R&D Scoreboard 2006

R&D Scoreboard 2006

R&D Scoreboard 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE R&D SCOREBOARD<strong>2006</strong>The top 800 UK & 1250Global companiesby R&D investmentCOMMENTARY AND ANALYSISVolume 1 of 2

The Commentary and Analysisforms part of the data in ‘The <strong>2006</strong>R&D <strong>Scoreboard</strong>’ - Company Datadocument, which is volume two.

What’s in the R&D <strong>Scoreboard</strong>?This report contains analysis of the top 1250 global companies and top800 UK companies by R&D using information taken from their auditedaccounts. The main contents of this volume are:Brief highlights .................................................................................................................2Ministerial Foreword........................................................................................................4Executive Summary (Key points from the analysis) ....................................................6Detailed list of contents ................................................................................................20Commentaries from UK company CEOs......................................................................22Analysis with information about: Chapter 1: How the <strong>Scoreboard</strong> is compiled and what is new .....................26 Chapter 2: The role of R&D-active companies in wealth generation ............31 Chapter 3: Business performance of R&D companies ...................................35 Chapter 4: Global 1250 R&D by company, sector and country .....................44 The countries where top R&D companiesare based and the top sectors by R&D The top 50 Global R&D companies and companies with bigincreases/decreases in R&DChapter 5: The relationship between a country’s............................................59mix of sectors and its average R&D intensityChapter 6: Middle-sized companies (sales £50-500m)....................................67 Chapter 7: The relationship between R&D and company performance .......75 Chapter 8: The different levels of patenting activity in 12 R&D sectors .......84Chapter 9: Analysis of UK R&D companies.....................................................93 Top 15 UK sectors Top 25 UK companies Top 21 foreign-owned UK companies Middle-sized UK companiesAbridged data sets for Global 1250 and UK 800 companies ...................................115Volume 2 of the <strong>Scoreboard</strong> contains full data on all the <strong>Scoreboard</strong>companies and some technical notes on definitions and data sources.

Brief highlightsGlobal 12501 The <strong>2006</strong> R&D <strong>Scoreboard</strong> contains extensive data on the top 1250global R&D investing companies and the top 800 from the UK.2. The Global 1250 is dominated by companies based in a few majoreconomies (82% of R&D is from companies based in the USA,Japan, Germany, France and the UK), by large companies (61% ofthe R&D is done by the top 100 companies) and by companies inmajor R&D sectors (70% of R&D is in the top 5 sectors: technologyhardware, pharmaceuticals, automotive, electronics and software).3. Growth trends apparent in the Global 1250 as a whole include:Further increases in company profitability and R&D growthover those reported in 2005.Pharmaceuticals and software R&D growing faster than otherlarge sectors (technology hardware, automotive andelectronics) and showing the highest profitability of the top15 sectors.Aerospace & defence growing R&D fastest of the top 15 sectors(+13.5%).Continued high growth of R&D from companies in SouthKorea and Taiwan.4. The Global 1250 companies from different countries have verydifferent sector mixes, with automotive dominating in Germany,pharmaceuticals in the UK and electronics in South Korea, forexample. The proportion of R&D-intensive, Capex-intensive andservice companies also varies considerably by country. Theselarge sector mix differences are the key determinant of averageprofitability, of average R&D intensity and of the patents-to-R&Dratio by country.5. Almost one quarter of the Global 1250 companies are middlesized(sales £50m to £500m); over three quarters of these are frompharmaceuticals, software and technology hardware. The USA hasthe largest proportion of its companies in the middle-sizedcategory. The UK has the second largest proportion amongst thetop 7 R&D nations.6. Middle-sized R&D-active companies can become large veryquickly – several have grown from sales of £300m to over £1bn injust 3 years. There are also several examples of profitable UKR&D-intensive companies that have grown sales fast over the last2 years.2 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

UK R&D and the UK8007. There are 72 UK-owned companies in the Global 1250, the thirdlargest country group (equal to Germany) which have total R&Dof £13.1bn, an increase over the previous year of over 8%.8. The total R&D of the separate UK 800 (which contains the 72companies in the Global 1250) is £19.2bn compared to £17bnreported in the 2005 <strong>Scoreboard</strong>. The increase is due both to greaterdisclosure of R&D under IFRS by companies in sectors such asbanks, insurance, media and retail and to an increase in R&Dmore generally (up 4% in <strong>2006</strong> compared to a decrease of 1% in2005). Listed UK companies have grown thier R&D by over 8%.9. UK R&D is particularly strong in pharmaceuticals and aerospaceand contains a growing software sector (119 companies in <strong>2006</strong>).The proportion of UK companies with R&D above £2.9m and withhigh R&D intensity (over 10%) is rising and is significantly abovethat of the rest of the EU although still below the USA.10. The top ten foreign-owned UK companies account for just overhalf of the £4.4bn of R&D performed by foreign-owned UKcompanies. Eight of these 10 have higher R&D intensities thantheir overseas parents and this emphasises the attractions of theUK as a location for R&D.R&D investment and company success11. R&D is a major investment contributing to company success alongwith other factors like excellent operations and good strategicchoices. There are well-established links between R&D growth andintensity and sales growth, wealth creation efficiency and marketvalue.12. The <strong>Scoreboard</strong> contains several technology companies thatincreased R&D from 2001 to 2002 even though sales declinedfollowing the 2000 high in technology stocks. These companiescontinued to increase R&D after 2002, and had strong salesgrowth in later years and are showing good profitability in2005/06. Some UK companies showed similar behaviour from2000 to 2005 and then also increased sales in the latter part of thisperiod with good profitability in 2005/06.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 3

Ministerial ForewordLord Sainsbury of TurvilleFor the first timewe are seeingsubstantial R&Dfrom UKcompanies…in financialservicesBusiness leadersmust seize theopportunitiesthat majoradvances inscience andinnovation openup for them.By Lord Sainsbury of Turville,Parliamentary Under Secretary of State for Scienceand InnovationThe level of R&D in the UK economy is of vital importance for ourfuture success because it benefits both the companies that investin it, and other companies as well. Technological improvementscan spread into a huge range of products, processes and servicesthat benefit producers and customers alike. Some R&D directlyleads to new products and services such as medicines, aircraft orcomputer games. In other cases, R&D leads to technology thatunderpins the business model of a company – integratingelectronic ordering with stock control and delivery management –or helps deliver public services better.Around two thirds of R&D done in the UK is carried out bycompanies. It has long been a key part of the corporate strategyof many so-called high-tech firms, both in manufacturing and inservices, particularly software companies. For the first time weare also seeing substantial R&D from UK companies outsidethese sectors, particularly in financial services. Much of this R&Dwas previously unreported; some of it represents increases inspending. But the most important point is the ever-wideningrelevance of technology – and the R&D that goes into its creation– for virtually all businesses.That means that virtually every company – and certainly allcompanies that are serious about growth – needs to think aboutinnovation and the role technology plays in it. For many this willmean assessing their level of R&D investment, among otherfactors. The list of the top R&D-active companies in this R&D<strong>Scoreboard</strong>, drawn from the accounts of R&D-active companiesbased in the UK and globally, can provide some usefulcomparators, whether by size, sector or profits. Smaller firms cancompare their R&D intensity (R&D as a percentage of sales) withparticular firms’ or sectors’ R&D intensity.R&D investments are globally mobile, and the UK is an attractivelocation for R&D activities for both UK and non-UK companies.Macroeconomic stability, a strong research and skills base, aforward-looking Technology Programme to support businessR&D in key areas and R&D tax incentives worth around £600m ayear all support decisions to locate and grow an R&D-activebusiness in this country. Eight of the top 10 non UK-owned firmsin the <strong>Scoreboard</strong> have higher R&D intensities than their parentcompanies – they are located here to make the most of ourstrengths in R&D.4 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

Global competition remains strong, and growth in Taiwanese andSouth Korean R&D continues apace: over 30% increase over last yearfor Taiwan, and nearly 12% for S Korea. By comparison, the UScompanies in the global <strong>Scoreboard</strong> grew their R&D by 8.2% over lastyear, a figure that the UK companies matched.The picture that emerges from the <strong>Scoreboard</strong> is of UK success in twotypes of business. The first is high value added, R&D-intensivesectors: the UK is strong in aerospace & defence and inpharmaceuticals, and in its top 800 R&D companies it has 119software businesses. The second is firms which use technology as akey part of their business but have a low ratio of R&D to sales, suchas telecoms, oil & gas and financial services. These firms showsignificant R&D in cash terms but relatively low R&D intensities. TheUK has relatively fewer of the first type and relatively more of thesecond type in the <strong>Scoreboard</strong>. Crucially, however, the UK companiesof both types are relatively profitable; they are concentrated in highvalue-added sectors.The UK also shows encouraging signs of growth in its smaller R&Dcompanies. Last year’s <strong>Scoreboard</strong> found there were 100 morecompanies spending over £300,000 on R&D; this year’s finds 88 moreUK firms spending over £500,000. There are also 105 more companiesspending over £3m on R&D than in the 2003 <strong>Scoreboard</strong>.The Government is committed to making the UK one of the bestplaces in the world for science and innovation, and we will, therefore,continue our support for companies who use R&D effectively to createcompetitive advantage. We are also doing more to make companiesaware of the UK’s benefits as a location for R&D. At the same timebusiness leaders must seize the opportunities that major advances inscience and innovation open up for them. This <strong>Scoreboard</strong> illustratesthe greatly increased sales for firms that maintained R&D investmentthrough the difficult times in the early part of this decade. Advances inscience and technology are opening up many opportunities forcompanies to innovate and grow, and I hope that the R&D <strong>Scoreboard</strong>will help inform their plans for the future.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 5

Executive SummaryOverview of Global R&D1. The top 1250 R&D-active companies in the world invested£249bn in R&D in 2005/06, up 7% on the previous year(compared to a 5% increase in 2005) and accounting for well over50% of estimated global business R&D. This £249bn of R&D ishighly concentrated in firms from 5 countries (82% in the USA,Japan, Germany, France and the UK), in 5 sectors (70% intechnology hardware, pharmaceuticals, automotive, electronicsand software) and in the top 100 companies (61% of the total).There are 72 UK companies in the Global 1250 contributing over£13bn of R&D, an 8% increase over the previous year. Figure ES1shows the country and sector concentrations.2. Clear growth trends in business performance, sectors andcountries are apparent from a comparison of the <strong>2006</strong><strong>Scoreboard</strong> with previous DTI <strong>Scoreboard</strong>s:The business performance of companies in <strong>2006</strong> has shown asteady improvement over the last 3 years with growth of R&Dnow 7% (5% in 2005), profitability increased to 11% (9.6% in2005) and market cap up a further 6% over 2005. Only 14 ofthe top 100 companies reduced R&D over the previous yearcompared to 27 in the 2005 <strong>Scoreboard</strong>.Within the five largest sectors there has been a steady relativeincrease in the volume of R&D performed by companies inpharmaceuticals and software; pharmaceuticals is now insecond place in the Global 1250, just behind technologyhardware. As recently as 1996 there were no pharmaceuticalcompanies in the Global top 20; there are now six. Software isthe fifth largest sector in <strong>2006</strong>, just 10% smaller thanelectronics & electrical (see figure ES1). Microsoft is now in 5thposition in the whole <strong>Scoreboard</strong> but was 65th in 1996.Rapid growth in R&D by companies from some countries inAsia continues. South Korea is now in seventh place in theGlobal 1250 (9th in 2003). Taiwan now has the sixth largestnumber of companies (44) in the <strong>Scoreboard</strong>, but is in 12thplace by volume of R&D since it has no large R&D companies.The top 50 companies are shown in figure ES2 and are drawnfrom 11 countries. Companies such as BAE Systems, Eli Lilly,Hyundai, Microsoft and Nokia were not in the top 50 of 1996.6 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

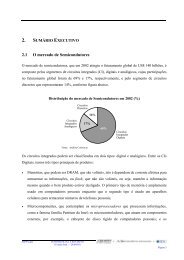

Figure ES3 Profitability vs. investment intensity for the largest 15 sectors in the R&D Global 125025Profitability (Operating Profit as % Sales)2015105Oil & GasFood ProducersHouseholdGeneral IndustrialsIndustrial Engineering ChemicalsAerospaceHealthLeisureSoftwareFixed LineTelecomsTechnology HardwareElectronicsPharmaceuticalsAutomotive00 5 10 15 20Investment Intensity (R&D + Capex) as % SalesThe Importance of Sectors for R&D and Business Performance3. Sectors differ markedly both in their inputs – the R&D andCapex required – and in their outputs such as profitabilityand market cap to sales ratio. The sector mix of the companiesfrom each country in the <strong>Scoreboard</strong> therefore has a major effecton country average performance measures. There are just 3sectors amongst the 39 which have R&D intensities (R&D as %sales) over 8%: pharmaceuticals, software and technologyhardware. These three together account for 45% of Global 1250R&D. Pharmaceuticals and software also have the highest averageprofitability amongst the 15 largest sectors (see figure ES3).Profitability also varies substantially amongst the variouscompanies within any one sector.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 9

Executive SummaryFigure ES4 Companies from each of 7 countries drawn from the top 6 in the FT Global 500 and in theR&D Global 1250 as proportions of the totals7.8%4.4%a) FT Global 500USAJapanGermany39.2%France24.6%Switzerland27 OthersCanadaUK2.2%6.0%3.8%12.0%1.9%5.8%b) R&D Global 125017.9%USAJapanGermany43.3%FranceSwitzerland2.7%4.3%32 OthersCanadaUK5.8%18.3%10 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

4. The groups of companies from different countries showvery different specialisations in two senses. The first is in theproportion of companies that are R&D-intensive as opposed tobeing from Capex-intensive or service sectors. This is illustratedby comparing the proportions of companies in the FT Global 500(the largest companies in the world by market cap) withproportions in the R&D Global 1250 (see figure ES4). R&D ‘heavy’countries like Germany are more strongly represented in the R&D1250 whereas R&D ‘light’ countries like Canada are stronger in theFT 500. The second type of specialisation is seen within the R&DGlobal 1250 where companies from different countries havedifferent sector strengths. This is illustrated by figure ES5 whichhighlights the top 8 sectors in the top 7 countries in the Global1250 and shows:The USA has 63% of its Global 1250 R&D in pharmaceuticals,software & technology hardwareJapan has 71% of its R&D in automotive, technologyhardware, electronics and leisure electronics while SouthKorea has 84% in automotive and electronics and Germany62% in automotive and electronics (nearly 50% in automotive).The UK has 57% of its Global 1250 R&D in pharmaceuticalsand aerospace while Switzerland has 66% in pharmaceuticalsalone.Figure ES5 The top 7 countries with their Global 1250 companies’ proportions of R&D in the top 8 sectors100908070% of country R&D6050403020100USA Japan Germany France UK SwitzerlandS KoreaOther Aerospace AutomotiveChemicalsElectronicsLeisurePharmaceuticalsSoftwareTechnology HardwareThe <strong>2006</strong> R&D <strong>Scoreboard</strong> 11

Executive SummaryFigure ES6a The R&D in the 5 sector groups for the 5 major countries45403530R&D £bn2520151050USA Japan Germany France UKPharmaceuticals & Health (Group 1) Electronics & IT (Group 2) Engineering & Chemicals (Group 3)Low R&D Intensity Sectors (Group 4)Very Low R&D Intensity Sectors (Group 5)Figure ES6b The sales in the 5 sector groups for the 5 major countries700600500Sales £bn4003002001000USA Japan Germany France UKPharmaceuticals & Health (Group 1) Electronics & IT (Group 2) Engineering & Chemicals (Group 3)Low R&D Intensity Sectors (Group 4) Very Low R&D Intensity Sectors (Group 5)12 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

5. Country specialisations reflect large sector mix differences intheir Global 1250 companies and have three importantconsequences:The overall profitability of a country’s group of companies inthe <strong>Scoreboard</strong> reflects its sector mix. Examples are Germanywith a low profitability of 7.1% (large automotive andelectronic & electrical sectors) and Switzerland with a highprofitability of 14.1% (large pharmaceutical sector).The average R&D intensity for a country’s group of Global1250 companies is determined not only by its proportion ofR&D from high R&D intensity sectors but also by its proportionof sales coming from companies with low R&D intensity. TheUK is a clear example of this with a low average R&D intensity(1.8% vs. the USA with 4.4%) caused both by the very largesales of its successful large companies in oil & gas, banks,telecoms, food producers & retailers and by its low overallpresence in electronics & technology hardware (see figure ES6which shows the amounts of both R&D and sales in each of5 sector groups). The substantial difference between UK andUS companies’ average R&D intensity in the Global 1250 isalmost entirely due to sector mix rather than different levels ofR&D intensity within sectors.The numbers of US patents filed by a country’s group of largerGlobal 1250 companies is also determined by sector mix sincethe number of patents granted per £10m of R&D varies by afactor of ten between pharmaceuticals (low at 0.6) andtechnology hardware and electronics (high at 6 to 6.5) – seeFigure ES7 The patents-to-R&D ratio for 12 sectorsPersonal Goods (9) 4.486.49Electronic &Electrical (24)6.46.54TechnologyHardware (50)5.996.38AutomotiveComponents (14)3.523.89Household (7)33.84Chemicals (29)2.733.31Aerospace &Defence (17)2.062.44US Patents per YearAveraged over 2001-2005Health (12)1.571.652005 US PatentsAutomotive(vehicles) (16)Software (21)Pharmaceuticals &Biotechnology (39)Telecoms (12)1.051.021.031.310.810.620.640.630 2 4 6 8US Patents per £10m R&D investment† number of companies used in the calculationThe <strong>2006</strong> R&D <strong>Scoreboard</strong> 13

Executive Summaryfigure ES7. This explains why the UK with its strong presencein pharmaceuticals and few large companies in electronics andtechnology hardware has no companies in the top 20 for 2005US patents while Japan and South Korea have 12 of the top 20.Middle-Sized Companies in the R&D <strong>Scoreboard</strong>6. There are some 300 middle-sized companies (sales £50m-£500m) in the Global 1250 and 77% of these are in 3 highR&D intensity sectors – pharmaceuticals, software andtechnology hardware. The USA has a strong presence in these3 sectors and thus accounts for 67% of these middle-sizedcompanies (and over 70% of those in the 3 high R&D intensitysectors) against its 43% of the Global 1250. While the US has 37%of its <strong>Scoreboard</strong> companies in the middle-sized category, the UKwith 21% has the second largest middle-sized proportion amongstthe top 7 countries in the <strong>Scoreboard</strong> with Japan, Germany andFrance all having under 10%.7. The 77% of middle-sized companies in pharmaceuticals, softwareand technology hardware can be divided into high, medium andlow growth categories by sales growth 2003/04 to 2005/06 with theUSA having over 60% of its companies in the high and mediumgrowth categories compared to just over 40% for non-UScompanies. The proportions are 38% and 28% respectively for thehigh growth category. This appears to be related to UScompanies’ practice of investing a high proportion of sales intoR&D and other investments in these three sectors in the earlierstages of company growth.Examples are given of a number of very high growth, profitablecompanies whose sales have more than tripled from 2002/03 to2005/06 and which have profitability over 8.5%. Of the thirteenexamples from three sectors, listed in figure ES8, nine are from theUSA with two from Europe (one from the UK, one fromSwitzerland); all were middle-sized in one or more of the four years.UK R&D and the UK 8008. The total R&D of the UK 800 (which includes 245 foreignownedcompanies) has increased by £2.2bn to £19.2bncompared to the £17bn recorded in 2005. There are two mainreasons for this:The introduction of IFRS has led to a higher level of disclosureof R&D in sectors where disclosure was previously rare.Examples of companies included in the <strong>Scoreboard</strong> for thefirst time in <strong>2006</strong> are, with their R&D in brackets, Royal Bank ofScotland (£329m), HSBC (£245m), Tesco (£115m), Royal & SunAlliance (£122m) and Reed Elsevier (£102m).Companies in the UK 800 increased their R&D by 4% over theprevious year compared to the 1% decrease for the 750companies in the 2005 <strong>Scoreboard</strong>. A number of largeincreases reported this year by UK companies such as BAESystems (£339m), GlaxoSmithKline (£297m) and BT (£205m)strongly contribute to the overall rise.14 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

Figure ES8 Fast growing companies in 3 R&D-intensive sectorsR&D as % Sales Sales £m Exports2002 2005 2004 2003 2002 fromCompany Country <strong>2006</strong> /03 Profitability /06 /05 /04 /03 Sector* RegionBiogen Idec USA 30.9 22.5 8.7% 1411 1288 396 235 P n/aGilead Sciences USA 13.7 28.9 54.7% 1182 772 506 272 P 51%Celgene USA 27.8 56.6 14.3% 313 220 158 79 P n/aActelion Switzerland 25.8 46.1 23.0% 293 209 136 57 P 52%Kos USA 16.4 25.5 24.1 438 290 171 101 P n/aPharmaceuticalsGoogle USA 9.8 9.2† 32.9% 3576 1858 854 256 S 39%Red Hat USA 14.7 24.7 31.7% 162 114 73 53 S n/aUnited Online USA 7.6 14.8 16.5% 306 261 162 98 S n/aJuniper USA 17.2 29.6 21.7% 1202 778 409 318 TH n/aNetworksSanDisk USA 8.4 11.7 25.2% 1343 1035 629 315 TH 54%Research Canada 7.6 18.2 20.4% 1203 787 346 179 TH n/ain MotionSunplus Taiwan 10.4 12.2 8.5% 480 336 197 153 TH n/aTechnologyCSR UK 12.4 45.5 23.0% 283 147 39 16 TH 89%† R&D intensity 15.7% in 2003*P = Pharmaceuticals S = Software TH=Technology Hardware9. The UK 800 shows marked concentration of R&D with 65%in the top 5 sectors (pharmaceuticals, aerospace,automotive, technology hardware, software), 85% in the top100 companies and 70% in UK-owned companies. There is amarked difference in overall performance between UK listedcompanies, which increased R&D by more than 8% over the prioryear, and foreign-owned companies that decreased R&D by 9%(large reductions by 3 companies accounted for most of thedecrease). Average profitability for the UK listed companies was13.5% compared to 4.8% for the foreign-owned companies.Two-thirds of the R&D of the foreign-owned UK companies iscarried out by the top 20 companies and just over half by the topten; eight of the top ten have a higher R&D intensity than theiroverseas parents.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 15

Executive Summary10. The UK has an increasing number of companies in the<strong>Scoreboard</strong> with high R&D intensity. A comparison of similarsizedUS-owned (from the US <strong>Scoreboard</strong>), UK-owned and EU(excluding UK)-owned (both from the EU <strong>Scoreboard</strong>) companies(figure ES9) shows that the USA has a higher proportion ofcompanies in the high intensity range (R&D over 10% of sales)than the EUexUK companies and a lower proportion of companieswith very low intensity (2% or less). The UK-owned companies liebetween the US and EUexUK at both intensity levels. This reflects anincreasing number of UK companies in high R&D intensity sectors.Figure ES9 R&D Intensity distributions for US, EUexUK and UK companies in the same range%40Proportion of companies in band30201000-2% 2-4% 4-6% 6-10% 10-20% >20%R&D Intensity bandUSA UK EU ex UK16 The <strong>2006</strong> R&D <strong>Scoreboard</strong>Middle-sized Companies in the UK80011. The UK has a growing set of middle-sized companies andthere are 144 UK companies in the <strong>Scoreboard</strong> with sales inthe range £25m to £500m and with R&D intensity of at least4%, with 104 being UK-owned. The pharmaceutical, softwareand technology hardware sectors together account for 59 of theUK-owned and 21 of the foreign-owned companies. The numberof UK software companies in this size range has increasedmarkedly over the last few years and there are now 119 softwarecompanies in the UK 800, over 90% of them UK-owned. Sevenexamples are given of UK-owned, middle-sized companies from4 sectors with R&D intensity over 4% and profitability of 10% ormore which have shown sales growth of 70% to over 600% duringthe last two years (see figure ES10).

R&D and Company Performance12. R&D is linked to company success: companies succeedconsistently by making good strategic choices,demonstrating operational excellence and making wise andbalanced investments which include R&D. Innovation is animportant component of all three. R&D is therefore linked tocompany performance but good R&D does not assure strongfinancial performance since a company could make poor strategicchoices (e.g. a bad acquisition), have indifferent operations orunbalanced investments (e.g. a neglect of market development orbrands). Equally, underinvestment in R&D compared to sectorpeers leads to a less competitive range of products and servicesand this will be reflected in business performance. It is thereforenot surprising that the <strong>Scoreboard</strong>s do show links between R&Dgrowth and intensity on the one hand and performance measureson the other such as above average wealth creation efficiency,higher sales growth and portfolio value growth – the group ofhigher R&D intensity companies in the FTSE 100 has shown highervalue growth than the FTSE 100 index from 1997 (before the1999/2001 rise & fall of technology stocks) to <strong>2006</strong> (see figureES11). From 2002 growth in the portfolio is only just larger.Figure ES10 Fast growing, profitable R&D-intensive UK-owned companies<strong>2006</strong> <strong>Scoreboard</strong> ExportsR&D Sales Sales from MarketSector Company Profitability Intensity Sales £m 2004/05 2003/04 Region CapTechnology ARM 15.1% 34.5% 232 153 128 86% £1586mHardware CSR 23.0% 12.4% 283 147 39 89% £1462mWolfson 22.8% 12.9% 97 69 44 n/a £534mSoftware & Autonomy 10.0% 22.8% 56 38 33 62% £759mComputer AVEVA 17.1% 21.2% 66 58 38 53% £231mServicesOil Equipment Sondex 18.8% 8.3% 51 32 18 85% £174m& ServicesHousehold Dyson 17.5% 4.6% 426 277 235 48% n/lJamesThe <strong>2006</strong> R&D <strong>Scoreboard</strong> 17

Executive SummaryThere can be benefits for companies that increase R&Dthrough a recession. For example, all but one of the 19 largetechnology hardware companies showing positive R&D growth2001-2004 also showed positive sales growth 2001-2005 but 13 ofthe 17 companies with 10% or more R&D decrease 2001-04 alsoshowed sales decrease 2001-05. In addition, a number oftechnology hardware companies increased R&D after 2001 whentheir sales were decreasing in the technology downturn but thisresulted in increased sales growth in 2004 & 2005 together withgood profitability (see figure ES12). Similar behaviour was seenfor several UK companies for the period 2000 to 2005 also withsubsequent increases in sales and good profitability in the <strong>2006</strong><strong>Scoreboard</strong> (see figure 7.2.3b).Figure ES11 Percentage change in value of R&D portfolio and FTSE100 index from 1997250200% change from 100% in 199715010050097 98 99 2000 2001 2002 2003 2004 2005 <strong>2006</strong>FTSE 100R&D Portfolio18 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

Figure ES12 R&D and sales growth 2001 to 2005 for 6 companies150140SalesR&D% Change from 100% in 200113012011010090802001 2002 2003 2004 2005 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005Intel (37%)† Nokia (13%) Altera (19%)2001 Sales £15.4bn £21.4bn £489m2001 R&D £2.2bn £2.3bn £96m250SalesR&D% Change from 100% in 2001200150100502001 2002 2003 2004 2005 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005AMD (2%) Juniper Networks (22%) Adobe (37%)2001 Sales £2.3bn £517m £716m2001 R&D £379m £91m £131m† The number in brackets is the <strong>2006</strong> <strong>Scoreboard</strong> profitabilityThe <strong>2006</strong> R&D <strong>Scoreboard</strong> 19

ContentsBrief highlights................................................................................................2Ministerial Foreword....................................................................................4Lord Sainsbury of TurvilleParliamentary Under Secretary of State for Science & InnovationExecutive Summary.....................................................................................6Contents...........................................................................................................20CommentariesSir David McMurtry .....................................................................................22Chairman & Chief Executive, Renishaw plcDouglas Caster.............................................................................................24Chief Executive, Ultra Electronics plcAnalysis.............................................................................................................26Dr Mike Tubbs, Senior IndustrialistDTI Business Finance & Investment Unit1. IntroductionSummary......................................................................................................261.1 Improvements to the <strong>Scoreboard</strong> for <strong>2006</strong>..........................................281.2 The R&D and Value Added <strong>Scoreboard</strong>s .............................................291.3 The Importance of R&D for Companies...............................................292. R&D-Active Companies’ Role in the Global EconomySummary......................................................................................................312.1 The FT Global 500 and R&D Global 1250.............................................322.2 Value Added and Sector Mix ................................................................343. Overview of Companies R&D and Business PerformanceSummary......................................................................................................353.1 The Dataset ............................................................................................363.2 Business Performance of R&D Companies in 2005/06 vs. 2004/05....373.3 Business Performance of the Top 15 Sectors ......................................373.4 Changes in the Largest R&D Companies from 1992 to <strong>2006</strong> .............383.5 Companies with large one year changes in R&D................................403.6 Capitalised R&D .....................................................................................413.7 The Concentration of R&D ....................................................................434. Global 1250 R&D by Company, Sector and CountrySummary......................................................................................................444.1 R&D by Region and Country.................................................................464.2 R&D by Sector .......................................................................................484.3 The Top Global Companies by R&D, Growth and R&D Intensity.......5220 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

5. The Interpretation of R&D Intensity DifferencesBetween Companies in the Major CountriesSummary......................................................................................................595.1 Overview ................................................................................................595.2 Sector Group Analysis...........................................................................615.3 R&D Intensity Distributions...................................................................656. Middle-Sized CompaniesSummary......................................................................................................676.1 Global 1250 Middle-Sized Companies by Sector and Country...........686.2 Sector Mix for Middle-Sized Companies from Different Countries....696.3 Sales Growth of Middle-Sized Companies ..........................................716.4 High Growth Companies in the Global 1250 .......................................737. R&D and Company PerformanceSummary......................................................................................................75Introduction..................................................................................................757.1 Links between R&D and Business Performance .................................767.2 The Growth of R&D and Sales in R&D-Intensive Sectors...................777.3 Share Price Performance of UK R&D-Intensive Companies...............818. Patents and R&DSummary......................................................................................................84Introduction..................................................................................................848.1 The Patents-to-R&D Ratio .....................................................................858.2 Patents from Major Companies............................................................878.3 The Patents-to-R&D Ratio for Companies in 4 Sectors.......................899. R&D for the Top 800 CompaniesSummary......................................................................................................93Introduction..................................................................................................949.1 Overview and Concentration ................................................................949.2 Business Performance of UK 800 Companies .....................................959.3 The Top Sectors in the UK 800 .............................................................969.4 The Top UK 800 Companies by R&D,Growth of R&D and Intensity................................................................989.5 Foreign-Owned Companies in the UK 800 ........................................1039.6 Middle-Sized UK Companies ..............................................................1039.7 Examples of Successful Middle-Sized Companies............................1059.8 The Intensity Distribution of UK-Owned Companies ........................107Conclusion..................................................................................................108References............................................................................................109Appendix 1: Assignment of Global 1250 ...............................110Sectors to the Five Sector GroupsAppendix 2: Sector Group Analysis of R&D Intensity .....112Abridged Data Sets ..................................................................................115Accessing the Full Data Using the Website...............................140The <strong>2006</strong> R&D <strong>Scoreboard</strong> 21

CommentaryBy Sir David McMurtry CBE, RDI, CEng, FIMechE, FREng,Chairman & Chief Executive, Renishaw plcSir David McMurtryBy pioneering anew marketsector…weensured our earlypatentedproducts wereunique…givingus the profits weneeded todevelop sales,marketing andmanufacturingfacilities to meetgrowing demandand, importantly,to re-invest inR&D to providefurtherinnovations.22 The <strong>2006</strong> R&D <strong>Scoreboard</strong>Achieving sustained growththrough innovationRenishaw fundamentally believes that success comes frompatented and innovative products and processes, high qualitymanufacturing, and the ability to provide local customer supportin all its markets, around the globe.Differentiation through innovationWhen I last wrote a commentary for the 2002 edition of thispublication, I remarked how global competition is turning manyproducts into commodities, and how this makes innovationessential to avoid being priced out of business. The only thingthat has changed in the intervening years is the intensity of thispressure. It is no longer possible to succeed as a ‘me too’producer based in the UK.Throughout its 33-years’ history, Renishaw has pursued a simpleand effective business strategy based on innovation. Bypioneering a new market sector – touch-trigger probing on coordinatemeasuring machines (CMMs) – we ensured that ourearly patented products were unique. This allowed us to securehealthy margins, giving us the profits we needed to develop oursales, marketing and manufacturing facilities to meet growingdemand and, importantly, to re-invest in R&D to provide furtherinnovations.Success soon gets noticed and our growth could have beenquickly suppressed if a firm with greater resources had enteredour market, reducing prices to commodity levels. Our patents,which we vigorously defended, provided us with the space weneeded to build a global network of sales, service and supportcompanies, which provided steady year-on-year growth inrevenues.Innovation as a long-term strategy for growthPatented innovation remains at the core of Renishaw’s businessstrategy today. The key to our commercial success has beensustained investment in research and product development,which has provided a stream of inventions. Each successfulproduct provides a flow of margins that fund the development offuture products and processes.Renishaw continues to apply innovation in its core markets –probing on CMMs and machine tools – to continually regenerateits products to keep ahead of the changing demands of itsmanufacturing customers. As each new generation of productsreplaces the last – most recently the revolutionary Renscan5TM 5-axis CMM scanning technology – it provides higher performanceand productivity, whilst we benefit from existing and newcustomers seeking to further improve their manufacturingprocesses.

Profits from innovative products can fund expansion into newmarkets and enable a long-term perspective to be taken. A goodexample of this is our position encoder product line, which took morethan five years to develop into a profitable business, but which is nowa major contributor to current turnover and future growth.In recent years, Renishaw has looked for new market sectors in whichto apply our core skills of precision measurement and manufacturing.These include manufacturing applications such as semi-conductorfabrication, electronics assembly and packaging automation; medicalfields such as cancer research, dentistry and neurosurgery; as well asdiverse arenas such as forensic analysis, materials science and evenart restoration. In many cases we work closely with leading UKresearch universities to develop practical applications of the newtechnologies that we generate.Making innovations in the factoryAnother pillar of our strategy is to manufacture and assemble asmany of our products as possible ourselves. This goes against thegrain of modern business practice, where manufacturing is often seenas a ‘non-core’ process to be outsourced. We take a different view – ifyou make products that are used by other manufacturers, it helps noend if you know how best to use them yourself. Consequently,process innovation is a vital element of our strategy, requiring regularinvestment in capital equipment and ongoing development of newmanufacturing processes, ensuring that we keep costs on adownward path and that we are in full control of our quality.Renishaw assembles many of its products in the UK, whilst coremanufacturing processes such as CNC machining and electronicsassembly are also based here. Such co-location with our R&D staffhelps us to bring new products to market faster. However, we alsorecognise the need to control manufacturing costs, especially inlabour-intensive processes, where the UK is no longer competitive.The company is now investing in new, wholly owned facilities in Indiato produce mature, lower-margin products in a cost-effective manner.Influencing our own futureInnovation cannot insulate a company totally from competition, orfrom the business cycle, but it offers the best prospect of underlyinggrowth in turbulent markets. Although the waters have been a littlesmoother in the last few years, many of Renishaw’s product marketsare cyclical, and the distribution of business around the world is inconstant flux. Despite this, our organic growth strategy has allowedus to build a continuously profitable business with an annual turnoverin excess of £175 million of which over 90% is exported, that employsover 1,400 UK staff and an additional 600 in 30 countries globally.The best way to influence your future is to create it, rather than be atthe mercy of events. Recognising this, we continue to expand ourR&D and engineering investments – nearly £30 million last year – theengine that will secure the long-term success and growth of ourbusiness.Patentedinnovationremains at thecore ofRenishaw’sbusinessstrategy today.The key to ourcommercialsuccess hasbeen sustainedinvestment inresearch andproductdevelopment,which hasprovided astream ofinventions.Our organicgrowth strategyhas allowedus to build acontinuouslyprofitablebusiness withan annualturnover inexcess of£175m.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 23

CommentaryBy Douglas Caster, Chief Executive, Ultra Electronics Holdings plcDouglas Casterfollowing a majorR&D programmewith somesupport from theDTI, Ultra…withits UK teamingpartner GKN,has developeda revolutionarynew system forprotecting aircraftstructures fromice build upduring flight.This innovativesystem hasbeen selectedby Boeingfor its new787 Dreamliner.R&D for product innovation anddifferentiationUltra Electronics is a successful group of twenty specialistbusinesses offering a through-life product and services portfoliothat includes high technology electronic and electro-mechanicalsystems, sub-systems, products and components for defence,security, aerospace and transport applications worldwide. Ultra’sproducts and services are used on platforms such as aircraft,ships, submarines and armoured vehicles as well as insurveillance and communications systems, airports and transportsystems around the world.In Ultra’s main defence markets in recent times, expenditure hasbeen increasing on battlespace IT systems and equipment toprovide military customers with better situational awareness,quicker and more reliable command and control and the ability tosynchronise military firepower with much improved accuracy.Armed forces are being equipped to allow the rapid deploymentof light, mobile troops and to enable the exploitation of superiorintelligence of the military situation through the use ofbattlespace IT. Ultra has pursued a strategy that has positionedthe Group to benefit from these trends and constantly seeksopportunities to direct its R&D expenditure in order to offer newniche products and services to meet such customerrequirements.In the civil aerospace market, development programmes for newaircraft types provide Ultra with opportunities to win positionswith new and innovative solutions. For example, Ultra hasestablished itself as the world leader in cabin quietening forturboprop aircraft as a result of a continuous programme offocused R&D. More recently, following a major R&D programmewith some support from the DTI, Ultra, in conjunction with its UKteaming partner GKN, has developed a revolutionary new systemfor protecting aircraft structures from ice build up during flight.This innovative system has been selected by Boeing for its new787 Dreamliner aircraft for which it is a key technology enabler ofthe high efficiency wing that will help the aircraft achieve a 20percent improvement in fuel efficiency.Ultra believes that sustainable success is derived from a focus onpositioning its products and services on a broad range of majorinternational platforms and programmes. Such successfulpositioning is achieved by ensuring that Ultra’s offerings aredifferentiated from those of the competition in a manner that thecustomer values. Focus is sustained on creating and maintainingthis differentiation in the future and on continuing to provideinnovative solutions to satisfy customer requirements throughthe careful application of the company’s R&D funds.24 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

AnalysisThe <strong>2006</strong> R&D <strong>Scoreboard</strong> 25

Analysis of the <strong>2006</strong> R&D <strong>Scoreboard</strong>By Dr Mike Tubbs, Senior Industrialist,DTI Business Finance & Investment Unit1. IntroductionDr Mike TubbsThis is the 16thannual editionof the DTI’sR&D <strong>Scoreboard</strong>,the premiersource ofinformation andanalysis on R&Dactivecompaniesboth globallyand in the UK.It analyses R&Dby company,sector andcountry and isused bycompanies andinvestors as abenchmarkingtool and bybusiness policymakers.SummaryThe <strong>Scoreboard</strong> is designed to help companies (who useit as a benchmarking tool), investors and organisationsconcerned with technology and business policy.Improvements to the <strong>Scoreboard</strong> for <strong>2006</strong> include anincrease in the number of companies (the global list isnow 1250 compared to 1000 in 2005), the use of ICBsectors, data on companies’ exports from their homeregions, data on the proportion of R&D that iscapitalised and an increased emphasis on middle –sized company R&D.The <strong>2006</strong> dataset shows two main differences from2005: the increased representation of financial companies(an effect of IFRS) and a much smaller number of largecompanies reducing R&D (only 14 in the top 100compared to 27 in 2005).R&D is important for companies since it generates thenew products, processes and services that drive organicgrowth and higher value added. It is also a largeinvestment – larger than the sum of Capex and dividendsfor sectors such as pharmaceuticals, software andtechnology hardware.This is the 16th annual edition of the DTI’s R&D <strong>Scoreboard</strong>, thepremier source of information and analysis on global and UKR&D-active companies. The <strong>Scoreboard</strong> contains extensiveinformation on the largest 1250 R&D-active companies in the worldincluding R&D and Capex investment, financial performance(sales, operating profits, employees and growth), marketcapitalisation, market breadth and patents. All of this data exceptthat on market capitalisation and patents has been taken directlyfrom audited company accounts. A similar set of data covers thetop 800 UK-based companies of which 72 are in the Global 1250(the third equal largest number of companies from any country).The R&D <strong>Scoreboard</strong> is designed to help companies (who use itas a benchmarking tool), investors and organisations concernedwith technology and business policy (see the list of 16 endorserson the inside back cover).Industrial R&D (Research and Development) is a key componentof sustainable innovation-led growth since it helps to create thehigher value added product, processes and services on which thefuture of UK companies increasingly depends.26 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

How the <strong>Scoreboard</strong> data is compiled:Data in the R&D <strong>Scoreboard</strong> is compiled from the latest auditedcompany annual reports and consolidated accounts by CompanyReporting Ltd under contract to the DTI. The latest accounts areused up to a ‘cut-off’ date of 31st July <strong>2006</strong>. The <strong>Scoreboard</strong>rankings look at the R&D cash spending of the companiesinvolved; to arrive at the figure given in the <strong>Scoreboard</strong>, weexclude R&D paid for by external customers but include any R&Dthat has been capitalised. Full details of the methods andassumptions used are given at the back of the data section of the<strong>Scoreboard</strong> (volume 2 pages 248 to 256). Since the majority ofcompanies use a December or March financial year end, thismeans that most are reporting activity in calendar year 2005 orthe year April 2005 – March <strong>2006</strong>; a few companies are includedwith April or May <strong>2006</strong> year ends.Companies are classified into the ICB sectors used by FTSE andDow Jones and assigned to the country where the overall groupis incorporated. All FTSE 100 companies are assigned to the UK.In the Global ranking of R&D companies, we are thereforeshowing the performance of companies based in particularcountries and not the R&D activity within the borders of thosecountries, which is better measured by national businessexpenditure on R&D (BERD) statistics.The separate ranking of UK companies by R&D also includesforeign–owned UK companies with their UK R&D investment(although part of this could be carried out overseas) so that theirR&D activity can be assessed alongside that of UK-ownedcompanies. The global R&D is quoted for the latter since they arenot required to report in their accounts what proportion of theirR&D is performed in the UK. No subsidiaries of any kind areincluded in the global listing to avoid double counting of R&D.The <strong>Scoreboard</strong> does not cover all R&D activity undertaken bycompanies. Those investing too little to feature in the lists arenecessarily excluded; the minimum for the Global 1250 is £19m,while the UK 800 requires at least £370,000 of R&D to enter.Companies that do not identify R&D in their accounts are also notincluded. In addition, the <strong>Scoreboard</strong> measures only the R&Dfunded by a company itself, so publicly funded R&D or work doneunder contract is excluded.Definition of R&DThe R&D reported in the <strong>Scoreboard</strong> comes from accountsprepared in line with generally accepted accounting principles(GAAP). UK companies use the SSAP 13 or IAS 38 standard.These accounting definitions are based on the Frascati manual,which defines R&D for statistical purposes.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 27

Analysis of the <strong>2006</strong> R&D <strong>Scoreboard</strong>The R&D and VA<strong>Scoreboard</strong>s arecomplementarysince R&D isan input to thewealth creationprocess whilevalue added isan outputmeasure of thewealth createdby a company.1.1 Improvements to the <strong>Scoreboard</strong> for <strong>2006</strong>As part of our policy of continuous improvement, the <strong>2006</strong> R&D<strong>Scoreboard</strong> has six main enhancements over previous editions:The number of global R&D investing companies has beenincreased to 1250 from 1000 in 2005 and companies investing only£19.2m are now included compared to £22.4m in 2005. Theincrease means that the number of companies from the largerEuropean countries has risen significantly (e.g. the UK from 54 to72 companies) and the <strong>Scoreboard</strong> contains many more middlesizedcompanies (sales £50-500m).The number of UK companies in the separate UK listing has beenincreased from 750 to 800. The minimum R&D for inclusion hasnevertheless risen from £0.3m to £0.37m. This reflects growth inthe number and size of UK R&D-active companies with 88 morecompanies this year with R&D over £0.5m.The names and labelling numbers of sectors have been changedto ensure commonality between <strong>Scoreboard</strong> sectors and thoseused in the new international sector classifications agreedbetween FTSE and Dow Jones and brought into use on 3rdJanuary <strong>2006</strong> (the ICB sectors). The total number of sectors is now39 and these same ICB sectors were also used in the <strong>2006</strong> ValueAdded <strong>Scoreboard</strong> (reference 1).The introduction of IFRS 1 in Europe has also meant that morecompanies have capitalised part of their R&D and that R&D mustbe disclosed. This has, as in previous years, been de-capitalisedand added to the revenue R&D so that the <strong>Scoreboard</strong> quotes thetotal company funded R&D. Since companies are required underIFRS to capitalise R&D that meets the criteria (i.e projects forwhich the outcome is predictable), the ratio of revenue tocapitalised R&D (where it is disclosed) gives a first estimate of therisk profile of a company’s R&D portfolio.The percentage of a company’s sales exported from its homeregion are given in the main data tables for the first time. Forexample, a European company with 60% of its sales outsideEurope would have a figure of 60% in this column. There isevidence 2 to suggest that many successful companies have higherthan average exports to other leading economies at an early stageof their growth.The increased number of middle-sized companies in the<strong>Scoreboard</strong> this year enables more analysis of this category –companies having sales up to £500m – and, in particular,companies with R&D intensity over 4%. Given this focus onmiddle-sized companies, the commentaries this year are fromsuccessful middle-sized UK companies.1 International Financial Reporting Standards which apply to the EU but not yet to the USA.2 From interviews with CEOs and founders of R&D-active companies28 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

1.2 The R&D and Value Added <strong>Scoreboard</strong>sIn addition to the R&D <strong>Scoreboard</strong>, the DTI also publishes a ValueAdded <strong>Scoreboard</strong> which looks at the performance of the Europeanand UK companies that create the most wealth. The R&D and ValueAdded <strong>Scoreboard</strong>s are complementary since R&D is an input to thewealth creation process while value added is an output measure ofthe wealth created by a company. A direct comparison of the two ispossible for European companies (the top 700 European companiesby value added are listed in the <strong>2006</strong> VA <strong>Scoreboard</strong>) but not for USor Japanese companies since the limitations of US GAAP 3 mean thatthere is not enough information in the accounts of companies fromthe US and Japan to enable value added to be calculated.The R&D <strong>Scoreboard</strong> has a long history and it is therefore possible totrack the progress of companies up and down the rankings from theearly 1990’s to <strong>2006</strong>. These movements reflect both changes in theimportance of sectors and of the relative performance of companieswithin each sector. Lists of the top 20 R&D companies in 1992 and<strong>2006</strong> are given in chapter 3 (figure 3.4.1) and only 7 of the companiesin the 1992 top 20 appear in the <strong>2006</strong> top 20. There were nopharmaceutical companies in 1992 but six in <strong>2006</strong>.1.3 The Importance of R&D for CompaniesMost companies in the R&D Global 1250 are in R&D-intensive sectors;for example, nearly 80% of the 1250 companies are in sectors withaverage R&D intensity (R&D as % sales) of at least 2.5% and over 50%are in sectors with R&D intensity of 5% or more. For this latter group,R&D investment is typically a large proportion of operating profit.There are three main reasons why R&D is important for a company inan R&D-intensive sector:R&D generates the new products, processes and services that givea company a competitive edge in the market. A company thatconsistently under-invests in R&D relative to its best competitors(allowing for size and sub-sector differences) will find that itsproducts are relatively less attractive to customers and that it isincreasingly competing on price in the lowest value added segmentof the market. A company that invests in R&D wisely and at a levelat least that of its best competitors, on the other hand, is much morelikely to gain customers and maintain or increase its value added.R&D is a substantial financial investment for R&D-intensivecompanies relative to other expenses such as Capex or dividendsand is a substantial proportion of operating profit. This isillustrated by figure 1.1, which shows the relative sizes of theseFigure 1.1 R&D vs. other major expenses for 3 sectorsR&D is importantsince it generatesnew products,processes andservices togive a companyits competitiveedge, is asubstantialfinancialinvestment andis an importantdriver for organicgrowth.Sector R&D Capex Dividends Operating Profitas % Sales as % Sales as % Sales as % SalesPharmaceuticals and Biotechnology 14.9% 4.9% 6.4% 20.2%Software and Computer Services 10.4% 3.9% 2.3% 19.6%Technology Hardware 8.2% 5.6% 1.2% 8.4%3 US GAAP is the US accounting standard also used by most Japanese companiesThe <strong>2006</strong> R&D <strong>Scoreboard</strong> 29

Analysis of the <strong>2006</strong> R&D <strong>Scoreboard</strong>R&D is alsoimportant forCapex-intensivesectors and forcompanies thatbenefit fromthe R&D oftheir suppliers.quantities for three of the largest R&D-intensive sectors. In allthree cases R&D exceeds the cost of Capex plus dividends andranges from over 50% to 98% of operating profit. The sheer sizeand importance of the company’s R&D budget in these sectorsmeans that the management of R&D for timely and effectiveresults is a key concern of top management. For sectors whereR&D is a significant investment, a company’s investors will beinterested both in the intensity of the investment relative tocompetitors and the results flowing from it. For example, apharmaceutical company will be asked by investors about its newproduct ‘pipeline’ and about the likely launch dates for productsfrom the pipeline which will replace medicines due to come offpatent. Similar questions are now being asked of companies inother sectors, particularly in view of evidence that R&D intensity islinked to company performance (see chapter 7 for details).Finally, R&D is an important driver for organic growth. Mostcompanies have a growth target and, given that majoracquisitions are associated with reduced shareholder returns insome two thirds of cases (references 2-5), organic growth throughR&D coupled with small bolt-on acquisitions of R&D-activecompanies is the preferred route to meet the growth targets set bymanagements and valued by investors.The discussion so far has concentrated on R&D-intensive sectors.However, R&D is also important in less R&D-intensive sectors asfollows:Companies in Capex-intensive sectors use often modest levels ofR&D to select the best equipment or production process (best forcost, quality, yield) for a new product or operation. There areimportant examples of this for companies in oil & gas and foodprocessing, both sectors where the UK has a strong position.Companies that benefit from the R&D of their suppliers. Examplesinclude software for financial institutions or retailers or animproved machine tool that lowers cost and/or improves qualityand throughput for a manufacturer.Given the importance of R&D, the <strong>Scoreboard</strong> provides a referencetool to help companies judge whether they are investing the rightamount in R&D relative to the best global or regional competitors intheir sector.Although the <strong>Scoreboard</strong> is a internationally-respected source ofinformation on company R&D, it does not pretend to be the only suchsource. we would encourage companies to assess evidence from the<strong>Scoreboard</strong> and elsewhere in the context of their technical strategiesand business plans.The R&D reported in companies’ annual accounts is not the onlymeasure of innovation. Investments in capital equipment, marketdevelopment, skills, brands, new ways of working, new businessprocesses, other intangible assets and linkages with otherorganisations are all methods of gaining competitive advantage.30 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

2. R&D-Active Companies‘ Role in theGlobal EconomySummaryThe Sector mix of R&D-intensive, Capex-intensive and servicesectors is different for different countries and the proportion oftotal wealth created by R&D intensive companies is thereforealso different. This proportion can be estimated approximatelyby comparing the percentages of total R&D <strong>Scoreboard</strong>companies from each country in the R&D Global 1250 withthose in the FT Global 500. For European companies, the ValueAdded <strong>Scoreboard</strong> (where European companies are ranked bythe wealth created) can be used instead of the FT Global 500.The results of a comparison of the R&D Global 1250 with theFT Global 500 highlight R&D-heavy countries such asGermany and Japan which have over 50% larger proportionsof companies in the R&D Global 1250 and R&D-light countriessuch as Canada with more than twice the proportion in theFT 500 as in the R&D 1250. The USA is more balanced withcomparable proportions of companies in both groups.These differences in sector mix between the sets of companiesfrom different countries also have a major effect on theaverage R&D-intensity (R&D as % sales) for the companiesfrom different countries in the R&D Global 1250 <strong>Scoreboard</strong>.This will be analysed in more detail in chapter 5. There arealso sector mix differences for different countries’ economiesbut these are likely to be of different size.IntroductionThe R&D Global 1250 companies carry out £249bn of R&D and havesales of £6,868bn and operating profits of £757bn. These are largesums but represent only part of the wealth created by largercompanies in the global economy. Companies from the R&D Global1250 account for only 214 of the 500 companies in the FT Global 500,the 500 largest companies in the world by market capitalisation. Theother companies in the Global 500 do less or no R&D and yet createsubstantial wealth in Capex-intensive or service sectors. Theproportion of wealth created by R&D-active companies varies fromcountry to country and it is helpful to estimate the proportions of R&DGlobal 1250 companies contributed by each major country asopposed to companies in other sectors since analysing R&D-intensivecompanies alone may give an erroneous impression of relative wealthcreation for some countries. There are two methods of estimation: The proportions of companies in the FT Global 500 (the top 500companies in the world by market capitalisation) can be comparedwith proportions in the R&D Global 1250. A country with a higherproportion of companies in the R&D Global 1250 than in the FTGlobal 500 is clearly likely to have a higher than averageproportion of companies in R&D-intensive sectors.The Global 1250companies carryout £249bn ofR&D but R&Dactivecompaniescreate onlypart of thewealth in theglobal economy.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 31

Analysis of the <strong>2006</strong> R&D <strong>Scoreboard</strong>For the UK, Germany and France, the Value Added <strong>Scoreboard</strong>(reference 1) provides a direct measure of the proportions ofEurope’s top 700 companies (by Value Added which measureswealth created) in R&D-intensive, Capex-intensive and servicesectors. It is not possible to include US and Japanese companiesin the Value Added <strong>Scoreboard</strong> since they do not give enoughinformation in their accounts to enable value added to be calculated.Figure 2.1.2 R&D-heavy and R&D-light countries in the FT Global 500 & R&D Global 1250% of Companies % of CompaniesCountry in R&D 1250 in FT Global 500R&D ‘Heavy’ Countries Japan 18.3% 12.0%Germany 5.8% 3.8%‘Balanced’ Countries USA 43.3% 39.2%R&D ‘Light’ Countries Canada 1.9% 4.4%UK 5.8% 7.8%2.1 The FT Global 500 and R&D Global 1250Differences inpresence in theGlobal 1250 andFT Global 500reflect sectormix differencesin companiesfrom the variouscountries.Figure 2.1.1 shows two pie charts for companies from seven leadingcountries comprising the top six in the R&D Global 1250 and the FTGlobal 500. The first – figure 2.1.1a – shows each country’s proportionof the 500 companies in the FT Global 500, the largest companies bymarket capitalisation. The second – figure 2.1.1b – shows each country’sproportion of the Global 1250 R&D-active companies. The proportionsin the two figures are significantly different for some of the countriesand these are highlighted by the three categories of figure 2.1.2.R&D ‘heavy’ countries such as Japan and Germany have muchlarger proportions of the companies in the R&D Global 1250 thanin the FT Global 500. This arises since they have large automotivesectors but small oil & gas sectors and smaller services sectorsthan the USA or UK.R&D ‘light’ countries such as Canada (and, to a lesser extent, theUK) which have much larger proportions of the FT Global 500companies than of those in the R&D Global 1250. The UK, forexample, has twice the number of companies of Germany in theFT Global 500. These differences can be understood since Canada,for example, has strong natural resources companies in the FTGlobal 500 and many of these do not have enough R&D to gainentry to the R&D Global 1250.Relatively ‘balanced’ countries such as the USA which havecomparable proportions of companies in both the FT Global 500and R&D Global 1250 (slightly larger in the latter).These differences reflect sector mix differences in the sets ofcompanies from the various countries that are represented in theFT Global 500 and R&D Global 1250 rankings. These sector mixdifferences can be accurately displayed for European companiesusing value added data as is shown in Figure 2.2.1.32 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

Figure 2.1.1 Companies from 7 countries drawn from the top 6 in the FT Global 500 and in theR&D Global 1250 as proportions of the totals7.8%4.4%a) FT Global 500USAJapanGermany39.2%France24.6%Switzerland27 OthersCanadaUK2.2%6.0%3.8%12.0%1.9%5.8%b) R&D Global 125017.9%USAJapanGermany43.3%FranceSwitzerland2.7%4.3%32 OthersCanadaUK5.8%18.3%The <strong>2006</strong> R&D <strong>Scoreboard</strong> 33

Analysis of the <strong>2006</strong> R&D <strong>Scoreboard</strong>Figure 2.2.1 Proportions of European 700 Value Added in each of 3 sector groups for UK, German &French companies706050% of Value Added403020100R&D-Intensive Sectors Capex-Intensive Sectors Service SectorsUKGermanyFranceThe UKcompanies in theVA <strong>Scoreboard</strong>have the largestproportion ofVA and thehighest growthand wealthcreationefficiency.It should be emphasised that these are comparisons betweencompanies headquartered in particular countries and not between thecountries themselves. Sector mix differences are also seen in the datafor countries but these may well be of different size.2.2 Value Added and sector mixCompanies from the UK, Germany and France account for 64% of thevalue added of the top 700 European companies listed in the <strong>2006</strong>Value Added <strong>Scoreboard</strong> (reference 1). The proportions of these threecountries’ value added in each of three groups of sectors are shownin figure 2.2.1. The groups are R&D intensive sectors (R&D over 2.5%of sales). Capex-intensive sectors (Capex over 4.3% of sales but R&Dbelow 2.5%) and service sectors (R&D and Capex both below theintensities quoted). It can be seen that the UK has the largestproportions of value added in the Capex-intensive and service sectorsbut the smallest in the R&D-intensive sectors 4 . However, for theEuropean 700 companies as a whole, the UK group of companieshave the largest proportion of value added and also the highestgrowth and wealth creation efficiency. This UK out-performance is theresult both of sector mix differences and of the strong performance ofUK companies within their sectors.4 Although the group of UK companies have the lowest proportion of R&D-intensive companies, they havea larger proportion of value added in sectors with a high wealth creation efficiency. This reflects the UKcompanies’ strength in pharmaceuticals while German and French companies have a much higherproportion of R&D in sectors such as automotive and engineering which have a much lower average wealthcreation efficiency.34 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

3. Overview of Companies’ R&D andBusiness PerformanceSummaryThe <strong>2006</strong> dataset of 1250 companies shows three maindifferences from 2005. These are the larger proportion of USand UK companies in the last 250, the increasedrepresentation of financial companies (an effect of IFRS) andthe much smaller number of large companies reducing R&Dover the previous year. Indeed for 2005/06, amongst the top120 companies, 20 increased R&D by over £200m compared toonly 3 that reduced it by this much.The business performance of the Global 1250 R&D companieshas improved further over the previous year with sales up 9%,R&D up 7% and profitability up to 11% from 9.6% in 2005.Amongst the largest 15 sectors by R&D, pharmaceuticals andsoftware show the highest profitability and also the highestR&D intensity.There have been major sectoral changes in the group of thelargest R&D companies since 1992 with the rise ofpharmaceutical companies being the most obvious – the top20 companies by R&D contained none from pharmaceuticalsin 1992 but 6 in <strong>2006</strong>.The <strong>Scoreboard</strong> has recorded those companies thatcapitalised part of their R&D. Disclosure of capitalised R&Dvaries by country and sector with under 10% of companiesdisclosing capitalised R&D in pharmaceuticals but 30% insoftware and automotive. Global 1250 R&D is concentrated in the top 5 countries (82%),the top 5 sectors (70%) and the top 100 companies (61%).The majority of company results for the 2005/06 financial year 5covered by this <strong>Scoreboard</strong> show improvements in businessperformance and increases in R&D investment, reflecting the healthierbusiness climate for most sectors with sizeable R&D investment. Thischapter provides an overview of the dataset and of some highlights ofthe <strong>2006</strong> <strong>Scoreboard</strong>. More analysis by company, sector and countryappears in chapter 4.5 The majority of companies in the <strong>Scoreboard</strong> have financial years ending in December or March.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 35

Analysis of the <strong>2006</strong> R&D <strong>Scoreboard</strong>3.1 The DatasetThe number of listed and unlisted companies in the worldwidedataset has been increased to 1250 for <strong>2006</strong> compared to 1000 for2005. The minimum R&D for inclusion is now just over £19m. Formost major countries it has been possible to identify a representativenumber of companies in the size band of 1001 to 1250 and this issummarised in figure 3.1.1 where the number of companies in the last250 is compared with that in the first 1000 for the five majorcountries.Figure 3.1.1 Size distributions of R&D Global 1250 companies for 5 countriesTotal companies Total companies Companies in last 250Country in first 1000 1001-1250 as % of first 1000All countries 1000 250 25%USA 418 123 29.4%Japan 196 33 16.8%Germany 63 9 14.3%UK 53 19 35.8%France 45 9 20.0%The majorimpacts of IFRSare on thecapitalisationof R&D andon improveddisclosureof R&D.It can be seen that the USA and UK have much higher percentagesof smaller companies by R&D compared to Japan and Germany.This may either reflect genuine differences in the size distributions(such as a lower rate of middle-sized company formation in Japancompared to the USA) or some greater difficulty in identifying smallerR&D companies in Japan and Germany. Amongst the other largerAsian countries in the <strong>Scoreboard</strong>, Taiwan has a ratio of almost 23%but South Korea has only one company in the last 250 out of a total of17; however, the notes in volume 2 explain that accounts are eithernot available or do not disclose R&D for a number of South Koreancompanies identified as possibly having sufficient R&D to be includedin the <strong>Scoreboard</strong>. There are two other noticeable features of the <strong>2006</strong>dataset:The impact of IFRS which has been adopted by many Europeanlisted companies for the first time. The major differences IFRSmakes from previous years are that the criteria on R&Dcapitalization are more strict (where the criteria are met, R&Dmust be capitalised) and that R&D must be disclosed. This has ledto improved disclosure of R&D in some sectors where there waspreviously little disclosure. For example, in the 2005 <strong>Scoreboard</strong>banks, insurance and general financial companies accounted for£125m of R&D but in <strong>2006</strong> this has risen to nearly £1400m, about0.6% of Global 1250 R&D, and these same sectors account fornearly 5% of UK 800 R&D.36 The <strong>2006</strong> R&D <strong>Scoreboard</strong>

To minimise the impact of the transition to IFRS, prior yearcomparatives given in the latest accounts are used where possiblerather than the prior year accounts since the former give morereliable one year growth figures (see notes in volume 2 for furtherdetails).The number of large companies reducing R&D over the previousyear has decreased significantly. For example, only 14 of the top100 companies in the <strong>2006</strong> <strong>Scoreboard</strong> reduced R&D compared to27 in 2005; of these reductions, only 3 in <strong>2006</strong> were of 10% ormore compared to 8 in 2005.3.2 Business performance of R&D Companies in 2005/06The overall business performance of R&D companies has improvedover the last year as illustrated by the data in figure 3.2.1. This showsthat profitability is higher than that reported in the 2005 <strong>Scoreboard</strong> forall three world regions and that there have been significant increasesin both sales and R&D. The big increase in average profitability for UKcompanies within the Global 1250 is partly a result of the improvedIFRS disclosure of R&D which brings in several profitable companiesin financial sectors which are in the <strong>2006</strong> <strong>Scoreboard</strong> but not the 2005<strong>Scoreboard</strong>. The overall change in R&D was 7% in <strong>2006</strong> vs. 5% in 2005but the increase for the Americas was the largest (8.3% vs. 7% in 2005)with Asia-Pacific 6.2% and Europe 5.8% for 2005/06 over 2004/05.The overallbusinessperformanceof R&D-activecompanieshas improvedagain over thelast year.Figure 3.2.1 Business performance of R&D-active companies in 2005/06 vs. 2004/05Global RoW (mainly UK within1250 Americas Japan) Europe EuropeNumber of Companies 1250 575 316 359 72Change in Sales 8.9% 11.0% 8.8% 6.9% 5.5%over Previous YearProfitability 11.0% 12.3% 8.3% 11.6% 12.5%(operating profit as % sales) (9.6%)* (11.3%)* (8.0%)* (9.2%)* (9.5%)*Change in R&D 7.0% 8.3% 6.2% 5.8% 8.2%(5% in 2005) (7% in 2005) (6% in 2005) (2% in 2005) (1% in 2005)* The figure in brackets is from the 2005 <strong>Scoreboard</strong> for the R&D Global 10003.3 Business performance of the top 15 R&D SectorsThe overall company profitability data shown in figure 3.2.1 areaverages over all sectors. The top 15 sectors in the R&D Global 1250all account for 1% or more of the total R&D but have very differentprofiles of investment intensity (R&D plus Capex as % sales) andprofitability (operating profit as % sales). This is illustrated by figure3.3.1 which shows the 15 sectors exhibited on a chart with dottedlines showing investment intensity and profitability levels of 10% 6 .The 15 sectors can be characterised as follows:6 GE has been removed from General Industrials for the purposes of this figure since it has very substantialturnover and operating profit from financial services.The <strong>2006</strong> R&D <strong>Scoreboard</strong> 37

Analysis of the <strong>2006</strong> R&D <strong>Scoreboard</strong>Figure 3.3.1 Profitability vs. investment intensity for the largest 15 sectors in the R&D Global 125025Profitability (Operating Profit as % Sales)2015105Oil & GasFood ProducersHouseholdGeneral IndustrialsIndustrial Engineering ChemicalsAerospaceHealthLeisureSoftwareFixed LineTelecomsTechnology HardwareElectronicsPharmaceuticalsAutomotive00 5 10 15 20Investment Intensity (R&D + Capex) as % SalesThere were nopharmaceuticalcompanies in thetop 20 of 1992but six in <strong>2006</strong>.The sectors with average investment intensities above 10% arefound in two groups – one with high profitability led by softwareand pharmaceuticals and one with profitability below 10% led bytechnology hardware.The sectors with average investment intensity below 10% are ledby oil & gas followed by a group of 6 sectors just above andbelow the 10% profitability line.Amongst the five sectors with the highest profitability, two are veryCapex-intensive (oil & gas and telecoms) and three R&D-intensive.There is, of course, a wide spread of company performance within eachof these four groups so that, for example, 5 of the top 10 automotivecompanies have higher profitability than 4 of the top 10 softwarecompanies. However, all the top 10 pharmaceutical companies havehigher profitability and higher investment intensity than all the top10 automotive companies (pharmaceuticals, software & health).3.4 Changes in the largest R&D companies from 1992 to <strong>2006</strong>The 20 largest companies in the world by R&D are shown in figure3.4.1 for the <strong>2006</strong> and 1992 <strong>Scoreboard</strong>s (see reference 6 for thelatter). Just seven companies are common to both lists although threeothers (Volkswagen, Sony and Honda) were placed just outside thetop 20 in 1992 (between 21 and 24).The major differences between top 20 sectors and regions in 1992 and<strong>2006</strong> are summarised in figure 3.4.2 which shows that the largest38 The <strong>2006</strong> R&D <strong>Scoreboard</strong>