124 Interest of Promoters and Directors Except as stated ... - Edelweiss

124 Interest of Promoters and Directors Except as stated ... - Edelweiss

124 Interest of Promoters and Directors Except as stated ... - Edelweiss

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

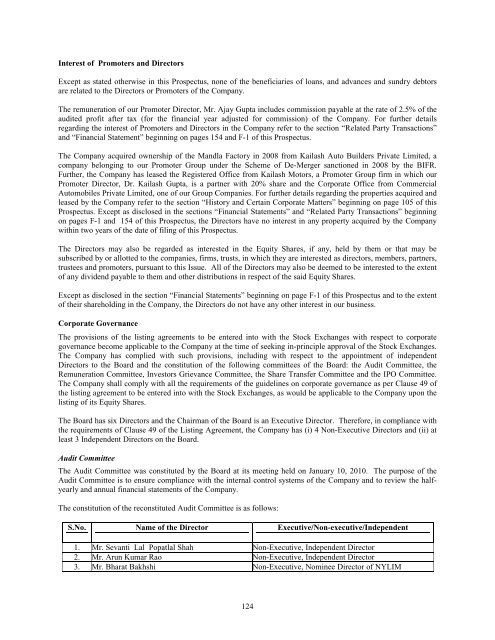

<strong>Interest</strong> <strong>of</strong> <strong>Promoters</strong> <strong>and</strong> <strong>Directors</strong><strong>Except</strong> <strong>as</strong> <strong>stated</strong> otherwise in this Prospectus, none <strong>of</strong> the beneficiaries <strong>of</strong> loans, <strong>and</strong> advances <strong>and</strong> sundry debtorsare related to the <strong>Directors</strong> or <strong>Promoters</strong> <strong>of</strong> the Company.The remuneration <strong>of</strong> our Promoter Director, Mr. Ajay Gupta includes commission payable at the rate <strong>of</strong> 2.5% <strong>of</strong> theaudited pr<strong>of</strong>it after tax (for the financial year adjusted for commission) <strong>of</strong> the Company. For further detailsregarding the interest <strong>of</strong> <strong>Promoters</strong> <strong>and</strong> <strong>Directors</strong> in the Company refer to the section “Related Party Transactions”<strong>and</strong> “Financial Statement” beginning on pages 154 <strong>and</strong> F-1 <strong>of</strong> this Prospectus.The Company acquired ownership <strong>of</strong> the M<strong>and</strong>la Factory in 2008 from Kail<strong>as</strong>h Auto Builders Private Limited, acompany belonging to our Promoter Group under the Scheme <strong>of</strong> De-Merger sanctioned in 2008 by the BIFR.Further, the Company h<strong>as</strong> le<strong>as</strong>ed the Registered Office from Kail<strong>as</strong>h Motors, a Promoter Group firm in which ourPromoter Director, Dr. Kail<strong>as</strong>h Gupta, is a partner with 20% share <strong>and</strong> the Corporate Office from CommercialAutomobiles Private Limited, one <strong>of</strong> our Group Companies. For further details regarding the properties acquired <strong>and</strong>le<strong>as</strong>ed by the Company refer to the section “History <strong>and</strong> Certain Corporate Matters” beginning on page 105 <strong>of</strong> thisProspectus. <strong>Except</strong> <strong>as</strong> disclosed in the sections “Financial Statements” <strong>and</strong> “Related Party Transactions” beginningon pages F-1 <strong>and</strong> 154 <strong>of</strong> this Prospectus, the <strong>Directors</strong> have no interest in any property acquired by the Companywithin two years <strong>of</strong> the date <strong>of</strong> filing <strong>of</strong> this Prospectus.The <strong>Directors</strong> may also be regarded <strong>as</strong> interested in the Equity Shares, if any, held by them or that may besubscribed by or allotted to the companies, firms, trusts, in which they are interested <strong>as</strong> directors, members, partners,trustees <strong>and</strong> promoters, pursuant to this Issue. All <strong>of</strong> the <strong>Directors</strong> may also be deemed to be interested to the extent<strong>of</strong> any dividend payable to them <strong>and</strong> other distributions in respect <strong>of</strong> the said Equity Shares.<strong>Except</strong> <strong>as</strong> disclosed in the section “Financial Statements” beginning on page F-1 <strong>of</strong> this Prospectus <strong>and</strong> to the extent<strong>of</strong> their shareholding in the Company, the <strong>Directors</strong> do not have any other interest in our business.Corporate GovernanceThe provisions <strong>of</strong> the listing agreements to be entered into with the Stock Exchanges with respect to corporategovernance become applicable to the Company at the time <strong>of</strong> seeking in-principle approval <strong>of</strong> the Stock Exchanges.The Company h<strong>as</strong> complied with such provisions, including with respect to the appointment <strong>of</strong> independent<strong>Directors</strong> to the Board <strong>and</strong> the constitution <strong>of</strong> the following committees <strong>of</strong> the Board: the Audit Committee, theRemuneration Committee, Investors Grievance Committee, the Share Transfer Committee <strong>and</strong> the IPO Committee.The Company shall comply with all the requirements <strong>of</strong> the guidelines on corporate governance <strong>as</strong> per Clause 49 <strong>of</strong>the listing agreement to be entered into with the Stock Exchanges, <strong>as</strong> would be applicable to the Company upon thelisting <strong>of</strong> its Equity Shares.The Board h<strong>as</strong> six <strong>Directors</strong> <strong>and</strong> the Chairman <strong>of</strong> the Board is an Executive Director. Therefore, in compliance withthe requirements <strong>of</strong> Clause 49 <strong>of</strong> the Listing Agreement, the Company h<strong>as</strong> (i) 4 Non-Executive <strong>Directors</strong> <strong>and</strong> (ii) atle<strong>as</strong>t 3 Independent <strong>Directors</strong> on the Board.Audit CommitteeThe Audit Committee w<strong>as</strong> constituted by the Board at its meeting held on January 10, 2010. The purpose <strong>of</strong> theAudit Committee is to ensure compliance with the internal control systems <strong>of</strong> the Company <strong>and</strong> to review the halfyearly<strong>and</strong> annual financial statements <strong>of</strong> the Company.The constitution <strong>of</strong> the reconstituted Audit Committee is <strong>as</strong> follows:S.No. Name <strong>of</strong> the Director Executive/Non-executive/Independent1. Mr. Sevanti Lal Popatlal Shah Non-Executive, Independent Director2. Mr. Arun Kumar Rao Non-Executive, Independent Director3. Mr. Bharat Bakhshi Non-Executive, Nominee Director <strong>of</strong> NYLIM<strong>124</strong>

Under the Tata Growth Fund Agreement, Tata Trustee will nominate a director for appointment to our Board within90 days <strong>of</strong> July 29, 2010. Thereupon, the nominee <strong>of</strong> Tata Trustee will replace Mr. Bharat Bakhshi on the AuditCommittee for a term <strong>of</strong> 12 months. The nominee director <strong>of</strong> Tata Trustee <strong>and</strong> NYLIM will sit on the AuditCommittee for alternating periods <strong>of</strong> 12 months (till such time <strong>as</strong> Tata Trustee <strong>and</strong> NYLIM are entitled to nominate<strong>Directors</strong> to our Board, for details <strong>of</strong> which refer to the section “History <strong>and</strong> Certain Corporate Matters” beginningon page 105 <strong>of</strong> this Prospectus.The terms <strong>of</strong> reference <strong>of</strong> the Audit Committee are <strong>as</strong> follows:Regular review <strong>of</strong> accounts, accounting policies <strong>and</strong> disclosures.Review the major accounting entries b<strong>as</strong>ed on exercise <strong>of</strong> judgment by management <strong>and</strong> review <strong>of</strong> significantadjustments arising out <strong>of</strong> audit.Review any qualifications in the draft audit report.Establish <strong>and</strong> review the scope <strong>of</strong> the independent audit including the observations <strong>of</strong> the auditors <strong>and</strong> review <strong>of</strong>the quarterly, half-yearly <strong>and</strong> annual financial statements before submission to the Board.Upon completion <strong>of</strong> the audit, attend discussions with the independent auditors to <strong>as</strong>certain any area <strong>of</strong> concern.Establish the scope <strong>and</strong> frequency <strong>of</strong> the internal audit, review the findings <strong>of</strong> the internal auditors <strong>and</strong> ensurethe adequacy <strong>of</strong> internal control systems.Examine re<strong>as</strong>ons for substantial defaults in payment to depositors, debenture holders, shareholders <strong>and</strong>creditors.Examine matters relating to the Director’s Responsibility Statement for compliance with Accounting St<strong>and</strong>ards<strong>and</strong> accounting policies.Oversee compliance with Stock Exchange legal requirements concerning financial statements, to the extentapplicable.Examine any related party transactions, i.e., transactions <strong>of</strong> the Company that are <strong>of</strong> a material nature withpromoters or management, their subsidiaries, relatives, etc., that may have potential conflict with the interests <strong>of</strong> theCompany.Appointment <strong>and</strong> remuneration <strong>of</strong> statutory <strong>and</strong> internal auditors.Such other matters <strong>as</strong> may from time to time be required under any statutory, contractual or other regulatoryrequirement.Monitoring <strong>of</strong> the use <strong>of</strong> the Net Proceeds <strong>of</strong> the Fresh IssueUtilisation <strong>of</strong> the Net Proceeds <strong>of</strong> the Fresh Issue shall be placed before the Audit Committee for consideration<strong>and</strong> approval <strong>as</strong> per disclosure requirements under the listing agreement with the Stock Exchanges.Remuneration CommitteeThe Remuneration Committee w<strong>as</strong> constituted by the Board at its meeting held on January 10, 2010. The objective<strong>of</strong> the Remuneration Committee is to ensure that the Company’s remuneration policies in respect <strong>of</strong> ManagingDirector, Whole-time Director, senior executives are competitive such that the Company is able to recruit <strong>and</strong> retainthe best talent <strong>and</strong> to ensure appropriate disclosure <strong>of</strong> remuneration paid to such persons.The constitution <strong>of</strong> the Remuneration Committee is <strong>as</strong> follows:S.No. Name <strong>of</strong> the Director Executive/Non-executive/Independent1. Mr. Sudhir Kumar Vadhera Additional Non-Executive, Independent Director2. Mr. Arun Kumar Rao Non-Executive, Independent Director3. Mr. Bharat Bakhshi Non-Executive, Nominee Director <strong>of</strong> NYLIMThe terms <strong>of</strong> reference <strong>of</strong> the reconstituted Remuneration Committee are <strong>as</strong> follows:• Determine the remuneration, review performance <strong>and</strong> decide on variable pay <strong>of</strong> executive <strong>Directors</strong>.• Establish <strong>and</strong> administer employee compensation <strong>and</strong> benefit plans.• Determine the number <strong>of</strong> stock options to be granted under the Company’s Employees Stock Option Schemes<strong>and</strong> administer any stock option plan.• Such other matters <strong>as</strong> may from time to time be required under any statutory, contractual or other regulatoryrequirement.125

Under the Tata Growth Fund Agreement, Tata Trustee will nominate a director for appointment to our Board within90 days <strong>of</strong> July 29, 2010. Thereupon, the nominee <strong>of</strong> Tata Trustee will also be given a seat on the RemunerationCommittee.Investor Grievance CommitteeThe Investor Grievance Committee w<strong>as</strong> constituted by the Board at its meeting held on January 10, 2010. TheInvestor Grievance Committee is responsible for addressing investors’ or shareholders’ grievances, for example, nonreceipt <strong>of</strong> share certificates after transfer, loss <strong>of</strong> share certificates, dividend related issues <strong>and</strong> matters connectedtherewith.The constitution <strong>of</strong> the Investor Grievance Committee is <strong>as</strong> follows:S.No. Name <strong>of</strong> the Director Executive/Non-executive/Independent1. Dr. Kail<strong>as</strong>h Gupta Chairman cum Managing Director2. Mr. Sevanti Lal Popatlal Shah Non-Executive, Independent Director3. Mr. Arun Kumar Rao Non-Executive, Independent DirectorThe terms <strong>of</strong> reference <strong>of</strong> the Investor Grievance Committee are <strong>as</strong> follows:• Supervise investor relations <strong>and</strong> redressal <strong>of</strong> investor grievance in general <strong>and</strong> relating to non-receipt <strong>of</strong>dividends, interest, <strong>and</strong> non-receipt <strong>of</strong> balance sheet in particular.• Such other matters <strong>as</strong> may from time to time be required under any statutory, contractual or other regulatoryrequirement.Share Transfer CommitteeThe Share Transfer Committee w<strong>as</strong> constituted by the Board at its meeting held on January 10, 2010. The ShareTransfer Committee is responsible for all decisions in relation to the transfer/transmission/split/consolidation <strong>of</strong> theshares <strong>of</strong> the company.The constitution <strong>of</strong> the Share Transfer Committee is <strong>as</strong> follows:S. No. Name <strong>of</strong> the member Executive/Non-executive/Independent1. Mr. Ajay Gupta Whole Time Executive Director2. Mr. Sevanti Lal Popatlal Shah Non-Executive, Independent Director3. Mr. Arun Kumar Rao Non-Executive, Independent DirectorThe terms <strong>of</strong> reference <strong>of</strong> the Share Transfer Committee are <strong>as</strong> follows:• Approve <strong>and</strong> register the transfer or transmission <strong>of</strong> the Equity Shares <strong>of</strong> the Company.• Sub divide/split, consolidate <strong>and</strong> or replace any share certificates <strong>of</strong> the Company including issue <strong>of</strong> duplicateshare certificates.• Authorise affixation <strong>of</strong> Common Seal <strong>of</strong> the Company to share certificates.• Provide for the safe custody <strong>of</strong> the Common Seal <strong>of</strong> the Company.• Do all other acts <strong>and</strong> deeds <strong>as</strong> may be necessary <strong>and</strong> incidental to these terms <strong>of</strong> reference.126

MANAGEMENT ORGANIZATIONAL STRUCTUREWhole –TimeExecutive DirectorMr. Ajay GuptaExecutive VicePresidentMr. Abhishek JaiswalExecutive Vice President(Railways)Mr. Pradeep GuptaCompany SecretaryMr. Anurag MisraChief FinanceOfficerMr. Abhijit KanvindeSenior General Manager(Railways <strong>and</strong> NewBusiness Development)Mr. Atul N. KarmarkarSenior General Manager(Railways <strong>and</strong> BusinessDevelopment)Mr. Rajiv Malhotra128

Key Management PersonnelThe key management personnel <strong>of</strong> our Company are <strong>as</strong> follows:Mr. Abhijit Kanvinde, Chief Finance OfficerMr. Abhijit Kanvinde is 45 years old <strong>and</strong> is the Chief Finance Officer <strong>of</strong> our Company. He is a commerce graduate<strong>and</strong> a qualified Chartered Accountant. He h<strong>as</strong> over 18 years <strong>of</strong> experience in the fields <strong>of</strong> finance, accounts,taxation <strong>and</strong> insurance management. He h<strong>as</strong> worked with numerous companies including Shringar Cinem<strong>as</strong>Limited, Novartis Consumer Health India Pvt. Ltd., L’Oreal, <strong>and</strong> Mafatlal Dyes <strong>and</strong> Chemicals Ltd. In ourCompany, he is responsible for the preparation <strong>of</strong> operational budgets, supervision <strong>and</strong> finalization <strong>of</strong> corporateaccounts <strong>and</strong> statutory audits, direct <strong>and</strong> indirect taxation, sector insurance <strong>and</strong> internal audit functions. He joinedour Company on January 15, 2007. The gross remuneration paid to him during fiscal year 2010 w<strong>as</strong> Rs. 1.81million. Key details <strong>of</strong> his contract <strong>of</strong> employment with the Company are <strong>as</strong> follows: (a) The employment is on anexclusive b<strong>as</strong>is; (b) The contract can be terminated by either party by giving two months notice in writing; (c)employee is prohibited from divulging trade secrets <strong>and</strong> other facts <strong>and</strong> information relating to the Companyduring the tenure <strong>of</strong> employment.Mr. Abhishek Jaiswal, Executive Vice PresidentMr. Abhishek Jaiswal is 40 years old <strong>and</strong> is the Executive Vice President <strong>of</strong> our Company. He holds a graduatedegree in Production Engineering <strong>and</strong> h<strong>as</strong> over 16 years <strong>of</strong> experience, <strong>and</strong> w<strong>as</strong> previously employed <strong>as</strong> a PlanningEngineer (Welding Shop) with Kinetic Honda from June, 1990 to March, 1993. He is responsible for overalloperations <strong>of</strong> all units <strong>of</strong> the Company <strong>and</strong> he functionally oversees production, robotic welding, press shop <strong>and</strong>CNC machine operations. He joined our Company in March, 1993. The gross remuneration paid to him duringfiscal year 2010 w<strong>as</strong> Rs. 1.72 million. Key details <strong>of</strong> his contract <strong>of</strong> employment with the Company are <strong>as</strong> follows:(a) The employment is on an exclusive b<strong>as</strong>is; (b) The contract can be terminated by either party by giving twomonths notice in writing; (c) employee is prohibited from divulging trade secrets <strong>and</strong> other facts <strong>and</strong> informationrelating to the Company during the tenure <strong>of</strong> employment.Mr. Pradeep Gupta, Executive Vice President (Railways)Mr. Pradeep Gupta is 59 years old <strong>and</strong> is the Executive Vice President (Railways) <strong>of</strong> our Company. He holds agraduate degree in Mechanical Engineering. He h<strong>as</strong> over 30 years <strong>of</strong> experience in project management,manufacturing, marketing, product engineering, quality <strong>as</strong>surance, vendor development <strong>and</strong> export execution in therailway industry. He w<strong>as</strong> previously employed with the OMBESCO Group from January, 2005 to January, 2009.He is responsible for looking after our projects in the railway division. He joined our Company on January 14,2010. The gross remuneration paid to him during fiscal year 2010 w<strong>as</strong> Rs. 0.40 million. Key details <strong>of</strong> his contract<strong>of</strong> employment with the Company are <strong>as</strong> follows: (a) The employment is on an exclusive b<strong>as</strong>is; (b) The contractcan be terminated by either party by giving two months notice in writing; (c) employee is prohibited fromdivulging trade secrets <strong>and</strong> other facts <strong>and</strong> information relating to the Company during the tenure <strong>of</strong> employment.Mr. Atul Nagesh Karmarkar, Senior General Manager (Railways <strong>and</strong> New Business Development)Mr. Atul Nagesh Karmarkar is 41 years old <strong>and</strong> is the Senior General Manager, Railways <strong>and</strong> New BusinessDevelopment, <strong>of</strong> our Company. He holds a diploma in Mechanical Engineering, <strong>and</strong> an MBA in Marketing. He isa certified internal auditor for QS 14001 <strong>and</strong> TS 16949. He h<strong>as</strong> over 17 years <strong>of</strong> experience in production planning<strong>and</strong> control. He w<strong>as</strong> previously employed with Pinnacle Industries Ltd. <strong>as</strong> Senior Manager-Production fromAugust, 2005 to June, 2008. He is responsible for all in-house production <strong>and</strong> planning activities <strong>and</strong> stream-liningprocesses <strong>and</strong> procedures. He also manages the Company’s service teams in six warehouses across the country. Hejoined our Company on June 15, 2008. The gross remuneration paid to him during fiscal year 2010 w<strong>as</strong> Rs. 1.18million. Key details <strong>of</strong> his contract <strong>of</strong> employment with the Company are <strong>as</strong> follows: (a) The employment is on anexclusive b<strong>as</strong>is; (b) The contract can be terminated by either party by giving two months notice in writing; (c)employee prohibited from divulging trade secrets <strong>and</strong> other facts <strong>and</strong> information relating to the Company duringthe tenure <strong>of</strong> employment.129

Mr. Rajiv Malhotra, Senior General Manager (Railways <strong>and</strong> Business Development)Mr. Rajiv Malhotra is 40 years old <strong>and</strong> is the Senior General Manager (Railways <strong>and</strong> Business Development) <strong>of</strong>our Company. He holds a graduate degree in Mechanical Engineering. He h<strong>as</strong> over 17 years <strong>of</strong> experience inproduction, product development <strong>and</strong> project designs. He w<strong>as</strong> previously employed with Hindalco IndustriesLimited from December, 1992 to June, 1996. He is in charge <strong>of</strong> marketing for railways <strong>and</strong> our business withDLW. He is also in charge <strong>of</strong> our operations for production, robotic welding, press shop, CNC bending, punchingfabrication <strong>and</strong> <strong>as</strong>sembly. He joined our Company on July 1, 1996. The gross remuneration paid to him duringfiscal year 2010 w<strong>as</strong> Rs. 1.28 million. Key details <strong>of</strong> his contract <strong>of</strong> employment with the Company are <strong>as</strong> follows:(a) The employment is on an exclusive b<strong>as</strong>is; (b) The contract can be terminated by either party by giving twomonths notice in writing; (c) employee prohibited from divulging trade secrets <strong>and</strong> other facts <strong>and</strong> informationrelating to the Company during the tenure <strong>of</strong> employment.Mr. Anurag Misra, Company SecretaryMr. Anurag Misra is 34 years old <strong>and</strong> is the Company Secretary <strong>of</strong> our Company. He holds a post graduate degreein commerce <strong>and</strong> is an <strong>as</strong>sociate member <strong>of</strong> Institute <strong>of</strong> Company Secretaries <strong>of</strong> India (ICSI). He h<strong>as</strong> over 7 years<strong>of</strong> experience in secretarial practices <strong>and</strong> legal compliance working with the Company. He is responsible forlooking after secretarial, legal <strong>and</strong> other statutory compliances <strong>of</strong> the Company. His other responsibilities alsoinclude managing the finances <strong>of</strong> the Company, managing mergers <strong>and</strong> acquisitions, <strong>and</strong> joint ventures. He joinedour Company in January, 2003. The gross remuneration paid to him during fiscal year 2010 w<strong>as</strong> Rs. 0.6 million.Key details <strong>of</strong> his contract <strong>of</strong> employment with the Company are <strong>as</strong> follows: (a) The employment is on anexclusive b<strong>as</strong>is; (b) The contract can be terminated by either party by giving two months notice in writing; (c)employee is prohibited from divulging trade secrets <strong>and</strong> other facts <strong>and</strong> information relating to the Company duringthe tenure <strong>of</strong> employment.All the key management personnel mentioned above are permanent employees <strong>of</strong> the Company.None <strong>of</strong> our key management personnel are related to each other.None <strong>of</strong> our key management personnel have any interest in the Company apart from their remuneration.None <strong>of</strong> our key management personnel w<strong>as</strong> selected pursuant to any arrangement or underst<strong>and</strong>ing with any <strong>of</strong>our major shareholders, customers, suppliers or other parties.Shareholding <strong>of</strong> key management personnelNone <strong>of</strong> our key management personnel hold any equity shares in the Company apart from their remuneration.Bonus or pr<strong>of</strong>it sharing plan for the key management personnelThere is no bonus or pr<strong>of</strong>it sharing plan for key management personnel <strong>of</strong> the Company .Employee Stock Option Plan / Employee Stock Purch<strong>as</strong>e SchemeWe do not have any employee stock option scheme <strong>as</strong> <strong>of</strong> the date <strong>of</strong> filing <strong>of</strong> this Prospectus .Changes in the Key Management PersonnelThe following are the changes in the key management personnel <strong>of</strong> the Company in the l<strong>as</strong>t three years precedingthe date <strong>of</strong> filing this Prospectus:S. NameDate <strong>of</strong>DesignationDate <strong>of</strong> Re<strong>as</strong>onNo.AppointmentCessation1. Mr. Pradeep January 14, Executive Vice President- AppointmentGupta2010(Railways)2. Mr. Atul Nagesh June 15, 2008 Senior General Manager (Railways - Appointment130

S.No.NameKarmarkarDate <strong>of</strong>AppointmentDesignation<strong>and</strong> New Business Development)Date <strong>of</strong>CessationRe<strong>as</strong>onPayment or Benefit to Officers <strong>of</strong> the Company<strong>Except</strong> <strong>as</strong> disclosed in this Prospectus <strong>and</strong> any statutory payments made by the Company in the l<strong>as</strong>t two years, theCompany h<strong>as</strong> not paid any sum to its employees in connection with superannuation payments <strong>and</strong> ex-gratia orrewards <strong>and</strong> h<strong>as</strong> not paid any non-salary amount or benefit to any <strong>of</strong> its <strong>of</strong>ficers.<strong>Except</strong> <strong>as</strong> disclosed in this Prospectus, none <strong>of</strong> the beneficiaries <strong>of</strong> loans <strong>and</strong> advances <strong>and</strong> sundry debtors arerelated to the <strong>Directors</strong> or the <strong>Promoters</strong> <strong>of</strong> the Company.131

OUR PROMOTERS, GROUP COMPANIES AND PROMOTER GROUP<strong>Promoters</strong>The following are the <strong>Promoters</strong> <strong>of</strong> the Company:1. Dr. Kail<strong>as</strong>h Gupta2. Mr. Ajay Gupta<strong>Promoters</strong>’ DetailsThe details <strong>of</strong> the <strong>Promoters</strong> are <strong>as</strong> follows:Dr. Kail<strong>as</strong>h GuptaIdentificationDetailsAge 63Residential Address486, South Civil Lines, Pachpedi, Jabalpur, Madhya Pradesh482101, India.Voter ID NumberMP/25/194/027374Driving License NumberNot applied forDesignation Chairman cum Managing Director w.e.f May 26, 2010Educational qualifications <strong>and</strong>pr<strong>of</strong>essional experienceSee the section “Our Management” beginning on page 120 <strong>of</strong> thisProspectusOther <strong>Directors</strong>hipsSee the section “Our Management” beginning on page 120 <strong>of</strong> thisProspectusDr. Kail<strong>as</strong>h Gupta owns 12,644,800 Equity Shares, representing 29.48% <strong>of</strong> the pre-Issue share capital <strong>and</strong> 23.01%<strong>of</strong> the post-Issue share capital <strong>of</strong> the Company. He also holds <strong>as</strong> representative <strong>of</strong> the Promoter Group pursuant tothe Scheme <strong>of</strong> De-Merger 980 Equity Shares, representing less than 0.0 percent <strong>of</strong> the pre-Issue share capital <strong>and</strong>less than 0.0 percent <strong>of</strong> the post-Issue share capital <strong>of</strong> the Company.Mr. Ajay GuptaIdentificationDetailsAge 38Residential Address486, South Civil Lines, Pachpedi, Jabalpur, Madhya Pradesh482101, IndiaVoter ID NumberNot applied forDriving License NumberMH-01-90-23675DesignationWhole-Time Executive Director, appointed <strong>as</strong> Additional Directorby the Board on October 1, 2005 <strong>and</strong> confirmed by the shareholdersin general meeting on September 29, 2006.132

IdentificationEducational qualifications <strong>and</strong>pr<strong>of</strong>essional experienceOther <strong>Directors</strong>hipsDetailsSee the section “Our Management” beginning on page 120 <strong>of</strong> thisProspectusSee the section “Our Management” beginning on page 120 <strong>of</strong> thisProspectusMr. Ajay Gupta owns 11,281,270 Equity Shares, representing 26.30% <strong>of</strong> the pre-Issue share capital <strong>and</strong> 20.53% <strong>of</strong>the post-Issue share capital <strong>of</strong> the Company.Promoter GroupThe following natural persons, HUFs, companies <strong>and</strong> partnership firms, other than the <strong>Promoters</strong> named above,constitute our promoter group <strong>as</strong> defined under the ICDR Regulations (the “Promoter Group”):The natural persons who are part <strong>of</strong> the Promoter Group, are <strong>as</strong> follows:Immediate Relatives <strong>of</strong> Dr. Kail<strong>as</strong>h Gupta1. Ms. Rekha Gupta (wife)2. Mr. Ishwar Ch<strong>and</strong>ra Gupta (brother)3. Mr. Manik Ch<strong>and</strong>ra Gupta (brother)4. Mr. Prem Ch<strong>and</strong> Gupta (brother)5. Mr. Arun Gupta (brother)6. Late Mr. Kapoor Ch<strong>and</strong> Gupta (brother)7. Ms. Angoori Devi Goel (sister)8. Ms. Shakuntala Gupta (sister)9. Ms. Nirmala Bansal (sister)10. Ms. Manju Agrawal (sister)11. Ms. Shalini Gupta (daughter)12. Ms. N<strong>and</strong>ini Malpani (daughter)13. Ms. Anubha Bhartia (daughter)14. Late Mr. Prem Narayan Agarwal (wife’s father)15. Late Ms. K<strong>as</strong>turi Devi (wife’s mother)16. Mr. Indraprak<strong>as</strong>h Agarwal (wife’s brother)17. Mr. B<strong>as</strong>ant Kumar Agarwal (wife’s brother)18. Mr. Rajan Kumar Agarwal (wife’s brother)19. Ms. Sh<strong>as</strong>hi Singhal (wife’s sister)Immediate Relatives <strong>of</strong> Mr. Ajay Gupta1. Late Mr. Gopal Gupta (father)2. Ms. Asha Devi Gupta (mother)3. Mr. Aditya Gupta (brother)4. Ms. Anita Bharatiya (sister)5. Mr. Shrivardhan Gupta (son)6. Mr. Aniruddha Gupta (son)7. Ms. Shalini Gupta (wife)8. Ms. N<strong>and</strong>ini Malpani (wife’s sister)9. Ms. Anubha Bhartia (wife’s sister)10. Dr. Kail<strong>as</strong>h Gupta (wife’s father)11. Ms. Rekha Gupta (wife’s mother)HUFs that are part <strong>of</strong> the Promoter Group are <strong>as</strong> follows:1. Kail<strong>as</strong>h Ch<strong>and</strong> Gupta Hindu Undivided Family2. Ajay Gupta Hindu Undivided Family133

3. JN Gupta & Sons Hindu Undivided Family4. Ishwar Ch<strong>and</strong>ra & Brothers Hindu Undivided Family5. Prem Ch<strong>and</strong> Kail<strong>as</strong>h Ch<strong>and</strong> Hindu Undivided Family6. Manik Ch<strong>and</strong> Kail<strong>as</strong>h Ch<strong>and</strong> Hindu Undivided Family7. Jai Narain Ishwar Ch<strong>and</strong> Manik Ch<strong>and</strong> Kapoor Ch<strong>and</strong> Hindu Undivided Family8. Ishwar Ch<strong>and</strong> Prem Ch<strong>and</strong> Hindu Undivided Family9. Ishwar Ch<strong>and</strong>ra Hindu Undivided Family10. Manik Ch<strong>and</strong>ra Hindu Undivided Family11. Prem Ch<strong>and</strong> Gupta Hindu Undivided FamilyTrusts that are part <strong>of</strong> the Promoter Group are <strong>as</strong> follows:1. Jai Narayan Charitable Trust2. J<strong>as</strong>hn Beneficiary TrustCompanies that are part <strong>of</strong> the Promoter Group are <strong>as</strong> follows:1. Kail<strong>as</strong>h Auto Finance Limited2. J.N. Auto Private Limited3. Commercial Automobiles Private Limited4. Shivam Motors (P) Limited5. Shubham Multi Services Private Limited6. Kail<strong>as</strong>h Moser Industries Private Limited7. Kail<strong>as</strong>h Motors Finance Private Limited8. Shivam Phoenix Transport Services Private Limited9. Narmada Auto Care Services Private Limited10. Commercial Motors (Dehradun) Private Limited11. Kail<strong>as</strong>h Motors (Private) Limited12. Commercial Cars Private Limited13. Tirupati Services Limited14. Tirupati Services (Dehradun) Private Limited15. Kail<strong>as</strong>h Vahan Udyog Limited16. Kail<strong>as</strong>h ShinMaywa Industries Limited17. Commercial Auto (Dehradun) Private Limited18. Commercial Treads Private Limited19. Vineet Capital Services (P) Limited20. Tirupati Equipments Private Limited21. Kail<strong>as</strong>h Auto Builders (P) Limited22. Commercial Motor Sales Private LimitedFirms that are part <strong>of</strong> the Promoter Group are <strong>as</strong> follows:1. Commercial Instalment2. Commercial Body Builders3. Kail<strong>as</strong>h Traders4. Eur<strong>of</strong>ibre India5. Kail<strong>as</strong>h Finance Company Kanpur6. Kail<strong>as</strong>h Motors7. Ch<strong>and</strong>ra Brothers8. Commercial Motors Bareilly9. Kail<strong>as</strong>h Motors Company Kanpur10. Kail<strong>as</strong>h Automobiles11. Commercial Auto Centre12. Kail<strong>as</strong>h Auto Centre Kanpur134

Companies <strong>and</strong> Firms forming part <strong>of</strong> our Group Companies:The following companies, firms <strong>and</strong> ventures have been promoted by the <strong>Promoters</strong> <strong>of</strong> the Company <strong>and</strong> arereferred to in this Prospectus <strong>as</strong> the “Group Companies”. The Group Companies are companies, firms <strong>and</strong>ventures in which the <strong>Promoters</strong> (i) exercise control; or (ii) have been named <strong>as</strong> promoters by such entity in anyfiling with the stock exchanges in India. We define “control” (<strong>as</strong> per the terms <strong>of</strong> the ICDR Regulations) <strong>as</strong> the(a) ownership, directly or indirectly through subsidiaries, <strong>of</strong> 50% or more <strong>of</strong> the equity share capital or votinginterest <strong>of</strong> the entity; or (b) power to appoint the majority <strong>of</strong> the directors or similar governing body <strong>of</strong> suchentity; or (c) power to control the management or policy decisions <strong>of</strong> the entity, directly or indirectly, includingthrough the exercise <strong>of</strong> shareholding or management or similar rights or voting arrangements or in any othermanner. Joint ventures in which any Promoter is a joint venture partner have been disclosed <strong>as</strong> GroupCompanies, even where the Promoter holds less than 50% <strong>of</strong> the equity share capital or voting interest <strong>of</strong> therelevant joint venture. In addition, if a Promoter in practice controls an entity owing to the other shareholders orpartners not actively participating in the business <strong>of</strong> the entity, such entity h<strong>as</strong> been included <strong>as</strong> a GroupCompany.B<strong>as</strong>ed on the above, our Group Companies are set forth below:Companies1. Kail<strong>as</strong>h Auto Finance Limited2. Shivam Motors Private Limited3. Shubham Multi Services Private Limited4. Commercial Automobiles Private Limited5. J.N. Auto Private Limited6. Kail<strong>as</strong>h Motors Finance Private Limited7. Kail<strong>as</strong>h Moser Industries Private Limited8. Shivam Phoenix Transport Services Private Limited9. Narmada Auto Care Services Private LimitedFirms1. Commercial Instalment2. Commercial Body Builders3. Kail<strong>as</strong>h Traders4. Eur<strong>of</strong>ibre IndiaExcluded Entities <strong>of</strong> Immediate RelativesNo information is available with the Company, the <strong>Promoters</strong> or their other Immediate Relatives about thecompanies, firms, HUFs or trusts <strong>of</strong> the Immediate Relatives specified below. Further, none <strong>of</strong> these individuals<strong>and</strong> the Company or any Promoter or any <strong>of</strong> their other Immediate Relatives have any common interest, whetherdirectly or indirectly, in any companies, firms, HUFs or trusts. Therefore, companies, firms, HUFs or trusts, if anyin which the individuals specified below have interests, are not included in the above list <strong>of</strong> Promoter Groupentities:(1) The daughters <strong>and</strong> sisters <strong>of</strong> Dr. Kail<strong>as</strong>h Gupta: Ms. Angoori Devi Goel (sister), Ms. Shakuntala Gupta(sister), Ms. Nirmala Bansal (sister), Ms. Manju Agrawal (sister), Ms. Anubha Bhartia (daughter) <strong>and</strong> Ms.N<strong>and</strong>ini Malpani (daughter), save that Ms. N<strong>and</strong>ini Malpani is a director <strong>of</strong> Commercial Automobiles PrivateLimited. For details, refer to heading “Commercial Automobiles Private Limited” further in this section.(2) The siblings <strong>of</strong> Ms. Rekha Gupta: Mr. Indraprak<strong>as</strong>h Agarwal, Mr. B<strong>as</strong>ant Kumar Agarwal, Mr. Rajan KumarAgarwal <strong>and</strong> Ms. Sh<strong>as</strong>hi Singhal.(3) The siblings <strong>and</strong> mother <strong>of</strong> Mr. Ajay Gupta: Mr. Aditya Gupta (brother), Ms. Anita Bharatiya (sister) <strong>and</strong> Ms.Asha Devi Gupta (mother) save that Ms. Asha Devi Gupta is a trustee <strong>of</strong> J<strong>as</strong>hn Beneficiary Trust.135

DeclarationThe Company confirms that the Permanent Account Number, Bank Account details <strong>and</strong> P<strong>as</strong>sport Number <strong>of</strong> the<strong>Promoters</strong> h<strong>as</strong> been submitted to the Stock Exchanges at the time <strong>of</strong> filing the Draft Red Herring Prospectus withthem.Neither the Company nor the <strong>Promoters</strong>, Group Companies, the relatives (<strong>as</strong> per Companies Act, 1956) <strong>of</strong> the<strong>Promoters</strong> have been identified <strong>as</strong> wilful defaulters by Reserve Bank <strong>of</strong> India or other authorities. Neither (i) the<strong>Promoters</strong>, members <strong>of</strong> the Promoter Group, Group Companies <strong>of</strong> <strong>Promoters</strong>, nor (ii) the companies with whichany <strong>of</strong> the <strong>Promoters</strong> are or were <strong>as</strong>sociated <strong>as</strong> a promoter, director or person in control, are debarred or prohibitedfrom accessing the capital market for any re<strong>as</strong>on by SEBI or any other authority.History/Background <strong>of</strong> <strong>Promoters</strong>The Company, <strong>Promoters</strong> <strong>and</strong> Group Companies have further confirmed that there are no violations <strong>of</strong> securitieslaws committed by them in the p<strong>as</strong>t or currently pending against them except for a violation <strong>of</strong> its listing agreementwith the BSE <strong>and</strong> certain filing requirements under the Takeover Code by one <strong>of</strong> the Group Companies, Kail<strong>as</strong>hAuto Finance Limited. Kail<strong>as</strong>h Auto Finance Limited had also failed to comply with the disclosure requirementsunder the Takeover Code <strong>as</strong> well <strong>as</strong> under the SEBI (Prohibition <strong>of</strong> Insider Trading Regulations), 1992. Most <strong>of</strong>these non-compliances have been regularized by Kail<strong>as</strong>h Auto Finance Limited a few days prior to the date <strong>of</strong> thisProspectus. For details <strong>of</strong> such violations by Kail<strong>as</strong>h Auto Finance Limited, refer to the Section “Outst<strong>and</strong>ingLitigation <strong>and</strong> Material Developments” on page 182 <strong>of</strong> this Prospectus <strong>and</strong> the section “Risk Factors” on page XIII<strong>of</strong> this Prospectus. A public announcement for the purch<strong>as</strong>e <strong>of</strong> shares <strong>of</strong> Kail<strong>as</strong>h Auto Finance Limited by M/sPadma Impex Private Limited h<strong>as</strong> been made on May 18, 2010. Our Promoter Director – Dr. Kail<strong>as</strong>h Gupta <strong>and</strong>certain other members <strong>of</strong> the Promoter Group are proposing to sell their entire stake in Kail<strong>as</strong>h Auto FinanceLimited. One <strong>of</strong> our Promoter Group companies, Vineet Capital Services (P) Limited used to be registered withSEBI <strong>as</strong> a stock broker on the U. P. Stock Exchange Association Limited, Kanpur under registration numberINB101022839. Vineet Capital Services (P) Limited ce<strong>as</strong>ed to carry on this business from 2004 <strong>and</strong> voluntarilysurrendered its registration on October 29, 2004 pursuant to which its registration w<strong>as</strong> cancelled vide letter numberMIRSD/DR-1/45002/2005 dated July 15, 2005. Vineet Capital Services (P) Limited h<strong>as</strong> confirmed to us that it isnot currently engaged in any securities related business <strong>and</strong> that there are no penalties, enquiries or investigationsby SEBI against it <strong>and</strong> nor does it owe any fees to SEBI.Acquisition <strong>of</strong> Equity Shares by our <strong>Promoters</strong> within the l<strong>as</strong>t 5 yearsOne <strong>of</strong> our <strong>Promoters</strong>, Mr. Ajay Gupta, first acquired shares in the Company within the l<strong>as</strong>t 5 years i.e. onDecember 23, 2006. For details <strong>of</strong> Equity Shares acquired by him in the Company including the date, terms <strong>and</strong>price <strong>of</strong> acquisition <strong>of</strong> such Equity Shares refer to the Section “Capital Structure” on page 25 <strong>of</strong> this Red HerringProspectus. Our other promoter, Dr. Kail<strong>as</strong>h Gupta, h<strong>as</strong> held Equity Shares in the Company indirectly throughGroup Companies <strong>and</strong> Promoter Group entities since 1980 <strong>and</strong> directly since October 2005.Common PursuitsThe <strong>Promoters</strong> do not have any interest <strong>of</strong> 10% or more in the equity share capital <strong>of</strong> any venture that is involvedin common pursuits <strong>as</strong> those <strong>of</strong> the Company <strong>and</strong> nor are the Group Companies or <strong>as</strong>sociates <strong>of</strong> the Companyinvolved in any common pursuits <strong>as</strong> those <strong>of</strong> the Company.<strong>Interest</strong> <strong>of</strong> Individual <strong>Promoters</strong>Our Promoter <strong>Directors</strong>, Dr. Kail<strong>as</strong>h Gupta <strong>and</strong> Mr. Ajay Gupta, are interested parties in any dividend <strong>and</strong>distributions made by the Company or to the extent <strong>of</strong> their shareholding in the Company. The remuneration <strong>of</strong>Mr. Ajay Gupta includes commission payable at the rate <strong>of</strong> 2.5% <strong>of</strong> the audited pr<strong>of</strong>it after tax (for the financialyear adjusted for commission) <strong>of</strong> the Company.The Company’s <strong>Promoters</strong> will also be interested in any future contracts that the Company may enter into with any<strong>of</strong> the Group Companies. Our <strong>Promoters</strong> are also directors on the board <strong>of</strong>, or members <strong>of</strong>, certain Group136

Companies <strong>and</strong> Promoter Group entities <strong>and</strong> they may be deemed to be interested to the extent <strong>of</strong> payments madeby our Company, if any, to these parties. <strong>Except</strong> <strong>as</strong> <strong>stated</strong> otherwise in this Prospectus, none <strong>of</strong> the beneficiaries <strong>of</strong>loans, <strong>and</strong> advances <strong>and</strong> sundry debtors are related to <strong>Promoters</strong> <strong>of</strong> the Company. For further details, ple<strong>as</strong>e see thesection “Related Party Transactions” beginning on page 154 <strong>of</strong> this Prospectus.The Promoter <strong>Directors</strong> <strong>of</strong> the Company may be deemed to be interested in properties acquired, le<strong>as</strong>ed or licensedby the Company from Group Companies <strong>and</strong> entities belonging to the Promoter Group in which they haveshareholding. For details <strong>as</strong> to such properties refer to the sections “Our Business” <strong>and</strong> “History <strong>and</strong> CertainCorporate Matters” beginning on pages 77 <strong>and</strong> 105 <strong>of</strong> this Prospectus.<strong>Except</strong> <strong>as</strong> <strong>stated</strong> otherwise in this Prospectus, we have not entered into any contract, agreement or arrangementduring the preceding two years from the date <strong>of</strong> this Prospectus in which the <strong>Promoters</strong> are directly or indirectlyinterested <strong>and</strong> no payments have been made to them in respect <strong>of</strong> any contract, agreement or arrangement that isproposed to be made with them, other than in the normal course <strong>of</strong> business.Group CompaniesUnless otherwise specifically <strong>stated</strong>, none <strong>of</strong> the Group Companies described below (i) is listed on any stockexchange; (ii) h<strong>as</strong> completed any public or rights issue since the date <strong>of</strong> its incorporation; (iii) h<strong>as</strong> become a sickcompany; (iv) is under winding-up; or (v) had a negative net worth <strong>as</strong> <strong>of</strong> FY2009. Unless otherwise specifically<strong>stated</strong>, no application h<strong>as</strong> been made in respect <strong>of</strong> any <strong>of</strong> the Group Companies to the relevant Registrar <strong>of</strong>Companies in whose jurisdiction such Group Company is registered, for striking <strong>of</strong>f its name. Further, except <strong>as</strong><strong>stated</strong> below, there h<strong>as</strong> been no change in the capital structure <strong>of</strong> any <strong>of</strong> the Group Companies in the l<strong>as</strong>t sixmonths. The summary financial information <strong>of</strong> the Group Companies presented below is b<strong>as</strong>ed on the auditedfinancial statements <strong>of</strong> each such Group Company. For litigation regarding the Group Companies, refer to theSection “Outst<strong>and</strong>ing Litigation <strong>and</strong> Material Developments” beginning on page 182 <strong>of</strong> this Prospectus.1. Kail<strong>as</strong>h Auto Finance Limited (“KAFL”)KAFL w<strong>as</strong> incorporated on November 14, 1984. The principal activity <strong>of</strong> KAFL is to carry on business <strong>as</strong>collection <strong>and</strong> recovery agents <strong>of</strong> Tata Motors Limited in Orissa, Raj<strong>as</strong>than, Chhattisgarh <strong>and</strong> Madhya Pradesh inrelation to hire purch<strong>as</strong>e agreements entered into by Tata Motors Limited with its customers.The capital structure <strong>of</strong> KAFL <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Authorized Share CapitalIssued, Subscribed <strong>and</strong> Paid-upCapitalShareholding PatternNumber <strong>of</strong> shares10,000,000 equity shares <strong>of</strong> Rs. 10 each <strong>and</strong>500,000 preference shares <strong>of</strong> Rs. 100 each3,805,900 equity shares <strong>of</strong> Rs. 10 each <strong>and</strong>94,100 Forfeited Equity SharesAmountRs. 100,000,000Rs. 50,000,000Rs. 38,059,000Rs. 857,033The shareholding pattern <strong>of</strong> KAFL <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Name <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued CapitalDr. Kail<strong>as</strong>h Gupta 867,837 22.80Dr. Kail<strong>as</strong>h Gupta (HUF) 24,100 0.63Dr. Kail<strong>as</strong>h Gupta (HUF) / Mr. Raghav14,325 0.38GuptaMs. Rekha Gupta 917,439 24.10Mr. Ishwar Ch<strong>and</strong>ra Gupta 8,500 0.22137

Name <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued CapitalMr. Atul Goel 11,600 0.30Mr. Vineet Ch<strong>and</strong>ra/Ms. Rekha Gupta 58,081 1.52Mr. Raghav Gupta 64,876 1.70Ms. Shalini Gupta 20,250 0.53Ms. Anubha Gupta 25,961 0.68Mittar Sen Goel 3,100 0.08Ms. Angoori Devi 1,100 0.03Aradhana Motors Private Limited 4,500 0.12The Company 86,650 2.27Commercial Automobiles Private323,867 8.50LimitedCommercial Instalment (P) Limited 48,438 1.27Commercial Motors Finance Limited 27,343 0.72Kail<strong>as</strong>h Auto Builders (P) Limited 25,925 0.68Kail<strong>as</strong>h Motors Limited 1,050 0.03Shivam Motors (P) Limited 49,375 1.30Tirupati Services Limited 32,200 0.85Mr. Ashok Goel 200 0.01Mr. Mohit Goel 3,600 0.10Ms. Rita Goel 1,725 0.05Ms. Pratima Goel 3,325 0.09Mr. Alok Aggarwal 1,000 0.03Ms. Amita Arren 1,425 0.04Ms. Anjana Goel 1,100 0.03Ms. Draupadi Devi 7,812 0.21Mr. Mukul Arren 2,049 0.05Mr. Mukul Arren6,250 0.16(Trustee Anuj Family Trust)Ms. Neeru Gupta 375 0.01Ms. Parul Goel 200 0.01Mr. Prem Prak<strong>as</strong>h Gupta 6,625 0.17Ms. Renu Aggarwal 1,000 0.03Ms. Ruchi Goel 1,100 0.03Ms. Shada Devi 3,612 0.09Mr. Babulal Nema 6,700 0.18Mr. Bhaiyalal Shukla 10,000 0.26Mr. Gaurishankar Agarwal 6,700 0.18138

Name <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued CapitalMs. Sudesh Puri 200 0.01Ms. Suman Uberoi 200 0.01Public 1,<strong>124</strong>,185 29.54Board <strong>of</strong> <strong>Directors</strong>Total 3,805,900 100.00The board <strong>of</strong> directors <strong>of</strong> KAFL <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Dr. Kail<strong>as</strong>h Gupta2. Ms. Shalini Gupta3. Mr. Rajesh B. Dhirawani4. Mr. Rahul AgrawalFinancial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009Total Income 27.07 28.92 39.42Sales (income from operation) 16.14 26.28 38.87Pr<strong>of</strong>it/(Loss) after Tax (6.66) 3.24 18.96Equity Share Capital (paid up) 38.91 38.91 38.91Reserves <strong>and</strong> surplus (excludingrevaluation reserves) <strong>and</strong> debit balance<strong>of</strong> Pr<strong>of</strong>it/(Loss) Account(2) 11.37 11.37 11.37Earnings/(Loss) per share (B<strong>as</strong>ic)(1) N.A. 1.91 4.67Diluted Earnings per share(1) N.A. 1.91 4.67Net Asset Value per share(1) (11.40) (10.56) (5.70)(1) Face value <strong>of</strong> each equity share is Rs.10.(2) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.KAFL h<strong>as</strong> not made any public or rights issue in the preceding three years. It h<strong>as</strong> not become a sick companyunder the meaning <strong>of</strong> SICA, is not under winding up. It h<strong>as</strong> not made a loss in FY 2009. However, KAFL h<strong>as</strong> anegative net worth <strong>of</strong> Rs. 22.23 million. For details <strong>of</strong> KAFL <strong>as</strong> to market price, capital issues in the l<strong>as</strong>t ten years<strong>and</strong> investor grievances, refer to the Section “Other Regulatory <strong>and</strong> Statutory Disclosures” beginning on page 227<strong>of</strong> this Prospectus.2. Shivam Motors (P) Limited (“Shivam Motors”)Shivam Motors w<strong>as</strong> incorporated on March 22, 1983. The principal activity <strong>of</strong> Shivam Motors is to carry onbusiness <strong>as</strong> authorized dealers in certain districts <strong>of</strong> Chhattisgarh for commercial vehicles produced by Tata MotorsLimited. Shivam Motors also sources hire-purch<strong>as</strong>e business for various financiers on commission-b<strong>as</strong>is.The capital structure <strong>of</strong> Shivam Motors <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Number <strong>of</strong> sharesAmountAuthorized Share Capital 500,000 equity shares <strong>of</strong> Rs. 100 each Rs. 50,000,000Issued, Subscribed <strong>and</strong> Paid-upCapital334,500 equity shares <strong>of</strong> Rs. 100 each Rs. 33,450,000139

During the p<strong>as</strong>t six months, there h<strong>as</strong> been a change in the capital structure <strong>of</strong> SMPL whereby the authorized sharecapital which earlier comprised <strong>of</strong> Rs. 19,250,000 equity share capital <strong>and</strong> Rs. 20,750,000 preference share capitalh<strong>as</strong> been changed to Rs. 50,000,000 equity share capital. Also, the issued capital <strong>of</strong> SMPL h<strong>as</strong> changed from Rs.17,150,000 equity share capital <strong>and</strong> Rs. 15,800,000 preference share capital to Rs. 33,450,000 equity share capital.Shareholding PatternThe shareholding pattern <strong>of</strong> Shivam Motors <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Equity SharesName <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued Equity CapitalTriupati Services Limited 8,000 2.39Commercial Automobiles Private800 0.24LimitedTriupati AutoComp Pvt Limited 50,000 14.95Kail<strong>as</strong>h Motors Finance Pvt Limited 5,000 1.50M/s Kail<strong>as</strong>h Vahan Udyog Ltd 34,000 10.16Kail<strong>as</strong>h Motors 800 0.24Kail<strong>as</strong>h Motors Co. 550 0.16Kail<strong>as</strong>h Gupta 132,200 39.52Rekha Gupta 37,500 11.21Vineet Ch<strong>and</strong>ra 46,850 14.01Raghav Gupta 18,800 5.62Total 334500 100Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> Shivam Motors <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Dr. Kail<strong>as</strong>h Gupta2. Mr. Prem Ch<strong>and</strong> Gupta3. Mr. Raghav Gupta4. Ms. Rekha GuptaFinancial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009Total Income (Sales) 2011.65 1927.75 2003.04Pr<strong>of</strong>it/(Loss) after Tax 10.79 2.82 9.89Equity Share Capital (paid up) 27.95 27.95 32.95Reserves <strong>and</strong> surplus (excluding revaluationreserves) <strong>and</strong> debit balance <strong>of</strong> Pr<strong>of</strong>it/(Loss)Account(2) 35.54 37.73 47.46Earnings/(Loss) per share (B<strong>as</strong>ic)(1) 137.47 35.21 90.51Diluted Earnings per share(1) 137.47 35.21 90.51Net Asset Value per share(1) 522.09 875.83 682.93(1) Face value <strong>of</strong> each equity share is Rs.100.(2) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.Shivam Motors is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the preceding three years.It h<strong>as</strong> not become a sick company under the meaning <strong>of</strong> SICA, is not under winding up <strong>and</strong> does not have negativenet worth. It h<strong>as</strong> not made a loss in FY 2009.140

3. Shubham Multi Services Private Limited (“Shubham”)Shubham w<strong>as</strong> incorporated on April 28, 2010. The principal activity <strong>of</strong> Shubham is to carry on business <strong>of</strong>investment in properties <strong>and</strong> shares.The capital structure <strong>of</strong> Shubham <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Number <strong>of</strong> sharesAmountAuthorized Share Capital 1,00,000 Equity Shares <strong>of</strong> Rs. 10each. Rs. 10,00,000Issued, Subscribed <strong>and</strong> Paid-upCapital100,00 Equity Shares <strong>of</strong> Rs. 10 each Rs. 100,000Shareholding PatternThe shareholding pattern <strong>of</strong> Shubham <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Equity SharesName <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued Equity CapitalPrem Ch<strong>and</strong> Gupta 1 0.01Shivam Motors Private Limited 9,999 99.99Total 10,000 100Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> Shubham <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Mr. Vineet Ch<strong>and</strong>ra2. Mr. Arun GuptaFinancial PerformanceThe financial performance <strong>of</strong> Shubham for the l<strong>as</strong>t 3 fiscal years is not available since it w<strong>as</strong> recently incorporatedon April 24, 2010.Shubham is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the preceding three years. It h<strong>as</strong>not become a sick company under the meaning <strong>of</strong> SICA, is not under winding up <strong>and</strong> does not have negative networth. It h<strong>as</strong> not made a loss in FY 2009.4. Commercial Automobiles Private Limited (“Commercial Automobiles”)Commercial Automobiles w<strong>as</strong> incorporated on September 1, 1997 <strong>as</strong> a private limited company. The principalactivity <strong>of</strong> Commercial Automobiles is to carry on business <strong>as</strong> authorized dealers in certain districts <strong>of</strong> MadhyaPradesh <strong>of</strong> commercial vehicles <strong>and</strong> p<strong>as</strong>senger cars produced by Tata Motors Limited.The capital structure <strong>of</strong> Commercial Automobiles <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Authorized Share CapitalNumber <strong>of</strong> shares13,000,000 equity shares <strong>of</strong> Rs.10each.AmountRs. 130,000,000Issued, Subscribed <strong>and</strong> Paid-up 9,400,000 equity shares <strong>of</strong> Rs. 10 Rs. 94,000,000141

Capitaleach.During the p<strong>as</strong>t six months, there h<strong>as</strong> been a change in the capital structure <strong>of</strong> CAPL whereby the authorized sharecapital which earlier comprised <strong>of</strong> Rs. 60,000,000 equity share capital <strong>and</strong> Rs. 40,000,000 preference share capitalh<strong>as</strong> been changed to Rs. 130,000,000 equity share capital. Also, the issued capital <strong>of</strong> SMPL h<strong>as</strong> changed from Rs.52,500,000 equity share capital <strong>and</strong> Rs. 39,928,000 preference share capital to Rs. 94,000,000 equity share capital.Shareholding PatternThe shareholding pattern <strong>of</strong> Commercial Automobiles <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Equity SharesName <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued Equity CapitalKail<strong>as</strong>h Motors 477,500 5.08Kail<strong>as</strong>h Motors Finance Private Limited 900,000 9.57Kail<strong>as</strong>h Gupta 6,237,750 66.36Rekha Gupta 215,000 2.29Kail<strong>as</strong>h Gupta & Rekha Gupta (Joint holder) 60,000 0.63Rekha Gupta & Kail<strong>as</strong>h Gupta (Joint holder) 1,047,250 11.14Prem Ch<strong>and</strong> Gupta 90,000 0.96Shakun Ch<strong>and</strong>ra 90,000 0.96Arun Gupta 90,000 0.96Meera Gupta 55,000 0.58Kapoor Ch<strong>and</strong> Gupta 35,000 0.37Usha Chabdra 25,000 0.27Ishwar Ch<strong>and</strong>ra HUF 25,000 0.27Vineet Ch<strong>and</strong>ra 25,000 0.27Nidhi Ch<strong>and</strong>ra 15,000 0.16Kail<strong>as</strong>h Ch<strong>and</strong> HUF 12,500 0.13Total 9,400,000 100.00Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> Commercial Automobiles <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Dr. Kail<strong>as</strong>h Gupta2. Mr. Ishwar Ch<strong>and</strong>ra3. Mr. Rahul Agrawal4. Ms. Angoori Devi5. Mr. Anirudh MalpaniFinancial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009Total Income (Sales) 1639.16 1816.48 1614.22Pr<strong>of</strong>it/(Loss) after Tax (2.55) 2.67 8.32Equity Share Capital (paid up) 84.93 84.93 92.43Reserves <strong>and</strong> surplus (excluding revaluationreserves) <strong>and</strong> debit balance <strong>of</strong> Pr<strong>of</strong>it/(Loss)Account(2) 23.68 24.55 32.46Earnings/(Loss) per share (B<strong>as</strong>ic)(1) 2.86 2.45 4.67142

Diluted Earnings per share(1) 2.86 2.45 4.67Net Asset Value per share(1) 20.17 68.99 75.17(1) Face value <strong>of</strong> each equity share is Rs.10.(2) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.Commercial Automobiles is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the precedingthree years. It h<strong>as</strong> not become a sick company under the meaning <strong>of</strong> SICA, is not under winding up <strong>and</strong> does nothave negative net worth. It h<strong>as</strong> not made a loss in FY2009.5. J. N. Auto Private Limited (“J. N. Auto”)J. N. Auto w<strong>as</strong> incorporated on March 19, 1996. The principal activity <strong>of</strong> J. N. Auto is to carry on business <strong>as</strong>manufacturers <strong>and</strong> galvanizers <strong>of</strong> telecommunications <strong>and</strong> transmission towers.The capital structure <strong>of</strong> J. N. Auto <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Number <strong>of</strong> equity shares <strong>of</strong>AmountRs. 10 eachAuthorized Share Capital 2,000,000 Rs. 20,000,000Issued, Subscribed <strong>and</strong> Paid-up Capital1,900,000 Rs. 19,000,000During the p<strong>as</strong>t six months, there h<strong>as</strong> been a change in the capital structure <strong>of</strong> J. N. Auto whereby the issued equityshare capital h<strong>as</strong> changed from Rs. 9,000,000 to Rs. 19,000,000.Shareholding PatternThe shareholding pattern <strong>of</strong> J. N. Auto <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Name <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued CapitalDr. Kail<strong>as</strong>h Gupta 500,100 26.32Ms. Rekha Gupta 678,500 35.72Dr. Kail<strong>as</strong>h Gupta <strong>and</strong> Ms. Rekha Gupta (jointly) 5,000 0.26Kail<strong>as</strong>h Motors 50,000 2.64Mr. Ishwar Ch<strong>and</strong>ra 200,100 10.53Mr. Prem Ch<strong>and</strong> Gupta 200,100 10.53Ms. Usha Ch<strong>and</strong>ra 1200 0.06Ms. Meera Gupta 5000 0.26Mr. Ishwar Ch<strong>and</strong>ra <strong>and</strong> Ms. Usha Ch<strong>and</strong>ra(jointly) 5000 0.26Mr. Prem Ch<strong>and</strong>ra <strong>and</strong> Ms. Urmil Gupta (jointly) 5000 0.26Mr. Manik Ch<strong>and</strong>ra <strong>and</strong> Ms. Shakun Ch<strong>and</strong>ra(jointly) 5000 0.26Mr. Vineet Ch<strong>and</strong>ra <strong>and</strong> Ms. Nidhi Ch<strong>and</strong>ra 5000 0.26Mr. Vikunth Ch<strong>and</strong>ra 40,000 2.11Ms. Nidhi Ch<strong>and</strong>ra 200,000 10.53Total 1900,000 100.00143

Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> J. N. Auto comprises <strong>of</strong> the following:1. Dr. Kail<strong>as</strong>h Gupta2. Mrs. Rekha Gupta3. Mr. Ishwar Ch<strong>and</strong>raFinancial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009Total Income 0.01 0.15 35.98Pr<strong>of</strong>it/(Loss) after Tax 2.83 (0.08) 1.11Equity Share Capital (paid up) 5.00 5.00 19.00Reserves <strong>and</strong> surplus (excluding revaluationreserves) <strong>and</strong> debit balance <strong>of</strong> Pr<strong>of</strong>it/(Loss)Account(2) 0.68 (0.43) (0.31)Earnings/(Loss) per share (B<strong>as</strong>ic)(1) 6.34 0 0.83Diluted Earnings per share(1) 6.34 0 0.83Net Asset Value per share(1) 9.36 9.15 21.20(1) Face value <strong>of</strong> each equity share is Rs.10.(2) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.J. N. Auto is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the preceding three years. It h<strong>as</strong>not become a sick company under the meaning <strong>of</strong> SICA, is not under winding up <strong>and</strong> does not have negative networth. It h<strong>as</strong> not made a loss in FY2009.6. Kail<strong>as</strong>h Motors Finance Private Limited (“Kail<strong>as</strong>h Motors Finance”)Kail<strong>as</strong>h Motors Finance w<strong>as</strong> incorporated on March 13, 1981. The principal activity <strong>of</strong> Kail<strong>as</strong>h Motors Finance isto carry on business <strong>as</strong> collection <strong>and</strong> recovery agents <strong>and</strong> participation business for Tata Motors Limited in OrissaRaj<strong>as</strong>than, Chattisgarh <strong>and</strong> Madhya Pradesh.The capital structure <strong>of</strong> Kail<strong>as</strong>h Motors Finance <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Number <strong>of</strong> sharesAmountAuthorized Share Capital 300,000 equity shares <strong>of</strong> Rs. 100 each Rs. 30,000,000Issued, Subscribed <strong>and</strong> Paid-up Capital 249,785 equity shares <strong>of</strong> Rs. 100 each Rs. 24,978,500Shareholding PatternThe shareholding pattern <strong>of</strong> Kail<strong>as</strong>h Motors Finance <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Name <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued CapitalCompany 62,920 25.19%Commercial Automobiles PrivateLimited 250 0.10%Kail<strong>as</strong>h Motors 750 0.30%Kail<strong>as</strong>h Motors Company Kanpur 750 0.30%144

Ms. Rekha Gupta 152,000 60.85%Mr. Kail<strong>as</strong>h Gupta 18,000 7.21%Rajnig<strong>and</strong>ha Industries PrivateLimited 3,000 1.20%Mr. Krishna Kumar Agrawal 2,745 1.10%Ms.Shalini 2,600 1.04%Ms. Rekha Agrawal 640 0.26%Mr. Atul Goel 500 0.20%Mr. Ashok Gupta 440 0.18%Ms. Amita Arren 400 0.16%Mr. Ankur Goel 400 0.16%Mr. Mukul Arren 400 0.16%Ms. Neeru Gupta 400 0.16%Ms. Nidhi Vineet Ch<strong>and</strong>ra 400 0.16%Mr. Santosh Jain 400 0.16%Mr. Satish Jain 350 0.14%M<strong>as</strong>ter Vikunth 350 0.14%Ms. Ruchi 300 0.12%Mr. Jai Jain 250 0.10%Mr. Bhiki Bhai Jain 200 0.08%Ms. Rekhch<strong>and</strong> Kochar 200 0.08%Ms. Usha Ch<strong>and</strong>ra 200 0.08%Mr. Kamlesh Agrawal 140 0.06%Mr. Ram Niw<strong>as</strong> Agarwal 100 0.04%Mr. Ashkaran Bajmar 100 0.04%Mr. Deepch<strong>and</strong> Kochar 100 0.04%Mr. Prem Ch<strong>and</strong> Gupta 100 0.04%Mr. Raghav Gupta 100 0.04%Mr. Sampatlal Jain 100 0.04%Ms. Shanti Bai Bajmar 100 0.04%Ms. Sunder Bai Kochhar 100 0.04%Total 249,785 100.00%Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> Kail<strong>as</strong>h Motors Finance <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Dr. Kail<strong>as</strong>h Gupta2. Mr. Prem Ch<strong>and</strong>ra Gupta3. Mrs. Usha Ch<strong>and</strong>raFinancial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009Total Income 14.56 2.41 1.45145

Pr<strong>of</strong>it/(Loss) after Tax 3.27 0.70 0.57Equity Share Capital (paid up) 24.97 24.97 24.97Reserves <strong>and</strong> surplus (excluding revaluationreserves) <strong>and</strong> debit balance <strong>of</strong> Pr<strong>of</strong>it/(Loss)Account(2) (2.47) (1.77) (1.20)Earnings/(Loss) per share (B<strong>as</strong>ic)(1) 12.33 4.18 3.18Diluted Earnings per share(1) 12.33 4.18 3.18Net Asset Value per share(1) 80.27 84.45 87.13(1) Face value <strong>of</strong> each equity share is Rs.100.(2) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.Kail<strong>as</strong>h Motors Finance is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the precedingthree years. It h<strong>as</strong> not become a sick company under the meaning <strong>of</strong> SICA, is not under winding up <strong>and</strong> does nothave negative net worth. It h<strong>as</strong> not made a loss in FY 2009.7. Kail<strong>as</strong>h Moser Industries Private Limited (“Kail<strong>as</strong>h Moser”)Kail<strong>as</strong>h Moser w<strong>as</strong> incorporated on July 12, 1993. The principal activity <strong>of</strong> Kail<strong>as</strong>h Moser w<strong>as</strong> to carry onbusiness <strong>of</strong> manufacturers <strong>of</strong> garbage compactors. Kail<strong>as</strong>h Moser h<strong>as</strong> been defunct since 1994 <strong>as</strong> it w<strong>as</strong> not able toget significant orders for its business.The capital structure <strong>of</strong> Kail<strong>as</strong>h Moser <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Number <strong>of</strong> sharesAmountAuthorized Share Capital 1,000,000 equity shares <strong>of</strong> Rs. 10 each Rs. 10,000,000Issued, Subscribed <strong>and</strong> Paid-up Capital 171,100 equity shares <strong>of</strong> Rs. 10 each Rs. 1,711,000Shareholding PatternThe shareholding pattern <strong>of</strong> Kail<strong>as</strong>h Moser <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Name <strong>of</strong> ShareholderNumber <strong>of</strong> equityshares% <strong>of</strong> Issued CapitalDr. Kail<strong>as</strong>h Gupta 28,700 16.77Ms. Rekha Gupta 80,500 47.05Mr. Kurt Fluri 61,900 36.18Total 171,100 100.00Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> Kail<strong>as</strong>h Moser <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Dr. Kail<strong>as</strong>h Gupta2. Mr. Vineet Ch<strong>and</strong>raFinancial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009146

Sales 0.00 0.00 0.00Pr<strong>of</strong>it/(Loss) after Tax (0.01) (0.008) (0.14)Equity Share Capital (paid up) 17.11 17.11 17.11Reserves <strong>and</strong> surplus (excluding revaluationreserves) <strong>and</strong> debit balance <strong>of</strong> Pr<strong>of</strong>it/(Loss)Account(2) (37.34) (37.44) (37.53)Earnings/(Loss) per share (B<strong>as</strong>ic)(1) N.A. N.A. N.A.Diluted Earnings per share(1) N.A. N.A. N.A.Net Asset Value per share(1) N.A. N.A. N.A.(1) Face value <strong>of</strong> each equity share is Rs.10.(2) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.Kail<strong>as</strong>h Moser is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the preceding three years.It h<strong>as</strong> not become a sick company under the meaning <strong>of</strong> SICA <strong>and</strong> is not under winding up. Kail<strong>as</strong>h Moser h<strong>as</strong> anegative net worth <strong>of</strong> Rs. 2.06 million. It h<strong>as</strong> made a loss <strong>of</strong> Rs. 14,000 in FY 2009. Kail<strong>as</strong>h Moser h<strong>as</strong> filed anapplication before the RoC for its name to be struck <strong>of</strong>f from the record.8. Shivam Phoenix Transport Services Private Limited (“Shivam Phoenix”)Shivam Phoenix w<strong>as</strong> incorporated on March 16, 2010. The principal activity <strong>of</strong> Shivam Phoenix is to carry onbusiness <strong>of</strong> running local transport buses.The capital structure <strong>of</strong> Shivam Phoenix <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:Number <strong>of</strong> sharesAmountAuthorized Share Capital 50,000 equity shares <strong>of</strong> Rs. 10 each Rs. 500,000Issued, Subscribed <strong>and</strong> Paid-up Capital 10,000 equity shares <strong>of</strong> Rs. 10 each Rs. 100,000Shareholding PatternThe shareholding pattern <strong>of</strong> Shivam Phoenix <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Name <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued CapitalDr. Kail<strong>as</strong>h Gupta 5,000 50%Mr. Vishwanath Kunjilal Dubey 5,000 50%Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> Shivam Phoenix <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Dr. Kail<strong>as</strong>h Gupta2. Mr. Vishwanath Kunjilal DubeyFinancial PerformanceThe financial performance <strong>of</strong> Shivam Phoenix for the l<strong>as</strong>t 3 fiscal years is not available since it w<strong>as</strong> recentlyincorporated on March 16, 2010.Shivam Phoenix is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the preceding three years.It h<strong>as</strong> not become a sick company under the meaning <strong>of</strong> SICA, is not under winding up <strong>and</strong> does not have negativenet worth.9. Narmada Auto Care Services Private Limited (“Narmada Auto”)147

Narmada Auto w<strong>as</strong> incorporated on February 16, 2010. The principal activity <strong>of</strong> Narmada Auto is to carry onbusiness <strong>of</strong> tourist agents <strong>and</strong> contractors <strong>and</strong> to facilitate traveling for tourists including the provision <strong>of</strong>conveniences <strong>of</strong> all kinds such <strong>as</strong> tickets, sleeper cars, berths, lodging arrangements <strong>and</strong> other allied services.The capital structure <strong>of</strong> Narmada Auto <strong>as</strong> on July 30, 2010 is <strong>as</strong> follows:148

Number <strong>of</strong> sharesAmountAuthorized Share Capital 50,000 equity shares <strong>of</strong> Rs. 10 each Rs. 500,000Issued, Subscribed <strong>and</strong> Paid-upCapital10,000 equity shares <strong>of</strong> Rs. 10 each Rs. 100,000Shareholding PatternThe shareholding pattern <strong>of</strong> Narmada Auto <strong>as</strong> <strong>of</strong> July 30, 2010 is <strong>as</strong> follows:Name <strong>of</strong> Shareholder Number <strong>of</strong> equity shares % <strong>of</strong> Issued CapitalMr. Rahul Agrawal 5,000 50%Ms. Rekha Gupta 5,000 50%Board <strong>of</strong> <strong>Directors</strong>The board <strong>of</strong> directors <strong>of</strong> Narmada Auto <strong>as</strong> on July 30, 2010 comprises <strong>of</strong> the following:1. Mr. Rahul Agrawal2. Ms. Rekha GuptaFinancial PerformanceThe financial performance <strong>of</strong> Narmada Auto for the l<strong>as</strong>t 3 fiscal years is not available since it w<strong>as</strong> recentlyincorporated on February 16, 2010.Narmada Auto is an unlisted company <strong>and</strong> it h<strong>as</strong> not made any public or rights issue in the preceding three years.It h<strong>as</strong> not become a sick company under the meaning <strong>of</strong> SICA, is not under winding up <strong>and</strong> does not have negativenet worth.10. Commercial Instalment (“Commercial Instalment”)Commercial Instalment is a partnership firm set up on July 1, 1979. The principal activity <strong>of</strong> CommercialInstalment is to carry on the business <strong>of</strong> finance, le<strong>as</strong>ing <strong>and</strong> hire-purch<strong>as</strong>e. It h<strong>as</strong> been defunct since 1999 owingto the entry <strong>of</strong> new companies <strong>and</strong> banks in the same business with whom it w<strong>as</strong> unable to compete.Partnership <strong>Interest</strong>The partnership interest in Commercial Instalment <strong>as</strong> <strong>of</strong> July 30, 2010 w<strong>as</strong>:Name <strong>of</strong> Partner% <strong>of</strong> Partnership <strong>Interest</strong>Dr. Kail<strong>as</strong>h Gupta 6%Ishwar Ch<strong>and</strong>ra HUF (Ishwar Ch<strong>and</strong>ra) 21%Prem Ch<strong>and</strong> Gupta HUF (Prem Ch<strong>and</strong> Gupta) 21%Manik Ch<strong>and</strong>ra HUF (Manik Ch<strong>and</strong>ra) 21%Kapoor Ch<strong>and</strong> Gupta HUF (Raghav Gupta) 21%Mr. Arun Gupta 10%Total 100%Financial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009149

Total Income 1.36 2.97 0.94Pr<strong>of</strong>it/(Loss) after Tax (1.72) (0.65) (2.92)Reserves <strong>and</strong> surplus (excluding revaluationreserves) <strong>and</strong> debit balance <strong>of</strong> Pr<strong>of</strong>it/(Loss)Account(1) NIL NIL NIL(1) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.Commercial Instalment h<strong>as</strong> a negative worth <strong>of</strong> Rs. 23.83 million <strong>and</strong> h<strong>as</strong> made a loss <strong>of</strong> Rs. 2.92 million in FY2009.11. Commercial Body Builders (“CBB”)CBB is a partnership firm set up on March 28, 1977. CBB is in the business <strong>of</strong> rendering financial advice oncommission b<strong>as</strong>is <strong>and</strong> renting out immovable properties.Partnership <strong>Interest</strong>The partnership interest in CBB <strong>as</strong> <strong>of</strong> July 30, 2010w<strong>as</strong>:Name <strong>of</strong> Partner% <strong>of</strong> Partnership <strong>Interest</strong>Kail<strong>as</strong>h Ch<strong>and</strong> Gupta HUF (Dr. Kail<strong>as</strong>h Gupta) 20%Mr. Ishwar Ch<strong>and</strong>ra 12.50%Mr. Arun Gupta 12.50%Mr. Raghav Gupta 15%Mr. Manik Ch<strong>and</strong> Gupta 15%Mr. Prem Ch<strong>and</strong> Gupta 12.50%Ms. Nidhi Ch<strong>and</strong>ra 12.50%Total 100%Financial Performance(Rs. In million except in per share data)For the period ended March 312007 2008 2009Total Income 39.75 81.48 48.82Pr<strong>of</strong>it/(Loss) after Tax 1.37 (0.38) 8.15Reserves <strong>and</strong> surplus (excluding revaluationreserves) <strong>and</strong> debit balance <strong>of</strong> Pr<strong>of</strong>it/(Loss)Account(1) NIL NIL NIL(1) Net <strong>of</strong> miscellaneous expenditure not written <strong>of</strong>f.CBB h<strong>as</strong> a negative worth <strong>of</strong> Rs. 12.77 million. CBB h<strong>as</strong> not made a loss in FY 2009.12. Kail<strong>as</strong>h TradersKail<strong>as</strong>h Traders is a partnership firm set up on March 28, 1977. The principal activity <strong>of</strong> Kail<strong>as</strong>h Traders is tocarry on the business <strong>of</strong> finance <strong>and</strong> trading. It h<strong>as</strong> been defunct since 1999 owing to the entry <strong>of</strong> new companies<strong>and</strong> banks in the business <strong>of</strong> finance, le<strong>as</strong>ing <strong>and</strong> hire-purch<strong>as</strong>e with whom it w<strong>as</strong> unable to compete.Partnership <strong>Interest</strong>The partnership interest in Kail<strong>as</strong>h Traders <strong>as</strong> <strong>of</strong> July 30, 2010 w<strong>as</strong>:Name <strong>of</strong> Partner% <strong>of</strong> Partnership <strong>Interest</strong>Ms. Rekha Gupta 25%Mr. Arun Gupta 10%150