The BRICS Securities and Derivatives Markets - Hong Kong ...

The BRICS Securities and Derivatives Markets - Hong Kong ...

The BRICS Securities and Derivatives Markets - Hong Kong ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

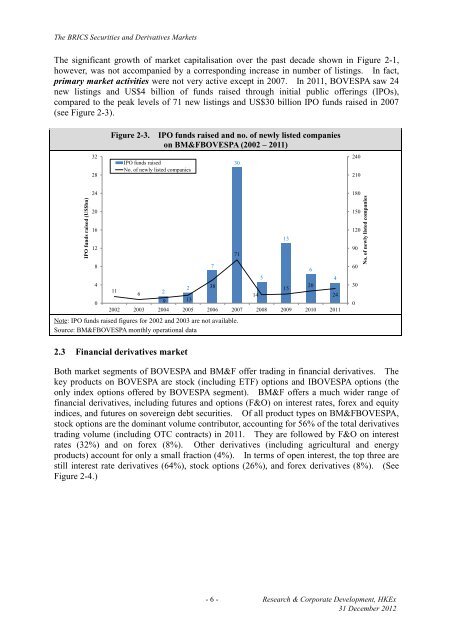

IPO funds raised (US$bn)No. of newly listed companies<strong>The</strong> <strong>BRICS</strong> <strong>Securities</strong> <strong>and</strong> <strong>Derivatives</strong> <strong>Markets</strong><strong>The</strong> significant growth of market capitalisation over the past decade shown in Figure 2-1,however, was not accompanied by a corresponding increase in number of listings. In fact,primary market activities were not very active except in 2007. In 2011, BOVESPA saw 24new listings <strong>and</strong> US$4 billion of funds raised through initial public offerings (IPOs),compared to the peak levels of 71 new listings <strong>and</strong> US$30 billion IPO funds raised in 2007(see Figure 2-3).3228Figure 2-3. IPO funds raised <strong>and</strong> no. of newly listed companiesIPO funds raised on BM&FBOVESPA <strong>and</strong> no. of newly listed companies (2002 on – BM&FBOVESPA 2011) (2002 - 2011)IPO funds raisedNo. of newly listed companies30240210241802015016127113120908765442 3820111562149 130242002 2003 2004 2005 2006 2007 2008 2009 2010 2011Note: IPO funds raised figures for 2002 <strong>and</strong> 2003 are not Note: IPO funds raised figures for 2002 <strong>and</strong> 2003 are available.Source: BM&FBOVESPASource: BM&FBOVESPA monthly operational data603002.3 Financial derivatives marketBoth market segments of BOVESPA <strong>and</strong> BM&F offer trading in financial derivatives. <strong>The</strong>key products on BOVESPA are stock (including ETF) options <strong>and</strong> IBOVESPA options (theonly index options offered by BOVESPA segment). BM&F offers a much wider range offinancial derivatives, including futures <strong>and</strong> options (F&O) on interest rates, forex <strong>and</strong> equityindices, <strong>and</strong> futures on sovereign debt securities. Of all product types on BM&FBOVESPA,stock options are the dominant volume contributor, accounting for 56% of the total derivativestrading volume (including OTC contracts) in 2011. <strong>The</strong>y are followed by F&O on interestrates (32%) <strong>and</strong> on forex (8%). Other derivatives (including agricultural <strong>and</strong> energyproducts) account for only a small fraction (4%). In terms of open interest, the top three arestill interest rate derivatives (64%), stock options (26%), <strong>and</strong> forex derivatives (8%). (SeeFigure 2-4.)- 6 - Research & Corporate Development, HKEx31 December 2012