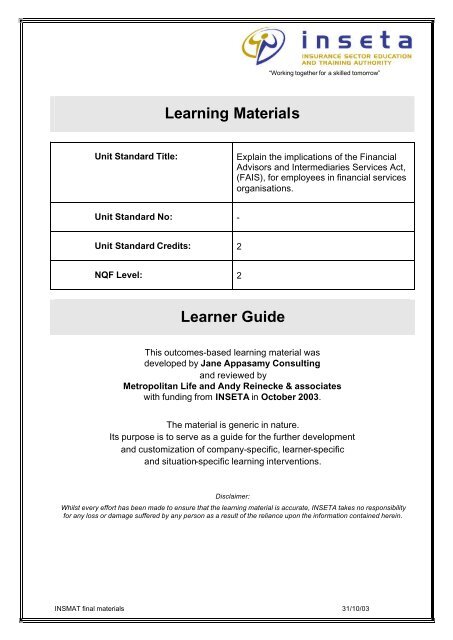

Learning Materials Learner Guide - INSETA

Learning Materials Learner Guide - INSETA

Learning Materials Learner Guide - INSETA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Unit Standard – L2 FAIS Page 3CONTENTSICONS serve as cuesIntroduction to Course OutcomesIntroduction to Course StructureIntroduction to OBE and Skills Development terminologyUnit Standard BreakdownModule 1: Fraud as it occurs in Long Term InsuranceModule 2: Legal aspects relating to fraud in long term insuranceModule 3: The internal processes around the investigation of fraud in long terminsurance.Module 4: Trends and the impact of fraud in long term insurance.Module 5: Control mechanisms used to contain fraud in long term InsuranceINSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 4ICONS SERVE AS CUES:Throughout this learner guide, you will find icons representing various kinds ofinformation. These icons serve as an “at-a-glance” reminder of their associated text.Task:Represents the beginning of a task, which is subject to assessment.<strong>Learner</strong> note:A margin note that highlights information for learners.Glossary Term:A margin note that represents a definition. This definition also appears inthe glossary.Information:Represents some useful information.Pen and Paper Exercise:Represents an exercise to practice your skills and knowledge.Group Exercise:Represents a collective learning activityConduct Research:A margin note to guide you to obtain additional information from other sources(eg articles, newspapers, textbooks, work manuals, websites etc)INSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 7INTRODUCTION TO FAISCOURSE STRUCTUREI acknowledge, with thanks• All those who assisted with information and shared their knowledge - for theircontribution to this manual.This series consists of five modules:1. An introduction to Skills Development and Outcomes Based Education2. Background to, and reasons why the Financial Advisors and Intermediaries Services(FAIS) Act was passed.3. The application of FAIS to a specific work environment.4. The giving of advice and the consequences for the employee.5. The policies, procedures and documents in an organisation that support FAIS.Module 1: An introduction to Skills Development and Outcomes Based EducationThis workshop will look at terminology and methodology of Skills Development and outcomesbased education.Module 2: Background to, and reasons why the Intermediaries Services’ (FAIS) legislation waspassed.This workshop will examine the reasons behind the FAIS legislation and the environment withinwhich financial advisors operated before the legislation.Module 3: The application of FAIS to a specific work environment.This module will explore the application of FAIS to the work environment of the learner.Module 4: The giving of advice and the consequences for the employee.This module will focus on the giving of advice by employees and the difference between advicegiversand non-advice givers. It will also highlight the possible consequences for non-advicegivers inadvertently giving advices.Module 5: The policies, procedures and documents in an organisation that support FAIS.This module provides a practical, hands-on indication of what the relevant policies, proceduresand documents are which support FAIS.INSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 8A NOTE TO THE LEARNER:THE FOLLOWING INFORMATION IS DESIGNED TO GUIDE YOU THROUGH SKILLSDEVELOPMENT TERMINOLOGY AND THE METHODOLOGY OF OUTCOMES BASEDEDUCATION. PLEASE ENSURE THAT YOU READ AND UNDERSTAND THE CONTENTSBEFORE YOU BEGIN YOUR JOURNEY THROUGH THE FAIS LEGISLATION.Index1. What is the value of lifelong learning?2. Getting creative3. What is the national qualifications framework (NQF)?4. What are qualifications?5. What are unit standards?6. What is assessment?7. What is a portfolio of evidence?8. What is recognition of prior learning (RPL)?9. What is outcomes based education?10. What are critical cross field outcomes (CCFO’s)?11. Levels of learning activity12. How to conduct research13. Website sources of South African insurance information14. CopyrightINSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 91. What is the value of lifelong learning?<strong>Learning</strong> is a process of active engagement with experience. It may involve anincrease in skills, knowledge, understanding, values or the capacity to reflect.Effective learning will lead to change, development and a desire to learn more.Lifelong learning means making a commitment to continue learning and improvingone's skills, knowledge, understanding etc throughout the duration of your life. Thislearning could be personal, professional, academic, general - the list is endless.The following are some benefits of being a lifelong learner:• You become adaptable and change-worthy i.e. constant change no longer scaresyou• You ensure your continued employability and marketability by learning new jobskills• You increase your performance and promotability by enhancing existing skills• You can expand your work/professional credentials to broaden your experiencesand prepare for career transitions• You can prepare for obtaining formal qualifications• You can network with other participants who have similar goals and experiences• You can challenge your personal standards for excellence to reach new levels• You can discover insights into how to make your personal and professional lifemore efficient, effective and enjoyable• You can develop new interests by simply trying something new• You can keep motivated when life gets a little overwhelming• You can fulfill personal and professional aspirations2. Getting creative• What is Creativity?Creativity is the process of challenging accepted ideas and ways of doing things inorder to find new solutions or concepts. Being creative means seeing ideas orobjects in a different context, either by recognizing the potential to be used in adifferent way, or by putting previously unconnected ideas together to createsomething completely new. We generate ideas by thinking creatively and then weuse logical thinking to turn these thoughts into realistic actions.• The importance of Creative ThinkingThe ability of human beings to find creative solutions to problems is essential for thewell being of the human race:Thinking is the most fundamental human skill Your skill in thinking will determine yourhappiness and success in lifeYou need thinking to make plans, take initiatives, solve problems, open upopportunities and design your way forwardThinking is fun and enjoyable – if you learn how to make it soThinking is a skill that can be learned, practiced and developedINSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 10• Understanding Logical and Creative ThinkingWhen we are faced with a familiar problem, logical thinking enables us to tap into ourpersonal experiences and find a suitable solution with the minimum of effort. Byassessing a situation against your relevant experience, you can choose the mostappropriate path, and move towards a solution. This logical approach, which is alsoknown as convergent thinking, is very efficient. However, it can become a barrierwhen you have little relevant experience; when there are more than one potentialsolution, or when you need a brand new solution.Divergent thinking, or creative thinking, involves opening up your mind to find newsolutions and new ways of doing things. Instead of taking your usual, logicalapproach to a problem, you can learn to suspend your judgment and look fordifferent, more inventive solutions. Once you have generated as many ideas aspossible in this way, use a logical thinking process to refine your ideas and identifythe best solution to the problem.• Unlocking CreativityUnlock your creativity and empower yourself to question your ways of doing things.“Where will you end up if you always apply the same way of thinking?” or “Where willyou end up if you act without thinking?”A person who is able to work outside the bounds of his / her experiences, will bemore successful in the long run. You can also become more creative if youremember to:! Use your imagination! Remain open-minded! Connect the unconnected! Generate new solutions! Challenge old ideas! Ask questions• Develop a Framework for Effective ThinkingThe following steps will provide you with a framework for effective thinking,integrating divergent and convergent thinking processes:Step 1: Identify the direction of your thinkingWhat is the focus / purpose of your thinking?What do you hope to achieve with your thinking?What are you thinking about?Step 2: Obtain information and generate possibilitiesIdentify different sources of informationAsk questions to obtain information from other people.Determine the quality of information obtained.Identify the perceptions and feelings of the people involved.Make the ‘most’ of information, by reading between the lines.10

Unit Standard – L2 FAIS Page 11Generate as many possibilities as you can.Do not immediately evaluate each possibility as it arises - you will stay firmly withinyour own thinking.Step 3: Choose between possibilitiesDevelop possibilities to become usable ideas.Spend time improving and building up the idea.Do not be satisfied just because an idea seems good – it may be possible to make iteven better.Divide possibilities into groups of stronger and weaker. Choose some quality orcharacter, which all usable ideas should have.Step 4: Decide and take actionDecide what to do – to proceed, or not.Do a hindsight check – spell out the reasons why a decision has been made.Examine the need for a decision as well as the risks involved.Make things happen – putting the output of thinking to work.• Taking a new approachBeing creative means using a different approach to the way you solve certainproblems. This is not something you need to do all the time, for example when aproblem is clear or close-ended. However, if a problem is open-ended and has anumber of potential solutions, start to apply what you have learned about effectivethinking.“… thinking is a skill that can be learned, practiced, and developed. But youhave to want to develop that skill. You need to learn how to ride a bicycle or drivea car…”Edward de BonoSources:Edward de Bono: Teach Yourself to Think.Moi Ali, George Boulden, et al: Thinking Creatively.3. What is the National Qualifications Framework (NQF)?The South African Qualifications Authority Act (1995) created a new framework foreducation and training in South Africa by:• Creating a single, unified system of classifying qualifications (the NationalQualifications Framework or NQF)• Creating the institutions and infrastructure to ensure that these qualifications areof a high quality.In the past, learning done at institutions such as technikons, technical colleges anduniversities was viewed as “education”, and learning within companies was viewedas “training”. Often there was no formal recognition for training. According to the11

Unit Standard – L2 FAIS Page 12SAQA Act both education and training are recognized forms of learning, andindividuals should be able to move freely between these two types of learning.The NQF is a framework on which qualifications, courses, and learning programmesare registered. Achievements obtained by learners are recorded and recognizednationally. It is therefore an integrated approach towards education and training.The objectives of the NQF are as follows:• Create an integrated national framework of learning achievements;• Facilitate access to, and mobility and progression within education, training andcareer paths;• Enhance the quality of education and training;• Accelerate the redress of past unfair discrimination in education, training andemployment opportunities, and thereby• Contribute to the full personal development of each learner and the social andeconomic development of the nation at large.The NQF is like a single, but wide, ladder that covers many possible learning andcareer paths, which include all forms of education and training. The ladder isdesigned to make it easy for people to move sideways and upwards as they movefrom one type of learning to another or from one career to another.Like ladders, the NQF has different rungs or levels that make it clear how far aperson is from the bottom or from the top, and what the next step is. All types ofcareer paths have the same steps or levels.The NQF ladder currently has eight steps, whereby all education and training isclassified according to eight levels. The levels measure the complexity of learning fordifferent levels, rather than focusing on how long a person has studied. The levelsallow for comparison between different courses, as well as comparison betweeneducation and training received in different places and in different ways. Comparisoncan also be made internationally, in order to compare South African qualifications tothose from other countries.Qualifications are registered on the different levels based on the exit level of thatqualification ie. what the person will know and be able to do once they havecompleted their qualification.The full National Qualifications Framework looks like this:NQF LevelPostgraduate8(4)Postgraduate8(3)Postgraduate8(2)GeneralDoctorPhilosophyResearchMaster’sdegreeStructuredMaster’sdegreeofArticulation –horizontal and diagonalArticulation credits,articulation transfers, RPL,alsoadditionalqualifications that facilitatemobility and access.Career focused/vocationalDoctor of Philosophy.Professional DoctorateResearchMaster’sdegree.Master oftechnologyStructuredMaster’sdegreeMaster’s Diploma e.g. Master’s Certificate Professional Master’sdegree.Master’s Diploma12

Unit Standard – L2 FAIS Page 13NQF LevelPostgraduate8(1)GeneralBachelor Honours degreePost graduate DiplomaArticulation –horizontal and diagonale.g.CertificatePostgraduate7 General Bachelor’s degree e.g. Graduate Certificate,Advanced CertificateCareer focused/vocationalAdvanced career focusedBachelor’s degree,Bachelor of TechnologyPostgraduate DiplomaCareer-focused Bachelor’sdegree, National Certificate(L7) – master artisan6 National Diploma National Diploma, NationalCertificate (L6)5 e.g. Foundation Certificate National Certificate (L5)4 Further Education andTraining CertificateFETC (L4)3 National Certificate (L3)2 National Certificate (L2)e.g. Bridging CertificateNational Certificate (L4)ABET 4/GETC General Education and Training Certificate – GETC (L1)For all aspects, the requirements are not exclusionary.ABET 3ABET 2ABET 1ABET Level 3 CertificateABET Level 2 CertificateABET Level 1 Certificate4. What are qualifications (according to the NQF)?In the past, a student would obtain course material, write an examination and obtaina qualification.However, a qualification registered on the NQF is defined as “a planned combinationof learning outcomes which has a defined purpose and which is intended to providequalifying learners with applied competence and a basis for further learning…”.A learning outcome is what a student will know and be able to do when they havecompleted their qualification and have been judged competent. These outcomes willbe recognized through national standards and qualifications.A qualification carries formal recognition (a certificate, a diploma, a degree) and isregistered on a level of the NQF. It consists of a meaningful combination of learningoutcomes, planned for a particular purpose.Qualifications now have to be registered on the NQF via SAQA (the South AfricanQualifications Authority). SAQA is responsible for ensuring that qualifications meethigh standards and contain the right outcomes for a qualification at that level.Qualifications registered on the NQF are transferable from one workplace to anotherand from one educational institution to another ie. they are portable.Qualifications now come in two different types:a) “whole” qualifications ie. qualifications which are based on specific learningoutcomes as a whole13

Unit Standard – L2 FAIS Page 14b) unit standard-based qualificationsThere are also strict rules governing what terms can be used to describequalifications. A national certificate, for example, needs to contain a certain numberof points or credits (120 to be exact). A national diploma needs to contain 240credits.Unit standard- based qualifications have to consist of three different sections:a) fundamental unit standards (comprising basic skills such as numeracy andcommunication skills)b) core unit standards (which are compulsory and define the specific qualification)c) elective unit standards (which allow for learner choice in specific areas ofspecialization)5. What are unit standards?A qualification is now required to be based on unit standards. A unit standarddescribes the learning outcomes to be achieved by the learner, as well as theassessment criteria against which the student’s performance will be judged. Theseunit standards are the minimum levels of competency as agreed by an entireindustry.Unit standards are the smallest, independent parts of a qualification and when puttogether in a combination can form a qualification that will prepare a learner for aparticular occupation. Each unit standard describes the skills, knowledge and valuesused by a competent person to perform well over a period of time.A unit standard is defined as:a description of the end points of learning for which the learner will get credit. A unitstandard is therefore a statement of expectation and/or aspiration. It also providesa basis for the judgments or assessments that are made.Unit standards contain the following:The title, which is broken down into smaller, moremanageable outcomes.A coherent and meaningful outcome (milestone/end point)of learning or training that is formally recognizedThe associated standard of performance used by theassessor to determine whether the outcome has beenmet.The context(s) in which the individual is expected toperform.UNIT STANDARD TITLESPECIFIC OUTCOMESASSESSMENT CRITERIARANGEAssessment criteria form a very important part of a unit standard. They are used toassess learners (ie. to make a judgment about whether a learner is competent ornot).14

Unit Standard – L2 FAIS Page 15Assessment criteria are statements that describe the standard to which learnersmust perform the actions, roles, knowledge, understanding, skills values andattitudes stated in the outcomes.They are a clear and transparent expression of requirements against whichsuccessful (or unsuccessful) performance is assessed.Unit standards are made up of credits. What are credits?Credits are the positive values given to unit standards and qualifications. Theybecome a tool for comparing one unit standard with another as well as onequalification with another. A credit value of a unit standard or qualification is based onthe number of notional hours it takes an average learner to achieve the outcomes ofthat unit standard. One credit is equal to ten notional hours of learning.To summarise, a qualification is made up of unit standards. Unit standards are madeup of credits.The big benefit of credits is that they are portable. If a person doesn’t want toundertake a full qualification, he/she can obtain credits (linked to specific unitstandards). Over time, these credits may add up to a full qualification. These creditsare portable across educational institutions and workplaces.Once awarded, credits are recorded on the National <strong>Learner</strong> Records Database. Thisforms a permanent record of credits which are awarded to individuals.6. What is assessment?In order to obtain credits (or a full qualification) towards qualifications registered onthe NQF, a learner must be assessed against the unit standards of that qualification.In the past, assessment was based on measuring a person’s achievements againstothers being assessed. The most common way to assess an individual was bymeans of a written examination.However, SAQA describes assessment as:A structured process for gathering evidence and making judgments about anindividual’s performance in relation to registered national standards andqualifications.Therefore, assessment is a way of allowing individuals to prove that they arecompetent. Competence is the ability to transfer and apply knowledge and skills inthe workplace.Assessment allows an individual to prove that they have achieved the outcomesdescribed in the unit standards. The process involves gathering information about theindividual’s achievements.Different types of evidence are collected, using a variety of assessment methods (forexample workplace evidence, projects, presentations, case studies etc). Theevidence is then assessed and recorded against the outcomes of the unit standard.15

Unit Standard – L2 FAIS Page 16Judgments about an individual’s performance in relation to the unit standards (andnot in relation to other learners) are made by a registered assessor (some-one whohas proven himself/herself competent against the registered assessor unitstandards). Assessors play a vital role in ensuring that quality is maintained.There are four principles of good assessment which if followed, ensure credibility.They are• fairness (an assessment should not in any way hinder or advantage a learner,and the process should be clear, transparent and available to learners)• validity (which refers to measuring what is supposed to be measured;assessment should stay within the parameters of what is required)• reliability (ie. consistency. The same judgements should be made in similarcontexts, each time an assessment is made for a specific purpose)• practicality (assessments should not be costly or resource intensive).Instead of using the traditional test or exam approach, there are many different typesof assessment instruments. Some are listed below:ObservationProductEvaluationINSTRUMENTAlternative response questionsbAssertion/reason questionsbAssignments b bAural/oral testsbCase studies b bCompletion questionsbExaminations/tests b bExtended response questionbGrid questionsbLog books b bMatching questionsbMultiple response questionsbOral questionsbPersonal interviewsbPractical exercises/demonstrations b b bPortfolios b bProjects b b bQuestionnaires b bRestricted response questionsbRole plays b bSimulations b bShort answer questionsbStructured questionsbWhat does a typical assessment process look like?QuestioningWritten/oralThe assessment process• The assessor designs the assessment by selecting the appropriate methods,instruments and designing the appropriate materials• The assessor informs the learner about the requirements for the assessment• The assessor reaches an agreement with the learner on how the evidence is tobe collected and presented• The assessor explains the roles and responsibilities of the learner with regard tohis/her assessment• The assessor conducts the assessment and collects the evidence16

Unit Standard – L2 FAIS Page 17• The assessor makes a judgment about the evidence against the criteria of theunit standard• The assessor provides feedback to the learner with regard to the assessmentdecision• The assessor competes the administration according to established requirements• The assessor evaluates the processThe learner has the right to appeal if he/she is not satisfied with the outcome of theassessment and the explanations provided.7. What is a portfolio of evidence?A portfolio is a collection of different types of evidence relating to the work beingassessed. It can include a variety of work samples.It is important that the evidence in the portfolio meets the requirements of sufficiencyand currency.The learner and assessor usually plan the portfolio jointly as sources of evidencemay vary. The learner is then responsible for the collection of evidence and thecompilation of the portfolio.Once a portfolio of evidence has been compiled, this portfolio needs to be assessedby an assessor to see if it meets all the requirements of the specific unit standard/sbeing assessed.8. What is recognition of prior learning (RPL)?Recognition of prior learning (RPL) is a key principle of the NQF particularly in as faras accelerated learning and ensuring the redress of past inequities isconcerned, though it is not confined for use in these instances. It can be defined as:Recognition of prior learning is giving credit to what learners already know and can doregardless of whether this learning was achieved formally, informally or non-formally.The NQF recognizes that learning takes place in a variety of settings, for example:• Formal education and training programmes• Formal and informal on the job education and training• Self-study for enjoyment or improvement of qualifications• Informal experience gained in the workplace or community• Non-formal in-house education and trainingWhere appropriate, such learning should be recognized and credited.NOTE:There is no fundamental difference in the assessment of previously acquired skillsand knowledge and the assessment of skills and knowledge achieved through acurrent learning programme. The learner seeking credits for previously acquired skillsand knowledge, still has to comply with all the requirements as stated in the unitstandard and will be assessed to determine competence.17

Unit Standard – L2 FAIS Page 18The only difference is that this learner will not need to go through a learningprogramme. Obtaining credentials is not dependent on time spent in a learningprogramme, rather on the learner’s readiness to demonstrate competence. A learnerwho feels ready can present himself/herself for assessment and/or submit thenecessary evidence as required by the learning outcomes and assessment criteria.Exactly the same principles, i.e. currency of evidence, sufficiency of evidence, validityof evidence and authenticity of evidence, apply in an assessment of prior knowledge.Another useful way to understand RPL is to refer to it as “recognition of currentcompetence”.9. What “outcomes based education”?Outcomes based education means that there is a focus on the outputs and endresults of learning and not the inputs. In other words, what is the learner capable ofproducing or applying at the end of the learning? What competence can the learnerdisplay?The diagram below attempts to explain this in more detail:Assessment in OutcomesBased Education (OBE)Emphasis on:Outputs or end productsIn the form of:Outcomes and competenceTogether these are a statementof the standards the learners areexpected to achieveMeasured by means of:Assessment criteriaWhich measures:Applied competenceOutcomes based education holds the following key beliefs about learning andsuccess:• What and whether learners learn successfully is more important than exactlywhen, how and from whom they learn it.• All learners can learn and succeed, but not on the same day in the same way.• Successful learning promotes more successful learning, just as poor learningfosters more poor learning.18

Unit Standard – L2 FAIS Page 1910. What are critical cross field outcomes (CCFO’s)?Critical Cross-field Education and Training Outcomes describe the qualities which theNQF identifies for development in students within the education and training system,regardless of the specific area or content of learning i.e. those outcomes that aredeemed critical for the development of the capacity for life-long learning.Some or all of the CCFO’s as they are known, need to form part of each and everyunit standard, and need to form part of every qualification as a whole.The Critical Outcomes adopted by SAQA are as follows:• Identify and solve problems in which responses display that responsibledecisions using critical and creative thinking have been made;• Work effectively with others as a member of a team, group, organisation,community;• Organise and manage oneself and one’s activities responsibly and effectively;• Collect, analyse, organise and critically evaluate information;• Communicate effectively using visual, mathematical and/or language skills in themodes of oral and/or written presentation;• Use science and technology effectively and critically, showing responsibilitytowards the environment and health of others;• Demonstrate an understanding of the world as a set of related systems byrecognising that problem-solving contexts do not exist in isolation;In order to contribute to the full personal development of each learner and the socialand economic development of the society at large, it must be the intention underlyingany programme of learning to make an individual aware of the importance of:• Reflecting on and exploring a variety of strategies to learn more effectively;• Participating as responsible citizens in the life of local, national and globalcommunities;• Being culturally and aesthetically sensitive across a range of social contexts;• Exploring education and career opportunities, and• Developing entrepreneurial opportunities.11. Levels of learning activityIn doing learning activities with a view to obtaining credits and/or a qualification, youare likely to come across the following words which ask you to do certain tasks in acertain way. The table below provides some explanation of what is expected of youwhen specific words are used:Level Description ExplanationLow Order (ie. learners RecallTo remember or to recollectreport on what theyknow or believe)RecountTo give an account of something; todescribe something in your own wordsDescribeTo explain or tell what you read orexperiencedExpress an opinion To give your own view or judgement aboutwithoutsomething, without necessarily givingsubstantiation reasons as to why you hold that particularview.19

Unit Standard – L2 FAIS Page 20Level Description ExplanationYes/No questions To state “yes’ or “no” to specific questions,based on your opinionMiddle Order (ie. InterpretExplain the meaning of something, usinglearners reorganiseyour own wordswhat they know) Summarise To state something in a concise manner; tosum up what the main ideas or content is ofa particular topicCompareTo draw a comparison between two things;to highlight the differences and similaritiesbetweentwoideas/concepts/approaches/beliefs etcTranslateTo restate something in different, oftensimpler, languageExemplify To provide an example of youropinion/belief/statementCategorise To place something in a category (usuallythere are a set number of categories ie. thelist of categories is not endless)ClassifyAs per “categorise” aboveApplyTo give a practical example or illustration ofa theoretical conceptExtrapolate To infer more widely from a limited range ofknown factsHigh Order (ie. SpecifyingTo name or mention expressly a connectionlearners develop new relationships or association of one thing with anotherknowledge)FormulatinghypothosesTo make a statement as a starting point forfurther investigation from known facts; tomake a proposition as a basis for reasoning,Devising ways oftestingFormulatinggeneralisationsJustifying claimsMaking inferencesSolving problemsProducing newideasExpressing valueEvaluatingwithout knowing the outcomeTo come up with quantitative or qualitativemethods for assessing the validity orotherwise of a specific idea/concept/beliefTo draw overall or holistic conclusionsbased on dataTo provide examples and reasons formaking certain statements (“claims”).To form a conclusion from premisesTo find a solution to a problemTo produce new thinking on a topicDescribing the relative worth or value ofsomething in relation to something else; toestimate the value of somethingTo assess or appraise something; to make ajudgement12. How to conduct researchOften, as part of a structured learning activity, you will be asked to “conductresearch”. What this means in essence is that you need to find other sources ofinformation about your topic and you will need to provide additional information in acoherent and summarized manner. Below are some tips and techniques toconducting research:20

Unit Standard – L2 FAIS Page 21a) Get focused. You will be more effective in doing research if you know exactlywhat you want and why you want it. So before you start, write a short sentencedescribing exactly what you want to find and why. An example could be “I want tofind out what changes there have been to UIF (Unemployment Fund) legislationand how this affects domestic workers”.b) List all possible sources for finding out information. Be creative! Resources canusually be placed into three categories:• Hard copy (anything you can pick up, such as newspapers, books, technicalmanuals)• People (experts in certain fields)• Auditory and visual media (internet, radio, TV)Be specific. Don’t just put down “internet” as a source; instead list the specificwebsites which may be helpful. For people resources, put down the names of thespecific people who could be useful sources of information. Once you’ve identifieddifferent sources of information, highlight three to five sources that you believe willbe most useful to you. Now focus on those!c) Hunt with a purpose. Once you’ve decided on your most likely sources ofinformation, gather information from those sources. Don’t get sidetracked intoirrelevant (but often very interesting) details. Refer back to your short sentence(or “mission statement”) to make sure that you stay focused.When obtaining information from hard copy, it is often useful to go straight to theindex to find what you want.When obtaining information from people, compile a list of the questions you wantto ask them. Be very clear and concise in your questioning, and don’t take toomuch time. If you are unfocused in your questions or take up too much time (forexample more than half an hour), you will find that next time the person will bereluctant to help you in the future.When obtaining information from the internet, use a good search engine to focuson what you want. Many people find the GOOGLE search engine useful:http://www.google.com/.d) Stop when you have enough information. Easier said than done! Most people fallinto one of two traps• Obtaining too little information, usually from a single source (“Hasty Harriet”)• Obtaining too much information and subsequently getting bogged down in amass of data (“Drowning David” )You have enough information when you can answer your short sentence,referring to more than one source. Simple as that!e) Organise your information carefully. Don’t be afraid to discard what you don’tneed. It is unlikely that you will need all the information that you gathered.f) Credit your sources. Copying something without referring to the source is calledplagiarism (academic cheating!) However if you acknowledge your source thenyou can copy as much as you like (but remember to put things you copy into“inverted commas” to describe what you are copying) and state who you arequoting. It is good practice to provide the name of the author, the21

Unit Standard – L2 FAIS Page 22paper/book/source in which you found the information and the year of publishingif available.The following are useful sites for global insurance research:http://www.virtualchase.com/resources/insurance.shtmlhttp://astre.scor.com/astrehelp/en/general/Insurance/biindex.htmhttp://www.irmi.com/expert/insurance.asp#Draftinghttp://www.risksmartsolutions.com/http://www.aig.com/GW2001/home/http://www.insweb.com/research/glossaries.htmhttp://www.hcra.harvard.edu/http://www.riskinfo.com/http://vu.iiaa.net/default.htmhttp://www.businessinsurance.com/http://www.aiu.com/http://www.insweb.com/learningcenter/default.htmhttp://www.insurancenewsnet.com/default.asp?a=home13. Website sources of South African insurance informationName of Organisation/Professional BodyAssociation of Health Benefit AdvisorsAssociation of Collective InvestmentsBanking Council of South AfricaBoard of Healthcare FundersFinancial Planning Institute of SAFinancial Services BoardInstitute of BankersInstitute of Internal AuditorsInstitute of Loss AdjustersInstitute of Marketing ManagementInstitute of Pension and Provident Fund TrusteesInstitute of Retirement FundsInsurance and Banking Staff AssociationInsurance Brokers CouncilInsurance Institute of SALife Offices AssociationLife Underwriters Association of SAMicro Lenders AssociationSA Risk and Insurance Management AssociationSociety of Risk ManagersSA Financial Services Intermediaries AssociationSA Institute of Chartered AccountantsSA Institute of Financial MarketsWeb Addresswww.ahba.org.zawww.aci.org.zawww.banking.org.zawww.bhf.co.zawww.fpi.co.zawww.fsb.co.zawww.iob.co.zawww.iiasa.org.zawww.ilasa.org.zawww.imm.co.zawww.pensionsworld.comwww.irfsa.co.zawww.ibsa.co.zawww.ibcprotea.comwww.iisa.co.zawww.loa.co.zawww.luasa.co.zawww.satis.co.za/miawww.sarima.org.zawww.srm.org.zawww.safsia.co.zawww.saica.co.zawww.saifm.co.za22

Unit Standard – L2 FAIS Page 2314. CopyrightCopyright gives the owner of copyright the sole right to exploit the work commerciallyfor a set period of time. For there to be infringement of copyright, there has to beactual copying. This does not mean that it has to be a "carbon copy" of the original; italso refers to reproduction (eg converting a literary work into a movie) or adaptation(eg translating a literary work). For infringement to take place, the copying musthave been done of a substantial portion of the work (eg a small but extremelyimportant part of it, or alternatively a large quantity of material is used).In terms of the Copyright Act, there are exemptions from infringement. Some of theseare:a) Using work for the purposes of private research or studyb) Use for criticism or review of the work (the source ie the work concerned, as wellas the name of the author must be provided)c) Use for reporting current events in a newspaper, magazine or similar periodical,or by means of a broadcast or cinema film (again the source and the name of theauthor must be mentioned)d) Use for quotation. Quotations may be made from all categories of works (exceptartistic works) provided that- the work must be lawfully available to the public- the quotation must be compatible with fair practice (eg not used out ofcontext)- the extent of the quotation must not be excessive, bearing in mind thepurpose to be served by the quotation- the source of the quotation and the author's name must be mentionede) Use for teaching (ie any teaching situation which includes private lessons). Thefollowing provisions must be complied with:- the work should not be the sole or primary means of instruction, and shouldbe used by way of illustration- the use must be compatible with fair practice (eg not used out of context)- the source and the author's name must be mentionedf) The following official texts and news enjoy very limited copyright:- official texts of a legislative, administrative or legal nature- political speeches- news of the day which is only an item of press information.23

Unit Standard – L2 FAIS Page 24AN INTRODUCTION TO THE FINANCIAL ADVISORY ANDINTERMEDIARY SERVICES ACT, 2002Module OneBackground to, and reasons whythe FAIS legislation was passed24

Unit Standard – L2 FAIS Page 25INTRODUCTION TO FAISModule 1Background to, and reasons why the FAIS Act was passedThis workshop will examine the reasons behind the FAIS legislation and theenvironment within which financial advisors operated before the legislation.Outcomes for Module 1:<strong>Learner</strong>s will• Reflect on reasons why the FAIS legislation was promulgated anddemonstrate an understanding thereof with examples.• Demonstrate an understanding of the FAIS ACT and how it affectsemployers/organisations.• Demonstrate an understanding of the protection that the FAIS legislationgives clients, by citing examples.• Reflect on circumstances under which an employee may give financialadvice, with examples from the learners own organisation.• Demonstrate an understanding of the role of the Ombud in terms ofhis/her role in supporting FAIS.25

Unit Standard – L2 FAIS Page 26ACTIVITY SHEET 1 AFAIS IN MARTIAN TERMS…You are on your way to work and you suddenly see a space ship (which happen tobe from Mars), packed with Martians approaching. As soon as they land, the leadercomes up to you and demands to know what this thing called FAIS is about. Insimple terminology, explain to this Martian what your thoughts are around the reasonfor the introduction of FAIS. For example: It is a law. It protects consumers.26

Unit Standard – L2 FAIS Page 27ACTIVITY SHEET 1 BFUN ACTIVITY TO INTRODUCE THECONCEPT OF COMPLIANCE TO THE LEARNERInstruction to the <strong>Learner</strong>:Decide who in your group will play the following two roles:1. Client2. SalespersonTake the following script and familiarize yourself with it. In the meantime, therest of the group can prepare to jot down the “compliance points” from thisrole-play, for e.g. The handing out of a statutory notice and letter of intro, is a“compliance point”.Then, once the role-play is over, the group will discuss these points jointly.You might wish to use this story of Compliance and the Shoe Salesman as an “icebreaker” to the course at the very outset. as a “fun role-play exercise”.COMPLIANCE.........FOR THE SHOE SALESMAN !!!!"I'd like to buy a pair of black leather shoes, please.""Sir, if only it were that simple. Here's my card. Letter of introduction and here's yourStatutory Notice.""What's this for?""It tells you that I can only talk to you about shoes and allied products sold by thisshop. I can't talk to you about shoes sold by any other shoe shop nor can I giveadvice on sausages for instance.""I see.""Probably the best way to proceed is to show you where we fit into thefootwear industry. We buy the most of our footwear from the Far East at afairly modest price and sell them onto the public at a considerably higherprice. Of course, out of the mark-up we pay for transportation, importduties, rent and sales, display staff, sales staff, cleaners and administration staffetc., and, of course, the shareholders have to be paid a dividend out of the remainingprofits. Not many people think about this when they buy shoes. It may be that evenwhen I have all the facts I mayrecommend that you do not buy footwear at all. May I proceed?""What do you want to know?""Well how many arms and legs have you got for a start?""What have arms got to do with shoes?""Well, sir, if for example you had only one arm and I sold you a pair of shoes withlaces - it could be construed by BASTARD as bad advice."27

Unit Standard – L2 FAIS Page 28"Who's Bastard?""The Boot and Shoe Trade and Regulatory Directorate.""What would they do?""Put the boot in. A friend of mine had to leave the industry.""What did he do wrong?""Sold a pair of carpet slippers.""What's wrong with that?""Turned out the guy didn't have a carpet. So you see. I need to build up a full profileof you. For example, do you need the shoes for business orpleasure or business and pleasure? How many shoes have you got already?How many are casual, smart, trainers and sandals? How many suits and whatcolour are they? Do you have athlete's foot? Can you touch your toes?Any corns or bunions or has your family a history of foot rot? What kind of socks doyou wear? How often do you cut your toenails? How much do you earn and what'syour overall budget? Well, thank you for that information ... I'll give it some seriousthought and will be able to advise you about the appropriate product in two week'stime."Two weeks later..."Ah, good morning sir I've given your enquiry serious thought and what you need is apair of black leather shoes." "Isn't that what I asked for in the first place?""With respect sir, you have had the benefit of my professional advice basedupon all the relevant facts as provided and you now know with somecertainty that you require black leather shoes. All the guesswork's beentaken out of it. Here's your Risk Analysis - I recommend you buy theseleather shoes because they'll keep your feet dry, match your suits, look smart andyou can afford them.""Well, I'm glad that's settled." Right. Please complete this application form. Here's aquotation for your signature. It shows a complete breakdown of costs and profits andincludes my 1.27% commission. The product particulars describe in great detail howthe shoes are made and the "key features" are a summary of the productparticulars, highlighting the risk factors."Risk factors?"Yes, for example, if you live too long the shoes may need repairing. Onthe other hand, if you die before you've had your wear out of them, I'mafraid there'll be no refund, even if they don't fit another member of the family. Sojust to recap: you've got my card, Letter of Introduction, yourStatuary Notice, product particulars, key features, quotation and RiskAnalysis. Now please take a seat while we await the letter from my headoffice advising you that I do in fact work for this company. By the way,there is a cooling off period - you can still return the shoes within 30days and receive a full refund if you don't like them for any reason.Incidentally, how are you paying?""Cash.""Well, sir, we have to consider the possibility of money laundering, so would youmind nipping home for a telephone bill or utility bill, your last tax return with your taxnumber clearly printed by SARS and a certified copy of your South African Identitydocument to prove your identity so that I can be sure that you are genuine and notmixed up in some sort of unsavoury financial arrangement? And one last thing, sir,do any of your friends require shoes?"28

Unit Standard – L2 FAIS Page 29THE REASON FOR THE INTRODUCTION OF FAISThe FAIS Act was introduced to regulate thebusiness of all Financial Service Providers who give advice or provide intermediaryservices to clients, regarding a wide range of financial products. In terms of the Act,such Financial Services Providers need to be licenced, and professional conduct iscontrolled through Codes of Conduct and enforcement measures.The Act aims to achieve the following objectives:• Professional Conduct• Better informed clients, and• A professional, responsible sectorWhat is the history behind the legislation?Historically, there has been no formal system of regulating Financial Advisors andFinancial Services Providers. Aggrieved clients could do very little about unethicaland dishonest Representatives (financial advisors) or negligence on the part ofFinancial Services Providers. The Policy Board for Financial Services andRegulation were responsible for conceptualizing and designing the basic frameworkwhich would become FAIS. The FAIS Bill (before it was enacted) was drafted on thebasis of a framework of specifications (provided by the Policy Board for FinancialServices and Regulation), which only covered the furnishing of advice. Since then,the ambit of the Bill was extended to all intermediary services rendered in respect offinancial products (as defined in the legislation) and now has more far-reachingimplications.During the drafting process, which lasted for more than 2 years, several drafts of theBill were put on the Financial Service’s Board’s (FSB) website, followed bystatements in the media inviting comments. In addition to this, and given the fact thatthe Bill attracted interest from all the different industry players within the financialservices sector, a number of workshops, as well as several road shows, were hostedby the FSB. These events covered discussions around the contents of the then Billand its possible impact on the industry.29

Unit Standard – L2 FAIS Page 30TASK SHEET: 1.1SELF REFLECTION and the GROUP REFLECTIONWhat is the aim or purpose of the FAIS legislation?Who is protected by FAIS?Why did they need protection?Who has to abide by the rules withinFAIS?How will consumers be protected?Completed By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments30

Unit Standard – L2 FAIS Page 31TASK SHEET: 1.2SELF REFLECTION and then GROUP REFLECTION:In an article by journalist Jenny Barbour on FAIS, Gerry Anderson – DeputyExecutive Officer of the Financial Service Board is quoted as saying:”The (FAIS) Bill is a consumer protection measure and will be measured in benefitsto the consumer rather than inconvenience to the profession”.Using this quote as the starting point of your group discussion, debate the issue ofweighing up the “inconvenience to the profession” versus the “benefits to theconsumer”, whilst at the same time bearing in mind the type of activities/behaviour inthe Financial Services Industry which prompted legislation such as FAIS to beenacted.NOTE YOUR IDEAS AND THOUGHTS HERE…BENEFITS TO THE CONSUMER INCONVENIENCE TO THEPROFESSIONCompleted By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments31

Unit Standard – L2 FAIS Page 32PURPOSE OF THE FAIS LEGISLATIONThe FAIS Act is designed not only to raise the standard of the industry, but alsoto protect consumers from dishonest Representatives and negligent or dishonestFinancial Services Providers (FSP’s).POSSIBLE IMPACT OFFAIS ON CONSUMERSA higher overall standard ofadvice – all licenced advisorshave to be competent.For example, allRepresentatives will have to becompetent at a certain NQFlevel in order to sell a product.Protection for consumers –intermediaries must sellaccording to client’s needs.For example, the General Codeof Conduct under FAIS makes itcompulsory for the advisor to doa Needs Analysis on the client32

Unit Standard – L2 FAIS Page 33THE FAIS ACT AND HOW IT AFFECTS EMPLOYERS/ORGANISATIONSPOSITIONING OF THE ACTThe Act itself is made up of seven chapters, which deal with various issues, as canbe seen below:FAISACT37 of2002• chapter I ADMINISTRATION OF ACT• chapter II AUTHORISATION OF FSP’S• chapter III REPRESENTATIVES OF AUTHORISED FSP’S• chapter IV CODES OF CONDUCT• chapter V DUTIES OF AUTHORISED FSP’S• chapter VI ENFORCEMENT• chapter VII MISCELLEANEOUS33

Unit Standard – L2 FAIS Page 34In addition to the Act are the pieces of SUBORDINATE LEGISLATION whichsupport the requirements of the Act. Here is a graphic depiction of the Act with someof the pieces of subordinate legislation:1.GENERAL CODE OFCONDUCT FOR AUTHORISEDFSP’S AND REPRESENTATIVES10. DETERMINATION OF FORM ANDMANNER OF REPORT OF EXTERNALAUDITOR OF AUTHORISED FSP’S ONMONEY AND ASSETS HELD ONBEHALF OF CLIENTS2. DETERMINATION OFPROCEDURE FORAPPROVAL OF KEYINDIVIDUALS3. FINANCIAL ADVISORYAND INTERMEDIARYSERVICES REGULATIONSFAIS9. QUALIFICATIONS ANDEXPERIENCE OF COMPLIANCEOFFICERS IN RESPECT OFFINANCIAL SERVICESBUSINESS8. DETERMINATION OFFIT AND PROPERREQUIREMENTS FORFSP’S4. DETERMINATION OFFEES PAYABLE TO THEREGISTRAR OF FSP’S7. DETERMINATION OFCOMPLIANCE REPORTS BYCOMPLIANCE OFFICERS ANDAUTHORISED FSP’S5. DETERMINATION OFFUNCTIONS TO BEPERFORMEDBY RECOGNISEDREPRESENTATIVE BODIES6. RULES ONPROCEEDINGS OF THEOFFICE OF THE OMBUDFOR FSP’S34

Unit Standard – L2 FAIS Page 35Below is a brief description of what each piece of subordinate legislation deals with and should give youan idea of what the contents of each would contain. Remember that not every single piece of subordinatelegislation would apply to your organisation. For example, if you do not wish to become a recognised body then number 5 - Functions ofRecognised Bodies would not apply to your organisation.SHORT NAME DESCRIPTION IN “ENGLISH”!1. GENERAL CODE OF CONDUCT Provides detail on Code of Conduct for authorisedFSP’s and their representatives.This is a document which describes how FSP’sshould behave.2. APPROVAL – KEY INDIVIDUALS Provides detail on rules of procedure for approvalof Key IndividualsThis document gives more information on therequirements for Key Individuals to be approved.3. REGULATIONS Provides detail on regulations to the Act This document gives more information.4. FEES PAYABLE Provides detail on fees payable to the Registrar ofFinancial Services ProvidersOutlines the actual fees which have to be paid forthe various applications (see example below) .5. FUNCTIONS – RECOGNISEDBODIESShows detail of functions to be performed byRecognised BodiesOutlines the functions which the recognised bodieswill be able to perform.6. RULES - OMBUD Provides rules for the proceedings of the Office ofthe Ombud for Financial ServicesThe Ombud’s office will have to abide by thisdocument in its proceedings7. COMPLIANCE REPORTS Provides detail on the form and manner ofCompliance reportsGives an example or precedent of what aCompliance Report should look like.8. FIT & PROPER REQUIREMENTS Provides detail of the determination of Fit & Properrequirements for representatives.Provides information on what it would take for aRepresentative or Key Individual to be Fit andProper for FAIS purposes. (see excerpts from9. QUALIF/EXPERIENCE –COMPLIANCE OFFICERProvides guidelines for the criteria and approval ofCompliance OfficersDetermination below )This document tells one exactly what qualificationsand experience one must have in order to be aCompliance Officer.INSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 36SHORT NAME DESCRIPTION IN “ENGLISH”!10. REPORT – EXTERNALAUDITORProvides guidance on the form and manner ofreports by the External AuditorShows an example of what an Auditor’s reportshould look like.11. SPECIFIC CODE OF CONDUCT Provides detail on Code of Conduct for authorised The do’s and don’ts that an FSP and theirFOR AUTHORISED FSP’s AND FSP’s and their representatives involved in representatives ought to abide by. This onlyREPRESENTATIVES - SHORT-TERM DEPOSIT-TAKINGBUSINESSShort Term Deposit Taking businessapplies to FSP’s who are involved in the ShortTerm Deposit Taking Business, for e.g. MoneyMarket accounts.12.REPRESENTATIVE BODIESAPPLICATIONS13. EXEMPTIONS OF FSPREGARDING REPRESENTATIVES14. REQUIREMENT FORREAPPOINTMENT OF DEBARREDREPRESENTATIVES15. EXEMPTION OF FSP’s ANDREPRESENTATIVES FROMPOLICYHOLDER PROTECTIONRULES16.DETERMINATION FOR THECRITERIA AND GUIDELINES FORTHE APROVAL AS COMPLIANCEOFFICERSProvides details of the application form to becompleted by Representative Bodies who wish tobecome Recognised BodiesContains detail of the exemptions which areavailable to FSP’s regarding their representativesDeals with reappointment of representatives whohave been debarredProvides details on the exemption of FSP’s andrepresentatives from Policyholder Protection RulesProvides detail on the criteria for approval ofcompliance officersGives the application form which must be filled outby a party who is interested in becoming aRecognised Body.The FAIS Act offers the FSP certain exemptionsfrom particular sections of the Act, subject toconditions. This document lays out theseexemptions.In certain instances, when a representative doesnot act in an acceptable manner, he/she may bedebarred. This document outlines whatrequirements that representative would have tofulfil to be debarred in order to operate as aRepresentative again.The FAIS act replaces the Long and Short TermInsurance Acts PPR – This document gives thedetail of such an exemption to the FSP and theirrepresentatives.This document tells one what the criteria andguidelines are to be approved as a ComplianceOfficer.36

Unit Standard – L2 FAIS Page 37TASK SHEET 1.3• Use the table on the previous pages as a resource.• Consult with the relevant individuals (for example, Compliance Officer)within your organisation and pick out the pieces of FAIS subordinatelegislation which would apply to your organisation.Subordinate legislation What does it deal with? Why does it apply to yourorganisation?Completed By: Signed DateAssessed BYSignedDate:Moderated By Signed DateCommentsINSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 38WHO ARE THE DIFFERENT ROLE PLAYERS IN THE LEGISLATION?FINANCIAL SERVICES BOARDKEYINDIVIDUALSRECOGNISEDBODYFINANCIALSERVICESPROVIDEREXTERNALAUDITORCOMPLIANCEOFFICERREPRESENTATIVES(advice givers)Support staff (nonAdvice-giving staff)38

Unit Standard – L2 FAIS Page 39WHAT ARE THE FUNCTIONS OF THE ROLE-PLAYERS?FINANCIAL SERVICES BOARDThis is the regulatory body for the financial services industry and is the body whichwill be issuing licences to authorised FSP’s.FINANCIAL SERVICES PROVIDERThis is an entity/person which is involved either in:The rendering of advice; or the rendering of an intermediary service; or both.This could be an entity such as a large corporate who is also a product supplier oreven an independent brokerage who operates as an SMME (Small, medium, microenterprise).KEY INDIVIDUALSThese are natural persons within the FSP who are either managing or overseeing theactivities of the FSP relating to financial services (for example a manager of adistribution unit in an FSP).REPRESENTATIVESThese are the persons who give financial advice to clients.COMPLIANCE OFFICERThis is the person who embeds compliance within the FSP and reports to the FSB oncompliance issues within the FSP. Can be an internal person or outsourced.AUDITORThis is the person responsible for the financial statements of the FSP and whosubmits reports to the FSB on the financial state of the FSP.SUPPORT STAFFThese are the staff who support the function of the sales staff such as theadministrative functions of a FSP, for example a secretary. These are not advicegiving staff.39

Unit Standard – L2 FAIS Page 40RECOGNISED BODYIt is a requirement of the Act that no person may act as a Financial ServicesProvider (FSP) without a licence. The Financial Services Board will beresponsible for issuing such licences.As an FSP, the application for a licence can either be submitted directly to theFinancial Services Board, or through a Recognised Representative Body.Essentially, a Recognised Body is a body which will assist you in becominglicenced by dealing with the FSB and submitting the application for a licence onbehalf of the FSP.In order to become a recognised body, representative and membership bodieswill have to make an application (special form to apply to be a “recognised body),containing all the details and infrastructure information about the organisation.Once this application form is looked at, the FSB makes a decision and if it isaccepted, then the organisation gets approved as a “recognised body” and mayact as an agent on behalf of the organisation applying to become an authorisedFSP, in submitting the licence to the FSB on the FSP’s behalf.As can be seen from the diagram, the FSP can either go directly to the FSB to belicenced as an Authorised Service Provider, or go via a Recognised Body.FSBRECOGNISEDBODYFINANCIALSERVICESPROVIDER40

Unit Standard – L2 FAIS Page 41ACTIVITY SHEET 1CTERMINOLOGY POSTERYou will be given a pack of cards containing either terminology or definitions.You will also be given a blank poster on which you can stick your cards.In your groups, stick the definitions onto the board and match up eachdefinition with a description. The group with the most definitions right is thewinner.Write the correct description next to the definitions your group got wrong here:41

Unit Standard – L2 FAIS Page 42ACTIVITY SHEET 1DGROUP REFLECTION:In your groups, make up a poster with a diagram of who the various roleplayers in the FAIS Act are, and how they relate to each other.42

Unit Standard – L2 FAIS Page 43TASK SHEET 1.4SELF REFLECTION and then GROUP DISCUSSION:Relate these role-players back to your organisation and research who theactual individuals are within your company. Then discuss in your groups.ROLE PLAYER(FAIS)e.g. ComplianceOfficerPERSON IN YOURORGANISATIONJohn DoeFUNCTION OF THAT PERSONResponsible for the fullcompliance function of theorganisation.Submits compliance reports asper FAIS to the FSBCompleted By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments43

Unit Standard – L2 FAIS Page 44ACTIVITY SHEET 1ESELF REFLECTION/GROUP REFLECTION:Read the article below in which the Executive Director of the FinancialPlanning Institute, Sakkie van der Merwe, is interviewed on the requirement ofa Compliance Officer and discuss the main points of the article in your group.44

Unit Standard – L2 FAIS Page 45ARTICLE: APPOINTMENT OF COMPLIANCE OFFICERSIt is the requirement of the Financial Advisory and Intermediary Services Act(FAIS) that compliance officers or consultants be appointed. However, the subordinatelegislation specifically dealing with qualifications and experience willonly be finalized later, writes Sakkie Van De Merwe, executive directorFinancial Planning Institute (FPI).However, there are strong indications as to what can be expected in terms of thesub-ordinate legislation. The Financial Planning Institute (FPI) would caution financialplanners and intermediaries to be careful before appointing a compliance officer oremploying the services of a consultant without considering these indications.The latest draft regarding compliance officer qualifications and requirements statethat such a person needs to hold a legal or accounting university degree, with at leastthree years experience in the financial services industry. Compliance officers will alsobe approved to be appointed if they have passed a specific financial services industryor compliance related course, recognised by the registrar, with at least three yearsworking experience.Compliance officers could also be approved if they are accredited members of theCompliance Institute of South Africa, or any other organisation recognised by theregistrar. A compliance officer could also be appointed by virtue of a law. It isnecessary for compliance officers to have sufficient and appropriate knowledge of theprovisions of the Act that will enable them to fully understand the duties andobligations of the office. The officer should comply with personal character qualities,showing integrity and honesty.The compliance officer should have adequate resources to ensure propercompliance monitoring that enables them to function independently and objectively.He must be able to function in a manner ensuring that no actual or potential conflictsof interests arise. Written records of all activities undertaken should be kept. A reportshould be provided to all parties concerned on a quarterly basis. This must includethe monitoring of duties, progress achieved and recommendations made.45

Unit Standard – L2 FAIS Page 46SOME MORE FAIS TERMINOLOGY …FAIS persona Acronym Definition from Act Possible person/entityFinancial FSP An “authorised financial services provider” or ‘‘provider’’ means a BrokerageServicesProduct Supplierperson who has been granted an authorisation as a financial servicesProviderMay be a sole proprietor/provider by the issue to that person of a licence under section 8; partnership/CC/company orbusiness trustRepresentative RepThe term “representative” means any person who renders a financialservice to a client for or on behalf of a financial services provider, interms of conditions of employment or any other mandatoryagreement, but excludes a person rendering clerical, technical,administrative, legal, accounting or other service in a subsidiary orsubordinate capacity, which service—person; or(a) does not require judgment on the part of the latter(b) does not lead a client to any specific transaction in respectof a financial product in response to general enquiries;Advice giverKey Individual K.I. A “key individual”, in relation to an authorised financial servicesprovider, or a representative, carrying on business as—(a) a corporate or unincorporated body, a trust or apartnership, means any natural person responsible formanaging or overseeing, either alone or together with otherExamples are Director, Headsof Business Units, Managers(who oversee or manage anyactivity relating to therendering of any financialservice).INSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 47so responsible persons, the activities of the body, trust orpartnership relating to the rendering of any financial service;or(b) a corporate body or trust consisting of only one naturalperson as member, director, shareholder or trustee, meansany such natural person;AuditorThe term Auditor means an auditor registered in terms of the PublicAccountants’ and Auditors’ Act, 1991 (Act No. 80 of 1991)47

Unit Standard – L2 FAIS Page 48PROTECTION THAT THE FAIS LEGISLATION GIVES CLIENTSThe Act lays down standards for market conduct of both Providers andrepresentatives – the focus is on the client - from the right of the consumer to betreated fairly, full disclosure of relevant information and the responsibility of industryto display professionalism and put clients’ needs before their own.The Code of Conduct combined with the Consumer Education drive should result inconsumers becoming better advised and equipped to make intelligent, informedfinancial decisions.The following extract from the General Code of Conduct is an example whichillustrates the care and protection afforded to clients by the FAIS legislation.PART VCONTACTING OF CLIENT6. A provider must–(a) in making contact arrangements, and in all communications and dealingswith a client, act honourably, professionally and with due regard to theconvenience of the client; and(b) at the commencement of any contact, visit or call initiated by the provider,explain the purpose thereof and at the earliest opportunity, provide theinformation referred to in section 5.There are two main pieces of protection afforded to clients:1. The Ombud’s office, and2. The authority given to the Registrar to apply for interdicts and instituteclass actions* against offenders.More detail on the Ombud’s office is provided later on in this manual.*This refers to actions which are instituted by groups of people against a perpetrator. Forexample, a class action in this context could be a group of individuals suing a representativefor misrepresenting the features of a product.INSMAT final materials 31/10/03

Unit Standard – L2 FAIS Page 49TASK SHEET 1.5SELF REFLECTION and then GROUP REFLECTION:If you plan to buy a life policy, how will the FAIS Code of Conduct protect you as aconsumer? Refer to extracts from the FAIS Code of conduct below and list at least 7instances of protection for you, the consumer. Discuss this in your groups after yourself reflection.FAIS - GENERAL CODE OF CONDUCT FOR AUTHORISED FINANCIALSERVICES PROVIDERS AND THEIR REPRESENTATIVESPART IIGENERAL PROVISIONSGeneral duty of provider2. A provider must at all times render financial services honestly, fairly, with dueskill, care and diligence, and in the interests of clients and the integrity of thefinancial services industry.Specific duties of provider3. (1) When a provider renders a financial service–(a) representations made and information provided to a client by theprovider–(i) must be factually correct;(ii) must be provided in plain language, avoid uncertainty or confusionand not be misleading;(iii) must be adequate and appropriate in the circumstances of theparticular financial service, taking into account the factuallyestablished or reasonably assumed level of knowledge of the client;(iv) must be provided timeously so as to afford the client reasonablysufficient time to make an informed decision about the proposedtransaction;(v) may, subject to the provisions of this Code, be provided orally and,at the client’s request, confirmed in writing within a reasonable timeafter such request;(vi) must, where provided in writing or by means of standard forms orformat, be in a clear and readable print size, spacing and format.49

Unit Standard – L2 FAIS Page 50How the FAIS Code of Conduct protects me:Completed By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments50

Unit Standard – L2 FAIS Page 51TASK SHEET 1.6SELF REFLECTION and then GROUP REFLECTION:Which employees in your company can give advice – to whom can they giveadvice and on what can they give advice?WHICH EMPLOYEESCAN GIVE ADVICE?TO WHOM CANTHIS ADVICE BEGIVENWHAT CAN THISEMPLOYEEGIVE ADVICE ON?Completed By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments51

Unit Standard – L2 FAIS Page 52THE ROLE OF THE OMBUD IN TERMS OF THE ROLE IN SUPPORTINGFAISDEFINITIONIn terms of the Act:"Ombud" means-(a) the Ombud for Financial Services Providers appointed in terms ofsection 21(1); and 20(b) for the purposes of sections 27, 28, 31 and 39, includes a deputy Ombud”.Section 20 of the FAIS Act introduces the Ombud’s office and its functions andobjectives:Ombud for financial services providersOffice of Ombud for Financial Services Providers20. (1) There is an office to be known as the Office of the Ombud for FinancialServices Providers.(2) The functions of the Office are performed by the Ombud for FinancialServices Providers.(3) The objective of the Ombud is to consider and dispose of complaints in aprocedurally fair, informal, economical and expeditious manner and byreference to what is equitable in all the circumstances, with due regard to-(a) the contractual arrangement or other legal relationship betweenthe complainant and any other party to the complaint; and(b) the provisions of this Act.(4) When dealing with complaints in terms of sections 27 and 28 the Ombudis independent and must be impartial.52

Unit Standard – L2 FAIS Page 53• POWERS OF THE OMBUD FOR FINANCIAL SERVICESThe Ombud is empowered to:• Award fair compensation for any financial prejudice or damage sufferedby the complainant.• Issue a direction to an FSP to take appropriate steps in relation to thecompliant.It is important to remember that a determination by the Ombud has the effect of acivil judgment and can be processed through the ordinary judicial process.In addition to this, civil remedies are available in the form of class actions, asoutlined above.Finally, criminal sanctioning is provided for through heavy fines and terms ofimprisonment.• DUTIES OF THE OMBUD FOR FINANCIAL SERVICESThe Ombud will consider complaints in a procedurally fair, informal, economical andspeedy, taking account of the following:• The contractual and legal relationship between the complainant and the otherparty.• The provisions of the FAIS Act.The Office of the Ombud for Financial Services will serve as a speedy, cost effectivedispute resolution system through which customer complaints against FSP’s orrepresentatives will be processed.The office has been set up in such a way that the constitutional requirements ofindependence and objectivity are achieved.53

Unit Standard – L2 FAIS Page 54TASK SHEET 1.7QUESTIONS AND ANSWERS:NOTE TO LEARNER: You can find some of these answers by going into theFSB website and looking under FAIS Facts, or by contacting the FSB directlyon (012) 428 8000. Some of the answers are in the notes on the Office of theOmbud above.1. Who is presently the Ombud for Financial Services?2. Why has the Office of the Ombud for Financial Servicesbeen set up?3. What are the powers of the Office of the Ombud for FinancialServices?4. On what requirements from our constitution is the function ofthe office of the Ombud based?Completed By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments54

Unit Standard – L2 FAIS Page 55ACTIVITY SHEET 1 FREFLECTION ON OWN LEARNINGPlease complete the following questions:1. Summarise what you have learnt in the last module from an“introduction to FAIS” perspective.______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________2. Be brutally honest with yourself: What are the key advantages anddisadvantages of this law?55

Unit Standard – L2 FAIS Page 56AN INTRODUCTION TO THE FINANCIAL ADVISORY ANDINTERMEDIARY SERVICES ACT, 2002Module TwoThe application of FAIS to a specific work environment56

Unit Standard – L2 FAIS Page 57INTRODUCTION TO FAISModule 2The Application of FAIS to a specific work environmentThis module will explore the application of FAIS to the work environment of thelearner.Outcomes for Module 2:<strong>Learner</strong>s will• Demonstrate an understanding of how the FAIS legislation applies to themain functions of a specific organisation/division/department byinvestigating the application of FAIS to it.• Reflect on the requirements of FAIS as they apply to an individual’s ownposition within an organisation, and identify what could constitute advice inthat situation.• Reflect on the direct and indirect consequences for the organisation ifemployees inadvertently give advice and demonstrate an understandingthereof by citing examples.57

Unit Standard – L2 FAIS Page 58HOW THE FAIS LEGISLATION APPLIES TO THE MAIN FUNCTIONS OF ASPECIFIC ORGANISATION/DIVISION/DEPARTMENTSome of the MAIN FUNCTIONS WHICH FAIS will affect will include, amongstothers:• Compliance function• Legal function• Sales and Distribution function• Human Resources functiono Recruitmento Disciplinary proceduresAN AUTHORISED FSP, ONCE AUTHORISED, MUST ENSURE THE FOLLOWING,AMONGST OTHERS:• Maintain a register of representatives.• Take reasonable steps to ensure that the representatives comply with theapplicable codes of conduct as well as other laws relating to conduct of business.• Be satisfied at all times that the representatives are fit and proper – meaning thatthey must be competent (in terms of qualifications and experience), are honestand have integrity, are operationally sound and are financially sound.• Display a certified copy of the licenses within every business premises andinclude reference to the licence in all business documentation, advertisementsand promotional material.• Maintain proper accounting records in respect of the business carried on by theauthorised Provider. Such records will have to be audited by an external auditorand approved by the Registrar.• Maintain records for a minimum period of five years, concerning varioustransactions and complaints received, amongst others.58

Unit Standard – L2 FAIS Page 59Therefore typically, an FSP will have to be responsible for:• Maintaining a representative register• Compliance with the respective Code/s of Conduct• Appointment of Compliance Officers• Implementing good record keeping systems• Maintaining good accounting and audit processes• Reporting regularly to the FSB (Registrar)• Performing ongoing competency and integrity checks for theirRepresentatives• Installing and maintaining an internal complaints resolution process andpolicy• General compliance with the ActFrom the above notes, it is evident that FAIS will touch “the heart of the business” asit will impact on almost every business unit in some way or another. It seems as ifthe FSP is going to have to function like a well-oiled machine, where themaintenance and upkeep of one part of the machine, will impact on it’s overallcapability.59

Unit Standard – L2 FAIS Page 60Here are SOME OF THE GUIDELINES OF STEPS THAT FSP’S WILL NEED TOTAKE to fulfill the requirements of FAIS …FAIS “TODO” LIST• Decide who is going to take on your compliance responsibilities.• Apply to be licensed as a Financial Service Provider. (Fit and Properrequirements, training, relevant experience, operational ability.)• Prepare manuals and train your staff on FAIS.• Ensure that your licence is displayed correctly and that your licence numberappears on all printed documentation.• Design standard operating procedures and forms for disclosures, adviceprocess, client interactions (notes), new business, existing business,replacements, surrenders, receipts of documents etc.• Design and implement client compliant procedures as required by FAIS.• Evaluate, design and implement data storage and backup systems.• Design and implement control procedures to detect deviations fromrequirements.• Design and implement risk management procedures.• See that professional indemnity cover is in place for the business (if not yet inplace).• Apply good accounting procedures and systems (if not yet in place).• Design and implement all the required reports and registers as required byFAIS.• Prepare and submit yearly compliance reports to the Financial ServicesBoard.• Maintain knowledge about the relevant acts applicable to the financialservices environment.• Maintain product knowledge and product accreditation for the relevantcontracts you have with service providers.• Maintain legal and technical knowledge relevant to the lines of business youadvise on.60

Unit Standard – L2 FAIS Page 61TASK SHEET 2.1SELF REFLECTION and then GROUP REFLECTION:• From the notes above, list at least 5 examples of which functions,divisions or departments of an organisation (FINANCIAL SERVICESPROVIDER), FAIS could possibly be applied to.• State what will change or be different once one applies therequirements of the Act.• Then discuss in your groups.WHICH FUNCTION, DEPT, DIVISIONExample: Human Resources divisionWHAT THE APPLICATION WILL ENTAILThe interviewing process for Key Individualsand Representatives will be altered to includeFit and Proper checks, such as Criminal andCivil checks, educational qualification checksand ITC credit worthiness checks.Completed By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments61

Unit Standard – L2 FAIS Page 62TASK SHEET 2.2SELF REFLECTION and then GROUP REFLECTION:• From the notes above, make a TO DO list for your organisation withonly 5 items, which you see as being important for the business to becompliant with FAIS.• Then in your group, compare your TO DO lists and discuss why youchose the requirements on your list.THE FAIS TO DO LIST FOR MY ORGANISATIONCompleted By: Signed DateAssessed BYSignedDate:Moderated By Signed DateComments62

Unit Standard – L2 FAIS Page 63THE REQUIREMENTS OF FAIS AS THEY APPLY TO AN INDIVIDUAL’S OWN POSITION WITHIN AN ORGANISATION andWHAT COULD CONSTITUTE ADVICE IN A SITUATION:The Act is quite clear as to what constitutes advice and what does not:TERM DEFINITION FROM ACT IN “ENGLISH”!“Advice”Advice means any recommendation, guidance or proposal of a financialnature furnished, by any means or medium, to any client or group ofclients:-a) in respect of the purchase of, or the investment in any financialproduct; orb) on the conclusion of any other transaction, including a loan orcession, aimed at the incurring of any liability or the acquisition ofany right or benefit in respect of any financial product; orc) on the variation of any term or condition applying to a financialproduct, on the replacement of any such product, or on thetermination of any purchase of or investment in any such product.This is irrespective of whether or not such advice:-(i) is furnished in the course of or incidental to financial planning inconnection with the affairs of the client; orresults in any such purchase, investment, transaction, variation,replacement or termination, as the case may be, being effected.It appears from this definition, that the key words are:• recommendation• guidance• or proposal of a financial natureAll these words contain an element of DISCRETION orOPINION.In other words, the person giving advice is exercising hisjudgment and formulating an opinion, which he ispassing on to the client.INSMAT final materials 31/10/03