2006 The top 800 UK & 1250 Global companies by R&D investment

2006 The top 800 UK & 1250 Global companies by R&D investment

2006 The top 800 UK & 1250 Global companies by R&D investment

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

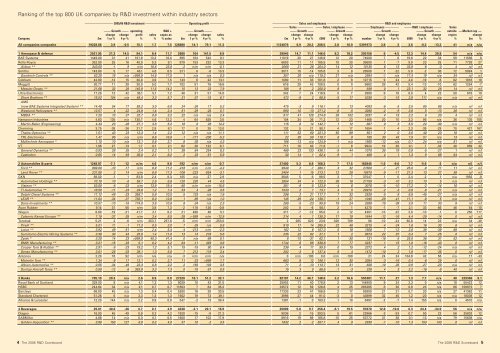

Ranking of the <strong>top</strong> <strong>800</strong> <strong>UK</strong> <strong>companies</strong> <strong>by</strong> R&D <strong>investment</strong> within industry sectors–––––––––––––––––– 2005/06 R&D <strong>investment</strong> –––––––––––––––––– ——–—–– Operating profit ——–—–– ––––––––––––––––– Sales and employees ––––––––––––––––– ————––—–––—— R&D and employees ——–—––——––––—–––––––––– Sales –––––––––– ––––– Sales / employee ––––– ––––––––– Employees ––––––––– ––––– R&D / employee ––––– Sales––––– Growth ––––– operating R&D + ––––– Growth ––––– ––––– Growth ––––– –––––– Growth ––––– ––––– Growth ––––– –––––– Growth ––––– outside –––Market cap –––change change profit sales capex as change change sales change change change change change change change change region changeCompany £m 1 yr % 4 yr % % % % sales £m 1 yr % 4 yr % % £m 1 yr % 4 yr % £000 1 yr % 4 yr % number 1 yr % 4 yr % £000 1 yr % 4 yr % % £m %All <strong>companies</strong> composite 19228.66 3.9 -0.5 15.1 1.7 7.5 126880 14.1 79.1 11.3 1124076 6.9 20.2 208.5 2.8 16.9 5391973 3.8 3 3.6 -0.2 -13.2 41 n/a n/a1 Aerospace & defence 2521.95 21.3 14.5 94.1 8.4 11.7 2680 104 141.5 8.9 29945 14.7 11.1 146.0 8.2 18.2 205156 6 -4.5 12.3 14.4 28.8 54 n/a n/aBAE Systems 1449.00 31 41 161.9 13.2 16.0 895 164 542 8.1 11019 20 27 148.9 12 20 74000 7 6 19.6 22 34 59 11586 8Rolls-Royce 352.00 25 16 40.0 5.3 9.1 879 153 232 13.3 6603 11 11 185.5 10 20 35600 1 -7 9.9 23 25 71 7728 27Airbus ** 343.00 -1 9 n/m 16.6 23.0 -2 n/m n/m -0.1 2068 21 26 204.0 14 12 10135 6 13 33.8 -6 -3 4 n/l n/lSmiths 143.60 5 17 46.1 4.8 8.5 311 6 -6 10.3 3017 10 -14 105.8 3 9 28509 7 -22 5.0 -2 36 72 5094 1Goodrich Controls ** 52.20 18 n/a >999.9 14.6 17.5 1 n/a n/a 0.3 357 20 n/a 119.2 21 n/a 2994 -1 n/a 17.4 19 n/a 34 n/l n/lCobham 42.90 -12 15 30.0 3.9 7.5 143 6 22 13.1 1090 11 33 101.8 2 8 10715 9 24 4.0 -19 -6 62 1818 18Meggitt 30.77 11 28 30.0 5.0 7.7 102 51 76 16.6 616 29 43 108.5 0 0 5682 28 42 5.4 -13 -10 62 1254 -7Messier-Dowty ** 21.68 32 28 145.9 11.5 14.2 15 13 23 7.9 188 9 2 200.0 9 1 939 0 1 23.1 32 28 14 n/l n/lUltra Electronics 17.29 12 42 36.1 5.1 7.2 48 31 51 14.0 342 7 24 118.9 0 7 2880 8 16 6.0 4 23 50 678 19Short Brothers ** 15.52 104 n/a 49.4 3.3 5.7 31 -37 -15 6.7 472 -8 2 88.5 -5 17 5330 -3 -15 2.9 111 n/a n/a n/l n/lAMS(now BAE Systems Integrated System) ** 14.49 54 77 59.2 3.0 6.0 24 -26 17 5.2 475 -3 8 116.1 3 13 4093 -6 -5 3.5 65 88 n/a n/l n/lWestland Helicopters ** 12.57 4 -22 24.8 1.4 2.4 51 -29 -26 5.7 890 -10 -13 271.2 -8 -5 3280 -2 -9 3.8 5 -13 26 n/l n/lMBDA ** 7.20 10 37 32.7 0.8 3.2 22 n/a n/a 2.4 917 41 129 274.8 35 102 3337 4 15 2.2 6 20 4 n/l n/lHampson Industries 4.83 135 n/a 130.7 4.6 12.2 4 64 628 3.5 104 34 36 71.2 12 23 1468 20 10 3.3 96 n/a 36 135 105Martin-Baker (Engineering) 4.43 23 -28 27.1 3.8 5.2 16 6 28 14.2 115 0 14 142.7 1 12 807 0 2 5.5 24 -30 n/a n/l n/lChemring 3.75 -38 -26 21.7 2.8 8.1 17 0 35 13.0 132 5 21 80.1 4 17 1654 1 4 2.3 -39 -29 70 427 167Thales Optronics ** 1.51 43 23 12.3 1.4 2.2 12 n/a n/a 11.1 111 52 90 221.3 50 89 501 2 0 3.0 40 23 18 n/l n/lTRL Electronics 1.47 96 n/a n/m 6.6 16.6 -1 -171 -200 -5.2 22 38 58 119.7 6 8 185 30 45 7.9 51 n/a 13 n/l n/lMcKechnie Aerospace * 1.10 10 n/a 13.1 0.6 3.7 8 -38 n/a 4.3 196 -13 n/a 124.9 -1 n/a 1565 -12 n/a 0.7 24 n/a 81 n/l n/lVT 1.06 27 -13 1.7 0.1 2.1 62 28 122 8.7 711 18 40 71.6 -1 9 9924 19 28 0.1 7 -33 40 859 42General Dynamics ** 0.93 28 35 2.4 0.2 1.1 38 64 254 8.2 469 23 133 438.1 -9 44 1070 35 79 0.9 -5 -27 1 n/l n/lCastledon 0.65 14 93 36.0 2.1 8.2 2 23 -51 5.9 30 14 1 62.4 9 1 488 4 1 1.3 9 88 64 n/l n/l2 Automobiles & parts 1248.97 -7.1 -12 n/m 4.6 9.8 -192 n/m n/m -0.7 27400 5.3 6.8 168.3 7 17.5 162845 -1.6 -9.6 7.7 -5.6 -3 n/a n/l n/lFord ** 689.00 -10 -17 n/m 6.9 11.2 -416 n/m n/m -4.2 9940 2 -1 360.1 3 32 27600 -1 -27 25.0 -9 11 11 n/l n/lLand Rover ** 231.80 2 14 n/m 6.8 17.3 -106 -223 -954 -3.1 3404 1 15 313.1 12 28 10870 -9 -11 21.3 13 27 36 n/l n/lGKN 88.00 -1 1 83.8 2.4 8.3 105 n/a -27 2.9 3648 5 8 98.5 3 7 37047 1 0 2.4 -2 1 n/a 1982 -8Automotive Holdings ** 70.10 10 -6 58.7 2.6 6.6 120 220 44 4.5 2654 34 4 122.0 38 16 21759 -3 -10 3.2 13 5 n/a n/l n/lVisteon ** 53.00 -8 -23 n/m 13.9 19.4 -60 n/m n/m -15.6 381 -9 -5 123.9 -4 6 3076 -5 -10 17.2 -2 -14 16 n/l n/lTI Automotive ** 18.50 -11 -23 34.6 1.2 7.4 53 4 -28 3.5 1533 2 1 73.1 4 5 20970 -2 -3 0.9 -9 -21 n/a n/l n/lDelphi Diesel Systems ** 17.12 -48 -33 358.7 5.8 10.5 5 133 n/a 1.6 296 2 21 117.7 7 32 2520 -5 -9 6.8 -45 -27 n/a n/l n/lLEAR ** 11.64 -34 -37 782.1 8.0 12.6 1 -89 n/a 1.0 145 -29 -24 138.7 -1 27 1045 -28 -41 11.1 -8 5 n/a n/l n/lDana Investments ** 10.57 -10 -16 174.0 3.9 10.6 6 -34 n/a 2.3 269 -5 -23 99.8 18 24 2698 -19 -38 3.9 11 33 8 n/l n/lAvon Rubber 9.14 31 56 n/m 3.8 7.3 -2 -118 -126 -0.8 240 0 -6 56.1 2 1 4270 -1 -7 2.1 33 66 46 54 -10Wagon 8.80 -19 -21 41.7 2.1 8.2 21 486 46 5.1 417 -7 -12 95.0 2 12 4391 -10 -22 2.0 -10 -1 0 250 117Calsonic Kansei Europe ** 7.19 -37 -28 n/m 3.4 8.5 -28 >-999 n/m -12.9 214 4 1 130.3 17 19 1644 -12 -16 4.4 -29 -14 0 n/l n/lTorotrak 5.21 2 -6 n/m 253.7 257.6 -5 n/m n/m -253.0 2 285 623 23.9 329 789 86 -10 -24 60.6 14 23 n/a 34 -49Pirelli ** 5.01 11 -1 71.3 0.5 2.0 7 -35 n/a 0.8 919 17 14 285.9 22 48 3215 -4 -24 1.6 16 30 6 n/l n/lLotus ** 3.92 49 -51 n/m 2.4 5.4 -4 -213 n/m -2.3 162 12 6 107.3 5 18 1508 7 -12 2.6 39 -39 68 n/l n/lSumitomo Electric Wiring Systems ** 3.38 30 43 25.8 1.4 11.0 13 13 278 5.6 235 22 92 27.1 1 2 8673 22 87 0.4 7 -25 0 n/l n/lZytek * 3.28 14 23 >999.9 40.3 41.4 0 n/a -99 0.1 8 -15 -31 62.1 1 -30 131 -16 -5 25.0 36 31 52 n/l n/lBMW Manufacturing ** 3.21 -15 -33 5.1 0.2 4.2 64 -11 493 3.6 1744 8 88 538.8 7 77 3237 1 15 1.0 -16 -43 0 n/l n/lCooper Tyre & Rubber ** 2.91 -9 -23 19.2 1.2 5.1 15 -15 90 6.4 236 4 17 99.5 0 15 2372 4 2 1.2 -12 -24 n/a n/l n/lDenso Manufacturing ** 2.61 -26 -33 38.1 1.3 5.6 7 212 119 3.4 202 -3 6 137.4 8 4 1472 -10 2 1.8 -17 -35 0 n/l n/lAntonov 2.20 76 92 n/m n/a n/a -3 n/m n/m n/a 0 n/m -100 0.0 n/m -100 21 24 24 104.8 42 56 n/a 17 -43Michelin Tyre ** 1.34 -9 17 12.1 0.2 2.7 11 -23 >999 1.7 663 8 12 196.1 12 30 3384 -3 -16 0.4 -6 29 0 n/l n/lAlbion Automotive ** 0.55 -34 -49 22.3 0.8 2.2 2 156 103 3.5 71 2 -13 113.7 13 31 628 -10 -35 0.9 -27 -23 n/a n/l n/lDunlop Aircraft Tyres ** 0.50 -12 -6 363.8 3.3 7.3 0 -75 -91 0.9 15 3 0 66.5 -1 -3 228 4 3 2.2 -16 -8 40 n/l n/l3 Banks 705.10 20.3 n/a 2.6 0.9 0.9 27220 10.1 51.2 33.1 82191 14.2 46.7 148.0 2.2 16.6 555381 11.7 27 1.3 7.7 n/a 40 229366 9.1Royal Bank of Scotland 329.00 9 n/a 4.1 1.3 1.3 8029 10 43 31.0 25902 11 40 178.8 2 13 144900 9 24 2.3 0 n/a 18 55422 12HSBC 244.64 34 n/a 2.1 0.7 0.7 11803 7 64 35.2 33572 12 59 126.6 4 25 265285 8 30 0.9 23 n/a 66 109973 7Barclays 68.00 45 n/a 1.3 0.4 0.4 5280 16 39 30.5 17333 23 41 186.8 2 17 92<strong>800</strong> 21 21 0.7 20 n/a 27 41362 11Standard Chartered 51.26 6 n/a 3.3 1.3 1.3 1562 19 73 39.1 3996 27 44 91.0 -3 0 43899 32 45 1.2 -20 n/a n/a 18039 12Alliance & Leicester 12.20 144 n/a 2.2 0.9 0.9 547 -2 13 39.4 1387 -1 3 163.2 1 10 8497 -2 -7 1.4 150 n/a 0 4570 n/a4 Beverages 29.01 40.6 -36 0.7 0.1 4.9 4238 -3.1 20.1 16.9 25090 5.8 9.7 256.4 -6.1 19.5 97870 12.8 -10.8 0.3 24.4 -34.9 56 n/a n/aDiageo 16.00 45 -49 0.8 0.2 4.2 1920 -15 -9 21.2 9036 2 -15 393.5 5 61 22966 -3 -53 0.7 50 22 56 25802 12SABMiller 4.66 14 n/a 0.3 0.1 6.5 1600 17 102 17.9 8916 19 69 165.8 -10 25 53772 31 38 0.1 -13 n/a 79 15639 n/aGolden Acquisition ** 3.86 150 127 6.8 0.2 4.0 57 10 -2 3.5 1632 2 -2 557.1 4 9 2930 -1 -10 1.3 153 143 0 n/l n/l4 <strong>The</strong> <strong>2006</strong> R&D Scoreboard<strong>The</strong> <strong>2006</strong> R&D Scoreboard 5