Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Annual Report 2010/11 - Sonova

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

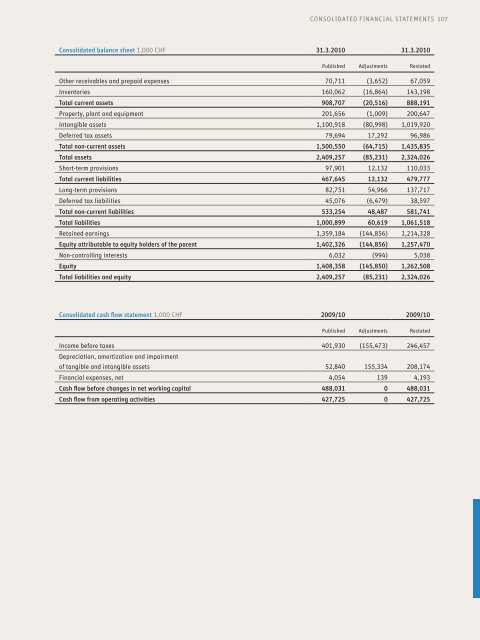

consolidated financial statements 107<br />

Consolidated balance sheet 1,000 chf 31.3.<strong>2010</strong> 31.3.<strong>2010</strong><br />

Published adjustments Restated<br />

other receivables and prepaid expenses 70,7<strong>11</strong> (3,652) 67,059<br />

Inventories 160,062 (16,864) 143,198<br />

Total current assets 908,707 (20,516) 888,191<br />

Property, plant and equipment 201,656 (1,009) 200,647<br />

Intangible assets 1,100,918 (80,998) 1,019,920<br />

deferred tax assets 79,694 17,292 96,986<br />

Total non-current assets 1,500,550 (64,715) 1,435,835<br />

Total assets 2,409,257 (85,231) 2,324,026<br />

shortterm provisions 97,901 12,132 <strong>11</strong>0,033<br />

Total current liabilities 467,645 12,132 479,777<br />

longterm provisions 82,751 54,966 137,717<br />

deferred tax liabilities 45,076 (6,479) 38,597<br />

Total non-current liabilities 533,254 48,487 581,741<br />

Total liabilities 1,000,899 60,619 1,061,518<br />

Retained earnings 1,359,184 (144,856) 1,214,328<br />

Equity attributable to equity holders of the parent 1,402,326 (144,856) 1,257,470<br />

noncontrolling interests 6,032 (994) 5,038<br />

Equity 1,408,358 (145,850) 1,262,508<br />

Total liabilities and equity 2,409,257 (85,231) 2,324,026<br />

Consolidated cash flow statement 1,000 chf 2009/10 2009/10<br />

Published adjustments Restated<br />

Income before taxes 401,930 (155,473) 246,457<br />

depreciation, amortization and impairment<br />

of tangible and intangible assets 52,840 155,334 208,174<br />

financial expenses, net 4,054 139 4,193<br />

Cash flow before changes in net working capital 488,031 0 488,031<br />

Cash flow from operating activities 427,725 0 427,725