Sub: Request for Bonding Authorised Signatory - STPI

Sub: Request for Bonding Authorised Signatory - STPI

Sub: Request for Bonding Authorised Signatory - STPI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

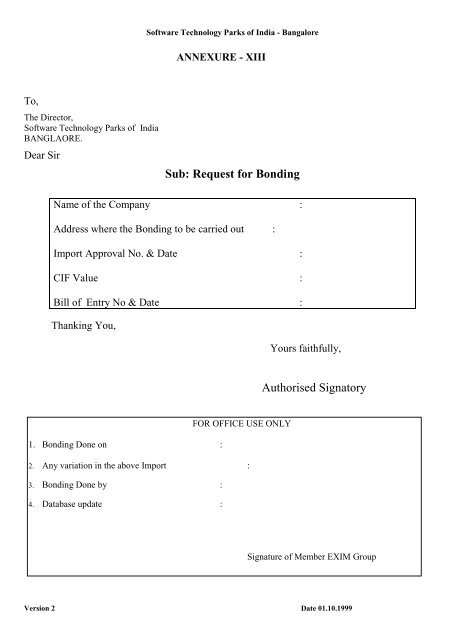

Software Technology Parks of India - BangaloreANNEXURE - XIIITo,The Director,Software Technology Parks of IndiaBANGLAORE.Dear Sir<strong>Sub</strong>: <strong>Request</strong> <strong>for</strong> <strong>Bonding</strong>Name of the Company :Address where the <strong>Bonding</strong> to be carried out :Import Approval No. & Date :CIF Value :Bill of Entry No & Date :Thanking You,Yours faithfully,<strong>Authorised</strong> <strong>Signatory</strong>FOR OFFICE USE ONLY1. <strong>Bonding</strong> Done on :2. Any variation in the above Import :3. <strong>Bonding</strong> Done by :4. Database update :Signature of Member EXIM GroupVersion 2 Date 01.10.1999

Software Technology Parks of India - Bangalore5. Particulars of maximum stock actually held at any one time under the expiring license (<strong>for</strong> use in case of renewalsonly).(a) Date :(b) No. of packages :(c) Value :(d) Duty :6. Particulars of any change in proprietorship of the firm since date of last renewal. (to be filled by firms applying <strong>for</strong>renewal)7. Particulars of premises to be licensed.(a) Name and address of the owner(b) Place at which situated(c) Dimensions (in feet)(i) Length(ii) Breadth(iii) Height(d) Distance from Custom House.Note : If more than one godown is to be licensed, separate particulars should be given <strong>for</strong> each, if necessary on a separatesheet.8. Name and address of bankers or other persons to whom reference may be made regarding the financial status of theLICENSEE.We hereby declare the above particulars to be true and apply <strong>for</strong> grant of a license under Section 58 of the Customs Act,1962 in accordance therewith.Place :<strong>Authorised</strong> <strong>Signatory</strong>Date :Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XXIIIApplication <strong>for</strong> Enhancement of CG limit1. Name of Company2. a) STP permission Letter No. & Dateb) Any subsequent amendment, if any3. Customs <strong>Bonding</strong> No. & Date4. Customs <strong>Bonding</strong> valid upto5. Value of capital goods approved so far6. Value of exports to be achieved as per thepermission letter7. Details as per enclosure-1 enclosed Yes NoVersion 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XXIIAPPLICATION FORM FOR CLAIMING SPECIAL IMPORT LICENSEFOR OFFICIAL USEFile No. : Date :1. Name and Address of the applicant :2. IEC Number :3. Application Fee : Rs. :Bank/Receipt/ DD :No. & DateIssued by :4. Details of exportsSl. Shipping GR Form Description FOB Value Equivalent Date of CIF Value NFE SIL EntitlementNo. Bill & No No & Date of Exports in freely Value in realisation of advance RateDate convertible Rupees Lic. + 25currencytimes of DEPB1 2 3 4 5 6 7 8 9 10 115. Value of License claimed : Rs.(in words and figures)Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreDECLARATION/UNDERTAKING1. I/We hereby declare that the particulars and the statements made in this application are true and correct to the best ofmy/our knowledge and belief and nothing has been concealed or held there <strong>for</strong>m.2. I/We fully understand that any in<strong>for</strong>mation furnished in the application if proved incorrect or false will render me/usliable <strong>for</strong> any penal action or other consequences as may be prescribed in law or otherwise warranted.3. I/We undertake to abide by the provisions of the Foreign Trade (Development and Regulation) Act, 1992, the rules andorder framed thereunder, the Export and Import Policy and the Handbook of Procedures.4. I hereby certify that I am authorised to verify and sign this declaration as per Paragraph 3.8 of the Policy.Place :…………………………………..Signature of the ApplicantName :Date : Designation :Official Address :Tel No :Residential Address :Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreCertified of Chartered Accountant/Cost and Works Accountant <strong>for</strong> issue of Special Import License <strong>for</strong> specifiedcategory of ExportersI/We hereby confirm that I/We have examined the prescribed registers and also the relevant records ofM/s……………………………….. <strong>for</strong> the period ………………………… and hereby certify that :(i) M/s …………………………………………………… (full name and address of the applicant) have made the exportsduring April-September ………………. / October-March ………………… (whichever is applicable)(ii) The following documents/records have been furnished by the applicant and have been examined and verified by me/usnamely.(iii)Export order/Contract, Shipping bills Bill of Lading (and/or Airways Bills/Receipts). Customs/Bankattested Invoices, Bank certificates of exports showing exports made in freely convertible currency intheir own name and connected books of accounts.(iii) The relevant registers have been authenticated under my/our seal/signature.(iv) The financial in<strong>for</strong>mation given in the above statement is in agreement which the relevant register and records: the samehas been incorporated in the books of accounts maintained by the exporter: and is also true and correct.(v) It has been ensured that the in<strong>for</strong>mation furnished is true and correct in all respect; no part of it is false or misleadingand no relevant in<strong>for</strong>mation has been concealed or withheld.(vi) Neither I, nor any of my partners is partners, director or an employee of the above named entity or its associatedconcerns.(vii) I/We fully understand that any statement made in this certificate, if proved incorrect or false, will render me/us liable<strong>for</strong> any penal or other consequences as may be prescribed in law or otherwise warranted.(Signature and Stamp/Seal of the signatory)(Chartered Accountant/Cost & Works Accountant)Name of the signatory :Full Address :Place :Membership No. :Date : :Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreIf any documents or record mentioned in item(ii) of the certificate have not been maintained/furnished, examined orverified, they may please be specified below :1.2.3.Documents to be enclosed with the application <strong>for</strong>m1. Bank Receipt (in duplicate)/Demand Draft evidencing payment of application fee in terms of Appendix2. Self certified copy of valid RCMC.3. E.P copy of shipping bills (in original)4. Bank certificate of exports as given in Appendix - (in original)Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XVIRE - EXPORT INVOICE / PACKING LISTEXPORTER : INVOICE No. & DATE EXPORTER’S REF.BUYER’S ORDER No. AND DATE (DETAILS OF REFERENCE)1) COPY OF STP APPROVAL REF. No. & DATE2) COPY OF APPROVED INVOICE3) COPY OF YELLOW BILL OF ENTRY No. & DATE4) Bond No. and Bond Date5) SUPPLIER LETTER REF. No. & DATE(<strong>Request</strong> letter from the supplier/service center etc.)(ALL THE DOCUMENTS TO BE ENCLOSED )CONSIGNEE : BUYER (If other than consignee)Country of Origin of GoodsCountry of Final DestinationTerms of Delivery and PaymentPre-Carriage byPlace of Receiptby Pre-CarrierVessel/Flight No. Port of Loading Port of Discharge Final DestinationMarks & Nos. No. & Kind Description of Goods Quantity Rate AmountContainer No. of PackingAmount in Words.This is dummy Invoice <strong>for</strong> Customs Valuation only. These Goods are being returned <strong>for</strong> ______________________Declaration :We declare that this Invoice shows the actual price of the goods described and that all particulars are true and correct.Date : <strong>Authorised</strong> <strong>Signatory</strong>Place :Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XVIIISHIFTING INVOICE / PACKING LISTFROM : INVOICE No. & DATE EXPORTER’S REF.BUYER’S ORDER No. AND DATE (DETAILS OF REFERENCE)1) COPY OF STP APPROVAL REF. No. & DATE2) COPY OF APPROVED INVOICE3) COPY OF YELLOW BILL OF ENTRY No.4) Bond No. and Bond Date5) SUPPLIER LETTER REF. No. & DATECUSTOMS BONDED LICENCE No.(<strong>Request</strong> letter from the supplier/service center etc.)DATE (ALL THE DOCUMENTS TO BE ENCLOSED )TO :CUSTOMS BONDED LICENCE No. Country of Origin of Goods Final DestinationDATETerms of Delivery and PaymentPre-Carriage by Place of Receipt Shifting of Imported Goods <strong>for</strong> the purpose ofby Pre-Carrier No commercial Transaction involved in this invoice.Vessel/Flight No. Port of Loading Port of Discharge Final DestinationMarks & Nos. No. & Kind Description of Goods SL. No. QTY. Rate AmountContainer No. of Packing inAmount in Words.This is dummy Invoice <strong>for</strong> Customs Valuation only. These Goods are being shifted TEMPERORLY / PERMANNETLY<strong>for</strong>Declaration :We declare that this Invoice shows the actual price of the goods described and that all particulars are true and correct.Date : <strong>Authorised</strong> <strong>Signatory</strong>Place :Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XXVIINo ………………………..Date …………………………Form C.T.3This is to certify that.(1) Mr./ M/s. …………………………….. ( Name and address) is/are bona fide licensee, holding license No……………………………. Valid up to ………………………………..(2) That he/they has/have executed a bond in Form B-16 (General Surety/General Security).No …………….. date ……………………….. <strong>for</strong> Rs. ……………………… with Assistant Collector of CentralExcise ……………………… and as such may be permitted to remove ……………………. (quantity) of ……excisable goods) from the unit at ……………………………………………(3) That the specimen signature of his/their authorised agent namely.Shri …………………………………… are furnished here below duly attested:Specimen Signatures of the Sd/- Central Excise Office-in-Charge of the 100%owner of his authorised agent Attested Export-Oriented Undertaking/ElectronicsHardware Technology Park (EHTP) unit/Software Technology Parks (STP) unit.Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - IIISTANDARD CONDITIONS ATTACHED TO THE LETTER OF INTENT/PERMISSION IN RESPECT OF EHTP/STP SCHEME1. The production of the undertaking under this scheme shall be carried out in the customs bondedarea. Location of the undertaking would be subject to clearance by the concerned collectorof Customs. You are, there<strong>for</strong>e advised to approach the jurisdictional Collector of Customsand Central Excise immediately in this behalf2. Import of Capital goods, raw materials and components <strong>for</strong> production under the scheme shall beexempted from Customs duties in terms of Customs notification in <strong>for</strong>ce, subject to theconditions specified therein. likewise, indigenously procured capital goods components and rawmaterials required by the undertaking would also be exempt from the levy of excise dutiesin terms of customs notification subject to the fulfillment of the conditions prescribedtherein.3 The finished products authorized <strong>for</strong> manufacture/production under the scheme shall be exemptedfrom payment of excise duties on their export from India subject to the observance of theprescribed procedures. Export duties shall be livable unless specifically exempted. The saleof goods manufactured in DTA would be permitted as per the prescribed policy and excise dutiesshall be levied as per prescribed rates. The clearance of rejects, waste of scrap material rags,trimmings, etc. shall be governed by the provision of policy as notified from time to time andclearance by customs authorities in accordance with their notification.4. On completion of the stipulated export obligation period covered by bond Government may decidethe conditions under which the undertaking may be allowed to produce <strong>for</strong> domestic tariff areaand the conditions so decided shall be conditions attached to the concerned industrial license ofsuch undertaking.5. On de-bonding after the period of export obligation, the undertaking will be liable to pay thefollowing:-1) Customs duty on capital goods on the depreciated values but at rates provolone on the date ofimporting.2) Customs duty on unused imported raw materials and component on value of the time ofimport and the rates in <strong>for</strong>ce on the date of clearance, and3) In respect of exciseable goods excise duty to be levied without depreciation on such goodand at rate attracted as on date of clearance.Version 2 Date 01.10.1999

Software Technology Parks of India - Bangalore6. The undertaking will have to execute a bond/legal undertaking with the jurisdictionalDirector, STP and the undertaking would be liable to penalty in terms of such bond/legalundertaking besides on penalty, if any, under the Import Trade Control Regulation or any otherregulation as may be applicable.7. If the undertaking fails to fulfill its export and other obligations under this scheme it will beliable to pay all penalties, customs and excise duties and such other amounts as may bedecided by the Government.8. Adequate steps shall be taken to the satisfaction of the Government to prevent air, water andsoil pollution, such anti-pollution measures to be installed should con<strong>for</strong>m to the effluent andemission standards prescribed be State Government in which the factory of the Industrialundertaking is located. Further adequate Industrial safety measures as provided in the FactoriesAct shall be made to the satisfaction of the State Government in which the factory of theIndustrial undertaking is located.9. External Commercial borrowing, if any, shall be subject to the approval of Ministry of Finance(D/o Economic affairs - ECB Division).10. Import of US controlled items will be subject to the following terms and conditions:1. The applicant will import the item into India and shall not redirect it or any part of it toanother destination be<strong>for</strong>e its arrival in India.2. The applicant shall provide, if asked, verification that procession of the items was taken.3. The applicant shall not re-export the item without written approval of the certificateIssuing Authority.4. The applicant shall not retransfer <strong>for</strong> within India the item(s) specified in the Certificatewithout the written approval of the certificate Issuing Authority.5. The applicant shall obtain permission in writing from the certificate Issuing Authority priorto any change in the end user which shall be preceded by the new user notifying theCertificate Issuing Authority that he/she agrees to the conditions contained in thisdocument(i.e. certificate).The applicant shall obtain permission from the certificate issuing authority be<strong>for</strong>e export ofproducts manufactured out of US controlled it.11. The applicant is required to send the quarterly progress report of implementation of theproject in the prescribed pro<strong>for</strong>ma to the department of Electronic and their designatedofficers as notified by Department of Electronics.Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - IITerms & Condition attached to a Letter of Permissioni) The entire (100%) production shall be exported against Hard Currency except the sales inDomestic Tariff Area Admissible as per entitlement.ii)You shall undertake the entire production (100%) excluding rejects not exceeding 5 (FIVE)percent and DTA sales as per entitlement <strong>for</strong> a period of 5 (FIVE) years. For this purpose, youwill furnish the requisite legal agreement, After the export obligation period is over the unit shallbe allowed to produce <strong>for</strong> domestic market in the light of Industrial policy in <strong>for</strong>ce at the time inrelation to manufacture of items reserved <strong>for</strong> small scale sector.iii) The DTA (Domestic Tariff Area) sale entitlement shall be in accordance with notification No.Customs 138 dated Oct 22 1991 and Customs 140 dated Oct 22, 1991iv)In case External commercial borrowing is resorted to, you shall obtain necessary permission fromMinistry of Finance (D/o Eco. Affairs) Government of India.v) It is noted that you require imported capital goods worth Rs. (Rupees ) <strong>for</strong> the project. Youare advised to send the list of capital goods proposed to be imported duly signed to theDepartment of Electronics or Jurisdictional Director of the STP.vi) Export turnover of Rs. (Rupees ) in 5 years is anticipated, according to yourprojections. However, the unit would be under obligation to achieve the minimum ExportPer<strong>for</strong>mance as prescribed in the EXIM Policy/Handbook of Procedures.vii)Separate accounts shall be maintained <strong>for</strong> STP unit.viii) The unit shall be custom bonded.ix)Import of second hand capital goods shall be permitted in accordance with Import Export policy.3. This letter of Permission is valid <strong>for</strong> 3 years from its date of issue within which you shouldimplement the project and commence commercial production. As soon as commercialproduction starts an intimation to this effect should be sent to the Software Technology Parks ofIndia, Department of Electronics under intimation to SIA (EOU Section).4. You are requested to confirm acceptance of the above terms and conditions to the SoftwareTechnology Parks of India Department of Electronics with a copy to Secretariat <strong>for</strong> IndustrialApproval (EOU section) within a period of 30 days from the date of receipt of this letter.Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XXII-AAPPENDIX -1APROMOTER OF EXPORTER/IMPORTERFile No ………………….(For Office Use)Date ………………………1. Name of the Applicant :2. Address of the applicant (Registered Office in :case of limited companies, and Head Office <strong>for</strong> others) :3. Date of Establishment of business/factory in IndiaTelex No. …………………………..FAX No. …………………………..E-Mail ………………………………4. IEC No. ………………………… Date of Issue ……………… Issuing Authority ……………….5. (1) Merchant Exporter (2) Manufacturer Exporter (3) Service Provider (4) Other (specify)6. Permanent Account Number (PAN) of Income Tax ………………. Issuing Authority ………. Date7. No & Date of SSI Registration/Industrial License/IEM Issuing Authority ……………….Others (specify)8. EH/TH/STH/SSTH Certificate No ………………….. Date ……………… valid upto ………….9. Nature of the applicant firm: (1) Government undertaking (2) Public Limited Company(3) Proprietorship (4) Private Limited Company (6) Others (please specify)10. Details of main Banker & Bank AccountName :Address of the Bank :Type of Account :Account No :11. (1) RCMC No. ………………. Date of Issue …………. Valid upto ……….. Issuing Authority12. Details of Directors/Partners/Proprietor/Karta to be given in the following manner:(1) (a) Name :(b) Father’s Name :(c) Residential Address :(d) Telephone :Place :Date :Signature of the Director/Proprietor/Karta ………………Name ……………………………………………………Designation ……………………………………..Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XXVIAPPENDIX 16.IApplication <strong>for</strong> claiming reimbursement of Central Sales Tax against ‘C’ Form <strong>for</strong>the goods brought into the bonded Premises of STP/EHTP units1. Name of the applicant :2. Full Postal Address3. (a) No and date of Letter of Approval issuedunder STP/EHTP Scheme.(b) Whether the Letter of Approval is still validon the date of this application.4. Registration No:(With date of issue) issued by S.T Authoritiesunder CST Act 19565. Details of the goods brought into units(a) Name & address of the supplier (including the nameof the state where the supplier is located)(b) Description of Goods :(c) Quantity :(d) Value :(e) Date of purchase of goods :(f) Date of receipt of goods in the Customs BondedPremises of the EHTP/STP unit :(g) Total amount of CST paid against ‘C’ Form(h) Sales Tax Registration No & date of the supplierVersion 2 Date 01.10.1999

Software Technology Parks of India - BangaloreUndertaking and declarationa) I/we hereby solemnly undertake/declare that the particulars stated above are true and correct to thebest of my/our knowledge and belief.b) No other application <strong>for</strong> claiming CST has been made or will be made in future against purchasescovered by the application.c) The goods <strong>for</strong> which the claim has been made are meant <strong>for</strong> production of goods <strong>for</strong> export and/or<strong>for</strong> export production of the EHTP/STP unit will be utilised only in our factory and we shall notdivert or dispose off the material procured without obtaining prior permission of the concernedDevelopment Commissioner.d) The goods <strong>for</strong> which the claim has been made have been entered into the stock register maintainedby the unit.e) In case the unit is wound up or the unit is allowed to be prematurely de-bonded, we undertake torefund the entire CST claimed <strong>for</strong> our EHTP/STP unit.f) Any in<strong>for</strong>mation, if found to be incorrect, wrong or misleading, will render me/us, liable to rejectionof our claim without prejudice to any other action that may be taken against us in this behalf.If as a result of scrutiny any excess payment is found to have been made to me/us, the same may beadjusted against any of the subsequent claims to be made by my/our firm or in the event no claim ispreferred, the amount overpaid will be refunded by me/us to the extent of the excess amount paid.Signature ……................................................Name in Block letter ………..............................Designation ………............................................Name of the Applicant .…………......................Firm ....................................................Version 2 Date 01.10.1999

Software Technology Parks of India - BangaloreANNEXURE - XXVI-AANNEXURE - IIChartered Accountant CertificateI/We hereby confirm that I/We have examined the prescribed registered and prescribed material/receiptregisters and also the relevant records of M/s ........................................... <strong>for</strong> the period and herebycertify thatI. The following documents/records have been furnished by the applicant and have been examined andverified by me/us namely material handling registers certified by the Zone administration/<strong>Bonding</strong>OfficerII. Relevant registers have been authenticated under my/our seal, signature. It has been ensured that thein<strong>for</strong>mation furnished is true and correct in all respects, no part is false or misleading and no relevantin<strong>for</strong>mation has been concealed or withheldIII. Neither me or any of my parterns is a partner is a partner/Director or an employee or the abovenamed entity or its associated concerns.IV. I fully understand that any submission made in this certificate if proved incorrect or false, will renderme/us liable to case any penal action or other consequences as may be prescribed in law or otherwisewarranted.Signature .……..................................Name ...……......................................Designation ..……..............................Name and address of the Institution where registered. Registration Number and date ofCorporate Membership.Date: ....................................Place: ...................................Version 2 Date 01.10.1999

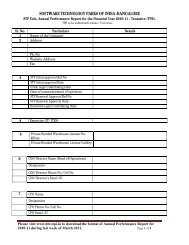

Software Technology Parks of India - BangaloreAnnexure - XXXIIAnnual ReportDate : ………………………….1. Name of STP Unit :Approval No. & Date2. Address3. Action taken to implement the projecta) Custom <strong>Bonding</strong> License No. …………….. Valid upto ……………….b) Legal Agreement Signed : YES/NO4. Date of Commence of operation :5. Procurement of Capital Goods (Duty Free)6. Import of Capital Goods :PeriodDuring theFinancial YearOutrightPurchaseLoan Basis Free of Charge TotalFrom the day ofinception7. Procurement of Indigenous Goods(under CT3 Exemption)PeriodDuring theFinancial YearTotalFrom the day ofinceptionVersion 2 Date 01.10.1999

Software Technology Parks of India - Bangalore8. Exports:PeriodThroughDatacommunicationOnisteConsultancyPhysical MediumTotalDuring theFinancial YearFrom the day ofinception8. Investment DetailsPeriod(Foreign Direct/ Indirect)NRI InvestmentIndianInvestmentTotalDuring the FinancialYearFrom the day of inception9. Foreign Exchange Inflow : Other than Export Earnings(i.e., Inflow of Foreign Exchange through Borrowing from Parent/Collaborator company, ExternalCommercial Borrowings, Any other funds)During the Financial YearFrom the day of inceptionPeriodTotal10. Foreign Exchange Outflow(i.e, Outflow of Foreign Exchange other than import of capital goods)PeriodDuring the Financial YearFrom the day of inceptionTotalVersion 2 Date 01.10.1999

Software Technology Parks of India - Bangalore11. Wage Bill <strong>for</strong> the year :12. DTA SalesDTA Sales PermissionDTA Sales ActualDuring the YearCumulative from the year of inception13. Central Sales TaxCST ClaimedCST ReimbursedDuring the YearCumulative from the year of inception(Signature of Head Finance/Chief Executive Officer/<strong>Authorised</strong> <strong>Signatory</strong>)Place :Date:Version 2 Date 01.10.1999