Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In the financial year <strong>2010</strong>/<strong>11</strong> <strong>Sonova</strong> generated revenues<br />

of CHF 1,616.7 million, another record sales level, and<br />

a growth of 13.3% in local currencies, or 7.8% in Swiss<br />

Francs. Profitability, as indicated by an EBITA margin<br />

of 20.2%, has decreased compared to the previous year,<br />

mainly due to the voluntary recall of Advanced Bionics<br />

and the strong Swiss franc. With an equity financing ratio<br />

of 61.9% and net debt of CHF <strong>11</strong>1.3 million, the <strong>Sonova</strong><br />

Group has a very solid financial position.<br />

This section contains a summary of financial information<br />

and describes the reported financial results for <strong>2010</strong>/<strong>11</strong><br />

as compared with the financial results for 2009/10 for the<br />

<strong>Sonova</strong> Group and its two business segments – hearing<br />

in struments and hearing implants. Note that the 2009/10<br />

financial results have been restated to reflect the finalization<br />

of the acquisition accounting for Advanced Bionics<br />

(see note 3.7 of the consolidated financial statements).<br />

ANoTHER yEAR oF SAlES GRoWTH<br />

once again, due to an innovative and comprehensive product<br />

portfolio, <strong>Sonova</strong> remains the market leader in the<br />

hearing industry. <strong>Sonova</strong> increased its sales in financial<br />

year <strong>2010</strong>/<strong>11</strong> to CHF 1,616.7 million (2009/10: CHF<br />

1,500.3 million), posting an overall growth rate of 13.3%<br />

in local currencies, or 7.8% in Swiss francs. The introduction<br />

of innovative products, such as the Spice generation<br />

of hearing instruments, contributed to this growth<br />

rate. While sales of the hearing implant segment increased<br />

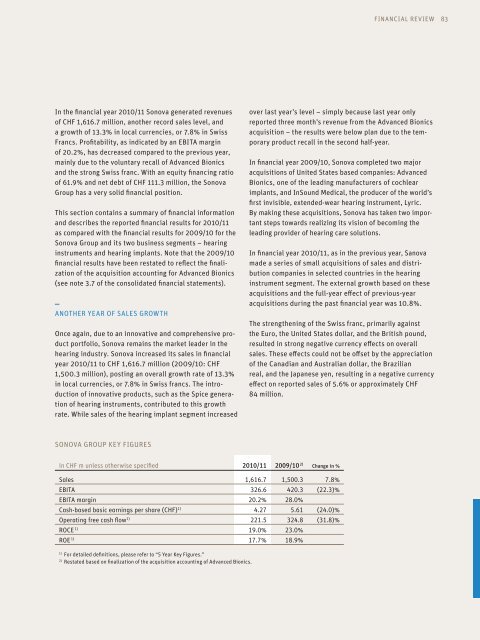

SoNoVA GRoUP kEy FIGURES<br />

in CHF m unless otherwise specified <strong>2010</strong>/<strong>11</strong> 2009/10 2)<br />

FINANCIAl REVIEW<br />

over last year’s level – simply because last year only<br />

reported three month’s revenue from the Advanced Bionics<br />

acquisition – the results were below plan due to the temporary<br />

product recall in the second half-year.<br />

In financial year 2009/10, <strong>Sonova</strong> completed two major<br />

acquisitions of United States based companies: Advanced<br />

Bionics, one of the leading manufacturers of cochlear<br />

im plants, and InSound Medical, the producer of the world’s<br />

first invisible, extended-wear hearing instrument, lyric.<br />

By making these acquisitions, <strong>Sonova</strong> has taken two important<br />

steps towards realizing its vision of becoming the<br />

leading provider of hearing care solutions.<br />

In financial year <strong>2010</strong>/<strong>11</strong>, as in the previous year, Sanova<br />

made a series of small acquisitions of sales and dis tribution<br />

companies in selected countries in the hearing<br />

instrument segment. The external growth based on these<br />

acquisitions and the full-year effect of previous-year<br />

acquisitions during the past financial year was 10.8%.<br />

The strengthening of the Swiss franc, primarily against<br />

the Euro, the United States dollar, and the British pound,<br />

resulted in strong negative currency effects on overall<br />

sales. These effects could not be offset by the appreciation<br />

of the Canadian and Australian dollar, the Brazilian<br />

real, and the Japanese yen, resulting in a negative currency<br />

effect on reported sales of 5.6% or approximately CHF<br />

84 million.<br />

Change in %<br />

Sales 1,616.7 1,500.3 7.8%<br />

EBITA 326.6 420.3 (22.3)%<br />

EBITA margin 20.2% 28.0%<br />

Cash-based basic earnings per share (CHF) 1) 4.27 5.61 (24.0)%<br />

operating free cash flow 1) 221.5 324.8 (31.8)%<br />

RoCE 1) 19.0% 23.0%<br />

RoE 1) 17.7% 18.9%<br />

1) For detailed definitions, please refer to “5 year key Figures.”<br />

2) Restated based on finalization of the acquisition accounting of Advanced Bionics.<br />

83