Publication

Publication

Publication

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.nordecon.comSky is the limit(OK, sometimes it’s the roof)Experts in construction and real estate development.

TOP ESTONIAN ENTERPRISES 2008ContentsEntrepreneurship Award 2008 – summary 8Estonian Companies’ Competitiveness Ranking 2008 - summary 9Entrepreneurship Award 2008 – winners 10Estonian Companies’ Competitiveness Ranking 2008 – winners 11Entrepreneurship Award 2008 - methodology 13Entrepreneurship Award 2008 - nominees and winners 14The History of the Entrepreneurship Award 32The History of the Estonian Companies’ Competitiveness Ranking 33Estonian Companies’ Competitiveness Ranking 2008 - main chart 37Estonian Companies’ Competitiveness Ranking 2008 - categories and winners 44Swedbank’s Special Prize to the Most Successful Expander in the Baltics 94Student Company 2008 95European Enterprise Awards - "Recognise promoters of enterprise 2008" 96“Financial Year 2007 - year of the cooling down of economy” 98– Leev Kuum, Estonian Institute of Economic ResearchEnterprise Estonia 102Estonian Chamber of Commerce and Industry 104Estonian Employers’ Confederation 106Review of the entrepreneurship contests’ ceremonial award-gala 2008 1084November2008

In-flight magazine of Estonian Air “In Time”Autumn 2008Magazine of Enterprise Estonia“Inseneeria” 3/2008aripaev.ee 28.08.2008Export is the future of Estonian economy.ESTONIAN EXPORT DIRECTORYTHE AIM OF THE ESTONIAN EXPORT DIRECTORY IS TO FACILITATE ESTABLISHING FOREIGN TRADERELATIONS FOR ESTONIAN ENTERPRISES IN EUROPE AS WELL AS ALL OVER THE WORLD.Estonian Chamber ofCommerce and IndustryIn January 2009 Estonian Chamber of Commerceand Industry will publish already for the fourteenthtime Estonian Export Directory - a practicalbusiness catalogue on Estonian Exporters.The Estonian Export Directory presents more than1300 Estonian exporting companies in alphabeticalorder and also by HS products and services classification.Additionally, you will find up-to-dateoverview about the constantly developing economicsituation in Estonia, useful addresses and overviewabout the Estonian Companies’ CompetitivenessRanking in English, German and French.Estonian Export Directory in the web:www.estonianexport.eePaper copy and CD of the Estonian Export Directory2008 & 2009 are for free. Ordering now onlydelivery costs will be added.Estonian Export Directory is published with co-operation Infoatlas AS, phone: +372 626 6988.Ask the catalogue:Estonian Chamber of Commerce and IndustryPhone: +372 640 0060 • Fax: +372 640 0061 • E-mail: koda@koda.ee • www.koda.ee

TOP ESTONIAN ENTERPRISES 2008Wishing strength to survive successfully in a world that is rapidly changing!The last year has been a year of major changes – both in the worldeconomy and in Estonia. The previous year, 2007, was very successfulfor us, but the current year, 2008, signifies the end of one economicgrowth cycle and the beginning of renewal necessary for a newgrowth cycle.It is very promising to be here today, among the most viable and successfulentrepreneurs in the Estonian economy. Moreover, we have reasonto celebrate today, because in a few moments, entrepreneurshipprizes will be awarded to the best companies of last year.But besides joy, the current situation is overshadowed by uncertainty.East and West from us, stock markets are crumbling to such an extentonly those who can remember more than a decade can recall. Financialinstitutions that only recently were considered to be the foundationsof a successful and functioning economic system are collapsing.In Estonia, we see difficulties with matching the revenue and expenditureof the state budget, because the economic growth we have becomeaccustomed to has slowed down. Our familiar logic behind thedrafting of the state budget, including the planning of revenue and expenditure,is significantly more difficult and causing more tension thanduring the last years of success.During the past decade, the Estonian economy has sometimes hadsuccess that has been miraculous. Today, our feet are firmly on theground again. The way things have turned out obliges us to ask twothings: have we overlooked something or have we done somethingwrong? Or is all this just an inevitability?Our success so far has to a great extent been a result of the advantagesthat were meant to disappear, such as very cheap labour force or lowdebt burden. Those were the advantages of a transitory economy ascompared to more mature economies; but in essence those advantageswere temporary and they had to be used to their full extent. Regardingthat, we have managed well. But the economic situation today –even without the problems of world economy – seems to be sayingthat passing one exam with flying colours does not put us amongwealthy countries. There is more to be done in order to achieve that.changes in other areas. This structure has remained unchanged in mostareas. With the economic structure Estonia has today, it is very difficult– if not impossible – to be among the truly developed countries.The structure of an economy is not something that can be changedovernight and by direct order. Changes must instead be the result ofthorough and thoughtful long-term work, taking into account one’sown and the entire world’s future needs.It would certainly mean investments into education, research and development.It might also mean a need for changes not only in investmentsbut also in general values.Now is not the time for accusations or finger pointing, inter alia,between politicians and entrepreneurs, who should really be eachother’s partners in a democratic society. Accusations against one anotherand the constant reminders of possible miscalculations do notmove Estonia forward. But we have to keep moving. Pessimism, beingconfused and looking for someone to blame would make us stop. Thatin turn would mean lost time and missed opportunities. We do nothave any time to lose.How to move forward? Do not look back at the past, but open youreyes and minds to new opportunities. These opportunities exist, onejust has to know how to notice them and learn how to use them. It isnamely because of this that I am happy to see several innovative companiesamong the nominees of today’s awards. I hope that those kindsof enterprises are the winners of the main prizes.In conclusion I would like to wish all entrepreneurs strength to survivesuccessfully in a world that is rapidly changing, and which is perhapsnot in the most stable state at the moment. All of you areresponsible for whether in ten years we can again talk about the Estonianeconomic miracle or not.Address to the enterpreneurs on the awarding gala on September 18th, 2008The turning points in economy are difficult times, but they also containopportunities for the future. Let us remember that the successfulsolutions to the economic problems of our Nordic neighbours at thebeginning of the 90s were the basis for their success today. And in thiscase, it is not about economy in the narrow sense. Namely, the Nordiccountries are one of the few countries in Europe today where social issuesand labour market policies have also been successfully addressedand whose state budget is sustainable even in the conditions of anaging population.The basis for all that was nevertheless the productivity of thoseeconomies, which in turn was based on their innovativeness, goodedu cation and advanced technology. Also, we should not forget thatthe great transparency of those societies causes the corruption level tobe low; and where there is less corruption, there is a better economy.This year we have often read from reputable sources that the structureof the Estonian economy has not managed to be up-to-date with greatToomas Hendrik IlvesThe President of the Republic of EstoniaNovember 20087

TOP ESTONIAN ENTERPRISES 2008Entrepreneurship Award 2008Entrepreneurship Award is the entrepreneurship competition with thelongest history in Estonia which dates back to the year 1996. Just inthis year the competition was organised under the leadership of thePresident Lennart Meri for the issue of the title “Foreign Investor1995”. The competition has changed and expanded with time andsince 2000 Enterprise Estonia organises the choosing and recognitionof the best companies under the name of “Entrepreneurship Award”.The primary objective of the competition is to recognise the successfuland perspective Estonian companies and set them as the examplesfor others. The wider aim is to contribute to the promotion of entrepreneurship,growth of the international competitiveness of the Estoniancompanies and therewith to the faster economic development.Each year the number and name of categories are slightly updated toguarantee the valuation of the companies in the more important sectorsfrom the viewpoint of the state economy. This year the categorieswere the Developer, Innovator, Exporter, Foreign Investor, IndustrialEnterprise and Tourism Innovator of the Year.The basis of choice is the questionnaires sent by the companies. In cooperationwith the Estonian Institute of Economic Research the rankingof each category is specified, of which the advisory committees ofEnterprise Estonia choose the three nominees and the winner companyper each category. The main winner of the EntrepreneurshipAward is chosen among the category winners by the representativejury, the members of which are the representatives of the universities,key ministries and circles of entrepreneurship.The participation in the competition has increased from year to year,good companies worthy of recognition exist in all categories and thereforethe making of choices is complicated. In several cases the discussionslasted for hours, but finally the results were also achieved.The competition “Enterprise Award 2008” culminates with the festivegala night in the concert hall of Estonia, where the winners will be announcedand the deserved awards will be given to the best.8November2008

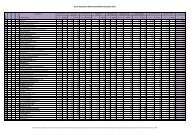

TOP ESTONIAN ENTERPRISES 2008Estonian Companies’ Competitiveness Ranking 2008As a representation organisation for Estonian businesses the EstonianChamber of Commerce and Industry has been working to promoteentrepreneurship through creating a business friendly climate for thelast 82 years. Generally the Chamber aims to conceive this throughconstructive partnerships – with the different ministries, the parliamentand the government. From time to time we try to grab and guidethe attention of Estonians towards very simple but significant economictruths – which, if occasionally remembered, help the businessmanbe more successful in his undertakings. That’s why we havedecided to draw your attention to competition.Competitiveness can be seen as the most significant characteristic of abusiness, a common denominator for individual special capabilities,and a complex ability. Businesses, which are better than others in therespective market – i.e. sell more and produce cheaper, manufacturebetter goods etc – are more competitive. The latter is reflected in betterfinancial results, in a more effective use of resources. Competitivenessshows the level of productivity, with which the business operatesand uses its resources.As in many other countries, various entrepreneurship contests in Estoniaare important means of developing the economic environment.The contests provide an opportunity to recognise the best companiesand promote entrepreneurship. The Estonian Companies’ CompetitivenessRanking is aimed at providing all Estonian companies withthe opportunity to compare themselves to those who are better. Thiscontest is granted by the representative organisations of Estonian companies- the Estonian Chamber of Commerce and Industry and theEstonian Employer’s Confederation. The evaluation methodology isprepared by the Estonian Institute of Economic Research. Only quantitativeindicators are taken into account, such as profit, turnover, investment,salary levels, return on capital, growth indicators, etc.A summary publication on the basis of the contest results has beenprepared for several years now. In addition to disclosure of rankinglists, its objective is to show why and how the winners have achievedsuch good results.ParticipantsAs many as 420 Estonian companies participated in the compilationof the Estonian Companies’ Competitiveness Ranking 2008 and 375of them qualified for the final countdown. The main reason for notqualifying was the negative net gain in 2007, but also incompletenessof submitted data and number of financial years which was insufficientfor participation.Competitive Small and medium size enterprise were established. Weare glad to note that 192 companies wished to be compared to othercompanies in this category. As in previous years, the largest number ofcompanies in the Competitiveness Ranking was among industrial orenergy related (101) enterprises. The least number of companiesequally in all the categories (11) came from food industry, tourism,business services, real estate and financial intermediation. It is interestingto note that there were as many construction companies thisyear as there were last year (55) and there was an intriguing change ofpositions among the best of the Ranking. Moreover, compared to previousyears several large companies did not compete this year, includingthe winners of various categories.WinnersFour of the last year’s winners were able to maintain their position andremain highly competitive – BLRT Grupp AS for the fifth and MažeikiuNafta Trading OÜ for the third year in a row. It is nice to see newnames among the winners, although the names are not very new ifyou look at the time they have been operating. For the second year ina row Tallink Grupp AS received the title of the Most Competitive Enterprise.Tallink Grupp AS also proved to be the Most Competitiveamong tourism companies. The winner of The Most Competitive Smalland Medium size Enterprise is Kaamos Kinnisvara OÜ, who was establishedin 2002 and who has also gained a high second place in itsown category (business services and real estate).The companies who have won titles in the Competitiveness Rankinghave the average history of 11 years, unless we consider Saku Õlletehaswhich was established in 1820 and has been operating for 188years. The youngest winners are Oma Ehitaja AS, Oilseeds Trade ASand Varmapartner OÜ (established in 2005) respectively among construction,agriculture, forestry and retail companies. If we look at theequity capital of the best companies in the Ranking, then almost 7companies are based 100% on Estonian private capital, 1 companybelongs to the Estonian Republic 100%, 1 company is based 100% onforeign capital and the equity capital of the rest of the winners is dividedbetween Estonian and foreign owners .We are also very proud that almost all the winners are the members ofthe Estonian Chamber of Commerce and Industry.The charts, methodology and any information regarding the competitionis available at: www.konkurents.eeAs last year, the participants could choose between 12 fields of activi -ty in order to benchmark themselves against their competitors. In additionto the general winner, for the second time this year the MostNovember 20089

TOP ESTONIAN ENTERPRISES 2008Entrepreneurship Award 2008Entrepreneurship Award 2008Foreign Investor 2007ABB AS 14Year of foundation: 1991Chairman of the Board: Bo Henriksson, Heiki KalveField of activity: energy and control engineeringtechnologyTourism Innovator 2008Emajõe Lodjaselts MTÜ 17Year of foundation: 2004Chairman of the Board: Priit Jagomägi, Ilmar TammField of activity: organisation of barge trips, trainingInnovator 2008VKG Oil AS 20Year of foundation: 1999Chairman of the Board: Nikolai PetrovitšField of activity: thermal treatment of oil shaleExporter 2008Ecometal AS 23Year of foundation: 1999Chairman of the Board: Marja KiristajaField of activity: recycling of lead-plate batteriesManufacturing Enterprise 2008Favor AS 26Year of foundation: 1990Chairman of the Board: Aivar KärmasField of activity: manufacture of leaf metal productsDeveloper of the Year 2008Tiptiptap OÜ 29Year of foundation: 2004Chairman of the Board: Kadri Klaassen, Rasmus VarunovField of activity: design, manufacture, installationof children’s playgroundsPHOTO: TOOMAS TUUL10November2008

TOP ESTONIAN ENTERPRISES 2008Estonian Companies’ Competitiveness Ranking 2008The Most Competitive Enterprise 2008The Most Competitive Tourism Enterprise 2008Tallink Grupp AS (group) 44Year of foundation: 1997Chairman of the Board: Enn PantField of activity: marine transportThe Most Competitive Small and Medium-sizedEnterprise 2008Kaamos Kinnisvara OÜ (group) 47Year of foundation: 2002Chairman of the Board: Priit UustulndField of activity: real estate developmentThe Most Competitive Retail Enterprise 2008Varmapartner OÜ 53Year of foundation: 2005Chairman of the Board: Riho SaksusField of activity: sale of waste handling equipmentThe Most Competitive WholesaleEnterprise 2008Mazeikiu Nafta Trading House OÜ 56Year of foundation: 2003Chairman of the Board: Tõnu ÄäroField of activity: wholesaleThe Most Competitive Industrial and EnergyEnterprise 2008BLRT Grupp AS (group) 59Year of foundation: 1996Chairman of the Board: Fjodor BermanField of activity: ship building and repairThe Most Competitive Food IndustryEnterprise 2008Saku Õlletehase AS 64Year of foundation: 1820Chairman of the Board: Veli Pekka TenniläField of activity: production and wholesale of low-alcoholbeverages, table water and soft drinksThe Most Competitive ConstructionEnterprise 2008Oma Ehitaja AS (group) 68Year of foundation: 2005Chairman of the Board: Kaido FridolinField of activity: main contracting for construction, real estate developmentThe Most Competitive Communicationand IT-services Enterprise 2008Eesti Telekom AS (group) 71Year of foundation: 1991Chairman of the Board: Valdo KalmField of activity: telecommunication,activity of holding enterprisesThe Most Competitive Forestry and AgricultureEnterprise 2008Oilseeds Trade AS 75Year of foundation: 2005Chairman of the Board: Veikko VaharField of activity: trade of cereals and rape seedThe Most Competitive Business Serviceand Real Estate Enterprise 2008Mainor AS (group) 78Year of foundation: 1979Director General: Ants PilvingField of activity: business developmentThe Most Competitive Financial BrokerageEnterprise 2008Gild Professional Services AS (group) 82Year of foundation: 1999Chairman of the Board: Rain TammField of activity: investment banking, private baking,management of alternative fundsThe Most Competitive Service Company 2008Olympic Casino Eesti AS 85Year of foundation: 1993Managing Director: Erki TavasField of activity: organisation of gamblingThe Most Competitive Transportationand Logistics Enterprise 2008Tallinna Sadam AS (group) 91Year of foundation: 1992Chairman of the Board: Ain KaljurandField of activity: work of portsNovember 200811

TOP ESTONIAN ENTERPRISES 2008The Methodologyof Entrepreneurship Award 2008Peep SürjeChairman of the Jury of Enterpreneurship Award 2008Rector of the Tallinn University of TechnologyThe objective of the competition“Enterprise Award 2008” is to expressstate recognition to the companiesthat are not only successful in thefinancial results of the recent years,but also innovative and sustainable inthe longer run.This year, awards will be given in sixcate gories: Developer of the Year 2008,Innovator 2008, Exporter 2008, Foreign Investor2008, Industrial Enterprise 2008 andTourism Promoter 2008. By determining categories,the companies of the fields the constantdevelopment and good performance of whichis the most important are pointed out.Assessment criteria are elaborated for everyaward category, of which some are the same inall categories – high profitability, innovative solutionsand ability of a company to establish itselfon export markets. The basis and methodsfor the evaluation criteria have been preparedby the specialists of Enterprise Estonia, experiencefrom previous years as well as advice fromseveral renowned experts including AndresSütt (the Bank of Estonia), Erik Terk (The EstonianInstitute for Future Studies), JaakLeimann (Tallinn University of Technology),etc., have been taken into account.Participation in the competition was voluntaryfor enterprises; the prerequisite is the filling inof the questionnaire and readiness to provideinformation on their activity and economic indicators.The questionnaires were prepared andinitial processing of information organised bythe Estonian Institute of Economic Research.The assessment of companies was organised intwo stages. First, a ranking of companies thatqualified on the basis of the methods preparedfor every category (considering the proportionsof various criteria) was compiled and ten bestcompanies given for further assessment to thecouncils of Enterprise Estonia. The councils selectedthree nominees from every category, anda category winner from these nominees. Thisyear, the competition was extremely tough inthe category of industrial enterprises, in case ofwhich the council made an exception andpointed out four presentable nominees. Whenselecting winners of the categories, in additionto the economic performance of the competingcompanies, the councils also took guidancefrom the general national development prioritiesof the Estonian entrepreneurship. The largejury of the competition selected the main prizewinner from the winners of all categories.The jury included the Rector of Tallinn Universityof Technology Peep Sürje, the Rectorof the University of Tartu Alar Karis, theMinister of Economic Affairs and CommunicationsJuhan Parts, the Minister of ForeignAffairs Urmas Paet, the President of theBank of Estonia Andres Lipstok, the formerChairman of the Supervisory Board of EnterpriseEstonia Üllar Jaaksoo and a Memberof the Management Board of AS TallinkGrupp, last year’s winner of the competition.November 200813

TOP ESTONIAN ENTERPRISES 2008Nominees for the Entrepreneurship Award 2008Enterprise Established Main activity Private capital Private capital Owners' equity Sales Change in sales Net profit Investment to Employees Sales perEstonia foreign 2007 2007 2007 compared 2007 fixed assets 2007 employee 2007(%) 2007 (%) 2007 (mln EEK) (mln EEK) to 2006 (%) (mln EEK) 2007 (mln EEK) (mln EEK)TTIPTIPTAP OÜ 2004 DESIGN, MANUFACTURE, 100 0 3.34 19.59 58 2.28 0.113 19 1.03INSTALLATION OF CHILDREN’S PLAYGROUNDSFAVOR AS 1990 MANUFACTURE OF LEAF METAL PRODUCTS 100 0 82.70 309.86 23 65.67 15.14 165 2.09ABB AS 1991 ENERGY AND CONTROL ENGINEERING TECHNOLOGY 0 100 352.00 1,700.00 24 82.00 145.00 704 2.41VKG OIL AS 1999 THERMAL TREATMENT OF OIL SHALE 100 0 1,727.00 1,460.00 36 329.40 716.97 597 3.68ECOMETAL AS 1999 RECYCLING OF LEAD-PLATE BATTERIES 100 0 90.50 314.52 120 122.00 2.00 53 5.93EMAJÕE LODJASELTS MTÜ 2004 ORGANISATION OF BARGE TRIPS, TRAINING 100 0 N/A 0.85 373 0.30 N/A 3 0.281 EUR = 15.6466 EEK; 1 EEK = 0.0639 EUR; based on 2007 data See also www.konkurents.eeEntrepreneurship Award 2008EEntrepreneurship Award 2008Foreign Investor 2008ABB ASEight reasonswhy ABB loves EstoniaABB, who won the Foreign Investor prizefor the second year in a row, and whowas also the overall winner of the EntrepreneurshipAward 2008, considers Estonia to bea good place to do business in. The group’smanager of the Baltic States, Bo Henriksson,gives eight reasons why that is the case.Favourable economic environmentRegarding Estonian competitiveness, a lot hasbeen said about the tax environment and thelow level of costs. Henriksson thinks that thelabour costs here are not at all lower than elsewhereanymore, but the tax environment certainlybenefits the development of the company.So far, the owners of ABB have not taken dividendsfrom the Estonian unit, but instead havedirected all of the profits to the development ofproduction. When the profits are not taxed, thecompanies do not need as many loans to investin production. And that is a relief for the industry.The parties support economic growthAccording to Henriksson, the Estonian governmentshave not interfered with entrepreneurship,they have focused more on establishingthe rules for an attractive business environment.He thinks that one of the outcomes ofthis is the local significantly smaller businessbureaucracy and greater transparency than inthe neighbouring country Latvia.Confidence in the economy’s perseveranceAt a time when the Estonian economy is ratherstormy, many foreign investors are doubtfulabout the situation here. Henriksson, however,affirms that he is certain that the favourableeconomic environment will persevere. The Estonian,Finnish and Swedish factories of theABB group form a “triangle” whose corners supporteach other. If any problems occur here,help will come from across the gulf. And theunits in Estonia are subcontractors for the factoriesacross the gulf. Henriksson does not ruleout the possibility that in the future Finnishand Swedish factories will be the subcontractorsfor Estonian factories instead.14November2008

TOP ESTONIAN ENTERPRISES 2008The ABB group’s manager of the Balticstates, Bo Henriksson, “The image ofEstonians as lazy workers with low productivityis not true in the case of ABB.In the factories of ABB Eesti the workproductivity and people’s motivation areon the same level as in the Finnish factories”.PHOTO: TOOMAS TUULContinuously strong know-how ofyoung specialistsThe Estonian labour force is well qualified anddespite there being constant talk about labourforce shortage, ABB has managed to successfullyfind all the necessary employees. At leastso far. According to Henriksson, the workingclimate here is similar to the Nordic countries:the workers do not need to be told twice whatto do and how. Once is enough. ABB has investeda lot in the employees’ training. For instance,Estonian vocational schools do notteach how to produce wind turbine generators– consequently, ABB had to train that part ofthe staff themselves. In addition to that, thecompany co-operates a lot with Tallinn Universityof Technology and several vocationalschools such as Tallinn Polytechnic School andTallinn Industrial Education Centre. ABB considersmaintaining a good reputation importantas well, so that they would not have to lure peoplewith high salaries but more with their goodname.People’s strong will to workBased on the above-mentioned one could saythat ABB has managed to dispel a number ofmyths – for instance the one about Estonia havinga labour force shortage, or that the businessenvironment is not favourable for industry inEstonia. Hereby, another myth is dispelled.Namely, Henriksson says that the image of Estoniansas lazy workers with low productivity isnot true in the case of ABB. In the factories ofABB Eesti the work productivity and people’smotivation are on the same level as in theFinnish factories. It might even be slightly betterhere, the head of ABB’s Baltic region says.One of the reasons for this is definitely thebene fits offered to the workers, for instance thestudy benefit: should you wish to study – thecompany will support you.Good ties with Finland and SwedenIn Henriksson’s opinion, Estonia’s Western-Nordic culture matches well with the Finnishand Swedish ones. The reasons for this are historical,of course, and are based on the inflowof Nordic capital into the Estonian economy.“Besides, the gulf between Tallinn and Helsinkihardly exists anymore. A helicopter covers thedistance in about 20 minutes, a ship in aboutan hour and a half,” Henriksson says.A good opportunity for expanding productionWithin the ABB group, the Estonian unit is lobbyingfor expanding the production, becausefor instance in Finland, the company has runout of space for that. Henriksson does not ruleout the possibility that ABB Eesti could build afactory for instance in Narva or Tartu, wherefinding labour force is slightly easier. At thesame time, the company must consider thegroup’s expansion policies: new productionbases are established where the demand is increasing.Global economy favours production inEstoniaHenriksson thinks that global economic trendsfavour production in those countries where demandis close by. The manager of ABB is referringto two things. First of all, the trend to shiftproduction to China has started to reverse. Severalfactories have been moved back from Asiato Europe, realizing that some problems arebound to occur in countries with cheap labourforce, for instance, the transporting of one windturbine generator from China into Europe is extremelyineffective. Secondly, Henriksson saysthat in ABB’s practice, the business modelwhere the so-called mother factory is in Finlandand a daughter factory supports it from Estoniaworks well.The investments of ABB EestiABB Eesti primarily produces wind turbinegenerators and frequency changers. The productionof both products has been expandedseveral times.For example, in the year 2007, approximately145 million kroons was invested mainly in thesubstation equipment manufacturing facility inMaardu and the production of frequencychangers in Jüri.This year, almost 200 million kroons was investedinto the factories in Jüri that produce frequencychangers and wind turbine generators.Due to the expansion of production, nearly 250new jobs were created in the year 2007, thisyear almost 100 were added. Altogether over1000 people work in the factories of ABB Eesti.The first wind turbine generators were fully assembledin Jüri in the year 2007, before thatthe factory produced only components of thegenerators, mainly stators and rotors. The productionis sold to the world’s leading wind parkmanufacturers. They enter into yearly contracts,as a rule, altogether regarding 200-500generators, for instance. One generator costsabout one million kroons.The ABB group operates in more than 100countries and it employs more than 100 000people.November 200815

TOP ESTONIAN ENTERPRISES 2008Nominees for the Foreign Investor 2008Enterprise Main activity Total amount of Sales 2007 Net profit 2007 Share of export Change infixed assets Average number ofinvestment (mln EEK) (mln EEK) (mln EEK) in sales 2007 (%) 2006/2007 (mln EEK) employeesIF EESTI KINDLUSTUS AS INSURANCE 200 1,239.05 213 0 1.69 409ABB AS PREPARATION, SALE AND SERVICING OF ENERGY 645 1,700.00 82 65 100 1021PRODUCTS AND SYSTEMS, CONTROL ENGINEERING ANDPROCESS CONTROL ENGINEERING PRODUCTS AND ROBOTSPÕLTSAMAA FELIX AS PRODUCTION AND MARKETING OF FOODSTUFFS 190 284.39 7.42 34 37.05 2091 EUR = 15.6466 EEK; 1 EEK = 0.0639 EUR; based on 2007 data See also www.konkurents.eeIf Eesti Kindlustus ASAS If Eesti Kindlustus belongs to the leadingNordic non-life insurance group If P&C InsuranceHolding Ltd, which is owned by SampoPlc. AS If Eesti Kindlustus has operated in theEstonian non-life insurance market as the marketleader since the year 2000. The company’smarket share in 2007 amounted to 33.3%(36.1% in 2006). Last year, the premiums writtenwere divided into insurance categories asfollows: voluntary motor own damage insurance(36%), property insurance (32%), mandatorymotor third party liability insurance (24%)and other insurance (8%). The insurance companydevelops and offers non-life insurance solutionswhich guarantee security and stabilityfor the customer in both business and privatelife.The year 2007 was good for If Eesti Kindlustusas far as economic activities were concerned.The volume of written insurance premiums increased9.6% as compared to the year 2006;this growth was smaller than the averagegrowth of the market but it reached the targetset for the year 2007 – the turnover was ca 1.2billion kroons. The insurance company’s consolidatednet profit during the accounting periodturned out to be 213.1 million kroons (theamount for the same period last year was 215million kroons), of which profit from financialinvestments accounted for 50 million kroons(the profit in the year 2006 was 26.4 millionkroons) and the profit from insurance activitiesaccounted for 163.1 million kroons (188.6 millionkroons in the year 2006). The companyemploys more than 400 people. The volume ofinvestments made into Estonia exceeds 200million kroons, the added value per employeeis 521 000 kroons.Põltsamaa Felix ASThe tradition of production in Põltsamaa canbe traced back to the year 1920 when the predecessorof the company, then known as EestiTarvitajateühistute Keskühisus (The Central Associationof Estonian Consumer Associations)was founded. During different periods of time,Põltsamaa has produced spirits, potato flakes,coffee, starch, fruit and vegetable conserves andberry wines.Today, AS Põltsamaa Felix produces and marketshigh-quality food products such as juicesand drinks, pickles, cooked dishes, sauces,jams, spreads, wines, fish products and muchmore. The company is increasingly focused onthe taste, quality and healthiness of the food.Põltsamaa Felix has by now become the biggesttaxpayer and the largest employer of the regionwith more than 170 employees. The turnoverof the company in the year 2007 was more than280 million kroons, and the company’s netprofit exceeded 7 million kroons. PõltsamaaFelix’s investments in Estonia amounted to 190million kroons, a total volume which puts thecompany in third place among other candidatesfor Foreign Investor 2008. The absolute changein the company’s capital assets put the companyin second place among the candidates. The investmentsthat the company made were varied.More than half of the capital was invested inequipment and property. A fifth of the capitalwas invested in intellectual property and stafftraining. The company was the only one amongthe candidates to invest in supporting infrastructure.The company employs more than200 people.FOREIGN INVESTORThose enterprises are recognisedwhich are especially outstandingwith regard to the volume of directforeign investments made intoEstonia and to the contribution intothe Estonian economy viainvolvement of new technologiesand creation of highly qualifiedpositions.16November2008

Entrepreneurship Award 2008Tourism Innovator 2008EMAJÕE LODJASELTS MTÜThe barge men enliven the tourismof Emajõgi and PeipsiMTÜ Emajõe Lodjaselts, the most notabletourism innovator of the year, attractstourists to south-eastern Estonia with itshanseatic barge, barge yard and imaginativeideas like a magnet.The barge men erected a small barge yard ona coast of Emajõgi and built two small Peipsiskiffs and a barge there. The latter is now usedto take people around Emajõgi, Lake Peipsiand Võrtsjärv. There is a veritable cornucopiaof colourful plans, starting from building a bigbarge yard and ending with building newViking barges and a paddled steamer.From the interview with the spiritual engineof the barge society, Priit Jagomägi, it becomesclear that even though all this could be a goodbusiness, it is more of a fanatic passion for allthose involved.How did the building of the barge go?Together with all the initial preparations ittook about a year and a half or two years. Thebuilding of the barge was completed in theyear 2006. We went to Russia and to Frieslandin the Netherlands to search for ship mastersand talk to cog builders. Prior to that we hadmade a small Peipsi skiff under the guidanceof an old boat master, and because it turnedout well, we had enough courage to build abarge. Life itself has taught us to build ships.The wisdom has accumulated over the years,with the help of the trial-error method. Everythinghas its own tricks and methods, butThe spiritual engine of the barge society,Priit Jagomägi, “Our main idea is tooffer people a chance to travel in time.”PHOTO: TOOMAS TUULNovember 200817

TOP ESTONIAN ENTERPRISES 2008when you put your heart into it, it will slightlycompensate for the lack of skill. Or as theysay: well begun is half done. But just half, therest comes with hard work, arguments andtoiling.The barge is completed, but the other goal –building a big barge yard and the River Centrein Tartu – has not been fulfilled yet. Doesthat mean that only a half of the initial planhas been realized?Definitely a lot less than a half. We have shipbuilding plans for the following 20 years atleast! Next year, we would like to start thebuilding of a copy of the Swedish battleshipUlrica. During the Great Northern War, theSwedes built altogether 30 two-masted battleshipslike that, with six pairs of oars and tencannons near Tartu, but they quickly becamethe booty of the Russians after the battle ofKastre in 1704. We acquired very accurate designsof the ship from the Swedish war archiveand we have talked to the Swedish Embassyabout it as well. Because the timetable of thebarge has been absolutely mad, we have notmanaged to start doing all the things we haveplanned.How big is the interest in sailing on thebarge?The demand is huge. It sails so much it ispractically falling apart! We cannot have allthe interested people on board this tiny barge.Even though the barge could take even 500people on board, we mostly do not allow morethan 30 people on board at once. And we cannotdo many more trips because the scheduleis already so full that there is little time foreven maintenance breaks. We should really tryto finish the Viking barges that are under constructionquickly and start operating them. Upto 30 people at once – that sets its limits, becausetravel operators calculate tourists accordingto arriving busloads. So the barge istoo small for busloads of Finnish tourists.How much have you advertised the barge?We have not advertised the barge at all. Therehas been quite a lot of publicity surroundingus in the media. And the people who havebeen on the barge, and been satisfied with it,talk about it to their friends. So this famecomes from a snowball-effect. And of course,people want to see nutcases like us. It seemsthat not even the big ships of Tallink have hadas much attention as our little barge. It hasreally been blown out of proportion.What is the purpose of the new ships – toserve more tourists?Our main idea is to offer people a chance totravel in time. Travelling in space has alreadybeen made so easy – a plane can take you tothe other end of the world in a few hours andthat does not amaze anyone. But the real effectis when you can travel back in time, 500-600 years, when you step on the barge.Naturally, we could not build a very archaicship, because it has to meet today’s requirementsof passenger transport. For instance, ithas to have an engine and safety equipment.So, the hanseatic barge Jõmmu is probably theworld’s first Peipsi barge equipped with an engine!What other ideas do you have besides buildinga Swedish warship?We would like to build a large two-mastedbarge, we got the drawings from the EstonianNational Museum. It would fit many morepassengers, certainly a tax-free shop, anaquatic centre, a lobby bar and a casino(smirks).One of our biggest, most distant and most expensivedreams is finding “Juliane Clementine”,the first paddle steamer of the Balticcountries, from the bottom of Lake Peipsi andbuilding a replica of that ship. The only cannonboat left from the War of Independence,Uku, is rusting away at the bottom of the EmajõgiRiver – it should be fixed up by the republic’s100. Independence Day!What other possibilities would you like tooffer to people on the barge besides showingmovies and theatre performances?Instead of just driving up and down we wouldlike to develop the theme of a nature barge.We initiated it this year: we went to listen tobirds’ song with the ornithologists on earlymornings, and at night we sailed especially tolisten to bats and night birds. In addition tothat, we sailed from Piirissaare to Tartu withnature photographers. In autumn we wouldlike to organize cranberry trips and on-bargeobservations of stars and constellations.Who sail on the barge?We do not have any actual statistics. But thereare a lot of Estonian companies who bringtheir foreign visitors onto the barge. Peoplefrom 20 different countries have visited us, includingfrom Sri Lanka and Bangladesh. Thepopularity is a bit of a disservice for us. Becausethe barge has been booked a long timein advance, it is not really possible to offer aride for random tourists visiting Tartu. At thesame, the employees of Tartu’s tourist informationcentre say that the first thing all foreigntourists ask about is a barge ride andPiirissaare. Unfortunately, they have to be directedto Toomemägi and the museums. Weare being used very successfully as a decoyduck for attracting tourists to this area.What is this barge thing for you personally– a business, a hobby, a source of income?Right now it tends to be all rolled into one.Peipsi-Emajõgi barge is a unique ship with anextraordinary appearance that helps to promoteand introduce the region, and to set itapart from others. In that sense, the bargerides are not a big business, but in spite of thewinter break in rides we still manage, andwith the help of sponsors we can set somethingaside for the self-financing of newpro jects. As a non-profit association we have amajor advantage compared to a company, becausewe do not have to make profit, but instead,we can use all the acquired income forinitiating new interesting attractions. A largepart of the profit is spent on the maintenanceof the ship – taking it to the shipyard in thewinter, tarring, inspections etc. All this equalsup to be quite expensive. We are trying to runthe barge thing so that it would be nice andinteresting for us as well. If it were only somethingcommercial, I would definitely get boredreally quickly.THE BARGE JÕMMU HAS ENLIVENEDTHE SUPPLY OF TOURISM SERVICESIN THE EMAJÕGI AND LAKE PEIPSIREGION.The ship that was completed in the year2006 is the only representative in the worldof the type of ship that used to be unique tothe region and very numerous. There usedto be more than 600 of those kinds of shipssailing around in that region.Archaic and modern technology has beencombined on board the ship. In contrast tothe old-fashioned building technology(pine wood, tar, flax products, hemp ropes)there are, among other things, mobile WiFiinternet, modern presentation technology,stand-alone electricity supply, economicalengine running on bio-diesel, navigationaltechnology etc. Jõmmu is equipped with aclay oven, bunk beds and berths. The bargeas an especially environmentally-friendly18November2008

TOP ESTONIAN ENTERPRISES 2008Nominees for the Tourism Innovator 2008Enterprise Main activity Established Sales 2007 Net profit 2007 Labour expenses 2007 Owners' equity 2007 Average number(mln EEK) (mln EEK) (mln EEK) (mln EEK) of employeesMTÜ EMAJÕE LODJASELTS ORGANISATION OF BARGE TRIPS, TRAINING 2004 0.85 0.30 - - 3STRAND AS HOTEL, ACCOMMODATION AND CATERING SERVICES 2001 61.95 -0.02 14.41 39.98 111DEMJANOV AS ACTIVITY OF THE RESTAURANTS 1996 22.98 -1.80 5.44 6 561 EUR = 15.6466 EEK; 1 EEK = 0.0639 EUR; based on 2007 data See also www.konkurents.eeStrand ASAS Strand owns one of the biggest hotels in Pärnu– Strand. As a result of a consistent activity andlarge investments, a modern spa and conferencehotel has been built, which offers four-star levelcomforts to business travellers, conferencetourists and holidaymakers. The goal of the companyhas been to create an environment thatwould attract customers not only during theshort summer season, but also during the winterseason, which is otherwise very quiet in Pärnu.The biggest achievement of the year 2007, whichthey used to get a nomination in the category ofTourism Innovator, is the start of a separate airservice between Stockholm and Pärnu, with thegoal of bringing new spa tourists directly toPärnu. Especially significant about this achievementis the fact that three of the biggest spa hotelsin Pärnu supported the idea in the interest oftheir common goal – in addition to Strand, Tervisand Tervise Paradiis as well. The first seasonwas successful for the airline; and the initiatorsare inviting other interested companies of thesummer capital to take part in the project.The turnover of AS Strand in the year 2007 was62 million kroons, the company employs 111people.Demjanov ASAS Demjanov is responsible for the running ofthe restaurants Gloria and Egoist, Gloria WineCellar the Guesthouse. The company considersits goal to be the developing of a new Estoniancuisine, and combining it with the Nordic andEuropean food culture. The company itself preparesall the food it serves, preferring to usemostly domestic and organic raw material. Traditionalfood preparation methods are combinedwith the most modern technology.As a service enterprise the focus lies constantlyon the improvement and perfection of the serviceprocess. The service includes the chef, thesommelier and the waiting staff who inform thecustomer about a dish’s compatibility with awine, the order of the served food and drinks;and the preparation methods and technologyof the dishes.The efforts of the company resulted in one ofits restaurants being chosen as one of the bestin the Nordic countries by a leading Britishfood magazine – no other Estonian catering establishmentor restaurant has reached that levelbefore. AS Demjanov restaurants have repeatedlybeen awarded in local competitions aswell. The company is involved in educatingother enterprises and people on the market byorganizing visits by internationally recognizedguest chefs and organizing international cookingcompetitions. The CEO and owner of thecompany, Dmitri Demjanov, is known as a proponentof the Estonian innovative cuisine bothin Estonia and in several foreign countries.The turnover of AS Demjanov in the year 2007was ca 23 million kroons, the company employed56 people.vessel has been given its very own individualblue flag.Several different services and events are connectedto the barge and the small barge yard.Among these are, for example, the trips of thecinema and theatre barge and several concertsand theatre performances in the bargeyard. Or the services “Cargo hold seminar” ora meeting during a barge ride and “The littleman’s barge package“ or a barge ride meantfor children where they are taught about sailingand taught to use old-fashioned woodcarvingand blacksmith tools.When in 2006 there were 3000 passengerson the barge, then last year there were 5000and this year over 6000.The ship was 100% handmade in a smallbarge yard. Building it cost 1.3 millionkroons and more than 150 volunteers helpedout. The construction was financed with thehelp of the European Union programme, inaddition to funds of the city of Tartu andTele2; the state forest management centregave them the necessary wood material. Itwas initially planned to build a big barge yardwith the help of the EU support as well, butthe project was postponed to the significantincrease in construction prices.The Hanseatic barge Jõmmu has an especiallyround (wide and flat) hull. It is 12 metreslong and 7.5 metres wide, it weighs 23tonnes and it can carry up to 50 tonnes. Itsmast is 15 metres tall and it can reach thespeed of 7-10 knots.Barge trips are quite pricey. An hour costs2400 kroons, if you want to rent the bargefor an entire week you have to pay 49 000kroons. The prices do not include valueadded tax. During larger events the barge hasdone round trips with a ticket of 50-75kroons as well.TOURISM INNOVATOREfficient companies are recognisedwhich have developed innovativeand high-quality tourism products,which are competitive among foreignas well as local tourists visitingEstonia.November 200819

Entrepreneurship Award 2008Innovator 2008VKG OIL ASThe VKG men finally foundthe Estonian NokiaThe Estonian Nokia is oil shale“, say theoil-shale chemists of Viru Keemia Grupp(VKG) that is operating in Kohtla-Järve. Nokidding.This year, VKG uses 1.8 million tonnes of oilshale. Looking at all the things the companycan make out of oil shale, there is no doubt –the long sought-after Estonian Nokia has finallybeen found. “It is said that Estonia is an innovativecountry, that a whole bunch of geniuseslive here,” says Jaanus Purga, the R&D Managerof VKG. “But only about five patents are issuedhere every year. And we got three of them lastyear. Not bad, as Mati Alaver would say!”What is so striking about the VKGmen?It is common knowledge that Eesti Energia usesoil shale to fuel the power plant in Narva sothat we would have electricity in our homes.For years, VKG has mostly been producing oilproducts out of oil shale, with a volume of over220 000 tonnes a year. Oil accounts for moreThe R&D Manager of VKG,Jaanus Purga, “It is said that Estonia isan innovative country, that a wholebunch of geniuses live here.”PHOTO: TOOMAS TUUL20November 2008

TOP ESTONIAN ENTERPRISES 2008than a half of the company’s 1.8 billion kroonturnover, and it is mostly exported. Consideringthe rally of energy prices on the global market,the business continues to be profitable andstabile. Despite the rapidly rising fuel pricesgoing slightly down recently, the “energy currency”USD keeps getting stronger.So, Purga has to admit that when people inTallinn are complaining about the economybeing stagnant, but people in Kohtla-Järve donot know anything about it. Instead, a brandnew oil plant that is one of the most modern inthe world is being built near VKG, and morethan a billion kroons will be invested in it. Theplant has to start operating already next year,increasing the company’s oil production by athird.Purga, “We have amended the plant’s technologyto such an extent that we do not know howit will even work. In spring 2009 we will just behoping for the best!!”It is not a piece of news anymore that the oilindustry’s by-products are, to a small extent, bitumen,coke and pitch. That is no news eitherthat the subsidiaries of VKG produce and sellheat, power and gas, supplying the industryand population of Kohtla-Järve with them. Areal innovation in the group was initiated lastyear, when they started producing chemicals ofhigh purity. The technology for producing themwas born in VKG’s Research and DevelopmentDepartment, its main author was Anatoli Tsepelevits.When the price of a tonne of oil is approximately7000 kroons on the market at the moment,then a tonne of these chemicals can easilysell for more than half a million. Since last autumn,VKG produces and sells 2-Methylresorcinolto the world’s cosmetic and tanningsubstance industries. However, this happens insmall quantities: when last year and this yearthe company managed to produce only up toten tonnes, then next year the production willbe expanded to 30 tonnes. Purga says that even500 kilograms is a considerable amount on thismarket, because the global demand for2-Methylresorcinol is less than 100 tonnes ayear. “More than 30 tonnes would already be asuper result for us!”Oil shale phenols Made in Kohtla-Järve havethus far been sold toward three directions: toIndia, where they will be used in brown hairdyes, and to the USA and Great Britain, wherethey are used for tanning hides. VKG used toproduce resin for the Soviet tyre industry forseveral decades. But then the times changedand the old quality was not good enough anymorefor the Western market. Now the companywants to add even more value to oil shale,trying to get a foot through the door of theglobal tyre industry. In order to achieve this, thecompany has for years been flirting with theworld’s biggest resorcinol and tyre resins producer,the US company Indspec Chemical Corporation,whose customers include the fivebiggest tyre manufacturers starting withGoodyear and Michelin. Purga says that theyhave tried to convince Indspec that it would bemore affordable to produce resin in Estoniawith the help of VKG, for the European andAsian markets. When at the beginning, theAmericans would politely show the Estoniansthe door after this suggestion, then as time wentby, they have started to see that it is a good idea.Moreover so because the resins produced basedon Estonian raw materials turned out to have avery competitive quality.“On the one hand, those buggers themselvestook the patent for the resins of our raw material.On the other hand, it is good that in cooperationwith them, we can get our footthrough the door of the global tyre industry.Now we can manufacture the tyre resins for Europeand Asia here, using the raw material ofour oil shale, based on the recipe of Americans.Could there be any better cross-border co-operation?”Purga asks.Processing oil shale means that more than halfof it is left as ashes and half coke, and scientistshave been wondering for a long time how touse that residue effectively. The ashes are storedin mountains, but the men at VKG are smarter– they want to build a 2.5 billion kroon cementfactory by the year 2011. “We researched differentpossibilities for making both mixturesand blocks, but the only material that can beproduced out of half coke and oil shale ashesin large quantities in accordance with Europeandemands turned out to be cement,” Purga says.At the moment, the world’s top three suppliersof cement producing technology are dealingwith the realization of VKG’s ambitions. And itis not an easy task, even if it sounds like one,because the oil shale by-product has to bemixed with other substances in order for it topetrify.The plans of VKG do not stop there. They haveone more ambitious idea – to start producingdiesel fuel that would be of good enough qualityto use in cars. A large part of shale oils producedin Estonia are suitable for refining fuel,the only thing that needs a finishing touch isthe necessary technology, and that is being industriouslyresearched at the moment. “In sixyears we could be producing 350 000 tonnesof diesel fuel, which would almost cover theneed of entire Estonia,” Purga declares. “Whenthey say that the Estonian export potential istilted, then be my guest: a cement factorywould give an additional billion kroons worthof export turnover and an oil refinery wouldbalance the export and import of diesel fuel tozero!”Nominees for the Innovator 2008Enterprise Main activity Sales 2007 Net profit 2007 Labour expenses 2007 Owners' equity 2007 Average number(mln EEK) (mln EEK) (mln EEK) (mln EEK) of employeesVKG OIL AS THERMAL TREATMENT OF OIL SHALE 1461.88 329.39 106.77 1,727.26 597CYBERNETICA AS HARDWARE AND SOFTWARE DEVELOPMENT; PRODUCTION AND SALE OF INFORMATION SYSTEMS 92.66 16.22 31.19 24.36 94WEBMEDIA AS ELABORATION AND DEVELOPMENT OF SOFTWARE PACKAGES 135 22.09 64.77 53 1681 EUR = 15.6466 EEK; 1 EEK = 0.0639 EUR; based on 2007 data See also www.konkurents.eeNovember 200821

TOP ESTONIAN ENTERPRISES 2008Webmedia ASWebmedia is a company based on Estoniancapital that was founded in Tartu in the year2000. Even though initially, the company’smain line of business was chosen to be web design,it was changed into software developmentalready in the second half of the year 2000, becauseit seemed more attractive and profitable.At the end of 2004, Webmedia expanded intoTallinn; in 2005 its business started in Lithuania,Finland and Denmark; and additionally,there are development centres in Romania andSerbia. Among the customers of the companyare besides several Estonian, Lithuanian andSerbian governmental institutions also thebiggest Estonian, Finnish and Swedish telecommunicationscompanies, banks and medical institutions.Webmedia is co-operating intenselywith BEA Systems (licensing mediation andmaintenance, trainings), CA Wily Technologies(licensing mediation and maintenance, trainings,Performance Management consultations),Microsoft Eesti (Webmedia is MS Gold CertifiedPartner), ILOG (JRules business rulesmaintenance, licensing mediation and maintenance,trainings) and with Oracle (licensingmediation, trainings). During the last fouryears, the company’s turnover has grown ca60% per year on average, reaching 135 millionkroons in the year 2007.For the Innovator 2008 competition, Webmediasubmitted its product, which is aimed atmaking the work of Java programmers more effective.It is an improvement to the Java programminglanguage, which shortens thewaiting time in a programmer’s work. A programmerwould normally write codes blindlyand check them later, and the waiting time tosee the results can be ca 2-3 minutes. WithJavaRebel the deploy takes 1-2 seconds. Thecompany started using JavaRebel in March2007 and starting from August 2007 the softwareis used in all of Webmedia’s software developmentprojects. JavaRebel as an inventionand its consistent marketing in the world (USA,India and Europe) have certainly helped to improvethe reputation of Estonia as an innovativeand front-rank e-country; and the licensesales have increased and diversified Estonianexport.Cybernetica ASCybernetica is an internationally evaluated privateresearch and development company whichwas originally founded in 1997 by joining theresearch and development departments of theCybernetics Institute of the Estonian Academyof Sciences and Arvutustehnika Erikonstruee -rimisbüroo (Computer R&D Division) - EKTA.The goal of Cybernetica is to offer advancedand modern technological tailored solutions(from start to finish) in the fields of informationsecurity, software development and visualnavigation systems. The turnover of the companyin the year 2007 was ca 93 millionkroons, the net profit amounted to more than16 million kroons.AS Cybernetica competed for the EntrepreneurshipAward in the category of Innovatorwith one of their products, the range lightE8554, which has the highest intensity lightbeam among its kind in the world. It consists ofa high power LED matrix with individuallenses, a power supply unit and a flasher (acontroller that makes the light blink). The constructionof the product enables to create powerfulsources of modular light signals that couldbe implemented in marine navigation – inlighthouses and sea marks.The lens of the omnidirectional lantern E8275can collect the maximum amount of light fromthe LED-s and project them in the required verticalangle of the navigation implement.The sea mark light E8921, specifically createdfor the use of the Norwegian Coastal Administration,illuminates the sea mark’s informationsurface using only 2W of power.LED indicator panel E5813 is a safety indicatorfor port cranes and container spreaders that letsthe crane operator know about the status of thecontainer’s lifting automatics. By now, the productis being used by most of the world’s containercrane manufacturers; more than 99% ofthe production is exported.The ice buoy lantern E8291 tries to withstandthe wintry forces of nature that have so far ope -rated victoriously at sea; and it achieves it byhousing LED based light sources directly in theinnovative streamlined body (it is customary touse protective cupolas and bars that limit thespreading light and radio signals and whichoften turn out to be insufficient). The firstbatches of the product were sold in 2007, internationalmarketing started in the year 2008.INNOVATORThose enterprises are recognisedwhich have achieved economic successwith the help of outstanding innovationsin order to motivate theEstonian entrepreneurs to initiate,support and perform innovative activitiesin their enterprises.22November2008

Entrepreneurship Award 2008Exporter 2008ECOMETAL ASMore than a million batteriesa year are recycled in SillamäeOperating in Ida-Virumaa, Ecometal willcollect 20 000 tonnes of old batteriesfrom the surrounding region this year and produce12 000 of lead from them.The company Ecometal that was founded fiveyears ago would be a great example in anywaste management book, giving the term “recycling”a deep meaning. Old batteries that aredangerous to the environment are recycled upto 90% with the help of Ecometal. The company’smain products are soft lead and lead alloys,of which almost all is sold back to theEuropean battery industry as “gold ingots” fromthe factory in Sillamäe. The business is stabileand because the price of lead has made a greatjump in the global markets in recent years, themen in Sillamäe have plenty to be satisfiedwith.Tõnis Kaasik, Chairman of the Board and oneof the owners of Ecometal says that the idea tostart recycling batteries in Estonia was bornabout ten years ago already. But because thecompany had to get an integrated environmentalpermit – and Ecometal was one of the firstnew productions to get that permit in Estonia –it took years to get the factory running. “I havebeen involved with environmental protectionall my life and waste management is a risingtrend,” Kaasik says. „As waste collection wasfully operational here and old batteries werebeing transported from Latvia and Lithuaniathrough Estonia to factories in Spain and GreatBritain, we thought that why ship them that far,when they could be recycled in Estonia instead.”Indisputably the region’s most modern andmost environmentally-friendly battery recyclingfactory is located in Sillamäe, in the buildingsthat used to belong to Silmet. This location wasPHOTO: TOOMAS TUULChairman of the Board of Ecometal,Tõnis Kaasik says that the company isplanning to give more added value totheir products. Instead of selling lead asingots, it can be used for producingkeels for yachts or thin sheets of lead forx-rays instead. Lead can also be used forproducing tin roofs, cables etc.November 200823

TOP ESTONIAN ENTERPRISES 2008chosen because of the fitting infrastructure andindustrially-oriented people. Altogether 20 000tonnes of batteries will reach Sillamäe this yearthrough scrap metal collection networks.A lion’s share of these comes from Finland andLatvia. Those countries do not have factorieslike that. Ecometal also recycles all Estonian oldbatteries, collecting them from waste managementcompanies, car repair ships and even privatepersons. Estonian batteries account for afifth of the company’s recycling capacity.example, end up here. For instance, one of thebiggest computer companies in Hungary sendsits old batteries to Sillamäe.The 12 000 tonnes of lead and lead alloys, and1000 tonnes of polypropylene or the cover materialof batteries that are the end result of recycling,Ecometal mostly resells to theEuropean battery industry. A part of lead, forinstance, goes to a Polish battery producer,Jenox.notes. Even though this year, the price for thismetal has fallen two times, the companies arewilling to pay a price high enough for makingthe business of battery recycling profitable.What is produced in Estonia is an addition tothe so-called secondary global market of lead,which accounts for more than 60% of the entireglobal lead production. In most Western Europeancountries and in the USA, used car batteriesare collected and more than 90% of themare recycled.Kaasik says that it would be possible to bringbatteries from Lithuania as well to Estonia, butfor some reason, the Lithuanians are allowed touse the “axe method” dating from the last centuryto solve the issue of old batteries – theysimply saw through the old batteries with acidsplashing everywhere! “Of course, this kind ofsituation cannot be sensible: that there is a singleEuropean Union, but that there are differentdemands – in one country, the investment is afactory, and in another a saw, and they have tocompete with one another,” Kaasik says.About a half of Finnish battery scraps reachesthe Ecometal factory; the Finnish sell the restto Germany for recycling. Last year, Ecometalstarted to buy batteries from Sweden as well,even though there already is a big recycling factorythere. Not only car batteries, but also computerbatteries and phone batteries, forBoth the electrolyte and the plastic are used.The insulation layers made of the different materialsof the batteries have a high calorific valueand reach the furnaces of Kunda cement factoryas alternative fuel. Ecometal is currently allowedto dump sodium sulphate watersolutions in the sea, but the company wouldlike to start using that compound in the futureas well. Currently, a 40 million kroon expansionto the factory is being built, where at theend of the year they could start crystallizingsodium sulphate and sell it to the paper-, textile-and household chemicals industry. A smallpart of the slag that contains lead, which comesfrom the smelters, is deposited underground ina landfill for dangerous waste in Vaivara.“We were lucky to get on board the train of risingglobal lead prices in the year 2003,” KaasikAccording to Kaasik, the company is planningto give more added value to their products. Insteadof selling lead as ingots, it can be used forproducing keels for yachts or thin sheets of leadfor x-rays instead. Lead can also be used forproducing tin roofs, cables etc.An old battery is at the same time a dangerouswaste product and a marketable commoditywhich is worth a lot of money. That is why theyare not dumped by a side of a forest anymore.In some places, there is a very active black marketfor batteries as well. For instance, batteriesare transported from South Estonia into Latvia,where the state subsidizes their collection. ”Latviangypsies go to rubbish tips by minivans tobuy batteries, paying a higher price thanks tothe subsidies. In the end, those batteries reachus anyway,” Kaasik says.Nominees for the Exporter 2008Enterprise Main activity Sales 2007 Export sales 2007 Increase in export sales Net profit 2007 Average number Added value(mln EEK) (mln EEK) 2007 compared to 2006 (%) (mln EEK) of employees per employee (th EEK)NORMA AS PREPARATION AND SALE OF SECURITY SYSTEMS 1,263.94 1,250 19 105.9 972 378AND DETAILS FOR CARSTERG AS MANUFACTURE OF METAL STRUCTURES 57.05 38.249 40 1.455 14 507ECOMETAL AS RECYCLING OF LEAD-PLATE BATTERIES 314.52 311 80 122 52 27111 EUR = 15.6466 EEK; 1 EEK = 0.0639 EUR; based on 2007 data See also www.konkurents.eeEXPORTERThose enterprises are recognisedwhose export turnover, growth inexport turnover and value addedper one employee was the greatestin 2007, who have made a contributionto the development of productsand who use an approvedquality management system.Ecometal’s buying of old batteries(Portion of old batteries’ purchase turnover in 2007)Finland 34%Latvia 32%Estonia 18%Lithuania 14%Sweden 2%Ecometal’s export markets(Portion of production’s sales turnover in 2007)Germany 44%Italy 11%Sweden 6%Poland 19%England 14%Finland 4%Estonia 1%Latvia 1%24November2008

TOP ESTONIAN ENTERPRISES 2008Norma ASAS Norma was founded in 1891 in Paldiski as atin working company. Until 1973, Norma’smain product groups were tin products alongwith consumer goods and toys. Starting from1973, the company has focused on producing,selling and developing safety equipment componentsand safety systems for cars. Norma-Osvar ZAO (Russia) belongs to the group, andits main line of business is the distribution of ASNorma’s goods and services, warehousing andbeing involved with customs’ procedures.In addition to manufacturing and distributingsafety systems for cars, the current Norma isgradually becoming a considerable manufacturerof safety equipment components for theinternational automotive industry. The companyprovides engineering services on the design andadaptation of safety systems for cars and safetybelt components. In 2007, the sale of safety systemsfor cars was added to the turnover.The turnover of the group in the year 2007 was1.2 billion kroons; and the net profit amountedto 106 million kroons. Compared to the year2006 the production volumes increased by12%. In the year 2007, Norma exported 98.9%of its production, the increase in export was18% compared to the previous year. The mostimportant export markets are Sweden (39% ofthe turnover), Russia (53%) and Germany (3%).The increase in the sales of safety equipment toRussia and the Ukraine in the year 2008 was72%.From the year 1999, Norma belongs to the internationalgroup Autoliv, which owns 51% ofAS Norma’s shares. The company’s shares havebeen quoted on the primary list of the TallinnStock Exchange since 1997; its shares are alsotraded with on the Frankfurt, Berlin and Munichstock exchanges. According to the most recentdata, the group employs 998 people. Theadded value per employee is 378 159 kroons.AS Norma has been certified with the automotivequality management standard ISO/TS16949:2002 and the environmental managementsystem standard ISO 14001:2004. In theyear 2007, the company was awarded the title ofan exemplary supplier by AVTOVAZ.Terg ASOÜ Terg was founded in the year 1991. Thecompany’s main fields of business are the prefabricationand installation of steel construction;cleaning of steel materials and steelproducts on a shot cleaning line; cutting steelprofiles on band saw. The average number ofemployees dropped to 19 in the year 2006. Inthe company, the added value per employee is507 862 kroons. The sales revenue has beenfluctuating somewhat in recent years, but it increasedsignificantly in 2005 and maintainedthat level during the next period of 2006. In theyear 2007, the company’s turnover was 57 049509 kroons, of which export accounted for90%. Steel constructions have been sold to Finland,Sweden, Norway, France, Germany, Belgium,Italy, Latvia and elsewhere. In recentyears the company has been profitable, the netprofit of the year 2007 was ca 1.4 millionkroons. The company is based on Estonian privatecapital.

Entrepreneurship Award 2008Manufacturing Enterprise 2008FAVOR AS“20 keys” brings success to FavorEstonia’s largest thin sheet metalworkingcompany Favor is ahead of its competitorsby affordable prices and flexibility, but oneof the success factors for the company is usingthe quality improvement methodology “20keys”.The company operating in Maardu has grownrapidly in recent years – in four years, theturnover has almost trebled, reaching nearly400 million kroons this year. Favor is a strongexporter, as nearly 48% of the output is exported.Last year, a new factory was openedthat cost 63 million kroons.One of the special traits of the company is thatwhen in the Estonian economy in general peopleare trying to ascribe a negative and disapprovingmeaning to the term “outsourcing”,then Favor is not ashamed it. Favor is a serviceenterprise who offers its customers the outsourcedservices of cutting thin sheet metal andproducing thin sheet metal components and assemblies.The company also produces differentbuilding profiles and sells suspended ceilings.Aivar Kärmas, the Chairman of the Board ofFavor says that outsourcing the production of amore complicated construction or detail offersa far greater profitability than being on the marketwith your own product. “The volume effectand specializing give the possibility to producewith less waste, and the companies who submitlarge orders guarantee a stabile product developmentand a market ten times as big ascould be achieved by producing the end-producton our own,” Kärmas says. Besides, thereare not enough skilled workers in the Estonianprocessing industry to produce and assembleall the parts of a complicated and innovativeproduct, according to Kärmas.Flexibility and affordable prices have helpedAivar Kärmas, the CEO of Favor:”The successfulness of “20 keys” is basedon a complete approach to managing acompany. Different units of the companysupport each other and the synergy that iscreated from that influence helps the companyto quickly reach a new level indevelopment”PHOTO: TOOMAS TUUL26November 2008

TOP ESTONIAN ENTERPRISES 2008Favor gain success next to larger competitors.This in turn is achieved by good co-operationwith both customers and suppliers. Favor purchases30% of its raw material from its “neighbour”,ArcelorMittal Tallinn (formerly knownas Galvex). Favor has several well-known customerswhom they supply with sheet metalcomponents and assemblies. Among these are,for instance, ABB, who uses these in its automaticsand energetics’ products and Carrier refrigerationequipment, and Radio FrequencySystems, who are also supplied with aluminiumcomponents and assemblies of the telecommunicationsfield, including mobile network antennas,for instance.In addition to flexibility, the company’s workeffectiveness has risen with the implementationof the “20 keys” methodology as if by magic.This methodology was developed by a Japaneseprofessor, Iwao Kobayashi, and companiesall over the world re using it to systematicallywork themselves up, increase the chances ofsurvival and make their development faster.Using the “20 keys” methodology, Favor is constantlycomparing itself to its competitors andcontrasts the productivity and effectiveness ofdifferent units’ work. In addition to that, thecompany recognizes good achievements andsets challenging goals to its employees andteams. Favor’s principles also include the systematicdevelopment of the skills of the company’sapproximately 180 employees, andraising their qualifications and salary based onthe indicators of effectiveness. It is consideredimportant that every Favor employee knowswhat is expected of them.”The successfulness of “20 keys” is based on acomplete approach to managing a company.Different units of the company support eachother and the synergy that is created from thatinfluence helps the company to quickly reach anew level in development,” Kärmas says. Inessence, “20 keys” means keeping the “back office”of production pedantically in order, keepingthe production economical and fine-tuned,and keeping the staff well-motivated. Nothinghappens just because, no resources are wastedanywhere, the development never stops. Favorhas invested in effective production and the resultscan already be seen: the employees’ addedvalue has more than doubled in the companyduring the past four years!Kärmas says that in the business of outsourcing,the trump-card of a company can only beflexibility, which means producing in smallquantities and in a short period of time.“We consider the shortening of transition periodsfrom one product to another very important,”Kärmas says. Favor is trying to achievethis with carefully planning the benches’ workand production programme in advance and optimizingthe benches’ work the maximum. “Ofcourse, with every kind of automatization aswell, to free the employee of tasks that are monotonous,physically difficult or dangerous,”Kärmas adds.Favor’s four metalworking divisions• CutCenterServices for cutting sheet steel coils to lengthand slitting them, and selling sheet steel.The customers are industrial enterpriseswho require a partner that takes their needsinto account when supplying raw materialsand who can provide them with completesolutions regarding sheet steel. In the year2007, Favor processed 19 000 tonnes ofsheet metal and exported a significant partof it to Latvia, Lithuania, Finland and Sweden.Regarding this line of business, thecompany’s market share in Estonia is 60%.• MetaformProduction services of thin sheet metalworking,components and assemblies.These services are mainly meant for export,the customers being the producers of refrigeratingand electric equipment in Germany,the Netherlands, Great Britain, Sweden,Finland and Hungary.• ProfilineProducing a variety of building profilesusing the roll-forming technology. Therange of products includes lightweight battens,lightweight frames for interior buildingand metal suspended ceiling systems.The Profiline products are known across theentire building market of the Baltic countriesfor reliability and stabile high quality.Favor’s market share in this line of businessis 65-70% in Estonia and 15-20% in Latvia.• LaekeskusA professional sales centre specialized insuspended ceiling products targeted at businesscustomers. The product range includesall types of suspended ceilings from differentglobal producers, and in addition tothat, the company offers an installation serviceand technical support for the suspendedceilings. Laekeskus has more than fifty partnersamong construction materials shops inEstonia and the company’s market share inthat line of business is 22% in Estonia.Nominees for the Manufacturing Enterprise 2008Enterprise Main activity Sales 2007 Change in sales 2007 Net profit 2007 Investment to fixed assets Average number Added value(mln EEK) compared to 2006 (%) (mln EEK) (mln EEK) of employees per employee (th EEK)VKG OIL THERMAL TREATMENT OF OIL SHALE, MAIN PRODUCTS: 1,461.88 36 329.32 716.18 597 818.8DIFFERENT FUEL OILS, PETROLEUM COKE AND PITCH,SUMMARISED OIL SHALE PHENOLS, ANTISEPTIC TIMBERIMPREGNATION OILS AND OIL SHALE BITUMENFAVOR AS MANUFACTURE OF LEAF METAL PRODUCTS 309.86 23 65.67 15.14 165 703.3ECOMETAL AS RECYCLING OF LEAD-PLATE BATTERIES 314.52 120 122.58 2.04 53 2,710.0HARJU ELEKTER MANUFACTURE OF SUBSTATIONS, DISTRIBUTOR BOXES, 269.84 45 21.5 8.93 175 456.6ELEKTROTEHNIKA AS SWITCHBOARDS, CONTROL ENGINEERING AND CONTROLPANELS AND LEAF METAL PRODUCTS INSURANCE1 EUR = 15.6466 EEK; 1 EEK = 0.0639 EUR; based on 2007 data See also www.konkurents.eeNovember 200827

TOP ESTONIAN ENTERPRISES 2008Harju Elekter Elektrotehnika ASThe history of the company starts in 1968when it started producing electrical equipmentas a part of Harju KEK. Ever since the year2005 it continues operations as Harju Elekter100% subsidiary. AS Harju Elekter Elektrotehnikadesigns, manufactures and marketselectrical products to the power supply sector(substations, distribution panels), to the industrialsector (automation and control systems);and to the construction sector (distribution andcontrol switchboards). In addition, the companyoffers a large number of different sheetmetal products. The company is one of theleading manufacturers of MV/LV systems in theBaltic states. Great emphasis is put on productdevelopment; there is active co-operation withuniversities and vocational educational institutions.More than 40% of the production is exported,the main export markets being Finland,Latvia, Lithuania, Sweden, Greece and Russia.In the year 2007, the company’s turnover wasalmost 270 million kroons and its profit was 21million kroons. The company employs 175people. AS Harju Elekter Elektrotehnika has theISO9001:2000 certificate for quality managementand the ISO14001:2004 certificate for environmentalmanagement.MANUFACTURINGENTERPRISEAn Estonian enterprise engaging inindustrial production is recognised(EMTAK division C) which had thefastest growth in turnover in 2007,whose value added created and investmentsin product developmentand in the development of newtechnologies were the greatest.VKG Oil ASVKG Oil AS was also a nominee for Innovator2008 and was declared the winner of thatcategory. Read more about the company onpage 20Ecometal ASEcometal AS was also a nominee for Exporter2008 and was declared the winner of thatcategory. Read more about the company onpage 2328November 2008

Entrepreneurship Award 2008Developer of the Year 2008TIP TIP TAP OÜEstonian playgrounds sellin Finland and SwedenPHOTO: TOOMAS TUULThe executive manager of Tip Tip Tap,Rasmus Varunov: “Our market dependson how a government or a city sets its priorities– whether it directs money intochildren’s development or not. In Estonia,there has been a huge leap for the betterin that issue, but in Latvia and Lithuaniait is all yet to happen. Cities are differentas well – Tallinn is truly active, but Tartuorders perhaps only a tenth of what thecapital city does.”November 200829