ashapura intimates fashion limited - Securities and Exchange Board ...

ashapura intimates fashion limited - Securities and Exchange Board ...

ashapura intimates fashion limited - Securities and Exchange Board ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

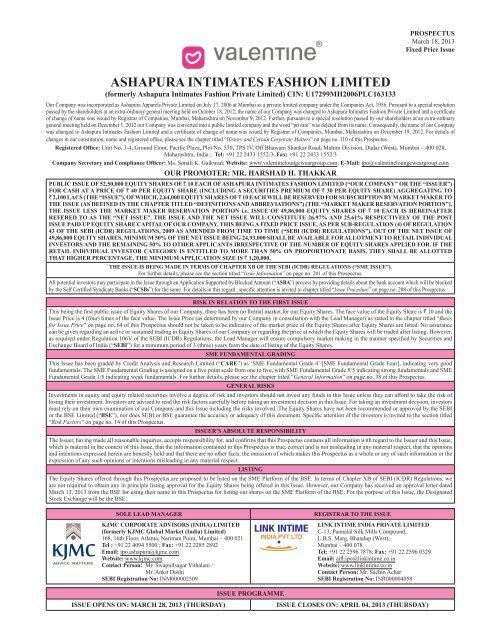

PROSPECTUSMarch 18, 2013Fixed Price IssueASHAPURA INTIMATES FASHION LIMITED(formerly Ashapura Intimates Fashion Private Limited) CIN: U17299MH2006PLC163133Our Company was incorporated as Ashapura Apparels Private Limited on July 17, 2006 at Mumbai as a private <strong>limited</strong> company under the Companies Act, 1956. Pursuant to a special resolutionpassed by the shareholders at an extra-ordinary general meeting held on October 18, 2012, the name of our Company was changed to Ashapura Intimates Fashion Private Limited <strong>and</strong> a certificateof change of name was issued by Registrar of Companies, Mumbai, Maharashtra on November 9, 2012. Further, pursuant to a special resolution passed by our shareholders at an extra-ordinarygeneral meeting held on December 1, 2012 our Company was converted into a public <strong>limited</strong> company <strong>and</strong> the word “private” was deleted from its name. Consequently, the name of our Companywas changed to Ashapura Intimates Fashion Limited <strong>and</strong> a certificate of change of name was issued by Registrar of Companies, Mumbai, Maharashtra on December 19, 2012. For details ofchanges in our constitution, name <strong>and</strong> registered office, please see the chapter titled “History <strong>and</strong> Certain Corporate Matters” on page no. 110 of this Prospectus.Registered Office: Unit No. 3-4, Ground Floor, Pacific Plaza, Plot No. 570, TPS IV, Off Bhawani Shankar Road, Mahim Division, Dadar (West), Mumbai – 400 028,Maharashtra, India ; Tel: +91 22 2433 1552/3, Fax: +91 22 2433 1552/3Company Secretary <strong>and</strong> Compliance Officer: Ms. Sonali K. Gaikwad; Website: www.valentineloungeweargroup.com; E-Mail: ipo@valentineloungeweargroup.comOUR PROMOTER: MR. HARSHAD H. THAKKARPUBLIC ISSUE OF 52,50,000 EQUITY SHARES OF ` 10 EACH OF ASHAPURA INTIMATES FASHION LIMITED (“OUR COMPANY” OR THE “ISSUER”)FOR CASH AT A PRICE OF ` 40 PER EQUITY SHARE (INCLUDING A SECURITIES PREMIUM OF ` 30 PER EQUITY SHARE) AGGREGATING TO` 2,100 LACS (THE “ISSUE”), OF WHICH, 2,64,000 EQUITY SHARES OF ` 10 EACH WILL BE RESERVED FOR SUBSCRIPTION BY MARKET MAKER TOTHE ISSUE (AS DEFINED IN THE CHAPTER TITLED “DEFINITIONS AND ABBREVIATIONS”) (THE “MARKET MAKER RESERVATION PORTION”).THE ISSUE LESS THE MARKET MAKER RESERVATION PORTION i.e. ISSUE OF 49,86,000 EQUITY SHARES OF ` 10 EACH IS HEREINAFTERREFERED TO AS THE “NET ISSUE”. THE ISSUE AND THE NET ISSUE WILL CONSTITUTE 26.97% AND 25.61% RESPECTIVELY OF THE POSTISSUE PAID UP EQUITY SHARE CAPITAL OF OUR COMPANY. THIS BEING A FIXED PRICE ISSUE, AS PER SUB-REGULATION (4) OF REGULATION43 OF THE SEBI (ICDR) REGULATIONS, 2009 AS AMENDED FROM TIME TO TIME (“SEBI (ICDR) REGULATIONS”), OUT OF THE NET ISSUE OF49,86,000 EQUITY SHARES, MINIMUM 50% OF THE NET ISSUE BEING 24,93,000 SHALL BE AVAILABLE FOR ALLOTMENT TO RETAIL INDIVIDUALINVESTORS AND THE REMAINING 50% TO OTHER APPLICANTS IRRESPECTIVE OF THE NUMBER OF EQUITY SHARES APPLIED FOR. IF THERETAIL INDIVIDUAL INVESTOR CATEGORY IS ENTITLED TO MORE THAN 50% ON PROPORTIONATE BASIS, THEY SHALL BE ALLOTTEDTHAT HIGHER PERCENTAGE. THE MINIMUM APPLICATION SIZE IS ` 1,20,000.THE ISSUE IS BEING MADE IN TERMS OF CHAPTER XB OF THE SEBI (ICDR) REGULATIONS (“SME ISSUE”).For further details, please see the section titled “Issue Information” on page no. 201 of this Prospectus.All potential investors may participate in the Issue through an Application Supported by Blocked Amount (“ASBA”) process by providing details about the bank account which will be blockedby the Self Certified Syndicate Banks (“SCSBs”) for the same. For details in this regard , specific attention is invited to chapter titled “Issue Procedure” on page no. 208 of this Prospectus.RISK IN RELATION TO THE FIRST ISSUEThis being the first public issue of Equity Shares of our Company, there has been no formal market for our Equity Shares. The face value of the Equity Share is ` 10 <strong>and</strong> theIssue Price is 4 (four) times of the face value. The Issue Price (as determined by our Company in consultation with the Lead Manager) as stated in the chapter titled “Basisfor Issue Price” on page no. 64 of this Prospectus should not be taken to be indicative of the market price of the Equity Shares after Equity Shares are listed. No assurancecan be given regarding an active or sustained trading in Equity Shares of our Company or regarding the price at which the Equity Shares will be traded after listing. However,as required under Regulation 106V of the SEBI (ICDR) Regulations, the Lead Manager will ensure compulsory market making in the manner specified by <strong>Securities</strong> <strong>and</strong><strong>Exchange</strong> <strong>Board</strong> of India (“SEBI”) for a minimum period of 3 (three) years from the date of listing of the Equity Shares.SME FUNDAMENTAL GRADINGThis Issue has been graded by Credit Analysis <strong>and</strong> Research Limited (“CARE”) as ‘SME Fundamental Grade 4’ [SME Fundamental Grade Four], indicating very goodfundamentals. The SME Fundamental Grading is assigned on a five point scale from one to five, with SME Fundamental Grade 5/5 indicating strong fundamentals <strong>and</strong> SMEFundamental Grade 1/5 indicating weak fundamentals. For further details, please see the chapter titled “General Information” on page no. 38 of this Prospectus.GENERAL RISKSInvestments in equity <strong>and</strong> equity related securities involve a degree of risk <strong>and</strong> investors should not invest any funds in this Issue unless they can afford to take the risk oflosing their investment. Investors are advised to read the risk factors carefully before taking an investment decision in this Issue. For taking an investment decision, investorsmust rely on their own examination of our Company <strong>and</strong> this Issue including the risks involved. The Equity Shares have not been recommended or approved by the SEBIor the BSE Limited (“BSE”), nor does SEBI or BSE guarantee the accuracy or adequacy of this document. Specific attention of the investors is invited to the section titled“Risk Factors” on page no. 14 of this Prospectus.ISSUER’S ABSOLUTE RESPONSIBILITYThe Issuer, having made all reasonable inquiries, accepts responsibility for, <strong>and</strong> confirms that this Prospectus contains all information with regard to the Issuer <strong>and</strong> this Issue,which is material in the context of this Issue, that the information contained in this Prospectus is true, correct <strong>and</strong> is not misleading in any material respect, that the opinions<strong>and</strong> intentions expressed herein are honestly held <strong>and</strong> that there are no other facts, the omission of which makes this Prospectus as a whole or any of such information or theexpression of any such opinions or intentions misleading in any material respect.LISTINGThe Equity Shares offered through this Prospectus are proposed to be listed on the SME Platform of the BSE. In terms of Chapter XB of SEBI (ICDR) Regulations, weare not required to obtain any in principle listing approval for the Equity Shares being offered in this Issue. However, our Company has received an approval letter datedMarch 13, 2013 from the BSE for using their name in this Prospectus for listing our shares on the SME Platform of the BSE. For the purpose of this Issue, the DesignatedStock <strong>Exchange</strong> will be the BSE.SOLE LEAD MANAGERKJMC CORPORATE ADVISORS (INDIA) LIMITED(formerly KJMC Global Market (India) Limited)168, 16th Floor, Atlanta, Nariman Point, Mumbai – 400 021Tel : +91 22 4094 5500 ; Fax: +91 22 2285 2892Email: ipo.<strong>ashapura</strong>@kjmc.comWebsite: www.kjmc.comContact Person: Mr. Swapnilsagar Vithalani /Mr. Ankit DoshiSEBI Registration No: INM000002509REGISTRAR TO THE ISSUELINK INTIME INDIA PRIVATE LIMITEDC-13, Pannalal Silk Mills Compound,L.B.S. Marg, Bh<strong>and</strong>up (West),Mumbai – 400 078Tel: +91 22 2596 7878; Fax: +91 22 2596 0329Email: aifl.ipo@linkintime.co.inWebsite: www.linkintime.co.inContact Person: Mr. Sachin AcharSEBI Registration No: INR000004058ISSUE PROGRAMMEISSUE OPENS ON: MARCH 28, 2013 (THURSDAY)ISSUE CLOSES ON: APRIL 04, 2013 (THURSDAY)

TABLE OF CONTENTSSECTION I – GENERAL ............................................................................................................................ 1DEFINITIONS AND ABBREVIATIONS ..................................................................................................... 1PRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATA ............................................... 11FORWARD-LOOKING STATEMENTS ..................................................................................................... 13SECTION II – RISK FACTORS ...............................................................................................................14SECTION III – INTRODUCTION ............................................................................................................29SUMMARY OF INDUSTRY ....................................................................................................................... 29SUMMARY OF BUSINESS ........................................................................................................................ 32SUMMARY FINANCIAL INFORMATION ............................................................................................... 34THE ISSUE ................................................................................................................................................... 37GENERAL INFORMATION ....................................................................................................................... 38CAPITAL STRUCTURE .............................................................................................................................. 45OBJECTS OF THE ISSUE ........................................................................................................................... 56BASIS FOR ISSUE PRICE .......................................................................................................................... 64STATEMENT OF TAX BENEFITS ............................................................................................................ 66SECTION IV – ABOUT THE COMPANY ..............................................................................................81INDUSTRY OVERVIEW ............................................................................................................................ 81OUR BUSINESS ........................................................................................................................................... 89REGULATIONS AND POLICIES ............................................................................................................. 104HISTORY AND CERTAIN CORPORATE MATTERS ............................................................................ 110OUR MANAGEMENT ............................................................................................................................... 114OUR PROMOTER AND PROMOTER GROUP ....................................................................................... 126GROUP COMPANY .................................................................................................................................. 129DIVIDEND POLICY .................................................................................................................................. 132SECTION V – FINANCIAL INFORMATION ......................................................................................133RESTATED FINANCIAL STATEMENTS ............................................................................................... 133MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTSOF OPERATIONS ......................................................................................................................................166FINANCIAL INDEBTEDNESS ................................................................................................................. 176SECTION VI – LEGAL AND OTHER INFORMATION ....................................................................182OUTSTANDING LITIGATION AND MATERIAL DEVELOPMENTS ................................................. 182GOVERNMENT APPROVALS ................................................................................................................. 184OTHER REGULATORY AND STATUTORY DISCLOSURES .............................................................. 186SECTION VII – ISSUE INFORMATION ..............................................................................................201TERMS OF THE ISSUE ............................................................................................................................. 201ISSUE STRUCTURE ..................................................................................................................................206ISSUE PROCEDURE ................................................................................................................................. 208RESTRICTIONS ON FOREIGN OWNERSHIP OF INDIAN SECURITIES ........................................... 222SECTION VIII – MAIN PROVISIONS OF THE ARTICLES OF ASSOCIATION .........................227SECTION IX – OTHER INFORMATION .............................................................................................263MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION ................................................... 263DECLARATION .......................................................................................................................................265ANNEXURE – GRADING RATIONALE FOR SME FUNDAMENTAL GRADING .......................266

SECTION I – GENERALDEFINITIONS AND ABBREVIATIONSThis Prospectus uses certain definitions <strong>and</strong> abbreviations which, unless the context otherwise indicates orimplies, shall have the meaning as provided below. References to any legislation, act or regulation shall beto such legislation, act or regulation as amended from time to timeGeneral TermsTerm“We” / “our Company” / “the Company”/ “AIFL” / “the Issuer” / “us”"You" / "Your" / "Yours"DescriptionAshapura Intimates Fashion Limited, a company incorporatedunder the Companies Act <strong>and</strong> having its Registered Office atUnit No. 3-4, Ground Floor, Pacific Plaza, Plot No. 570, TPSIV, Off Bhawani Shankar Road, Mahim Division, Dadar(West), Mumbai – 400 028, Maharashtra, IndiaProspective Investors in this IssueCompany related termsTermArticles / Articles of Association / AOAAudit CommitteeAuditor / Statutory Auditor<strong>Board</strong> / <strong>Board</strong> of Directors / our <strong>Board</strong>Draft ProspectusDirector(s) / our DirectorsEquity Share(s)Executive Director(s)Group Company / iesIndependent Directors / Non - ExecutiveDirectorsInvestor Grievance CommitteeKey Management PersonnelDescriptionArticles of Association of our Company, unless the contextotherwise specifiedThe committee of the <strong>Board</strong> of Directors constituted as ourCompany’s Audit Committee in accordance with Clause 52of the SME Equity Listing Agreement to be entered into withthe BSEThe statutory auditor of our Company, M/s JDNG &Associates, Chartered Accountants (Firm Registration No.104315W) having their office at F – 30 / 31, Dreams TheMall, L.B.S. Marg, Bh<strong>and</strong>up – (West), Mumbai – 400 078,Maharashtra, IndiaThe board of directors of our Company or a duly constitutedcommittee thereof, unless the context otherwise specifiedDraft Prospectus dated February 18, 2013 filed with BSE onFebruary 19, 2013The director(s) of our Company, unless the context otherwisespecifiedEquity Shares of our Company of the face value `10 each,fully paid-up, unless the context otherwise specifiedManaging Director or Whole Time Director(s) of ourCompanyThe companies or firms <strong>and</strong> ventures disclosed in thechapters titled “Our Promoter <strong>and</strong> Promoter Group” <strong>and</strong>“Group Company” on page no. 126 <strong>and</strong> page no. 129respectively of this Prospectus, irrespective of whether suchentities are covered under Section 370 (1B) of theCompanies Act, 1956Independent Directors <strong>and</strong> Non - Executive Directors of ourCompanyThe committee of the <strong>Board</strong> of Directors constituted as ourCompany’s Investor Grievance Committee in accordancewith Clause 52 of the SME Equity Listing Agreement to beentered into with the BSEKey Management Personnel of our Company1

TermMAPL / Momai Apparels Private LimitedMemor<strong>and</strong>um / Memor<strong>and</strong>um ofAssociation / MOAPeer Reviewed AuditorPromoterPromoter GroupDescriptionMomai Apparels Private Limited, a company incorporatedunder the Companies Act <strong>and</strong> having its Registered Office atUnit No. 305-309, 3 rd Floor, Pacific Plaza, Plot No. 570, TPSIV, Off Bhawani Shankar Road, Mahim Division, Dadar(West), Mumbai – 400 028, Maharashtra, India; GroupCompanyMemor<strong>and</strong>um of Association of our Company, unless thecontext otherwise specifiedStatutory Auditor of our Company, being M/s JDNG &Associates, Chartered AccountantsMr. Harshad H. ThakkarThe persons <strong>and</strong> entities constituting the promoter group ofour Company in terms of Regulation 2(zb) of the SEBI(ICDR) Regulations <strong>and</strong> disclosed in the chapter titled “OurPromoter <strong>and</strong> Promoter Group” on page no. 126 of thisProspectusRegistered Office The registered office of our Company, located at Unit No. 3-4, Ground Floor, Pacific Plaza, Plot No. 570, TPS IV, OffBhawani Shankar Road, Mahim Division, Dadar (West),Mumbai – 400 028, Maharashtra, IndiaRemuneration CommitteeStock <strong>Exchange</strong>Whole Time DirectorsIssue Related TermsThe committee of the <strong>Board</strong> of Directors constituted as ourCompany’s Remuneration Committee in accordance withClause 52 of the SME Equity Listing Agreement to beentered into with the BSEUnless the context requires otherwise, refers to BSE LimitedWhole Time Directors of our CompanyTermAllotment of Equity Shares / Allot /AllottedAllotment AdviceAllotteeApplicant(s)Application Form(s) / ApplicationASBA / Application Supported byBlocked AmountASBA AccountASBA Investors / ASBA ApplicantASBA Application FormDescriptionUnless the context otherwise requires, means the allotment ofEquity Shares pursuant to this Issue to successful applicants.Note or advice or intimation of Allotment sent to theApplicants who are Allotted Equity Shares after the Basis ofAllotment has been approved by the Designated Stock<strong>Exchange</strong>The successful applicant to whom the Equity Shares havebeen allottedAny prospective investor who makes an application for EquityShares in terms of this ProspectusThe Form in terms of which the applicant shall apply for theEquity Shares of our CompanyMeans an application for subscribing to this Issue containingan authorization to block the application money in a bankaccount maintained with SCSB. ASBA is m<strong>and</strong>atory for QIBs<strong>and</strong> Non Institutional Applicants participating in this IssueAn account maintained with the SCSB <strong>and</strong> specified in theApplication Form for blocking the amount mentioned in theApplication FormAny prospective investor(s) in this Issue who applies throughthe ASBA processThe form, whether physical or electronic, used by an ASBAApplicant to make an Application, which will be consideredas the application for Allotment for the purposes of this2

TermBanker to the CompanyBanker(s) to the IssueBasis of AllotmentBSE / Designated Stock <strong>Exchange</strong>CAREControlling Branches of the SCSBsDepository / DepositoriesDesignated BranchesDP IDEligible NRIEmployee(s)IPOISINIssue / Issue Size / Public Issue / OfferingIssue Opening DateIssue Closing DateIssue PriceIssue Proceeds / Gross ProceedsLM / Lead Manager / KJMCDescriptionProspectusBank of Baroda, Colaba Branch, Esperanca Building,Shahid Bhagat Singh Road, Colaba, Mumbai – 400 039,Maharashtra, IndiaThe banks registered with SEBI as Banker to the Issue withwhom the Public Issue Account will be opened <strong>and</strong> in thiscase being IndusInd Bank Limited, Cash ManagementServices, Solitaire Corporate Park, No. 1001, Building No. 10,Ground Floor, Guru Hargovindji Marg, Andheri (East),Mumbai – 400 093, Maharashtra, India.The basis on which Equity Shares will be Allotted tosuccessful applicants under the Issue <strong>and</strong> which is describedunder the chapter titled “Issue Procedure” on page no. 208 ofthis ProspectusBSE Limited, the Designated Stock <strong>Exchange</strong>Credit Analysis & Research Limited, an agency appointed byour Company for following:- obtaining SME Fundamental Grading- obtaining rating under National Small IndustriesCorporation (NSIC) – CARE Performance & CreditRating scheme for Micro <strong>and</strong> Small EnterprisesSuch branches of the SCSBs which co-ordinate applicationunder this Issue by the ASBA Applicants with the Registrar tothe Issue, Lead Manager <strong>and</strong> the Designated Stock <strong>Exchange</strong><strong>and</strong> a list of which is available at www.sebi.gov.in or at suchother website as may be prescribed by SEBI from time to timeA depository registered with SEBI under the SEBI(Depositories <strong>and</strong> Participant) Regulations, 1996, as amendedfrom time to time in this case being CDSL <strong>and</strong> NSDLSuch branches of the SCSBs which shall collect the ASBAApplication Form used by ASBA Applicant <strong>and</strong> a list ofwhich is available on www.sebi.gov.inDepository Participant's Identity NumberA Non Resident Indian, resident, in a jurisdiction outside Indiawhere it is not unlawful to make an application to subscribe tothis IssueEmployees of Ashapura Intimates Fashion LimitedInitial Public OfferingThe International <strong>Securities</strong> Identification Number of ourCompany being INE428O01016The Public Issue of 52,50,000 Equity Shares of ` 10 each at `40 each (including securities premium of ` 30) per EquityShare aggregating to ` 2,100 Lacs by our Company throughthis ProspectusMarch 28, 2013 (Thursday)April 4, 2013 (Thursday)The price at which the Equity Shares are being issued by ourCompany under this Prospectus being ` 40 (includingsecurities premium of ` 30) per Equity Share unless thecontext otherwise specifiedProceeds to be raised by our Company through this Issuebeing ` 2,100 LacsLead Manager to the Issue, in this case being KJMCCorporate Advisors (India) Limited [formerly known as3

TermListing Agreement / SME Equity ListingAgreementMarket Maker(s)Market Making AgreementMarket Maker Reservation PortionMutual FundsNet Issue / Net Issue to the publicNon Institutional Investor(s) / NonInstitutional Applicant(s)OCB / Overseas Corporate BodyPayment through electronictransfer of fundsProspectusPublic Issue AccountQualified Institutional Buyers / QIBsDescription“KJMC Global Market (India) Limited”]Unless the context specifies otherwise means the SME EquityListing Agreement to be executed between our Company <strong>and</strong>the BSE for listing on the SME PlatformMember Brokers of BSE who are specifically registered asMarket Makers with the BSE SME Platform. In our case,NNM <strong>Securities</strong> Private Limited (Registration No.SMEMM0053924082012) is the sole Market Maker in termsof the Market Making AgreementThe Agreement dated March 5, 2013 entered between theMarket Maker, Lead Manager <strong>and</strong> our Company includingany supplemental / amendment agreement entered into formodifying the said Agreement.2,64,000 Equity Shares reserved out of the Issue Size on firmallotment basis to Market MarkerMeans mutual funds registered with SEBI pursuant to SEBI(Mutual Funds) Regulations, 1996, as amended from time totime49,86,000 Equity Shares out of the Issue SizeInvestors other than Retail Individual Investors, NRIs <strong>and</strong>QIBsA Company, partnership, society or other corporate bodyowned directly or indirectly to the extent of at least 60% byNRIs, including overseas trust in which not less than 60% ofbeneficial interest is irrevocably held by NRIs directly orindirectly as defined under Foreign <strong>Exchange</strong> Management(Deposit) Regulations, 2000. OCB are not allowed to invest inthis Issue.Payment through NECS, ECS, RTGS, NEFT or Direct Credit,as applicableThe Prospectus, filed with the RoC containing, inter alia, theIssue Opening <strong>and</strong> Closing Dates <strong>and</strong> other informationAccount opened with the Banker to the Issue <strong>and</strong> in whosefavour the Applicant (excluding the ASBA Applicant) willissue cheque/(s) or draft/(s) in respect of the Applicationamount when submitting an Application• Mutual Funds, Venture Capital Funds, AlternativeInvestment Funds or Foreign Venture Capital Investorsregistered with the SEBI;• FIIs <strong>and</strong> their sub-accounts registered with the SEBI, otherthan a subaccount which is a foreign corporate or foreignindividual;• Public financial institutions as defined in section 4A of theCompanies Act;• Scheduled Commercial Banks;• Multilateral <strong>and</strong> Bilateral Development FinancialInstitutions;• State Industrial Development Corporations;• Insurance Companies registered with the InsuranceRegulatory <strong>and</strong> Development Authority;• Provident Funds with minimum corpus of ` 2,500 Lacs;• Pension Funds with minimum corpus of ` 2,500 Lacs;• National Investment Fund set up by resolution F. No.4

TermDescription2/3/2005-DDII dated November 23, 2005 of theGovernment of India published in the Gazette of India;<strong>and</strong>• Insurance Funds set up <strong>and</strong> managed by army, navy, or airforce of the Union of India.• Insurance Funds set up <strong>and</strong> managed by the Department ofPosts, IndiaRefund Account(s)Refund Bank(s)Refunds through electronic transfer offundsRegistrar to the Issue / RegistrarRestated Financial Statements / RestatedSummary StatementsRetail Individual Investor(s)SCSB AgreementSelf Certified Syndicate Bank(s) /SCSB(s)SIDBISME Platform of BSE / BSE SME<strong>Exchange</strong>UnderwritersUnderwriting AgreementApart from above, any other entity as specified by SEBI.Account opened with a Refund Bank from which the refundsof the whole or part of the Application amount (excluding tothe ASBA Applicants), if any, shall be madeThe bank(s) which are registered with the SEBI as Banker tothe Issue, at which the Refund Accounts will be opened, inthis case being IndusInd Bank Limited, Cash ManagementServices, Solitaire Corporate Park, No. 1001, Building No. 10,Ground Floor, Guru Hargovindji Marg, Andheri (East),Mumbai – 400 093, Maharashtra, IndiaRefunds through electronic transfer of funds mean refundsthrough ECS, Direct Credit or RTGS or NEFT or the ASBAprocess, as applicableRegistrar to this Issue, in this case being Link Intime IndiaPrivate LimitedRestated Financial Statements dated January 15, 2013 of ourCompany certified by the Peer Review AuditorIndividual Investors who have applied for Equity Shares foran amount not more than ` 2 Lacs (including HUFs applyingthrough their Karta) <strong>and</strong> ASBA Applicants, who have Appliedfor an amount less than or equal to ` 2 LacsThe deemed agreement between the SCSBs, the LM, theRegistrar to the Issue <strong>and</strong> our Company, in relation to thecollection of Applicants from the ASBA Applicants <strong>and</strong>payment of funds by the SCSBs to the Public Issue AccountThe banks which are registered with SEBI under the SEBI(Banker to an Issue) Regulations, 1994 <strong>and</strong> offer services ofASBA, including blocking of an ASBA account in accordancewith SEBI (ICDR) Regulations, a list of which is available onhttp://www.sebi.gov.in/pmd/scsb.pdf or any such otherwebpage as may be prescribed by SEBI from time to timeSmall Industries Development Bank of IndiaThe SME Platform of BSE, approved by SEBI as an SME<strong>Exchange</strong> on September 27, 2011, for listing of equity sharesoffered pursuant to the provisions of Chapter XB of the SEBI(ICDR) RegulationsThe LM <strong>and</strong> NNM <strong>Securities</strong> Private Limited who haveunderwritten this Issue pursuant to the provisions of the SEBI(ICDR) Regulations <strong>and</strong> the SEBI (Underwriters) Regulations,1993, as amended from time to timeThe Agreement dated March 5, 2013 entered between theUnderwriters <strong>and</strong> our Company including any supplemental /amendment agreement entered into for modifying the saidAgreementWorking Days In accordance with the SEBI circular no. CIR / CFD / DIL / 3/ 2010 dated April 22, 2010, unless the context otherwise5

TermDescriptionrequires working days shall mean all days excluding Sundays<strong>and</strong> Bank holidays in the State where the registered office thecompany is situated, in this case being MaharashtraTechnical / Industry Related TermsTermCADCAMDG SetEBOsMBOsDescriptionComputer Aided DesignComputer Aided ManufacturingDiesel Generator SetExclusive Br<strong>and</strong> OutletsMulti Br<strong>and</strong> OutletsConventional Terms / AbbreviationsTermDescriptionAdditional Duties of Excise (Textiles <strong>and</strong>Textile Articles) ActThe Additional Duties of Excise (Textiles <strong>and</strong> TextileArticles) Act, 1978 as amended from time to timeA/CAccountAGMAnnual General MeetingAir (Prevention <strong>and</strong> Control of Pollution)ActThe Air (Prevention <strong>and</strong> Control of Pollution) Act, 1981 asamended from time to timeAlternative Investment FundsAlternative Investment Funds as defined in <strong>and</strong> registeredunder SEBI AIF RegulationsApprox.ApproximatelyAS Accounting St<strong>and</strong>ards as notified under Companies(Accounting St<strong>and</strong>ard) Rules, 2006Assessment YearPeriod of twelve months commencing on 1 st April every year<strong>and</strong> ending on 31 st March of the next yearAYAssessment YearBombay Shops <strong>and</strong> Establishments Act The Bombay Shops <strong>and</strong> Establishments Act, 1948 as amendedfrom time to timeC&FClearing <strong>and</strong> Forwarding AgentCAGRCompounded Annual Growth RateCDSLCentral Depository Services (India) LimitedCentral Sales Tax Act / CSTThe Central Sales Tax Act, 1956 as amended from time totimeChild Labour Prohibition <strong>and</strong> RegulationActThe Child Labour Prohibition <strong>and</strong> Regulation Act, 1986 asamended from time to timeCIIConfederation of Indian IndustryCINCorporate Identification NumberCompetition ActThe Competition Act, 2002 as amended from time to timeCompanies ActThe Companies Act, 1956 as amended from time to timeContract Labour (Regulation <strong>and</strong> The Contract Labour (Regulation <strong>and</strong> Abolition) Act, 1970Abolition) ActCotton Control OrderThe Cotton Control Order, 1986 as amended from time to timeDepositories ActThe Depositories Act, 1996 as amended from time to timeDepository ParticipantA depository / ies participant as defined under theDepositories ActDINDirector Identification NumberDIPPDepartment of Industrial Policy <strong>and</strong> PromotionECSElectronic Clearing ServicesEGMExtra Ordinary General Meeting6

TermEmployers’ Liability Act / ELAEnvironment (Protection) Act / EPAEmployees’ Provident Fund <strong>and</strong>Miscellaneous Provisions Act / EPFEmployees’ State Insurance Act / ESI ActEPSEqual Remuneration ActEURO / €Excise ActFactories ActFCNRFDIFEMAFIPBFII(s)Financial Year / Fiscal / FYFVCIGDPGIRGOIHNIHPHUFICAIIDIFRSIFSCIndian Contract ActHazardous Waste (Management <strong>and</strong>H<strong>and</strong>ling) RulesIncome Tax Act / IT ActIndian GAAPIndustrial Disputes ActIndustrial Dispute (Central) RulesIndustrial Employment (St<strong>and</strong>ing Orders)Act / St<strong>and</strong>ing Orders ActInter-State Migrant Workman (Regulationof Employment <strong>and</strong> Conditions ofService) ActIT RulesDescriptionThe Employers’ Liability Act, 1938 as amended from time totimeEnvironment (Protection) Act, 1986 as amended from time totimeThe Employees’ Provident Fund <strong>and</strong> MiscellaneousProvisions Act, 1952 as amended from time to timeThe Employees’ State Insurance Act, 1948 as amended fromtime to timeEarnings Per ShareThe Equal Remuneration Act, 1979 as amended from time totimeEuro, the official currency of the European UnionThe Central Excise Act, 1944 as amended from time to timeThe Factories Act, 1948 as amended from time to timeForeign Currency Non Resident AccountForeign Direct InvestmentThe Foreign <strong>Exchange</strong> Management Act, 1999 read with rules<strong>and</strong> regulations thereunder <strong>and</strong> amendments theretoFEMA (Transfer or Issue of Security by a Person ResidentOutside India) Regulations 2000 <strong>and</strong> amendments theretoForeign Investment Promotion <strong>Board</strong>, Ministry of Finance,Government of IndiaForeign Institutional InvestorsThe period of twelve months ending on March 31 of each yearForeign Venture Capital Investor registered under the<strong>Securities</strong> <strong>and</strong> <strong>Exchange</strong> <strong>Board</strong> of India (Foreign VentureCapital Investor) Regulations, 2000Gross Domestic ProductGeneral Index Registration NumberGovernment of IndiaHigh Net worth IndividualHorse PowerHindu Undivided FamilyThe Institute of Chartered Accountants of IndiaIdentificationInternational Financial Reporting St<strong>and</strong>ardsIndian Financial System CodeThe Indian Contract Act, 1872 as amended from time to timeHazardous Waste (Management <strong>and</strong> H<strong>and</strong>ling) Rules, 1989 asamended from time to timeThe Income Tax Act, 1961 as amended from time to timeGenerally Accepted Accounting Principles in IndiaThe Industrial Disputes Act, 1947 as amended from time totimeIndustrial Dispute (Central) Rules, 1957 as amended from timeto timeThe Industrial Employment (St<strong>and</strong>ing Orders) Act, 1946 asamended from time to timeThe Inter-State Migrant Workman (Regulation of Employment<strong>and</strong> Conditions of Service) Act, 1979 as amended from time totimeThe Income Tax Rules, 1962, as amended from time to time,except as stated otherwise7

TermINR / Rs. / Rupees / `IRDAKVAMaharashtra Recognition of Trade Unions<strong>and</strong> Prevention of Unfair Labour PracticesActMaternity Benefit ActMATMENAMerchant BankerMICRMinimum Wages Act / MWAMOFMOUMRTP ActMSEsMSPMVAN.A.National Textile Policy / Textile PolicyNAVNECSNEFTNo. / no.NOCNon Resident(s)NPVNRE AccountNRIs / Non Resident IndiansNRO AccountNSDLp.a.PANPATPayment of Bonus ActPayment of Gratuity Act / PGAPayment of Wages Act / PWADescriptionIndian Rupees, the legal currency of the Republic of India.Insurance Regulatory <strong>and</strong> Development AuthorityKilo Volt AmperesThe Maharashtra Recognition of Trade Unions <strong>and</strong> Preventionof Unfair Labour Practices Act, 1971 as amended from time totimeThe Maternity Benefit Act, 1961 as amended from time totimeMinimum Alternate TaxMiddle East <strong>and</strong> North AfricaMerchant Banker as defined under the <strong>Securities</strong> <strong>and</strong><strong>Exchange</strong> <strong>Board</strong> of India (Merchant Bankers) Regulations,1992 as amended from time to timeMagnetic Ink Character RecognitionThe Minimum Wages Act, 1948 as amended from time totimeMinistry of Finance, Government of IndiaMemor<strong>and</strong>um of Underst<strong>and</strong>ingThe Monopolies <strong>and</strong> Restrictive Trade Practices Act, 1969 asamended from time to timeMicro <strong>and</strong> Small EnterprisesMinimum Selling PriceManufacturing Value AddedNot ApplicableThe National Textile Policy, 2000 as amended from time totimeNet Asset ValueNational Electronic Clearing ServicesNational Electronic Fund TransferNumberNo Objection CertificateA person resident outside India, as defined in the Foreign<strong>Exchange</strong> Management Act, 1999 as amended from time totimeNet Present ValueNon Resident External AccountA person resident outside India, as defined under FEMA <strong>and</strong>who is a citizen of India or a Person of Indian Origin underForeign <strong>Exchange</strong> Management (Transfer or Issue of Securityby a Person Resident Outside India) Regulations, 2000 asamended from time to timeNon Resident Ordinary AccountNational <strong>Securities</strong> Depository LimitedPer AnnumPermanent Account Number allotted under the Income TaxAct, 1961 as amended from time to timeProfit after TaxThe Payment of Bonus Act, 1965 as amended from time totimeThe Payment of Gratuity Act, 1972 as amended from time totimeThe Payment of Wages Act, 1936 as amended from time totime8

TermPerson(s)R&DRBIRBI ActRoC / Registrar of CompaniesRoERoNWRTGSSCRASCRRSEBISEBI ActSEBI AIF RegulationsSEBI (Foreign Institutional Investors)RegulationsSEBI (Foreign Venture Capital Investor)RegulationsSEBI (ICDR) Regulations or ICDRRegulations or RegulationsSEBI Takeover Regulations or SEBI(SAST) RegulationsSEBI (Venture Capital) RegulationsSICASl. No.Societies Registration ActSq. ft.Textile Committee ActTINTANTrade Union ActTrade Marks ActUKUS / USAUSD / US$US GAAPU.S. <strong>Securities</strong> ActVATDescriptionA natural person or an artificial person constituted underapplicable laws in India or outside IndiaResearch <strong>and</strong> DevelopmentReserve Bank of IndiaThe Reserve Bank of India Act, 1934 as amended from timeto timeRegistrar of Companies, Mumbai situated in the State ofMaharashtraReturn on EquityReturn on Net WorthReal Time Gross Settlement<strong>Securities</strong> Contracts (Regulation) Act, 1956, as amended fromtime to time<strong>Securities</strong> Contracts (Regulation) Rules, 1957, as amendedfrom time to timeThe <strong>Securities</strong> <strong>and</strong> <strong>Exchange</strong> <strong>Board</strong> of India constituted underthe SEBI Act, 1992, as amended from time to time<strong>Securities</strong> <strong>and</strong> <strong>Exchange</strong> <strong>Board</strong> of India Act 1992, as amendedfrom time to time<strong>Securities</strong> <strong>Exchange</strong> <strong>Board</strong> of India (Alternate InvestmentFund) Regulations, 2012 as amended from time to time.<strong>Securities</strong> <strong>Exchange</strong> <strong>Board</strong> of India (Foreign InstitutionalInvestors) Regulations 1995 as amended from time to time<strong>Securities</strong> <strong>Exchange</strong> <strong>Board</strong> of India (Foreign Venture CapitalInvestor) Regulations, 2000 as amended from time to time<strong>Securities</strong> <strong>Exchange</strong> <strong>Board</strong> of India (Issue of Capital <strong>and</strong>Disclosure Requirements) Regulations, 2009 issued by SEBIon August 26, 2009, as amended, including instructions,circulars, orders, directions <strong>and</strong> clarifications issued by SEBIfrom time to time<strong>Securities</strong> <strong>and</strong> <strong>Exchange</strong> <strong>Board</strong> of India (SubstantialAcquisition of Shares <strong>and</strong> Takeover) Regulations, 2011, asamended from time to time<strong>Securities</strong> <strong>Exchange</strong> <strong>Board</strong> of India (Venture Capital)Regulations, 1996 as amended from time to timeSick Industrial Companies (Special Provisions) Act, 1985, asamended from time to timeSerial NumberThe Societies Registration Act, 1860 as amended from time totime.Square feetThe Textile Committee Act, 1963 as amended from time totimeTax Identification NumberTax Deduction <strong>and</strong> Collection Account NumberThe Trade Union Act, 1926 as amended from time to timeThe Trade Marks Act, 1999 as amended from time to timeUnited KingdomUnited States of AmericaUnited States DollarsGenerally Accepted Accounting Principles in the USAU.S <strong>Securities</strong> Act, 1933 as amended from time to timeValue Added Tax9

TermVCFsw.e.f.Water (Prevention <strong>and</strong> Control ofPollution) ActWorkmen’s Compensation Act / WCAWTOY-o-Y / y-o-yDescriptionVenture Capital FundsWith effect fromThe Water (Prevention <strong>and</strong> Control of Pollution) Act, 1974 asamended from time to timeThe Workmen’s Compensation Act, 1923 as amended fromtime to timeWorld Trade OrganizationYear on yearAll other words <strong>and</strong> expressions used but not defined in this Prospectus, but defined in the Companies Act,the SEBI (ICDR) Regulations or in the <strong>Securities</strong> Contracts (Regulation) Act, 1956 <strong>and</strong>/ or the rules <strong>and</strong>the regulations made there under, shall have the meanings respectively assigned to them in such acts or therules or the regulations made there under or any statutory modification or re-enactment thereto, as the casemay be.10

PRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATAAll references to “India” contained in this Prospectus are to the Republic of India.Financial DataUnless stated otherwise, our financial data included in this Prospectus is derived from the audited financialstatements, prepared in accordance with Indian GAAP <strong>and</strong> the Companies Act <strong>and</strong> restated in accordancewith the SEBI (ICDR) Regulations. In this Prospectus, any discrepancies in any table between the total <strong>and</strong>the sums of the amounts listed are due to rounding off.Our Company’s financial year commences on April 1 <strong>and</strong> ends on March 31 of the next year. Allreferences to particular financial year, unless otherwise indicated, are to the 12 months period ended March31 of that year.There are significant differences between Indian GAAP, US GAAP <strong>and</strong> IFRS. The reconciliation of thefinancial statements to IFRS or US GAAP financial statements has not been provided. Our Company hasnot attempted to explain those differences or quantify their impact on the financial data included in thisProspectus, <strong>and</strong> it is urged that you consult your own advisors regarding such differences <strong>and</strong> their impacton our Company’s financial data. Accordingly, the degree to which the restated summary statementsincluded in this Prospectus will provide meaningful information is entirely dependent on the reader’s levelof familiarity with Indian accounting practices. Any reliance by persons not familiar with Indian accountingpractices on the financial disclosures presented in this Prospectus would accordingly be <strong>limited</strong>.Unless otherwise indicated, any percentage amounts, as set forth in the section titled “Risk Factors”,chapters titled “Our Business” <strong>and</strong> “Management’s Discussion <strong>and</strong> Analysis of Financial Condition <strong>and</strong>Results of Operations” on page no. 14, page no. 89 <strong>and</strong> page no. 166 respectively of this Prospectus, <strong>and</strong>elsewhere in this Prospectus have been calculated on the basis of the restated summary statements.Currency <strong>and</strong> Units of PresentationAll references to “Rs. / INR / `” or “Rupees” are to Indian Rupees, the official currency of the Republic ofIndia.All references to “US$” or “USD” are to United States Dollars, the official currency of the United States ofAmerica.All references to “Euro” or “€” are to European Union, the official currency of the European Union.<strong>Exchange</strong> RatesThe following table sets forth, for the periods indicated, information with respect to the exchange ratebetween the Rupee <strong>and</strong> the USD (in Rupees per USD) <strong>and</strong> the Rupee <strong>and</strong> the Euro (in Rupees per Euro).January 10, 2013 March 31, 2012 March 31, 2011 March 31, 2010US$ 54.63 51.16* 44.65 45.14Euro 71.32 68.34* 63.24 60.56Source: RBI Reference Rate* <strong>Exchange</strong> rate as on March 30, 2012, as RBI Reference Rate is not available for March 31, 2012 being aSaturday.No representation is made that the Indian Rupee amounts actually represents such USD or EURO amountsor could have been or could be converted into USD or EURO at the rates indicated, any other rate or at all.The USD or EURO amounts received, or remitted, by our Company have been converted at the prevailingexchange rates at the time of such conversion.11

Any conversions of USD or EURO or other currency amounts into Indian Rupees in this Prospectus shouldnot be construed as a representation that those USD or EURO or other currency amounts could have been,or can be, converted into Indian Rupees at any particular conversion rate.Industry <strong>and</strong> Market DataUnless stated otherwise, industry <strong>and</strong> market data used in this Prospectus have been obtained or derivedfrom publicly available information as well as industry publications <strong>and</strong> sources. Industry publicationsgenerally state that the information contained in those publications has been obtained from sources believedto be reliable but that their accuracy <strong>and</strong> completeness are not guaranteed <strong>and</strong> their reliability cannot beassured. Accordingly, no investment decision should be made on the basis of such information. Although,we believe that industry data used in this Prospectus is reliable, it has not been independently verified.The extent to which the market <strong>and</strong> industry data used in this Prospectus is meaningful depends on thereader’s familiarity <strong>and</strong> underst<strong>and</strong>ing of the methodologies used in compiling such data. There are nost<strong>and</strong>ard data gathering methodologies in the industry in which we conduct our business, <strong>and</strong>methodologies <strong>and</strong> assumptions may vary widely among different industry sources.DefinitionsFor definitions, please see the chapter titled “Definitions <strong>and</strong> Abbreviations” on page no. 1 of thisProspectus. In the section titled “Main Provisions of the Articles of Association” on page no. 227 of thisProspectus, defined terms have the meaning given to such terms in the AOA of our Company.12

FORWARD-LOOKING STATEMENTSThis Prospectus contains certain “forward-looking statements”. These forward-looking statementsgenerally can be identified by words or phrases such as “aim”, “anticipate”, “believe”, “expect”,“estimate”, “intend”, “objective”, “plan”, “project”, “will”, “will continue”, “will pursue” or other words orphrases of similar import. Similarly, statements that describe our Company’s strategies, objectives, plans orgoals are also forward-looking statements. All forward-looking statements are based on proposed plans,estimates <strong>and</strong> expectations subject to risks, uncertainties <strong>and</strong> assumptions about our Company that couldcause actual results to differ materially from those contemplated by the relevant forward-looking statement.Actual results may differ materially from those suggested by the forward-looking statements due to risks oruncertainties. Important factors that could cause actual results to differ materially from our Company’sexpectations include, but are not <strong>limited</strong> to, the following:• failure to manage our growth <strong>and</strong> scalability or adapt to industry trends, consumer behaviour <strong>and</strong>technological developments;• inability to provide better products or services than our competitors;• failure to maintain <strong>and</strong> enhance awareness of our br<strong>and</strong>;• changes in laws, rules <strong>and</strong> regulations <strong>and</strong> legal uncertainties;• inability to control raw material cost <strong>and</strong> supply;• unprecedented <strong>and</strong> challenging economic conditions; <strong>and</strong>• political instability or change in economic liberalization <strong>and</strong> deregulation policies.For further discussion of factors that could cause the actual results to differ from the expectations, pleasesee the section titled “Risk Factors”, chapters titled “Our Business” <strong>and</strong> “Management’s Discussion <strong>and</strong>Analysis of Financial Condition <strong>and</strong> Results of Operations” on page no. 14, page no. 89 <strong>and</strong> page no. 166respectively of this Prospectus. By their nature, certain market risk disclosures are only estimates <strong>and</strong> couldbe materially different from what actually occurs in the future. As a result, actual gains or losses couldmaterially differ from those that have been estimated.Forward-looking statements reflect the current views as on the date of this Prospectus <strong>and</strong> are not aguarantee of future performance. These statements are based on our Management’s beliefs <strong>and</strong>assumptions, which in turn are based on currently available information. Although we believe theassumptions upon which these forward-looking statements are based are reasonable, any of theseassumptions could prove to be inaccurate, <strong>and</strong> the forward-looking statements based on these assumptionscould be incorrect. Neither our Company, our Directors, the Lead Manager nor any of their respectiveaffiliates have any obligation to update or otherwise revise any statements reflecting circumstances arisingafter the date hereof or to reflect the occurrence of underlying events, even if the underlying assumptionsdo not come to fruition. Our Company will ensure that investors in India are informed of materialdevelopments until the time of the grant of listing <strong>and</strong> trading permission by the Designated Stock<strong>Exchange</strong>..13

SECTION II – RISK FACTORSAn investment in equity shares involves a high degree of risk. You should carefully consider all theinformation disclosed in this Prospectus, including the risks <strong>and</strong> uncertainties described below, beforemaking an investment decision in our Equity Shares. The risks described below are not the only onesrelevant to us or our Equity Shares, the industry in which we operate or India. Additional risks <strong>and</strong>uncertainties, not presently known to us or that we currently deem immaterial may also impair ourbusiness, results of operations <strong>and</strong> financial condition. To obtain a complete underst<strong>and</strong>ing of ourCompany, prospective investors should read this section in conjunction with the chapters titled “OurBusiness” <strong>and</strong> “Management’s Discussion <strong>and</strong> Analysis of Financial Condition <strong>and</strong> Results ofOperations” on page no. 89 <strong>and</strong> page no. 166 respectively of this Prospectus, as well as the other financial<strong>and</strong> statistical information contained in this Prospectus. If any of the risks described below actually occur,our business, prospects, financial condition <strong>and</strong> results of operations could be adversely affected, thetrading price of our Equity Shares could decline, <strong>and</strong> prospective investors may lose all or part of theirinvestment. You should consult your tax, financial <strong>and</strong> legal advisors about the particular consequences toyou of an investment in this Issue.Prospective investors should pay particular attention to the fact that our Company is incorporated underthe laws of India <strong>and</strong> is subject to a legal <strong>and</strong> regulatory environment which may differ in certain respectsfrom that of other countries.This Prospectus also contains forward-looking statements that involve risks <strong>and</strong> uncertainties. Our actualresults could differ materially from those anticipated in these forward-looking statements as a result ofcertain factors, including the considerations described below <strong>and</strong> elsewhere in this Prospectus. Please seethe chapter titled “Forward-Looking Statements” on page no.13 of this Prospectus.Unless specified or quantified in the relevant risks factors below, we are not in a position to quantify thefinancial or other implication of any of the risks described in this section. Unless otherwise stated, thefinancial information of our Company used in this section has been derived from the chapter titled“Restated Financial Statements” on page no. 133 of this Prospectus.INTERNAL RISK FACTORS1. Our Promoter is a party to litigation related to tax matters, which is pending before the Income TaxAuthorities.The Income Tax Appellate Tribunal, Mumbai Bench “H”, Mumbai dealing with the miscellaneousapplication moved by the Department of Revenue under Section 254(2) of the IT Act passed an orderdated October 31, 2012 against our Promoter directing reassessment proceedings by the AssessingOfficer re-examining the genuineness <strong>and</strong> creditworthiness of the loan amount of ` 1,00,000 each fromMr. Manilal Savla <strong>and</strong> Shilpa Shah. The matter is pending before the Income Tax Authorities. Noassurances can be given that the above proceedings shall be determined in favour of our Promoter.Except as mentioned above, there are no other litigations, proceedings, civil or criminal past, pending orcontemplated, by or against our Company, Promoter, Directors <strong>and</strong> Group Company.For further details of these legal proceedings, please see the chapter titled “Outst<strong>and</strong>ing Litigation <strong>and</strong>Material Developments” on page no. 182 of this Prospectus.2. Our Group Company MAPL has now applied for factory license under Factories Act.Our Company procures non-br<strong>and</strong>ed intimate garments from various vendors including MAPL. MAPLdoes not have approval/license under the Factories Act, since inception. One of the “Objects of theIssue” is also to invest in MAPL. MAPL has now applied for the registration required under theFactories Act vide application dated December 26, 2012. The Company <strong>and</strong> its directors which includethe Promoter of our Company may be liable for penalties under the Factories Act <strong>and</strong> other laws. The14

non registration under the Factories Act, may also adversely impact MAPL’s ability to supply goods toour Company, which may further impact our Company’s ability to supply products to its customers. Ifthe said registration is not granted in a timely manner or not granted at all, it may adversely affect ourbusiness <strong>and</strong> operations as stated above.MAPL has already made an application for registration under the Factories Act as mentioned above <strong>and</strong>the management of MAPL is following up with the authority for obtaining the said registration.3. Our Company may require a number of approvals, licenses, registrations <strong>and</strong> permits for itsbusiness.Our Company requires a number of approvals, licenses, registrations <strong>and</strong> permits for its business.Additionally, we may need to apply for renewal of approvals which expire from time to time <strong>and</strong> as <strong>and</strong>when required in the ordinary course. Our Company‘s failure to receive the approvals within the timeframes anticipated or at all could result in interruptions of our operations <strong>and</strong> may have an adverseeffect on our business <strong>and</strong> financial position.Our Company has obtained the requisite licenses <strong>and</strong> approvals from time to time during the regularcourse of our business. Some of the applications may be pending with the relevant authorities. Howeverour Company has not obtained statutory approvals under the Factories Act for carrying onmanufacturing activities since inception. The registration required under the Factories Act was appliedfor in the year 2009 but the said application was later withdrawn. Such non compliance may result inproceedings against our Company <strong>and</strong> the Directors under the Factories Act <strong>and</strong> such actions maydirectly <strong>and</strong> immediately affect our operations <strong>and</strong> performance.For further details of approvals, licenses, registrations <strong>and</strong> permits required by our Company please seethe chapter titled “Government Approvals” on page no. 184 of this Prospectus.4. Assignment of trademark “Valentine” in the name of our Company is pending at the office ofRegistrar of Trademark, Mumbai <strong>and</strong> registration <strong>and</strong> assignment for the trademark “Night & Day”is pending at the office of Registrar of Trademark, MumbaiThe Promoter of our Company is the proprietor of the registered trademark “Valentine” (Class 25)(application no.1220489). Our Promoter has assigned the “Valentine” Trademark in favour of ourCompany through the agreement for sale of his proprietary business entered on October 22, 2007.Consequently, our Company has made an application for assignment of the trademark <strong>and</strong> the same ispending at the office of Registrar of Trademark, Mumbai.The assignment of br<strong>and</strong> allows us to use the “Valentine” trademark. Since, the application asmentioned above is pending; the use of such trademarks by third parties cannot be prohibited by ourCompany by means of statutory protection until our Company’s name is entered as a subsequentregistered proprietor on the trademark register.Further, it may be noted that the proprietor of the registered trademark being the Promoter of ourCompany may prohibit use of such trademarks by third parties.Mr. Dinesh C. Sodha, Whole Time Director, of our Company, has applied for registration of “Night &Day” trademark under class 25 vide application no. 1851839 dated August 18, 2009. He has also agreedto assign the trademark “Night & Day” in favour of our Company upon the grant of the registrationwhich will enable our Company to prohibit the use of such trademark by third parties. If the registrationis not granted, it may have an adverse impact on business of our Company.15

5. Registration of 10 (ten) trademarks (excluding the 2 (two) trademarks mentioned above) is pending atthe office of Registrar of Trademark, Mumbai.Our Company has applied for registration for 10 (ten) trademarks with Registrar of Trademark,Mumbai. There can be no assurance that the all or any of the above mentioned trademark applicationsshall be granted. Our Company may need to litigate in order to protect our interests; such litigation maybe costly <strong>and</strong> time consuming with no guarantee of favourable result. The business or goodwill of ourCompany may be adversely affected by its failure to protect the trademark against misuse by any thirdparty.For further details, please refer to the chapter titled “Our Business – Intellectual Property” on page no.99 of this Prospectus.6. We have entered into, <strong>and</strong> will continue to enter into, related party transactions.We have entered into transactions with related parties. Although, those transactions are typicallyundertaken at an arm’s length basis, there may be potential conflicts of interests between our Company<strong>and</strong> such person in light of such transactions entered into with our Company. We cannot assure you thatsuch transactions could not have been made on more favourable terms with unrelated parties.We have also entered into certain agreements with related parties namely:Sl. No. Date Nature of Agreement Parties1. January 23, 2013 Exclusive Manufacturing Agreement MAPL & AIFL2. January 23, 2013 Share Subscription Agreement MAPL & AIFL3. January 31, 2013 Machineries Lease Agreement MAPL & AIFLFor further details, please refer to the chapter titled “Our Business” on page no. 89 <strong>and</strong> the chaptertitled “Restated Financial Statements - Related Party Transactions” on page no. 148 of this Prospectus.The abovementioned agreements could involve conflict of interest, thereby adversely affecting ourCompany’s operations <strong>and</strong> financial condition. Our Company cannot give an assurance that theseabovementioned agreements with MAPL could not have been made on terms more favourable to ourCompany with unrelated parties. Our Company has entered into the above-mentioned agreementswithout obtaining the requisite prior approval of the central government under section 297 of theCompanies Act. Our Company <strong>and</strong> its officers in default are liable for penalties for the said default.Further, MCA has issued a circular no. 03/2013 dated February 8, 2013 informing all the stakeholdersabout the non functioning of the website from January 17, 2013 due to technical issues in MCA-21system.Our Company has uploaded the requisite form on February 18, 2013 to obtain the approval of CentralGovernment. There is no certainty that the approval from central government will be received forentering into these agreements. Further, we have received a notice vide email dated March 12, 2013from RoC for not obtaining prior approval as required <strong>and</strong> have inter – alia sought below mentioneddetails from our Company:a) Furnish the details of transactions during January 31, 2013 to till date <strong>and</strong> explain as to how theprovisions of section 297 of the Companies Act have been complied.b) The Company intends to enter into separate Exclusive Manufacturing Agreement in this connectionplease pay separate application fee <strong>and</strong> also furnish the estimated value of marketing agreement<strong>and</strong> period of proposed contract under said agreement.16

c) Details of related party transactions during the last three years in a tabular form indicating thereinname of contractee party, nature of transactions, date & period of transactions, value of transactions<strong>and</strong> explain as to how the provisions of section 297 of the Companies Act, have been complied.Our Company is in the process of replying to RoC for the said Notice.7. Objects of the Issue have not been appraised by any bank, financial institution or other independentagency <strong>and</strong> the same are based on internal management estimates <strong>and</strong> quotation from third partiesas may be applicable.As the objects of the issue have not been appraised, there may be changes in costs including due tofactors not in control of our Company which may require the Company to revise or cancel the plannedexpenditures which may have an adverse effect on the business of our Company. Further, the <strong>Board</strong> ofDirectors shall have significant flexibility in applying the proceeds of the Issue, which may affect theresults of our operations.Our estimated funding requirements are as per our current business plan. The actual operations maydiffer from the internal management estimates <strong>and</strong> third party quotations. Therefore, our Company maynot be able to deploy funds as planned.We believe that our Promoter <strong>and</strong> Management have requisite experience in setting up the operations<strong>and</strong> we may not face substantial challenges to deploy the Issue Proceeds.For further details, please see the chapter titled “Objects of the Issue” on page no. 56 of this Prospectus.8. We have not placed any orders for the purchase of machinery in connection with our proposedmodernisation for which a part of Issue Proceeds are proposed to be deployed. Further, some of themachinery that we propose to procure may be imported <strong>and</strong> we may be subject to the risks arising outof currency rate fluctuations. If we are unable to procure such machinery in a timely manner, oncommercially favourable terms <strong>and</strong> / or at all, our operations, profitability <strong>and</strong> financial conditionmay be adversely affected. We may face time <strong>and</strong> cost overruns for the same.We have not placed any orders or entered into any written arrangements in connection with thepurchase of machinery aggregating to ` 300 Lacs, relating to our proposed modernisation, as furtherdetailed in chapter titled “Objects of the Issue” on page no. 56 of this Prospectus.We believe that our Promoter has requisite experience for purchases of machinery <strong>and</strong> we may not facesubstantial challenges in procuring the machinery on commercially acceptable terms. It may further benoted that the Company has started discussion with vendors for the purchase of the machinery.9. Our business growth depends largely on the relationships built by our Management including ourPromoter over a period of time, design team <strong>and</strong> operations team including other skilledprofessionals with stakeholders. If we are unable to retain, motivate <strong>and</strong> / or attract them, ourbusiness may be unable to grow.Our ability to satisfy the existing customers <strong>and</strong> to add new customers depends largely on our ability toattract, train, motivate <strong>and</strong> retain such personnel. Further, we may not be able to redeploy <strong>and</strong> retrainour employees to keep them abreast with continuing changes in the segment which we operate <strong>and</strong>changing consumer preferences <strong>and</strong> tastes. We believe that there is significant competition forprofessionals with the necessary skill-sets in our industry.17

Our Promoter shareholding is 1,13,18,440 Equity Shares which would constitute 58.14% of post Issuepaid up equity share capital whereby he will continue to hold substantial interest <strong>and</strong> control of ourCompany. The relationships that our Promoter has built <strong>and</strong> nurtured have rendered significantadvantages to our Company. Also, most of our employees have been with the Company for a longperiod of time.10. We may have liability under the ESI ActIn July, 2012, our Company had received a notice from the Employees State Insurance Corporation(“ESIC”) regarding the applicability of the Employees’ State Insurance Act (“ESI Act”) to us. OurCompany was requested to take immediate steps for registration of its employees; however, noassessment order was issued against our Company by the ESIC. There has been no furthercommunication from the ESIC in this regard.It may be noted that our Company has complied <strong>and</strong> obtained requisite registration under the ESI Act.Further, our Company has regularised payments under ESI Act upto November 30, 2012.There can be no assurance that the ESIC will not issue an assessment order <strong>and</strong> penalty proceedingsagainst our Company. If an assessment order is passed against us the Company will have to contest thesame <strong>and</strong> may have to deposit a significant amount of money. This could adversely affect our financialcondition <strong>and</strong> our business.For further details, please see the chapter titled “Government Approvals” on page no. 184 of thisProspectus.11. Our Company may have liability under the Contract Labour (Regulation <strong>and</strong> Abolition) ActOur Company <strong>and</strong> our Directors may incur a liability under the Contract Labour (Regulation <strong>and</strong>Abolition) Act. Our Company is not registered under the Contract Labour (Regulation <strong>and</strong> Abolition)Act. Our Company’s failure to apply for such requisite approvals, if applicable within the time frameanticipated or at all may have an adverse effect on our business <strong>and</strong> financial position.12. We may have liability under the EPF ActIn October 2012, our Company received a notice from the Employee Provident Fund Organisationregarding the applicability of the EPF Act to us. Our Company was requested to comply with the EPFAct <strong>and</strong> the schemes framed there under with effect from 01/05/2009 <strong>and</strong> make the payments of PFcontributions <strong>and</strong> allied dues; however there has been no further communication from the EmployeeProvident Fund Organisation in this regard.It may be noted that our Company has complied <strong>and</strong> obtained requisite registration under the EPF Act.Further, our Company has regularised payments under EPF Act upto November 30, 2012.There can be no assurance that our Company will not incur a liability of significant amounts of moneyunder the EPF Act for unpaid dues <strong>and</strong> penalties. Incurring such liability could adversely affect ourfinancial condition <strong>and</strong> our business.13. Our inability to correctly identify <strong>and</strong> underst<strong>and</strong> changing consumer preferences <strong>and</strong> tastes mayaffect our business.It is our endeavour to keep ourselves abreast with the latest <strong>fashion</strong> trends <strong>and</strong> to introduce the designsaccording to the consumer preferences like comfort, choice etc. to broaden our base of productportfolio <strong>and</strong> enhance our business.18

We believe our management expertise lies in designing <strong>and</strong> styling of our products after identifying<strong>fashion</strong> trends, consumer needs <strong>and</strong> preferences which are derived from continuous interaction with ourcustomers for their valued feedback. We have consistently endeavoured to provide products which areglamorous <strong>and</strong> stylish coupled with products which render comfort <strong>and</strong> fit.14. We sell our products in highly competitive markets <strong>and</strong> our inability to compete effectively may leadto lower market share or reduced operating margins, <strong>and</strong> adversely affect our results of operationsOur Company sells its products in a highly competitive market <strong>and</strong> faces competition from otherbr<strong>and</strong>s. To remain competitive in the business we must make continuous efforts to effectively marketour products. This may adversely affect our profitability <strong>and</strong> results of operations.Our Company focuses on design, marketing <strong>and</strong> br<strong>and</strong>ing of our products. We have been able toestablish various br<strong>and</strong>s which are launched by us very successfully even while other br<strong>and</strong>s wereprevailing in the market. Our continuous efforts towards devising the good marketing strategy coupledwith stylish, comfortable <strong>and</strong> glamorous product portfolio shall enable us to grow our market share <strong>and</strong>maintain our competitiveness.15. Our Company has not entered into any binding agreements with distributors <strong>and</strong> retailers fordistributing its products in the market.Although, our Company believes that it maintains good relations with the existing distributors, there canbe no assurance that the distributors would not fail to fulfill their obligations. In such an event, ourCompany may be unable to enforce such obligations or succeed in a claim against them for damages.This may have a material adverse effect on our business <strong>and</strong> financial condition as our Company maynot be able to find replacements on time.Inherent ingredients of our business are trust, underst<strong>and</strong>ing <strong>and</strong> relationships with our associatesincluding customers <strong>and</strong> vendors. Our Company <strong>and</strong> promoter <strong>and</strong> management have been able toestablish cordial relationship with distributors <strong>and</strong> retailers over a period of time. We do not foreseechallenges in maintaining these relationships to help grow our business.16. There are no binding agreements with raw material suppliers on whom our Company relies for acontinued supply of raw materials except an exclusive manufacturing agreement entered withMAPL. Any disruption in that supply could have an adverse affect on our business.Our Company purchases raw materials, such as fabric, accessories, embellishments, etc. on its own forthe products depending on the <strong>fashion</strong> trends <strong>and</strong> seasons from a number of suppliers. We also providespecifications, for the fabric, accessories, etc. required for manufacturing, to vendors who provide usthe non br<strong>and</strong>ed intimate garments. These vendors may procure such raw materials required fromdomestic market <strong>and</strong> / or from international markets. However, our Company has not yet entered intoany binding agreements with these raw material suppliers on whom our Company relies for a continuedsupply of raw materials except an exclusive manufacturing agreement entered with MAPL.Therefore, in the event that these raw material suppliers fail to fulfill their obligations to us, ourCompany may be unable to enforce such obligations or succeed in a claim against them for damages,which could have an adverse affect on our business <strong>and</strong> financial condition. Our Company cannotconfirm that if we succeed in a claim against raw material suppliers, damages, if any, payable would besufficient compensation for our losses.The Company feels that in case of disruption in supply from existing vendors for the required rawmaterial, there are other vendors from whom the Company can source their raw materials requirementon competitive terms.19

17. We have indebtedness <strong>and</strong> will continue to have debt service obligations after the Issue. We haveavailed of certain loans from related parties, which may be recalled at any time.Pursuant to various financing <strong>and</strong> other related agreements, our Company has availed secured loansaggregating to ` 5,281.71 Lacs <strong>and</strong> unsecured loans aggregating to ` 260.63 Lacs as on January 31,2013. Subject to the terms <strong>and</strong> conditions of the said loan agreements, such unsecured loans may berecalled at any time by such lenders. In the event such loans are recalled our business, prospects, resultsof operations <strong>and</strong> financial condition could be adversely affected. Of the above mentioned unsecuredloans availed by our Company, ` 149.49 Lacs is from the related parties viz. Mr. Harshad H. Thakkar,Mr. Dinesh C. Sodha <strong>and</strong> Momai Apparels Private Limited.For further details, please see the chapter titled “Financial Indebtedness” on page no. 176 <strong>and</strong> “RestatedFinancial Statements - Related Party Transaction” on page no. 148 respectively of this Prospectus.18. Our lenders have imposed certain conditions <strong>and</strong> restrictions through the agreements whereby theyhave lent funds to our Company. These conditions <strong>and</strong> restrictions may adversely affect our ability toconduct business.Our financing arrangements are secured by movable <strong>and</strong> immovable assets. Our financing agreementsalso include various conditions <strong>and</strong> covenants that require us to obtain lenders consents prior to carryingout certain activities <strong>and</strong> entering into certain transactions. Failure to obtain these consents or observethese covenants could have significant consequences on our business <strong>and</strong> operations.Any failure to comply with the requirement to obtain consent, or other condition or covenant under ourfinancing agreements that is not waived by our lenders or is not otherwise cured by us, may lead to atermination of our credit facilities <strong>and</strong> acceleration of all amounts due may affect our ability to conductour business.For further details, please see the chapter titled “Financial Indebtedness” on page no. 176 of thisProspectus19. If we are unable to obtain the necessary funds for our growth plans, our business <strong>and</strong> results ofoperations may be adversely affected.There can be no assurance that debt or equity financing or our internal accruals shall be available orsufficient to fund our growth plans. Following limitation may restrict our ability to obtain requiredcapital on acceptable terms in addition to other uncertainties:• limitations on our ability to incur additional debt, as a result of prospective lenders’ evaluationsof our creditworthiness <strong>and</strong> due to restrictions on further incurrence of debt in our existing <strong>and</strong>anticipated credit facilities;• our future results of operations, financial condition <strong>and</strong> cash flows.Due to our inability to raise sufficient capital to finance our growth plans, the business of our Company<strong>and</strong> results of operations may be adversely affected.20. Our Company has experienced negative cash flows in prior periods. Any negative cash flows in thefuture would adversely affect our results of operations <strong>and</strong> financial conditionWe have in the past, experienced negative cash flows as further detailed below:20