Group - L. Possehl & Co. mbH

Group - L. Possehl & Co. mbH Group - L. Possehl & Co. mbH

CaPitaL ExPENditUrE aNd fiNaNCiNG financing Strategy L. Possehl as the management holding company is primarily responsible for the financial management of the Possehl Group. The primary objective of centralized financial management is to ensure the liquidity and creditworthiness of the Group. The reduction in the cost of capital, the optimization of the capital structure, and effective risk management are contributing factors. We decide on a case-by-case basis whether liquidity is distributed internally within the Group from a central source or held decentrally in the individual companies. The same applies to the assumption of financial assistance in the form of parent guarantees or other backing by L. Possehl. Financial transfers for the companies in Germany are carried out via a cash management system. Our policy on assuming debt is conservative and designed for flexibility. Along with long-term loans we particularly take advantage of short-term bank credits. An asset-backed securities program in the International Trading division is also at our disposal. We use financial derivatives to hedge risks from operations and financial transactions. However, we do not enter into any contracts without an underlying core transaction. CHANGES IN CASH FLOW AND CAPITAL ExPENDITURE in € million 2007 2006 Cash flow from operating activities 84.6 97.9 Cash flow from investing activities 52.8 -102.2 Cash flow from financing activities 2.6 -11.8 Changes in cash or cash equivalents over the period Cash and cash equivalents 140.0 -16.1 on December 31 179.9 42.0 Cash flow from operating activities exceeded consolidated net income excluding extraordinary items as in the previous year. The decline of € 13.3 million from the previous year stemmed primarily from lower provisions adjusted for changes in the group of consolidated companies. In addition, higher tax payments reduced cash flow from operating activities. 24 Cash flow from investing activities was € 52.8 million in the reporting period after € -102.2 million in the previous year. This significant change resulted primarily from proceeds from the sale of the NA equity stake. Expenditures for acquisitions were € 29.8 million in the reporting year and primarily involved the acquisition of the remaining shares in Hako and the purchase of Pomini. In 2007, expenditures on property, plant, and equipment plus intangible assets were € 22.4 million. They were approximately 28 % less than in the previous year, which included expenditures for building a new factory in Dongguan. Excluding this extraordinary item, capital expenditures remained at the same level as in the previous year. Capital expenditures on property, plant, and equipment plus intangible assets were slightly below depreciation and amortization. Capital expenditures net of acquisitions were mainly related to the Production segment and there specifically to the areas of Cleaning Machines (€ 9.5 million), Electronics (€ 4.4 million), and Elastomer Processing (€ 2.7 million). Expenditures were devoted primarily to the planned modernization of manufacturing sites, environmental protection, and information technology. Otherwise, capital expenditure was mainly to replace assets. The financing of capital expenditures on intangible assets plus property, plant, and equipment came almost exclusively from cash flow from operating activities. We obtained favorable borrowing terms for the medium-term and long-term external financing of the remaining shares in Hako. Cash and Cash Equivalents and Net debt As of December 31, 2007, the Group had cash and cash equivalents of € 179.9 million, which were completely available for financing future growth. The Group’s net debt declined by € 123.0 million. At the end of the fiscal year, the Possehl Group had positive net liquidity of € 6.1 million and thus was on balance debt free. The other liquidity and leverage key figures are on a highly solid basis.

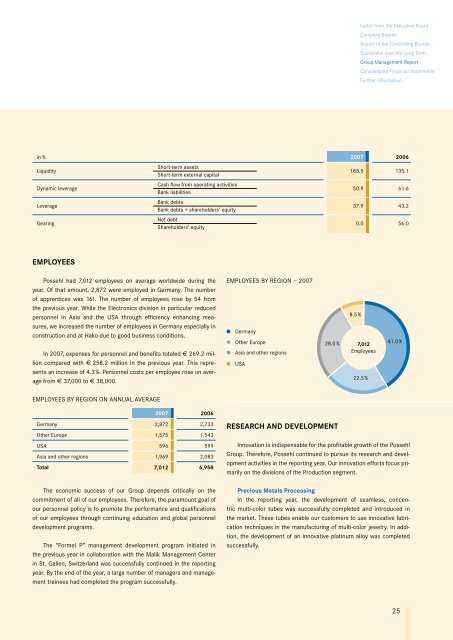

Letter from the Executive Board Company Boards Report of the Controlling Boards Successful over the Long Term Group Management Report Consolidated Financial Statements Further Information in % 2007 2006 Liquidity Dynamic leverage Leverage Gearing EMPLoyEES Short-term assets Short-term external capital Cash flow from operating activities Bank liabilities Bank debts Bank debts + shareholders’ equity Net debt Shareholders’ equity Possehl had 7,012 employees on average worldwide during the year. Of that amount, 2,872 were employed in Germany. The number of apprentices was 161. The number of employees rose by 54 from the previous year. While the Electronics division in particular reduced personnel in Asia and the USA through efficiency enhancing measures, we increased the number of employees in Germany especially in construction and at Hako due to good business conditions. In 2007, expenses for personnel and benefits totaled € 269.2 million compared with € 258.2 million in the previous year. This represents an increase of 4.3 %. Personnel costs per employee rose on average from € 37,000 to € 38,000. EMPLOYEES BY REGION ON ANNUAL AVERAGE 2007 2006 Germany 2,872 2,733 Other Europe 1,575 1,543 USA 596 599 Asia and other regions 1,969 2,083 total 7,012 6,958 The economic success of our Group depends critically on the commitment of all of our employees. Therefore, the paramount goal of our personnel policy is to promote the performance and qualifications of our employees through continuing education and global personnel development programs. The “Formel P” management development program initiated in the previous year in collaboration with the Malik Management Center in St. Gallen, Switzerland was successfully continued in the reporting year. By the end of the year, a large number of managers and management trainees had completed the program successfully. EMPLOYEES BY REGION – 2007 Germany Other Europe Asia and other regions USA 28.0 % rESEarCH aNd dEvELoPMENt 183.5 135.1 50.9 61.6 37.9 43.2 8.5 % 0.0 56.0 7,012 Employees 22.5 % 41.0 % Innovation is indispensable for the profitable growth of the Possehl Group. Therefore, Possehl continued to pursue its research and development activities in the reporting year. Our innovation efforts focus primarily on the divisions of the Production segment. Precious Metals Processing In the reporting year, the development of seamless, concentric multi-color tubes was successfully completed and introduced in the market. These tubes enable our customers to use innovative fabrication techniques in the manufacturing of multi-color jewelry. In addition, the development of an innovative platinum alloy was completed successfully. 25

- Page 1 and 2: Annual Report 2007 Successful over

- Page 3 and 4: Possehl - the Entrepreneurs’ Gr C

- Page 5 and 6: Table of Contents Letter from the E

- Page 7 and 8: Uwe Lüders, Born 1952, Dipl.-Volks

- Page 9 and 10: dr. Lutz Peters Letter from the Exe

- Page 11 and 12: All of this is essential for the su

- Page 13 and 14: The organizational structure of Pos

- Page 15 and 16: Possehl initially becomes deeply in

- Page 17 and 18: Possehl views each of its companies

- Page 19 and 20: ovErviEW of tHE ECoNoMiC CoNditioN

- Page 21 and 22: StratEGiC dirECtioN aNd MaNaGEMENt

- Page 23 and 24: The increase in net sales came prim

- Page 25 and 26: Cleaning Machines: Significant Grow

- Page 27: BALANCE SHEET STRUCTURE Fixed asset

- Page 31 and 32: The regular reporting is supplement

- Page 33 and 34: EPort oN SUBSEqUENt EvENtS, oPPortU

- Page 35 and 36: Consolidated Balance Sheet as of De

- Page 37 and 38: Consolidated Cash flow Statement fr

- Page 39 and 40: Cumulative 01/01/2007 Exchange rate

- Page 41 and 42: Group shareholders’ equity withou

- Page 43 and 44: Equity is consolidated under the eq

- Page 45 and 46: The biometric data underlying the m

- Page 47 and 48: As per the balance sheet date, the

- Page 49 and 50: NotES to tHE CoNSoLidatEd iNCoME St

- Page 51 and 52: NotES to tHE CoNSoLidatEd CaSH fLoW

- Page 53 and 54: auditors’ report * We have audite

- Page 55 and 56: Name Registered in Letter from the

- Page 57 and 58: CONTACT AND IMPRINT L. Possehl & Co

Letter from the Executive Board<br />

<strong>Co</strong>mpany Boards<br />

Report of the <strong>Co</strong>ntrolling Boards<br />

Successful over the Long Term<br />

<strong>Group</strong> Management Report<br />

<strong>Co</strong>nsolidated Financial Statements<br />

Further Information<br />

in % 2007 2006<br />

Liquidity<br />

Dynamic leverage<br />

Leverage<br />

Gearing<br />

EMPLoyEES<br />

Short-term assets<br />

Short-term external capital<br />

Cash flow from operating activities<br />

Bank liabilities<br />

Bank debts<br />

Bank debts + shareholders’ equity<br />

Net debt<br />

Shareholders’ equity<br />

<strong>Possehl</strong> had 7,012 employees on average worldwide during the<br />

year. Of that amount, 2,872 were employed in Germany. The number<br />

of apprentices was 161. The number of employees rose by 54 from<br />

the previous year. While the Electronics division in particular reduced<br />

personnel in Asia and the USA through efficiency enhancing measures,<br />

we increased the number of employees in Germany especially in<br />

construction and at Hako due to good business conditions.<br />

In 2007, expenses for personnel and benefits totaled € 269.2 million<br />

compared with € 258.2 million in the previous year. This represents<br />

an increase of 4.3 %. Personnel costs per employee rose on average<br />

from € 37,000 to € 38,000.<br />

EMPLOYEES BY REGION ON ANNUAL AVERAGE<br />

2007 2006<br />

Germany 2,872 2,733<br />

Other Europe 1,575 1,543<br />

USA 596 599<br />

Asia and other regions 1,969 2,083<br />

total 7,012 6,958<br />

The economic success of our <strong>Group</strong> depends critically on the<br />

commitment of all of our employees. Therefore, the paramount goal of<br />

our personnel policy is to promote the performance and qualifications<br />

of our employees through continuing education and global personnel<br />

development programs.<br />

The “Formel P” management development program initiated in<br />

the previous year in collaboration with the Malik Management Center<br />

in St. Gallen, Switzerland was successfully continued in the reporting<br />

year. By the end of the year, a large number of managers and management<br />

trainees had completed the program successfully.<br />

EMPLOYEES BY REGION – 2007<br />

Germany<br />

Other Europe<br />

Asia and other regions<br />

USA<br />

28.0 %<br />

rESEarCH aNd dEvELoPMENt<br />

183.5 135.1<br />

50.9 61.6<br />

37.9 43.2<br />

8.5 %<br />

0.0 56.0<br />

7,012<br />

Employees<br />

22.5 %<br />

41.0 %<br />

Innovation is indispensable for the profitable growth of the <strong>Possehl</strong><br />

<strong>Group</strong>. Therefore, <strong>Possehl</strong> continued to pursue its research and development<br />

activities in the reporting year. Our innovation efforts focus primarily<br />

on the divisions of the Production segment.<br />

Precious Metals Processing<br />

In the reporting year, the development of seamless, concentric<br />

multi-color tubes was successfully completed and introduced in<br />

the market. These tubes enable our customers to use innovative fabrication<br />

techniques in the manufacturing of multi-color jewelry. In addition,<br />

the development of an innovative platinum alloy was completed<br />

successfully.<br />

25