Accounting policy

Accounting policy

Accounting policy

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Accounting</strong> <strong>policy</strong> (definition in IAS 8)Apart from accounting policies, IAS 8 is devoted toerrors and accounting estimatesFor example, interim report of Infosys Ltd (form 10-K) is214 pages long7 pages (124-131) are focused on accounting <strong>policy</strong>2

Determines the way of how the assets, liabilities,equity, income and expenses have to be:• measured• recognized• presentedin accordance with the choice made by a companyE.g. machinery in ACME company have to bedepreciated in accordance with the straight-linemethod, residual value is assumed to be equal to 10% of their costs and those costs are capitalized intothe cost of the production4

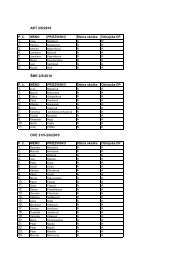

Impact of respective methodof depreciation on net incomeYearResidualvalueCapitalized/ ExpensedStraightlineSYD SYD 1 10% C 0 0 01 10% E -18 000 -6 000 -30 0001 20% C 0 0 01 20% E -16 000 -5 333 -26 667Total cost: 100 000 Estimated life: 55

If only one way of measurement, recognition and / orpresentation would have been possible, therewouldn´t been any need for disclosure of accounting<strong>policy</strong> in financial statements (i.e. in notes)However, there are many instances, in which the IFRSallows alternative accounting policies, e.g.:• various methods of depreciation (amortization) arepermitted; e.g. IAS 16 states:6

• there are various methods of presentation ofinterests and dividends permitted in accordancewith IAS 7.31-33:7

• government grant provided for the acquisition of assets couldrecognized in accordance with IAS 20.24• if the cost of asset has been 200, grant has been provided at 120 anduseful life of the asset are 5 years, thena) asset shall be recognized at 80 only; dep. charge is 16b) asset shall be recognized at 200, and liability (deffered income,measured at 120), should be recognized through profit or lossduring the expected life of the asset; depreciation charge is 40(=200 / 5), income is recognized at 24 (=120 / 5); net impact onprofit or loss is thus 168

• interest in companies are accounted for in accordance withthe to amount of such share:50 % ≤ IAS39> 50%;controll(IAS 27)(20 % - 50%);significantinfluence(IAS 28)9

• interest of up to 20% of outstanding shares of anycompany could be (in accordance with IAS 39) recognizedas follows:a) securities held for trading; in this case any change infair value is recognized through profit or lossb) securities available for sale; in this case any change infair value is recognized through equity , unless there isa severe and long-term impairment10

• buildings which are held for renting purposes areafter its initial measurement measured inaccordance with IAS 40 either at:a) costs, adjusted by accumulated depreciationand impairment charges (only such adjustmenthave a certain impact on profit or loss)b) at fair value, any change of fair value isrecognized through profit or loss11

In preparing financial statements, managementshould apply its judgment in various cases, e.g.:• what is the level of risk (required for determinationof provisions)• materiality of respective items to be presentd infinancial statements (e. g. whether they should bepresented as a separate line items)• amount of cash-flows to be derived from the assetsduring its economic life (e. g. in accordance withIAS 36)• whether the rules of IFRS have to be appliedbefore its effective dates12

There are accounting <strong>policy</strong> and accountingestimatesBoth of them are related to the application of thejudgment of a management<strong>Accounting</strong> <strong>policy</strong> determines general rule (e.gwhich method of the depreciation shall be applied)<strong>Accounting</strong> estimates specify parameters (e.g. whatis the useful life of the depreciable asset)14

<strong>Accounting</strong> <strong>policy</strong> shall be amended only in followingcases (IAS 8.14):As a result of 8.14b, it is prohibited to change it without justreason<strong>Accounting</strong> estimate could be changed anytime when theentity reaches to the conclusion, that the underlyingconclusions have been changed (e.g. competing software hasbeen introduced to the market) 15

<strong>Accounting</strong> estimate shall be changed prospectively:• for example, an asset with an estimated useful life of 5years has been acquired at the beginning of 2008 for 200;annual depreciation charge is 40• at the beginning of 2010 , carrying amount will be 120 (=200 – 2x40); at that moment it is assumed, that the usefullife of the asset is only 4 years; thus the carrying amountneed to be depreciated within remaining two years• as a result, depreciation charge is increased from 40 to 60;no amendment is made for former periods16

Amendment of the accounting <strong>policy</strong> is made in afollowing way (IAS 8.19):There are only two exceptions : a) when it is impracticable todo so; b) if there is non-materiality exception in accordancewith IAS 8.717

In our example, the asset with useful life of 5 years has beenacquired at the beginning of 2008 for 200The asset shall be depreciated in accordance with straightlinemethodIf the company would like to change its depreciation methodto units of production (as of 2010) it should do so from 2008,based on the estimate of the total production capacity andthe production data for 2008However, if there isn´t any production data for, say, 2009,(because nobody requires them at that time), new method ofdepreciation could be applied from 2010, even if there areavailable production data for 200818

Almost every IFRS calls for disclosure of furtherinformationFor example, IAS 8 requires information on:• first-time application of a new or amended IFRS(IAS 8.28) and a voluntary change of accounting<strong>policy</strong> (IAS 8.29)• amended IFRS which the company is not applyingbefore their effective date (IAS 8.30)• any change of accounting estimates and theirimpact on a financial position and financial results19of a company

There is a frequent requirement to reconcile endingbalances of line items with their beginning balancesFor cash and cash equivalents, there is a separatefinancial statement (prepared in accordance withIAS 7)Accordingly, there is a separate reconciliationstatement for equity (IAS 1 – Statement of Changesin Shareholders´Equity)20

For example, for provisions (IAS 37.84) followingreconciliation is required:21