Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

162<br />

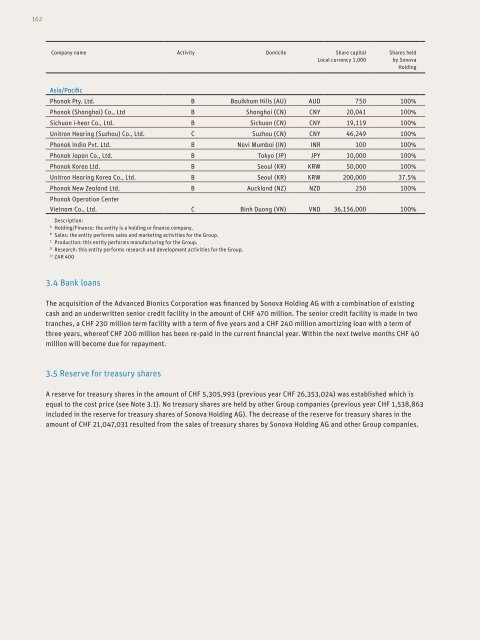

Company name Activity Domicile Share capital<br />

Local currency 1,000<br />

Asia/Pacific<br />

Shares held<br />

by <strong>Sonova</strong><br />

Holding<br />

Phonak Pty. Ltd. B Baulkham Hills (AU) AUD 750 100%<br />

Phonak (Shanghai) Co., Ltd B Shanghai (CN) CNy 20,041 100%<br />

Sichuan i-hear Co., Ltd. B Sichuan (CN) CNy 19,<strong>11</strong>9 100%<br />

Unitron Hearing (Suzhou) Co., Ltd. C Suzhou (CN) CNy 46,249 100%<br />

Phonak India Pvt. Ltd. B Navi Mumbai (IN) INR 100 100%<br />

Phonak Japan Co., Ltd. B Tokyo (JP) JPy 10,000 100%<br />

Phonak Korea Ltd. B Seoul (KR) KRW 50,000 100%<br />

Unitron Hearing Korea Co., Ltd. B Seoul (KR) KRW 200,000 37.5%<br />

Phonak New Zealand Ltd. B Auckland (NZ) NZD 250 100%<br />

Phonak Operation Center<br />

Vietnam Co., Ltd. C Binh Duong (VN) VND 36,156,000 100%<br />

Description:<br />

A Holding/Finance: the entity is a holding or finance company.<br />

B Sales: the entity performs sales and marketing activities for the Group.<br />

C Production: this entity performs manufacturing for the Group.<br />

D Research: this entity performs research and development activities for the Group.<br />

1) ZAR 400<br />

3.4 Bank loans<br />

The acquisition of the Advanced Bionics Corporation was financed by <strong>Sonova</strong> Holding AG with a combination of existing<br />

cash and an underwritten senior credit facility in the amount of CHF 470 million. The senior credit facility is made in two<br />

tranches, a CHF 230 million term facility with a term of five years and a CHF 240 million amortizing loan with a term of<br />

three years, whereof CHF 200 million has been re-paid in the current financial year. Within the next twelve months CHF 40<br />

mil lion will become due for repayment.<br />

3.5 Reserve for treasury shares<br />

A reserve for treasury shares in the amount of CHF 5,305,993 (previous year CHF 26,353,024) was established which is<br />

equal to the cost price (see Note 3.1). No treasury shares are held by other Group companies (previous year CHF 1,538,863<br />

included in the reserve for treasury shares of <strong>Sonova</strong> Holding AG). The decrease of the reserve for treasury shares in the<br />

amount of CHF 21,047,031 resulted from the sales of treasury shares by <strong>Sonova</strong> Holding AG and other Group companies.