Internet Business Banking Service Agreement - Union Bank

Internet Business Banking Service Agreement - Union Bank

Internet Business Banking Service Agreement - Union Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

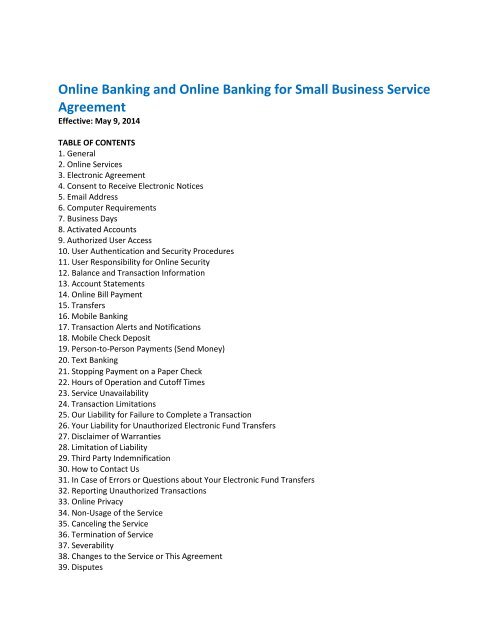

Online <strong><strong>Bank</strong>ing</strong> and Online <strong><strong>Bank</strong>ing</strong> for Small <strong>Business</strong> <strong>Service</strong><strong>Agreement</strong>Effective: May 9, 2014TABLE OF CONTENTS1. General2. Online <strong>Service</strong>s3. Electronic <strong>Agreement</strong>4. Consent to Receive Electronic Notices5. Email Address6. Computer Requirements7. <strong>Business</strong> Days8. Activated Accounts9. Authorized User Access10. User Authentication and Security Procedures11. User Responsibility for Online Security12. Balance and Transaction Information13. Account Statements14. Online Bill Payment15. Transfers16. Mobile <strong><strong>Bank</strong>ing</strong>17. Transaction Alerts and Notifications18. Mobile Check Deposit19. Person-to-Person Payments (Send Money)20. Text <strong><strong>Bank</strong>ing</strong>21. Stopping Payment on a Paper Check22. Hours of Operation and Cutoff Times23. <strong>Service</strong> Unavailability24. Transaction Limitations25. Our Liability for Failure to Complete a Transaction26. Your Liability for Unauthorized Electronic Fund Transfers27. Disclaimer of Warranties28. Limitation of Liability29. Third Party Indemnification30. How to Contact Us31. In Case of Errors or Questions about Your Electronic Fund Transfers32. Reporting Unauthorized Transactions33. Online Privacy34. Non-Usage of the <strong>Service</strong>35. Canceling the <strong>Service</strong>36. Termination of <strong>Service</strong>37. Severability38. Changes to the <strong>Service</strong> or This <strong>Agreement</strong>39. Disputes

1. GENERAL. This Online <strong><strong>Bank</strong>ing</strong> <strong>Agreement</strong> (“OLB <strong>Agreement</strong>”) and the All About Personal Accounts &<strong>Service</strong>s Disclosure and <strong>Agreement</strong> and applicable Fee Schedule or All About <strong>Business</strong> Accounts & <strong>Service</strong>sDisclosure and <strong>Agreement</strong> and Fee Schedule as applicable (“Account <strong>Agreement</strong>”) govern the use of <strong>Union</strong><strong>Bank</strong>’s Online <strong><strong>Bank</strong>ing</strong> <strong>Service</strong>s (the “<strong>Service</strong>”). Note that any reference to “<strong>Internet</strong> <strong>Business</strong> <strong><strong>Bank</strong>ing</strong>” is nowcalled Online <strong><strong>Bank</strong>ing</strong> for Small <strong>Business</strong> and is covered by this OLB <strong>Agreement</strong>. The terms of this <strong>Agreement</strong>supplement, and supersede where inconsistent, the terms of your Account <strong>Agreement</strong> with MUFG <strong>Union</strong> <strong>Bank</strong>,N.A. (“us,” “we” or “<strong>Bank</strong>”) and/or <strong>Union</strong>Banc Investment <strong>Service</strong>s (“Investment <strong>Service</strong>s”). In this <strong>Agreement</strong>,“you” refers to each person that accesses the <strong>Service</strong> and each owner of the accounts accessed by the <strong>Service</strong>.Your use of the <strong>Service</strong> will be further evidence of your agreement to these terms and the other agreementsthat we provide to you.2. ONLINE SERVICES. The <strong>Service</strong> allows you to:• Obtain account balance and transaction information for your Activated Accounts (as “ActivatedAccount” is defined in Section 8 below)• Transfer funds internally between Activated Accounts and set up recurring transfers from oneActivated Account to another (recurring transfers must be for the same amount)• Make payments on certain <strong>Bank</strong> lines of credit, mortgages, or loans• Pay bills to merchants, institutions, or individuals with a U.S. address, including same-day payments forcertain payees (only available in New <strong>Union</strong> <strong>Bank</strong> Bill Pay System)• Receive eBills for many of your payees (eBills available in Bill Pay System B and in New <strong>Union</strong> <strong>Bank</strong> BillPay System)• Pay your <strong>Union</strong> <strong>Bank</strong> credit card bill• Deposit checks to certain types of accounts using a mobile device• Check account balance and transfer funds between <strong>Union</strong> <strong>Bank</strong> accounts using a mobile device• View account statements and images of paid checks, deposit slips and deposited items electronically• Receive Customer Notices (as defined in Section 4 hereof) electronically• Request a wire transfer to a destination within the 50 United States• Reorder checks from Deluxe® Check Printers• Request a stop payment on a paper check• Receive account and transaction notices and alertsFor Personal Accounts Only:• Transfer funds between an Activated Account and an account at another financial institution in Online<strong><strong>Bank</strong>ing</strong>• Make person-to-person “Send Money” payments using a mobile device in Online <strong><strong>Bank</strong>ing</strong>3. ELECTRONIC AGREEMENT. You are agreeing to enter into this OLB <strong>Agreement</strong> electronically. By yourelectronic agreement, you consent to all terms and conditions governing use of the <strong>Service</strong> as set forth in this<strong>Agreement</strong>. We will make a printed copy of the <strong>Agreement</strong> available at your request.4. CONSENT TO RECEIVE ELECTRONIC NOTICES. By using the <strong>Service</strong>, you consent to and agree that:(a) Any notice, record or other type of information that is provided to you in connection with your accounts orthe <strong>Service</strong>, such as account disclosures, change-in-terms notices, privacy disclosures for consumers (only), feeschedules, transaction notices and alerts, account status notices, service messages, and any other type ofnotice, (each a “Customer Notice”), may be sent to you electronically. A Customer Notice may be provided as aseparate electronic document or may be included in an electronic account statement. An electronic Customer

Notice sent to any account owner shall be deemed sent to, and received by, all account owners on the day wesend it. We reserve the right to send a Customer Notice in paper format by postal mail.(b) You will promptly report to us any change to your contact information, including email address, name,physical address, mailing address (if different), and telephone numbers. You may update this information bycontacting us at 1-800-238-4486. Changes to certain contact information can be completed in the <strong>Service</strong>.(c) We will not be obligated to provide any Customer Notice to you in paper form unless you specificallyrequest us to do so. You may request a paper copy of a Customer Notice by contacting us at 1-800-238-4486.Unless set forth in the Account <strong>Agreement</strong> you will not be charged a fee.(d) Your consent to receive Customer Notices electronically remains in effect until you withdraw your consent,close your account, or discontinue or terminate the <strong>Service</strong> with us. You may withdraw this consent to receiveelectronic delivery of Customer Notices by contacting us at the address or telephone number in Section 30 ofthis OLB <strong>Agreement</strong>. However, withdrawing your consent means you may no longer be able to access the<strong>Service</strong>, and fee discounts or waivers associated with use of the <strong>Service</strong> may be discontinued.(e) In order to receive Customer Notices online you must maintain computer hardware and software ofsufficient capability to be able to access and retain them electronically. See section 6 below.5. EMAIL ADDRESS. A current, valid email address is critical to our successful delivery of the <strong>Service</strong> to you. Youagree to maintain an active email account at all times and record such email address within your profile in the<strong>Service</strong>. You further agree to promptly notify us of a change of email address by changing the address at theProfile link within the <strong>Service</strong>.If for any reason the email address you provide us changes or becomes inoperable for more than a short periodof time, you agree to contact us immediately so that we can arrange to provide you with Customer Notices andaccount statements through other means.If we contact you at the email address of record within the <strong>Service</strong> and learn that the email is undeliverable tothat address, we may, at our discretion: 1) require you to provide a valid email address at next login attempt; 2)require you to accept this OLB <strong>Agreement</strong> again at next login attempt; 3) attempt to contact you throughanother means to obtain a valid email address; 4) disable the <strong>Service</strong> for other users (Online <strong><strong>Bank</strong>ing</strong> for Small<strong>Business</strong> only); and/or 5) discontinue electronic Customer Notices and instead provide them by paper. If youhave chosen to receive account statements in online form and you do not provide us with a new email address,you agree that we may continue to comply with the terms of this OLB <strong>Agreement</strong> and the statement deliverypreference you have indicated within the <strong>Service</strong> until such time as you instruct us otherwise.6. COMPUTER REQUIREMENTS. The <strong>Service</strong> requires you to have certain computer capabilities, which we maychange from time to time without prior notice to you. Refer to www.unionbank.com/computerrequirementsfor our current computer requirements.7. BUSINESS DAYS. In this <strong>Agreement</strong>, the term “<strong>Business</strong> Day” means Monday through Friday, excluding bankholidays.8. ACTIVATED ACCOUNTS. You can have the following types of <strong>Union</strong> <strong>Bank</strong> or <strong>Union</strong>Banc Investment <strong>Service</strong>s(UBIS) accounts connected to the <strong>Service</strong>: checking accounts, savings accounts, money market depositaccounts, certificates of deposit, personal and small business loans and lines of credit, Cash Reserve line of

credit, Portfolio Connection® accounts, Investment <strong>Service</strong>s IRA and brokerage accounts (you may view accountbalance information only), and installment loans. We may allow other types of accounts to be connected to the<strong>Service</strong> from time to time. Linked accounts are referred to as "Activated Accounts." We reserve the right todetermine which accounts can be connected to the <strong>Service</strong>.9. AUTHORIZED USER ACCESS.The following parts of this section apply to Personal Accounts Only:Any personal account owner or sole proprietor account owner of an Activated Account may act alone in usingthe Online <strong><strong>Bank</strong>ing</strong> to perform account transactions. Such access is granted completely at the <strong>Bank</strong>’s discretion.Contact us at 1-800-238-4486 for additional information.The following parts of this section apply to <strong>Business</strong> Accounts Only:For all businesses, any individual identified in the <strong>Bank</strong>’s account records as a business Contracting Officer(“Contracting Officer”) or Owner can enroll in Online <strong><strong>Bank</strong>ing</strong> for Small <strong>Business</strong> as a Contracting Officer.In Online <strong><strong>Bank</strong>ing</strong> for Small <strong>Business</strong>, Contracting Officers or Owners may designate one or more individuals tohave access as a Web Administrator for the <strong>Service</strong>. At least one Web Administrator must be designated at alltimes. A Contracting Officer or Owner may designate himself/herself as a Web Administrator. In order tomaintain the <strong>Service</strong>, and for security reasons, at least one Web Administrator must log in to the <strong>Service</strong> at afrequency determined by us. Any Contracting Officer, Owner or Web Administrator, acting alone, maydesignate one or more Web Users and/or View Only Web Users for the <strong>Service</strong>, and further designate theActivated Accounts that an individual Web User or View Only Web User is authorized to access.View Only Web User.Each designated View Only Web User, for each Activated Account to which access is authorized by theContracting Officer, Owner or Web Administrator, may:• View account statements and images of deposit slips and paid checks electronically• Check account balances• Deposit checks to certain types of accounts using a mobile device• View Customer Notices delivered through the <strong>Service</strong>Web User.Each designated Web User, for each Activated Account to which access is authorized by the Contracting Officer,Owner or Web Administrator, may:• Obtain account balance and transactions• View account statements and images of deposit slips, deposited items, and paid checkselectronically• Transfer funds between Activated Accounts and set up recurring transfers from one Activated• Account to another (recurring transfers must be for the same amount)• Make payments on certain <strong>Union</strong> <strong>Bank</strong> lines of credit, mortgages, or loans• Receive account and transaction notices and alerts and designate manner of delivery• Request a stop payment on a paper check• Check account balance and transfer funds between <strong>Union</strong> <strong>Bank</strong> accounts using a mobile device• Order copies of paid checks and prior statements• Reorder checks from Deluxe® Check Printers• View Customer Notices delivered through the <strong>Service</strong>

Web Administrator.Each Web Administrator designated by the Contracting Officer or Owner may perform all of the functions of aWeb User and, in addition, may, for all Activated Accounts:• Pay bills to any merchant, institution or individual with a U.S. address, including same-day payments forcertain payees (Same day payments only available in New <strong>Union</strong> <strong>Bank</strong> Bill Pay System. Fees may apply.See applicable Fee Schedule.)• View payments made by other Web Administrators (Available in New <strong>Union</strong> <strong>Bank</strong> Bill Pay System only)• Receive eBills for many of your payees (eBills available in Bill Pay System B and in New <strong>Union</strong> <strong>Bank</strong> BillPay System)• Pay your <strong>Union</strong> <strong>Bank</strong> credit card bill• Deposit checks to certain types of accounts using a mobile device• Add an account to the <strong>Service</strong>, or delete an Activated Account from the <strong>Service</strong>• Designate Web Users and/or View Only Web Users and the Activated Accounts to which suchpersons may have access, and remove such designation and access• Select delivery method for account statements• Terminate electronic delivery of Customer Notices• Enroll in and designate Web User access to receive electronic account notices and alerts• Receive and accept changes in terms to this <strong>Agreement</strong> or to any Activated Account or relatedservice• Receive Customer Notices delivered electronically other than through the <strong>Service</strong>Contracting Officer or Owner.Each Contracting Officer, or Owner may perform all of the functions of a Web Administrator and, in addition,may:• Enter into or cancel the <strong>Service</strong>• Enter into, cancel, or modify additional online services• Schedule a wire transfer through the <strong>Service</strong>• Designate or remove a Web Administrator10. USER AUTHENTICATION AND SECURITY PROCEDURES. We reserve the right to deny access to the <strong>Service</strong>or reject a transaction on an Activated Account without notice to you if we believe that there is risk ofunauthorized, illegal, or fraudulent activity. You agree that we may, in our sole discretion, require verificationof user identity, in a manner satisfactory to us, at any time before allowing access or login to the <strong>Service</strong> orbefore authorizing an online transaction from an Activated Account. Such verification may be in any form wedetermine appropriate and may include, without limitation: 1) verification of User ID and/or password; 2)verification of personal information contained in <strong>Bank</strong> records; 3) correct response to previously submittedpersonal questions, sometimes referred to as ““security” or “challenge” questions;” 4) correct response toquestions devised from public records and consumer reporting agencies on subjects only the user likely wouldhave personal knowledge, sometimes called “out of wallet” or “knowledge based authentication” questions; 5)verification of online activity by simultaneous contact through a non-online channel, sometimes called “verifyby phone” or “out of band” authentication; or 6) any verification procedure that we may determineappropriate.In the event you do not successfully provide the information requested, we may, at our sole discretion: 1)refuse a transaction; 2) require you to contact us by phone or in person at a branch for further validation ofidentity; 3) cancel the <strong>Service</strong>; and/or 4) take any security precautions we deem appropriate to preventunauthorized use of the <strong>Service</strong> or Activated Account.

11. USER RESPONSIBILITY FOR ONLINE SECURITY. To sign on to the <strong>Service</strong>, you are required to input a User IDand password. After initial online setup, you will be required to select your own password. To help safeguardyour security, you should change your password frequently. Your password can be changed within the <strong>Service</strong>.Do not write your password anywhere or store it on your computer. If you forget your password, use theForgot Password process in the <strong>Service</strong> or call us at 1-800-238-4486 to regain access. You should never includeyour password in any oral, written, faxed, or email communication with us or anyone. No <strong>Union</strong> <strong>Bank</strong> employeewill ever ask you for your password.You acknowledge that maintaining confidentiality of the Activated Account is your responsibility. You agree tomaintain your account information and online User ID and password in strict confidence in order to preventunauthorized access to your accounts and the <strong>Service</strong>. You further agree to immediately notify us of anyunauthorized use, or potential unauthorized use, of the <strong>Service</strong> or Activated Account, or of any suspicious orunexplained activity in the Activated Account. You acknowledge that anyone with whom you share or whootherwise uses your User ID and password will have access to your Activated Accounts for all purposes,including making withdrawals and placing trades, regardless of ownership of such accounts. You furtheracknowledge that you will be responsible for any access to and from an Activated Account for any purpose.12. BALANCE AND TRANSACTION INFORMATION. You can use the <strong>Service</strong> to obtain balance and transactioninformation about your Activated Accounts. Ledger Balance and Available Balance shown are defined in theapplicable Account <strong>Agreement</strong>. In addition, information about deposits which have not yet posted is available.Balance and transaction information provided to you as part of the <strong>Service</strong> is not the official record of youraccount or its activity. Your account statement, furnished to you by us in electronic or paper format, is theofficial record. Balance and transaction information is generally updated regularly, but is subject to adjustmentand correction and therefore should not be relied upon by you for taking, or not taking, any action.If you overdraw your checking account and you have deposit account overdraft protection, the credit to yourchecking account will appear on the day the checking account is overdrawn, and the debit to your savingsaccount will not appear until the following day. This means that your savings account balance will be overstatedby the transfer amount for one day. If a transfer exceeds the available credit on your Cash Reserve or overdraftprotection line or business line of credit, the funds will appear in the account to which you transferred them,but will not be available for withdrawal. The transfer may be reversed the following <strong>Business</strong> Day.13. ACCOUNT STATEMENTS. You may obtain periodic statements for your Activated Accounts either onlinewithin the <strong>Service</strong> or in paper format delivered by postal mail. You agree to receive statements online for allaccounts eligible for online statements in the <strong>Service</strong>. You may change or indicate your preference by selectingthe applicable choice within the <strong>Service</strong> or by contacting us at 1-800-238-4486. Online statements contain thesame information as a paper statement, in addition to access to images of the front and back of paid checksand deposit slips. If you choose to receive statements online, we will notify you electronically when astatement is available for viewing within the <strong>Service</strong>. Each such electronic “statement ready” notice shall bedeemed sent to, and received by, all account owners on the day we send it. You agree to contact us promptly ifyou do not receive your online statement for any reason.Online account statements, including images of the front and back of paid checks and deposit slips, will beavailable for 7 years after date of delivery. You may print the documents or save them to your computer. If youencounter difficulty saving or printing the online statement or images of supporting transactions, contact us at1-800-238-4486 for a paper copy of the documents. You can terminate online statement delivery for any of

your Activated Accounts at any time by changing your statement delivery preference to “Paper StatementOnly” within the <strong>Service</strong> or by calling us at 1-800-238-4486. A fee to receive a paper statement may apply. Seethe applicable Account <strong>Agreement</strong>.We will make statements for your Activated Accounts available to you as required by law or upon request. Wemay stop making statements available at any time without notice in such circumstances as when your accountbecomes inactive, in default, in overdraft, or in similar circumstances.14. ONLINE BILL PAYMENT. Our Online Bill Payment <strong>Service</strong> (the “<strong>Service</strong>”) allows you to schedule billpayments through the <strong>Service</strong> seven days a week. Through the <strong>Service</strong> you can:• Pay bills to merchants, institutions, or individuals with a U.S. address, and on your <strong>Union</strong> <strong>Bank</strong> creditcard and loan accounts including same-day payments for certain payees (Same day payments onlyavailable in New <strong>Union</strong> <strong>Bank</strong> Bill Pay System)• Receive eBills for many of your payees (eBills available in Bill Pay System B and in New <strong>Union</strong> <strong>Bank</strong> BillPay System)• Set up payments to be made on a recurring basis• Make transfers, or set up automatic transfers, to and from your <strong>Union</strong> <strong>Bank</strong> Activated Accounts(e.g. transfers from your <strong>Union</strong> <strong>Bank</strong> checking account to your <strong>Union</strong> <strong>Bank</strong> loan or line of creditaccount).(a) Payment Account -- Each time you make an Online Bill Payment (“Payment”), you must indicate theActivated Account from which you wish the Payment to be made (the "Payment Account"). The <strong>Service</strong> is notavailable for certain types of accounts. Refer to the applicable Account <strong>Agreement</strong> for details. You may use the<strong>Service</strong> as a means to transfer funds between Activated Accounts (e.g. transfers from your <strong>Union</strong> <strong>Bank</strong> checkingaccount to your <strong>Union</strong> <strong>Bank</strong> loan or line of credit account). Except in the case of a <strong>Union</strong> <strong>Bank</strong> credit cardaccount, when a <strong>Union</strong> <strong>Bank</strong> account is added as a payee, it will be immediately accessible to you as a “Pay to”or “Transfer to" account within the <strong>Service</strong>.(b) Payment Method – A "Payee" is a person or business you are paying. You can designate Payees only withU.S. addresses. We may refuse to accept certain parties as Payees or may delete Payees from our system if youdo not transfer funds to them for an extended period of time.Bill System A: We will complete your Payment by transferring funds electronically from the Payment Account tothe Payee, or by mailing or otherwise delivering an Official Check (a <strong>Bank</strong> cashier’s check) payable to the Payee.Bill Pay System B & New <strong>Union</strong> <strong>Bank</strong> Bill Pay System: A third party service provider (“<strong>Service</strong> Provider”) willcomplete your Payment by transferring funds electronically from their corporate account to the Payee, or bymailing or otherwise delivering a Corporate/Paper Check payable to the Payee, drawn on their corporateaccount, to render Online Bill Pay services on your behalf. In some cases, the third party service provider willsend laser drafts drawn directly on your Payment Account to your Payee.(c) Timing and Scheduling Your Payments -- To allow time for the payee to receive your payment, you mustschedule the payment sufficiently in advance to allow for processing and delivery time. The required advancetime for a particular payment is indicated within the Online Bill Payment screens.The day by which the Payee indicates Payment is due is the "Due Date." We recommend that you do notschedule the Payment to be made during a grace period that your Payee grants between the Due Date and the

date by which the Payment is considered late (e.g. many mortgage payments). The <strong>Bank</strong> will not be liable forlate charges, penalties, interest, finance charges and other damages if you schedule your Payment to be paidduring a grace period.Bill Pay System A & B: To allow time for the Payee to receive your Payment, you must schedule the Paymentsufficiently in advance to allow for processing and delivery time. The required advance time for a particularPayment is indicated within the <strong>Service</strong> screens.New <strong>Union</strong> <strong>Bank</strong> Bill Pay System: You choose the date the payee will receive your Payment (the “Arrive Bydate”), rather than the date the Payment is sent. The <strong>Service</strong> will not permit you to select an Arrive By dateearlier than the earliest possible Arrive By date designated for each Payee.When requesting a Payment, your account will be debited as follows:Bill Pay System A -Your account will be debited on the day you designate the Payment to be made (the "Date to Send" or “Sendon Date”). The Payment will be mailed or sent electronically to the Payee the next <strong>Business</strong> Day. You must haveavailable funds on deposit in the account you specify on the Send on Date for the Payment to be made.Recurring Payments may be set up to occur at regular intervals. They must be for the same amount each time.Any scheduled or recurring Payment request you designate that falls on a Saturday, Sunday or a <strong>Bank</strong> holidaywill be made on the following <strong>Business</strong> Day.Bill Pay System B -Your account will be debited on the “processing day” you select based on the due date of your Payment.Recurring Payments may be set up to occur at regular intervals. They must be for the same amount each time.Any scheduled or recurring Payment request you designate that falls on a Saturday, Sunday or a <strong>Bank</strong> holidaywill be made on the following <strong>Business</strong> Day.New <strong>Union</strong> <strong>Bank</strong> Bill Pay System -Your account will be debited on the day you designate the Payment to be received by the Payee (the “Arrive Bydate”). However, depending on the method of Payment, your Payment Account may be debited prior to theArrive By date. For example, if the selected method of Payment is a laser draft, and the laser draft arrivesearlier than the Arrive By date due to expedited delivery by the postal service, and the Payee immediatelydeposits the laser draft, your Payment Account may be debited earlier than the Arrive By date. The Paymentwill be mailed or sent electronically to be received by the Payee on the Arrive By date indicated. Any futurescheduled recurring Payment request you designate that falls on a Saturday, Sunday or a <strong>Bank</strong> holiday will bemade on the prior <strong>Business</strong> Day.The <strong>Bank</strong> assumes no responsibility for late Payments if you do not properly schedule and submit your request.To ensure that critical or time-sensitive Payments, such as insurance premiums, are made in a timely manner,we recommend that you schedule those Payments well in advance of their Due Dates. Payees may requireextra time to post a Payment to your account because they do not receive a Payment coupon or invoicenumber with the Payment. Some payees disclose the extra processing time they require to post Payments thatdo not include a Payment coupon or invoice.

(d) Payment Authorization and Remittance -- By providing the <strong>Service</strong> with names and account information ofPayees to whom you wish to direct Payments, you authorize the <strong>Service</strong> to follow the Payment Instructionsthat it receives through the Site. In order to process Payments more efficiently and effectively, the <strong>Service</strong> mayedit or alter Payment data or data formats in accordance with Payee directives.When the <strong>Service</strong> receives a Payment Instruction, you authorize the <strong>Service</strong> to debit your Payment Account andremit funds on your behalf so that the funds arrive as close as reasonably possible to the Arrive By datedesignated by you. You also authorize the <strong>Service</strong> to credit your Payment Account for Payments returned to the<strong>Service</strong> by the United States Postal <strong>Service</strong> or Payee, or Payments remitted to you on behalf of anotherauthorized user of the <strong>Service</strong>.The <strong>Service</strong> will attempt to make all your Payments properly. However, the <strong>Service</strong> shall incur no liability andany liability for failure to complete a transaction (as described in Section 25) shall be void if the <strong>Service</strong> isunable to complete any Payments initiated by you because of the existence of any one or more of the followingcircumstances:i. If, through no fault of the <strong>Service</strong>, your Payment Account does not contain sufficient funds tocomplete the transaction or the transaction would exceed the credit limit of your overdraft account;ii. The Payment processing center is not working properly and you know or have been advised by the<strong>Service</strong> about the malfunction before you execute the transaction;iii. You have not provided the <strong>Service</strong> with the correct Payment Account information, or the correctname, address, phone number, or account information for the Payee; and/or,iv. Circumstances beyond control of the <strong>Service</strong> (such as, but not limited to, fire, flood, or interferencefrom an outside force) prevent the proper execution of the transaction and the <strong>Service</strong> has taken reasonableprecautions to avoid those circumstances.Provided none of the foregoing exceptions is applicable, if the <strong>Service</strong> causes an incorrect amount of funds tobe removed from your Payment Account or causes funds from your Payment Account to be directed to a Payeewhich does not comply with your Payment Instructions, the <strong>Service</strong> shall be responsible for returning theimproperly transferred funds to your Payment Account, and for directing to the proper Payee any previouslymisdirected transactions, and, if applicable, for any late Payment related charges.(e) Caution Regarding Tax Payments -- We discourage you from using the <strong>Service</strong> to pay federal, state or localtax agencies. Those agencies frequently require that coupons accompany Payments, which cannot be donethrough the <strong>Service</strong>. For this reason, unless the <strong>Bank</strong> made an error in scheduling a Payment, the <strong>Bank</strong> will notbe liable for penalties, interest or other damages of any kind to tax agencies.(f) Disconnected Online Session -- If you are disconnected from the <strong>Service</strong> before you log out, we recommendthat you log back onto the <strong>Service</strong> to verify that the Payments or transfers you scheduled appear on your“Pending Payments” or “Pending Transfers” screen. If a scheduled Payment or transfer is missing, call us at 1-800-238-4486. Do not reissue any Payment requests made during the interrupted session unless we advise youto do so. Otherwise, a duplicate Payment could result. You authorize us to pay any duplicate Payments youissue. We will not be responsible for any Payee's refusal to return any duplicate Payments issued by you.(g) Rejected Payment Requests – We may reject a Payment request if it appears to be fraudulent or erroneous.A Payment request may also be refused if there is any uncertainty regarding the transacting party's authority toconduct the transaction, or if there is any dispute or uncertainty regarding the ownership or control of thePayment Account. We reserve the right to reject your Payment request if profane, abusive, or threateninglanguage is used in your instruction. Use of such language may result in cancellation of the <strong>Service</strong>.(h) Insufficient Funds --

Bill Pay System A: We may complete the bill Payment by overdrawing your account or by making an advance onyour line of credit in excess of your credit limit. We may charge a fee for each bill Payment request that wouldoverdraw your account (or exceed your credit limit), whether or not we complete the transfer or bill Payment.We may charge a fee for NSF overdrafts and insufficient funds.Bill Pay System B: In most cases, Payments are made by the Payment processor on your behalf regardless of theavailable balance in your Payment Account. If there are insufficient available funds in an account you designateto make a bill Payment, or if making a transfer would cause your line of credit account to exceed your creditlimit, we may charge a fee for each bill Payment request that would overdraw your account (or exceed yourcredit limit). We may charge a fee for NSF overdrafts and insufficient funds.New <strong>Union</strong> <strong>Bank</strong> Bill Pay System:In using the <strong>Service</strong>, we will make Payments for you from your Payment Account when you instruct us to do so.After making such Payments per your Payment Instructions, the <strong>Service</strong> will debit your Payment Account. Ifthere are insufficient funds in your Payment Account, the <strong>Service</strong> Provider may notify you directly and willattempt to debit your Payment Account a second time. If there are still insufficient funds, the <strong>Service</strong> Providermay contact you directly to seek reimbursement for Payments made on your behalf. In each such case, youagree that:i. You will reimburse us or our <strong>Service</strong> Provider immediately upon demand the amount of the PaymentInstruction if we have delivered the Payment but there are insufficient funds in, or insufficient overdraft creditsassociated with, your Payment Account to allow us to complete the debit processing;ii. For any amount not reimbursed to us within fifteen (15) days of the initial notification, a late chargeequal to one and a half percent (1.5%) monthly interest or the legal maximum, whichever rate is lower, for anyunpaid amounts may be imposed by us or our <strong>Service</strong> Provider;iii. You may be assessed a fee by our <strong>Service</strong> Provider and by us if the Payment Instruction cannot bedebited because you have insufficient funds in your Payment Account, or the transaction would exceed thecredit or overdraft protection limit of your Payment Account, to cover the Payment, or if we cannot otherwisecollect the funds from you; the fee amount will be as set forth in your fee schedule. This fee may also apply ifwe attempt to debit the Payment Account a second time. You hereby authorize us to deduct these amountsfrom your designated Payment Account, including by ACH debit;iv. You will reimburse us and our <strong>Service</strong> Provider (including <strong>Service</strong> Provider's designated debtcollection agency, if applicable) for any fees or costs we incur in attempting to collect any amounts from you;andv. We and our <strong>Service</strong> Provider are authorized to report the facts concerning the debt to any creditreporting agency.(i) No Signature Required -- When a Payment is requested using the <strong>Service</strong>, you agree that we may chargeyour account to make the Payment without your signature. When using the <strong>Service</strong> to make transfers fromaccounts, you agree that we may take any action required to obtain loan advances on your behalf, includingcharging the Activated Account you designated without your signature.(j) Canceling or Modifying Payments --Bill Pay System A- After a Payment request is transmitted, and while the Payment is still in a “pending” state,you may use the <strong>Service</strong> to cancel or modify the Payment on the <strong>Bank</strong>'s "Pending Payment” page in the Bill Pay

electronic bills. The time for notification may vary from Payee to Payee. You are responsible for ensuring timelypayment of all bills.v. Cancellation of electronic bill notification. The electronic Payee reserves the right to cancel thepresentment of electronic bills at any time. You may cancel electronic bill presentment at any time. Thetimeframe for cancellation of your electronic bill presentment may vary from Payee to Payee. It may take up tosixty (60) days, depending on the billing cycle of each Payee. The <strong>Service</strong> will notify your electronic Payee(s) asto the change in status of your account and it is your sole responsibility to make arrangements for analternative form of bill delivery. The <strong>Service</strong> will not be responsible for presenting any electronic bills that arealready in process at the time of cancellation.vi. Non-Delivery of electronic bill(s). You agree to hold the <strong>Service</strong> harmless should the Payee fail todeliver your statement(s). You are responsible for ensuring timely payment of all bills. Copies of previouslydelivered bills must be requested from the Payee directly.vii. Accuracy and dispute of electronic bill. The <strong>Service</strong> is not responsible for the accuracy of yourelectronic bill(s). The <strong>Service</strong> is only responsible for presenting the information we receive from the Payee. Anydiscrepancies or disputes regarding the accuracy of your electronic bill summary or detail must be addressedwith the Payee directly.This <strong>Agreement</strong> does not alter your liability or obligations that currently exist between you and your Payees.15. TRANSFERS. The following types of transfers are available with the <strong>Service</strong>:For Personal Accounts Only:(a) Transfers between an Activated Account and an account owned by you at another financialinstitution. You may transfer funds between (to or from) your Activated Account with us and any otheraccount owned by you (or your business) at another U.S. financial institution that supports and permitssuch transfers. Such transfers settle within three <strong>Business</strong> Days.(b) Transfers from an Activated Account to an account at another financial institution that you do notown or that we have not verified or an account at <strong>Union</strong> <strong>Bank</strong> not owned by you (“Unverified Account”).You may make transfers from an Activated Account to an Unverified Account at another U.S. financialinstitution that supports and permits such transfers. Such transfers settle within two <strong>Business</strong> Days.For both Personal and <strong>Business</strong> Accounts:(c) Wire Transfers. You may initiate a wire transfer from an Activated Account to a destination within theUnited States. Transaction limits apply. For security reasons, we may require additional verification of youridentity prior to authorizing the wire transfer. All wire transfers are subject to the terms and conditions of the<strong>Union</strong> <strong>Bank</strong> Master Funds Transfer <strong>Agreement</strong>. A wire transfer fee will be imposed for a completed wiretransfer. Refer to the applicable Account <strong>Agreement</strong> for more information.(d) Transfers between Activated Accounts (CONSUMER AND BUSINESS). You may transfer the amount ofavailable funds from anActivated Account owned by you to another Activated Account. Transfers to and from your <strong>Union</strong><strong>Bank</strong> Activated Accounts are usually effective immediately if the “from” account has adequate funds andsecurity controls are met.

To make transfers of the type described in paragraph (a) or (b) above, you must follow procedures in the<strong>Service</strong> to verify your ownership of an account at another financial institution or follow setupprocedures to establish an Unverified Account to receive the transfer. You agree that you will notattempt to add accounts to your <strong>Service</strong> that you do not have the authority on which to transfer funds.At our discretion, we may establish customer eligibility requirements for transfers. We may further establishlimits on amount and frequency of transfers. We may change such eligibility requirements and transfer limitswithout prior notice to you. If a transfer exceeds current limits, it will not be processed. Funds availability andcutoff times are set forth in Section 22 of this <strong>Agreement</strong>. If there are insufficient available funds in an accountyou designate to make a transfer, or if making a transfer would cause your line of credit account to exceed yourcredit limit, we may refuse or reverse the transfer. If we choose, we may complete the transfer by overdrawingyour account or by making an advance on your line of credit in excess of your credit limit. We may charge a feefor each transfer request that would overdraw your account (or exceed your credit limit), whether or not wecomplete the transfer. Each transfer made from a line of credit account will be treated as a loan advance.16. MOBILE BANKING. Your enrollment in the <strong>Service</strong> enables you to access certain features and functionalityof the <strong>Service</strong> by use of an electronic wireless device, such as mobile telephones or tablet devices (“Mobile<strong><strong>Bank</strong>ing</strong>”). Mobile <strong><strong>Bank</strong>ing</strong> requires you to have a mobile device with <strong>Internet</strong> capability.(a) The following types of account transactions may be completed by using Mobile <strong><strong>Bank</strong>ing</strong>: 1) View accountbalance; 2) View transaction history; 3) Initiate a single (not recurring) bill Payment to an established bill payee;4) Perform a funds transfer between <strong>Union</strong> <strong>Bank</strong> accounts owned by you; 5) View pending bill Payments; and 6)View pending transfers. Additional Mobile <strong><strong>Bank</strong>ing</strong> services may be available for mobile devices with certaintechnical capabilities. See Section 18 of this <strong>Agreement</strong> regarding Mobile Check Deposit.(b) No fees are assessed to enroll in Mobile <strong><strong>Bank</strong>ing</strong>, to access Mobile <strong><strong>Bank</strong>ing</strong>, or to complete the types oftransactions described immediately above. You may, however, incur charges from your telecommunicationscarrier when sending or receiving messages to your wireless device. You may also incur charges to receive<strong>Internet</strong> service on your mobile device. <strong>Union</strong> <strong>Bank</strong> will not be responsible for any such charges that you mayincur.(c) You acknowledge and agree that the Mobile <strong><strong>Bank</strong>ing</strong> service is dependent upon the functionality of thetelecommunications or <strong>Internet</strong> service provider that supports your mobile device. <strong>Union</strong> <strong>Bank</strong> is notresponsible for the unavailability or temporary interruption of Mobile <strong><strong>Bank</strong>ing</strong> due to service interruptions orfailure of the device or telecommunications service provider.(d) Information you provide in connection with Mobile <strong><strong>Bank</strong>ing</strong> service will be stored on <strong>Union</strong> <strong>Bank</strong>’s secureservers and protected by advanced encryption techniques. As with all electronic banking, security is contingentupon your responsible behavior in protecting your User ID and password and your mobile device. You shouldavoid conducting any Mobile <strong><strong>Bank</strong>ing</strong> transaction in view of others and should never abandon your devicebefore your transaction is completed.17. TRANSACTION ALERTS AND NOTIFICATIONS. Your enrollment in the <strong>Service</strong> allows you to elect to receivetransaction alerts and notifications (“Alerts”). Alerts are electronic notices from us that contain transactionalinformation about the <strong>Union</strong> <strong>Bank</strong> account(s) you have designated (“Designated Account”). For example, Alertsmay include information about the receipt of wire transfers or other credits to an account, about withdrawalsthat exceed a certain dollar amount, or the status of Payments.

(a) By subscribing to the Alerts feature, you acknowledge and agree that: 1) Alerts are provided solely as aconvenience; 2) Alerts are not a substitute for the periodic statements for your Designated Accounts or anyother notices we may send you about such Designated Accounts, without regard to the manner in which youhave chosen to receive such periodic statements or other notices; 3) such periodic statements and othernotices remain the official records of your Designated Accounts; and 4) your ongoing obligation promptly toreview periodic statements, Customer Notices, and all other correspondence from us regarding yourDesignated Accounts and other services you obtain from us remains in full force and effect.(b) You agree to provide us a valid mobile phone number or email address so that we may send you Alerts.Additionally, you agree to indemnify, defend and hold us harmless from and against any and all claims, losses,liability, cost and expenses (including reasonable attorneys’ fees) arising in any manner from your providing usa phone number, email address, or other electronic delivery location that is not your own or that you provide inviolation of applicable federal, state or local law, regulation or ordinance. Your obligations under this paragraphshall survive termination of this <strong>Agreement</strong>.(c) We may provide Alerts through one or more of: 1) a cellular telephone, by text message, 2) a text or Webenabledmobile device; or 3) an email account. It is your responsibility to determine that each of the <strong>Service</strong>providers for the communication media described in 1) through 3), above supports the email and/or textmessage Alerts you selected above. You agree that the Alerts are subject to the terms and conditions of youragreements with your service provider(s) and that you are solely responsible for any fees imposed for an Alertby your service providers. By electing Alerts delivery to a Web-enabled mobile or cellular device, you agree toreceive Alerts through that device. Message and data rates may be imposed by your service provider. Thefrequency of Alerts delivered to your mobile or cellular device depends upon the frequency of events triggeringrequested types of Alerts.(d) You acknowledge and agree that: 1) Alerts may not be encrypted and may include personal or confidentialinformation about you and your transactions, such as your name and account activity or status; 2) your Alertsmay be delayed, misdirected, not delivered, or corrupted due to circumstances or conditions affecting yourservice providers or other parties; and 3) we will not be liable for losses or damages arising from (i) any nondelivery,delayed delivery, misdirected delivery, or corruption of an Alert, (ii) inaccurate, untimely orincomplete content in an Alert; (iii) your reliance on or use of the information provided in an Alert for anypurpose, or (iv) any other circumstances beyond our control.18. MOBILE CHECK DEPOSIT. Mobile Check Deposit enables you to deposit checks to your <strong>Union</strong> <strong>Bank</strong> depositaccount using an iPhone® or Android TM mobile wireless electronic device. An image of the front and back of thephysical check, taken using the wireless device, is transmitted to us through the <strong>Union</strong> <strong>Bank</strong> Mobile <strong><strong>Bank</strong>ing</strong>application and processed for deposit into your account. Following your deposit, we send email confirmation ofyour deposit to the email address we have for you on record in Online <strong><strong>Bank</strong>ing</strong> for Small <strong>Business</strong>. The physicalcheck is not later deposited or processed. For Mobile Check Deposit, you must be a <strong>Union</strong> <strong>Bank</strong> customer for atleast 90 calendar days, and account must be in good standing.(a) Mobile Check Deposit is available only for deposits into your <strong>Union</strong> <strong>Bank</strong> checking, money market, or savingsaccount. Deposits into a business account in the <strong>Service</strong>, certificate of deposit, or Portfolio Connection®account, and loan payments are not permitted.

(b) At our discretion, we may establish customer eligibility requirements to deposit checks using Mobile CheckDeposit. We may further establish limits on amount and frequency of deposits. We may change such eligibilityrequirements and deposit limits without prior notice to you. If a deposit exceeds current limits, it will not beprocessed.(c) In order for a check to be accepted and processed using Mobile Check Deposit, it must:1) Be an original paper check; 2) Be payable to you and endorsed by all payees; 3) Be payable in U.S. dollars;4) Be payable at a financial institution in the United States; 5) Be dated within 6 months prior to date ofdeposit; 6) Have all fields completed; and 7) Be legible and in good physical condition.We will not accept a: 1) Third-party check; 2) Substitute check or copy of a check image; 3) Check payable at afinancial institution outside the United States; 4) Check payable in a currency other than U.S. dollars; 5)Travelers’ cheque; 6) Savings bond; 7) Future-dated check; 8) Check dated more than 6 months prior todeposit; or 9) Non-cash item.At our discretion and without prior notice to you, we may further restrict the types and attributes of checksthat will be accepted and processed using Mobile Check Deposit.(d) You agree that, once you have deposited a check using Mobile Check Deposit, you will not cash the check,nor negotiate, transfer or deliver the check to any other person or entity, nor deposit the check again throughMobile Check Deposit, at an ATM, in person at a branch (unless we have directed you to do so), at anotherfinancial institution, or through any other means. Do not destroy the original check until the deposit appears onyour periodic account statement. Until it appears on the statement, you agree to keep the physical checksecurely stored to prevent theft or misuse. After the deposit has appeared on your statement, you agree tosafely destroy the original check.(e) Generally, funds will be available for withdrawal the <strong>Business</strong> Day after deposit. However, in some cases, wemay delay funds availability up to the 4th <strong>Business</strong> Day after deposit. We will notify you electronically by emailif we delay availability of your deposit. Funds availability rules set forth in Federal Reserve Regulation CC do notapply to checks deposited using Mobile Check Deposit.(f) We reserve the right to reject a check deposit at the time the deposit is attempted using the wireless device.We further reserve the right, upon subsequent review of the deposited check, to cancel the deposit andreverse prior credit to your deposit account for the amount of the deposited check due to non-negotiability ofthe check or any other reason that we may determine. We will notify you electronically through the mobiledevice of our immediate rejection of a deposit. If we subsequently cancel a deposit and reverse credit to youraccount, we will notify you by email.(g) We may, upon subsequent review of a deposited check, adjust the amount of the deposit to conform to thelegal amount of the check as determined by us. Our determination will be considered final. We will notify youby email of such adjustment.(h) Successful completion of a mobile check deposit is dependent upon a good-quality original check and a clearphotograph of the front and back of the check. You agree that you are responsible for accuratelyphotographing the front and back of the check according to our instructions. You acknowledge that not allchecks that meet our deposit criteria can be successfully deposited through Mobile Check Deposit due to thesensitivity and complexity of image recognition technology or other reasons, such as use of unconventionalcheck stock or failure or interruption of any data transmission channels. You acknowledge and agree that we

are not responsible for any loss or liability that you may incur due to inability to deposit, or delay in depositing,a check using Mobile Check Deposit.(i) A check deposit made using Mobile Check Deposit is subject to the same warranties and representations asthough the physical check were deposited, and is subject to the terms and conditions of your deposit account.19. PERSON-TO-PERSON PAYMENTS (SEND MONEY, Personal Accounts ONLY). <strong>Union</strong> <strong>Bank</strong>’s SendMoney service allows Online <strong><strong>Bank</strong>ing</strong> customers, using your mobile wireless device, to initiate a fundstransfer from your <strong>Union</strong> <strong>Bank</strong> personal checking or money market account (“Funding Account”) to aconsumer or business located within the United States. To initiate the transfer, you must provide therecipient’s email address or mobile telephone number. After we process the transfer, the recipient willbe notified by email or mobile text message by PayPal, Inc., <strong>Union</strong> <strong>Bank</strong>’s third-party funds transmitterfor Send Money (“PayPal”), of the availability of transferred funds.(a) Send Money is conducted through <strong>Union</strong> <strong>Bank</strong>’s Mobile <strong><strong>Bank</strong>ing</strong> application and requires you to havea mobile device with certain capabilities. For current device requirements, see Section 6 of this<strong>Agreement</strong>.(b) In order to access funds transferred through Send Money, the recipient must have registered thereceiving email address or mobile wireless number with PayPal. In the event the recipient does notregister the email or mobile wireless number with PayPal, transferred funds will be returned to <strong>Union</strong><strong>Bank</strong> 32 days after the date you initiated the transfer. <strong>Union</strong> <strong>Bank</strong> will credit the Funding Account for thefull amount of the returned transferred funds within 3 <strong>Business</strong> Days thereafter.(c) You agree that, each time you initiate a funds transfer using Send Money, you are authorizing andinstructing us and/or PayPal to send emails or text messages to the recipient on your behalf. You furtheragree that each person or business to whom we send emails or text messages on your behalf has givenyou permission for us to do so.(d) The Funding Account will be debited immediately for the amount of the transfer. You must havesufficient available funds in the Funding Account at the time you initiate a transfer through Send Money.If there are insufficient available funds in the Funding Account at the time you initiate the transfer, thetransfer will not be processed. We will not access overdraft protection or overdraft coverage services,such as Cash Reserve Account, Savings Overdraft Protection Plan, or overdraft coverage, to make up forany shortage in Available Funds.(e) We reserve the right to limit the frequency and dollar amount of transfers initiated through SendMoney. Such frequency and dollar limits may change from time to time without prior notice to you. If afunds transfer that you request would exceed any limits in effect at the time you initiate the transfer,the transfer will not be processed.(f) Once a funds transfer is initiated through Send Money, it cannot be modified. The transfer may becanceled only if the recipient has not registered the receiving email address or mobile wireless numberwith PayPal to accept the funds transfer. A transfer may be canceled only through <strong>Union</strong> <strong>Bank</strong> Mobile<strong><strong>Bank</strong>ing</strong> or Online <strong><strong>Bank</strong>ing</strong>. If you cancel a transfer, we will re-credit the Funding Account within 3<strong>Business</strong> Days after cancellation.

statements and other notices remain the official records of your account, and your ongoing obligationpromptly to review account statements, Customer Notices, and all other correspondence from usregarding your account and other services you obtain from us remains in full force and effect.21. STOPPING PAYMENT ON A PAPER CHECK. You can use the <strong>Service</strong> to place a stop payment order for atraditional paper check you have written on any Activated Account on which you can write checks. To do so,you must provide us with timely, complete and accurate information regarding the account number the item isdrawn upon, the item number, and the exact amount of the item (dollars and cents). If any information isincomplete or incorrect, we will not be responsible for failing to stop payment on the item. Also, depending onthe date you request a stop payment, we may not be able to verify whether the item has been paid, in whichcase we may ask you to contact us. Stop payment requests become effective only when we confirm theirreceipt and have verified that the item has not been paid. Thus, be sure to wait for an online confirmation thata stop payment was placed before you log out of the <strong>Service</strong>.To place a stop payment covering a range of checks that are missing or stolen, you must call us at1-800-238-4486 for personal assistance, or contact your banking office. Other terms and conditions governingstop payments are contained in your applicable Account <strong>Agreement</strong>.22. HOURS OF OPERATION AND CUTOFF TIMES. The <strong>Service</strong> is available to you 24 hours a day; 365/366 days ayear, except at times of "<strong>Service</strong> Unavailability" (see Section 23). Your Activated Account information isupdated at 6:00 a.m. (Pacific Time) Tuesday through Friday and 8:00 a.m. (Pacific Time) on Saturday, except on<strong>Bank</strong> holidays.(a) Payments -- We will process your transaction request as follows:Bill Pay System A - At the end of the <strong>Business</strong> Day if you complete and transmit the request by midnight, PacificTime - Monday through Friday, except on <strong>Bank</strong> holidaysBill Pay System B - "Cut-off Time" means payments scheduled in advance (before 12:00 a.m., Pacific Time onthe scheduled date) will be processed for payment at 12:00 a.m., Pacific Time and "ASAP" payments (paymentsscheduled after 2:00 a.m., Pacific Time on the scheduled date) will be processed at 1:00 p.m., Pacific TimeNew <strong>Union</strong> <strong>Bank</strong> Bill Pay System - We will process your transaction request at the end of the <strong>Business</strong> Day ifyou complete and transmit the request by 7:00 pm, Pacific Time for all payments (including <strong>Union</strong> <strong>Bank</strong> creditcards), other than to <strong>Union</strong> <strong>Bank</strong> loans and lines of credit; by midnight, Pacific Time for payments to <strong>Union</strong><strong>Bank</strong> loans and lines of credit; Monday through Friday, except on <strong>Bank</strong> holidays.Payment requests submitted after the Cutoff Time or on non-<strong>Business</strong> Days will be considered requested thenext <strong>Business</strong> Day. If you attempt to send a transaction request near the Cutoff Time, and your request is notcompleted before the Cutoff Time, your transaction request may be deemed received the next <strong>Business</strong> Day.The exact timing of the update time or the Cutoff Time may vary without advance notice. We will not beresponsible for any loss or delay related to any variation. You may make Payments to your <strong>Bank</strong> loan ActivatedAccounts up to midnight (Pacific Time) on the Date Due for same day processing(Note: This does not includepayments to your <strong>Union</strong> <strong>Bank</strong> credit card account).(b) Transfers between an Activated Account and an account owned by you at another financialinstitution are processed on the <strong>Business</strong> Day they are scheduled, if the transfer request is received by10:00 p.m. (Pacific Time). The funds are withdrawn from the funding account the following <strong>Business</strong> Day

and are credited to the receiving account two (2) <strong>Business</strong> Days later (for example, a transfer submittedbefore 10:00 p.m. (Pacific Time) on Monday will be withdrawn from the funding account on Tuesday anddeposited to the receiving account on Thursday). Once we have processed the transfer request, thetransfer cannot be canceled or stopped. Transfers can be scheduled for the current <strong>Business</strong> Day or upto one year in the future and on a one-time or a recurring basis. Any one-time, future-dated or recurringtransfer scheduled for a non-<strong>Business</strong> Day will be processed on the first <strong>Business</strong> Day after the Send onDate (also referred to as the Date to Send).(c) Transfers from an Activated Account to an Unverified Account are processed on the <strong>Business</strong> Daythey are scheduled, if the transfer request is received by midnight (Pacific Time). Once we haveprocessed the transfer request, the transfer cannot be canceled or stopped. Transfers can be scheduledfor the current <strong>Business</strong> Day or up to one year in the future and on a one-time or a recurring basis. Anyone-time, future-dated or recurring transfer scheduled for a non-<strong>Business</strong> Day will be processed on thefirst <strong>Business</strong> Day after the Send on Date.(d) For limitations on cancelling or modifying a payment, See Section 14(i) above.(e) Checks deposited using Mobile Check Deposit before 9:00 p.m. (Pacific Time) on a <strong>Business</strong> Day will beconsidered deposited that <strong>Business</strong> Day.(f) Wire transfer requests can be submitted through the <strong>Service</strong> only between 7:30 a.m. and 2:30 p.m.(Pacific Time).23. SERVICE UNAVAILABILITY. Access to the <strong>Service</strong> may be unavailable with or without notice at certain timesfor the following reasons:(a) Scheduled Maintenance -- There are periods when systems require maintenance or upgrades. Thesetypically occur as follows: (a) available for inquiries only Tuesday to Saturday 12:00 a.m. to as late as1:00 a.m., Pacific Time (b) unavailable Sunday from 12:00 a.m. to 6 a.m. (Pacific Time) (c)unavailable 2:00 a.m. to 4:00 a.m. Monday, Pacific Time. Transfers between an Activated Accountand an account owned by you at another financial institution may be unavailable between 9:00 p.m.Saturday and 3:00 a.m. Sunday, Pacific Time(d) New <strong>Union</strong> <strong>Bank</strong> Bill Pay System - unavailableSaturday, 11:00 p.m. to Sunday, 3:00 a.m., or Sunday, 1:00 a.m. to 3:00 a.m., Pacific Time. Subjectto Sunday maintenance window schedule.(b) Unscheduled Maintenance -- The <strong>Service</strong> may be unavailable when unforeseen maintenance is necessary.(c) System Outages -- Major unforeseen events, such as earthquakes, fires, floods, computer failures,interruptions in telephone service, or electrical outages may interrupt <strong>Service</strong> availability. During“Inquiry Only” mode, you may not be able to schedule payments or transfers, or change your password.Although we undertake reasonable efforts to ensure the availability of the <strong>Service</strong>, we will not be liable in anyway for its unavailability or for any damages that may result from such unavailability.(d) The <strong>Service</strong> is subject to system capacity and technical limitations. If the <strong>Service</strong> encounters such limitations,such as an excessive number of bill payments or payees, the <strong>Service</strong> may not have the capability to display all of

your information. If this occurs, the <strong>Bank</strong> is not responsible to make the <strong>Service</strong> operable for you, and wereserve the right to discontinue the <strong>Service</strong> to you.24. TRANSACTION LIMITATIONS. Federal regulation limits certain types of withdrawals or transfers from yoursavings or money market account (including online/telephone transfers and Deposit Overdraft Protectiontransfers) to a maximum of six (6) each monthly statement period (money market accounts) or calendar month(savings accounts or money market accounts when the statement period date was requested on a specific day).<strong>Union</strong> <strong>Bank</strong> will charge a $15 Excess Activity Charge for each excess transfer paid against the account.If you exceed these limits, the <strong>Bank</strong> is required to close your account or convert your account to one notsubject to transfer limitations. If your account is closed or converted due to excessive activity, you will not beable to open another <strong>Union</strong> <strong>Bank</strong> savings and/or money market account for 12 months. Please see theapplicable Account <strong>Agreement</strong> for more information.We further reserve the right to limit the frequency and dollar amount of transactions from yourActivated Accounts for security reasons.25. OUR LIABILITY FOR FAILURE TO COMPLETE A TRANSACTION. If we do not complete a transfer to or fromyour account on time or in the correct amount according to this <strong>Agreement</strong>, we will be liable for your losses ordamages. There are some exceptions, however. We will not be liable, for instance, if:(a) You fail to provide us with timely, complete and accurate information for any transaction;(b) Through no fault of ours, you do not have enough available funds or credit availability in your account tomake the payment or transfer;(c) The payment or transfer would exceed the credit limit under any credit arrangement established to covernegative balances;(d) Your computer, <strong>Internet</strong> connection, and/or software malfunctioned for any reason, or the transactioncould not be completed due to <strong>Service</strong> unavailability;(e) Circumstances beyond our control (such as fire, flood, water damage, power failure, strike, labor dispute,computer breakdown, telephone line disruption, or a natural disaster) prevent or delay the transfer despitereasonable precautions taken by us;(f) The system or terminal was not working properly and you knew, or should have known, about the problemwhen you started the transaction;(g) The funds in your account are subject to legal process, an uncollected funds hold, or are otherwise notavailable for withdrawal;(h) The payment account is closed or frozen;(i) The information supplied by you or a third party is incorrect, incomplete, ambiguous, or untimely;(j) You did not properly follow <strong>Service</strong> instructions on how to make the transfer or payment (this includesincorrect date, amount, and/or address information);(k) You did not authorize a payment early enough for the payment to be scheduled, transmitted, received, andcredited by the payee’s Due Date;(l) We made a timely payment, but the payee refused to accept the payment or did not promptly credit yourpayment after receipt; or(m) Any third party through whom any bill payment is made fails to properly transmit the payment to theintended payee.There may be other exceptions stated in our other agreements with you.

26. YOUR LIABILITY FOR UNAUTHORIZED ELECTRONIC FUND TRANSFERS. Tell us AT ONCE if you believe yourPassword has been lost, stolen, or otherwise compromised, or someone has transferred or may transfer moneyfrom your account without your permission. Telephoning is the best way of limiting your possible losses. Youcould lose all the money in your accounts (plus the aggregate maximum amount of your lines of credit for yourActivated Accounts). You agree to review promptly all statements, Customer Notices, and transactioninformation made available to you, and to report all unauthorized transactions and errors to us immediately.You agree that we may process payment and transfer instructions that are submitted with correct online logininformation, and agree that such instructions will be deemed effective as if made by you, even if they are nottransmitted or authorized by you.Personal Accounts Only: Tell us AT ONCE if you believe your password or PIN has been lost or stolen.Telephoning is the best way of limiting your possible losses (see Section 30). You could lose all the money inyour account (plus your maximum line of credit). If you tell us within two <strong>Business</strong> Days that your password hasbeen lost or stolen, you can lose no more than $50 if someone used your password without your permission. Ifyou do NOT tell us within two <strong>Business</strong> Days after you learn of the loss or theft of your password, and we canprove we could have stopped someone from using your password without your permission if you had told us,you could lose as much as $500. Also, if your statement or information you access online shows transfers thatyou did not make, tell us at once.If you do not tell us within 60 days after the statement was mailed to you, you may not get back any money youlost after the 60 days if we can prove that we could have stopped someone from taking the money if you hadtold us in time. If a good reason (such as a long trip or a hospital stay) kept you from telling us, we may extendthe time periods.<strong>Business</strong> Accounts: The limitations on customer liability set forth in the preceding paragraph do notapply to accounts held by businesses. <strong>Business</strong> customers agree to review promptly all statements,Customer Notices, and transaction information made available to them, and to report all unauthorizedtransactions and errors to us immediately. <strong>Business</strong> customers agree that we may process payment andtransfer instructions that are submitted with correct online login information, and agree that suchinstructions will be deemed effective as if made by them, even if they are not transmitted or authorizedby the customer.27. DISCLAIMER OF WARRANTIES. To the fullest extent permitted by law, we make no representations orwarranties of any kind in respect of the <strong>Service</strong>, either express or implied, statutory or otherwise, including butnot limited to implied warranties of merchantability or fitness for a particular purpose, and we hereby disclaimany such representations, warranties and conditions of any kind. We do not represent or warrant that the<strong>Service</strong> will be uninterrupted, timely, secure or error free, that defects will never arise or will be corrected, orthat our website that makes the <strong>Service</strong> available is free of viruses or other harmful components.28. LIMITATION OF LIABILITY. Except as specifically set forth herein or where the law requires a differentstandard, we shall not be responsible for any loss, damage or injury or for any direct, indirect, special,incidental, exemplary or consequential damages, including lost profits, loss of data, files, profit or goodwill orthe costs of procurement of substitute goods or services, arising from or related to the <strong>Service</strong>, the inability touse the <strong>Service</strong>, or otherwise in connection with this <strong>Agreement</strong>, even if advised of the possibility of suchdamages.

29. THIRD PARTY INDEMNIFICATION. Except to the extent that we are liable under the terms of this<strong>Agreement</strong> or another agreement governing the <strong>Service</strong> or Activated Accounts, you agree to indemnify,defend, and hold us, our affiliates, officers, directors, employees, consultants, agents, service providers, andlicensors harmless from any and all third-party claims, liability, damages, and/or costs (including but not limitedto reasonable attorney's fees) arising from:(a) A third-party claim, action, or allegation of infringement, misuse, or misappropriation based on information,data, files, or other materials submitted by you to us;(b) Any fraud, misrepresentation, manipulation, or other breach of this <strong>Agreement</strong> or the <strong>Service</strong>;(c) Your violation of any law or rights of a third party; or(d) The provision of the <strong>Service</strong> or use of the <strong>Service</strong> by you or any third party.We reserve the right, at our own expense, to assume the exclusive defense and control of any matterotherwise subject to indemnification by you, in which event you will cooperate with us in asserting anyavailable defenses. You will not settle any action or claims on our behalf without our prior written consent. Thisindemnification is provided without regard to whether our claim for indemnification is due to your use of the<strong>Service</strong>.30. HOW TO CONTACT US. For questions regarding the <strong>Service</strong>, call us at 1-800-238-4486, or write to us at<strong>Union</strong> <strong>Bank</strong>, P.O. Box 2327, Brea, CA 92822-2327.Telephoning us is the fastest way to reach us. We may not immediately receive email that you send to us.Therefore, you should not rely on email if you need to communicate with us immediately, for example, if youneed to report a lost or stolen card or password, or report an unauthorized transaction from one of youraccounts. We cannot take action on your email request until we actually receive your message and have areasonable opportunity to act.Email or social network websites may not be used to request account information or to conduct transactionswith us. Also, because email and social network websites may not be secure, never include confidential,financial, or account information when using those communication channels. If in doubt, contact us at 1-800-238-4486 or call your banking office.31. IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR ELECTRONIC FUND TRANSFERS.For Personal Accounts Only:Telephone us at 1-800-238-4486, or write to us at <strong>Union</strong> <strong>Bank</strong>, P.O. Box 2327, Brea, CA 92822-2327 as soon asyou can if you think your statement is wrong or if you need more information about a transfer listed on thestatement. We must hear from you no later than 30 days after we sent the first statement on which theproblem or error appeared. (1) Tell us your name and account number. (2) Describe the error or the transferyou are unsure about, and explain as clearly as you can why you believe it is an error or why you need moreinformation. (3) Tell us the dollar amount of the suspected error. If you tell us orally, we may require that yousend us your complaint or question in writing within 10 <strong>Business</strong> Days. We will tell you the results of ourinvestigation within 10 <strong>Business</strong> Days after we hear from you and will correct any error promptly. If we needmore time, however, we may take up to 45 days to investigate your complaint or question. If we decide to dothis, we will re-credit your account within 10 <strong>Business</strong> Days for the amount you think is in error, so that you willhave the use of the money during the time that it takes us to complete our investigation. If we ask you to putyour complaint or question in writing and we do not receive it within 10 <strong>Business</strong> Days, we may not re-credityour account. If we decide that there was no error, we will send you a written explanation within three