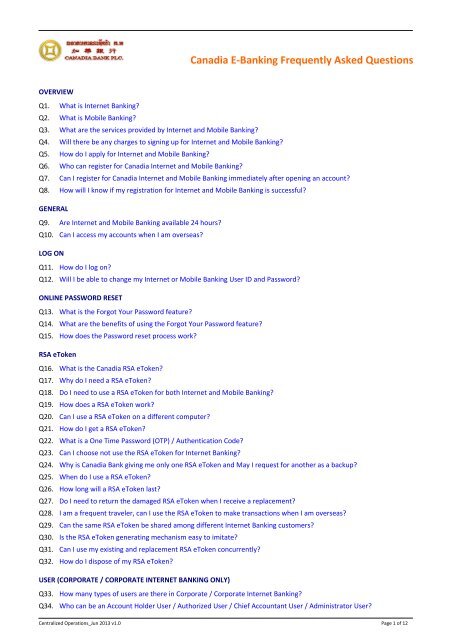

Canadia E-Banking Frequently Asked Questions - Canadia Bank Plc.

Canadia E-Banking Frequently Asked Questions - Canadia Bank Plc.

Canadia E-Banking Frequently Asked Questions - Canadia Bank Plc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OVERVIEWQ1. What is Internet <strong><strong>Bank</strong>ing</strong>?A. Internet <strong><strong>Bank</strong>ing</strong> is an electronic service provided by <strong>Canadia</strong> <strong>Bank</strong> to allow you to perform transactions, paymentsetc. over the internet – through a bank’s secure website.Q2. What is Mobile <strong><strong>Bank</strong>ing</strong>?A. Mobile <strong><strong>Bank</strong>ing</strong> is a wireless internet base service that allows you to do your banking safely and conveniently whileyou are out and about using a mobile device.Q3. What are the services provided by Internet and Mobile <strong><strong>Bank</strong>ing</strong>?A. You will be able to perform the following transaction on your linked transaction accounts: Manage your accountView your balance and transaction history Self transfer fundsTransfer money between your own accounts within the <strong>Canadia</strong> <strong>Bank</strong> Third party transferTransfer money to any other accounts within <strong>Canadia</strong> <strong>Bank</strong> Pay your billsMake an online payment to any of our registered Billers Open and close Fixed Deposit onlineInvest your money on a set term at a fixed interest rate or early breakout / close it by your own Manage your automatic paymentsMake recurring transfer anytime, be it one time, daily, weekly or monthly to any other accounts within <strong>Canadia</strong> <strong>Bank</strong> Add new beneficiary’s nameSave the beneficiary’s name of a person, organization or company so you do not need to remember their account number Transaction templatesCreate, save, edit and delete templates for transactions you make on a regular basis for easy re‐use SecurityUse One Time Password (OTP) for additional security as two‐factor authentication while banking online View foreign exchange rate (Mobile <strong><strong>Bank</strong>ing</strong> Only)View daily indicative foreign exchange rate View interest rate (Mobile <strong><strong>Bank</strong>ing</strong> Only)Access to table of Fixed Deposit interest rate at your needs Search for ATM locations (Mobile <strong><strong>Bank</strong>ing</strong> Only)Tell you where the nearest ATM location is for your convenienceCorporate / Corporate customer can also: Pay employees and suppliers with batch paymentsSave time by making multiple payments to employees and your supplier in one hit Back to top Back to top More user types are available to customize Internet <strong><strong>Bank</strong>ing</strong> accessDelegate different access level for your employees and your accountant, register once and maintain online Back to topQ4. Will there be any charges to signing up for Internet and Mobile <strong><strong>Bank</strong>ing</strong>?A. You do not need to pay any charges to sign up.Please note that certain transaction services may require a levy. Back to topCentralized Operations_Jun 2013 v1.0 Page 3 of 12

Q5. How do I apply for Internet and Mobile <strong><strong>Bank</strong>ing</strong>?A. Visit the nearest <strong>Canadia</strong> <strong>Bank</strong> branches and fill in application form for registration. Back to topQ6. Who can register for <strong>Canadia</strong> Internet and Mobile <strong><strong>Bank</strong>ing</strong>?A. Any customer who: holds an <strong>Canadia</strong> <strong>Bank</strong> account(s) that can be linked to <strong>Canadia</strong> Internet and Mobile <strong><strong>Bank</strong>ing</strong>, and is 18 years of age or moreThe following customer can register for <strong>Canadia</strong> Internet and Mobile <strong><strong>Bank</strong>ing</strong>: A customer who is the sole signatory of an account A customer who is one of the signatories of a joint account which is alternated sign “OR” A Corporate customer who nominates authorized users to transact on their Corporate accountsIf a minor has a guardian who is authorized to operate the account, then only the guardian can have access to<strong>Canadia</strong> Internet and Mobile <strong><strong>Bank</strong>ing</strong>.Q7. Can I register for <strong>Canadia</strong> Internet and Mobile <strong><strong>Bank</strong>ing</strong> immediately after opening an account?A. Yes, if you open an account that is eligible for Internet and Mobile <strong><strong>Bank</strong>ing</strong> access you can immediately complete aregistration for <strong>Canadia</strong> Internet and Mobile <strong><strong>Bank</strong>ing</strong>.Q8. How will I know if my registration for Internet and Mobile <strong><strong>Bank</strong>ing</strong> is successful? Back to top Back to topA. You will immediately receive an email from <strong>Canadia</strong> <strong>Bank</strong> after registration, informing about your User ID andTemporary Password. You should log on immediately using your Internet or Mobile <strong><strong>Bank</strong>ing</strong> User ID, TemporaryPassword and Security Code which random pop‐up on log on screen. Back to topGENERALQ9. Are Internet and Mobile <strong><strong>Bank</strong>ing</strong> available 24 hours?A. 7 days a week with some limitation of services at this stage. However, transactions make outside working hours orholiday will be processed immediately but transaction date will record next Corporate day.Q10. Can I access my accounts when I am overseas? Back to topA. Yes, as long as you have an Internet connection and your mobile phone (Rooming connection requires) or yourRSA eToken (if applicable). Back to topLOG ONQ11. How do I log on?A. Access to <strong>Canadia</strong> Internet and Mobile <strong><strong>Bank</strong>ing</strong> website and do following steps: Enter the User ID followed by Temporary Password you have received from <strong>Canadia</strong> <strong>Bank</strong> email, and Key in the Security Code which you may get on log on screen.Then you will be required to change Temporary Password and select a new Password comprising of both upperand lower case, numeric characters and special character with minimum of 6 and maximum of 16 characters long. Back to topCentralized Operations_Jun 2013 v1.0 Page 4 of 12

Q12. Will I be able to change my Internet or Mobile <strong><strong>Bank</strong>ing</strong> User ID and Password?A. You cannot change your Internet or Mobile <strong><strong>Bank</strong>ing</strong> User ID but you can change your Password anytime byselecting the Change Password button for the Internet <strong><strong>Bank</strong>ing</strong> or Setting button for Mobile <strong><strong>Bank</strong>ing</strong>. Back to topONLINE PASSWORD RESETQ13. What is the Forgot Your Password feature?A. Forgot Your Password allows you to reset your Password online when you forgot your current one, provided thatyou have remembered your registered email address. This means that you do not have to submit any forms to thebank for processing.Q14. What are the benefits of using the Forgot Your Password feature? Back to topA. You will be able to reset your Password instantly, at any time without visiting branch. Back to topQ15. How does the Password reset process work?A. Select the Forgot Your Password link on the log on screen. You will be asked to enter your registered emailaddress. Upon correct entry, then you will be asked to enter your OTP / Authentication Code from SMS alert orRSA eToken. Upon correct entry, you will proceed to reset your password. And <strong>Canadia</strong> <strong>Bank</strong> will send a newPassword to your registered email address above. Back to topRSA eTokenQ16. What is the <strong>Canadia</strong> RSA eToken?A. The <strong>Canadia</strong> RSA eToken is a small, key‐ring size, digital code generator provided to Corporate / corporatecustomers (optional for Individual customer). Once activated, you will need to use the RSA eToken to generateauthentication code, which is required when you transact on <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong>. Back to topQ17. Why do I need a RSA eToken?A. Security for customers is always <strong>Canadia</strong> <strong>Bank</strong>’s top priority. The RSA eToken serves to protect you from potentialInternet risks while using Internet <strong><strong>Bank</strong>ing</strong>.Q18. Do I need to use a RSA eToken for both Internet and Mobile <strong><strong>Bank</strong>ing</strong>? Back to topA. No, only Internet <strong><strong>Bank</strong>ing</strong> that requires you to use a RSA eToken once you initiate transactions. Back to topCentralized Operations_Jun 2013 v1.0 Page 5 of 12

Q19. How does a RSA eToken work?A. The RSA eToken works by generating a new six digit number every 60 seconds. This number is a single useauthentication code.Every time initiate transactions, you will be asked to enter the authentication code that is displayed on your RSAeToken at that time. The code numbers are in step with code numbers in the <strong>Canadia</strong> <strong>Bank</strong> system. Because theRSA eToken matched to your User ID, it cannot be used by any other customer.The narrow horizontal bars to the left of the number indicate how many 10 second blocks of time remain until thecode changes again.Q20. Can I use a RSA eToken on a different computer?A. The RSA eToken is linked to the User ID, so it can be used anywhere where you have access to the Internet.Q21. How do I get a RSA eToken?A. You can get it at the time you register for <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong>. Back to top Back to topCorporate customer is compulsory to use the RSA eToken when apply for <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong> while it is anoptional for Individual customer.Q22. What is a One Time Password (OTP) / Authentication Code? Back to topA. A One Time Password (OTP) / Authentication Code is a single‐use, time‐sensitive password generated by the RSAeToken or SMS alert. The OTP / Authentication Code is required for most transactions made in Internet <strong><strong>Bank</strong>ing</strong>.Q23. Can I choose not use the RSA eToken for Internet <strong><strong>Bank</strong>ing</strong>? Back to topA. For Individual Internet <strong><strong>Bank</strong>ing</strong>:Yes, as compulsory one is OTP (SMS alert) and you still can switch to use the RSA eToken at your convenience.For Corporate Internet <strong><strong>Bank</strong>ing</strong>:No, <strong>Canadia</strong> <strong>Bank</strong> has a duty to ensure that your online transactions are safe and secure. The use of the RSAeToken will allow us to provide maximum security to you.Q24. Why is <strong>Canadia</strong> <strong>Bank</strong> giving me only one RSA eToken and May I request for another as a backup? Back to topA. Only one RSA eToken can be linked to your Internet <strong><strong>Bank</strong>ing</strong> User ID at anytime point in time. This is to ensure thatonly you are able to access your Internet <strong><strong>Bank</strong>ing</strong> Service. The RSA eToken is a unique and has a distinctive SerialNumber that helps prevent copying, alteration or tampering. Back to topQ25. When do I use a RSA eToken?A. You are required to use your RSA eToken every time making transactions in your Internet <strong><strong>Bank</strong>ing</strong>. Back to topQ26. How long will a RSA eToken last?A. The RSA eToken should last for approximately five years. Back to topCentralized Operations_Jun 2013 v1.0 Page 6 of 12

Q27. Do I need to return the damaged RSA eToken when I receive a replacement?A. Yes, it is strongly recommended that you send back the damaged RSA eToken to the bank. Back to topQ28. I am a frequent traveler, can I use the RSA eToken to make transactions when I am overseas?A. Yes, at any time you make transactions. This is the reason the RSA eToken has been designed to be small, light andportable.Q29. Can the same RSA eToken be shared among different Internet <strong><strong>Bank</strong>ing</strong> customers? Back to topA. No, the RSA eToken cannot be shared between different Internet <strong><strong>Bank</strong>ing</strong> customers. Each Internet <strong><strong>Bank</strong>ing</strong>customer will receive one RSA eToken, which will be associated with only one User ID.Q30. Is the RSA eToken generating mechanism easy to imitate?A. The OTP / Authentication Code is randomly generated number. The probability of guessing the number isextremely low given that the number is only valid for a short period of time.Q31. Can I use my existing and replacement RSA eToken concurrently?A. No, once you start using a replacement RSA eToken, the existing one will be deactivated automatically.Q32. How do I dispose of my RSA eToken? Back to top Back to top Back to topA. We recommend you to return the device to <strong>Canadia</strong> <strong>Bank</strong>, not to dispose it. Back to topUSER (CORPORATE / CORPORATE INTERNET BANKING ONLY)Q33. How many types of users are there in Corporate / Corporate Internet <strong><strong>Bank</strong>ing</strong>?A. There are five types of users in Corporate / Corporate Internet <strong><strong>Bank</strong>ing</strong>, namely Account Holder User, AuthorizedUser, Chief Accountant User, Administrator User and Internal User.Q34. Who can be an Account Holder User / Authorized User / Chief Accountant User / Administrator User? Back to topA. These users must be an Owner / Director / Authorized Signatory of the Corporate, and nominated by Board ofDirector(s) by indicating in the Application Form. Back to topQ35. How many Account Holder User / Authorized User / Chief Accountant User / Administrator User are allowed?A. As follows: Account Holder User: at least one and only one is allowed for Corporate / Corporate Internet <strong><strong>Bank</strong>ing</strong> Authorized User: as many as Corporate requirement Chief Accountant User: as many as Corporate requirement Administrator User: at least one and only one is allowed for Corporate / Corporate Internet <strong><strong>Bank</strong>ing</strong> Back to topCentralized Operations_Jun 2013 v1.0 Page 7 of 12

Q36. What can an Account Holder / Authorized User do?A. Approve (but not initiate) all transactions created by Internal User. The last approval before the transactionssubmits to <strong>Canadia</strong> <strong>Bank</strong> for processing.Q37. What can Chief Accountant User do?A. Approve (but not initiate) all transactions created by Internal User before it submits to Account Holder /Authorized Signatory for the last approval.Q38. What can Administrator User do?A. Only perform administrative functions, create, maintain or delete of the Internal User in Corporate / CorporateInternet <strong><strong>Bank</strong>ing</strong>.Q39. Who can be an Internal User?A. A Corporate / corporate can assign anyone to be an Internal User for its Corporate / Corporate Internet <strong><strong>Bank</strong>ing</strong>. Itcan be an authorized signatory or another employee who is not an authorized signatory yet. The Internal User isnot created by the <strong>Canadia</strong> <strong>Bank</strong>, it is done by the Administrator User.Q40. What can an Internal User do?A. The Internal User can perform all or part of the non‐administrative functions depending on the rights and dailylimits assigned to him/her by the Administrator User.Q41. Will Internal User become active once they are created online?A. Yes, once created online by the Administrator User, the Internal User will be active and can initiate anytransactions. Back to top Back to top Back to top Back to top Back to top Back to topAUTHORIZATION (CORPORATE INTERNET BANKING ONLY)Q42. How does the Authorization work?A. The Authorization service enables the users who have been granted sufficient authority to authorize or rejecttransactions that are pending for authorization. Pending transactions are initiated by the Internal User, onceauthorized, the transactions will be submitting for processing.Authorization is compulsory for Corporate Internet <strong><strong>Bank</strong>ing</strong>. Back to topQ43. What happens if the transaction has not been fully authorized?A. A transaction cannot be processed unless it is fully authorized by Chief Accountant / Authorized User or AccountHolder User.ACCOUNTS Back to topQ44. How far back can I view my account history?A. You may view your account history up to 90 days from today. Back to topCentralized Operations_Jun 2013 v1.0 Page 8 of 12

Q45. What should I do to select or deselect my accounts for online access?A. You will specify which accounts you want to link to Internet <strong><strong>Bank</strong>ing</strong> at the time you register. And if you specify allaccounts in the Application Form, then all accounts opened afterward will be automatically linked to your Internet<strong><strong>Bank</strong>ing</strong>. To deselect some or select more accounts, please fill in the Internet <strong><strong>Bank</strong>ing</strong> Amendment Form andreturn to <strong>Canadia</strong> <strong>Bank</strong> at the nearest branch. Back to topTRANSFERQ46. Are there Maximum <strong>Bank</strong> Limits allowed for different transfers?A. Yes, please refer to Individual Internet and Mobile <strong><strong>Bank</strong>ing</strong> Daily Limit or Corporate Internet <strong><strong>Bank</strong>ing</strong> Daily Limit fordetails.Q47. Can I make transfer to and from any of my accounts? Back to topA. You can make transfers to most of your Internet <strong><strong>Bank</strong>ing</strong> accounts. However there are some limitations to thetransfer feature, for example, you cannot transfer funds to repay your loan with us.Q48. When I transfer money, is the transfer effective immediately? Back to topA. Yes, once sufficient balance in your funding account, the transaction will be effective immediately. Back to topQ49. How can I view those transactions done on my account?A. The Transaction History on Internet <strong><strong>Bank</strong>ing</strong> allows you to view all transactions done on your accounts for the last90 days.Q50. What happens if I transfer funds to a wrong payee? Back to topA. If the amount has been credited wrongly to another account, please notify us immediately so that we can informthe payee of this incident.Q51. Why am I receiving transaction alerts? Back to topA. This is to enhance your transactional security and acts as a measure to protect our customers against fraudulentactivities. Back to topBILL PAYMENTSQ52. Which accounts can I use for the Bill Payment service?A. You can pay your bills from any payment account you have with <strong>Canadia</strong> <strong>Bank</strong>. Back to topCentralized Operations_Jun 2013 v1.0 Page 9 of 12

Q53. When I make a Bill Payment, is the payment effected immediately?A. For bill payment made before 3pm from Monday to Friday, it will be processed on the same day to the Biller.For bill payment made after 3pm from Monday to Friday, it will be processed on the next Corporate day.The cut‐off time of 3pm is valid for a normal, working day only. If any of these days is a public holiday, regardlessof when the bill payment is made, the transaction is treated as the next Corporate day’s transaction.To ensure sufficient time for your billing organization to process your payment to the Biller, we would advise thatyou effect your payment 2 Corporate days in advance.Q54. Will I be charged for using the Bill Payment service?A. You will be pleased to know that US$0.25 or KHR1,000 will be charged from your account per transaction. Back to top Back to topAUTOMATIC PAYMENTSQ55. What is an automatic payment?A. Automatic payment is used for regular recurring payments with the same due date and amount, be it One Time,Daily, Weekly or Monthly.Q56. What transactions can I make for future payments?A. You can make: Third party transfer_Same Currency Third party transfer_Different Currency Back to topThese can be a one‐off or a recurring payment Back to topQ57. Can I delete automatic payments?A. Yes, it must be done by the person who initiated the original transaction and prior to 08.00am (Cambodian Time)on the Corporate day prior to the payment date. Back to topONLINE FIXED DEPOSITQ58. Can I open a Fixed Deposit in Internet <strong><strong>Bank</strong>ing</strong>?A. Yes, you can request to open a new Fixed Deposit in Internet <strong><strong>Bank</strong>ing</strong> by selecting “Open Fixed Deposit” from theAccess List Menu. The minimum Fixed Deposit amount is US$1,000 or equivalent. This is subject to you havingavailable cleared funds in your account on the date of your request.Q59. How soon will my new Fixed Deposit be available? Back to topA. Immediately after you confirm and submit the transaction. Your new Fixed Deposit will also be displayed in theAccount List Screen of your Internet <strong><strong>Bank</strong>ing</strong>. Back to topCentralized Operations_Jun 2013 v1.0 Page 10 of 12

Q60. Can I request to close my online Fixed Deposit at the branch?A. No. Fixed Deposit opened in the Internet <strong><strong>Bank</strong>ing</strong> cannot be closed at the branch, it must be closed throughInternet <strong><strong>Bank</strong>ing</strong>.The same as your Fixed Deposit opened at branch cannot be closed through Internet <strong><strong>Bank</strong>ing</strong>. Back to topQ61. Will penalty apply if I breakout or close my online Fixed Deposit before maturity?A. No, but interest rate will be paid as equivalent of prevailing Savings account interest rate. Back to topSYSTEM AND SECURITYQ62. Is any special software or hardware needed to access Internet <strong><strong>Bank</strong>ing</strong>?A. For the best <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong> experience we recommend and support the following browser andoperating systems:Internet <strong><strong>Bank</strong>ing</strong>: (Web Browser Software) Internet Explorer 8 or above Firefox 10.0 or above Chrome 20.0 or above Safari 5.1.7 or aboveMobile <strong><strong>Bank</strong>ing</strong>: (Operating System) iOS 4.1 or above (iPhone, iPad, iPod) Android 2.3 or above (Android Phone) Android 4.0 or above (Android Phone) Android 3.0 or above (Android Tablet) Back to topQ63. Can I log on to <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong> at two computers at the same time?A. If you are logged on to two computers with <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong>, the connection on the first computer will beterminated and it pops up “You Have Been Logged Out Because You Logged In A Different Computer or Device”.Q64. Is <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong> secure? Back to topA. <strong>Canadia</strong> <strong>Bank</strong> employs a range of security measures to assist in protecting a customer’s account information.These measures include data encryption and two‐factor authentication.Q65. How should I choose a password? Back to topA. You would better choose a password: it should be 6 ‐ 16 characters, no spaces they should select something that they will easily remember but which will not be obvious to others. It shouldnot be easily identifiable, for example family names, street names or birth months. it should include at least one number and one letter, and ideally, mixture of upper and lower case. Note thatpasswords are case sensitive. alpha characters can be use e.g. ( ) ` ~ ! @ # $ % ^ & * ‐ _ = + [ ] { } \ | : ; “ ‘ < > , . ? / Back to topCentralized Operations_Jun 2013 v1.0 Page 11 of 12

Q66. How should I keep my password secure?A. Remember that when using your password, you should: change your password regularly, preferably every 30 days keep your password confidential, it should not be shared or revealed to anyone. when changing your password, it is recommended that the customer makes it significantly different frompassword used previously.Q67. What is a time out limit? Back to topA. <strong>Canadia</strong> Internet <strong><strong>Bank</strong>ing</strong> session can remain unattended for a maximum of 15 minutes for Internet <strong><strong>Bank</strong>ing</strong> and 5minutes for Mobile <strong><strong>Bank</strong>ing</strong>. After this time, the system automatically logs off and ends a session.If you are not using your computer for a period of time, you should ‘log off’ completely from <strong>Canadia</strong> Internet<strong><strong>Bank</strong>ing</strong> so that your sensitive banking information cannot be viewed by others.In addition, only one session can be active at any time. This means that you cannot be logged into <strong>Canadia</strong>Internet <strong><strong>Bank</strong>ing</strong> at more than once computer at the same time. Back to topCentralized Operations_Jun 2013 v1.0 Page 12 of 12