Managing Conflict of Interest - Organisation for Economic Co ...

Managing Conflict of Interest - Organisation for Economic Co ... Managing Conflict of Interest - Organisation for Economic Co ...

164 Managing Conflict of Interest(ISA 240) 1 offers a simple definition: Fraud is an intentional act committedby one or more individuals in management—those chargedwith governance, employees, or third parties—involving the use ofdeception to obtain an unjust or illegal advantage.Measuring the Cost of Fraud and Conflict of Interest: MissionImpossible?Determining the true cost of fraud and abuse is an impossibletask, because fraud is a crime based on concealment. Some casesof fraud are never detected or the perpetrators are caught only afterfraud has occurred for several years. Many cases that are detectedare never reported for a variety of reasons, including the desire topreserve the company’s reputation. Moreover, incidents that arereported are often not prosecuted. Finally, there is no agency ororganization specifically charged with gathering comprehensivefraud-related information. These factors combined make it very difficultto estimate the true cost of fraud. Thus, the measure is justthat: an estimate.A 2004 survey conducted by the Association of Certified FraudExaminers (ACFE) in the United States examined occupational fraudand found that, on the average, US organizations lose 6% of theirrevenue, or an estimated USD660 billion a year—about USD4,500for every worker—to fraud. This study determined that 59% offrauds occur because of weaknesses in internal controls, and 95%of US companies report employee theft.Not surprisingly, it is much less expensive to prevent embezzlementthan it is to investigate it. It is estimated that for each USD1lost due to fraud, an organization loses an additional USD4. Thesecalculations are conservative, and do not take into account otherlosses the organization will ultimately suffer, including its good nameor reputation. To put it another way, each loss caused by internal orexternal fraud costs at least five times the original amount:1The International Auditing and Assurance Standards Board (IAASB), underthe aegis of the International Federation of Accountants, issues InternationalStandards on Auditing (ISAs), which are followed by professional accountantsand auditors in most jurisdictions around the world. ISA 240 outlines the standardregarding “The Auditor’s Responsibility to Consider Fraud and Error inan Audit of Financial Statements.”ADB/OECD Anti-Corruption Initiative for Asia and the Pacific

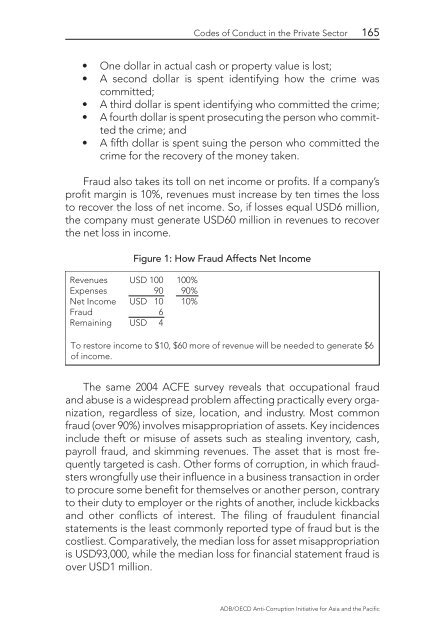

Codes of Conduct in the Private Sector 165•••••One dollar in actual cash or property value is lost;A second dollar is spent identifying how the crime wascommitted;A third dollar is spent identifying who committed the crime;A fourth dollar is spent prosecuting the person who committedthe crime; andA fifth dollar is spent suing the person who committed thecrime for the recovery of the money taken.Fraud also takes its toll on net income or profits. If a company’sprofit margin is 10%, revenues must increase by ten times the lossto recover the loss of net income. So, if losses equal USD6 million,the company must generate USD60 million in revenues to recoverthe net loss in income.Figure 1: How Fraud Affects Net IncomeRevenuesExpensesNet IncomeFraudRemainingUSD 10090USD 106USD 4100%90%10%To restore income to $10, $60 more of revenue will be needed to generate $6of income.The same 2004 ACFE survey reveals that occupational fraudand abuse is a widespread problem affecting practically every organization,regardless of size, location, and industry. Most commonfraud (over 90%) involves misappropriation of assets. Key incidencesinclude theft or misuse of assets such as stealing inventory, cash,payroll fraud, and skimming revenues. The asset that is most frequentlytargeted is cash. Other forms of corruption, in which fraudsterswrongfully use their influence in a business transaction in orderto procure some benefit for themselves or another person, contraryto their duty to employer or the rights of another, include kickbacksand other conflicts of interest. The filing of fraudulent financialstatements is the least commonly reported type of fraud but is thecostliest. Comparatively, the median loss for asset misappropriationis USD93,000, while the median loss for financial statement fraud isover USD1 million.ADB/OECD Anti-Corruption Initiative for Asia and the Pacific

- Page 156 and 157: 114 Managing Conflict of InterestSe

- Page 158 and 159: 116 Managing Conflict of InterestNB

- Page 160 and 161: 118 Managing Conflict of InterestA

- Page 162 and 163: 120 Managing Conflict of Interestho

- Page 164 and 165: 122 Managing Conflict of Interestor

- Page 166 and 167: 124 Managing Conflict of Interestin

- Page 168 and 169: 126 Managing Conflict of InterestFr

- Page 170 and 171: Tracking corruption in the USA: Pol

- Page 172 and 173: 130 Managing Conflict of InterestMo

- Page 174 and 175: 132 Managing Conflict of InterestFi

- Page 176 and 177: 134 Managing Conflict of InterestFi

- Page 179: Section 3:Prevention andEnforcement

- Page 182 and 183: Codes of conduct and mechanisms top

- Page 184 and 185: 142 Managing Conflict of Interestof

- Page 186 and 187: 144 Managing Conflict of Interestha

- Page 188 and 189: 146 Managing Conflict of Interestfa

- Page 190 and 191: Preventing conflicts of interest in

- Page 192 and 193: 150 Managing Conflict of Interestwo

- Page 194 and 195: 152 Managing Conflict of Interestac

- Page 196 and 197: 154 Managing Conflict of InterestAg

- Page 198 and 199: 156 Managing Conflict of Interestha

- Page 200 and 201: 158 Managing Conflict of Interest

- Page 203 and 204: Chapter 5Codes of conduct in thepri

- Page 205: Good corporate governance: Essentia

- Page 209 and 210: Codes of Conduct in the Private Sec

- Page 211 and 212: Codes of Conduct in the Private Sec

- Page 213 and 214: Codes of Conduct in the Private Sec

- Page 215 and 216: Codes of Conduct in the Private Sec

- Page 217 and 218: Compliance enforcement in a multina

- Page 219 and 220: Living business ethics: Good govern

- Page 221: Codes of Conduct in the Private Sec

- Page 225 and 226: Appendix 1: Seminar agendaADB/OECD

- Page 227 and 228: Appendix 185The experience of asset

- Page 229 and 230: Appendix 187Detecting conflict of i

- Page 231 and 232: Appendix 2: List of participantsMem

- Page 233 and 234: Appendix 191Asad Ali SHAHPartner, D

- Page 235 and 236: Appendix 193WaluyoDeputy of Prevent

- Page 237 and 238: Appendix 195PALAUSecilil ELDEBECHEL

- Page 239 and 240: Appendix 197Sandie HITOJOSenior Con

- Page 241 and 242: Appendix 199TRANSPARENCY INTERNATIO

- Page 243 and 244: Appendix 201Arie SISWANTOAssistant

- Page 245: Secretariat 203ADB/OECD Anti-Corrup

<strong>Co</strong>des <strong>of</strong> <strong>Co</strong>nduct in the Private Sector 165•••••One dollar in actual cash or property value is lost;A second dollar is spent identifying how the crime wascommitted;A third dollar is spent identifying who committed the crime;A fourth dollar is spent prosecuting the person who committedthe crime; andA fifth dollar is spent suing the person who committed thecrime <strong>for</strong> the recovery <strong>of</strong> the money taken.Fraud also takes its toll on net income or pr<strong>of</strong>its. If a company’spr<strong>of</strong>it margin is 10%, revenues must increase by ten times the lossto recover the loss <strong>of</strong> net income. So, if losses equal USD6 million,the company must generate USD60 million in revenues to recoverthe net loss in income.Figure 1: How Fraud Affects Net IncomeRevenuesExpensesNet IncomeFraudRemainingUSD 10090USD 106USD 4100%90%10%To restore income to $10, $60 more <strong>of</strong> revenue will be needed to generate $6<strong>of</strong> income.The same 2004 ACFE survey reveals that occupational fraudand abuse is a widespread problem affecting practically every organization,regardless <strong>of</strong> size, location, and industry. Most commonfraud (over 90%) involves misappropriation <strong>of</strong> assets. Key incidencesinclude theft or misuse <strong>of</strong> assets such as stealing inventory, cash,payroll fraud, and skimming revenues. The asset that is most frequentlytargeted is cash. Other <strong>for</strong>ms <strong>of</strong> corruption, in which fraudsterswrongfully use their influence in a business transaction in orderto procure some benefit <strong>for</strong> themselves or another person, contraryto their duty to employer or the rights <strong>of</strong> another, include kickbacksand other conflicts <strong>of</strong> interest. The filing <strong>of</strong> fraudulent financialstatements is the least commonly reported type <strong>of</strong> fraud but is thecostliest. <strong>Co</strong>mparatively, the median loss <strong>for</strong> asset misappropriationis USD93,000, while the median loss <strong>for</strong> financial statement fraud isover USD1 million.ADB/OECD Anti-<strong>Co</strong>rruption Initiative <strong>for</strong> Asia and the Pacific