Letno poroÄilo 2009.pdf - UniCredit Banka Slovenija dd

Letno poroÄilo 2009.pdf - UniCredit Banka Slovenija dd

Letno poroÄilo 2009.pdf - UniCredit Banka Slovenija dd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

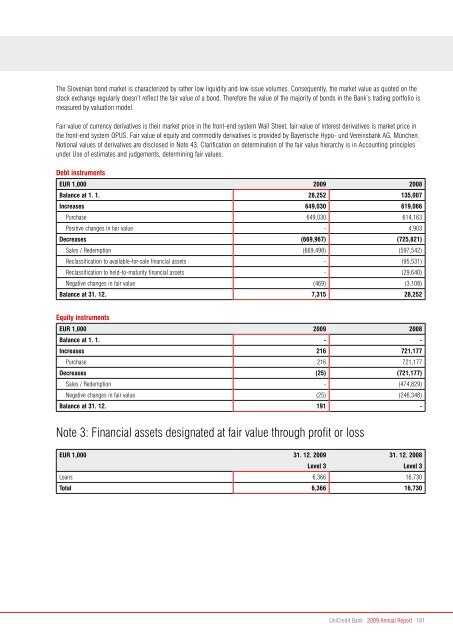

The Slovenian bond market is characterized by rather low liquidity and low issue volumes. Consequently, the market value as quoted on thestock exchange regularly doesn’t reflect the fair value of a bond. Therefore the value of the majority of bonds in the Bank’s trading portfolio ismeasured by valuation model.Fair value of currency derivatives is their market price in the front-end system Wall Street, fair value of interest derivatives is market price inthe front-end system OPUS. Fair value of equity and commodity derivatives is provided by Bayerische Hypo- und Vereinsbank AG, München.Notional values of derivatives are disclosed in Note 43. Clarification on determination of the fair value hierarchy is in Accounting principlesunder Use of estimates and judgements, determining fair values.Debt instrumentsEUR 1,000 2009 2008Balance at 1. 1. 28,252 135,007Increases 649,030 619,066Purchase 649,030 614,163Positive changes in fair value - 4,903Decreases (669,967) (725,821)Sales / Redemption (669,498) (597,542)Reclassification to available-for-sale financial assets - (95,531)Reclassification to held-to-maturity financial assets - (29,640)Negative changes in fair value (469) (3,108)Balance at 31. 12. 7,315 28,252Equity instrumentsEUR 1,000 2009 2008Balance at 1. 1. - -Increases 216 721,177Purchase 216 721,177Decreases (25) (721,177)Sales / Redemption - (474,829)Negative changes in fair value (25) (246,348)Balance at 31. 12. 191 -Note 3: Financial assets designated at fair value through profit or lossEUR 1,000 31. 12. 2009 31. 12. 2008Level 3 Level 3Loans 6,366 16,730Total 6,366 16,730<strong>UniCredit</strong> Bank · 2009 Annual Report 181