Group - L. Possehl & Co. mbH

Group - L. Possehl & Co. mbH

Group - L. Possehl & Co. mbH

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The increase in net sales came primarily from Germany and other<br />

European countries, while net sales in North America sank as a result<br />

of declines in the US dollar and trading activity. Germany accounted<br />

for approximately 42 % of total sales versus 39 % in the previous year.<br />

ordinary Earnings Before taxes increased again<br />

After ordinary earnings before taxes reached a record of<br />

e 73.9 million in the previous year, this record was broken again<br />

during the reporting year by approximately 2 %. This development is<br />

particularly encouraging as we succeeded in compensating for lower<br />

earnings in the Electronics segment through growth in the other<br />

segments. As a percentage of sales, ordinary earnings before taxes<br />

amounted to 4.9 % after 5.1 % in the previous year. While we could<br />

largely pass along higher prices for raw materials in the form of<br />

higher selling prices, the weak US dollar negatively influenced the<br />

<strong>Group</strong>’s success in the reporting year.<br />

the Gain on Sale Leads to a Large Extraordinary result<br />

The extraordinary result contains a e 59.7 million gain on the sale<br />

of our 10 % equity stake in Norddeutsche Affinerie AG (NA). We used<br />

a portion of the gain in the amount of e 10.2 million to pay for the<br />

transition from German to international accounting rules, specifically<br />

by accounting for pension liabilities immediately according to International<br />

Financial Reporting Standards (IFRS).<br />

Substantial increase in <strong>Co</strong>nsolidated Net Profit<br />

The consolidated net profit rose by e 15.0 million or 15.1 % to<br />

e 114.1 million. Along with the slight increase in operating earnings,<br />

the higher extraordinary result was primarily responsible for the improvement.<br />

The <strong>Group</strong>’s tax expenses remained low particularly as a<br />

result of the utilization of loss carry-forwards in Germany as well as<br />

tax rebates. Income taxes as a proportion of ordinary earnings before<br />

taxes amounted to 10.7 % after 7.1 % in the previous year.<br />

The pre-tax return on equity amounted to 27.6 % in the reporting<br />

year. Despite the increase in earnings, it declined by 7.7 percentage<br />

points from the prior year as a result of a significant increase in shareholders’<br />

equity. The EBIT return on sales was 5.6 %, slightly lower than<br />

in the previous year.<br />

EarNiNGS PoSitioN iN tHE<br />

oPEratioNaL SEGMENtS<br />

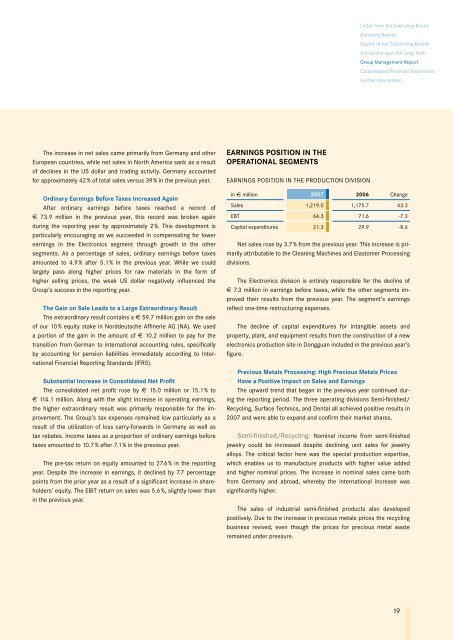

EARNINGS POSITION IN THE PRODUCTION DIVISION<br />

Letter from the Executive Board<br />

<strong>Co</strong>mpany Boards<br />

Report of the <strong>Co</strong>ntrolling Boards<br />

Successful over the Long Term<br />

<strong>Group</strong> Management Report<br />

<strong>Co</strong>nsolidated Financial Statements<br />

Further Information<br />

in e million 2007 2006 Change<br />

Sales 1,219.0 1,175.7 43.3<br />

EBT 64.3 71.6 -7.3<br />

Capital expenditures 21.3 29.9 -8.6<br />

Net sales rose by 3.7 % from the previous year. This increase is primarily<br />

attributable to the Cleaning Machines and Elastomer Processing<br />

divisions.<br />

The Electronics division is entirely responsible for the decline of<br />

e 7.3 million in earnings before taxes, while the other segments improved<br />

their results from the previous year. The segment’s earnings<br />

reflect one-time restructuring expenses.<br />

The decline of capital expenditures for intangible assets and<br />

property, plant, and equipment results from the construction of a new<br />

electronics production site in Dongguan included in the previous year’s<br />

figure.<br />

Precious Metals Processing: High Precious Metals Prices<br />

Have a Positive impact on Sales and Earnings<br />

The upward trend that began in the previous year continued during<br />

the reporting period. The three operating divisions Semi-finished/<br />

Recycling, Surface Technics, and Dental all achieved positive results in<br />

2007 and were able to expand and confirm their market shares.<br />

Semi-finished/Recycling: Nominal income from semi-finished<br />

jewelry could be increased despite declining unit sales for jewelry<br />

alloys. The critical factor here was the special production expertise,<br />

which enables us to manufacture products with higher value added<br />

and higher nominal prices. The increase in nominal sales came both<br />

from Germany and abroad, whereby the international increase was<br />

significantly higher.<br />

The sales of industrial semi-finished products also developed<br />

positively. Due to the increase in precious metals prices the recycling<br />

business revived, even though the prices for precious metal waste<br />

remained under pressure.<br />

19