The BRICS Securities and Derivatives Markets - Hong Kong ...

The BRICS Securities and Derivatives Markets - Hong Kong ...

The BRICS Securities and Derivatives Markets - Hong Kong ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

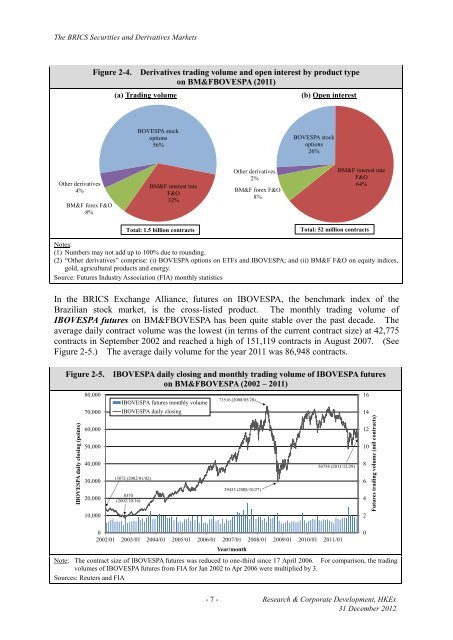

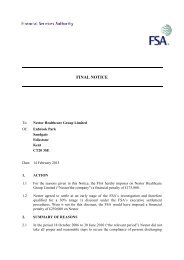

IBOVESPA daily closing (points)Futures trading volume (mil contracts)<strong>The</strong> <strong>BRICS</strong> <strong>Securities</strong> <strong>and</strong> <strong>Derivatives</strong> <strong>Markets</strong>Figure 2-4. <strong>Derivatives</strong> trading volume <strong>and</strong> open interest by product typeon BM&FBOVESPA (2011)BM&FBOVESPA — <strong>Derivatives</strong> market open interest by product type (2011)BM&FBOVESPA — <strong>Derivatives</strong> market trading volume by product type (2011)(a) Trading volume(b) Open interestBOVESPA stockoptions56%BOVESPA stockoptions26%Other derivatives4%BM&F forex F&O8%BM&F interest rateF&O32%Other derivatives2%BM&F forex F&O8%BM&F interest rateF&O64%Notes:Notes:(1) Numbers may not add up to 100 per cent due to rounding.(2) “Other derivatives” comprise: (i) BOVESPA options on ETFs <strong>and</strong> IBOVESPA; <strong>and</strong> (ii) BM&F F&O on equity indic(2) “Other derivatives” comprise: (i) BOVESPA options on ETFs <strong>and</strong> IBOVESPA; <strong>and</strong> (ii) BM&F F&O on equity indices,Notes:(1) Numbers may not add up to 100 per cent due to rounding.(1) Numbers may not add up to 100% due to rounding.gold, agricultural products <strong>and</strong> energy.gold, agricultural (2) “Other products derivatives” <strong>and</strong> energy. comprise: (i) BOVESPA options on ETFs <strong>and</strong> IBOVESPA; <strong>and</strong> (ii) BM&F F&O on equity indices,Source: Futures Industry Association (FIA)gold, agricultural products <strong>and</strong> energy.Source: Futures Industry Association (FIA) monthly statisticsSource: Futures Industry Association (FIA)Total: 1.5 billion contractsTotal: 52 million contractsIn the <strong>BRICS</strong> Exchange Alliance, futures on IBOVESPA, the benchmark index of theBrazilian stock market, is the cross-listed product. <strong>The</strong> monthly trading volume ofIBOVESPA futures on BM&FBOVESPA has been quite stable over the past decade. <strong>The</strong>average daily contract volume was the lowest (in terms of the current contract size) at 42,775contracts in September 2002 <strong>and</strong> reached a high of 151,119 contracts in August 2007. (SeeFigure 2-5.) <strong>The</strong> average daily volume for the year 2011 was 86,948 contracts.Figure 2-5. IBOVESPA daily closing <strong>and</strong> monthly trading volume of IBOVESPA futuresIBOVESPA daily on closing BM&FBOVESPA <strong>and</strong> monthly trading volume (2002 of – IBOVESPA 2011) futures (2002 - 2011)80,00070,000IBOVESPA futures monthly volumeIBOVESPA daily closing73516 (2008/05/20)161460,0001250,0001040,00056754 (2011/12/29)830,00013872 (2002/01/02)620,0008370(2002/10/16)29435 (2008/10/27)410,0002002002/01 2003/01 2004/01 2005/01 2006/01 2007/01 2008/01 2009/01 2010/01 2011/01Year/monthNote: <strong>The</strong> Note: contract <strong>The</strong> contract size size of of IBOVESPA futures was reduced to one-third to since since 17 April 172006. April For 2006. comparison, For comparison, the trading the tradingvolumes volumes of IBOVESPA of IBOVESPA futures futures from FIA for Jan 2002 to to Apr Apr 2006 2006 were were multiplied multiplied by 3. by 3.Sources: Reuters <strong>and</strong> Futures Industry Association (FIA)Sources: Reuters <strong>and</strong> FIA- 7 - Research & Corporate Development, HKEx31 December 2012