Chemring Interim 2006 - Chemring Group PLC

Chemring Interim 2006 - Chemring Group PLC Chemring Interim 2006 - Chemring Group PLC

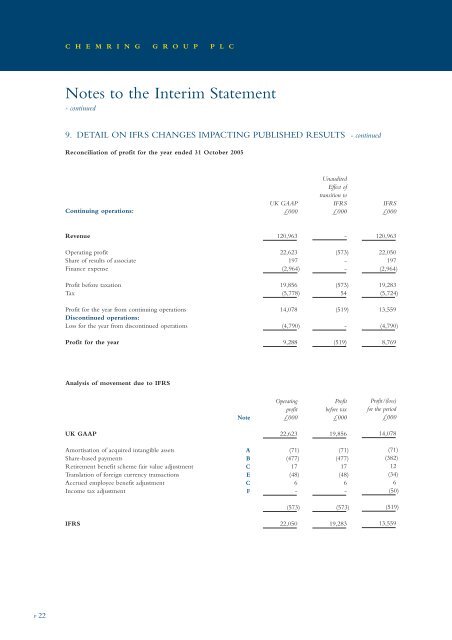

C H E M R I N G G R O U P P L CNotes to the Interim Statement- continued9. DETAIL ON IFRS CHANGES IMPACTING PUBLISHED RESULTS - continuedReconciliation of profit for the year ended 31 October 2005Continuing operations:UK GAAP£000UnauditedEffect oftransition toIFRS£000IFRS£000Revenue120,963-120,963Operating profitShare of results of associateFinance expense22,623197(2,964)(573)--22,050197(2,964)Profit before taxationTax19,856(5,778)(573)5419,283(5,724)Profit for the year from continuing operationsDiscontinued operations:Loss for the year from discontinued operations14,078(4,790)(519)-13,559(4,790)Profit for the year9,288(519)8,769Analysis of movement due to IFRSNoteOperatingprofit£000Profitbefore tax£000Profit/(loss)for the period£000UK GAAP22,62319,85614,078Amortisation of acquired intangible assetsShare-based paymentsRetirement benefit scheme fair value adjustmentTranslation of foreign currency transactionsAccrued employee benefit adjustmentIncome tax adjustmentABCECF(71)(477)17(48)6-(71)(477)17(48)6-(71)(382)12(34)6(50)(573)(573)(519)IFRS22,05019,28313,559P 22

I N T E R I M R E P O R T 2 0 0 6Reconciliation of equity at 30 April 2005 (six month comparative figures)Non-current assetsDevelopment costsGoodwillTangible assetsInvestment in associateDeferred tax assetsNoteB,C,FUK GAAP£0002,57527,98442,2361,073-UnauditedEffect oftransition toIFRS£000----6,674IFRS£0002,57527,98442,2361,0736,674Total non-current assets73,8686,67480,542Current assetsInventoriesTrade and other receivablesCash and cash equivalentsC,E31,12330,114327-(187)-31,12329,927327Total current assets61,564(187)61,377Current liabilitiesLoansObligations under finance leasesBank overdraftsTrade and other payablesCorporation taxB,C,D,E(4,388)(915)(12,477)(25,250)(1,932)---95-(4,388)(915)(12,477)(25,155)(1,932)(44,962)95(44,867)Non-current liabilitiesLoansObligations under finance leasesOther payablesDeferred tax liabilitiesLong-term provisionsPreference sharesRetirement benefit obligationsBC,E,FC(21,519)(733)-(3,431)(170)(62)---(81)(1,857)--(18,051)(21,519)(733)(81)(5,288)(170)(62)(18,051)(25,915)(19,989)(45,904)Net assets64,555(13,407)51,148EquityShare capitalShare premium accountSpecial capital reserveRevaluation reserveRetained earningsF1,45526,94012,9392,39220,559---(723)(12,684)1,45526,94012,9391,6697,875Equity attributable to equity holders of the parentEquity attributable to minority interests64,285270(13,407)-50,878270Total equity64,555(13,407)51,148P 23

- Page 1 and 2: I N T E R I M R E P O R T2 0 0 6C H

- Page 3 and 4: I N T E R I M R E P O R T 2 0 0 6Co

- Page 5 and 6: I N T E R I M R E P O R T 2 0 0 6Th

- Page 7 and 8: I N T E R I M R E P O R T 2 0 0 6ha

- Page 9 and 10: I N T E R I M R E P O R T 2 0 0 6Un

- Page 11 and 12: I N T E R I M R E P O R T 2 0 0 6Re

- Page 13 and 14: I N T E R I M R E P O R T 2 0 0 6No

- Page 15 and 16: I N T E R I M R E P O R T 2 0 0 6No

- Page 17 and 18: I N T E R I M R E P O R T 2 0 0 62.

- Page 19 and 20: I N T E R I M R E P O R T 2 0 0 66.

- Page 21 and 22: I N T E R I M R E P O R T 2 0 0 69.

- Page 23: I N T E R I M R E P O R T 2 0 0 6Re

- Page 27 and 28: Photographs:© Chemring Group PLC

C H E M R I N G G R O U P P L CNotes to the <strong>Interim</strong> Statement- continued9. DETAIL ON IFRS CHANGES IMPACTING PUBLISHED RESULTS - continuedReconciliation of profit for the year ended 31 October 2005Continuing operations:UK GAAP£000UnauditedEffect oftransition toIFRS£000IFRS£000Revenue120,963-120,963Operating profitShare of results of associateFinance expense22,623197(2,964)(573)--22,050197(2,964)Profit before taxationTax19,856(5,778)(573)5419,283(5,724)Profit for the year from continuing operationsDiscontinued operations:Loss for the year from discontinued operations14,078(4,790)(519)-13,559(4,790)Profit for the year9,288(519)8,769Analysis of movement due to IFRSNoteOperatingprofit£000Profitbefore tax£000Profit/(loss)for the period£000UK GAAP22,62319,85614,078Amortisation of acquired intangible assetsShare-based paymentsRetirement benefit scheme fair value adjustmentTranslation of foreign currency transactionsAccrued employee benefit adjustmentIncome tax adjustmentABCECF(71)(477)17(48)6-(71)(477)17(48)6-(71)(382)12(34)6(50)(573)(573)(519)IFRS22,05019,28313,559P 22