Final Sameer Annual Report 2010 - Sameer Africa Limited

Final Sameer Annual Report 2010 - Sameer Africa Limited

Final Sameer Annual Report 2010 - Sameer Africa Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

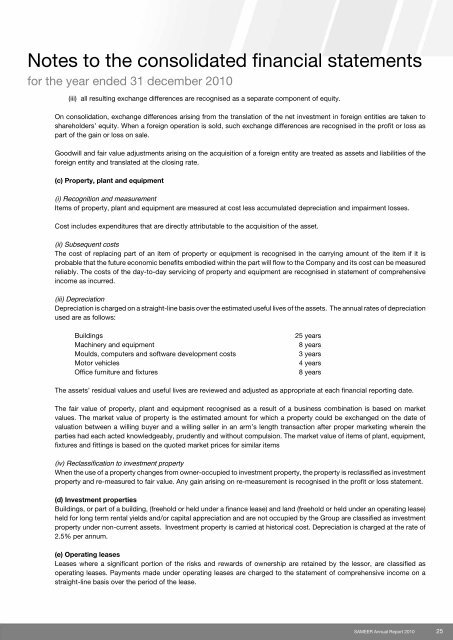

Notes to the consolidated financial statements<br />

for the year ended 31 december <strong>2010</strong><br />

(iii) all resulting exchange differences are recognised as a separate component of equity.<br />

On consolidation, exchange differences arising from the translation of the net investment in foreign entities are taken to<br />

shareholders’ equity. When a foreign operation is sold, such exchange differences are recognised in the profit or loss as<br />

part of the gain or loss on sale.<br />

Goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities of the<br />

foreign entity and translated at the closing rate.<br />

(c) Property, plant and equipment<br />

(i) Recognition and measurement<br />

Items of property, plant and equipment are measured at cost less accumulated depreciation and impairment losses.<br />

Cost includes expenditures that are directly attributable to the acquisition of the asset.<br />

(ii) Subsequent costs<br />

The cost of replacing part of an item of property or equipment is recognised in the carrying amount of the item if it is<br />

probable that the future economic benefits embodied within the part will flow to the Company and its cost can be measured<br />

reliably. The costs of the day-to-day servicing of property and equipment are recognised in statement of comprehensive<br />

income as incurred.<br />

(iii) Depreciation<br />

Depreciation is charged on a straight-line basis over the estimated useful lives of the assets. The annual rates of depreciation<br />

used are as follows:<br />

Buildings 25 years<br />

Machinery and equipment 8 years<br />

Moulds, computers and software development costs 3 years<br />

Motor vehicles 4 years<br />

Office furniture and fixtures 8 years<br />

The assets’ residual values and useful lives are reviewed and adjusted as appropriate at each financial reporting date.<br />

The fair value of property, plant and equipment recognised as a result of a business combination is based on market<br />

values. The market value of property is the estimated amount for which a property could be exchanged on the date of<br />

valuation between a willing buyer and a willing seller in an arm’s length transaction after proper marketing wherein the<br />

parties had each acted knowledgeably, prudently and without compulsion. The market value of items of plant, equipment,<br />

fixtures and fittings is based on the quoted market prices for similar items<br />

(iv) Reclassification to investment property<br />

When the use of a property changes from owner-occupied to investment property, the property is reclassified as investment<br />

property and re-measured to fair value. Any gain arising on re-measurement is recognised in the profit or loss statement.<br />

(d) Investment properties<br />

Buildings, or part of a building, (freehold or held under a finance lease) and land (freehold or held under an operating lease)<br />

held for long term rental yields and/or capital appreciation and are not occupied by the Group are classified as investment<br />

property under non-current assets. Investment property is carried at historical cost. Depreciation is charged at the rate of<br />

2.5% per annum.<br />

(e) Operating leases<br />

Leases where a significant portion of the risks and rewards of ownership are retained by the lessor, are classified as<br />

operating leases. Payments made under operating leases are charged to the statement of comprehensive income on a<br />

straight-line basis over the period of the lease.<br />

SAMEER <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> 25