Anglo American Annual Report 2012

Anglo American Annual Report 2012

Anglo American Annual Report 2012

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

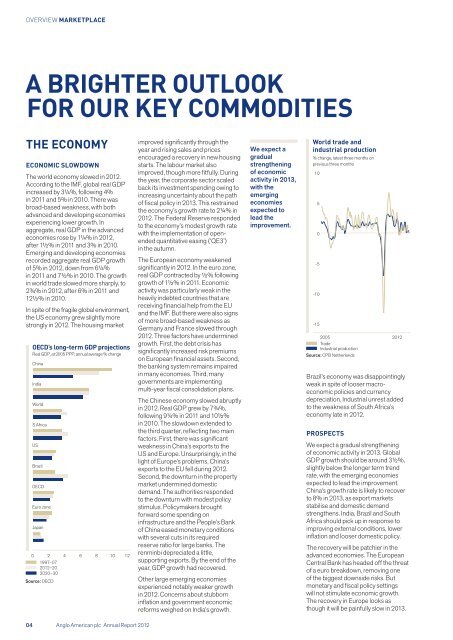

OVERVIEW MARKETPLACEA BRIGHTER OUTLOOKFOR OUR KEY COMMODITIESTHE ECONOMYECONOMIC SLOWDOWNThe world economy slowed in <strong>2012</strong>.According to the IMF, global real GDPincreased by 3¼%, following 4%in 2011 and 5% in 2010. There wasbroad-based weakness, with bothadvanced and developing economiesexperiencing lower growth. Inaggregate, real GDP in the advancedeconomies rose by 1¼% in <strong>2012</strong>,after 1½% in 2011 and 3% in 2010.Emerging and developing economiesrecorded aggregate real GDP growthof 5% in <strong>2012</strong>, down from 6¼%in 2011 and 7½% in 2010. The growthin world trade slowed more sharply, to2¾% in <strong>2012</strong>, after 6% in 2011 and12½% in 2010.In spite of the fragile global environment,the US economy grew slightly morestrongly in <strong>2012</strong>. The housing marketOECD’s long-term GDP projectionsReal GDP, at 2005 PPP, annual average % changeChinaIndiaWorldS AfricaUSBrazilOECDEuro zoneJapan0 2 4 6 8 10 121997–07<strong>2012</strong>–202020–30Source: OECDimproved significantly through theyear and rising sales and pricesencouraged a recovery in new housingstarts. The labour market alsoimproved, though more fitfully. Duringthe year, the corporate sector scaledback its investment spending owing toincreasing uncertainty about the pathof fiscal policy in 2013. This restrainedthe economy’s growth rate to 2¼% in<strong>2012</strong>. The Federal Reserve respondedto the economy’s modest growth ratewith the implementation of openendedquantitative easing (‘QE3’)in the autumn.The European economy weakenedsignificantly in <strong>2012</strong>. In the euro zone,real GDP contracted by ½% followinggrowth of 1½% in 2011. Economicactivity was particularly weak in theheavily indebted countries that arereceiving financial help from the EUand the IMF. But there were also signsof more broad-based weakness asGermany and France slowed through<strong>2012</strong>. Three factors have underminedgrowth. First, the debt crisis hassignificantly increased risk premiumson European financial assets. Second,the banking system remains impairedin many economies. Third, manygovernments are implementingmulti-year fiscal consolidation plans.The Chinese economy slowed abruptlyin <strong>2012</strong>. Real GDP grew by 7¾%,following 9¼% in 2011 and 10½%in 2010. The slowdown extended tothe third quarter, reflecting two mainfactors. First, there was significantweakness in China’s exports to theUS and Europe. Unsurprisingly, in thelight of Europe’s problems, China’sexports to the EU fell during <strong>2012</strong>.Second, the downturn in the propertymarket undermined domesticdemand. The authorities respondedto the downturn with modest policystimulus. Policymakers broughtforward some spending oninfrastructure and the People’s Bankof China eased monetary conditionswith several cuts in its requiredreserve ratio for large banks. Therenminbi depreciated a little,supporting exports. By the end of theyear, GDP growth had recovered.Other large emerging economiesexperienced notably weaker growthin <strong>2012</strong>. Concerns about stubborninflation and government economicreforms weighed on India’s growth.We expect agradualstrengtheningof economicactivity in 2013,with theemergingeconomiesexpected tolead theimprovement.World trade andindustrial production% change, latest three months onprevious three months1050-5-10-152005TradeIndustrial productionSource: CPB Netherlands<strong>2012</strong>Brazil’s economy was disappointinglyweak in spite of looser macroeconomicpolicies and currencydepreciation. Industrial unrest addedto the weakness of South Africa’seconomy late in <strong>2012</strong>.PROSPECTSWe expect a gradual strengtheningof economic activity in 2013. GlobalGDP growth should be around 3½%,slightly below the longer term trendrate, with the emerging economiesexpected to lead the improvement.China’s growth rate is likely to recoverto 8% in 2013, as export marketsstabilise and domestic demandstrengthens. India, Brazil and SouthAfrica should pick up in response toimproving external conditions, lowerinflation and looser domestic policy.The recovery will be patchier in theadvanced economies. The EuropeanCentral Bank has headed off the threatof a euro breakdown, removing oneof the biggest downside risks. Butmonetary and fiscal policy settingswill not stimulate economic growth.The recovery in Europe looks asthough it will be painfully slow in 2013.04 <strong>Anglo</strong> <strong>American</strong> plc <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>

![English PDF [ 189KB ] - Anglo American](https://img.yumpu.com/50470814/1/184x260/english-pdf-189kb-anglo-american.jpg?quality=85)

![pdf [ 595KB ] - Anglo American](https://img.yumpu.com/49420483/1/184x260/pdf-595kb-anglo-american.jpg?quality=85)

![pdf [ 1.1MB ] - Anglo American](https://img.yumpu.com/49057963/1/190x240/pdf-11mb-anglo-american.jpg?quality=85)