Letno poroÄilo 2009.pdf - UniCredit Banka Slovenija dd

Letno poroÄilo 2009.pdf - UniCredit Banka Slovenija dd

Letno poroÄilo 2009.pdf - UniCredit Banka Slovenija dd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

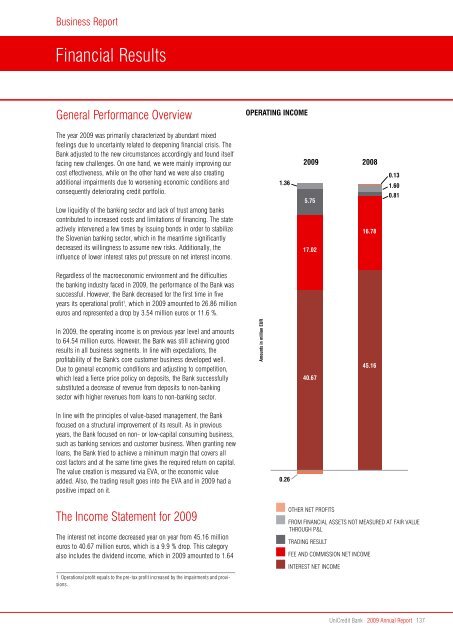

Business ReportFinancial ResultsGeneral Performance Overviewoperating incomeThe year 2009 was primarily characterized by abundant mixedfeelings due to uncertainty related to deepening financial crisis. TheBank adjusted to the new circumstances accordingly and found itselffacing new challenges. On one hand, we were mainly improving ourcost effectiveness, while on the other hand we were also creatinga<strong>dd</strong>itional impairments due to worsening economic conditions andconsequently deteriorating credit portfolio.Low liquidity of the banking sector and lack of trust among bankscontributed to increased costs and limitations of financing. The stateactively intervened a few times by issuing bonds in order to stabilizethe Slovenian banking sector, which in the meantime significantlydecreased its willingness to assume new risks. A<strong>dd</strong>itionally, theinfluence of lower interest rates put pressure on net interest income.1.362009 20085.7516.7817.020.131.600.81Regardless of the macroeconomic environment and the difficultiesthe banking industry faced in 2009, the performance of the Bank wassuccessful. However, the Bank decreased for the first time in fiveyears its operational profit , which in 2009 amounted to 26.86 millioneuros and represented a drop by 3.54 million euros or 11.6 %.In 2009, the operating income is on previous year level and amountsto 64.54 million euros. However, the Bank was still achieving goodresults in all business segments. In line with expectations, theprofitability of the Bank's core customer business developed well.Due to general economic conditions and adjusting to competition,which lead a fierce price policy on deposits, the Bank successfullysubstituted a decrease of revenue from deposits to non-bankingsector with higher revenues from loans to non-banking sector.Amounts in million EUR40.6745.16In line with the principles of value-based management, the Bankfocused on a structural improvement of its result. As in previousyears, the Bank focused on non- or low-capital consuming business,such as banking services and customer business. When granting newloans, the Bank tried to achieve a minimum margin that covers allcost factors and at the same time gives the required return on capital.The value creation is measured via EVA, or the economic valuea<strong>dd</strong>ed. Also, the trading result goes into the EVA and in 2009 had apositive impact on it.0.26The Income Statement for 2009The interest net income decreased year on year from 45.16 millioneuros to 40.67 million euros, which is a 9.9 % drop. This categoryalso includes the dividend income, which in 2009 amounted to 1.64 Operational profit equals to the pre-tax profit increased by the impairments and provisions.OTHER NET PROFITSFROM FINANCIAL ASSETS NOT MEASURED AT FAIR VALUETHROUGH P<RADING RESULTFEE AND COMMISSION NET INCOMEINTEREST NET INCOME<strong>UniCredit</strong> Bank · 2009 Annual Report 137