Memorandum of Understanding with Unit 12 - Dpa - State of California

Memorandum of Understanding with Unit 12 - Dpa - State of California

Memorandum of Understanding with Unit 12 - Dpa - State of California

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

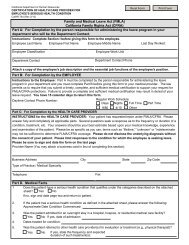

B. Health Benefits(3) The <strong>State</strong> shall pay $452.00 per month for coverage <strong>of</strong> an eligibleemployee plus two or more dependents.1. Employee Eligibilitya. For purposes <strong>of</strong> this section, “eligible employee” shall be defined by thePublic Employees’ Medical and Hospital Care Act.b. Permanent Intermittent Employees2. Family Member Eligibility(1) Initial Eligibility – A permanent intermittent employee will beeligible to enroll in health benefits during each calendar year if theemployee has been credited <strong>with</strong> a minimum <strong>of</strong> 480 paid hours in one<strong>of</strong> two control periods. For purposes <strong>of</strong> this section, the controlperiods are January 1 through June 30 and July 1 through December31 <strong>of</strong> each calendar year. An eligible permanent intermittentemployee must enroll in a health benefit plan <strong>with</strong>in 60 days from theend <strong>of</strong> the qualifying control period.(2) Continuing Eligibility – To continue health benefits, a permanentintermittent employee must be credited <strong>with</strong> a minimum <strong>of</strong> 480 paidhours in a control period or 960 paid hours in two consecutive controlperiods.For purposes <strong>of</strong> this section, “eligible family member” shall be defined by thePublic Employees’ Medical and Hospital Care Act.3. Technical Clean Up To Health Benefit Vesting LanguageThe Union agrees to support legislation to amend Section 22825.3 to read asfollows:a. 22825.3 Not<strong>with</strong>standing Sections 22825, 22825.1 and 22825.2, stateemployees who become state members <strong>of</strong> the Public Employees’ RetirementSystem after January 1, 1989, and who are included in the definition <strong>of</strong> stateemployee in subdivision (c) <strong>of</strong> Section 3513 shall not receive any portion <strong>of</strong>the employer’s contribution payable for annuitants, pursuant to Section22825.1, unless these employees are credited <strong>with</strong> 10 years <strong>of</strong> state serviceas defined by this section, at the time <strong>of</strong> retirement.b. Not<strong>with</strong>standing Sections 22825, 22825.1 and 22825.2, a state employeewho became a state member <strong>of</strong> the Public Employees’ Retirement Systemafter January 1, 1990, is either (1) excluded from the definition <strong>of</strong> stateemployee in subdivision (c) <strong>of</strong> Section 3513; or (2) a non-elected <strong>of</strong>ficer oremployee <strong>of</strong> the executive branch <strong>of</strong> government who is not a member <strong>of</strong> thecivil service, shall not receive any portion <strong>of</strong> the employer’s contributionpayable for annuitants, pursuant to Section 22825.1, unless the employee iscredited <strong>with</strong> 10 years <strong>of</strong> state service as defined by this section, at the time<strong>of</strong> retirement.c. The percentage <strong>of</strong> employer contribution payable for post retirementhealth benefits for an employee subject to this section shall be based on themember’s completed years <strong>of</strong> state service at retirement as shown in thefollowing table:23BU <strong>12</strong>(99-01)