Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

Trust Board papers - University Hospital Southampton NHS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

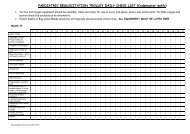

managed out, these reserves will become available to put into the central “bank” towhich bids for funding to improve services, quality and the hospital environment, canbe made.Cash & LiquidityThe period end cash balance at £16.3m was £6.9m below plan due mainly toincreased working capital balances(£4.1m) higher net capital expenditure (£2.2m)and lower cash generated from earnings (£0.9m) partly offset by lower financingcosts (£0.3m).The year end cash forecast at £15.7m is £4.7m lower than plan due mainly to highernon cash income within the <strong>Trust</strong> planned surplus and less external income tosupport the capital programme.With a working capital facility in place of £43m, the current financial position resultsin a liquidity rating of 3 and an overall Monitor risk rating of 3 (Schedule 1 and Annex5). This is forecast to remain a 3 at the year end.Schedule 1 also shows some key balance sheet indicators.Annex 4 shows cumulative capital expenditure compared to Plan. £12.7m has beenspent to date, £1.1m less than the updated Plan. £1.9m of new finance leases havebeen taken out in the first eight months of the year, compared to a Plan of £3.9m.ForecastA review of the year end Forecast was carried out in the light of October’s results.Whilst the forecast remains in line with Plan there was a level of control actionrequired to ensure the <strong>Trust</strong> delivers the planned surplus for the year. There will be afurther review of progress following the production of the November.RisksIdentifiedDescriptionPotentialValue £mLikelihoodWeightedvalue £mMitigationRisksOveralldemandlevelsThe <strong>Trust</strong> isanticipating incomein excess ofcontracted levels,based on capacityin place to deliveranticipated demandand experience ofdrug growth£15m L -10%£1.5m Ensure that paymentsfor overperformanceare secured. If activitydoes not occur ensurethat capacity andcosts are reducedaccordingly.CIPsNon-delivery ofCIPs£5m M –50%£2.5m Strong performancemanagementActivityManagementCost reductionrequired inresponse tosuccessful ActivityManagement.(NB: This risk andthe risks regarding“overall demandlevels” abovecannot becompounded).£5m L –10%£0.5m Ensure fullengagement in ActivityManagement; ensurecosts which can beremoved are removed.DivisionaloverspendingRisks ofoverspending dueto operationalpressures, capacityissues etc£10m M-50%£5.0m Strong performancemanagement.6