Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

Notes to Financial Statements - BDO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

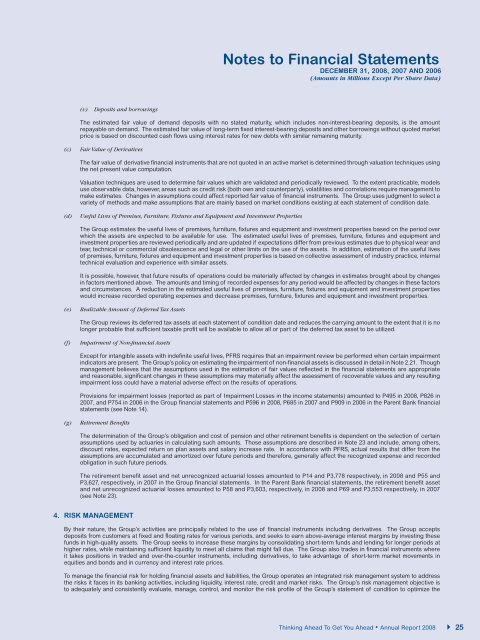

<strong>Notes</strong> <strong>to</strong> <strong>Financial</strong> <strong>Statements</strong>DECEMBER 31, 2008, 2007 AND 2006(Amounts in Millions Except Per Share Data)(v)Deposits and borrowingsThe estimated fair value of demand deposits with no stated maturity, which includes non-interest-bearing deposits, is the amountrepayable on demand. The estimated fair value of long-term fixed interest-bearing deposits and other borrowings without quoted marketprice is based on discounted cash flows using interest rates for new debts with similar remaining maturity.(c)Fair Value of DerivativesThe fair value of derivative financial instruments that are not quoted in an active market is determined through valuation techniques usingthe net present value computation.Valuation techniques are used <strong>to</strong> determine fair values which are validated and periodically reviewed. To the extent practicable, modelsuse observable data, however, areas such as credit risk (both own and counterparty), volatilities and correlations require management <strong>to</strong>make estimates. Changes in assumptions could affect reported fair value of financial instruments. The Group uses judgment <strong>to</strong> select avariety of methods and make assumptions that are mainly based on market conditions existing at each statement of condition date.(d)Useful Lives of Premises, Furniture, Fixtures and Equipment and Investment PropertiesThe Group estimates the useful lives of premises, furniture, fixtures and equipment and investment properties based on the period overwhich the assets are expected <strong>to</strong> be available for use. The estimated useful lives of premises, furniture, fixtures and equipment andinvestment properties are reviewed periodically and are updated if expectations differ from previous estimates due <strong>to</strong> physical wear andtear, technical or commercial obsolescence and legal or other limits on the use of the assets. In addition, estimation of the useful livesof premises, furniture, fixtures and equipment and investment properties is based on collective assessment of industry practice, internaltechnical evaluation and experience with similar assets.It is possible, however, that future results of operations could be materially affected by changes in estimates brought about by changesin fac<strong>to</strong>rs mentioned above. The amounts and timing of recorded expenses for any period would be affected by changes in these fac<strong>to</strong>rsand circumstances. A reduction in the estimated useful lives of premises, furniture, fixtures and equipment and investment propertieswould increase recorded operating expenses and decrease premises, furniture, fixtures and equipment and investment properties.(e)Realizable Amount of Deferred Tax AssetsThe Group reviews its deferred tax assets at each statement of condition date and reduces the carrying amount <strong>to</strong> the extent that it is nolonger probable that sufficient taxable profit will be available <strong>to</strong> allow all or part of the deferred tax asset <strong>to</strong> be utilized.(f)Impairment of Non-financial AssetsExcept for intangible assets with indefinite useful lives, PFRS requires that an impairment review be performed when certain impairmentindica<strong>to</strong>rs are present. The Group’s policy on estimating the impairment of non-financial assets is discussed in detail in Note 2.21. Thoughmanagement believes that the assumptions used in the estimation of fair values reflected in the financial statements are appropriateand reasonable, significant changes in these assumptions may materially affect the assessment of recoverable values and any resultingimpairment loss could have a material adverse effect on the results of operations.Provisions for impairment losses (reported as part of Impairment Losses in the income statements) amounted <strong>to</strong> P495 in 2008, P826 in2007, and P754 in 2006 in the Group financial statements and P596 in 2008, P685 in 2007 and P909 in 2006 in the Parent Bank financialstatements (see Note 14).(g)Retirement BenefitsThe determination of the Group’s obligation and cost of pension and other retirement benefits is dependent on the selection of certainassumptions used by actuaries in calculating such amounts. Those assumptions are described in Note 23 and include, among others,discount rates, expected return on plan assets and salary increase rate. In accordance with PFRS, actual results that differ from theassumptions are accumulated and amortized over future periods and therefore, generally affect the recognized expense and recordedobligation in such future periods.The retirement benefit asset and net unrecognized actuarial losses amounted <strong>to</strong> P14 and P3,778 respectively, in 2008 and P55 andP3,627, respectively, in 2007 in the Group financial statements. In the Parent Bank financial statements, the retirement benefit assetand net unrecognized actuarial losses amounted <strong>to</strong> P58 and P3,603, respectively, in 2008 and P69 and P3,553 respectively, in 2007(see Note 23).4. RISK MANAGEMENTBy their nature, the Group’s activities are principally related <strong>to</strong> the use of financial instruments including derivatives. The Group acceptsdeposits from cus<strong>to</strong>mers at fixed and floating rates for various periods, and seeks <strong>to</strong> earn above-average interest margins by investing thesefunds in high-quality assets. The Group seeks <strong>to</strong> increase these margins by consolidating short-term funds and lending for longer periods athigher rates, while maintaining sufficient liquidity <strong>to</strong> meet all claims that might fall due. The Group also trades in financial instruments whereit takes positions in traded and over-the-counter instruments, including derivatives, <strong>to</strong> take advantage of short-term market movements inequities and bonds and in currency and interest rate prices.To manage the financial risk for holding financial assets and liabilities, the Group operates an integrated risk management system <strong>to</strong> addressthe risks it faces in its banking activities, including liquidity, interest rate, credit and market risks. The Group’s risk management objective is<strong>to</strong> adequately and consistently evaluate, manage, control, and moni<strong>to</strong>r the risk profile of the Group’s statement of condition <strong>to</strong> optimize theThinking Ahead To Get You Ahead • Annual Report 2008 25