Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

Bahamas - FirstCaribbean International Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

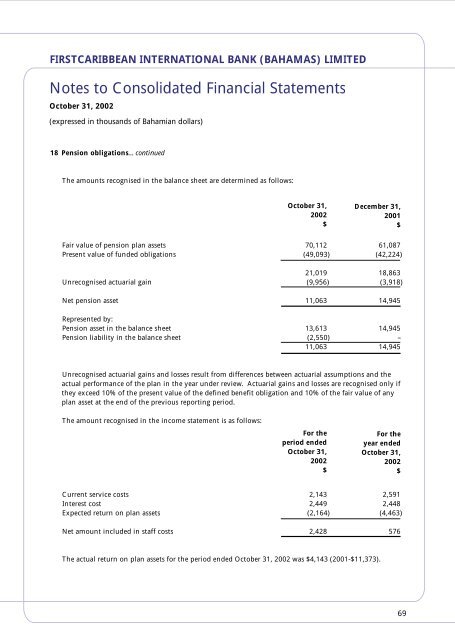

FIRSTCARIBBEAN INTERNATIONAL BANK (BAHAMAS) LIMITEDNotes to Consolidated Financial StatementsOctober 31, 2002(expressed in thousands of Bahamian dollars)18 Pension obligations…continuedThe amounts recognised in the balance sheet are determined as follows:October 31,2002$December 31,2001$Fair value of pension plan assets 70,112 61,087Present value of funded obligations (49,093) (42,224)21,019 18,863Unrecognised actuarial gain (9,956) (3,918)Net pension asset 11,063 14,945Represented by:Pension asset in the balance sheet 13,613 14,945Pension liability in the balance sheet (2,550) –11,063 14,945Unrecognised actuarial gains and losses result from differences between actuarial assumptions and theactual performance of the plan in the year under review. Actuarial gains and losses are recognised only ifthey exceed 10% of the present value of the defined benefit obligation and 10% of the fair value of anyplan asset at the end of the previous reporting period.The amount recognised in the income statement is as follows:For theperiod endedOctober 31,2002$For theyear endedOctober 31,2002$Current service costs 2,143 2,591Interest cost 2,449 2,448Expected return on plan assets (2,164) (4,463)Net amount included in staff costs 2,428 576The actual return on plan assets for the period ended October 31, 2002 was $4,143 (2001-$11,373).69