried by reason of or in pursuance of a contract ofemployment) being carried in or upon or entering or getting on to or alighting from your vehicle at the time of theoccurrence of the event out of which any claim arises; Damage to property belonging to or in the custody of or control of or held in trust by you or your authorizeddriver or any member of your household or being conveyed by your vehicle; Any claims brought against any person in any country in courts outside Malaysia, the Republic of Singapore orNegara Brunei Darussalam; and All legal costs and expenses which are not incurred in or recoverable in Malaysia, the Republic of Singapore orNegara Brunei Darussalam.Note.This list is non-exhaustive. Please refer to the motor policy document for the full list of exclusions under this policy.7. Can I cancel my policy?You may cancel your policy at any time by giving written notice to the insurance company;You shall within seven days from the date of cancellation under the above paragraph, surrender the certificate ofinsurance to us or if it has been lost or destroyed, to provide us with a statutory declaration to that effect;Upon cancellation, you are entitled to a refund of the premium based on short-period rates, where any minimumpremium paid (exceeding 8 months) under the policy is not refundable;We may also cancel this policy by giving you 14 days written notice by registered post to your last knownaddress; andIn the case of cancellation by us, you shall be entitled to a pro-rata refund of the unexpired premium calculatedfrom the date of receipt by us of the certificate or statutory declaration in the event that the certificate is lost ordestroyed.

8. What do I need to do if there are changes to my contact details?It is important that you inform us of any change in your contact details to ensure that all correspondences reach you ina timely manner.9. Where can I get further information?Should you require additional information about motor insurance, please refer to the insuranceinfo booklet on ‘Motor<strong>Insurance</strong>’, available at all our branches or you can obtain a copy from the insurance agent or visitwww.insuranceinfo.com.myIf you have any enquiries, please contact us at:<strong>Pacific</strong> & <strong>Orient</strong> <strong>Insurance</strong> Co. <strong>Berhad</strong>11th Floor Wisma Bumi RayaNo. 10, Jalan Raja Laut50350 Kuala LumpurTel : 03-2698 5033Fax : 03-2693 8145E-mail : pob@pacific-orient.com10. Other types of motor insurance cover availableThird party coverIMPORTANT NOTE:YOU MUST ENSURE THAT YOUR MOTORCYCLE IS INSURED AT THE APPROPRIATEAMOUNT AS IT WILL AFFECT THE AMOUNT YOU CAN CLAIM. YOU SHOULD READ ANDUNDERSTAND THE INSURANCE POLICY AND DISCUSS WITH THE AGENT OR CONTACTTHE INSURANCE COMPANY DIRECTLY FOR MORE INFORMATION.The information provided in this disclosure sheet is valid as at 1 July 2012