Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SHArEHOLDInGS Of MEMBErS Of THE BOArD Of DIrECTOrS AnD THE MAnAGEMEnT BOArD<br />

COMPEnSATIOn rEPOrT<br />

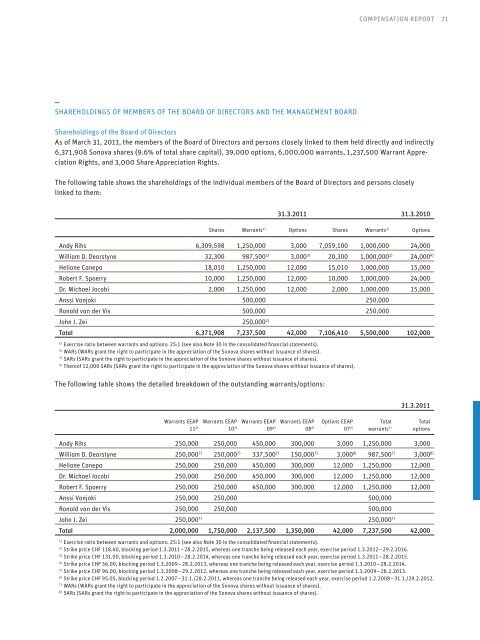

Shareholdings of the Board of Directors<br />

As of March 31, 20<strong>11</strong>, the members of the Board of Directors and persons closely linked to them held directly and indirectly<br />

6,371,908 <strong>Sonova</strong> shares (9.6% of total share capital), 39,000 options, 6,000,000 warrants, 1,237,500 Warrant Appreciation<br />

rights, and 3,000 Share Appreciation rights.<br />

The following table shows the shareholdings of the individual members of the Board of Directors and persons closely<br />

linked to them:<br />

31.3.20<strong>11</strong> 31.3.<strong>2010</strong><br />

Shares Warrants 1) Options Shares Warrants 1) Options<br />

Andy rihs 6,309,598 1,250,000 3,000 7,059,100 1,000,000 24,000<br />

William D. Dearstyne 32,300 987,5002) 3,0003) 20,300 1,000,0002) 24,0004) Heliane Canepa 18,010 1,250,000 12,000 15,010 1,000,000 15,000<br />

robert f. Spoerry 10,000 1,250,000 12,000 10,000 1,000,000 24,000<br />

Dr. Michael Jacobi 2,000 1,250,000 12,000 2,000 1,000,000 15,000<br />

Anssi Vanjoki 500,000 250,000<br />

ronald van der Vis 500,000 250,000<br />

John J. Zei 250,0002) Total 6,371,908 7,237,500 42,000 7,106,410 5,500,000 102,000<br />

1) Exercise ratio between warrants and options: 25:1 (see also note 30 in the consolidated financial statements).<br />

2) WArs (WArs grant the right to participate in the appreciation of the <strong>Sonova</strong> shares without issuance of shares).<br />

3) SArs (SArs grant the right to participate in the appreciation of the <strong>Sonova</strong> shares without issuance of shares).<br />

4) Thereof 12,000 SArs (SArs grant the right to participate in the appreciation of the <strong>Sonova</strong> shares without issuance of shares).<br />

The following table shows the detailed breakdown of the outstanding warrants/options:<br />

Warrants EEAP<br />

<strong>11</strong> 2)<br />

Warrants EEAP<br />

10 3)<br />

Warrants EEAP<br />

09 4)<br />

Warrants EEAP<br />

08 5)<br />

Options EEAP<br />

07 6)<br />

Total<br />

warrants 1)<br />

31.3.20<strong>11</strong><br />

Total<br />

options<br />

Andy rihs 250,000 250,000 450,000 300,000 3,000 1,250,000 3,000<br />

William D. Dearstyne 250,0007) 250,0007) 337,5007) 150,0007) 3,0008) 987,5007) 3,0008) Heliane Canepa 250,000 250,000 450,000 300,000 12,000 1,250,000 12,000<br />

Dr. Michael Jacobi 250,000 250,000 450,000 300,000 12,000 1,250,000 12,000<br />

robert f. Spoerry 250,000 250,000 450,000 300,000 12,000 1,250,000 12,000<br />

Anssi Vanjoki 250,000 250,000 500,000<br />

ronald van der Vis 250,000 250,000 500,000<br />

John J. Zei 250,0007) 250,0007) Total 2,000,000 1,750,000 2,137,500 1,350,000 42,000 7,237,500 42,000<br />

1) Exercise ratio between warrants and options: 25:1 (see also note 30 in the consolidated financial statements).<br />

2) Strike price CHf <strong>11</strong>8.40, blocking period 1.3.20<strong>11</strong> – 28.2.2015, whereas one tranche being released each year, exercise period 1.3.2012 – 29.2.2016.<br />

3) Strike price CHf 131.00, blocking period 1.3.<strong>2010</strong> – 28.2.2014, whereas one tranche being released each year, exercise period 1.3.20<strong>11</strong> – 28.2.2015.<br />

4) Strike price CHf 56.00, blocking period 1.3.2009 – 28.2.2013, whereas one tranche being released each year, exercise period 1.3.<strong>2010</strong> – 28.2.2014.<br />

5) Strike price CHf 96.00, blocking period 1.3.2008 – 29.2.2012, whereas one tranche being released each year, exercise period 1.3.2009 – 28.2.2013.<br />

6) Strike price CHf 95.05, blocking period 1.2.2007 – 31.1./28.2.20<strong>11</strong>, whereas one tranche being released each year, exercise period 1.2.2008 – 31.1./29.2.2012.<br />

7) WArs (WArs grant the right to participate in the appreciation of the <strong>Sonova</strong> shares without issuance of shares).<br />

8) SArs (SArs grant the right to participate in the appreciation of the <strong>Sonova</strong> shares without issuance of shares).<br />

71