Výroční zpráva\Annual Report - CETELEM ČR, as

Výroční zpráva\Annual Report - CETELEM ČR, as

Výroční zpráva\Annual Report - CETELEM ČR, as

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to 2006 Financial Statements<br />

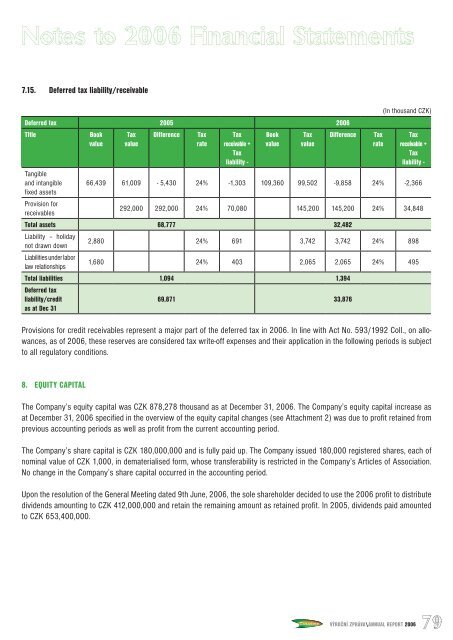

7.15. Deferred tax liability/receivable<br />

Deferred tax 2005 2006<br />

Title Book<br />

value<br />

Tax<br />

value<br />

Difference Tax<br />

rate<br />

Tax<br />

receivable +<br />

Tax<br />

liability -<br />

Book<br />

value<br />

Tax<br />

value<br />

Difference Tax<br />

rate<br />

(In thousand CZK)<br />

Tax<br />

receivable +<br />

Tax<br />

liability -<br />

Tangible<br />

and intangible<br />

fixed <strong>as</strong>sets<br />

66,439 61,009 - 5,430 24% -1,303 109,360 99,502 -9,858 24% -2,366<br />

Provision for<br />

receivables<br />

292,000 292,000 24% 70,080 145,200 145,200 24% 34,848<br />

Total <strong>as</strong>sets 68,777 32,482<br />

Liability – holiday<br />

not drawn down<br />

2,880 24% 691 3,742 3,742 24% 898<br />

Liabilities under labor<br />

law relationships<br />

1,680 24% 403 2,065 2,065 24% 495<br />

Total liabilities<br />

Deferred tax<br />

1,094 1,394<br />

liability/credit<br />

<strong>as</strong> at Dec 31<br />

69,871 33,876<br />

Provisions for credit receivables represent a major part of the deferred tax in 2006. In line with Act No. 593/1992 Coll., on allowances,<br />

<strong>as</strong> of 2006, these reserves are considered tax write-off expenses and their application in the following periods is subject<br />

to all regulatory conditions.<br />

8. EQUITY CAPITAL<br />

The Company’s equity capital w<strong>as</strong> CZK 878,278 thousand <strong>as</strong> at December 31, 2006. The Company’s equity capital incre<strong>as</strong>e <strong>as</strong><br />

at December 31, 2006 specified in the overview of the equity capital changes (see Attachment 2) w<strong>as</strong> due to profit retained from<br />

previous accounting periods <strong>as</strong> well <strong>as</strong> profit from the current accounting period.<br />

The Company’s share capital is CZK 180,000,000 and is fully paid up. The Company issued 180,000 registered shares, each of<br />

nominal value of CZK 1,000, in dematerialised form, whose transferability is restricted in the Company’s Articles of Association.<br />

No change in the Company’s share capital occurred in the accounting period.<br />

Upon the resolution of the General Meeting dated 9th June, 2006, the sole shareholder decided to use the 2006 profit to distribute<br />

dividends amounting to CZK 412,000,000 and retain the remaining amount <strong>as</strong> retained profit. In 2005, dividends paid amounted<br />

to CZK 653,400,000.<br />

VÝROČNÍ ZPRÁVA\ANNUAL REPORT 2006 79