Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

Derivatives in Plain Words by Frederic Lau, with a ... - HKU Libraries

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

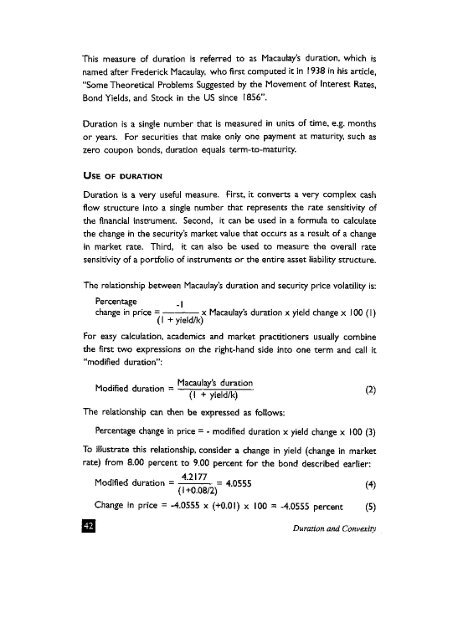

This measure of duration is referred to as Macaulay's duration, which isnamed after <strong>Frederic</strong>k Macaulay, who first computed it <strong>in</strong> 1 938 <strong>in</strong> his article,"Some Theoretical Problems Suggested <strong>by</strong> the Movement of Interest Rates,Bond Yields, and Stock <strong>in</strong> the US s<strong>in</strong>ce 1856".Duration is a s<strong>in</strong>gle number that is measured <strong>in</strong> units of time, e.g. monthsor years. For securities that make only one payment at maturity, such aszero coupon bonds, duration equals term-to-maturity.USE OF DURATIONDuration is a very useful measure. First, it converts a very complex cashflow structure <strong>in</strong>to a s<strong>in</strong>gle number that represents the rate sensitivity ofthe f<strong>in</strong>ancial <strong>in</strong>strument. Second, it can be used <strong>in</strong> a formula to calculatethe change <strong>in</strong> the security's market value that occurs as a result of a change<strong>in</strong> market rate. Third, it can also be used to measure the overall ratesensitivity of a portfolio of <strong>in</strong>struments or the entire asset liability structure.The relationship between Macaulay's duration and security price volatility is:Percentage _ |change <strong>in</strong> price = - x Macaulay's duration x yield change x 100 (I)(I + yield/k)For easy calculation, academics and market practitioners usually comb<strong>in</strong>ethe first two expressions on the right-hand side <strong>in</strong>to one term and call it"modified duration":M ,.* , , . Macaulay's duration , xModified duration = — / . - (2)(I + yield/k)v 'The relationship can then be expressed as follows:Percentage change <strong>in</strong> price = - modified duration x yield change x 100 (3)To illustrate this relationship, consider a change <strong>in</strong> yield (change <strong>in</strong> marketrate) from 8.00 percent to 9.00 percent for the bond described earlier:Modified duration = -~~~ 4.0555 (4)Change <strong>in</strong> price = -4.0555 x (+0.01) x 100 = -4.0555 percent (5)Duration and Convexity