Chemring Interim 2006 - Chemring Group PLC

Chemring Interim 2006 - Chemring Group PLC Chemring Interim 2006 - Chemring Group PLC

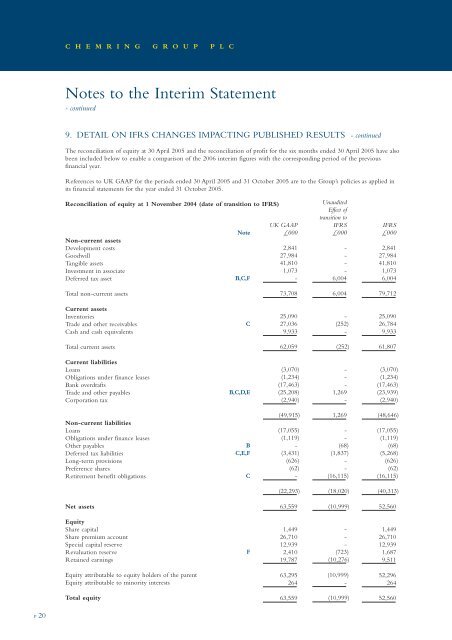

C H E M R I N G G R O U P P L CNotes to the Interim Statement- continued9. DETAIL ON IFRS CHANGES IMPACTING PUBLISHED RESULTS - continuedThe reconciliation of equity at 30 April 2005 and the reconciliation of profit for the six months ended 30 April 2005 have alsobeen included below to enable a comparison of the 2006 interim figures with the corresponding period of the previousfinancial year.References to UK GAAP for the periods ended 30 April 2005 and 31 October 2005 are to the Group’s policies as applied inits financial statements for the year ended 31 October 2005.Reconciliation of equity at 1 November 2004 (date of transition to IFRS)Non-current assetsDevelopment costsGoodwillTangible assetsInvestment in associateDeferred tax assetNoteB,C,FUK GAAP£0002,84127,98441,8101,073-UnauditedEffect oftransition toIFRS£000----6,004IFRS£0002,84127,98441,8101,0736,004Total non-current assets73,7086,00479,712Current assetsInventoriesTrade and other receivablesCash and cash equivalentsC25,09027,0369,933-(252)-25,09026,7849,933Total current assets62,059(252)61,807Current liabilitiesLoansObligations under finance leasesBank overdraftsTrade and other payablesCorporation taxB,C,D,E(3,070)(1,234)(17,463)(25,208)(2,940)---1,269-(3,070)(1,234)(17,463)(23,939)(2,940)Non-current liabilitiesLoansObligations under finance leasesOther payablesDeferred tax liabilitiesLong-term provisionsPreference sharesRetirement benefit obligationsBC,E,FC(49,915)(17,055)(1,119)-(3,431)(626)(62)-1,269--(68)(1,837)--(16,115)(48,646)(17,055)(1,119)(68)(5,268)(626)(62)(16,115)(22,293)(18,020)(40,313)Net assets63,559(10,999)52,560EquityShare capitalShare premium accountSpecial capital reserveRevaluation reserveRetained earningsF1,44926,71012,9392,41019,787---(723)(10,276)1,44926,71012,9391,6879,511Equity attributable to equity holders of the parentEquity attributable to minority interests63,295264(10,999)-52,296264Total equity63,559(10,999)52,560P 20

I N T E R I M R E P O R T 2 0 0 6Reconciliation of equity at 31 October 2005 (date of last UK GAAP Financial Statements)Non-current assetsIntangible assetsDevelopment costsGoodwillTangible assetsInvestment in associateDeferred tax assetsNoteAAB,C,FUK GAAP£000-54135,05850,6981,068-UnauditedEffect oftransition toIFRS£0002,929-(378)--7,440IFRS£0002,92954134,68050,6981,0687,440Total non-current assets87,3659,99197,356Current assetsInventoriesTrade and other receivablesCash and cash equivalentsAssets classified as held for saleC,E27,82127,4507,77414,646-(282)--27,82127,1687,77414,646Total current assets77,691(282)77,409Current liabilitiesLoansObligations under finance leasesBank overdraftsTrade and other payablesCorporation taxLiabilities classified as held for saleB,C,D,E(1,957)(925)(10,744)(26,474)(1,150)(1,776)---1,226--(1,957)(925)(10,744)(25,248)(1,150)(1,776)(43,026)1,226(41,800)Non-current liabilitiesLoansObligations under finance leasesOther payablesDeferred tax liabilitiesLong-term provisionsPreference sharesRetirement benefit obligationsBA,C,E,FC(46,320)(602)-(4,457)(170)(62)---(163)(4,501)--(20,189)(46,320)(602)(163)(8,958)(170)(62)(20,189)(51,611)(24,853)(76,464)Net assets70,419(13,918)56,501EquityShare capitalShare premium accountSpecial capital reserveRevaluation reserveRetained earningsF1,45927,27412,9392,37426,096---(734)(13,184)1,45927,27412,9391,64012,912Equity attributable to equity holders of the parentEquity attributable to minority interests70,142277(13,918)-56,224277Total equity70,419(13,918)56,501P 21

- Page 1 and 2: I N T E R I M R E P O R T2 0 0 6C H

- Page 3 and 4: I N T E R I M R E P O R T 2 0 0 6Co

- Page 5 and 6: I N T E R I M R E P O R T 2 0 0 6Th

- Page 7 and 8: I N T E R I M R E P O R T 2 0 0 6ha

- Page 9 and 10: I N T E R I M R E P O R T 2 0 0 6Un

- Page 11 and 12: I N T E R I M R E P O R T 2 0 0 6Re

- Page 13 and 14: I N T E R I M R E P O R T 2 0 0 6No

- Page 15 and 16: I N T E R I M R E P O R T 2 0 0 6No

- Page 17 and 18: I N T E R I M R E P O R T 2 0 0 62.

- Page 19 and 20: I N T E R I M R E P O R T 2 0 0 66.

- Page 21: I N T E R I M R E P O R T 2 0 0 69.

- Page 25 and 26: I N T E R I M R E P O R T 2 0 0 6Re

- Page 27 and 28: Photographs:© Chemring Group PLC

C H E M R I N G G R O U P P L CNotes to the <strong>Interim</strong> Statement- continued9. DETAIL ON IFRS CHANGES IMPACTING PUBLISHED RESULTS - continuedThe reconciliation of equity at 30 April 2005 and the reconciliation of profit for the six months ended 30 April 2005 have alsobeen included below to enable a comparison of the <strong>2006</strong> interim figures with the corresponding period of the previousfinancial year.References to UK GAAP for the periods ended 30 April 2005 and 31 October 2005 are to the <strong>Group</strong>’s policies as applied inits financial statements for the year ended 31 October 2005.Reconciliation of equity at 1 November 2004 (date of transition to IFRS)Non-current assetsDevelopment costsGoodwillTangible assetsInvestment in associateDeferred tax assetNoteB,C,FUK GAAP£0002,84127,98441,8101,073-UnauditedEffect oftransition toIFRS£000----6,004IFRS£0002,84127,98441,8101,0736,004Total non-current assets73,7086,00479,712Current assetsInventoriesTrade and other receivablesCash and cash equivalentsC25,09027,0369,933-(252)-25,09026,7849,933Total current assets62,059(252)61,807Current liabilitiesLoansObligations under finance leasesBank overdraftsTrade and other payablesCorporation taxB,C,D,E(3,070)(1,234)(17,463)(25,208)(2,940)---1,269-(3,070)(1,234)(17,463)(23,939)(2,940)Non-current liabilitiesLoansObligations under finance leasesOther payablesDeferred tax liabilitiesLong-term provisionsPreference sharesRetirement benefit obligationsBC,E,FC(49,915)(17,055)(1,119)-(3,431)(626)(62)-1,269--(68)(1,837)--(16,115)(48,646)(17,055)(1,119)(68)(5,268)(626)(62)(16,115)(22,293)(18,020)(40,313)Net assets63,559(10,999)52,560EquityShare capitalShare premium accountSpecial capital reserveRevaluation reserveRetained earningsF1,44926,71012,9392,41019,787---(723)(10,276)1,44926,71012,9391,6879,511Equity attributable to equity holders of the parentEquity attributable to minority interests63,295264(10,999)-52,296264Total equity63,559(10,999)52,560P 20